An advance or deposit when purchasing an apartment is a way for the parties to confirm the seriousness of their intentions to conclude a transaction. The essence of both methods is that the buyer transfers a certain amount of money to the seller before signing the purchase and sale agreement for the apartment. This is why these two concepts are often confused in practice.

However, despite some common features, advance and deposit also have a number of significant differences. What is the difference between them, what are their advantages and disadvantages, and what is better to choose, we will analyze in this article.

What document confirms the fact of transfer of the advance?

The document confirming the transfer of an advance in cash is a receipt from the seller, duly executed. In order for it to have legal force, it must be properly executed.

The receipt must be in writing and contain full information about the persons who transferred and received the funds, the amount of the advance received in figures and words, the date and place of the receipt and receipt of the advance, as well as the obligation for which this advance was paid. The receipt must be signed by the person receiving the advance in the presence of the buyer. The original receipt must be kept by the buyer.

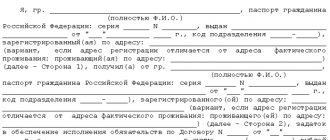

advance payment agreement for the purchase of an apartment (form).

The parties can also enter into an agreement or agreement on an advance and stipulate in it their rights and obligations regarding the payment of the advance, its return, as well as other conditions.

The difference between an advance and a deposit when buying an apartment

Advance payment can be accepted by both the agency and the seller by receipt or by agreement in the appropriate form. The conclusion of this agreement does not oblige the parties to conclude a purchase and sale agreement.

An advance payment when purchasing an apartment is a preliminary method of payment, so the agreement can be terminated by one of the parties without any serious consequences. In the event that the transaction is cancelled, the full advance payment is always returned to the buyer.

Mandatory payments when purchasing an apartment (utility payments, re-registration, debt)

The deposit agreement must be formalized in accordance with all necessary standards. In this case, the intentions of both parties, when one sells and the other buys, assume certain obligations.

If they are not followed, the culprit must bear the consequences.

Namely: if a deposit was made when purchasing an apartment and the buyer rejected the deal, then the money remains with the seller; if the deal fell through due to the fault of the seller, then double the amount of the deposit is returned to the buyer.

Therefore, a deposit when buying and selling an apartment is a more responsible and civilized method of formalizing an agreement between the parties.

Understanding the amount of lost funds or the amount of double payment if the deal is rejected, neither party will take the risk of disrupting the deal.

In addition, the party that has not fulfilled the transaction agreement is obliged to compensate losses to the other party, which cannot be predicted in advance.

Here are the main points that form the differences between buying an apartment with an advance payment and a deposit.

As a rule, the buyer who wants to purchase this property is often interested in completing a transaction.

But the reasons why the transaction may not take place can be different and most unpredictable, so the agreement to make an advance payment when purchasing an apartment is more loyal for both parties. In this case, the transaction is canceled and will not have any consequences for both the buyer and the seller.

At the same time, when the subject of the agreement is a deposit for the purchase and sale of an apartment, the settlement of this issue sometimes takes on the most unpredictable and unfavorable consequences, because such a concept as the “human factor” is not taken into account by the legislation in this case.

What documents confirm the transfer of the deposit?

In addition to the agreement, the party who received the deposit must issue a receipt indicating the personal and passport details of the persons who transferred and received the money, the date and place of drawing up the receipt, the amount of the deposit in figures and words and the obligation for which the deposit was issued. The receipt must be signed by the appropriate person with his full name.

The deposit can be transferred to the seller's account. In this case, the purpose of payment must indicate that the transferred amount of funds is a deposit, and the obligation secured by it must also be identified.

deposit agreement when purchasing an apartment.

Lawyers' answers to frequently asked questions

What questions most often arise for the parties to a contract when concluding a transaction with prepayment?

Concluding the narration of today’s material, our resource will present lawyers’ answers to frequently asked questions from those people who have decided to buy and sell an apartment with the payment/receipt of a deposit.

