Tax deduction for pensioners in 2020

Despite the availability of clarifications on the issues of receiving deductions by persons of retirement age, the topic is often the subject of discussion. The most popular are deductions related to the costs of treatment and the purchase of real estate by persons on well-deserved retirement. Let’s figure out whether pensioners can get a tax deduction, what the nuances are and the latest changes in legislation.

This service is applicable not only to the present, but also to the future income of an individual until the limit is exhausted. If a working pensioner does not have any problems with the return of overpaid tax, except for the return period for small incomes, then the situation with a non-working pensioner is somewhat different, because the pension is not subject to taxation. The Government of the Russian Federation, understanding the complexity of the situation, enshrined in paragraph 10 of Article 220 of the Tax Code of the Russian Federation one exception - citizens of retirement age can exercise their right to a deduction for the three years preceding the purchase of housing. If the amount of income tax for the period does not cover the maximum amount that a pensioner can receive by law, or he spent the last three years on a well-deserved vacation and did not pay personal income tax, then taxable income will be required to return the rest of the benefit. This can be not only wages, but also other income with the payment of income tax at a rate of 13 percent: sale of real estate or shares of enterprises, rental of real estate and others.

Is a tax deduction entitled to a pensioner who bought an apartment?

Expert's answer 0 + -

According to the law, after purchasing an apartment, you can return 13% of its cost in the form of a tax deduction (clause 3, clause 1, article 220 of the Tax Code of the Russian Federation). The basis for the deduction is the date of purchase of the apartment. When purchasing an apartment in a new building, the date the developer transfers the apartment to you. When purchasing on the secondary market - the date of registration of ownership of the property.

Article on the topic Apartments, surcharges, tax deductions. What benefits are they hiding from us?

Tax deductions can only be received by those taxpayers whose income is subject to personal income tax at a rate of 13%. Since tax on income from pensions is not withheld (clause 2 of Article 217 of the Tax Code of the Russian Federation), non-working pensioners will not be able to receive a property deduction when purchasing housing. But there are also nuances. At the same time, according to paragraph 10 of Art. 220 of the Tax Code of the Russian Federation, a pensioner has the right to transfer the balance of the property deduction “to previous tax periods.”

“For taxpayers receiving pensions in accordance with the law, property tax deductions can be carried forward to previous tax periods, but not more than three. A property tax deduction is provided in the amount of expenses actually incurred by the taxpayer for new construction or the acquisition on the territory of the Russian Federation of residential houses, apartments, rooms or share(s) in them, the acquisition of land plots or share(s) in them provided for individual housing construction, and land plots or shares (shares) in them on which the purchased residential buildings or share (shares) in them are located and a property tax deduction in the amount of expenses actually incurred by the taxpayer to repay interest,” says lawyer Nathan Budovnits.

For example, if a pensioner retired in March 2020, and in 2016 received the right to a deduction by purchasing real estate, then he, as a non-working pensioner at the time of purchasing real estate, can return taxes for 2020, 2014 and 2013. For 2020, the pensioner will be refunded the tax that his employer withheld from his salary for January-February 2020, and the remainder of the unused property deduction will be transferred to 2014 and 2013.

Thus, a pensioner who purchased an apartment can submit tax deduction returns for the three years preceding the year in which his right to deduction arose.

The maximum amount of property deduction for a pensioner is 2 million rubles.

Article on the topic Benefits for 6 acres. Who will be exempt from land tax?

Can a working pensioner get a tax deduction?

Yes maybe. On January 1, 2014, changes were made to the tax code of the Russian Federation that give the right to pensioners who continue their working activities to transfer property deductions to the previous three years (letter of the Federal Tax Service of Russia dated April 28, 2014 No. BS-4-11/8296).

What documents need to be provided?

To receive a deduction, a pensioner must provide the following documents:

A copy of the pension certificate; A copy of the home purchase agreement; A copy of the loan agreement (if the apartment was purchased with a mortgage); A certificate of interest paid to the bank (if the apartment was purchased with a mortgage); A copy of your passport; A copy of the certificate of ownership of housing; A copy of the payment document (which will confirm the fact of payment for the apartment). Declaration 3-NDFL for a pensioner to receive a deduction; Application for personal income tax refund.

When do you need to submit documents for deduction?

The deadline for submitting documents to receive a deduction has no restrictions. A pensioner can contact the tax authority at his place of registration at any time.

