Deductions for personal income tax in 2019-2020

The composition of deductions has remained virtually unchanged in recent years. An innovation for 2020 is the addition to their number of social deductions provided to individuals who independently pay the costs of conducting an independent assessment of their labor qualifications.

You can find out what types of deductions are provided for by law and how to exercise the right to reduce or refund previously paid tax from this article.

The most common type of personal income tax deductions is standard. They are provided to all employees who have minor children in their care. The amount of deductions depends on the number of children in the family and other criteria (healthy child or disabled child, two-parent family or single parent, etc.).

In addition, standard tax deductions are available to certain categories of citizens. These could be participants in the liquidation of the consequences of the accident at the Chernobyl nuclear power plant, Heroes of the Soviet Union and Russia, blockade survivors, and participants of the Second World War.

More details about who can claim standard deductions for personal income tax , as well as the amount of tax-free amounts for each category of citizens can be found in our articles:

- "St. 218 Tax Code of the Russian Federation: questions and answers";

- “Standard tax deductions in 2020 (personal income tax, etc.).”

To receive standard tax deductions, you must notify your employer of your intention, providing the necessary supporting documents.

About how often such a procedure should be performed, what the applicant has the right to expect, as well as other nuances of providing a deduction by the employer, read the article “The Ministry of Finance explained the procedure for providing standard deductions for personal income tax.”

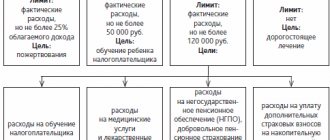

In addition to standard deductions, citizens can reduce the taxable amount of income based on other deductions they are entitled to. These include social tax deductions. They are provided if taxpayers have paid for treatment or education.

Find out about what expenses, in what volume and on what grounds give you the right to receive a social deduction, from the articles:

- “Social tax deductions for personal income tax in 2017-2018 (nuances)”;

- “Tax deductions for personal income tax in 2015-2018 - latest changes.”

Another popular type of deduction among taxpayers is property deductions. It is used when purchasing real estate or land. In addition, such a deduction makes it possible to reduce income taxes when selling real estate and other personal property.

You can learn about when these types of benefits can be used from the articles:

- “Tax deductions for personal income tax in 2015-2018 - latest changes”;

- "St. 220 Tax Code of the Russian Federation (2017): questions and answers.”

In addition, some categories of taxpayers have the right to apply deductions related directly to their activities. Such citizens include entrepreneurs, people whose profession is related to the provision of legal services, and persons working under GPC agreements.

A detailed list of entities that may qualify for professional deductions and the specifics of such transactions can be found in this article.

To confirm tax deductions for past periods, you must prepare documents with the Federal Tax Service, write an application and submit a declaration in Form 3-NDFL. It is permissible to indicate in the declaration several types of deductions to which an individual is entitled.

Certificate 2 personal income tax for tax deduction for what period

Advice from lawyers:

1. For what period is a 2-NDFL certificate required to return the tax deduction for training in a driving school from December 2020 to April 2020?

1.1. Certificate 2 of personal income tax for 2020.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

2. To receive a tax deduction for the purchase of an apartment, you need to take a certificate 2 personal income tax for what period do you need a certificate if I bought an apartment in June 2008 and where can I get it?

2.1. A personal income tax certificate for 2008 is required. You must take it at your place of work, i.e. where you worked in 2008.

Did the answer help you?YesNo

3. I am a pensioner, retired in January 2012, purchased an apartment in September 2013, according to the new law, I have the right to receive a tax deduction, for what period do I need a personal income tax certificate 2, to submit to the tax office, for the last three years or for the last year of my work? Thank you in advance!

3.1. Hello! If you have worked for the last 3 years, you can receive a property deduction for 2020, 2020, 2020. It is necessary to submit to the Federal Tax Service 3 personal income tax declarations for these years, documents (copies) for the apartment, income certificates, an application with bank details to transfer the deduction.

Did the answer help you?YesNo

4. For what period is the 2-NDFL certificate taken to determine the tax deduction when purchasing an apartment?

4.1. Hello, the 2-NDFL certificate is taken for a year (if you haven’t worked for a year, then for the months that you worked in the organization), you can submit documents for 3 years, but the certificates must be for each year separately.

