27 July 2020, 16:32 1868

Home / Newspaper / Moscow real estate market news

What is a mortgage? Who can take it? What documents are needed and how to complete everything correctly? Detailed instructions for applying for a mortgage loan on Restate.ru.

| New buildings and apartments in new buildings, Secondary housing market, Residential mortgage lending |

Read us in Yandex.News

- What is a mortgage

- How is a mortgage different from a regular loan?

- How is a mortgage different from a pledge?

- Basic lending

- Requirements for the borrower

- Documents for mortgage

- No down payment

- Is it possible to repay the loan early?

The cost of housing on the real estate market is high, so not everyone can buy it with their own savings. The solution is mortgage lending. If you buy an apartment with a mortgage, you won’t have to pay for years to live in a rented apartment. The advantage of a mortgage is a low interest rate compared to a consumer loan, the disadvantage is a long repayment period and more stringent requirements for the borrower.

What is a mortgage

A mortgage is a type of lending in which a pledge is issued on the purchased property. If the borrower does not make monthly payments on time, the lender may sell the property to recoup its losses. The debtor will lose real estate, even if it is his only home.

How is a mortgage different from a regular loan?

Mortgage lending has its own characteristics. Differences between a mortgage and a regular loan:

- A mortgage is a targeted loan. The funds can only be spent on purchasing housing or improving it.

- A mortgage is issued on the purchased object. The borrower becomes the owner of the apartment, but cannot dispose of it without the permission of the bank.

- When applying for a mortgage, you need to make an assessment of the value of the home.

- There are more requirements for the borrower and they are more stringent.

- A regular loan is easier to apply for.

How is a mortgage different from a pledge?

Mortgage and pledge are similar concepts, but they have differences.

Collateral is one of the conditions of a mortgage loan. An object that is used as collateral guarantees the creditor repayment of the debt. Not only real estate, but also other material assets can be used as collateral.

A mortgage is a targeted loan in which the purchased object is used as collateral.

Bank requirements

It is possible to obtain 2 mortgages at the same time only if the potential candidate for approval of the application fully complies with all the requirements put forward by the bank. And although each financial organization has its own, general conditions for secondary lending are defined that apply to all companies:

- The total income of the borrower and persons acting as co-borrowers must not only be stable, but also sufficient to regularly pay current installments on all loans a person has. This will need to be documented.

- The borrowed funds must not only have a specific purpose, but also provide financial benefit to the borrower. A re-mortgage is possible when it is used for a commercial type of real estate with subsequent rental of housing. An alternative is that the first debt is taken out to purchase an apartment that is already rented.

- Age restrictions - the applicant must be of legal age and able to work.

- Mandatory official employment.

- Having Russian citizenship.

- Impeccable credit reputation.

Note! If the amount of payments on existing loans is more than 40% of the total family income, then a second mortgage may be denied.

How a mortgage works: diagram

How the mortgage works:

- Submitting an application to the bank. The application indicates the amount that the future borrower is counting on and the purpose of receiving the money - the purchase of real estate.

- The bank checks the documents and application, then makes a decision - to issue money or refuse. In the second case, you need to take into account the bank’s requirements, correct your financial situation or credit history and try again.

- The future borrower independently looks for housing, taking into account the requirements of the bank and his wishes. When the object is found, he provides documents for the apartment to the bank.

- The bank is studying the documents. If he is satisfied with everything, he approves the application and reserves the required amount in a safe deposit box.

- The buyer and seller sign the contract.

- The bank prepares documents to register the transfer of ownership, including a mortgage on an apartment. This is an important document that will allow the bank to repossess the client's property if he stops paying.

- The parties contact Rosreestr or MFC and register the transfer of ownership. Along with it, the encumbrance on the apartment is also registered. From this moment the borrower becomes the owner of the property.

- The bank transfers the money to the seller.

- The borrower pays the debt to the bank.

Next, there are two possible options. The borrower regularly pays the mortgage or repays it early. After that, he takes the mortgage from the bank, draws up the necessary documents and removes the encumbrance. From this moment on, he can dispose of the apartment at his own discretion.

If the borrower stops paying, the bank can repossess the home and put it up for sale. The proceeds go to pay off the debt. If anything remains, it is returned to the debtor.

Mortgage to another person

Advice from lawyers:

1. Can I take out a mortgage on myself and make another person the owner?

1.1. Good afternoon. When purchasing real estate with a mortgage, information about the prohibition of registration actions related to a change of owner is simultaneously entered into Rosreestr. It can't be done the way you want. You can consider this the bank's insurance.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

2. Is it possible to take out a mortgage on yourself and register the apartment in the name of another person.

2.1. Elena, no bank will agree to such conditions; a mortgage is a loan secured by real estate.

Did the answer help you?YesNo

3. The mortgage is issued to me, can I transfer it to another person?

3.1. — Hello dear site visitor! No, of course not, don’t re-register anything. Good luck to you and all the best, with respect, lawyer Legostaeva A.V.

