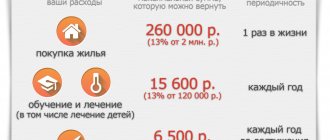

The state provides a tax benefit that provides for a property deduction for the purchase of real estate. The tax deduction allows you to return part of the money (13% of the transaction amount) spent on the purchase of housing. Property deduction refers to the amount that a citizen has the right to return after purchasing a property. The maximum deduction amount is 13% of the purchase price, not exceeding 260 thousand rubles. A person has the right to take advantage of this deduction only once in his life.

Who can return the tax deduction for the purchase of an apartment?

After acquiring real estate, an officially employed individual who receives a certain salary, from which income tax is withheld in favor of the state, has the right to apply for a property deduction. This right can only be exercised by citizens of the Russian Federation who are permanently registered and residing in the country. A foreigner who buys a plot of land, a house or an apartment in Russia will not be given a tax deduction. A citizen from whose earnings income tax is not withheld will not be able to apply for a property deduction. If an elderly person has a pension amount that is less than the established minimum subsistence level, then he will be denied a refund.

Grounds for receiving a tax deduction:

— periodic deduction by an individual of fixed amounts to the state budget (Article 220 of the Tax Code of the Russian Federation),

— acquisition of ownership rights to any residential property.

Tax refunds are made only from those amounts that were contributed by the payer to the state budget over the past three years.

Until what date can you file a tax return in 2020?

- funds received by a representative of the category of individual entrepreneurs;

- financial resources received by notarial workers conducting private practice;

- cash payments earned by lawyers who independently established law offices;

- other persons who have chosen private practice as the main purpose of their activities;

- funds that were received due to the performance of work of various categories, as well as due to the provision of various services, carried out in accordance with agreements concluded between the recipient of the service and the contractor, which are of a civil nature;

- remuneration of authors who created, performed, or produced any object of science, art, literature, made any discovery, invented something, etc.

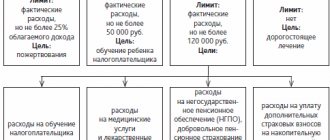

Professional deductions are amounts provided in the amount of expenses that were actually incurred by the taxpayer and were then confirmed. In some cases, the amount actually spent is not determined, and representatives of the category of self-employed people can receive a deduction, the amount of which will be 20% of the total income of the persons sought.

When to file a tax deduction for the purchase of an apartment

A person can use the right to receive a deduction at any time, starting from the next year after purchasing real estate. The Tax Code of the Russian Federation does not establish a statute of limitations. The property deduction is provided after the end of the tax period in which the real estate transaction was completed. For example, if housing was purchased in 2020, then you can submit documents for the deduction no earlier than 2020. However, the new owner may not wait until the end of the tax period. To receive a property deduction for purchased real estate, he should contact his employer immediately after completing the transaction. The owner should write an application to the tax office at the place of registration, requesting notification of the existing right to a property deduction. The application is written in any form. Attached to it is a certificate of registration of ownership of the property and a purchase and sale agreement with the specified transaction amount. The owner must give the notice received a month later to the employer. This paper will be the basis for canceling the withholding of personal income tax. If an employee has several employers, he has the right to receive a tax deduction in the year of purchase of housing from any of them. The return of withheld personal income tax from others occurs in the general manner during the following tax periods (clause 8 of Article 220 of the Tax Code of the Russian Federation). If it is not possible to receive a full refund in the year of purchase of the property, then next year the deduction is made in the general manner by submitting a new tax return to the tax office.

The validity period of the tax deduction when purchasing an apartment is not limited by law.

List of documents required to receive a tax deduction for treatment

Today, a number of situations may arise in which the taxpayer is allowed by law to return part of the money he previously spent, for example, when he becomes ill with various ailments. Therefore, it would be most appropriate and useful to talk in this article about what documents are needed for a tax deduction for treatment.

- Birth certificate. A copy of such a document is needed if you want to receive monetary compensation for the treatment of a child.

