Who will not receive a tax deduction?

A citizen of the Russian Federation cannot claim a tax deduction in the following cases:

- does not pay personal income tax;

- an individual entrepreneur conducts his activities under a special taxation regime that exempts him from paying personal income tax (applies to part of the income received in the course of conducting this type of activity).

Citizen Belyakov B.B. has unofficial income - personal income tax is therefore not paid. In 2020 Belyakov B.B. underwent a course of paid treatment. In 2020 and beyond, for the provision of tax deductions Belyakov B.B. cannot claim, and even if it does claim, the tax authorities will refuse a tax deduction.

What can you get a tax refund for?

The Tax Code provides for 3 types of refunds: standard, social and property tax deductions.

Standard deductions are regulated by Article 218 of the Tax Code of the Russian Federation. According to the legislative norm, the return of the established funds is carried out by the tax agent - the employer, by reducing the amount of money withheld. Tax costs for victims of the Chernobyl accident and those injured in other nuclear disasters or as a result of atomic weapons testing are reduced by 3 thousand per month. Budget contributions for disabled military personnel are reduced by the same amount.

This is interesting: Mil ru housing for military personnel

The tax burden for disabled people of groups 1 and 2, disabled people from childhood, heroes of the USSR and Russia, residents of besieged Leningrad, liquidators of the Chernobyl accident is reduced by half a thousand rubles.

For families with children, a tax reduction is also provided: 1 thousand 400 rubles per month at the birth of the first and second child, 3 thousand rubles for the third and subsequent ones. That is, parents with 4 children pay 8 thousand 800 rubles less to the state than couples without children. Adoptive parents also have the opportunity to reduce their tax burden. The state returns 12 thousand rubles per month if a family has a disabled child.

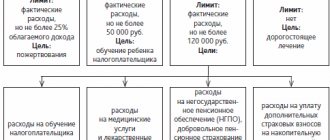

The return of social deductions is determined by Article 219 of the Code. However, unlike the standard, the amount of compensation is determined based on the tax already paid: 13 percent on income. According to the provisions of the Law, funds can be returned for charitable activities, when using paid educational services, as well as when receiving paid medical care.

Art. 220 of the Code makes it possible to return part of the funds spent on the purchase of real estate

Why can they refuse to receive a tax deduction?

Tax authorities do not always make positive decisions regarding the provision of tax deductions.

Refusals to provide a tax deduction may be due to a number of reasons:

- not the entire package of documents has been provided;

- documents were submitted to the Federal Tax Service at a location other than the taxpayer’s place of registration;

- there were errors in the documents;

- documents have been provided to pay for the treatment of persons who do not fall into the category of relatives specified in the legislation.

Questions and answers

- I want to submit documents to receive a tax deduction through government services, but I do not have an electronic signature. Can I do this without a signature?

Answer: Unfortunately, without certification of the tax return with an Enhanced Non-Qualified Electronic Signature, the document cannot be sent to the tax office, and therefore you will have to take care of obtaining UNEP, or use another method of submitting documents to the Federal Tax Service.

- Can I simply fill out the 3-NDFL declaration on the government services website without sending it?

Filing an application for a tax deduction through State Services allows a person to declare his right to a refund of 13% of his own official income. This format of application simplifies the procedure and saves time. However, when submitting it is necessary to take into account a number of important nuances.

What compensation is due?

The most popular types of compensation are:

- standard - for disabled people, military personnel, parents of children (up to 18 years old) and persons who have reached the age of majority (up to 24 years old) who are in stationary training;

- social – for citizens who are able to justify the costs (their own and those of their immediate relatives) for education, treatment, charity, contributions to the Pension Fund, etc.;

- property – for those purchasing housing stock, including mortgages.

This is interesting: Additional leave for long service

Some entrepreneurs whose professional activities are included in the relevant list provided for by law have the right to apply for a tax deduction through the State Services.

Registration procedure

So, let’s say that a person has registered on the State Services portal and has a digital electronic signature. What should he do in this case to receive a tax deduction? The step-by-step instructions in this case will be as follows:

- Log in to the site. To do this, you will need to enter your mobile phone number and password. Authorization via SNILS is also available.

- In the catalog of services, through the categories, select the “Taxes and Finance” section. And in the window that appears again, click on the “Acceptance of tax returns (calculations)” section.

- In the window that appears, click on. Next, a page will open with a detailed description of the service. The mode of provision of the service (without restrictions), cost (the service is provided to all citizens free of charge without exception) is indicated here. Step-by-step instructions for further actions and possible ways to send the declaration are also written here. After reading all the conditions, click on the “Get service” button.

