Legislation

Certain categories of citizens have the right to return personal income tax for the purchase of an apartment and the construction of their own home. There is a certain limit - 260 thousand rubles (13% of 2 million). The list of persons entitled to receive a deduction includes pensioners.

But an elderly person can receive payment for the purchase or construction of real estate only under certain conditions:

- Article 210 of the Tax Code indicates the amount of tax funds, which is 13% of the taxpayer’s income.

- Art. 217 excludes deductions from pensions and other social benefits.

- Clause 10 Art. 220 of the Tax Code of the Russian Federation indicates that an elderly person has the right to take advantage of a property deduction if housing was purchased 3 years before retirement.

- These rights are confirmed by letter of the Ministry of Finance of the Russian Federation dated February 12, 2015 No. 03-04-05/6179.

- Another letter from the Ministry of Finance of Russia dated April 17, 2014 No. 03-04-07/17776, where changes were made, indicates that payments are assigned to both a working pensioner and a non-working pensioner.

Based on all these documents, we conclude: pensioners have the right to receive compensation for the purchase of housing.

Free HOTLINE:

Moscow time +7 (499) 938 5119

St. Petersburg +7 (812) 467 3091

Fed +8 (800) 350 8363

Receiving a property deduction when purchasing an apartment

Example: pensioner Yablokova O.V. receives a state pension, and she also officially rents out an apartment. The money she receives from renting out an apartment is subject to income tax (O. V. Yablokova submits a 3-NDFL declaration every year, where she declares income from renting out an apartment and pays tax). In 2020, Yablokova O.V. bought herself another apartment.

Starting from 2020, Yablokova O.V. has the right to apply a property deduction from the purchase of an apartment to the tax from renting out an apartment. Accordingly, Yablokova will not pay tax on renting out an apartment until the property deduction is completely exhausted. Example: In 2020, Zhuravlev A.K. reached retirement age, but continued to work.

In 2020, he purchased an apartment worth 3 million rubles. At the end of 2020 (in 2020), Zhuravlev A.K. will be able to submit documents to the tax office at the place of registration to receive a property deduction for 2020, 2020, 2020, 2020 (since he is a pensioner and has the right to transfer the deduction). If the tax he paid for 2015-2018 is not enough to completely exhaust the deduction, he will be able to continue to receive it in subsequent years. Previously, the Tax Code contained a restriction according to which working (income-earning) pensioners could not transfer a property deduction.

However, on January 1, 2014, changes were made to the Tax Code of the Russian Federation that removed this absurd restriction. Accordingly, since 2014, not only pensioners who have no income, but also those who continue their working activities can take advantage of the right to transfer the property deduction to the previous three years. (Letter of the Federal Tax Service of Russia dated 04/28/2014 No. BS-4-11/ [email protected] , Letters of the Ministry of Finance of Russia dated 05/15/2015 No. 03-04-05/27966 and dated 04/17/2014 No. 03-04-07/17776). Since tax on income from pensions is not withheld (clause 2 of Article 217 of the Tax Code of the Russian Federation), pensioners who have only a pension as their source of income, in most cases cannot receive a property deduction when purchasing housing (letter of the Federal Tax Service of Russia dated May 15, 2013 No. ED- 4-3/ [email protected] , Letters of the Ministry of Finance dated June 29, 2011 No. 03-04-05/5-455, dated September 24, 2013 No. 03-04-05/39618).

An exception is the opportunity, under certain conditions, to transfer deductions to previous years , provided to pensioners by Federal Law No. 330-FZ of November 1, 2011.

Can a working and non-working pensioner return a tax deduction?

According to the law, people who have an official position with wages or other income, from which 13% are withheld, can apply for this.

If a person is of retirement age without a permanent job, and the main or only income is a budget payment (pension), then it will not be possible to return the money.

Exceptions are the following situations:

- sale of housing, shares and any other property;

- renting out living space or other premises.

If a pensioner does not have official earnings, but has income from this list, then he will definitely receive payments.

Attention! If a citizen has registered ownership of the purchased property 3 years after retirement and the last income tax deductions, then compensation is assigned to him.

How can pensioners get a tax deduction when buying an apartment?

When selling an apartment, everyone wants to return the 13% income tax due to citizens paying contributions (Tax Code of the Russian Federation). But do those who, due to their age, have stopped working, count on it? No payments are made from the pension, and the tax deduction when pensioners purchase an apartment is calculated for the early years.

Payments to the military are carried out like all people. However, if housing was purchased with money from the structures where the person works, it will definitely not be possible to return 13%. If you had to contribute your own money when purchasing real estate, then you can calculate the cost of the tax deduction for pensioners in 2020 from the amount paid personally. This is how the tax is reimbursed to police officers and people working in structures.