- Marriage certificate. For example, if a husband incurred expenses aimed at his wife’s recovery, then in order to receive a deduction, he must have a copy of the marriage certificate.

- Your own birth certificate. Such a copy is needed by those individuals who apply for a tax rebate for the treatment of their father or mother.

It should be noted that in order to successfully reduce the tax base in the case of cash expenses for treatment, it is not at all necessary to use the services of a state medical institution. You can contact any private clinic that has a license.

How to apply for a tax deduction when buying an apartment

To receive a tax deduction, you must fill out a declaration form 3-NDFL with a package of necessary papers and submit it to the tax office at the place of registration. Tax officials will check all documents and transfer the due amount to the specified bank account. To apply for a property deduction after purchasing an apartment, you must provide the following documents:

| Declaration and statement | Certificate in form 2-NDFL from place of work | Copies of documents for housing |

| Tax return in form 3-NDFL and application for a refund (which must indicate the bank details of the account to which the tax office will transfer the money) | Certificate 2-NDFL is issued at work. It reflects information about the employee, data on income and withheld tax for the calendar year. | Purchase and sale agreement, certificate of registration of title or deed of prima transfer, documents confirming payment (receipt, receipt, payment order, etc.), when using a mortgage: loan agreement; a certificate of interest withheld by the bank during the year; payment documents |

The verification of the submitted papers lasts up to three months at the tax office. After the end of this period, a notification of refusal or provision of a property deduction will be sent to the specified registration address. If the decision is positive, the funds will be transferred within two weeks. The entire process will take from one to three months.

Documents for tax deduction

The specific list depends on what type of compensation citizens apply for. It is best to contact representatives of the relevant authorities in advance to get advice.

When buying an apartment

For a taxpayer, the list of documents for a tax deduction for an apartment will look like this:

- Mandatory original certificate 2-NDFL.

- A copy of the taxpayer’s passport, which provides basic information regarding the citizen.

- Declaration of fees to the budget in form 3-NDFL.

If several jobs are maintained during the reporting period, then certificates are provided for each of them.

A sample 2-NDFL income certificate is here.

Additional applications are:

- Contract for purchase and sale.

- Confirming payment papers.

- Extract from the Unified State Register of Real Estate to confirm ownership.

- The act of acceptance and transfer of housing.

The transfer and acceptance certificate for the property will arrange for an inspection in the event of registration of shared ownership. A copy of the loan agreement will be needed if it has been drawn up previously. Then you also need a certificate regarding the interest withheld. Separately, if necessary, participation in the creation of design and estimate documentation is confirmed.

For mortgage

The law makes it possible to receive a tax deduction on mortgage interest. It was already mentioned above that you need not only the document itself, but also receipts along with checks according to which interest was paid. This will also help you save on this part of the agreement.

The inspection sometimes requires additional evidence to prove that the loan has been repaid. Then you can simply contact the company with which the contract was concluded.

For treatment

When applying for a deduction for treatment, the standard requirement remains the preparation of a tax return, for which form 3-NDFL is used.

In addition, regulatory authorities will need:

- Certificate from work 2-NDFL.

- Tax refund application.

But additional applications cannot be avoided when it comes to compensation based on the services that were provided to the patient. Dental treatment is done the same way.

Other documents:

- Certificate that payment has been made.

- Documents for tax deductions confirming the amount of expenses incurred.

- License of a medical organization on the basis of which activities are carried out.

In the case of medicines, it is necessary to save the prescriptions on the basis of which they were purchased. The payment document itself also plays the role of evidence. For voluntary health insurance, presentation of the policy is required.

Find out about receiving a tax deduction for your apartment. How many times can you apply for a tax deduction? See here.

For studying

When applying for a deduction for education, a citizen attaches the following types of documents to the declaration:

- All payment documents to confirm payments.

- License permit on the basis of which activities are carried out.

- Agreement with an educational institution.

- Return application.

- Help 2-NDFL.