“In what situations is it most common to terminate a preliminary agreement for the sale of real estate with an advance payment?”

Most often, termination of a preliminary agreement for the sale of real estate with an advance payment occurs in situations such as:

- violation of the terms of the transaction by one of the parties;

- the buyer found a more profitable option;

- additional conditions have been identified that do not satisfy the wishes of the seller or buyer.

In any situation where the contract is broken, the guilty party must bear legal responsibility.

What to do if the real estate purchase transaction did not take place, but the advance or deposit has already been paid?

“What happens to the advance/deposit if the transaction does not take place due to the fault of the seller/buyer?”

The advance payment must be returned in full by the seller to the buyer if the former is guilty of terminating the transaction or if it does not take place by mutual agreement.

If the buyer is the culprit for the failure of the transaction, then in a number of situations he undertakes to leave an advance payment to the seller of the apartment (under a preliminary agreement, for example).

The deposit is returned based on the legislative provisions of the Civil Code of the Russian Federation (Articles 380 and 381):

- if the buyer is the culprit for the failure of the transaction, then the deposit remains with the seller;

- if the seller is the culprit for the failure of the transaction, then the latter undertakes to return the entire amount of the deposit to the buyer and pay an equivalent amount on top.

“What should you do if, on the eve of the transaction, the price of your apartment was raised?”

If the preliminary agreement for the payment of a deposit or advance contains the cost of the apartment, then it is final and it is prohibited to change it.

Therefore, if the price of an apartment increases in this case, you have every right to go to court to resolve controversial issues.

In other cases, the seller has the right to change the price of the apartment. Therefore, when concluding a preliminary agreement, it is important to indicate the final price of the property, and not rely on the seller’s “honest” word.

As you can see, the legislation clearly regulates all issues regarding prepayment when purchasing an apartment, and the process of registering it is quite simple.

The main thing when executing such transactions is to document every action performed between the parties in full compliance with the legislation of the Russian Federation.

What to choose when buying an apartment: advance payment or deposit? You can learn about this from this video:

See also Phone numbers for consultation Jan 03, 2020 kasjanenko 340

Share this post

Discussion: 4 comments

- Elena says:

10/06/2018 at 11:29For the first time I come across the concept of an advance payment in a transaction for the purchase and sale of an apartment. I gave a deposit of 10% and if I refused the purchase, it would not be returned to me, it remains with the owner of the apartment. I was warned about this from the beginning.

Answer

- Larka says:

10/07/2018 at 01:13

An advance can only be given when buying an apartment only to someone you have known well for a long time, or to relatives, then the likelihood of deception is very small, and it’s somehow scary for a stranger.

Answer

- Lisa says:

10/08/2018 at 01:06

If the culprit of the failed transaction is the seller, then he at least returned the amount of money that he took, not to mention some additional money that is due for moral damage.

Answer

- Anya says:

10/09/2018 at 01:11

The seller’s “word of honor” is that it means almost nothing, everything must be documented. In general, even though I’ve read the information, I don’t understand why giving advances or deposits, it’s very risky.

Answer

What to choose?

The parties have the right to decide which method of advance payment to choose by mutual agreement. It all depends on the specific situation. For example, if the seller is not sure that he will subsequently conclude an agreement to purchase an apartment, it will be more profitable for him to make an advance payment, because only in this case will he be able to get back all the money paid. If the chosen apartment fully meets his requirements and he does not want to lose it under any circumstances, then in this case it is more profitable for him to make a deposit, because in this case, if the seller changes his mind about concluding the contract, he will have to pay the buyer double the amount of the deposit.

Regardless of which option is chosen by the parties, the buyer must check all documents for the apartment, as well as the powers of the persons signing the agreement, before depositing funds.

In the event of controversial situations, including situations related to the seller’s failure to return the amount of the advance payment or double deposit, the parties have the right to go to court to resolve the conflict.