Rules and nuances

The main nuance of reimbursement of benefits for the purchase of real estate by a pensioner is the shortened tax period of 3 years. It is during this period that funds are compensated.

According to the legislation of the Russian Federation, there are certain rules for processing a tax deduction if a pensioner:

- rents out its property;

- sells personal property (apartment, house, car, etc.);

- receives another type of pension on which the law allows you to pay tax;

- has other income, for example, entrepreneurial activity, from which (personal income tax, VAT and others) are paid.

Thus, a pensioner does not need to work and have a white salary in order for the due compensation to be transferred to him.

Pre-retirement age

The problem with tax deductions was raised in financial departments. A citizen with wages subject to personal income tax has the right to a refund of the property deduction. Funds are paid over several tax periods until the entire claimed amount is compensated.

If there is additional income

Additional sources of income for a pensioner also give him the right to return preferential money. These sources include:

- sale/rent of property;

- presence of IP;

- pension from NPF;

- additional wages.

All this income is subject to personal income tax, which allows you to qualify for a refund.

For reference! When issuing compensation, it is necessary to take into account that its amount should not exceed the tax transferred to the state budget.

Stopped working

Different situations happen in life, and it may well happen that an elderly person stops working. At the same time, the citizen applied for benefits for the purchase of an apartment or house, but did not manage to return the entire amount. If he has not received all the compensation for the past 3 years, then the remainder will not be reimbursed.

For reference! Payments can be resumed only if the taxpayer has found an additional source of income or has issued a deduction for a spouse.

Property purchased before retirement

For any real estate purchased before retirement, a refund of benefits is issued, but only if the citizen has an official place of work with a salary.

Property purchased in the year of retirement

If a pensioner bought real estate before retirement or in the year of retirement, then you need to register funds for the previous years before the purchase.

Married

A spouse (pensioner) has the right to receive a deduction for housing acquired during a legal marriage (shared property) only if she has white earnings. If both spouses are officially employed, then the amount of compensation reaches 520 thousand rubles per family.

When they can refuse

There are a number of reasons why property deductions are denied:

- Filling out a declaration with errors or misinformation in the 2-NDFL certificate.

- The documents were submitted, but the inspector refused because... It is impossible to issue a deduction according to the legalized scheme.

- The housing was purchased at the expense of the employer, but according to the documents it is registered in the name of the employee.

- The purchase and sale transaction was carried out between relatives.

- The applicant is a non-citizen of the Russian Federation.

- Unofficial salary.

- When transferring a deduction.

Social benefits for pensioners

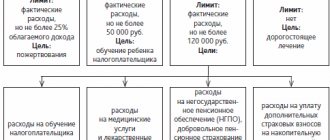

Social tax deductions can be issued:

- if tuition was paid (your own or your immediate family);

- when using paid healthcare services or purchasing medications;

- when transferring funds to charity;

- if funds are contributed for the purpose of voluntary pension insurance.

It is advisable to consider the specifics of processing social deductions using the example of reimbursements for treatment, since this is the option that is usually of interest to pensioners.

An important condition for receiving a deduction for treatment is that the medical institution must have a state license. Moreover, the deduction is provided only for those services that are contained in the legally established list. All of them are divided into two categories: conventional and expensive treatment.

| Options for deduction | Conventional treatment | Expensive treatment |

| Composition of dental services | Treatment, orthopedics, etc., except for expensive services | Implantation and prosthetics |

| Maximum deduction amount | 120,000 rubles | Limited to the amount of personal income tax paid last year |

| Maximum compensation | 15,600 rubles | 13% of personal income tax paid last year |

According to the law, social deductions include the following types of expenses of citizens:

- to receive services: educational;

- medical;

More on the topic Minimum pension from January 1, 2020

We discussed medicine above. A retired worker can apply for a social tax preference in the same manner. Non-working pension recipients are entitled to such a benefit only if they had taxable income in the reporting period (from rent or from the sale of real estate).

Hint: social preference is provided on a general basis.

A standard tax benefit is a reduction in the tax base at the place of duty on the grounds established by law. For example, if the applicant is raising a minor child. This is provided to pension recipients on a general basis.

For information: working pension recipients can apply for a standard relaxation.

Income tax refund when a pensioner purchases an apartment

To carry out this procedure, you must follow the step-by-step instructions:

- Prepare a package of papers and fill out a declaration. A receipt indicating the cost of finishing services (if necessary) is attached to the documents.

- Submit the documentation along with the completed Form 3-NDFL. Addressing is allowed to two authorities. If the pensioner works, then you can send it to the employer or to the Federal Tax Service.

- Documents are sent in several ways: in person, by mail and electronically. The tax service will review the papers for 3 months and another 1 month will be needed to transfer the money if the decision is positive. If the deduction is made through the employer, the funds will be received by the applicant after the authorization to receive payments is presented to the accounting department.