Did the answer help you?YesNo

4. We want to buy a private house. There is a plot and a foundation on it. The owner is an individual. face. This owner undertakes to build a house according to our drawings and is ready to sell it to us (on a mortgage). In order for us to be sure that the developer will not sell this house to other people, we must give him money. And to insure him that we won’t merge, a small advance payment is required. Question: what kind of agreement can be used to formalize this amount of prepayment/advance payment?

4.1. First, draw up a deed of land and register ownership. Initially, check the boundary plan and the cadastral plan without encumbrances.

Did the answer help you?YesNo

5. I have several questions: 1. The seller of the apartment is in another city, can he write a power of attorney for his person to simplify the transaction and avoid unnecessary trips? 2. The apartment that I am going to take out with a military mortgage is in shared ownership (husband, wife and 2 children), how does this affect the registration of the mortgage and if there are any nuances here?

5.1. 1. Power of attorney certified by a notary from all owners of the apartment. 2. Since the apartment has four owners, two of whom are minors, consent to the sale from the guardianship authority is required! Also, you need notarized consent from both spouses to sell the apartment.

Did the answer help you?YesNo

5.2. I will add that since the shares of children are being sold, in addition to the consent of guardianship, a mandatory notarization of the purchase and sale transaction is also required.

Did the answer help you?YesNo

6. I am interested in a situation in which two unmarried people (one of them is my father who died after they took the apartment) buy an apartment under an equity participation agreement, they invest part of the funds, and take part in a mortgage, and the borrower there is only one of them, to whom the ownership will be registered in this case, if I am the heir of my father, it is written in the Duty that the father has 1/2 and the other person too, 1/2

6.1. Good afternoon From the question it follows that you were not married and for some reason you call him father, while you bought an apartment, in fact, whoever the buyer is is the owner in the absence of a marriage relationship.

Did the answer help you?YesNo

6.2. If in the share participation agreement your father is listed as the party entitled to 1/2, then enter into the inheritance. Let the notary collect the contract and have your right recorded in the certificate of inheritance. If the notary for some reason does not do this, then go to court and demand in court to determine your right to 1/2 of the property rights under the contract. (such cases are not so rare and the practice has been formed by the courts). Contact the professionals.

Did the answer help you?YesNo

7. I bought a plot for 600 thousand. I built a house and now I’m moving to another city. An appraiser from the bank valued the house at 2,700 and the plot at 900 thousand. I am selling the house to a person with a mortgage for 3,500. Will I pay 13% VAT?

7.1. Israel Kazbekovich, VAT is not applied to these payments.

Did the answer help you?YesNo

7.2. It all depends on when you registered the title to the house and land.

Did the answer help you?YesNo

7.3. Sell in two separate contracts, separately the house and separately the land. The price for a plot can be set at 900 tons, in this case the price of the house will be 2.6 million, and you will pay tax only on the price of the house, and then not on 2.6 million, but on 1.6 million, 13%.

Did the answer help you?YesNo

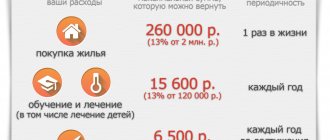

8. Please, if the mortgage is issued to another person, and I pay, and I have all the payment receipts, will he be able to receive a tax deduction without notifying me,

8.1. There is no obligation to you to inform you about payments and receipt of deductions. As for your material costs, you have the right to reimbursement.

Did the answer help you?YesNo

8.2. When submitting documents to the Federal Tax Service to receive a deduction, you do not need to attach payment receipts.

Did the answer help you?YesNo

8.3. In order to receive a tax deduction, you must confirm with checks that you made the payment.

Did the answer help you?YesNo

8.4. The deduction can only be received if the payer is the owner. The owner may be entitled to a deduction, but he will not be able to get back the portion of the deduction that is attributable to the amount you paid.

Did the answer help you?YesNo

9. After what period of time can a home be re-registered for another person, which was purchased with a mortgage and re-registered.

9.1. At any time, as soon as you become the owner according to Rosreestr and if there are no encumbrances that would interfere with registration.

Did the answer help you?YesNo

9.2. Hello. Whenever you want.

Did the answer help you?YesNo

10. I am on the waiting list for housing expansion. If I act as a co-borrower on another person’s mortgage, can I jump off the waiting list for an apartment?

10.1. If, according to the Rosreestr documents, you will be the owner of the apartment there, then of course.

Did the answer help you?YesNo

11. Please tell me if I have a 1/3 share in an apartment of 65 sq. m. m in one city, and I have a mortgage for 34 sq. m. m in another city (but in the same region) in a block-type multi-apartment dormitory (a room in which there is no kitchen), a shared kitchen on the floor, a family size of 2 people, can I count on a subsidy for the purchase of residential premises?

