Buying or selling an apartment is a serious step for any citizen. But if you have found a suitable option, then do not rush to rejoice and relax, because the seller or buyer may change their mind and thereby disrupt all plans.

It is to secure the obligations of your agreement that you need to enter into a deposit agreement.

What it is?

The deposit when purchasing an apartment is essentially a sum of money, which is a guarantee of fulfillment of obligations and is transferred by the buyer to the seller.

It acts as a guarantee of the fulfillment of the contract not only by the buyer, but also by the seller.

A deposit agreement is an interim measure that has consequences for both parties. It is concluded between the future participants in the apartment purchase and sale agreement and all essential conditions are specified in it.

Both parties to the transaction undertake to fulfill the clauses specified in the contract, otherwise there will be legal consequences for failure to fulfill the contract.

The essence and concept of the deposit is set out in Art. 380 of the Civil Code of the Russian Federation , as well as the consequences of failure to fulfill obligations. You need to understand that this is not just a transfer of money, but a conclusion of an agreement with serious intentions and consequences.

If one of the parties to this agreement does not fulfill its obligations, then legal consequences arise, which are regulated by Article 381 of the Civil Code of the Russian Federation . If the buyer fails to fulfill the agreements, the latter loses the amount transferred to the seller.

If the seller refuses his obligations, then by law he is obliged to reimburse the buyer twice the amount of the deposit, as stated in the Civil Code of the Russian Federation. Refunds are made through the courts.

But force majeure situations , in which the amount of the deposit for the apartment is simply returned by the seller to the buyer.

This refers only to those situations for which neither party can be held responsible. Essentially, this is an incident that occurs regardless of a person’s will (for example, death, serious illness, natural disaster).

Drawing up a deposit agreement

The deposit must be drawn up in writing, otherwise the transferred money is considered an advance, and the advance is just a preliminary payment that does not oblige anyone to anything and is returned in any case.

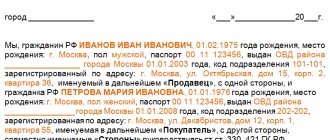

The agreement must contain information about the owner and buyer of the property, the characteristics of the property, its cost, the terms and conditions for concluding the purchase and sale agreement, as well as the amount of the deposit itself.

The main question that arises at this stage is how much the deposit should be. The law does not provide any instructions or recommendations in this regard. The parties entering into the agreement have the right to determine the amount of the transferred payment themselves. Most often it depends on the timing of fulfillment of obligations and the total amount of the transaction. As a rule, the amount of the deposit does not exceed 5% of the total cost of the property, less often – 10%. The amount in the contract is indicated in national currency. However, it is recommended to additionally enter the dollar equivalent.

The presence of a notary when signing and certifying signatures is not required. The agreement itself has legal force.

.

Pros of this agreement

Concluding a deposit agreement has significant positive aspects:

- The obligation to buy and the obligation to sell the apartment will be guaranteed in cash.

- The specific sale price of the apartment is fixed, which will protect the buyer from changes in the price of the purchase object.

- The agreement obliges to conclude the main transaction (apartment purchase and sale agreement) within a specific time frame.

- If one of the parties fails to comply with the agreements, consequences arise in the form of a monetary obligation from the seller or loss of the deposit amount from the buyer.

Having concluded such an agreement, you can calmly continue to prepare documents or wait for the main agreement, without worrying that the apartment will be sold to someone else, the seller will consider the agreed sale price insufficient, the buyer will find a more profitable option, etc.

Of course, all this can happen even if there is such an agreement, but in this case the party that refused the obligations loses money, and this is the best motivation for fulfilling the preliminary agreement.

Disadvantages of making an advance payment

Like any deal, there are downsides to making a deposit. This agreement should be concluded only if you are 100% sure of your intentions.

But this is not the only nuance that you should be afraid of. There are also many scammers who, with the help of a deposit, take possession of funds irrevocably.

To protect yourself from this, you just need to carefully read all the clauses of the contract. always worth indicating the real amounts that will be transferred , because this is precisely what scammers play on, persuading you to indicate an amount less than the actual amount.

It is worth carefully studying the seller’s documents, or it is better to go with him to the nearest notary office for clarification. The notary will check the compliance of all documents and explain possible problems, if any, that may arise.

Before concluding a purchase and sale agreement and making a deposit, it is worth considering the following points:

- It is advisable that all redevelopments be legalized before the deposit, otherwise it will be necessary to calculate the time for completing the documents;

- it is worth checking for arrests, encumbrances and other nuances that will make it impossible to conclude the main agreement;

- Before concluding a contract, you need to carefully examine not only the documents, but also the condition of the apartment, so that there are no unpleasant surprises.

