Types of tax deductions that can be obtained from an employer

Receiving deductions through the employer, and not through the tax office, only changes the form of payments, but not their purpose or size.

Accordingly, through your place of work you can receive the following deductions:

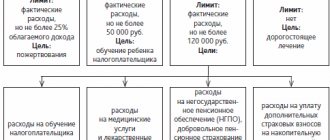

- Social deduction. If the employee has a need for personal treatment, or a tax deduction for treatment through the employer is necessary for relatives. Social deductions also include payments for education or raising a child

- Property. Tax deduction when purchasing an apartment through an employer, other real estate or cars

- Standard deduction. Obtained if there is a benefit (war veterans, Chernobyl liquidators, guardians, etc.)

- Professional deduction. Suitable for categories of citizens working under a copyright agreement or for royalties.

Register now and get a free consultation from Specialists

Treatment

Getting a tax deduction through your employer is easier than it seems. Only this scenario is not of much interest to the modern population. This is due to the peculiarities of the provision of payments.

When requesting a refund of income tax for treatment and medicine, the following components will be useful to the applicant:

- any identification document;

- contract for the provision of medical services;

- receipts for payment for services rendered and purchase of medications;

- extract with prescriptions and doctor’s report;

- medical company license;

- work permit for one or another specialist (if this provides for the profile of his activity).

If you need to request a refund for the treatment of a close relative, you will additionally have to take with you certificates of relationship between the patient and the payer. They can serve as:

- adoption or birth certificates;

- marriage certificates.

It is advisable to bring all statements along with their copies. This way you will be able to complete the task with minimal difficulty. Not all employers will accept original documentation and photocopy them themselves.

Social tax deductions from the employer: advantages and disadvantages

The main difference in receiving social deductions through the tax service and through an employer is that the tax service provides a deduction in the form of a fixed amount for taxes already paid to the budget.

In the case of an employer, compensation is provided for future payments. After the employee applies, the employer relieves him of the need to pay 13% (income tax) monthly to the budget.

Important : Even if you file deductions through your employer, contacts with the tax office cannot be avoided. Every calendar year you will have to confirm the legal basis for receiving funds from the tax service.

The main advantage is that there is no need to wait until the end of the calendar year to apply for a deduction (as is the case with the tax office). Receipt of deductions occurs upon the occurrence of the right to a refund.

The disadvantage is the lack of opportunity to receive real funds. Those. If we are talking about deductions for treatment, it is more profitable to receive a fixed large amount from the tax office than to simply be content with an “increase” in salary of 13%.

But if we are talking about social deductions, for example, when raising children, an “addition” in the form of a tax benefit will be more appropriate than just the amount for the calendar year. It is also more profitable to receive tax benefits for future payments if you do not have official work experience (deductions through the tax office will compensate for the funds for the last 3 years). Those. At the beginning of your career, it is more profitable to file deductions through your employer than through the tax office.

In general, the advantages and disadvantages of each method are determined by the specific circumstances and current situation.

Register now and get a free consultation from Specialists

Features of filing a deduction through an employer?

If it does not matter to the employee that the amount will be received in parts, you can apply for a tax deduction at the place of work. In some cases, there is no other method. For example, if we are talking about a personal income tax refund for an employee who has children, then they can reduce the tax base by 1,400 rubles. Thus, you can receive a salary of almost 200 rubles more. Processing such a refund through the tax office will be an inconvenient and difficult option. It is much easier to receive money every month, that is, through an employer.

The situation is similar with other types of returns. Here the due amount will simply be added to the salary every month. Thus, the employee will not be charged personal income tax in the amount of 13% until all funds have been paid.

A special feature of filing a tax deduction for an employee through an employer is that the taxpayer in this case has the right to use the returned money as soon as he submits the documents to the accounting department at the place of work. Things are different with the tax authorities, since here you have to wait about two to three months to receive the money. But in this case, the entire amount comes at once, which for many is a big plus.

Receiving a tax deduction through an employer is also beneficial because you do not need to collect a large package of papers. The basic documents are the same in each case, but the tax office often requires a number of additional papers, so registration through the employer is considered simpler.

Procedure for filing deductions at the place of work

To receive payments, you must provide certain documents for tax deduction to the employer. Below we will look at the registration procedure step by step.

Step 1: collecting documents proving the right to a tax refund

The list of certificates provided to the employer does not differ significantly from the package of documents for the tax office. The main difference is that there is no need to fill out the 3-NDFL form. You must also submit an application to your employer for a tax deduction. It has a standard format, and an example of how to fill it out can be found in the accounting department at your place of work.