11.1. Hello Evgenia. Of course you can, if you have not received a subsidy before, but it all depends on the coefficients and your length of service, for example: from January 1, 2020, the following increasing coefficients will be used when calculating the subsidy. The coefficient is 1.1, with experience from 7 to 9 years, 1.15 with experience from 9 to 11 years, 1.2 - from 11 to 15 years, 1.25 - from 15 to 20 years. If the service is more than 20 years, the coefficient increases by 0.025 for each year of service, but is no more than 1.5. . Records of the residential premises that you own are not kept before; you are entitled to a subsidy as a civil servant. Thank you for your time, with respect, Alexander Vladimirovich.

Did the answer help you?YesNo

12. What document should be drawn up in a situation where one person transfers money to another to pay the down payment on a mortgage, with the condition that this amount will be taken into account during the further division of property. That is, the right of ownership remains with the person who received this money and for whom the mortgage was issued. However, people are not married. In the future, it is planned to make shared ownership 1/2 each. Can I just indicate all this on the receipt?

12.1. If the property is registered in the name of one person, and not in marriage, then there will be no division of property! It is possible (and even necessary) to draw up a receipt. She will confirm the transfer of money. But it will not give rights to property.

Did the answer help you?YesNo

12.2. Hello, Vladislav. If you just return the money - a loan agreement with a repayment period established by the moment of demand. If the goal is to obtain ownership of a share in an apartment, a Preliminary Purchase and Sale Agreement for a SPECIFIC property.

Did the answer help you?YesNo

13. Egor: Good afternoon. Please tell me, there is an owner of a plot with a house, he bought it with a mortgage, there is only one owner of the plot and the house. Can he transfer the rights, without the consent of the bank, to another person who lives with him, but is not a spouse, to participate in meetings of homeowners and TD?

13.1. The owner may issue a power of attorney to any person to represent his interests in meetings. The bank's consent is not required for this.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

14. Is it possible to apply for a subsidy if the mortgage is issued for one person, but others are registered and live?

14.1. The following have the right to a housing subsidy: 1) Owners - this can be an apartment, or part of it, as well as a house or part of it; 2) Family members who live with the above persons.

Did the answer help you?YesNo

15. Is it possible to apply for a mortgage for one person (husband), and prepare documents for an apartment for another (wife)?

15.1. No matter who the property is registered in the marriage, it is in any case joint if there is no prenuptial agreement. If your husband is a borrower, then you will not be able to register an apartment in your name.

Did the answer help you?YesNo

16. I have such a problem with paying off the mortgage, but due to financial difficulties, we wrote an application to the bank to freeze it, but the bank did not wait for the deadline to end and sues us and the court makes a decision to sell the apartment and we paid and mat the capital, but in a miracle it didn’t they took it into account and now the bank has sold the apartment to another person and they are evicting us, what should we do now.

16.1. Good afternoon. You should contact a lawyer for a personal consultation. Since MSC was used, you had to allocate shares to the children. In this case, the sale requires the consent of the guardianship authorities. If the bank did not do this, the purchase and sale agreement between the bank and the new owner can be considered invalid.

Did the answer help you?YesNo

16.2. Lily, how was it possible to start the process? Did you think it would resolve on its own? Apparently, the 3-month appeal period has expired. Were the guardianship authorities not involved in court? Were there no shares allocated for the children in the apartment? Does the amount for the sale of the apartment completely cover the amount of debt? If so, then the balance should be transferred to your account. It’s impossible to figure it out without documents...

Did the answer help you?YesNo

17. My husband and I got married 2 years ago and drew up a prenuptial agreement for an apartment that I bought myself (I am the owner). Now I bought a new car, but my husband and I found out that he has a mortgage debt from his previous marriage. He and his ex-wife were buying a house, the mortgage was issued to another person, the husband wrote a receipt. He and his wife divorced. Can the bailiffs seize my property - an apartment and a car to repay the debt? Is it necessary to draw up a prenuptial agreement for a car?

17.1. They can’t buy an apartment, but they can buy a car. If it is not in the marriage contract.

Did the answer help you?YesNo

18. I took out a mortgage and registered an apartment in the name of another person, so it’s possible and if not, what’s at risk.

18.1. Good afternoon If I understand you correctly, have you sold your mortgaged home? There are four options for selling mortgaged housing: - early repayment of the loan; — independent sale when the buyer pays off the mortgage; - replacement of the debtor. If you mean that you are a party to the mortgage agreement, and another person is the owner of the property, then this is unlawful. Since there are always two parties to a mortgage agreement: the mortgagee (bank) and the mortgagor (home owner). In case of any violations, it threatens to terminate the mortgage agreement due to your failure to fulfill your obligations.

Did the answer help you?YesNo

19. Today we discovered that the apartment’s personal account is registered to another person and a debt has arisen. How is this possible. The apartment is pledged and has a mortgage. There is an encumbrance in the Russian register. We checked on the website in the Rosreestr according to the cadastral number of the sale. That's what the encumbrance is worth. There are no more movements. Where can I find out why changes have occurred to my personal account?

