Home / Family law / Inheritance

Back

Published: 08/05/2018

Reading time: 5 min

0

193

In Russia, the custom of writing a will is not common; most often, in the event of the death of one of the family members, inheritance occurs according to law.

- Who is the first priority heir?

- Procedure for entering into inheritance

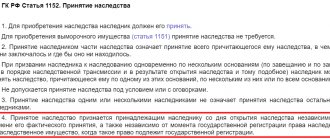

According to the third part of the Civil Code of the Russian Federation, heirs of the first priority are called upon to inherit according to the law.

Inheritance of property by will

The transfer of property by will is carried out if, at the time of the citizen’s death, there is a valid order regarding his will regarding who should receive his property: apartments, cars and other assets. At the same time, it is important that none of the relatives have any doubts that the will was drawn up personally by a deceased relative, for example, a father, and at the time of its execution he was in full legal capacity, that is, he was aware of his actions and their possible consequences. Otherwise, this document may be contested, which means that the entire procedure for distributing property in accordance with it will be declared invalid. If there is a will, in accordance with the law, the order prescribed in it takes precedence: all assets belonging to the deceased must be distributed exactly as he wished. For example, an apartment may be left by a father in his will to one of his sons, despite the fact that he has other children. The only exception may be a situation where the father did not mention minor or disabled children, parents, dependents or a spouse: in this case, in this part the law requires that the last will of the deceased be violated by providing such relatives with a part of his property in the amount of at least half of that amount , which they would have received if the will had not existed.

Nuances of the process: sequence

The procedure for inheriting property without a will established in the legislative framework is based on the principles of kinship. Following it, you get a kind of staircase:

- first in line are spouses - legal husband and wife, children and parents of the person who died;

- second stage - other relatives (grandchildren, cousins, second cousins, aunts and uncles).

This rule always works and does not fail, as it is the foundation of legal knowledge, ethics and culture. It is necessary to correctly and clearly apply current regulations in order to prevent violations of the law or infringement of property rights of individuals.

Transfer of property of a deceased person by law

If there is no order from the owner regarding the distribution of his property at the time of death, the mechanism described in the law should be used. In particular, Article 1141 of the Civil Code of the Russian Federation provides that in such a situation, inheritance is carried out in accordance with the relatives’ belonging to the so-called queues. Their composition is determined on the basis of the relationship between the deceased and his relatives, which can be based on kinship, property or dependency. For example, the first priority includes children, parents, and a spouse of a citizen. The second line is formed by his grandmothers, grandfathers, brothers and sisters, including both full and half-blooded ones, that is, having only a common father or mother with him. Inheritance of property, in accordance with the legal order, provides for the priority of each previous order in relation to the next. So, for example, if there is at least one heir of the first stage, representatives of all subsequent stages do not have the right to receive property. Thus, for example, if at the time of the death of a citizen he no longer has parents and a spouse, and the only heirs of the first priority are his two children, they will receive all of his property, regardless of whether there are applicants in other queues and what their number is.

The so-called "extraordinary" heirs

There is also a special category of heirs who can join any line called to inherit and receive an equal share with them. This:

- disabled relatives indicated as part of one of the lines of inheritance (from 2nd to 7th), provided that they received constant maintenance from the testator (i.e. they were his dependents) during the last year,

- disabled dependents who were already mentioned in the 8th line of heirs. If none of the heirs of the previous seven orders accepts the inheritance, then they will receive it in full.

But if closer relatives have declared their rights, then such dependents will inherit only a share equal to the rest of the heirs.

Please note that not only disabled people are now recognized as disabled, but also citizens who have reached pre-retirement age (i.e. women - 55 years old, men - 60 years old).

Therefore, such an unexpected situation may arise, for example: the children accepted the inheritance after their father, but he also had a cohabitant who was 55 years old, she did not receive a pension and for the last year she lived on the testator’s money.

Having proved her dependency, such a cohabitant can legally oblige the children to give her an equal share of the inheritance.

Source:

Legal subtleties

Heading:

Inheritance law

rights of heirs inheritance entry into inheritance

- Irina Sivakova, lawyer

Entry into inheritance rights: contacting a notary

In order to enter into your rights, in both cases: when inheriting by law, and when receiving property under a will, you must contact a notary.