It is better to know everything about the documents and the purchased object, so there is a greater chance of getting exactly the desired result without risks.

Registration of a deposit for the purchase and sale of real estate

Most often, the transfer of the deposit is formalized in the preliminary purchase and sale agreement for the apartment. However, other options are also possible, for example, a deposit agreement or an agency agreement with a real estate company.

In some cases, the transfer of the deposit occurs entirely on the basis of a regular receipt or without any written documentation at all. This completely deprives the deposit of its security function, and can lead to termination of the contract by the seller and to the loss of the entire amount of the deposit by the buyer.

On the one hand, failure to comply with the written form of the deposit does not deprive the interested party of the right to refer to the testimony of witnesses. On the other hand, since the legal requirement for written form is not met, the court may, at the request of one of the parties, invalidate the transaction.

In addition, transferring the deposit without proper legal registration deprives both the seller and the buyer of the opportunity to protect their interests. Therefore, we can name the basic requirements for the legal registration of a deposit:

- Receipt of the deposit by the seller must be formalized only in writing, regardless of the amount of the deposit paid;

- It is advisable to prepare a deposit as part of a preliminary agreement for the purchase and sale of an apartment;

- In the contract, the amount transferred to the seller must be called a deposit (not an advance or prepayment).

Failure to comply with these requirements may cause disputes and lead to adverse consequences for both parties.

In the preliminary agreement, the parties stipulate all the terms of the future purchase and sale agreement, including the final cost of the apartment, and also indicate the amount of the deposit and the adverse consequences that will arise for each party if they unilaterally refuse to conclude the main purchase and sale agreement.

It is advisable that the preliminary purchase and sale agreement be drawn up by a professional lawyer and certified by a notary. This will help the parties reduce risks and avoid misunderstandings.

Real estate firms very often take a deposit from a potential buyer when concluding an agency agreement. Sometimes there are even situations when a deposit is taken, but a suitable apartment has not yet been found. This is not entirely legal, especially since the deposit in this case loses its security function.

This is due to the fact that it is not transferred to the seller or his authorized representative, but to an intermediary who cannot guarantee the seller’s fulfillment of the preliminary agreement. Within the framework of an agency agreement with a realtor, we can talk about a deposit only when it is transferred directly as payment for the services of the realtor.

You should carefully check the terminology of the contract. The amount paid must be called a deposit. Otherwise, this amount will be considered by the court as an advance, even if it is not called an advance. Consequently, either party can terminate the agreement without penalty, since the advance must be fully returned to the buyer, regardless of whose fault the terms of the agreement were not fulfilled.

Another difficulty in preparing a deposit that the seller and buyer of an apartment may encounter is the loss of the security function of the deposit in case of partial fulfillment of obligations. Despite the fact that the deposit must ensure the full fulfillment of obligations under the preliminary agreement, a different situation has arisen in judicial practice. Very often, the court refuses to apply the provisions of the deposit to the injured party if the requirements of the contract have been partially fulfilled.

For example, the buyer can legally demand a double refund of the deposit if the seller does not move out of the apartment within the specified period. However, if the remaining terms of the contract were nevertheless fulfilled by the seller, the court most often refuses to collect the double amount of the deposit from the buyer.

Find out where to get an extract from the house register and what the procedure and deadlines for receiving it are.

Read all about the extract from the Unified State Register here.

If the preliminary purchase and sale agreement with the registration of a deposit is not certified by a notary, who himself checks all the necessary documents, when transferring and registering a deposit, you should pay attention to the following important points:

- the buyer must check with the seller for the availability of the original title documents for the purchased apartment;

- It is best to transfer the deposit through a safe deposit box at a bank. This, of course, will lead to additional costs, but will minimize the risk of losing money as a result of fraud. If the seller of the apartment turns out to be a fraudster, then the buyer, who personally transferred the money to him, will have to seek its return through the court. Using a safe deposit box, the buyer will be sure that the money will go to the seller only if the contract is properly executed;

- It is advisable that all apartment owners be present when signing the preliminary agreement. If this is not possible, the seller must provide a notarized power of attorney from the absent owners. For example, it should be remembered that an apartment purchased during marriage is legally the common property of both spouses, even if only one of them is the seller in the contract. The lack of consent of one of the apartment owners may subsequently lead to the recognition of the contract, and, consequently, the agreement on the deposit, as invalid;

- You should not make a deposit and sign a preliminary agreement if the apartment you are purchasing has unauthorized redevelopment. In this case, the seller must first legalize the redevelopment, since in this form he will not be able to sell the apartment and draw up the appropriate documentation for it.