19.1. Good evening! You can find out from your management company that issues receipts.

Did the answer help you?YesNo

20. I have 2 loans from Sberbank. And the mortgage is still 1/2 apartment with another person, I change my work for an hour because they don’t pay. And there is nothing to pay for a loan from Sberbank. There is enough spruce for a mortgage, tell me if you don’t pay to Sberbank, what will happen? They have the right to a 1/2 mortgage on the apartment.

20.1. The apartment is mortgaged and accordingly there are encumbrances. For another loan, the bank may go to court to return the entire portion of the loan debt. Accordingly, there will be a writ of execution for collection. They will collect it from your salary. I think you need to contact the bank and write an application for a credit holiday. Good luck.

Did the answer help you?YesNo

20.2. Sberbank can go to court with a claim to foreclose on the pledged property (even if the creditor is another bank); in this case, the property will be sold, the money from the sale will first go to the pledged creditor, and the remainder will go to Sberbank.

Did the answer help you?YesNo

I live in Khmao, family of 4, spouses are under 35 years old, we live and are registered with relatives,

An apartment with a mortgage is owned by one person. Can he transfer part of this apartment to another person, a family member?

I want to take out a mortgage on the apartment, but I can’t take it on myself, if I take out a mortgage for myself but arrange it for another person,

The administration says that they want to take them off the waiting list for subsidized housing, due to the fact that there is no construction,

They don't give you a mortgage if you have a bad credit history. If you take out a mortgage for another person and how can you not be left with nothing? Is it possible to be a borrower or someone else in a mortgage agreement?

I have a question, my ex-husband pays alimony for 2 daughters, and I would like him to buy an apartment (mortgage)

We are re-registering the mortgage for an apartment to another person, the realtor is asking for documents,

A family of 4 people, a husband, wife and two children (14 and 1.6 years old) live in an apartment with a mortgage.

If the mortgage payment comes from another account, can that person claim the apartment after the payment?

Please, we are purchasing housing with a mortgage. My husband takes it. There is only one child together.

Is it possible to notarize an apartment that is under a mortgage to another person during the validity of the mortgage agreement, but register it for him after the mortgage is paid off.

Types of mortgage

The type of mortgage loan depends on the buyer and the property being purchased.

Basic lending

The loan is issued to a person with a good credit history if he meets the bank’s requirements.

The standard program does not provide government support. The terms of the program depend on the bank and the property being purchased. Its type plays a role - a country house or an apartment; type of market - primary or secondary; status of housing - built or under construction.

The currency of the loan may also change (dollars are sometimes more profitable than rubles), and the type of payment (annuity or differentiated).

Special programs

Mortgages under these programs are issued only to certain categories of buyers.

Mortgage with government support

This loan is issued only to citizens who are eligible for social support. These are families with two or more children, social security workers, public sector workers, young professionals and others. To obtain such a mortgage, you need to get in line to improve your living conditions.

The peculiarity of such a loan is that you do not need to pay a down payment, part of the debt will already be repaid with a government subsidy, the interest rate and the initial cost of housing will be lower.

Mortgage for a young family

Families where one or both spouses are under 35 years of age can count on it. To obtain such a loan, you need to prove the need to improve your living conditions.

A special feature of the program is that the state pays the down payment if it is less than 30% of the total cost of housing.

Military mortgage

There is a preferential mortgage program for the military. The state pays the cost of housing for the military. At the same time, he can choose the property himself. Money will be transferred during the term of service and in a limited amount.

APPLICATION FOR ACCESSION TO THE RULES

Back to list of articles

Who is eligible for a mortgage?

In order to be able to obtain a mortgage, a potential borrower must meet a number of requirements that are necessarily put forward by the lending bank. The first step is to determine who is eligible for the mortgage. When applying for a mortgage, banks focus primarily on lending to citizens of the Russian Federation; an important aspect is also the presence of registration of the borrower at the place of his application for a loan. In some cases, banks can provide mortgages to foreign citizens, but of course, those who do not have the right to a mortgage are stateless persons.

The category of persons who have the right to a mortgage includes citizens who have a permanent job. At the same time, most banks require the presence and confirmation of continuous work experience and work activity at the last place of work for a period of up to 6 months. The longer the borrower’s continuous work experience is confirmed, the greater the bank’s confidence in the stability of the borrower’s income.

There are also age limits that determine who is eligible for a mortgage. As a rule, banks prefer to provide mortgage loans to persons over the age of 21, and the age at the time of repayment of the loan is also determined, usually 55-60 years. But in some cases, banks are ready to extend the lending age to 70 or even 75 years of age.