Other grounds

A passport and proof that income tax is regularly paid remain the main requirements in all circumstances. The remaining papers depend on each specific case and its features.

The main thing is to present certificates that would confirm the expenses. This is important even in the case of charity.

You cannot do without a certificate of registration of an individual entrepreneur when it comes to professional deductions. Sometimes proof of copyright for an invention or discovery is required. What specific papers are needed are explained by the service staff on site.

A sample application for a tax deduction is here.

What amount is returned and for how long?

The maximum refundable amount cannot exceed the income tax paid for the year. This amount is 13% of the annual salary, according to the certificate in form 2-NDFL. The remaining amount is carried over to the next year. This will continue until the entire due deduction is returned. As a rule, the property deduction will be provided in full within several years. The maximum amount of real estate that is not subject to income tax has been established - 2 million rubles. If the purchased apartment is more expensive, then the refund will be calculated as for housing purchased for 2 million rubles. Thus, the largest return will be 260 thousand rubles (13% of 2 million rubles). If housing was purchased with a mortgage, then in addition to this amount, the taxpayer has the right to return 13% of all interest paid for using the loan. There is no maximum amount set for them. For what period of time can I receive a deduction? Funds are returned for the last 3 years. For each year, you must submit a new declaration with a complete package of documents. Refunds for the current year can only be made in the next year. Each declaration must contain information about the balance from the previous document.

The amount of tax deduction cannot exceed 260 thousand rubles.

Property tax deduction increased from January 1

In Belarus, the size of the property tax deduction has been increased. From January 1, 2020, instead of 10%, it will be 20% of taxable income. It is used for expenses to purchase real estate. Expenses must be actually incurred and documented. The changes are spelled out in the new edition of the Tax Code, which has been in force since the new year.

We recommend reading: Putting Budynok into Operation 2020

If in the current tax period an individual was not provided with a property tax deduction or was not provided in full, then the unused amount is carried over to subsequent periods. Until it is completely used.

Deadlines for filing an application for a tax refund

The taxpayer has the right to receive the paid 13% of the cost of housing. However, the timing of applying to the Federal Tax Service should be taken into account. There are several rules for determining:

- the application is advisable only after the end of the calendar year in which the purchase and sale transaction of a residential property was completed. The rule is valid in general, but there are exceptions;

- It is not necessary to contact the tax service until a certain date next year. There is a misconception that this is the period set for filing 3-NDFL, but this is not so. The applicant has the right to submit a declaration throughout the year;

- Personal income tax is reimbursed only for the last 3 years. The exception is the filing of a declaration by pensioners;

- receiving a property deduction has no statute of limitations. This means that the interested person has the right to submit a declaration in 15, 20, etc. years after the transaction. At the same time, do not forget about the compensation period (last 3 years).

The listed rules are general. There are some nuances to the procedure when applying. If the applicant did not know about the existence of the right to issue a tax deduction, at any time when he became aware of this, he has the right to submit documents to the Federal Tax Service office.

Through the employer

In other cases, the period for applying for the collection of amounts due begins only after the end of the calendar year in which the transaction was concluded. When registering through an employer, not only the procedure, but also the timing of payment of funds changes.

The main difference is that you can apply for a deduction through your employer without waiting for the end of the year.

To do this, you must follow a certain sequence of actions:

- Drawing up an application for a deduction and submitting it to the Federal Tax Service.

- Preparation and submission of copies and originals of payment papers to verify the implementation of the transaction.

- Waiting period of 30 days for verification of submitted documents.

- Obtaining permission for registration from the tax service.

- Submitting the received document to the appropriate department of the employer.

After this, the person concerned will be gradually given a deduction through no salary deductions. The peculiarity of the procedure for compensation through the employer is that an appeal to the Federal Tax Service is possible during the period of time when the transaction is concluded.

Through the tax office

The general deadlines apply when applying for deductions through the Federal Tax Service branch. However, the procedure for its registration is different. The interested party acts according to the step-by-step instructions:

- Fills out the 3-NDFL declaration.