Tax deduction for pensioners when buying and selling an apartment

When selling an apartment, the tax deduction for pensioners is no different from the application of this deduction for all other citizens. What type of pension the pensioner receives (state or non-state), whether he continues to work or not, does not matter.

But here, again, there is a nuance! Those pensioners who bought an apartment after retirement (both state and non-state) have the right to return the previously paid personal income tax from their salary for the three previous years (Opens in a new tab.”>paragraph 4, paragraph 3, Article 210 of the Tax Code of the Russian Federation and Opens in a new tab."> clause 10, Article 220 of the Tax Code of the Russian Federation). Of course, within the maximum amounts stated above.

Is there a tax deduction?

Good afternoon, thank you for your question. You should know that the most important thing you need to know about tax deductions is that a citizen of the Russian Federation who receives income taxed at a rate of 13% can claim them.

According to paragraphs. 3 p. 1 art. 220 of the Tax Code of the Russian Federation, When determining the size of the tax base in accordance with paragraph 3 of Article 210 of this Code, the taxpayer has the right to receive the following property tax deductions, provided taking into account the specifics and in the manner provided for by this article:

Property tax deduction for pensioners

Employees of law enforcement agencies and the Ministry of Defense of the Russian Federation also pay a state-established income tax at a rate of 13%. And, therefore, a tax deduction for the purchase of real estate for military pensioners is provided in the same manner as for other persons in this category.

For the first time, pensioners had the right to use the transfer of deductions on January 1, 2012, but it was limited to a narrow circle of people. Those pensioners who did not work or receive other income subject to the taxation system at a rate of 13% could receive state relief.

Tax deduction of 13% when purchasing an apartment with a mortgage with maternity capital

Also, upon the birth of 2 children, Russian families receive additional state support in the form of a maternal certificate. It has several directions of implementation. The most important and common use of capital is the purchase of residential space. The funds can be used for a down payment or to cover the principal amount of existing obligations. In the real estate market, such transactions are the most relevant and in demand. According to regulatory documents, a tax deduction for a mortgage using maternity capital is also allowed. The calculation of the refund amount in this situation differs from the standard one.

Since 2001, an individual who has purchased a home has the opportunity to receive compensation from the state. It consists in the return of personal income tax, which was transferred for the reporting period. There are no restrictions on the method of completing the transaction. Real estate can be purchased with cash or with a mortgage.

Are pensioners entitled to a tax deduction when buying an apartment?

The deduction can be obtained not only for those years that a person has already worked. But also extend it to the next 3 years, provided that dismissal is not planned. So the amount received will be greater. Because there is official income.

- Officially employed and working pensioners.

- People who do not have an official job, but receive a pension, provided that they previously worked officially and paid income tax.

- Pensioners who purchased living space with a mortgage (but will have to provide an extended package of documents).

Interesting read: They are not giving a list of medications prescribed to pregnant women for free in 2020 in Ust-Katava

Tax deduction for pensioners

Please note: a pensioner can also receive a benefit if he has additional income (for example, he rents out an apartment, on the income from which he pays personal income tax annually) or sold property on which he also paid income tax.

Example 3: Sakharov A.S. He retired in July 2014, and since that period he has had no income other than a state pension. In 2020, he purchased a one-room apartment. Sakharov has the right to transfer the benefit to three years preceding the year of purchase of the apartment: 2020, 2014 and 2013. Since Sakharov no longer worked in 2020, he will be able to receive a deduction based on income from 2014 and 2013.

Tax deduction for pensioners: conditions for receipt and registration

The main regulatory framework on the issue under consideration is the Tax Code of the Russian Federation. It reflects the conditions, procedure for obtaining benefits and its amount. A tax deduction is considered to be a partial refund of funds contributed by a citizen in the established amount (13%) from his own income to the state fund.

If the deduction has already been issued previously for a full or partial period established by the state, it is no longer possible to receive it again for these years. If a person acquired property in the year he became a pensioner, then a deduction is assigned not only for the previous 3 years, but also for the current one. In this case, documents are submitted no earlier than the year following the transaction. Let’s say a person became a pensioner and purchased a home in 2020. He has the right to issue a deduction for 4 years in 2020: 2020, 2020, 2020, 2020.

Are all pensioners entitled to a tax deduction when buying an apartment?

The most difficult situation is with regard to tax deductions for disabled pensioners. For many, this is the most confusing situation - all pensioners are entitled to a deduction, but they cannot claim it. In fact, this is not entirely correct information - it all depends on the duration of retirement, the year of purchase/sale of residential real estate and the presence/absence of taxable income.