A very important point in determining who is eligible for a mortgage is the general level of solvency of the potential client. Therefore, banks require the borrower to confirm the level and regularity of income. Information on income can be submitted using Form 2 personal income tax, using a bank form or through information from the tax office. Not only information about income from the main place of work is accepted, but the borrower’s income from other sources that can be documented is also assessed and taken into account. Some banks are ready to take into account, when calculating the amount of payments, the income of co-borrowers that may be attracted by the client.

Also, when determining who is eligible for a mortgage, the bank pays attention to the presence of a positive credit history, which is an indicator of the client’s reliability as a borrower. In addition, to obtain a mortgage, the borrower must not have a criminal record or negative entries in his work record. For the bank, it is very important how reliable the client is, since the mortgage loan is long-term and large.

On our credit portal, anyone who wants to get a loan to purchase a home can take advantage of useful, reliable and comprehensive information about credit products and conditions of banks that work in the field of mortgage lending to the population.

What you need to get a mortgage: conditions

Different banks have different requirements for the borrower and the collateral.

Requirements for the borrower

To use the bank's services, you must meet special requirements.

Citizenship

You must have the status of a citizen of the Russian Federation. This is a requirement of most banks. Some credit institutions issue mortgages to people with citizenship of Ukraine, Kazakhstan and other CIS countries. Citizens of other countries can now take out a mortgage loan under a standard program provided by VTB 24, Bank of Moscow, Transcapitalbank. Raiffeisenbank provides loans for foreigners with a higher rate of 1.5-2%.

Registration

The borrower must be registered on the territory of the Russian Federation. Some lenders give mortgages to persons with temporary registration or without registration, for example, VTB 24.

Age

The borrower must be over 21 years of age and under 60 years of age. This requirement is made due to the greater solvency of people at this age.

Work experience

You must have worked in your current position for more than 6 months and have a total work experience of more than a year. Experience is a guarantee that the borrower has a stable job and salary. The period of work can be confirmed by a certificate of employment, an employment contract and an extract from the work record book.

Some banks can give a mortgage without requiring the borrower to confirm employment and permanent income. Under such conditions, the loan rate and down payment are higher, and the repayment period is shorter. This type of mortgage will be more difficult to pay off. The shorter the term, the higher the monthly payments.

Income

The money that a citizen receives from primary and additional sources, from the sale of shares, dividends from deposits, pensions and business profits, should give the borrower the opportunity not only to pay the loan, but also to live in normal conditions.

The formula for calculating solvency is as follows:

Minimum salary for mortgage approval = monthly loan payment + cost of living * number of family members

But most banks use the following formula:

Monthly loan payment / 0.6.

This guarantees not just survival and mortgage repayment, but also a comfortable life for the borrower and his family. Sometimes banks give mortgages to citizens with low salaries or even unemployed. To increase the likelihood of approval in such cases, you can involve a co-borrower or guarantor. In this case, the income of the borrower and all co-borrowers is summed up. But the bank will check the solvency of all participants.

Housing requirements

After the borrower has received approval for a mortgage, he must provide the bank with information about the home he plans to buy. The apartment must meet the requirements for the subject of collateral.

A home assessment will be required. This is necessary so that the bank can sell the apartment if the borrower cannot pay for it.

The requirements for the property are as follows:

- Location. If the location of the house is unfavorable, then the apartment in it is more difficult to sell in case of non-payment of the debt. They are more likely to approve a loan for the purchase of an apartment located in the city center or in another developed area.

- Condition of the house. A mortgage will not be given for housing that is included in the program for the demolition of dilapidated houses (you can find out this from the administration of the region, city, district, microdistrict or residential complex).

- Age of the building. There is no specific “good” age; it varies depending on the location of the housing. In the regions of Russia, the house must be built later than 1955, and in Moscow - later than 1970. The exception is St. Petersburg: housing in old buildings in the city center is easier to sell than an apartment in a new building. Requirements for the age of a building may change even within one constituent entity of the Russian Federation.

- Wear. It should be less than 70%. The degree of wear can be found in Rosreestr or in the BTI.

- Internal condition of the apartment. The layout of the apartment must correspond to the plan in the technical passport. Each living room should have a radiator and the windows should be glazed. The apartment must have access to running water, a bathroom and kitchen ventilation.

- Building material. Banks also pay attention to this criterion. The building must be constructed from fire-resistant materials. The foundation is made of concrete or stone.

Mortgage housing. What kind of housing do they get a mortgage for?

July 10, 2014

Contents

:

- Compliance with housing requirements is a guarantee of obtaining a mortgage

- Valuation of collateral housing

- Important nuances

If you want to buy a home , but do not have sufficient financial resources, use a mortgage. As collateral, the bank accepts an existing apartment or future housing that requires money to purchase. You will learn from this article what parameters a mortgaged house or apartment must meet.

Compliance with housing requirements is a guarantee of obtaining a mortgage

In order for the bank not to refuse to issue a mortgage, the property must meet the following conditions:

1. Minimum area:

- a one-room apartment must be at least 32 m2;

- two-room – 41 m2;

- three-room – 55 m2

- kitchen size - no less than 5.9 m2.