Step 2: Submit an application to your local tax authority

The application is submitted to the local tax office at the place of actual residence. According to Article 220 of the NKRF, tax authorities have 30 days to process documents. After this, the applicant receives either confirmation of the right to compensation for tax deductions or a refusal.

The application can be submitted either by mail or in person. At the same time, the second method has a higher priority, because allows you to verify on site that all documents are collected in the correct form. When applying via mail, there is a risk that the package of documents will be returned for revision, and this significantly slows down the registration process.

Step 3: Contact your employer for compensation

Having a notice of the right to deductions in hand, it should be handed over to the place of work. The application is submitted to the accounting department along with the application for deductions. Calculation of payments is the task of the employer. At the same time, the company is obliged to count wages without tax deductions starting from the month in which the notice was submitted. You can receive an “increased” salary either until the end of the tax deduction or until the end of the calendar year.

Register now and get a free consultation from Specialists

Arguments in favor of deduction from the beginning of the year

The Ministry of Finance has spoken out several times about deductions through the employer. There are letters in which the department says that the deduction must be provided from the beginning of the year. Even if the notice was received in May or September.

For example, an employee’s salary is 50 thousand rubles. Every month 6,500 personal income tax rubles are withheld from him. In September, he brings a notice of the right to deduct rent. By this time, 52 thousand rubles of tax had already been withheld from him. The Ministry of Finance says that this entire amount must be returned to the employee. And not according to the declaration, but along with the salary for the current year.

Providing a deduction from the beginning of the year means reducing income by the amount of the deduction from the beginning of the year. That is, part of the deduction is subtracted from the salary for January, then from the salary for February, March, and so on. This results in an overpayment of tax: it was withheld in January, February and March. The employer immediately returns this overpayment.

The Supreme Court, the Federal Tax Service and many experts have the same opinion. However, not all.

Can an employer refund taxes for previous months?

Based on the examples described above, it becomes clear that in order to return payments already made, you should contact the tax service. But since 2017, the government has changed its strategy on this issue. Now, the employer can return taxes paid since the beginning of the year. In fact, problems may arise with accounting, because... “fresh” innovations are not immediately integrated into practical application. Therefore, a higher priority way to return funds for the past months is to contact the tax office using Form 3-NDFL.

Important: in the case where deductions were determined for the current calendar year, but were not exhausted, you have the right to demand payments from the employer for the next year. In this case, you will have to contact the tax office for notification that you can receive unexhausted payments in the next calendar year.

Buying a home with a mortgage

In a situation where a citizen attracts credit funds to purchase real estate, special rules are provided. For mortgaged housing, the return is calculated based not only on its cost, but also taking into account the interest to the bank.

In this case, actual expenses are covered in an amount not exceeding three million Russian rubles. To resolve this issue with the tax authorities, you need to add some more official papers to the above documents:

- Extracts from a credit institution confirming the transfer of funds from the seller to the buyer.

- Check sheets for receipt orders.

Note that Article No. 220 of the Tax Code of the Russian Federation states: “If the amount of interest in a period is higher than the amount of a citizen’s income, unreimbursed mortgage interest is carried forward to the next year.” The transfer is possible until all interest is fully reimbursed and the loan agreement ends.

Article 220. Property tax deductions

Those who bought real estate from their parents, children or other relatives, as well as the employer - those who are considered “related persons” will not qualify for the property deduction. This clause is intended to protect the state from payments to scammers who use their close associates for fraudulent money schemes.

It will not be possible to reimburse your expenses even if one person paid for the property, and another became its actual owner - neither the new owner nor the person who financed the purchase will be able to claim a 13% refund. There is also a limitation for maternity capital.

This is important to know: Contract for chartering a vehicle for the transport of passengers: sample 2020

If part of the paid price of an apartment or other housing was paid in this way, the amount of capital cannot appear in payments from the state.

Refund of real estate deductions will help you save your budget

How to receive deductions if you have several jobs

Having multiple jobs makes it puzzling when it comes to getting deductions. Previously (before 2014), an employee had the opportunity to receive deductions for only one place of work. This situation was not fair enough, because a person paid taxes on all income, but could only partially compensate for them.

In 2014, amendments were made to the tax legislation. Thanks to them, the employee has the opportunity to receive deductions for all places of work at the same time. This norm is enshrined in the Tax Code (Article 220, paragraph 8).

This can only be done through the tax service. If you apply, you should indicate that you want to divide the deduction between all places of work. The task of tax officials is to notify employers about the availability of tax benefits.