Deposit

What is a deposit? A deposit is a specific amount of money that is transferred to the owner of the property as an advance payment for living space. He acts as a guarantor of the transaction in the future. When the sales contract is signed, the amount already paid is added to the total price to be paid.

Obligations arise in accordance with the norms of the Civil Code of Russia, which establishes the functions and concept of a deposit. There are several functions that characterize such a payment, among them:

- evidentiary – it serves as evidence of the conclusion of the contract,

- payment – the amount of such payment is counted towards the total cost if all conditions for the transaction are met,

- security – encourages the parties to comply with pre-agreed conditions.

The parties to the transaction may come to a common decision that the future buyer needs to make a deposit for the apartment they like. When a realtor is looking for housing for a citizen, he may also offer to sign papers to list it. It is necessary to take into account that if everything goes wrong due to the fault of the buyer, it will not be possible to get back the money given.

If the purchase of housing does not take place due to the fault of the seller, the amount will be returned at double the amount. According to the law, its amount depends on the benefits of the parties. That is, if a citizen likes the apartment, he leaves the seller a certain amount of deposit. If there are more people willing to buy the property who are willing to pay a different price for it than the previous agreement, then it will be more profitable for the owner of the home to sell the property to them. Even though you will have to return the deposit in double amount.

A citizen, by transferring money, reserves the right to purchase the area. If he finds a more profitable option, he will have to take into account the fact that he will lose the deposit.

Both citizens who participate in a real estate purchase and sale transaction are interested in ensuring that it takes place. Making the down payment in this form must be documented in writing.

A deposit agreement is drawn up, which indicates that the amount of money transferred by the citizen who acts as the buyer is a deposit. It also states:

- information about the real estate,

- information about the parties,

- full price for the property.

Before signing the contract, you need to make sure that:

- the certificate of ownership of the property belongs to the seller,

- all owners (if there is more than one) will be present at the signing of the transaction.

Advance payment in the form of a deposit can only be made to the owner of the real estate. You cannot transfer money to other persons or enter into similar agreements with them.

When housing is purchased with a mortgage, the banking institution will deduct the amount of the deposit from the amount of the down payment; this requires the conclusion of a binding agreement. Collateral obligations begin after signing the contract. An apartment that was purchased with its funds is given as collateral to the banking institution. The lender gets the opportunity to sell the property that is pledged.

How to distinguish a deposit agreement?

Any contract – the rights and obligations of its parties.

Deposit is a sum of money given by one of the contracting parties against payments due from it under the contract to the other party, as proof of the conclusion of the contract and to ensure its execution. This is how the deposit is defined by the Civil Code of the Russian Federation in Article 380.

The main features of a deposit agreement are: 1) it is concluded only in writing, 2) it must contain a condition on the recognition of the payment made by the buyer “as proof of the conclusion of the agreement and to ensure its execution.”

Without exception, all real estate agency agreements that we encountered when supporting the purchase of apartments and other real estate were essentially deposit agreements. You can be sure: if you buy an apartment through the seller’s agency, to reserve the apartment you will be asked to sign a deposit agreement.

It doesn't matter what the name of the contract is. It may be entitled simply: agreement, contract, or preliminary agreement for the purchase and sale of an apartment, or in another way. The essence of the agreement is not contained in the title but in its content.

Read the text of the contract carefully. As a rule, these are several sheets, and most importantly, it will not be located on the first sheet. Look for phrases: “security of obligation”, “amount paid is not refundable”, etc.

The contract is specially written in such a way that sometimes even lawyers who specialize in supporting the purchase of apartments find it difficult to correctly qualify the contract. Only experience in the systematic preparation of transactions for the purchase and sale of apartments and knowledge of the methods of real estate agencies can protect the buyer’s money and conclude an agreement on conditions favorable to the buyer, or apply another agreement, or significantly reduce the possible risks of the buyer.