- Next, you will have to install a special program on your computer to fill out the 3-NDFL form. After entering all the information, you will need to upload the declaration to the portal, sign it with an enhanced qualified signature and confirm sending.

In the future, a notification about the status of the document will be sent to your personal account and email. If everything is filled out correctly, the user will be able to receive the deduction due to him. And you don’t even have to go to the tax office for this. This convenient format of work has already been appreciated by many users and sent 3-NDFL through the State Services portal.

Unfortunately, for those who do not have their own digital signature, the online declaration service is not available. More precisely, a person can fill out the form fields in the program and even print it. It’s just that you won’t be able to submit a package of papers completely remotely. You will still have to go to the Federal Tax Service or send the papers by mail.

This is important to know: Grounds and procedure for removing an employee from work

A tax deduction is an obligation of the state to a citizen to partially compensate him for taxes paid or to allow him not to pay them on part of the income received. But this opportunity is not provided for all variations of taxes, but only in strictly limited cases.

And, by the way, now you can apply for a tax deduction through Gosuslugi, literally without leaving your home.

Tax deduction through Gosuslugi: how to apply?

Ways to receive a deduction

There are several ways to get a property tax deduction, these are:

- online application on the single portal of the State Service;

- personal visit to the Federal Tax Service;

- online application on the Nalog.ru website.

They all have their pros and cons, so let's look at each one separately.

Through State Services

So, how to apply for a deduction for the purchase of housing on a single portal? It's simple, you will need:

- scans of all documents;

- enhanced qualified signature;

- confirmed ESIA account.

If the latter does not exist, then we will figure out how to create it. You need:

- Open the official website of the single portal of State Services and click on the button at the top of the “Personal Account” screen.

- Select the registration procedure.

- Enter personal information and contact information.

- Create and enter a password in the special field.

- Confirm.

- Open the specified email inbox and activate the link in the letter.

- Return to the single portal.

- Go to your personal account by clicking on the “Personal Account” button.

- Go to the “My data and contacts” section and edit your profile by adding information to the empty columns.

- Wait about 15 minutes while the system checks the correctness of the information you entered.

To access all services, all you have to do is pass personal identification using one of the following methods:

- at the customer service center;

- using an enhanced qualified signature;

- through online banking (Tinkoff, Sberbank or Post Bank);

- by registered mail.

As soon as “Verified account” appears next to your name in your profile, you can begin filing 3-NDFL. For this:

- Open the “Services” tab on the main page of the site.

- Find the “Taxes and Finance” section and the “Receive Tax Returns” option.

- Click on the link “Acceptance of declarations for individuals (3-NDFL)”.

- Check the box next to “Form online” and click on “Get src=”https://gosgo.ru/wp-content/uploads/2019/08/sformirovat-deklaraciyu-onlajn.png” class=”aligncenter” width=”1181 ″ height=”403″[/img]

- Decide on the year for which you want to receive a deduction. The following are available for 2020: 2020, 2020, 2020, 2020.

- Enter information about yourself: taxpayer category, full name, tax identification number, telephone number, date and place of birth.

- Please indicate your citizenship status.

- Enter your passport details and select a branch of the tax office.

- Indicate all sources of income for the selected period.

- Click on the tab with the corresponding property deduction.

- Add information about the property: method of acquisition, type of property (for example, apartment), room code, address of the property, date of registration of property rights, cost (or interest on loans).

- Check the completed application again for any inaccuracies.

- Attach scans of documents certified with an enhanced electronic signature.

- Confirm and submit your application.

Important. The waiting period for a decision will be 3 months. Therefore, you should be patient.

Who can claim a tax deduction?

According to current legislative measures, citizens who meet the following requirements can apply for a tax deduction:

- Citizenship – Russian Federation only (a valid passport is required);

- availability of TIN certificate;

- a person pays personal income tax;

- the citizen is not an entrepreneur or an individual who does not pay personal income tax (these are entrepreneurs using the simplified taxation system).

Non-residents of the Russian Federation, accordingly, cannot claim such payments.

Make an appointment

If for some reason a citizen cannot submit a declaration through the Federal Tax Service website (for example, there is no electronic signature), then deductions can be obtained after personally submitting an application to the tax office. To make an appointment for an individual appointment with the Federal Tax Service, the taxpayer must log in to the State Services portal, then:

- open the item “Acceptance of tax returns”;

- in the section for choosing a treatment option;

- then go to the “Make an appointment with the Federal Tax Service” page.

An example of a declaration in form 3-NDFL. By the way, it changes slightly every year.

Can they refuse to provide a deduction and why?