Housing with a mortgage must be a separate apartment, with a heating system, bathroom, and electricity. If the subject of purchase is a room in a communal apartment, the bank may accommodate you. However, there are specific requirements and conventions...

2. Type of construction. The house must be built on a stone, cement or brick foundation. If the house is “standing on a tree,” that is, it has wooden floors, the bank may refuse to issue a mortgage.

3. Location and year of construction. The mortgaged housing must be located in the district or city where the bank is located. The year of construction was no earlier than 1957. Otherwise, you will have to present certificates stating that the house is not in disrepair and is not subject to major repairs or demolition. A number of banks refuse to issue a mortgage if the housing is located in a five-story panel building or the building is more than 30 years old.

4. Registration. If persons under guardianship are registered in the apartment, the transfer of the apartment as collateral is possible only with the permission of the relevant authorities. Persons serving in the army or in prisons should not be registered.

5. Mortgage housing should not be the subject of lawsuits.

Valuation of collateral housing

For the purpose of insurance, all banks make a preliminary assessment of collateral housing. It indicates its market value and condition. Based on the report, the bank decides the size of the loan. If the collateral property is worth less than the mortgage amount, then the bank may require additional property to be provided as “mortgage.”

Important nuances

- Before wasting time looking for an apartment, familiarize yourself with the mortgage requirements of the bank you are going to work with.

- The entire assessment procedure is paid by the borrower, please take into account additional costs.

- It is mandatory to have insurance: the borrower’s life and ability to work, private property, etc.

- Mortgage – long-term lending (from 3 to 50 years). If the loan is not repaid or the terms of the agreement are violated, the collateral housing may become the property of the bank.

Should you use a mortgage broker?

A mortgage broker is a specialist who can help a borrower choose the best option for a home loan. The broker will assess your chances of getting your mortgage approved and will help you figure out why banks are refusing a loan. A specialist can also help you get a mortgage with a bad credit history or gray salary.

The main advantages are saving time and the ability to choose the most profitable program.

There are also disadvantages. Mortgage brokers work for a fee, which increases the cost of purchasing an apartment. Nobody regulates their activities, so the result is not guaranteed.

It is worth contacting a mortgage broker if you do not have the time and desire to understand loan products or if the borrower does not meet the requirements of most banks - he has a bad credit history or a gray salary.

How to get a mortgage for an apartment

Stages of obtaining a mortgage loan:

- collection of necessary papers;

- contacting the bank with an application and documents;

- selection of real estate;

- property valuation;

- concluding a preliminary agreement with the seller;

- submitting documents for an apartment to the bank;

- obtaining approval from the bank and signing a mortgage agreement;

- conclusion of a purchase and sale agreement;

- registration of transfer of ownership and encumbrance on the apartment;

- transfer of money to the seller by the bank.

Documents for mortgage

To apply for a mortgage, you will need to collect a list of documents.

1. Passport of a citizen of the Russian Federation:

2. Copy of work record:

3. Certificate of income in form 2-NDFL (this certificate is issued by the accounting department of the place of work):

4. Certificate in the bank form from the accounting department from the place of work:

After collecting a package of documents, you need to find a bank with the most favorable conditions. To do this, you can use the service for selecting mortgage offers.

Documents for social mortgage

Depending on which social group you belong to, the package of documents for you may vary. However, there is a certain documentary base, that is, a set of documents that you will definitely need. This includes:

- Application for a social mortgage. It should be noted that this document is a regular application for a loan. Its form can be downloaded here.

- A document confirming tax registration.

- A certificate from your place of employment, which contains information about your current income and work experience.

- Passports of each family member (children under 14 years old usually require a birth certificate).

- Certificate from the house register in the prescribed form.

- Title document for the apartment.

- A copy of the work record book.

- Certificate confirming family composition.

- A certificate confirming the registration of ownership of the purchased property.

- Extract from the Unified State Register for the purchased living space.

- Bank account details.

Some situations imply that the property has already been purchased with a mortgage. That is, in this case, as part of a social program, the state will help pay off part of the existing debt or in another way help in simplifying the payment of the established amount. Check with your local authorities to find out which type of support you may qualify for.

Features of obtaining a mortgage in various situations

The conditions, procedure and package of documents may vary depending on the type of mortgage loan and the situation of the borrower.

No down payment

Getting a mortgage without a down payment is difficult, but possible. To do this, you need to find such an offer from the bank, take advantage of one of the government support programs or promotions held by developers and banks.

Young family

The “Young Family” program is a form of support from the state that involves compensating part of the cost of housing to young people who have recently gotten married. They are paid up to 30% of the cost of the purchased property.

To participate in the program, you must meet the following conditions: be under 35 years of age and need improved housing conditions. You will need to submit an application to the local administration and wait for a positive response.