Demand clarification of unclear clauses of the contract. If you don’t like something in the text of the contract, demand that these provisions be removed from the contract or stated in the wording you propose. You will be convinced that not a single agency will edit its contract to suit your wishes. The position will be tough: “Either sign such an agreement, or we won’t book the apartment.”

Attention: Since 2015, sellers have been using a new “trick” - payment under an advance agreement is called a “security payment”. And buyers easily sign such an agreement! After all, a security deposit is not a deposit, which means the seller will return it.

You are wrong, gentlemen, buyers! It is no easier to return a security deposit than a deposit.

Large brand agencies are especially guilty of such tricks.

The second sign of a deposit is a large amount in the contract. In Moscow, depending on the category of the apartment, the amount under the contract reaches 500 thousand rubles.

How to determine the amount of funds to transfer

Citizens can agree on any amount that builds them. It can be indicated in the agreement and in the receipt as a percentage of the total sales price of the apartment or in numbers with words.

The legislator does not limit the amount of prepayment, but usually it ranges from 1-10% . If you want to set a fixed value, then you can stop at the amount of 50-100 thousand rubles.

Read the Application for issuance of an old-style international passport 2020

Necessary measures before the transfer of the deposit

Surely every sane person understands that simply giving an impressive amount of money to a stranger is unacceptable. It is first necessary to draw up an official agreement, which will clearly state the amount and time of transfer of the deposit. Of course, such an agreement must have legal force. At first glance, the whole procedure seems simple and cloudless, but practice shows the opposite.

Not many real estate buyers know that they can get back part of the money spent using a tax deduction. Read about how much the tax deduction is when buying an apartment and what documents are needed to obtain it in our detailed article. Find out what assignment is and what are the nuances of registering the assignment of rights to claim an apartment in a new publication.

Today, there are a lot of various criminal schemes that allow you to deceive gullible citizens. High vigilance and awareness of the participants in the transaction will help you avoid falling for the bait. Below are some points to consider before handing over your money to the seller:

- If several people are registered in the apartment being sold, all of them must be present at the time of transfer of the deposit, because if the seller of the apartment is married, but only one is registered, his wife has the opportunity to present her rights to the living space for three years, even in the event of a divorce.

- The seller’s task is to transfer to the buyer the entire necessary list of documents , including documents for the right to own the apartment and the foundation agreement.

- It is also necessary to request a certificate of all persons registered in this living space. which should indicate the people registered in the apartment today and in the past. It may well turn out that some of those previously registered have the status of temporarily discharged due to imprisonment or military service. Accordingly, once they return, they will be able to lay claim to their property, and according to the law, you will not be able to oppose anything to this.

- Redevelopment of an apartment carried out without the consent of government control authorities will subsequently force you to shell out a considerable amount, and besides, litigation of this kind is quite labor-intensive and lengthy.

- It is very advisable, before the act of transferring money, to find out whether some of the rights to the living space being sold are held by third parties .

All data relating to registered owners and third parties are located in the Unified Legal Register.

If you feel something is wrong and have doubts, it is better to contact a legally competent person.

Drawing up an advance agreement

This is especially true when the buyer does not have the entire amount to pay at once, he plans to take out a loan or borrow from a private person.

Read Employee Characteristics

Therefore, an agreement on a deposit or preliminary purchase and sale has 3 main functions:

| Providing a guarantee | He wants to assure the seller of a future transaction. The latter, in turn, requires a deposit so that she “doesn’t fall through the cracks.” |

| Payment | When funds are deposited, the liability by its amount will be reduced upon completion of the main agreement. |

| Evidence-based | The transfer of money by receipt and in the presence of witnesses will be proof that the parties have already entered into a contractual relationship, albeit preliminary. |

In the Civil Code, art. 380 states that the deposit agreement must be drawn up only in writing.

The deposit agreement comes into force after it is signed by the parties and/or their representatives, who must act on the basis of a power of attorney.

In terms of content you need to enter:

- Name of the document, place and date of conclusion.

- Participant details (full name, passport details, contacts).