The applicant must write a statement in which he records the fact of taking over his rights and asks to issue a certificate of the right to inheritance, for example, for an apartment left to his son after the death of his father. Such an application must be accompanied by documents confirming the validity of such claims on the part of the applicant. This package must include the applicant’s passport, death certificate of a relative, and a certificate from his place of residence confirming his address of residence and permanent registration. In addition, depending on whether property is distributed according to a will or by law, the package of documents should be supplemented with other papers. So, if there is a valid order of the deceased regarding the procedure for dividing his property, the notary must be familiarized with it, proving, for example, the validity of the son’s claims to his father’s apartment. If the division of assets occurs in accordance with the legal order, the applicant must confirm the legitimacy of his claims by providing evidence of his membership in a certain line of inheritance. The easiest way to do this is for representatives of the first line: for example, the parents of the deceased will only need to provide a certificate of his birth, the children - a certificate of their birth, and the spouse - a marriage certificate. The applicant must submit documents to a notary, thereby declaring his rights to receive the property of a deceased citizen, within a period not exceeding six months from the date of his death or from the day he was declared dead. If this deadline has been missed, acceptance of the property, including an apartment, is possible, but to do this you will have to go to court, presenting evidence of valid reasons why the applicant failed to meet the deadline allotted by law. If the judicial authorities recognize the sufficiency of these grounds, the period for accepting the property will be restored. Having received the necessary documents, the notary will open a so-called inheritance case. After this, he will study all his circumstances, including the composition of the property that should pass from the deceased owner to his relatives, the presence of other heirs and the grounds for their rights to receive property, including applicants for the acquisition of compulsory shares. It will analyze the legitimacy of the documents submitted by the applicant or applicants and make a determination as to whether his or their claim to receive the deceased's property, including the apartment, is valid. If he recognizes them as such, within the period prescribed by law, the notary will issue the applicant with a certificate of right to inheritance.

This certificate is a key document confirming the rights of a relative of a deceased citizen to acquire his assets. Subsequently, he will be able to apply with this document to the state registration authorities. On this basis, they will be able to record his rights to this property and issue a certificate of ownership, which gives him the opportunity to dispose of this property and use it at his own discretion. It is important to remember that it will be possible to obtain a certificate of inheritance no earlier than after the expiration of the period allotted by law for its adoption, regardless of the date of filing the documents. Thus, the applicant will be able to become the owner of this certificate only six months from the date of the death of his relative, for example, his father, or he was declared dead. This restriction is established by law so that all applicants who have the right to receive his property have time to contact the relevant authorities, stating their claims.

How to receive an inheritance if there was no will?

Entry into inheritance takes place six months from the date of death of the testator.

This period is given to the heirs in order to submit an application for acceptance of the inheritance.

If the deadline for accepting an inheritance is missed, it remains possible to restore rights in court. But for this, the applicant for the inheritance will have to prove that he did not know and could not know about the fact of the death of the testator.

A valid reason is also the physical impossibility of submitting an application on time, supported by documentation (for example, a long-term illness).

To receive an inheritance, you must go to a notary's office and open an inheritance case with a notary.

Since there was no will, and therefore, the testator did not choose a notary during his lifetime to conduct the inheritance case, this case will be conducted by a state notary.

Finding it is not difficult: you need to find out which state notary is in charge of inheritance affairs in the territory of residence of the testator.

Persons claiming inheritance must provide the notary with the following documents:

- passport or equivalent identity document;

- the original death certificate of the testator and two copies of this document;

- original certificate of the place of registration of the testator and persons living with him, plus a copy;

- original and copy of the house register;

- documents confirming the relationship of the applicant for the inheritance with the testator.

The easiest way is to prove the relationship of the spouses (the original and a copy of the marriage certificate are enough), as well as children and parents (the original and a copy of the birth certificate are required).

Archival documents may be needed to prove distant degrees of relationship.

Warning

If the notary does not consider the evidence provided convincing, the relationship will have to be proven in court.

Entry into inheritance rights: actual acceptance of inheritance

In addition, it is necessary to take into account that the law allows for the possibility of dispensing with the formal legal procedure for registering an inheritance and contacting a notary. Thus, Article 1153 of the Civil Code of the Russian Federation establishes that the acceptance of property also recognizes the actual assumption of property rights by a relative of the deceased. In order to carry out such actual entry, the latter must take one of the actions indicating his intentions. As such actions, the law provides for the beginning of ownership, use or management of the property of the deceased, its protection from attacks on it by other persons who do not have the right to it, or other measures to preserve such property, for example, you can cover the car with a cover or put it in the garage . Among such actions, the law includes payment by a relative of expenses necessary to maintain the property of the deceased in proper condition, for example, payment of utilities for an apartment. In addition, this includes the payment of debt obligations of a deceased relative or, conversely, the receipt of funds that were due to him from debtors.