With maternal capital

Maternity capital is a government subsidy for families with children. It can be used to improve housing conditions, in particular, for a down payment or to pay off a mortgage.

In order to take out a mortgage with maternity capital, you need to find a suitable offer from the bank, attach a certificate and a certificate of subsidy to the package of documents, and also write an application to the Pension Fund for the disposal of maternity capital.

In another city

The main problems of buying an apartment with a mortgage in another city are that not all banks agree to such a procedure, the registration period increases, and the costs of traveling to inspect, check the apartment and conclude an agreement increase.

You can find suitable housing in another city on your own or with the help of a realtor. In the second case, you will have to pay a commission, but this will save time.

Most procedures can be carried out through a representative. Personal presence will only be required to sign loan documents.

Who gets a mortgage?

The reduction in interest rates that has occurred over the past 3-4 years has made mortgages more affordable for potential borrowers. At the same time, this type of lending is the most long-term and large in terms of amounts allocated by banks. Therefore, it is quite natural to present quite serious requirements to clients.

Basic requirements of banks for mortgages

When deciding whether to approve a mortgage loan to a particular potential borrower, banks are guided by several main criteria. These include, quite naturally, the client’s age and citizenship, his income level and credit history parameters.

Moreover, each bank has the opportunity to independently determine the value of the criteria it applies.

Most banks, including the undisputed leader of the domestic financial industry, Sberbank, have set the minimum age limit for issuing mortgages at 21 years old

.

This approach is explained by more serious requirements for long-term lending than, for example, for consumer lending, which is available at almost any financial institution upon reaching the age of 18.

However, some banks, the largest of which is Uralsib, are still ready to issue mortgages to clients if they are over 18 years old.

As for the upper age limit established for mortgage recipients, in most cases the age that the client will reach at the time of full payment of the loan is determined.

In Sberbank it is 75 years, as in a significant part of the other most famous and large banks.

Sovcombank lends to borrowers if they are under 85 years old at the end of the mortgage term.

Citizenship

Almost all major domestic credit organizations issue mortgages exclusively for Russian citizens. This number includes Sberbank, Gazprombank, Rosselkhozbank, etc.

However, in recent years, some financial institutions, taking into account the rather serious demand that has emerged, have begun to lend to foreign citizens legally residing and working in Russia.

This applies, first of all, to banks with foreign participation, including Rosbank, Raiffeisenbank, as well as a number of serious Russian banks, for example, VTB, Otkritie and Transcapitalbank.

In such a situation, the mandatory requirements for the borrower include official registration and a work permit in the Russian Federation.

Registration

Several years ago, a requirement related to the presence of permanent registration at the location of the bank

applying for a mortgage loan was mandatory.

Today, for some banks, including Sberbank, Rosselkhozbank, Uralsib and many others, a temporary registration of the borrower is enough to approve a mortgage transaction. Moreover, some credit organizations, for example, VTB, have completely excluded registration from the requirements for a client when applying for a mortgage.

In this case, the only condition for issuing a loan related to geographic location is work in Russia.

Experience

Availability of employment is almost always a mandatory requirement for a potential borrower when applying for a mortgage loan. However, the specific length of work experience in the last place is established by each bank independently. Typically, the client is required to have at least six months of employment.

However, in some cases this requirement is not critical, since even if you work for a month, it is quite possible to get a loan. This option is possible, for example, at DeltaCredit Bank. But at the same time, the borrower is offered less favorable mortgage terms, which may include:

- At an increased interest rate;

- In reducing the maximum loan period;

- The need to provide a surety or additional collateral.

Solvency

A key criterion that directly affects both the possibility of lending and the conditions offered by the bank. The client’s level of solvency depends on several factors, including:

- Total income taking into account all sources available to the client;

- The number of family members, which determines the amount of fixed expenses;

- Availability of existing credit and other types of financial obligations.

Based on the level of solvency, such an important loan parameter as the amount of the regular monthly payment is determined. Next, taking into account the resulting amount, the maximum mortgage amount and the duration of the loan agreement are calculated.

Thus, it is the solvency of the potential client that largely influences all loan parameters.

Down payment

The minimum down payment for the purchase of an apartment or other type of real estate with a mortgage is 10%. However, in some cases it is set at a higher level.

For example, when purchasing a finished apartment with a mortgage through Sberbank, the first payment must be at least 15%

, and in the case of purchasing a country house, it increases further and equals at least 25% of the cost of housing.

Conditions similar to those offered by Sberbank have been established in other credit institutions. The specified amount of the down payment depends, first of all, on the liquidity of the real estate being mortgaged. That is why when buying an apartment it is usually noticeably lower than when purchasing a private house.

Credit history

The presence of a problem-free credit history, along with the client’s solvency, is in modern conditions the most significant criterion for the approval of a mortgage transaction. Moreover, current delays in financial obligations already taken by the borrower mean an almost 100% probability of refusal to issue a loan. This policy of banks is explained quite simply.