Did the answer help you?YesNo

4.2. Depending on when you purchased the property, in what year - for that period and take a 2-NDFL certificate. If you bought an apartment in 2020, no matter what month, take a certificate for the whole year.

Did the answer help you?YesNo

5. I need a personal income tax certificate 2 for a tax deduction for the purchase of an apartment in 2020. I want to order a certificate from our government agency, but should I ask for what period, for the entire last year?

5.1. Hello! Certificate 2 of personal income tax is generated either for the entire previous year or for the period worked in the current year. That is, it does not matter when you purchased an apartment in 2020, a certificate will be issued to you for the entire year. And you will fill out the 3-NDFL declaration based on income for the entire year.

Did the answer help you?YesNo

6. For what period of time do I need to get personal income tax certificate 2 to return the tax deduction when buying an apartment? Now retired, work experience in Russia from 10/01/2014 to 05/31/2016, dismissed due to retirement. Before that, she lived in Kazakhstan.

6.1. You could receive a tax deduction as a pensioner for the previous three years: 2020, 2018, and 2020. But you have no experience for these years... Alas, now you will not be able to get anything. If you just start working again...

Did the answer help you?YesNo

7. I purchased an apartment at the end of 2020, and at the same time, in December 2017, I registered ownership of it. Now I have decided to submit an application to the tax office for a refund of my tax deduction. Question: for what period do I need to file a 3-NDFL tax return and take a 2-NDFL certificate from work?

7.1. Hello Dmitry! You have the right to receive a tax deduction starting from the year in which ownership of the apartment was registered. As far as I understand, you can now file two returns, the first for 2020, the second for 2020. Accordingly, 2-NDFL certificates must be obtained for 2020 and 2018. If you submit returns through the taxpayer’s personal account, these certificates (2-NDFL) should already be there, and there is no need to receive them separately.

Did the answer help you?YesNo

8. I took out a mortgage last year and now I want to get a tax deduction. For this I need a 2-NDFL certificate. For what period should I take it? Last year or last 12 months?

8.1. Nikita Vyacheslavovich, good morning! If you want to receive a deduction for 2020, then take the 2-NDFL certificate for 2018. I wish you good luck in resolving your issue.

Did the answer help you?YesNo

9. Please: I plan to quit my job in a month. And in the future, take out a loan to buy a home and receive a tax deduction. For what period should I request a 2-NDFL certificate from the accounting department? (for a year, two, three?) And for what period do I need to get a 2-NDFL certificate in order to register with the employment center?

9.1. If you are not a pensioner, then you will not need certificates for previous years: the tax deduction refund will start from the year in which the apartment was purchased. If in 2020, it means only for a few months when we worked in 2020. Then, if you get a new job, you can continue to receive a tax deduction. If a pensioner, then for 3 years preceding the year of purchase, provided that 3 years before the date of purchase they worked.

Did the answer help you?YesNo

10. I would like to know: I need a 2-personal income tax certificate to receive a tax deduction for training for what period of time is it needed and where can I get it if I quit my previous job and work at a new job for 3 months?

10.1. • Hello, if you want to return the deduction in 2020, then you need a personal income tax certificate 2 for 2020, if in 2020, then for 2017. I wish you good luck and all the best!

Did the answer help you?YesNo

11. To receive a tax deduction for the purchase of an apartment, you need to take a certificate 2 personal income tax for what period do you need to take a certificate if I bought an apartment on June 14?

11.1. Hello, are you asking for a certificate for the past year? You submit the declaration in 2020 before the month of May based on the results of 2020. You get a deduction.

Did the answer help you?YesNo

11.2. Good evening. When applying for a tax deduction, you must provide a personal income tax certificate 2 for the previous year. All the best and good luck.

Did the answer help you?YesNo

11.3. Hello! In this case, you need to provide certificate 2 of personal income tax for the previous year. Thank you for being with us, we were glad to help you!

Did the answer help you?YesNo

12. For what period should I take personal income tax certificate 2 for a tax deduction if the apartment was purchased in 2004?