How to get a tax deduction?

What is a tax deduction? (If absolutely correct, then a property deduction). Believe it or not, this is a wonderful gift from the state the moment you bought an apartment. There are deductions not only for the purchase of an apartment, but in this article I will only talk about them.

After all, the costs of buying an apartment (building a house), renovations, etc., probably took almost all your free money. And here, in some century, the state does not take money from you, but gives it to you. Well, it doesn’t exactly give, of course, but that’s not that important anymore. There is also a property deduction when selling an apartment, but more on that in the second part of the article.

A little clarification on tax deductions,

which I often have to give even to people who are quite literate in other areas, which means that these questions are not entirely obvious.

The first question that often comes up is: “How can I get my 260 thousand rubles from the state?” (at the moment) if I am not officially employed?

.

But if a person does not work (is not employed), it means that he does not pay income tax (even if he earns decent money). And if he does not pay income tax, then the state will not return anything to him.

A tax deduction, in essence, is that the state returns your money to you (or does not take it), which you pay or should have paid in the form of income tax. That's why I said that this is not really a gift.

And it turns out that if a person does not pay income tax because he is not employed, because he is an entrepreneur (individual entrepreneur does not pay income tax), then there is no tax deduction to speak of.

In total, if you pay income tax (13% of your salary), then with the help of a tax deduction you can avoid paying it or return this 13% to yourself at the end of the year. If you do not pay income tax or pay very little due to wages “in an envelope,” then you will not be able to take advantage of the tax deduction or to a much lesser extent than you expected.

Now let's move directly to how to get a tax deduction.

The simplest option, which I advise you, is to receive a tax deduction at your place of work.

That is, to put it simply, you will receive wages 13% more than before. (Let me remind you that we are talking about official wages).

At the same time, the company itself does not incur additional costs for your salary. It simply does not remit income taxes to the government.

To receive a tax deduction at work, you must provide

accounting decree from the tax office. You can do this at any time. This resolution (notification) is valid for one year, then it will need to be received again.

What do you need to do to get this resolution? The easiest option is to come to the tax office at the place of registration (precisely at the place of registration, even if it is another city), take from them a sample application for a tax deduction at the place of work and a list of necessary documents. (Of course, it’s not difficult for me to provide a sample application, but at every tax office there is a lot of help both with the application and with the list of attached documents. Therefore, you can take a sample application from the tax office and fill it out there. Don’t forget to take the documents with you, which must be attached to the application).

Among the documents that need to be submitted, or not necessary, but sometimes required, are the following:

- a copy and original (show) of the certificate of ownership of the apartment;

- a copy and original of the agreement and the act of acceptance of the transfer (sometimes this is one paper, the agreement states that it is also an act);

— if the apartment is registered as joint ownership, then you need to indicate in the application for deduction or a separate application how you and your wife want to distribute the tax deduction. For example, the husband works, but the wife does not. Then the distribution could be as follows: 100% deduction for the husband and 0% for the wife. (For example, I ask you to distribute the property deduction in the following way: husband’s full name – 100%, wife’s full name – 0%).

Additional documents that are sometimes required due to tax illiteracy, but they are not needed:

— receipt of receipt of money by the Seller. Completely unnecessary paper. After all, the contract or deed states that the money has been received in full. I received a tax deduction without a receipt, but I had to insist on an appointment, etc. If they ask and there is a receipt, then it is better to do as asked, you will save a lot of nerves;

— certificate 2-NDFL, which is given in the accounting department at work. This certificate is also not needed in order to receive a tax deduction at work (only this type). But, as I already said, in the tax office it’s often “who knows what,” and sometimes it’s easier to do as asked than to argue;

— certificate of assignment of TIN. In principle, you may not be asked for the certificate itself, but you must have a Taxpayer Identification Number (TIN) to receive a deduction. If you received it before, then simply indicate its number in the application; if you haven’t received it, then most likely they will force you to get it;

- copy of passport. It’s also not needed, but I’ll repeat once again, who cares.

Should I immediately do additional and sometimes unnecessary documents? It all depends on how difficult it is for you to go to the tax office again or do the paperwork. If the tax office is very far from you, the queues are long and there is no time to get to it (it’s difficult to leave work, or you live in another city), then sometimes it’s easier to do everything you need and don’t need in advance, just to avoid having to come again. If you have a free schedule, the tax office is nearby and there are no queues, then it is easier, of course, to find out everything first, so as not to do those papers that are not needed.