A tax deduction may be refused only in the following cases:

- Incorrect completion of 3-NDFL (if submitted through State Services). To check the correctness of filling out the declaration, you can use special online services. It's free.

- Incorrect information provided. Moreover, even a spelling error in the application can be regarded as unreliable data. But the form for applying for a tax deduction can be downloaded from the State Services website and filled out at home. The tax office will only sign to accept the document for consideration.

- A citizen does not belong to the category of taxpayers who have the right to receive a deduction. In this case, you can request a written explanation of why the authorized representative of the Federal Tax Service made such a decision. It is not prohibited to re-submit an application.

- The citizen is a non-resident of the Russian Federation. Even if he pays taxes, this does not mean that he can demand payment.

- Application not at the place of registration. That is, submitting an application to the representative office of the Federal Tax Service, which does not maintain fiscal data about the citizen. This often happens when applying through State Services, since many taxpayers simply do not know which branch they need to contact.

- More than 3 years have passed since the event giving the right to accrue the deduction. A citizen has the right to apply for payments for income and expenses that were made earlier (and even last year). But if more than 3 years have passed, then the right to claim is lost.

In all of the above cases, the taxpayer may require clarification. For individual consultations, he can contact any of the branches of the Federal Tax Service or use the services of social lawyers (provided by the state).

Now documents for deduction assignment can be submitted to the MFC

Property tax deduction when buying a home in 2020: changes, clarifications

A property deduction in 2020 can be issued through the tax office only for real estate purchased before the beginning of 2018.

CONTENT:

The tax deduction for real estate purchases changed significantly back in 2013. These changes came into force on January 1, 2014 and are also valid for the current year 2020. Namely:

- The tax deduction in 2020 is limited to 2,000,000 rubles, as it was since January 1, 2008, but from January 1, 2014, this limitation now applies not to the object of acquisition (house, apartment, room, land plot or share in them), but subject. That is, 2,000,000 rubles are now provided per person/taxpayer, while a deduction can be claimed for several objects of acquisition until their total value reaches 2,000,000 rubles. Until 2014, a deduction could be claimed only for one purchase item with a limit of 2,000,000 rubles, without the right to add a deduction for the next purchase, even if the price of the first was less than 2,000,000 rubles. Example No. 1: an apartment was purchased for 500,000 rubles and a house for 1,700,000 rubles in 2012. Deduction, optionally, from only one acquisition item. In this case, it is more profitable to receive a deduction for the house than for the apartment. Example No. 2: an apartment was purchased for 500,000 rubles and a house for 1,700,000 rubles in 2020. A deduction will be provided for both house and apartment in the amount of up to 2,000,000 rubles.

- The deduction for mortgage interest is limited to RUB 3,000,000. Thus, if previously the taxpayer received 13% of all expenses for paying mortgage interest, now there is a limit beyond which a deduction will not be provided.

Please note that these changes only apply to:

- those who did not receive a deduction for real estate, the rights to deduction for which arose before January 1, 2014. Example: real estate was purchased for 500,000 rubles under a sales contract in 2013 and the ownership was also registered in 2013. In 2020, real estate was purchased for 1,700,000 rubles. If you applied for a deduction for your first property, then you exercised your right to a deduction under the old legislation (deduction from one property, regardless of the cost) and you can no longer receive a deduction for real estate in 2015.

- that real estate for which the right to deduction arose after January 1, 2014. Example: real estate was purchased in 2012 for 1,000,0000 rubles according to the DDU, the transfer acceptance certificate was signed in 2013, the taxpayer applied for the deduction for the first time in 2016. When registering a deduction for this property, there will be no right to a deduction when purchasing the next one, since it is not the year of applying for the deduction that matters, but the year when the right to a tax deduction arose. In the described case, the right to deduction arose in the year of signing the transfer acceptance certificate.

Amount of tax deduction when purchasing real estate

The amount of property deduction depends on a number of factors:

- The refund is 13% of the value of the property under the contract, but not more than 260,000 rubles, if the right to deduction arose after January 1, 2014 (before 2014, the limit was 130,000 rubles). Example No. 1: real estate costs 5,000,000 rubles. Deduction of 260,000 rubles Example No. 2: real estate costs 1,500,000 rubles. Deduction 195,000 rubles

- Every year you can return no more than 13% of annual income, subject to personal income tax of 13% (subject to the limitation of the first point). Example : salary for the year is 1,000,000 rubles. The price of the apartment is 1,500,000 rubles. Over the course of a year, you will be returned 130,000 rubles (13% of your annual salary). Balance – you will need to register for the next year to receive the remaining amount.