12.1. Hello! . Documents to receive the deduction: passport, certificate of ownership, contract, certificate of your income in form 2-NDFL, tax return in form 3-NDFL at the end of the year. You can also check the list of documents required to receive a deduction on the Federal Tax Service website. Documents for deduction are provided only at the place of registration. Documents can be sent by mail. The deduction can be received after the end of the tax period. They have the right to check documents for exactly 3 months; if the decision is positive, it will be possible to receive a deduction.

Did the answer help you?YesNo

12.2. Take a certificate for the last three years. Because it is for them that you can claim a deduction. And further declare. Until you use the entire amount.

Did the answer help you?YesNo

13. For what period do you need to take personal income tax certificate 2 for a tax deduction for an apartment? From the moment of registration of ownership or not? Thanks in advance for your answer.

13.1. Good afternoon When submitting an application for a tax deduction, information for the previous 3 periods is submitted. All the best to you and good luck!

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

14. I purchased an apartment in May 2020, for what period do I need to take a 2nd personal income tax certificate and for what months for a tax deduction? Do I need to take a certificate for 2016 for 2020?

14.1. Hello! You can receive a property tax deduction for 2020, for 2020, so you need to take certificates for 2015, for 2020.

Did the answer help you?YesNo

15. For what period is a 2nd personal income tax certificate required for a tax deduction when purchasing an apartment? The apartment was purchased in July 2020.

15.1. For the entire 2020, you need a 2nd personal income tax certificate.

Did the answer help you?YesNo

16. For what period is a 2nd personal income tax certificate required for a tax deduction for the purchase of an apartment, if the apartment was purchased in July 2015

16.1. Hello! Certificate 2 of personal income tax for 2020 must be taken.

Did the answer help you?YesNo

17. The apartment was purchased in July 2014 under an equity participation agreement. In February 2020, the apartment was registered as a property. For what period do you need to provide 2 personal income tax certificates to receive a tax deduction for a mortgage? Do I need to write another application to the tax office to receive a deduction for mortgage interest paid?

17.1. If you work - 2nd personal income tax certificate for the last year. You need to write an application for mortgage interest and attach to it a bank certificate about accrued and paid interest.

Did the answer help you?YesNo

18. If a person retires in the year of purchasing a private house, for what period can he submit the Personal Income Tax Certificate-2 for a refund of the tax deduction? Thank you!

18.1. For the period from the date of registration of the right to the house until retirement, Article 78.220 of the Tax Code.

Did the answer help you?YesNo

19. What documents are needed from the Federal Tax Service to return the 13% tax deduction for training in a driving school? Certificate 2 personal income tax for what period?

19.1. Hello! Parents, guardians, trustees, and students themselves can receive a deduction for education if they paid for their education (clause 2, clause 1, article 219 of the Tax Code of the Russian Federation). To receive a deduction, you must submit a license from an educational institution to the Federal Tax Service. To receive the deduction you will also need: a passport; income certificate in form 2-NDFL for 1 year; a copy of the training agreement; copies of documents confirming tuition fees. After conducting a desk audit by the Federal Tax Service, you will be able to receive a tax deduction. From January 1, 2020, a social deduction can be received before the end of the tax period by submitting an application to the employer. In this case, it is necessary to provide confirmation of the right to these deductions issued by the tax authority. Confirmation is issued within a period not exceeding 30 days.

Did the answer help you?YesNo

20. In March 2020, I got dentures. For what period is it necessary to obtain a personal income tax certificate 2 for a tax deduction? Thank you.

20.1. Take personal income tax for 2014 and three months of 2020.

Did the answer help you?YesNo

Please, for what period do you need personal income tax certificate 2 for a tax deduction for the purchase of an apartment, if the apartment was purchased on November 6, 2013?

I purchased a room in July 2020, for what period do I need to take a 2nd personal income tax certificate and for what months for a tax deduction? Thank you.

Please tell me for what period is a 2nd personal income tax certificate required to obtain a tax deduction for the purchase of an apartment?

Please explain for what period to take personal income tax certificate 2 for a tax deduction if dental treatment was in 2014, study in 2014-2015 and treatment in March 2020.