- Information about the property:

- address;

- common and living area;

- cost of the apartment;

- specifications;

- who is the owner and on what basis the rights were acquired;

- whether there are registered citizens in the premises and when they should check out after completing the transaction;

- about the presence or absence of encumbrances on the property;

- others if necessary.

- The amount of the deposit in numbers and words, and how it should be transferred:

- cash;

- transfer to a card or account, in this case you need to provide payment details;

- send by postal order to the seller’s residential address, you must indicate the Russian postal division code.

- In what time frame will the transaction be completed after the preliminary agreement is drawn up?

- How should the buyer transfer the remaining money to the owner, and in what amount.

- Rights and obligations of the parties to the agreement, sanctions for failure to comply with them in accordance with the Civil Code, Art. 381. For example, the seller is obliged to hand over the apartment in the same condition as it was during the inspection. The acquirer is obliged to first pay a deposit, and then the rest within the agreed time frame.

- Who needs to bear the costs associated with the conclusion and transfer of real estate in the future.

- What circumstances can be considered force majeure?

- Is it possible to extend the preliminary agreement if the money is not transferred within the specified time frame for a valid reason?

Such an agreement is no different in structure from the main one, so at the end the details of the participants and their signatures are affixed. The parties should be aware that the amount is non-refundable if the transaction does not take place in the future, i.e. the deposit is not refundable by law.

Sample receipt for receiving a deposit for an apartment

What is the difference?

To clearly reflect the features of each type of payment, the information is presented in a comparative table:

| Differences | Deposit | Prepaid expense |

| Purpose of payment and its main function | It is financial security that guarantees the participation of the parties in the upcoming transaction. If he refuses, there will be material consequences. | Transferring and receiving an advance does not guarantee that the parties will fulfill their obligations, since the advance is only an advance payment for the upcoming transaction |

| Consequences of refusal of the transaction for the buyer | Non-refundable, remains entirely with the seller | Returned to the buyer in full |

| Consequences of refusal of the transaction for the seller | The buyer is refunded in full and a penalty payment in the same amount | |

| When concluding a purchase and sale agreement | Is part of the cost of the apartment | |

| Issued | An agreement and a receipt confirming the transfer of funds | |

| Size | It is the result of an agreement between the parties, most often 5-10 percent of the cost of the apartment | |

Drafting sample

After concluding an agreement on the deposit, it is recommended to obtain a receipt from the seller for receipt of funds. It is the most important document when making any real estate transaction. As a rule, it is concluded in writing, with the signatures of both parties. It is better to prepare a receipt in two copies at once, one of which remains with the owner of the property, and the other with the buyer.

Let's move on to the meat of the document itself. So it should contain:

- Passport data of all owners and buyers of the apartment;

- The total value of the property;

- The amount of the deposit;

- Information about the apartment (address, number of rooms, number of floors, total area);

- Responsibilities of the parties to the transaction;

- Other conditions for receiving a deposit.

Download

Sample receipt for a deposit when purchasing an apartment.doc form for a receipt for a deposit when purchasing an apartment.doc

A receipt for receipt of a deposit does not require mandatory notarization. However, it is very important for the outcome of the transaction itself. For example, this document should contain such a clause as the obligations of the parties. It should indicate that if the deal falls through due to the fault of the apartment owner, then he must compensate the buyer for damages in the amount of the full cost of the contribution. If, on the contrary, the buyer breaks the deal, then the deposit remains with the seller.

Examples

According to the Civil Code, the buyer, thanks to the deposit, shows the seller that he has serious intentions. Therefore, if he refused after transferring the money, it is logical that it will not be returned to him.

The Civil Code also provides for situations where funds can be returned. It is necessary to prove the owner’s guilt for which the transaction did not materialize, for example, he refused without serious reasons. In this case, the seller must return double the amount to the buyer.

Similar situations can be considered using examples:

| Without obtaining a mortgage |

|

| With a mortgage |

|