Exception: deduction from dividends, although 13% of personal income tax is withheld from them, is impossible.

Read more: Property deduction for shared ownership

Read more: Property deduction for joint ownership

Tax deduction for mortgage in 2020

Features of applying the property deduction when purchasing real estate with a mortgage in 2020:

- If the right to deduct on real estate arose after January 1, 2014, then the amount of deduction for mortgage interest is limited to 3,000,000 rubles.

- If the right to deduct on real estate arose before January 1, 2014, then the amount of deduction for mortgage interest is not limited and amounts to 13% of these expenses.

- Since the amount of the deduction directly depends on the amount of income received for the year, and more than the personal income tax withheld from income will not be returned, it makes sense to declare the deduction for a mortgage in the year the balance of the main property deduction is received. Collecting mortgage documents from the bank every year, which will take time, is pointless if your income does not even cover the basic property deduction. It’s simpler: in the year you receive the balance of the main deduction, collect documents from the bank from the start of lending to the end of the previous year and submit them all at once. Example No. 1: income for 2020 is 1,500,000 rubles, personal income tax is 195,000 rubles. The cost of the apartment is 2,500,000 rubles (which means you can return 260,000 rubles of the main property deduction), and there is also a mortgage. In 2020, when claiming a deduction for 2017, only 195,000 rubles will be returned, so there is no point in indicating a mortgage deduction, since 195,000 rubles is only part of the main deduction and there is still a balance of 65,000 rubles, which can be returned to next year. Example No. 2: income for 2020 is 2,500,000 rubles, personal income tax is 325,000 rubles. The cost of the apartment is 2,500,000 rubles (which means you can return 260,000 rubles of the main property deduction), and there is also a mortgage. It makes sense to apply for the main property deduction and the mortgage interest deduction in 2020 when applying for 2017.

Read more: Property deduction for a mortgage

At what point does the right to deduction arise?

Many believe that the right to deduction arises in the year of signing the purchase agreement, others - in the year of full payment under the agreement, and still others - in the year of full repayment of the mortgage. In fact, none of the described options is correct.

The right to a tax deduction arises:

Read more: Procedure for registering a property deduction

For which years in 2020 can you get a property deduction when buying an apartment?

There are a number of signs you need to know about property deductions:

- We determined the moment of emergence of the right above (see 1 paragraph above). Now you need to know when the right to a deduction disappears: the right to a property deduction never disappears. Even if the property was purchased in 2003, and you apply for the deduction only in 2020, you still have the right to it (subject to the restrictions in force in 2003, that is, at the time the right arose).

- The deduction can be issued from the year in which the right to a property deduction arose. For the years preceding the year the right arose, a deduction is not possible (with the exception of pensioners. They can apply for a deduction on the income of the past 4 years: in 2020, they can apply for a deduction on income from 2014-2017, if the right to a deduction arose before January 1, 2020) . Example No. 1: Real estate was purchased under a contract of agreement concluded in 2013. The transfer and acceptance certificate was signed in 2020. The deduction is issued for 2017. Example No. 2: Under a purchase and sale agreement concluded in 2020, real estate was purchased. Property from 2020. Property deduction in 2020 is issued for 2020 and 2020

- A property tax deduction in 2020 can be issued for income in 2020, 2020, 2017 (for pensioners - also 2014). If the entire deduction is not received, you can continue to apply annually. Example: Real estate was purchased under a purchase and sale agreement concluded in 2007. Property from 2007. The taxpayer applied for a deduction in 2020 - a deduction for income 2015-2017. The right to deduction for income 2007-2014 has already been lost, but the right to deduction has not been lost.

Deadlines for applying for a tax deduction in 2020 and the deadline for refunding funds

You can apply for the deduction at any time during 2020. If you submit it to the tax office in person, pay attention to the office hours.

The deadline is until April 30, 2020, only for those who, in addition to wanting to claim a property deduction, are required to report income from which personal income tax is not withheld (for example, the sale of a car whose ownership period was less than 3 years).

It is necessary to fill out the 3-NDFL declaration for property deduction, attach a set of documents confirming the right to deduction, and submit it to the tax office at the place of registration.

After delivery, a desk audit takes place within 3 months. If the decision based on the results of the desk audit is positive, then after another 1 month the money will be transferred to your account if you submitted an application for a personal income tax refund along with the declaration (if you submitted the application after the audit, then 1 month is counted from the date on which the application was submitted).

What to do if refused?

There are only two options: correct the mistakes made or assert your rights through the court.