Over the past few years, real incomes have been steadily declining, which has led to serious financial problems for a large number of borrowers.

It is obvious that difficulties in repaying previously taken loans can most likely lead to similar problems with a mortgage.

That is why it is extremely problematic for clients with a damaged credit history and, especially, current arrears, to count on mortgage loan approval.

Other requirements

In addition to the mandatory requirements listed above, some banks establish additional conditions, the fulfillment of which is also necessary to obtain a mortgage. These usually include:

- Providing additional collateral, in addition to the purchased apartment, in the form of any property. In this case, the client is provided with a reduced interest rate and more favorable lending conditions;

- Conclusion of a guarantee agreement. Another factor that positively influences the possible parameters of a mortgage;

- Opening an account with a bank that issues a loan. A standard practice for many financial institutions that seek to earn money not only by receiving interest on a loan, but also by providing clients with other types of banking services.

How are mortgage applicants studied?

The verification of a potential client is carried out by security and credit department employees of the bank. At the same time, each financial organization develops its own control mechanism. However, despite some differences, it is always checked:

- Client's credit history;

- Characteristics of the property that is planned to be purchased;

- Information about the borrower's income and place of employment.

The client's solvency is assessed taking into account several factors. The most important of them are: the level of permanent income, length of employment at the last place of work, position held, as well as the amount of expenses for maintaining the family and the amount of other mandatory payments for existing obligations.

Document requirements

When applying for a mortgage, a potential borrower is required to provide a package of documents, the first part of which relates directly to the client:

- Bank client questionnaire;

- Passport and other personal documents, the list of which is established by the bank, including TIN, SNILS, military ID, etc.;

- Certificate of income, as well as a copy of the work record book and the current contract;

- Documents on marital status;

- Documents confirming the ability to make a down payment, for example, a certificate of capital or a bank account statement.

The second part of the documents relates to the property being purchased with a mortgage and includes:

- A report on the assessment of an apartment, house or other type of real estate, indicating information about the expert who compiled it;

- Passport or other identification document of the seller;

- Certificate of ownership of the seller for the property or an extract from the Unified State Register of Real Estate;

- Technical and cadastral passports for an apartment or house;

- Consent of the second spouse, if he/she does not act as a co-borrower on the loan;

- Insurance policy for the purchased property (issued after preliminary approval of the transaction by the bank).

Who doesn't get a mortgage?

There are two main obstacles to getting a mortgage. The first of them is associated with the absence or insufficient level of official income. Freelancers, workers who receive wages under gray schemes, as well as entrepreneurs and the self-employed often find themselves in a similar situation.

The second problem is having a bad credit history. This situation is quite common today.

It can be further complicated by the presence of previously taken out and yet unpaid loans.

Is there an alternative?

An alternative to mortgage lending may be to obtain a consumer loan. The requirements for this category of clients are much less serious, although the interest rate is usually higher.

Another viable option for receiving funds is to contact an MFO

. However, in this case we are talking about small amounts and a short loan period. Obviously, purchasing an apartment in such a situation is unrealistic.

Who gets a mortgage with state support?

Mortgages with government support are provided to certain categories of potential borrowers. These include:

- Families who have received the right to maternity capital;

- Families that include disabled children or family members with disabilities;

- Families with minor children;

- Military personnel, as well as persons participating in hostilities.

Who gets a mortgage without a down payment?

The need for a down payment on a mortgage loan can be reduced or completely eliminated by using a maternity capital certificate, as well as obtaining housing under the military mortgage program.

In addition, you can avoid the initial payment by participating in promotions and programs that are periodically carried out by some banks and developers, while offering preferential terms for obtaining a mortgage.

Source: https://www.Sravni.ru/ipoteka/info/komu-dajut-ipoteku/

Things to remember when you've already taken out a mortgage

A mortgage is a long-term commitment. It is issued for 5-30 years. Loan repayments can take decades. All these years, the borrower will have the obligation to repay the money on time and in full every month.

Is it possible to repay the loan early?

Most banks do not prohibit paying off your mortgage early, although it is less profitable for them. Before applying for a loan, you need to ask a specialist if this is possible, and check that there are no prohibitions in the mortgage agreement.

What happens if you don't pay

When taking a mortgage on the property being purchased, a pledge is issued. This is an encumbrance that is registered in the real estate register. The collateral allows the bank to repossess the apartment if the borrower stops paying the mortgage.

In addition, the bank has the right to impose fines and penalties for late payments. They will depend on the mortgage agreement concluded with the borrower.

What to do if you can't pay off your mortgage

If you are temporarily unable to pay your mortgage, you need to go to the bank, provide documents confirming your lack of income, and ask for a deferment of payments. Banks often cooperate because it is easier for them to provide a deferment to a conscientious payer than to begin the procedure for repossessing real estate.