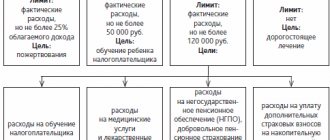

It is worth knowing that ICs in real estate transactions are in no way related to social deductions. According to the law, both working and non-working pensioners can claim deductions when purchasing a home. There are no social deductions for treatment or training for non-working pensioners. While persons who continue paid work may qualify for a refund of part of the funds spent.

Treatment abroad: is there a tax deduction? — Traditional methods of treating cancer

As statistics show, the number of medical services that Russian citizens receive abroad is growing every year. We are talking about the segment of expensive, high-tech operations, as well as modern preventive procedures, the purchase of medicines, and the like.

From the point of view of the letter of the law, the possibility of receiving compensation when undergoing treatment in Israel or Germany is not provided. At the same time, since mid-2011, consultations have been continuously held at the government level on the prospects for changing this legal norm. The reason for such transformations may be the increasing frequency of lawsuits in courts of various instances from consumers seeking to cover the costs of expensive operations, which were supervised by foreign specialists in foreign clinics.

We recommend reading: Why You Can’t Pay Off Loan Debt with Mat Capital

Tax deduction for pensioners when buying an apartment

Is it possible for a pensioner to receive a tax deduction? Many elderly citizens are interested in it. Part 10 Art. 220 of the Tax Code allows the transfer of property tax deductions for pensioners to previous periods. At the same time, the benefit is provided to both working and non-working citizens of retirement age.

If for 3 years, before purchasing an apartment, the pensioner did not work and therefore did not pay personal income tax, it is impossible to apply for the benefit. After all, the refund is made from previously paid income taxes. No tax means no benefit.

Is there a tax deduction for construction when purchasing building materials?

Taking into account the above, a sales receipt for the supply of construction and finishing materials issued by a trading organization to the buyer (an individual without indicating his last name, first name and patronymic) can be accepted as a document confirming the taxpayer’s expenses for the purpose of providing a property tax deduction provided for in subparagraph 2 of paragraph 1 of Article 220 of the Code, in the presence of a cash receipt indicating that he paid money for the purchased construction and finishing materials. Deputy Director of the Department S.V. Razgulin

When purchasing land plots provided for individual housing construction, or a share(s) in them, a property tax deduction is provided after the taxpayer receives a certificate of ownership of the house.

How to get a tax deduction for a pensioner when buying an apartment

According to paragraph 10 of Art. 220 of the Tax Code of the Russian Federation, both working and non-working pensioners are allowed to carry over the balance of the property deduction to previous years, but no more than 3 years from the date of purchase. For example, an apartment was purchased in 2020, which means that the benefit can be claimed for 2020, 2020 and 2014.

ATTENTION! If a non-working pensioner has additional income, for example, from renting out housing, and deducts 13% from it, he becomes an applicant for benefits on the same terms as an employed person.

Car tax deduction

If the period of ownership of the sold vehicle is three or more years, then the entire amount received for the car is included in the scope of the benefit and is not subject to taxation. In this case, the legislation allows not even to declare this income, and accordingly not to submit Form 3-NDFL reports to the Federal Tax Service.

But another question may arise. What if the vehicle was purchased on credit? Is it possible to get a discount on loan interest? Again we turn to the same article. 220 of the Tax Code of the Russian Federation, but already in paragraph 4, containing a list of property purchased on credit, for which you can receive a benefit in the amount of interest spent on repaying the loan. And again we see that there is not a word about transport. Therefore, in this situation there is no tax refund.

We recommend reading: What is privatization?

Justice pro

If the pensioner continues to work, then he will be able to transfer the remainder of the deduction to previous tax periods, and if the income for these years is not enough, then the working pensioner will be able to refund the tax when buying an apartment in subsequent years.

- to purchase an apartment,

- to repay interest on loans for the purchase of an apartment (including interest on loans received from banks for the purpose of refinancing (on-lending)). Interest deduction is provided only for one apartment.

Interesting read: What benefits are provided to widows of war participants?

How can you get a tax deduction from a consumer loan in 2018?