Table. Actions recommended by lawyers when receiving a refusal

| Cause | Recommended Action |

| Unreasonable refusal (no explanation) | Going to court |

| Illegal refusal (for example, insufficient circumstances to qualify for a tax deduction) | Contacting the Federal Tax Service for the region |

| The submitted package of documents is not sufficient | Request in writing a list of required documents, resubmit the application |

| They charged less than they should have | Submit an application to initiate an internal audit, and then contact the regional Federal Tax Service department |

In total, a tax deduction is a partial refund of taxes paid for personal income tax. Only citizens of the Russian Federation with a valid passport who pay personal income tax for individuals can receive it. You can submit a declaration, as well as make an appointment with the Federal Tax Service, through “State Services” - this is the most convenient and fastest option for processing a tax deduction.

Video - How to fill out the 3-NDFL declaration online and show a tax deduction in 2020?

Any working citizen over the age of 18 pays 13% of his salary to the state treasury. This type of deduction is called income tax.

Expert opinion

Kurtov Mikhail Sergeevich

Practitioner lawyer with 15 years of experience. Specializes in civil and family law. Author of dozens of articles on legal topics.

But there are situations when part of this tax can be returned to the citizen. To do this, you need to draw up a statement according to which the funds will be redistributed.

There are several ways to complete such an application. The taxpayer can personally visit the tax authorities, submit an electronic application using the Federal Tax Service website, or apply for a tax deduction through the State Services Internet portal.

Step-by-step instruction

The procedure for filling out an electronic application will not take much time. You just need to follow the instructions provided. First you need to answer the question of whether you are a user of the site. If you do not have an account, you must register in the system. Follow this algorithm:

- In the search bar, enter the address of the official website of the state portal: www.gosuslugi.ru. You can also enter the request in Russian: “Government services official website.” The main page should open. Now you need to find the “Register” button. It's on the right side of the screen.

- Next, a form will appear to fill out. Enter the requested information: personal and passport details. Don't ignore this registration step. Otherwise, the personal profile will be considered partially completed. The functionality of the site will be limited.

- In the “Login” line, the site will ask you to display your mobile phone number or email address.

- If all data has been filled out correctly, the user will receive an SMS message. It will contain a special code required to confirm registration. Enter the resulting combination in the appropriate lines.

- The entered data is sent to government agencies for verification. The automatic verification process usually takes no more than 10 minutes. In some cases it may take a little longer. Wait until registration is completed.

If you are already a user of the site and have previously registered, then you will need to log in. On the main page, find the account login form, enter your username and password. If entered correctly, your personal account will open. Next you need to follow this algorithm:

- On the main page of the portal, click the “Services” link. You can find it at the top of the screen.

- A list of government services will appear in a pop-up menu. From the list you must select the link to taxes and finance.

- A section with popular services will open. Here you should find a button for accepting tax returns. On the page that opens, the system will offer service options: electronic and non-electronic. In this case, you must select the first option.

- Information about the service completion time will appear on a new page. It is performed in real time. There is also information here that there is no charge for the provision of the service.

- Next, select the line where you are asked to fill out the declaration online. Click the button to receive the service. It is located in the upper right corner of the screen.

- It should be noted that this type of declaration is generated for one calendar year. Therefore, it is only possible to issue the document once a year.

- The next step is to indicate the period for which the report will be completed. According to the law, tax can be refunded for the last three years. Select the button where you are asked to fill out a new declaration.

- When you issue an electronic document, the State Services website will transfer your personal data from your profile. This will somewhat speed up the process of obtaining an electronic certificate. However, the transferred information must be checked to avoid errors in the future.

If the data transfer did not occur, then fill out the following lines yourself:

- passport details;

- address (you can indicate the place of temporary registration).

Important! Sometimes there is not enough information to complete the application. In this case, part of the entered data can be placed in the “Draft” folder. When you are ready to continue filling out, return to the saved form.

Now you will need to fill out your income information. In the form, enter your income for the year that you selected at the previous stage of registration.

Detailed information about your own earnings can be taken from the 2-NDFL certificate. This document is prepared by the employer at the request of the employee.

You should prepare an electronic copy of the issued certificate in advance. It will be attached to the completed tax deduction application form. The certificate is a supporting document and can only be issued to an officially registered employee.

You will then need to display deduction information. Indicate the types for which the application is being submitted. For example, if you plan to receive a deduction for the purchase of an apartment, you will need to provide information about the purchased property.

After filling out the proposed form, you will need to calculate the amount that will be credited as a refund. There are the following functions available for filling out form 3-NDFL:

- make a download;

- perform export;

- prepare the file for sending.

The very first option should be chosen by those who plan to submit information during a personal visit to the Federal Tax Service. The second function will help you save the file in a special format.