For what period do you need a personal income tax certificate 2 for a tax deduction? Tax deduction for prosthetics and dental treatment. 1 g.8 m worked in the organization.

I am a pensioner, retired in January 2012, purchased an apartment in September 2013, according to the new law, I have the right to receive a tax deduction,

I want to return 13% of my tuition fees. Study period from 2008 to 2012. For what period can I return the deduction?

I purchased an apartment with a mortgage in 2008. To apply for a tax deduction on a purchase

Features of standard tax deductions

The right to standard deductions (NDFL) can be exercised by all citizens of the Russian Federation if their situation meets the requirements of the Tax Code of the Russian Federation. Non-residents are also free to take advantage of these deductions. But at the same time, it is necessary to pay attention to the period of their stay on the territory of the Russian Federation.

Details of the deduction in this case can be found in the article “A refugee can claim deductions for personal income tax only when he becomes a resident.”

Often in practice, situations arise when an employee does not always receive a stable income throughout the year. Should we use standard deductions for the entire reporting period, thereby reducing the overall size of the tax base, or should we not take into account months in which there was no earnings? Officials have their own position on this matter.

You can learn about it from the articles:

- “Is it possible to provide an employee with a standard deduction for a month in which he has no income?”;

- “Is there a standard personal income tax deduction for “non-income” periods?”

The most popular standard tax deduction is the child tax deduction. This is what taxpayers and employers have the most questions about. The amount of the benefit depends on the number of children. Read about this in the article “Art. 218 of the Tax Code of the Russian Federation (2017-2018): questions and answers.”

An increased amount is provided for deductions for disabled children. Deductions for personal income tax in 2020 and subsequent periods for a disabled child for parents, adoptive parents, spouse of a parent are 12,000 rubles, and for guardians, trustees, adoptive parent, spouse of an adoptive parent - 6,000 rubles.

Learn more about “children’s” deductions from this material.

The judicial authorities believe that various children's personal income tax deductions should not be used as mutually exclusive, but together. More details about the position of the judges can be found in the article “The Supreme Court of the Russian Federation: the deduction for a disabled child does not absorb the usual children’s deduction, but complements it.”

The point of view of officials and controllers on the issue of summing up the standard deduction for a child and the deduction for a disabled child has recently coincided with the position of judges. You can familiarize yourself with it here.

The size of children's standard deductions for personal income tax did not change in 2017-2018. The income limit has also been retained. The standard deduction for personal income tax in 2020 and 2020, as well as in 2018, can be used for a child until the taxpayer’s income does not exceed 350,000 rubles .

The materials on our website will tell you about the nuances of providing child deductions:

- “The spouse of the child’s mother has the right to receive a “children’s” deduction”;

- “Free education for a child does not deprive the parent of the right to the standard deduction”;

- “Do they give a “child” deduction if the marriage with the child’s parent is not registered?”

Features of issuing personal income tax certificate 2 at the employee’s request

If an individual requests a certificate from an employer, this can be done in the following ways:

- submit an application through the secretary for signature by the manager;

- send the application by mail.

The deadline for providing a certificate in this case is 3 days from the date of submission of the application.

When filing reports from your last place of work through the Federal Tax Service website, the form is completed on the same day. The data is generated based on the information provided for tax purposes by the employer at the end of the reporting period. The finished document is endorsed by the electronic signature of the Federal Tax Service.

If an employee needs a reporting form from an enterprise that has already been liquidated, you can do the following:

- a new employer has the right to request a document through the Pension Fund or the Federal Tax Service;

- An employee can issue a certificate independently through the tax website or by personally contacting the service.

When requesting a certificate through government agencies, you must justify the reason for the need to provide data on the individual’s income:

- calculation of vacation pay;

- accounting for total income;

- provision of standard deductions.

The fastest way to generate information is your personal account on the Federal Tax Service website.

Social deductions for personal income tax in 2019-2020

Social deductions mean the right of citizens to reduce personal income tax due to previously paid expenses for treatment and education - both for themselves and for their relatives. In this case, you need to take some actions. You will learn about what is required from a citizen in order to receive a tax refund based on concluded contracts for treatment or training in the articles:

- “Procedure for the return of personal income tax (personal income tax) for treatment”;

- “The procedure for the return of income tax (NDFL) for training.”

