Features of the deduction

Before contacting the tax authorities, you should familiarize yourself with the legal framework. The Tax Code of the Russian Federation (Articles 220 and 78), Federal Law No. 214 “On participation in shared-equity construction of apartment buildings” regulate the possibility of returning personal income tax.

Important! To return part of the funds, the future owner of the apartment must draw up an agreement in accordance with the requirements of Federal Law No. 214 and go through the registration procedure at the Rosreestr branch.

Highlights

When concluding a share agreement, you will prevent unpleasant surprises. The document has a standard format. When signing it, take into account the following points:

- Accurate information regarding the transfer of property to the shareholder under the deed of acceptance and transfer must be indicated.

- Indication of the exact cost of the real estate property. Otherwise, the agreement cannot be considered valid. The cost of the apartment plays a big role when preparing documentation for personal income tax compensation.

The state returns part of the funds when the owner of the apartment has registered ownership. The tax amount is deducted if:

- An apartment has been purchased or a residential building has been built.

- Interest on mortgages and installments has been paid off.

According to the property tax deduction when constructing an apartment under the DDU, a person can get back 13% of the cost of the real estate. If mortgage funds are used to purchase a home, plus 13% of the interest paid under the mortgage agreement.

When a residential property under the DDU was built in 2014 and later, when compensating interest on a mortgage agreement, an amount of no more than 3,000,000 is taken into account. When a person has issued a refund for the purchase of an apartment built before 2014, he is not entitled to use the tax benefit in case of purchasing another residential property.

For example: Markova registered an apartment that she bought as part of an equity participation in construction in February 2015. An amount of 3,000,000 rubles was spent on the purchase of property. 1,000,000 of our own funds were invested in the purchase of housing; a mortgage loan was issued for 2,000,000 for 10 years. Rate – 10%. Citizen Markova has the right to compensation in the amount of 260,000 rubles - 13% of the cost of the apartment (only 2 million is taken into account) and 13% of the interest paid (3 million) on the mortgage loan for the period between the first payment and the last.

Due to the tax deduction for the purchase of housing under the DDU, you can reimburse:

- Payment for developer services.

- Costs for registering property rights.

- Financial resources spent on the purchase of building materials for finishing the apartment (if the developer handed over the property without finishing).

To receive payment, you will need many documents, which will be discussed later.

Who can claim a personal income tax refund?

A property deduction for shared construction is available to tax residents of the Russian Federation - persons living in the country for more than 183 days during the year. Other conditions:

- Official place of work.

- Salary on which tax is withheld at a rate of 13%.

Conditions for receiving the DDU deduction

The conditions and algorithm for payments under an equity participation agreement are similar to tax refunds under a regular agreement for the sale and purchase of residential real estate.

This type of compensation has clear requirements for documents submitted along with the application for a refund. If certain conditions are not met, it may be difficult to obtain compensation.

Cases of tax deduction distribution:

- Construction of residential real estate on your own plot of land;

- Registration of land for development;

- Purchasing a house or apartment in a multi-apartment development (purchase of a share is possible);

- Participation in share accumulation or shared construction;

- Partial repayment of a mortgage loan;

- Compensation for expenses incurred for repair work: workers’ services and finishing and construction materials (provided that the living space is purchased without the established minimum finishing, possible costs are indicated in the DDU).

We suggest you familiarize yourself with: The commercial lending limit is

Buying living space in an unfinished house is not uncommon. The option of drawing up a share participation agreement or a share accumulation agreement in a housing cooperative is suitable here. In both cases, the period between documenting the transaction and issuing a registration certificate of ownership reaches several years. Accordingly, buyers have a question: “In what time frame can a tax deduction be returned for shared participation in construction {q}”

Providing a registered certificate to the tax office is not required. The buyer receives the right to compensation immediately as soon as he signs the acceptance certificate with the developer. This document confirms ownership of the purchased living space. The acceptance certificate is signed when the house is completely completed and put into operation.

The presence of a transfer deed for the home is the main condition for receiving the deduction. Until the developer delivers the finished housing, it is impossible to receive an income tax refund from the budget. Even if the citizen takes out a mortgage loan and pays it regularly for several years. You can receive compensation from the budget only after the housing is completely ready and handed over by the developer.

Otherwise there are no exceptions. Property tax deduction under an equity participation agreement is provided on the general terms established by Article 220 of the Tax Code of the Russian Federation.

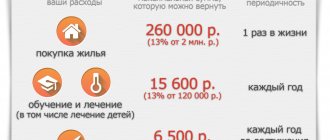

The amount of the deduction

The property deduction for shared construction is 2,000,000 rubles. When interest on the loan was paid when purchasing a home, the taxpayer will return 13% income tax on 3,000,000 rubles. The amount of the deduction cannot be higher than the upper limit - 260,000 and 39,000 rubles.

Important! A tax deduction for shared participation in construction is provided in the tax period in which the tax event took place and subsequent years. If a person bought housing under the DDU in 2020, he can apply to the Federal Tax Service with a deduction for the year 17. If the tax amount is not enough for a full refund, the balance is carried forward to 2020, 2020 and beyond until the full amount is paid.

Example: Pokrovsky purchased an apartment in 2015 in a building that was still under construction. Costs amounted to 3,000,000. In 2020, the property was registered. During this year, the employer withheld tax of 105,215 rubles from the salary to the state budget. For 2020, Pokrovsky received a deduction of 105,215 rubles, the balance of 154,785 rubles is carried over to the next year.

Ways to receive money

As for specific refund amounts, there are the following restrictions:

- The maximum amount from which payment can be made is 2 million rubles. Provided that the shared construction agreement is concluded before 1.01. 2008. If later, the deduction will be made from 1 million.

- The amount for calculating payments cannot be more than 2 million rubles.

- You can count on a refund in the following amounts: if the return calculation is 2 million, then 260 thousand rubles, if 1 million, then 130 thousand rubles.

- The calculation for each shareholder is based on the amounts that the employer transferred from the salary during the year. It is impossible to take more than this amount.

- You can receive funds in parts until the limit amount is reached.

If we are talking about the right to a property tax deduction under an equity participation agreement, then there are two mechanisms for receiving money that the legislator provided us with. You can return taxes paid after the fact through the tax office, and get the right not to pay taxes on time until the tax deductible amount has been exhausted. Let's take a closer look at these two situations.

We suggest you read: How to reduce taxes under OSNO, reduce income tax - “My business. Accountant".

Tax

Everything is simple here. You transfer money (or rather, not you, but your tax agent, as a rule) to the country’s budget. You have the right to return them. The legislator established a period of three years - this is the period for which taxes paid can be refunded. It's easier to explain with an example:

- The apartment was purchased in 2020

- You can submit an application to the tax office in 2020 requesting a refund of taxes paid in 2020.

- You can repeat the process in 2020 and 2020 - if the tax deduction limit is sufficient. In the case of DDU, the limit is the same as in the case of drawing up a purchase and sale agreement on the secondary market

Another example, more negative:

- You bought an apartment in 2014. We decided to make a tax deduction and came to the tax office in 2020. You will be able to get money back for taxes paid in 2020, 2020 and 2020.

- If you paid a lot of taxes in 2020, you will have to clarify whether it is really possible to issue a tax deduction for the DDU for this particular year at the tax office. But most likely not, because the legislator clearly established the period - three years before the year of application

Look carefully at which year is best to apply for a tax deduction. You might get more money if you wait a year. Or you may have to wait another one - if a job with a large income appears on the horizon. But in this situation, it is still better to use the offset method and receive a tax deduction for the DDU in the form of a salary increase. Let's take a closer look.

Job

Now let’s figure out what to do if in the past three years you actually didn’t receive much income, but now you bought an apartment under a DDU agreement and now you plan to receive a property deduction for it. Plus, you got a job in which the employer pays a fairly large amount of taxes for you every month.

It's simple - in fact, you can ask your employer not to pay taxes for you, but to transfer this amount to you directly. Of course, you need to notify the tax office before doing this. The process of applying for a tax deduction through the tax office or through an employer is described below.

It will look quite simple:

- You collect all the papers and write an application. For example, you took ownership of the apartment in March 2020. The statement was written in October 2020.

- Accordingly, if everything goes well at the tax office, then from November 2020 you will be able to receive not just your salary, but also a tax deduction from it

If you are thinking about how easy it is to get a tax deduction for DDU in 2019, use the option with the employer. It's much simpler, more efficient and faster. Naturally, if your employer formalizes everything without violations and “gray” salaries.

https://www.youtube.com/watch{q}v=yAqtrOr-K30

The amount of the deduction for the DDU does not differ from the amount of the benefit for the purchase of finished housing or for self-construction. The buyer of an apartment in a new building can count on 260,000 rubles of personal income tax refund based on the actual costs of purchasing living space. Provided that the cost of the apartment is 2 million or more. By purchasing real estate at a lower price, the taxpayer will receive only 13% of the actual cost of housing.

IMPORTANT! The agreed 2,000,000 rubles include not only the actual cost of square meters. The following types of expenses can also be counted:

- payment for the services of the developer, if this amount is highlighted as a separate line in the DDU;

- payment for design and estimate documentation for finishing work;

- payment for finishing work and materials if the apartment is rented without finishing.

You can receive 390,000 rubles of personal income tax refund on interest paid on a mortgage (target) loan or loan. Provided that the maximum amount of benefits for repaying interest on housing loans is 3 million rubles. By taking out a smaller amount for a mortgage, the taxpayer will receive a proportional refund (interest on the loan × 13% personal income tax).

We suggest you read: How much tax is paid when selling a house as a gift?

If the mortgage was received before 2014, then the amount of personal income tax refund is determined without a maximum limit. That is, you can get a tax refund on the entire amount of interest actually paid on the mortgage. Moreover, for refinanced loans, deductions can also be obtained on a general basis.

List of documents

Documents for obtaining a property deduction in case of purchasing real estate under the DDU:

- Apartment owner's passport (copy).

- An equity participation agreement in which the cost of a residential property is fixed.

- A paper certifying ownership of the purchased property.

- Extract from the Unified State Register of Real Estate.

- The act of transferring the apartment, signed by the interested parties.

- Documentation confirming payment for housing under an agreement with the developer.

- Declaration 3-NDFL.

- Certificate of income 2-NDFL.

- Various documentation: receipts and checks, which record the costs incurred for the preparation of design and estimate documentation, finishing work.

- Application for deduction.

If mortgage funds were used to purchase a home, attach an agreement and a certificate from a banking institution, which confirms the repayment of mortgage interest at the end of the year before issuing an income tax refund. If real estate was purchased by married people, you need an appropriate certificate and an agreement on the distribution of deduction shares between the spouses.