If the buyer, when signing the contract, did not pay attention to the illegal redevelopment, he, at best, will be faced with the impossibility of completing the purchase and sale transaction within the period stipulated by the contract. In the worst case, the seller will refuse to sell the apartment without returning the deposit in double amount due to the impossibility of legalizing unauthorized redevelopment.

Perhaps these are all the important points regarding the deposit in real estate transactions that we wanted to bring to your attention in this article.

All the details of obtaining an archival extract from the house register

Procedure for discharging a minor child from an apartment

Do pensioners need to pay land tax?

Liquidation of HOA

The procedure for obtaining and issuing an apartment card

We order a cadastral passport for an apartment via the Internet

Preparation of contract

It is best to conclude this agreement with a notary or a real estate agency. This is a safer option, because experienced lawyers will be able to advise and explain all the clauses of the contract.

It is worth noting that they will be able to check the documents before the transaction and warn against possible problems.

The deposit agreement is usually drawn up in printed form and signed by the parties. In addition, you should also make a receipt . The fact is that this agreement indicates your intentions and will be more reliable if a receipt for the transfer of money is attached to it.

The receipt is written by the seller himself and in blue ink. It indicates who accepted the money and from whom, how much and for what. It is also necessary to indicate passport details and the amount in words.

Essential terms of the deposit agreement

This agreement must indicate:

- FULL NAME.;

- passport details;

- registration;

- description of the subject of the contract (type of object, address, area, number of rooms, title document of the seller);

- cost (deposit amount and sales amount in words, with the proviso that these indicators remain unchanged);

- deadline for fulfillment of obligations (the exact date by which the main contract must be concluded);

- rights and obligations of the parties;

- responsibility for failure to fulfill the agreement.

All this will protect you from unnecessary problems and under such conditions the deposit agreement will be considered valid. If you neglect these points, the contract will be easy to terminate or cancel in court.

Preliminary agreement and deposit agreement

Our buyers and their “wizard” promised for two weeks in a row that we would make a deal tomorrow. We waited... The deadline specified in the preliminary contract passed, after that another month of promises passed, they lied so much that the storytellers smoked nervously... All this time we changed tickets, prepared for the deal, at least somehow tried to explain to our clients what was happening, although there were no censorship words. Then everyone suddenly fell silent, we tried to clarify the situation, but citizen buyers with heavy sighs said that we had to WAIT. The owner nevertheless flew away and entrusted us with conducting all negotiations.

Important

And two weeks later, our “favorite” buyers came to the agency and announced that the bank SUDDENLY refused them and now they want to get the deposit amount back. There was no strength to explain anything, they were simply refused, citing a preliminary agreement. And now we have received a summons to court.

Fact of money transfer

There are two tried and true ways to transfer money securely:

- Transferring money to the seller after he writes a receipt.

- Bank safe deposit box. The buyer puts money there, the amount of which is checked by a bank employee. Moreover, only the seller can receive them upon presentation of a properly executed deposit agreement for the apartment with the person who put the money in the box.

The first option is dangerous because they can slip counterfeit money. Therefore, if you enter into an agreement with a notary or real estate agency, insist on checking the authenticity of the banknotes . Otherwise, it is better to order this service from the bank.

Preliminary agreement

A preliminary agreement is, in essence, an agreement of intent that postpones the conclusion of a purchase and sale agreement due to the impossibility of concluding it for the time being.

This agreement is concluded in most cases by a notary, it takes into account all the points as in the deposit, but adds:

- clauses that oblige you to put documents in order;

- date of discharge of registered persons;

- date of repayment of utility bills;

- household items that will be transferred to the new owner along with the apartment are listed;

- other conditions agreed upon by the parties.

If you take into account all these points and treat the purchase or sale of an apartment responsibly, then everything will go smoothly and you will not be deceived.

What is a preliminary agreement and why is it needed?

Many participants in real estate transactions often ask – what is the PDKP agreement? A preliminary agreement for the purchase and sale of an apartment is an official document concluded between the parties to a transaction for the purchase of a real estate property on pre-agreed conditions. The main subject of this document is the transfer by the seller of the deposit for the apartment to the buyer, which can then be returned if the transaction does not take place. In addition, the agreement pursues the following essential conditions and goals important for both parties:

- The document certifies that both parties who signed it will act as the main participants in the transaction. This means that with his money the buyer guarantees the final choice of the apartment he likes, and the other party, in turn, stops selling it.

- This contract always fixes the final cost of housing, and no one has the right to change it individually, without agreement with the second party to the transaction.

- The agreement also sets out the exact date or period within which the main purchase and sale agreement for the property must be executed.

Apartment purchase

Important! The main thing for a contract is its legal force, which allows any of the parties to the contract to go to court if it is discovered that the opponent has violated its terms.