Additional documents for obtaining a tax deduction if the apartment was purchased using a mortgage loan are as follows:

— loan agreement;

— calculation for the loan agreement (about when to pay, how much is the balance, etc.);

- an original certificate from the bank stating how much you paid for the loan and interest on the loan. This certificate is given by the bank where you took out the loan, or if you sold it, then by the bank that bought your loan. To do this, you need to call (go) to the bank and ask. In some banks, such a certificate must be ordered through a form on the website. If you are receiving a deduction for the first time, then such a certificate is not needed, of course, since the year has not yet passed, and the interest on the loan will be taken into account at the end of the year.

Here, in fact, is the entire set of documents. Sometimes they also ask you to certify copies, that is, put “Copy is true” on the copies, signature, your last name and initials. If this is necessary, it is easier to do it in advance, rather than standing in line.

You hand over these documents and after a month (you will be told at the reception of documents where to call or come), you can pick up the tax decree and take it to work. After which you can receive a salary of 13% more.

It just seems that all this will take a lot of time and a lot of documents are needed. In fact, you already have almost all the documents and you just need to copy them. The tax deduction application itself is very simple. (I recommend taking another form and printing it at home next year and bringing in the full package of documents at once). You just need to go a couple of times and that’s it. If you don’t have time at all, you can send someone by proxy. You can even take a sample application without a power of attorney and find out everything more precisely.

The second option for obtaining a tax deduction is a refund of paid income tax by filing an income tax return.

Well, somehow you didn’t manage to get a tax deduction at work. Maybe you procrastinated and procrastinated and then quit your job. Maybe you are employed part-time in 5 other jobs and forgot to get a tax deduction for other jobs. Maybe you didn’t even know about such a good gift from the state as a tax deduction. Maybe you still had a bunch of other purchases and sales that need to be declared anyway and you decided not to receive a deduction at work. How then to get a tax deduction?

Then the second option remains - this is a refund of the income tax already paid by filing a return at the end of the year in which you paid taxes. Essentially, everything here is the same as in the previous case. Exactly the same set of documents, only the 2-NDFL certificate will need to be taken. And, of course, you will need to fill out a tax return.

I do not advise you to fill it out yourself unless you are a professional accountant. Of course, there is nothing particularly complicated in it, but usually there are companies near the tax office that, based on your set of documents, will fill it out for pennies.

Therefore, it’s up to you to collect all the necessary documents and copy them. I almost forgot, you also need the details of the bank to which you want to receive money. Sometimes they ask for a Sberbank book (I don’t know why, don’t ask, but I warned you). Well, if you don’t want or don’t have an account with Sberbank, then you need to provide the details of another bank.

When you have collected and filled out everything, you submit the declaration with the documents to the tax office and after some time all the money that you paid as income tax last year will be credited to your bank account.

How much is the tax deduction?

At the time of writing (October 23, 2011), the maximum tax (property) deduction is 13% from 2 million rubles, that is, 260 thousand rubles. (no mortgage).

For example, if you bought an apartment for 2 million rubles. or more expensive (we are talking about the fact that you paid with your own money, not credit), then you can receive a maximum benefit from the state of 260 thousand rubles. If you bought an apartment for less than 2 million rubles, for example 1 million rubles, then the benefit will be 1 million rubles. x 13% = 130 thousand rubles.

If you buy an apartment with a mortgage, then the amount of tax deduction can be much higher. After all, the tax deduction also includes the interest you pay on your mortgage loan. The amount of this interest is unlimited. Therefore, if you bought an apartment for 3 million rubles, of which 1 million rubles. there was an initial payment, then for 1 million rubles. you will be given a deduction (maximum two, as I already said), and for interest on 2 million rubles, which in 30 years can add up to 4 million, you will be given another deduction of 260 thousand rubles.

In general, if you have an expensive apartment and high income, then a gift from the state will not be so bad, take advantage of it. It’s quite simple to complete everything, despite the large list of documents, and the money is not that small.

In addition to the tax deduction for the purchase of an apartment, there is also a tax deduction for the sale of an apartment. Sometimes this point is also quite relevant. I will tell you about it in the next part of this article, which you can read HERE.

Article protected by copyright and related rights. When using or reprinting material, an active link to the women's website sun-hands.ru is required! Best regards, Rashid Kirranov.

Where to apply for registration

To receive a social refund of personal income tax, you can contact the Federal Tax Service or your employer. The delivery method will depend on the path chosen.

This is important to know: Changing the terms of the employment contract at the initiative of the employer

After submitting the documentation, you must wait for the inspection's decision. The money will be transferred to the applicant's bank account.

To provide this payment through an employer you must: