What is a tax deduction?

A tax deduction is a guarantee established by the legislation of the Russian Federation, which can be:

- Reimbursement to a citizen of personal income tax paid in the amount of 13%;

- The legal basis for a citizen’s failure to pay income tax is 13%.

Each of these guarantees has its own advantages. So, having received a large amount of personal income tax refund, you can spend it on something useful. In turn, without paying personal income tax, you can spend the freed-up funds immediately, without waiting for them to depreciate due to inflation.

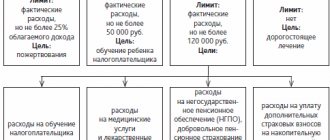

It is worth noting : which of these 2 guarantees can be used depends on the specific type of deduction. Russian laws establish a fairly large number of them. The most popular ones include:

- property deduction (provided when purchasing residential real estate);

- social deduction (provided when using paid services in the field of education and healthcare);

- standard deduction (provided to certain categories of the population).

All of these deductions are united by the fact that the condition for receiving them is that the citizen has income subject to personal income tax - a tax at a rate of 13%. In general, this tax is charged on wages received by a person under an employment contract.

For example, consider the following situation:

Citizen Pronin K.V. sold residential real estate that was owned for less than the period established by law (3 years). Thus, he is obliged to pay a tax of 13% on the amount of income received for the apartment. Moreover, if in the year of sale of the apartment K.V. Pronin purchases another property, in this case his obligation to pay taxes is relieved.

Obtaining such a benefit is quite simple; you just need to contact the tax office at your place of registration and submit a claim for the right to take advantage of the mutual deduction. Additionally, you will need to provide documents confirming the sale and purchase of housing.

How long do you need to work to receive a deduction?

How long do you need to work to get a tax deduction ?

The length of your work experience does not in any way affect the possibility of receiving a deduction. But to a certain extent it can influence its size. For example, a person bought an apartment worth 2,000,000 rubles. After this, he has the right to a deduction in the amount of 13% of this amount - that is, 260,000 rubles.

Let’s agree that a person earns 40,000 rubles a month. Personal income tax is charged on this amount at the rate of 13%, that is, 5,200 rubles. And in order to receive a deduction in the amount of 260,000 rubles, a person needs to work for about 50 months (260,000 / 5200).

In turn, if a person’s salary is 80,000 rubles, then he will need to work for 25 months. If the salary is 20,000, then it’s already 100 months, and so on proportionally.

I don't work officially

Advice from lawyers:

1. Can a daughter receive a tax deduction for her mother if the mother does not officially work?

1.1. Good afternoon If the mother does not officially work, then, unfortunately, it will not be possible to obtain a tax deduction; only those who work are entitled to a deduction.

Did the answer help you?YesNo

1.2. Can a daughter receive a tax deduction for her mother if the mother does not officially work? No, he can not. Only the mother herself has the right to deduction.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

2. Can I get a tax deduction if I don’t officially work?

2.1. No, you can't.

Did the answer help you?YesNo

2.2. The deduction must be made against tax on official income. No official income, no deduction.

Did the answer help you?YesNo

3. Can I get a tax deduction for a mortgage if I don’t work officially?

3.1. No, because you do not pay income tax. And it is this amount that is returned to you.

Did the answer help you?YesNo

4. At the end of 2014, my common-law spouse and I purchased an apartment. Property in shared ownership of 1/2 each. After which we officially got married. At the moment, the spouse does not officially work and has not worked; there are no permanent stable sources of income. Now we want to get a property deduction. I work officially. Can I get a deduction for it? Thank you for your reply.

4.1. Hello) Yes, it is possible.

Did the answer help you?YesNo

4.2. You have the right to receive a property tax deduction only for yourself up to 2 million rubles. Question: On providing spouses with a property deduction for personal income tax when purchasing an apartment in 2020 (Letter of the Federal Tax Service of Russia dated March 30, 2016 N BS-3-11 / [email protected] ) In the last paragraph of the letter of the Ministry of Finance of the Russian Federation dated September 13, 2013 N 03 -04-07/37870, communicated through the system of tax authorities by letter of the Federal Tax Service of Russia dated September 18, 2013 N BS-4-11 / [email protected] , to which you refer in your appeal, it is indicated that in relation to the provision of a property tax deduction upon acquisition real estate objects into common shared ownership, despite the absence in the new edition of Article 220 of the Tax Code of the Russian Federation (hereinafter referred to as the Code) of the corresponding norm, the previously existing procedure for providing property tax deductions to co-owners of real estate objects, including spouses, has not changed and is based on the amount expenses of each person, confirmed by payment documents, or based on the spouses’ application for the distribution of their expenses for the acquisition of real estate

.

Did the answer help you?YesNo

5. I am in a civil marriage. I don't officially work. The father of the child is IP. He will be listed as the father on the birth certificate. The child is legally recognized. Am I entitled to receive benefits and what kind? And what kind is it, if any? Is he entitled to a tax deduction?

5.1. Good evening. You need to contact the Social Service at your place of residence. For non-working women, the following payments are made at the birth of a child: a lump sum payment at the birth of a child, a child care allowance for up to 1.5 years, if the family income is less than twice the subsistence minimum, payments for up to 3 years in the amount of the subsistence minimum can be issued for each family member. There may also be regional payments. You can find out in detail about all the required payments based on your circumstances from the Social Security Department.

Did the answer help you?YesNo

6. The situation is like this. In May 2020, a house was purchased using maternal capital. Shares have been allocated tarially to the children and husband; due to the pandemic, we have not been to the MFC yet; there is no data in Rosreestr yet. We would like to receive a tax deduction from our funds invested in the purchase of a house. This is 400,000. I haven’t worked officially for a long time, I’m currently on maternity leave. My husband worked officially for several years until November 2020. Can a husband receive a tax deduction for himself and what needs to be done for this?

6.1. Your husband may receive a tax credit for 2020. The amount will be equal to the amount of tax paid for this period. Further, if you work and pay personal income tax, you will return the tax deduction annually until you receive 13% of 400,000 rubles. In this case, both you and your husband can receive a deduction. To receive a tax deduction, you need either through the taxpayer’s personal account or in person to contact the tax authority and provide documents, namely a purchase and sale agreement, ownership (extract from the Russian Register), a receipt for the transfer of funds, a passport, Inn, marriage information, if you want both receive. Other documents may be required.

Did the answer help you?YesNo

7. The apartment was purchased during marriage in 2020, with a mortgage, registered in the wife’s name. The mortgage is also for the wife. Previously, the wife received a deduction for the apartment she purchased before marriage in 2010. Thus, she does not have the right to deduction. My wife works and has an official salary. The husband does not officially work or has a very small official income. I have not received a deduction before. When applying for a deduction for an apartment for a husband, is it possible to provide income, 2-NFL certificates received by the wife from her work to increase the amounts received?

7.1. Hello. No, you can't do that.

Did the answer help you?YesNo

8. Question about tax deductions, I’m confused. I was a minor and my parents and I bought an apartment with 1/3 shared ownership. The cost is a little less than 3 million. I also purchased 1/1 land plot in 2020. As soon as I turned 18 (2018), I went to work and am still working, officially, taxes are deducted. What tax deduction can I claim, please explain, I don’t understand anything