Expert opinion

Kurtov Mikhail Sergeevich

Practitioner lawyer with 15 years of experience. Specializes in civil and family law. Author of dozens of articles on legal topics.

The system will offer to create an application for a tax refund. It is impossible to complete this procedure on the portal. You will be automatically redirected to the Internet resource of the Federal Tax Service.

Then you need to start sending documentation. The system will offer several options for filing a declaration:

- filling out a new declaration in real time;

- sending a form filled out in the program;

- installation of a program for filling out a declaration.

Ready reports can be sent using the Federal Tax Service website if the user is the owner of the electronic signature. Registration of a key certificate is possible on the Internet resource nalog.ru in your account. Next, you need to select a link to receive an electronic signature. The system will tell you in detail about this functionality.

The issued certificate is stored on the owner’s computer or in a special storage facility of the Federal Tax Service. The certificate is valid for one year. After time has passed, it needs to be replaced.

At the final stage, you need to upload the prepared documentation in xml format into a special field. Wait for information that the tax return has been received by the tax authority. The corresponding notification will be received in real time.

How to get a tax deduction through State Services and MFC

Often people face financial difficulties after purchasing a new apartment; during this period, every penny counts.

You need to pay off debts, make repairs, and don’t forget about everyday expenses. In this case, a tax deduction from the purchase of real estate comes to the rescue. In 2020, you can submit an application through the State Services website or an MFC branch.

What can you get a tax deduction for in 2020?

- for transactions made as a result of the purchase and sale of real estate (apartments, houses, cottages, etc.);

- housing purchased with a mortgage

- for children;

- for education;

- for treatment and medications;

- pension tax deduction;

- deduction for charity.

For what property transactions can you get a deduction?

A citizen who regularly pays taxes, i.e. is a taxpayer according to the TIN certificate, has the right to submit an application to the Federal Tax Service for a refund of tax deduction in relation to:

- real estate sales;

- real estate purchases;

- construction of housing or purchase of land for these needs;

- if a transaction has been carried out to purchase real estate from a taxpayer for the needs of the state and municipalities.

How to get a tax deduction when buying an apartment in 2018

Tax deductions for the purchase of an apartment, including a mortgage, according to the legislation of the Russian Federation, relate to property deductions; in 2018, you can submit an application to the Federal Tax Service:

- via the Internet in electronic form (State Services);

- at a personal reception in ;

- at a personal reception at the tax office at your place of residence;

- through the taxpayer’s personal account.

Read also: How to obtain certificate form No. 8 from the MFC

By submitting an application to the Federal Tax Service through your personal account on the State Services website, or a branch of a multifunctional center, you can return up to 13 percent in real money from the value of the property.

How to apply for a tax refund through State Services

Step 1. You must have a confirmed ESIA account (third level) and use it to log in to your personal account on the State Services website.

Step 2. Go to the “Taxes and Finance” section, click on the “Acceptance of declarations” tab, then “Submit Form 3-NDFL”.

Step 3. Next, select online declaration generation. If you are submitting 3-NDFL for the first time, please fill out a new declaration; when using the service again, click continue entering information into the existing form.

Important!

Step 4. Once you fill out the document, click the “Submit” button, the electronic application will be sent to the tax service automatically.

The official website of the Federal Tax Service at the link www.nalog.ru/rn39/program//5961249/ contains a special tool that allows you to check the correctness of entering information; the program will automatically generate declarations in forms 3-NDFL or 4-NDFL and check for errors.

How to register with the Federal Tax Service through State Services

Now you need to make an appointment with the tax office, the procedure is available from your personal State account at the link www.gosuslugi.ru/10054/25, in the “Select type of receipt” section, then follow the link “Make an appointment with the tax office.”

While at the tax office, you must fill out an application confirming the taxpayer’s right to a refund of property tax deductions; a sample form can be downloaded in advance.

More detailed information and procedures can be obtained on the official website of the Federal Tax Service:

- refund of deduction when purchasing an apartment;

- refund of deduction when selling an apartment.

How to submit tax deduction documents through the MFC

Recently, multifunctional centers have been closely interacting with government agencies, including the Federal Tax Service.

Read also: How to obtain and restore a death certificate at the MFC

Step 1. To apply for a tax deduction through the MFC, you must make an appointment in advance, or come to the nearest office and receive an electronic queue coupon at the terminal.

Step 2. Submit a tax return in form 3-NDFL, the procedure and list of required documents are specified in the instructions;

Step 3. Together with a specialist, fill out an application for the return of a property deduction according to the sample (provided at the MFC);

Step 4. Track the status of the application using the application number in the document acceptance receipt;

Step 5. At the appointed time, arrive at the Federal Tax Service with an identification document (passport).