Documents required for registration:

- passport of a citizen of the Russian Federation;

- marriage certificate (if the property was purchased during a legal marriage);

- contract of sale;

- certificate of ownership;

- act of transfer of property into ownership;

- payment papers;

- declaration;

- certificate 2-NDFL about income;

- current account number;

- statement;

- mortgage agreement and interest payment schedule (for a mortgage);

- application from spouses to receive a deduction in equal shares.

The declaration is filled out in two ways:

- independently by hand;

- electronically through the “Declaration” program or the “State Services” website.

Form 3-NDFL, completed manually, is submitted to the tax office independently during a personal visit or by mail along with a package of documents. It is sent electronically to the Federal Tax Service website through the taxpayer’s account.

The tax authority transfers the money to a bank account or card in a one-time payment. The employer will pay monthly the funds that were previously withheld in the form of income.

How to get a job

To receive a tax deduction for a working citizen of retirement age, you need to collect a package of documents from the previously given list, submit it to the Federal Tax Service at your place of residence or to your manager and wait for a response.

How to return someone who is not working

For a non-working pensioner, the situation is a little more complicated: he needs to provide the income form required by law. Otherwise, no one will return the funds to him.

Is there a deduction for pensioners?

Since a pensioner is a privileged category of citizens, they are entitled to a deduction. At the same time, there are no restrictions; both working and citizens of retirement age who have not been working for several years can apply for cash payments. It’s just that the process of processing documents for these categories of citizens will be different. Find out what the social package includes here.

In what cases can you claim a deduction?

A person may qualify for a payment, or rather, a refund, if:

- He has an official income.

- He has documents confirming ownership (purchase and sale agreement).

- The amount of the payment made does not exceed 2 million rubles.

In the video, there is a tax deduction when purchasing an apartment for pensioners:

A pensioner can be returned at least 13% per annum, the calculation takes place over 3 years, that is, in the end, the maximum amount that an apartment owner can count on is 260 thousand rubles. Read about benefits for group 3 disabled children here.

If the cost of housing was less, but the apartment underwent additional renovation work, this must be clarified in the contract. You should also clarify when applying for a tax deduction when selling an apartment.

That is, if it is documented that repair work was carried out on the premises, but its cost was less than 2 million rubles, then you can count on a larger deduction amount.

Refunds will be made after a thorough check of the documents. In order to return the money you must:

- personally contact the inspectorate at your place of residence;

- to the accounting department for work (if the pensioner works);

- fill out a declaration;

- submit a document (agreement) confirming property rights.

Certificates and documents are collected with the help of tax officials, and if a person does not work, he will also have to confirm the fact that over the previous 3 years he paid an income tax of 13%. Read this material on how to apply for benefits for pensioners in paying utility bills.

This is a mandatory condition for a refund; if the fact of payment of income tax has not been confirmed, you can forget about the deduction.

How to calculate and get a refund?

If you have the appropriate documents, you must go to the Tax Service to receive a deduction. Find out about property tax benefits for pensioners at this link.

The amount of money returned is calculated in different ways. What needs to be done to return the allocated funds, the mechanism of action for a working pensioner:

- It is necessary to purchase residential property and complete all documents.

- Contact the accounting department and ask to issue a 2-NDFL certificate; it will confirm that the apartment owner paid income tax during the specified time.

- Contact the inspectorate at your place of residence or registration and fill out a declaration.

Watch the video on how to correctly calculate the payout:

You will also have to indicate the personal account number to which the funds will be credited. Because you won’t be able to get money in your hands. Deductions are not paid in this way, and funds are not credited to foreign bank accounts.

With pensioners who do not work, everything is much more complicated. Since the pension is a social benefit and is not subject to income tax.

Previously, until 2012, it was believed that those who did not pay income tax were not entitled to receive a cash payment. But since 2012, there have been changes in legislation and now pensioners who do not work can claim a refund of funds previously paid for years of work.

That is, if a person retired in 2013, and purchased an apartment in 2014, he needs to contact the Tax Service when receiving a document confirming the fact of acquiring ownership of the residential premises. This article will tell you what benefits children of the war of 1941–1945 are entitled to.

The calculation will be carried out only for those years that the person officially worked, so if you apply late, there is a high risk of encountering certain problems.

Action diagram:

- It is worth contacting the Tax Service with a document confirming the acquisition of the fat premises as property.

- Contact the accounting department at the place of work (where the person last worked) employment must be official, with confirmation of the fact of payment of income tax of 13%.

- Fill out the declaration in form 3NDFL.

- Provide a personal current account in any Russian bank.

As for non-working pensioners, it is quite problematic to draw up documents in their name, since it is not always possible to obtain maximum monetary compensation.

Therefore, if an apartment was purchased by a married couple in which one of the spouses is retired and officially works, then it is better to issue documents for a tax deduction for the apartment in his name.