Consumer lending is often used by those who do not want or are unable to use a lending option, like a mortgage from a bank, but circumstances require improvement of housing conditions. If a potential borrower wants to receive a tax deduction in the future on interest on funds received, this must be specified in the loan agreement. If such wording is not provided for in the agreement, then in this case it will be impossible to obtain a tax deduction on interest. At the same time, a tax deduction on interest on a consumer loan from a bank is also taken into account.

The main point that anyone who wants to get a consumer loan from a bank should remember is that the tax deduction on interest is returned only during the year following the reporting year. That is, if a tax deduction needs to be returned for 2011, then documents for return are accepted only during 2012. In 2013, as well as in subsequent years, a refund of taxes paid by the employer is impossible.

Property tax deduction for pensioners

Hello, in July 2020 I bought an apartment for 1,560,000, received an income refund, in May 2020 I bought another apartment for 1,600,000, and since February 2020 I have been a non-working pensioner. Can I apply for an income deduction from a second apartment?

Hello Pavel. Yes, if there are personal income tax transfers at a rate of 13% to the budget, then it is possible to receive a deduction. If your father has never received a property deduction before, then in 2020 he will be able to submit documents and declarations for 2020, 2020, 2020, 2020.

How to get a deduction, what is needed for this

How to return personal income tax - procedure:

- Collect the necessary documents.

- Get a 2-NDFL and fill out a declaration with it.

- Contact the tax service with documents and the 3-NDFL .

- Get money.

Package of documents:

If an employee submits documents for a monthly deduction for children to the employer, he must provide copies of birth certificates for the children.

Are pensioners entitled to a tax deduction when buying an apartment and how to get it in 2020

The deadline for verifying the information contained in the declaration and transferring money is set at 3 months from the date of submission of the papers. This means that if the declaration was submitted on March 19, 2020, then the deduction for the purchase of an apartment for pensioners must be received before June 19, 2020 inclusive.

Attention. If several objects were purchased during the tax period (for example, an apartment and a room in a communal apartment), it is worth filing compensation for all. The main rule is that the deduction amount for all purchases should not exceed the maximum amount. This rule applies only to transactions made after 01/01/2014.

STEP-BY-STEP INSTRUCTIONS ON HOW TO GET A DEDUCTION

To receive a social tax deduction for expenses on the funded part of a labor pension, the taxpayer must complete the following steps:

- Fill out a tax return (form 3-NDFL) at the end of the year in which the contributions were paid.

- Receive documents at your place of work:

- a certificate of the amounts of accrued and withheld taxes for the corresponding year in form 2-NDFL;

- a certificate from the employer about the amounts of additional insurance contributions that were withheld and transferred by him on behalf of the taxpayer.

Expert opinion

Kurtov Mikhail Sergeevich

Practitioner lawyer with 15 years of experience. Specializes in civil and family law. Author of dozens of articles on legal topics.

3. Prepare copies of payment documents confirming the taxpayer’s actual expenses for paying contributions (cash register receipts, cash receipt orders, payment orders, etc.).

4. Submit to the tax authority at your place of residence a completed tax return with copies of documents confirming actual expenses and the right to receive a social tax deduction for expenses for paying additional contributions to the funded part of the labor pension.

This is important to know: Receiving a subsidy for the purchase of housing

*If the submitted tax return has calculated the amount of tax to be refunded from the budget, together with the tax return, you can submit to the tax authority an application for a personal income tax refund in connection with the costs of paying additional contributions to the funded part of the labor pension.

When submitting copies of documents confirming the right to deduction to the tax authority, you must have their originals with you for verification by a tax inspector. The declaration and attached documents are verified within 3 months

from the date of submission of documents to the tax authority ().

A pensioner bought an apartment: how can you get a tax deduction?

- a certificate of ownership was received (or an extract from the Unified State Register) - if the basis is a purchase and sale agreement;

- a transfer and acceptance certificate was signed - if the basis for the emergence of the right is a share participation agreement.

Legally married persons can receive property deductions for each other. To do this, you must have taxable income. In this case, the package of documents will need to be accompanied by a marriage certificate and a statement defining the shares of the spouses.

How to get a tax deduction for dental treatment

To get your money back for treatment and dental prosthetics, you must follow a certain procedure. All necessary documents must be collected and submitted the following year after the treatment was carried out, and before April 30.

Tax authorities have three months to review the papers. After this, a decision is made on whether to refund the money or not. In the latter case, the applicant must be notified of the reason for the negative response.

Refunds are made within a month after the relevant decision is made by transferring money to the taxpayer’s account specified in the application. It is impossible to obtain cash from the inspectorate.