Application consideration period

Employees of the Federal Tax Service of Russia, after receiving the necessary documents and an application for a tax deduction from an individual, must make a decision to provide payment to the applicant or not - within 3 months.

A positive decision will be the fact of transfer of funds to the applicant’s bank account. In case of refusal, a statement indicating the reasons will be sent to the taxpayer.

In 2020, at the initiative of Russian President Vladimir Putin, a tax amnesty was introduced for debts against individuals and legal entities.

What to do if you are denied a tax deduction

If for some reason you are denied a tax deduction refund and the reasoned refusal in the act does not seem legal, you have the right to appeal the procedure through:

- higher-level Department of the Federal Tax Service for the region;

- the central office of the Federal Tax Service in Moscow;

- through the court.

Before starting the process, we recommend that you consult our lawyers for FREE by phone:

You can also order a call back through the online consultant form on the website.

Deadlines

Funds will be transferred to the bank details that were reflected when completing the application. The transfer of the deduction is carried out after completion of the desk audit, which lasts about three months. After this, it will take another month to transfer funds.

Important! The payment of a tax deduction will be denied if the citizen has debt obligations to the Federal Tax Service. You can count on receiving government payments only after the debts are closed.

Registration of a tax deduction is a fairly popular service on the state portal. Thanks to the State Services website, the application can be completed quickly online.

Every citizen of the Russian Federation who receives income is taxed at a rate of 13%. A certain category of citizens has the right to a tax deduction, which provides for the possibility of returning previously paid income tax, for example, in connection with the purchase of an apartment, expenses for treatment, education, etc.

To receive a tax deduction, you must collect a package of documents and submit an application, which will result in a redistribution of funds . This can be done by contacting the tax office or remotely through the government services portal.

Tax deduction through government services provides significant time savings, so we will consider this option in detail.

Thanks to having an account on the State Services portal, you will be able to carry out all the manipulations of filling out and submitting documents to receive a tax deduction without visiting the federal tax service. You will also need an electronic digital signature .

It is enough to have an unqualified electronic signature, which is issued free of charge for a period of one year. We described how to obtain an electronic signature for a government service website in a separate article.

So, we bring to your attention a step-by-step guide on how to apply for a tax deduction through the State Services portal.

- Important

Receiving a tax deduction is possible only if the applicant is officially employed and income tax is withheld from his salary.

How to get a property tax deduction through State Services

The electronic portal of State services is a convenient way for citizens to interact with official bodies. Users of the service do not need to visit the offices of federal services, stand in queues, or waste precious time.

Remote service allows you to receive services at a convenient time from anywhere in the world where there is an Internet connection. Registration of tax deductions through State Services is one of the most popular options of the web resource.

Rules for obtaining a property deduction

By purchasing an apartment, house, plot or other housing, citizens can reduce the amount of personal income tax (NDFL) they pay. The benefit is provided by reducing income (tax base) by the purchase amount and interest paid on loans and credits, if the property was purchased with borrowed funds. There are two ways to receive a property deduction:

- Submit reports to the Federal Tax Service (FTS) at the end of the year and return the tax collected during the financial period. Supporting documents are provided along with the annual report.

- After purchasing real estate, receive a notification from the Federal Tax Service about the right to a property deduction and not pay personal income tax from your employer without waiting for the end of the year. The package of documents confirming the purchase is submitted to the inspectorate at the place of residence along with an application for notification.

The second option for obtaining a tax deduction when purchasing an apartment through State Services is not issued and will not be considered within the framework of the article. The following is the sequence of steps to return income tax by filing an annual return.

Step-by-step instruction

The sequence of actions for income tax refund through the electronic portal consists of several stages.

Step 1. Registration

The reporting service is available only to registered users. If you do not have an account on the portal, you must register. The process includes filling out a form on the State Services website and confirming your identity at any service center.

You can go to the registration window using the link on the main page of the gosuslugi.ru portal.

To create an account, the user must specify:

- last name;

- Name;

- contact number;

- email.

After clicking the “Register” button, a digital code will be sent to the specified phone number. Entering the verification numbers will complete the procedure.

Reference. To enter the site, you will need to create a password. SNILS (after filling out the profile) or phone number is used as a login.

Step 2. Obtaining 2-NDFL certificates

You must report on all taxpayer income for the year. To enter information correctly, salary certificates from all employers are required. Form 2-NDFL is issued to the employee upon his request by the enterprise’s accounting department.