- Collects and submits copies and originals of payment documents and income papers to the Federal Tax Service.

- Prepares an application for reimbursement.

- Waits for a specified period of time.

- Receives a deduction.

It is important to indicate the method of transferring funds. The delivery times vary:

- to a bank card about 3 months. In this case, the recipient's account number is indicated. This should not be confused with the card number, as these are different combinations of numbers.

- about 4 per savings book.

The peculiarity of receiving payment through the tax office is that it becomes possible to apply only the next year after the conclusion of the transaction.

Online

For holders of an electronic digital signature and a personal account on the Federal Tax Service website, it is possible to submit a declaration online. Deadlines and registration rules remain standard. If the taxpayer has both, he should act according to the instructions:

- Login to the Federal Tax Service website and account.

- Selecting the item “Tax on personal income”.

- Uploading the declaration to the website.

- Select an item from those offered by the system: download a program to create a declaration, send, fill out, etc. if it is necessary to create a new 3-NDFL, select the appropriate item.

- Filling out all the data required by the system.

- Sending the finished document.

- Sending the documents required for registration of the deduction.

After this, the taxpayer can track the status of the application in his personal account. After sending, you must go to the tax office to present the original documents.

INFS actions

Anyone who wishes to receive a deduction must submit a personal income tax return. In order to submit a tax deduction when purchasing an apartment or real estate, the Federal Tax Service clearly indicates what information to provide.

The processing time for a tax refund return is three months. During this period, the procedure for contributions, payment of insurance premiums, and benefits are considered. The ownership of an apartment that was purchased before applying for a tax deduction is also assessed.

To receive property personal income tax, citizens will have to submit all the required documents. And after making a positive decision, wait for the payment itself within a month. After insurance premiums and other indicators are verified, accrual will occur. The property deduction will return after this. Although in practice, when you can get a deduction for an apartment, it takes much longer to transfer it.

The remaining changes related to 3-NDFL declarations concern individual entrepreneurs and the self-employed population. The procedure for calculating insurance premiums, tariffs, liability and fines has been changed. For individuals applying for a property return, there are no other changes yet and are not expected. In any case, if difficulties arise, you can always contact specialized companies for advice.

Tax refund when buying an apartment in 2020

If you don’t feel confident that an online declaration for a partial refund of housing costs will be within your power, you will have to act traditionally – through the local Federal Tax Service. But here you will be dealing with real people, and not with electronic forms.

Citizen I. works, citizen K. does not. The calculation is carried out according to the object of taxation, therefore the maximum limit for reducing the tax base will be 1 million. A working citizen of I. will be returned 130 thousand (13% of a million) for the previous three years (2020–2020).

Income tax benefits

If the citizen alienating the property acquired this property free of charge or with partial payment, then the expenses for the acquisition of property also include the amounts on which income tax was calculated and paid upon the acquisition of such property, and in relation to real estate and vehicles, such expenses Also included are amounts that are not subject to taxation and (or) not recognized as objects of taxation in accordance with the legislation in force at the time of acquisition of this property. [∗] subclause 1.2 of Article 211 of the Tax Code of the Republic of Belarus

The tax deduction is provided to citizens and members of their family who are (who were at the time of concluding a credit agreement or loan agreement) registered as needing improved housing conditions. In this case, family members of a citizen include a spouse, their children and other citizens recognized as family members in court in the amount of their expenses for: [∗] subclause 1.1 of Article 211 of the Tax Code of the Republic of Belarus

We recommend reading: Programs for Large Families in Bashkortostan 2020

Until what date can you file a tax return in 2020?

According to the letter of the law, the period allotted for receiving a tax deduction provided for the purchase of housing, as well as other types of this tax refund, is unlimited. In other words, it does not have a statute of limitations, so you can claim a deduction for receiving this compensation from the state at least 50 years after the right to it arises.

The first and very important question that we must familiarize ourselves with is the desire to understand for which years information can be submitted in the current year. We answer: the tax can be returned only for the one-year period in which your right to receive a deduction arose.