You can take advantage of the social deduction not only for studying in higher educational institutions, but also when receiving additional education. A prerequisite for this is that the institution must have the appropriate license. Read about this in the article “How to apply for a tax deduction for training in a driving school?”

Is social deduction possible if studying remotely? Find out about this from our message.

An employee can receive social deductions for personal income tax for treatment and training not only from the tax office, but also from the employer. To do this, the employee must submit an application to the employer accompanied by a notification from the tax authority confirming the right to receive a social deduction.

When to provide an employee with a deduction if the employee brought documents for it in the middle of the year, we will tell you at the link.

Deductions for treatment are applicable not only when seeking medical services in specialized institutions, but also when purchasing certain medications. You can find out which medicines provide grounds for receiving benefits from the article “List of medicines for tax deductions”.

Help 2-NDFL: what it is and what it looks like

- the amount of taxable income paid to the employee: wages, bonus payments, payment of sick leave, other remuneration;

- the amount of accrued, withheld and transferred to the budget personal income tax;

- tax deductions provided to the employee.

Since 2020, an updated format for submitting a certificate has been introduced, which was approved by order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11 / [email protected] The innovation is that previously a single form 2 personal income tax was used, but now two different forms are used: the first is intended for organizations sending data to the Federal Tax Service (contains two sheets: the main one and the application), the second is issued to the employee upon his request (consists of a one-page form).

Let's give an example: a trade and service company is engaged in refilling cartridges and selling stationery and office products. For 2020, the accountant filled out Form 2 personal income tax certificates for each employee, with a monthly breakdown in the appendix. The completed information for the past year was submitted to the tax office in March 2020.

Note! If an employee requests confirmation of income for several previous years, for example, for 2 years, then certificates are issued in the form that was used during these periods. That is, for 2020 you need to prepare a report using the old form, and for 2020 - using the new form.

| Old form | New form |

| Contains 5 sections. | Consists of 3 sections and an appendix. |

| Document header and section 1. | Replaced by title page. The employer's tax identification number and checkpoint have been added to the header. |

| Section 2 “Data about an individual”. | The data is included in section 1. O. |

| Section 3 “Income taxed at the rate of 13%”. | Paid income and provided deductions, broken down by month, are entered in the application. |

| Section 4 “Standard, social and property tax deductions.” | Replaced by Section 3 of the same title. Descriptions of the type of notification for deductions have been replaced with codes for deductions, and a record has been added confirming the accuracy and completeness of the information specified in the certificate. |

| Section 5 “Total Amounts of Income and Tax.” | Replaced by section 2 with the same name, the indication “based on the results of the tax period” was added. |

Table 1. Differences between the old and new sample of form 2 personal income tax

The new form, intended for sending to the Federal Tax Service, is designed to be machine readable. This will facilitate and speed up the process of checking reports by the tax service.

Form 2 Personal Income Tax (1 sheet of form)

An additional sheet is an appendix to the certificate, reflects the employee’s income received for each month and the deductions provided to him, the corresponding codes are also indicated.

Form 2 Personal income tax (attachment)

Form 2 personal income tax (for employees)

The name has changed in the new format of the certificate for employees. Now the document is called “Certificate of income and tax amounts of an individual.”

We suggest you read: Can a wife’s property be seized for her husband’s debts?

This form has not undergone significant changes; details not required by individuals have been excluded from it.

Who needs a 2-NDFL certificate and why, and where it may be required

- tax agents;

- individual entrepreneurs (IP);

- working citizens;

- unemployed individuals.

Let's take a closer look at the features of handling Form 2 of personal income tax.

Tax agents

A legal entity or individual entrepreneur acts as a tax agent, which concludes employment contracts with employees, provides the staff with the opportunity to perform their job duties and pays them for their work. At the same time, the tax agent is obliged to withhold personal income tax from the income paid, transfer it to the budget of the Russian Federation, and report this to the tax authorities. Personal income tax certificate 2 serves as such a report.