Information on income must be obtained from all sources of payments (from banks, lottery organizers, brokerage houses, etc.). Information on transactions between individuals who are not entrepreneurs is entered on the basis of agreements, contracts, agreements, certificates of invoices.

Step 3. Filling out the declaration

Annual report on personal income tax - form 3-NDFL. An electronic version of reporting is created using special programs. There are two software tools distributed free of charge by the tax service:

- "Declaration";

- "Taxpayer Legal Entity".

Both programs can be found on the official website of the Federal Tax Service nalog.ru.

Healthy! The State Services website offers to download the “Taxpayer Legal Entity” application.

But this software package is designed for company accountants, in which 3-NDFL is just one report out of a huge number of forms offered for completion.

The “Declaration” program is better adapted for ordinary citizens. It has a user-friendly interface; you do not need to have any special knowledge to use the application.

Once the file is ready, it can be uploaded to your personal account of the State Services and sent to the inspection.

Another option is to fill out a report on the website.

Filling out annual personal income tax reporting using the Declaration program

Unlike the “Legal Taxpayer” program, the “Declaration” program is designed for a specific report and only for one year. That is, each financial period has its own version. You need to download the option that suits the taxpayer. For example, to report for 2020, download the “Declaration 2017” program.

To fill out the form correctly, you need to enter information into the sections sequentially. In the program they are located on the right side of the window. Some tabs open only after specifying certain information. For example, the “Entrepreneurs” section will become active if you confirm the presence of income from business activities in the “Set Conditions” window.

Information about benefits for real estate is located in the “Deductions” section, on the “Property” tab. You need to add an apartment, plot, house - click “+” and fill in the data on the object.

Attention!

Healthy. The file can be saved at any time. This will allow you to continue filling out or correct errors in the future. After preparing the report, you can use the “Check” button to check whether the form is filled out correctly.

A special file format is used to send to the Federal Tax Service. To prepare an electronic document, click the “xml file” button and save the file in the specified format.

How to apply for a tax refund

If a person has the right to a personal income tax refund, it is worth taking advantage of it. Various offline and online companies offer assistance in returning tax deductions. But they charge a certain fee for their services.

Everyone must decide for themselves whether to spend money on them or not. There is nothing complicated in the return processing procedure. The main thing is to strictly follow the instructions and indicate only reliable information in all documents.

You can apply for a tax refund in the following ways:

- by mail ;

- through any Federal Tax Service;

- through multifunctional centers

- through State Services;

- through the website of the Federal Tax Service of the Russian Federation.

By mail or through the Federal Tax Service

You can fill out the declaration on paper. To do this, you will need data on income for the previous year and it is advisable to request a salary certificate from your employer. It also contains information about tax amounts withheld and sent to the budget. The declaration form can be found on the Federal Tax Service website.

The completed declaration can be brought to any Federal Tax Service inspection. The taxpayer will need to have a passport with him. After checking the documents, the inspector will accept them and put a mark on the second copy of the declaration.

If it is not possible to visit the Federal Tax Service Inspectorate in person, you can ask an authorized representative to visit it or send it by mail. The representative will need a notarized power of attorney and his or her passport. When sending by mail, this document is not needed, but the declaration must be sent to the Federal Tax Service at the registration address.

Through State Services

State Services – a portal for receiving government services electronically.

You can make a deduction on it. But before receiving a tax deduction through State Services, you will have to register on the service and take care of obtaining a qualified electronic signature.

After this you need to do the following:

- Go to the portal and log into your personal account.

- Select from the catalog – https://www.gosuslugi.ru/10054/25.

- Indicate that the service is needed electronically.

- Fill out the declaration and sign it with the CEP.

- Send the document to the Federal Tax Service.

How to apply for a tax deduction when buying an apartment through State Services

The state tax benefit makes it possible to reimburse part of the overpayment for housing purchased with a mortgage, but it is valid only if taxes are paid from the income of the owner or his spouse. On the government services portal, you can fill out an application for a partial tax refund, indicating the details for which the tax refund will be made. It is noteworthy that first an application is submitted for the main deduction from the amount of the cost of the apartment, and only after that for mortgage interest.

- Only persons with Russian citizenship can take advantage of the benefit.

- If a person is not officially employed, has the status of a pensioner or a mother on parental leave, he does not receive wages from which taxes are calculated. Therefore, there is nothing to calculate the means from. The situation will change only if you have an officially paid job.

- The property must be purchased within the country.

- For citizens who purchased housing through a share accumulation agreement, it is necessary that the housing cooperative officially transfer the apartment to the citizen, and he pays the share contribution in full.

We recommend reading: How to calculate taxes