Where to go

There are two places where you can get a deduction. This:

- tax office at the end of the year;

- employer (by providing a certificate from the Federal Tax Service on exemption from personal income tax).

In addition to the Federal Tax Service, you can apply for this tax deduction through the State Services website or the MFC. The opportunity to receive a deduction at your place of work in Russia appeared in 2020. But you still won’t be able to avoid contacting the Federal Tax Service. To do this, you need to collect documents for deduction and send them to the inspectorate for review. If a positive decision is made, a corresponding notification is issued, which is submitted to the accounting department of the organization where the taxpayer works. They also write an application for a tax refund. From now on, personal income tax will not be withheld from wages.

If at the end of the period there is money left for deduction, the accounting department will not be able to transfer it to the next year. The balance is paid to the tax office by transfer to the account. Thus, the possibility of receiving a deduction at work did not simplify the process, but, on the contrary, even complicated it, since you will have to contact the inspectorate again.

The following example will help you understand the process in more detail:

Svetlova Irina Sergeevna paid 100 thousand rubles for dental treatment. in December 2020. She collected all the necessary papers, submitted them to the Federal Tax Service and received a notification about the possibility of applying a deduction. With this document, Svetlova I.S. went to the employer and wrote a statement in May. The employee's salary is 40 thousand rubles. She has no other deductions. Then, from the same month, the employer does not withhold personal income tax from Irina Sergeevna. The taxpayer has the right to receive a deduction of 100 thousand rubles. * 13% = 13 thousand rubles. Thus, in July the deduction amount will be paid, since from 40 thousand rubles. the amount of deductions is 5200 rubles. Therefore, from August, personal income tax will begin to be retained in the standard mode.

How to get a tax deduction for working pensioners when buying an apartment

Next, you need to visit the territorial tax number at your place of residence or registration. Here you need to provide details for transferring funds. It is worth remembering that you must have a current account at a branch of any Russian banking institution.

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

Tax deduction when using a subsidy

- TIN.

- Passport.

- Certificate 2-NDFL (from all employers, if there were several jobs).

- Document confirming the purchase.

- The act of acceptance and transfer to the owner of the house or apartment.

- Certificate of registration of ownership.

- Application for benefits.

- The cost of a housing property.

- Costs for building materials, drawing up projects and estimates, connecting to all communications or creating your own (autonomous) energy sources used in modern everyday life.

- Mortgage repayment costs (interest).

We recommend reading: In connection with what they give an Address Certificate

Tax deduction when buying an apartment for pensioners

The exception is situations where government money was allocated for the purchase of housing and the serviceman did not spend his savings. If he had to pay extra, then a tax deduction is applied for this amount.

- up to 260 thousand rubles. funds are returned if the cost of the purchased housing according to the purchase and sale agreement does not exceed 2 million rubles;

- up to 390 thousand rubles. funds are returned if the cost of the purchased housing according to the loan or mortgage agreement does not exceed 3 million rubles.

15 Sep 2020 uristland 115

Share this post

- Related Posts

- What Documents Are Needed to Renew a Passport If Lost?

- Tax deduction for medical treatment 2019

- Sample statement of claim for cancellation of alimony debt

- Find out the owner of a property by address

Property deduction when purchasing land

Land plots vary depending on their intended use. For example, land for individual housing construction (IHC) is intended for the construction of residential buildings on it, but the intended use of a site intended for gardening does not provide for this possibility. However, for the purposes of obtaining a tax deduction, the key condition is not the purpose of the land plot, but the presence of an individual residential building on this plot (Letter of the Federal Tax Service of Russia No. ED-4-3 / [email protected] dated December 10, 2012).

It is also important to note that the version of the Tax Code, which was in force before January 1, 2010, did not contain information about tax deductions for expenses for the acquisition of land. In this regard, only those citizens who registered ownership of the residential building located on it after January 1, 2010 have the opportunity to include in the deduction the costs of purchasing a land plot. In this case, it is the date of registration of ownership rights to the residential building that is important (since it is considered the moment the right to deduct arises), and the date of the purchase and sale agreement for the plot and other documents does not play a role. (Letter of the Federal Tax Service dated April 13, 2012 No. ED-4-3/ [email protected] , Letters of the Ministry of Finance of Russia dated December 1, 2011 No. 03-04-05/7-981, dated May 21, 2010 No. 03-04-05/9- 278).