The deduction can be obtained not only for those years that a person has already worked. But also extend it to the next 3 years, provided that dismissal is not planned. So the amount received will be greater. Because there is official income.

What tax authorities take into account when studying documents:

- The amount of income tax that was paid over the last 3 years while it was working officially.

- In what year did the person retire?

- At what time (year and month) the property was acquired and the transaction was concluded.

- Who is the owner of the residential premises?

Some examples of payment calculations:

- If a citizen became a pensioner in 2013, and purchased residential premises a year later, that is, in 2014, then it is worth contacting the tax office in 2020, and submitting a certificate for the period from 2011 to 2013, when the owner was officially employed. Paid income tax at 13%. In this case, no time is wasted and you will be able to receive the maximum cash payment.

- But if a person retired in 2012, purchased apartments in 2014 and submitted documents in 2020. Then they will give him a certificate not for 3, but for 2 years (2011 and 2012).

A similar scheme for non-working pensioners involves transferring payments to an early date, but not more than 3 years. That is, if you worked in 2010, and purchased an apartment in 2020, you should not count on receiving a deduction.

If the year of a citizen’s retirement and the year of registration and receipt of property documents coincide (2016), then it will be possible to take advantage of the benefit for another 3 years, it will be calculated from 2020 and until 2020 you can receive compensation in full.

But the Tax Service may refuse to receive funds. If the person did not have an official income or the period for receiving benefits has already expired. The decision is made within 3 months, this time is enough to review, process and verify the submitted documents.

Property tax rates

The amount of refunded funds directly depends on the Tax Code: the document states how much a citizen is entitled to. The maximum amount of payments is 13% of 2 million rubles - 260 thousand. A person receives this amount when applying for compensation for the purchase of a home.

There is another figure established by law - 3 million rubles. The applicant will receive a limit of 13% (390 thousand) of this amount in case of purchasing residential premises with a mortgage. In this situation, the taxpayer is entitled to a mortgage interest refund.

There is one more point in receiving money: dividing tax funds between spouses in equal shares or according to the deed. The amount will be 520 thousand rubles per family.

How to get a tax deduction for a pensioner when buying an apartment

- up to 2 million rubles paid to the seller under a housing purchase and sale transaction. That is, the maximum personal income tax refund amount will be 260 thousand rubles. If the contract price is below 2 million, then the contract amount is taken into account, if above 2 million, then the tax base is 2 million rubles;

- up to 3 million rubles in interest for loans and credits issued for residential real estate. It is possible to receive no more than 390 thousand rubles from the budget.

Sending is possible electronically from your personal account on the Federal Tax Service website. You can send not only a 3-NDFL declaration, but also an application to confirm the deduction, an application for a tax refund and attach copies of electronic documents. To do this, you need an electronic signature (if the taxpayer does not have his own multidisciplinary electronic signature verification key certificate, then on the tax service website you can order an electronic signature for tax document flow). The deadlines for approval and payment of property deductions may be violated. Therefore, it is necessary to record the moment of submission of documentation to the inspection and the composition of the documents (so that the Federal Tax Service cannot deny the fact of submission).

The inspector must be required to mark the submission of documentation. It is placed on a copy of the declaration. But it is better to prepare a cover letter that reflects the entire list of documents.

You should write a separate cover letter for each package (annual).

- Territorial tax office, to which a package of documents is submitted for deduction;

- Full name, INN, address (according to registration), contact telephone number of the taxpayer;

- This rule of law is always indicated;

- The year for which the tax is being reimbursed is indicated;

- An unchangeable indicator for any taxpayer, regardless of region;

- Same as in the declaration;

- Same as in the declaration;

- In the vast majority of cases, this is the name of the taxpayer's bank account;

- Details can be ordered from the servicing bank;

- In addition to your full name, it is necessary to indicate the full details of your passport;

- It is better to put the date the same as in the declaration.

It happens that some deductions have already been declared earlier and refunds have been received from the budget. Then you will have to declare “housing compensation” in the so-called clarifying 3-NDFL. The fact that it is clarifying can be judged by the numbers in the column “Adjustment number on the title page (the initial declaration has the number “0”, all other numbers indicate the number of clarifications, for example, we put 1 means there is only one adjustment, if we put 2 it means the report is being corrected for the second time, etc.). The deduction package can be sent by registered mail with a list of attachments. In this case, delivery is carried out by any postal institution (Russian Post, courier services, etc.).

The date of presentation to the Federal Tax Service will be the date on the postal receipt. The sent package should be submitted in notarized copies (this will ensure the authenticity of the documents and will remove many questions from the Federal Tax Service). In this case, copies of documents for the apartment are submitted at a time on the first application, minus the deduction. Refund of money when buying an apartment for a non-working pensioner