Article 1153 of the Civil Code of the Russian Federation establishes that the documentary method of entering into inheritance rights by applying to a notary and the actual entry into inheritance are equally legitimate ways of acquiring the property of a deceased relative, for example, a father. It should, however, be remembered that in order to ensure the full scope of their rights to dispose and own their property, for example, to sell an inherited apartment, the new owner will need a certificate of ownership. In this case, he will still have to apply first to a notary for a certificate of inheritance, and then to the state registration authorities to obtain a certificate of ownership. However, in this situation, he can inherit it regardless of the period of application: he cannot be charged with missing the deadline for accepting the inheritance, since he actually accepted it.

Do heirs have the right to live in an apartment before entering into inheritance?

» Payments and processing costs September 09, 2020

Who can live in an apartment before inheriting

Use of inherited property

Inheriting an apartment and its subsequent sale

To inherit an apartment, the heir will have to contact a notary. At the first stage, at the time of application, the heir writes an application to accept the inheritance. After the notary accepts it, he will explain to the heir what documents need to be collected in order to obtain a certificate of inheritance. In addition to the general documents required for registration of all types of inherited property, in order to inherit an apartment you will definitely need: a technical passport of the apartment, a document that will confirm that this apartment was the property of the testator, a document confirming the basis for the transfer of the apartment into the ownership of the testator.

Who can live in an apartment before inheriting

This norm existed in the USSR and may return to modern Russia. 21 March

On March 20, 2016, a new edition of the third part of the Civil Code of the Russian Federation came into force. The right of heirs to receive an increased amount of funds to organize a decent funeral for their deceased relative is established by law.

September 11, 2020

The Social Insurance Fund of Russia reminded that if the insured person did not receive temporary disability benefits during his lifetime, the employer is obliged to pay it to the relatives of the deceased.

Is it possible to live in an apartment without entering into the right of inheritance?

So the answer is yes. Both heirs have full right to use the apartment Posashkov Pavel Guru (3213) 6 years ago Yes, quite, this is called actual acceptance of the inheritance. Dmitry Orakul (72931) 6 years ago Some kind of documentary reasons for residence are needed. Elena Master (2132) 6 years ago Maybe and should. If there are other heirs, then everyone has equal rights.

Anna Zorina Expert (277) 6 years ago Of course it can.

Who can live in an apartment before inheriting

What can be done in this situation? July 11, 2013, 17:34 Nezhnova Oksana, Yekaterinburg Answers from lawyers (1) Based on clause 4 of Article 1152 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), an accepted inheritance is recognized as belonging to the heir from the date of opening of the inheritance, regardless of the time of its actual acceptance, and also regardless of the moment of state registration of the heir's right to inherited property, when such a right is subject to state registration. According to paragraph

What is the procedure (terms, documents) for entering into inheritance under a will?

which, in fact, is what this article is devoted to. Basic information about inheritance Those who are faced with such a legal phenomenon as inheritance for the first time have a huge number of questions.

In order to get a little comfortable in a new territory, you need to familiarize yourself with the basic information.

First of all, it should be said that there are two types of inheritance: by law and by will.

Is it possible to rent out an inherited apartment?

And at the same time you are required to pay utility bills and rent.

And if there are debts on this apartment, then you are obliged to pay off these debts. You know that not only property is inherited, but also the debts of the testator. It is quite obvious that you cannot sell this apartment.

If only because you do not have the necessary documents to register the transaction with the registration authority. But you can live in this apartment yourself. In accordance with Articles 1152 and 1153 of the Civil Code, you have every right to do this.

Is it possible to rent out such an apartment?

She checked all the documents confirming the relationship and legality of inheritance, warned clients about possible risks, and insisted that this be recorded in the contract. People live. This depends on the integrity of the lessor; almost everyone always knows about possible heirs. Liked post [0]: SVC wrote: Can he legally rent out the apartment?

Liked message [0]: Maybe.

Payment for housing and communal services in the period before inheritance: is it legal?

Is registration a basis for inheritance?

In practice, most citizens are not aware of the rules of inheritance, although sooner or later most will have to touch on this legal issue. The main provisions are enshrined in Chapter 3 of the Civil Code of the Russian Federation; in complex and controversial cases, controversial issues are resolved in court. Of particular importance is the inheritance of property, namely real estate. Knowledge of the provisions on inheritance of housing will allow you to avoid many misunderstandings when opening an inheritance and effectively protect your rights.

Basic provisions on inheritance

There are two ways to inherit property: by will and by law. Notaries deal with inheritance issues, and interested parties should contact them. The issue is considered at the location of the inherited property or the registration of the testator. Presumptive heirs must comply with the statutory period of six months after the death of the property owner; a later appeal is possible in court, indicating objective reasons.

Inheritance by will is possible for any individual or legal entity specified in the last will of the testator. The document can identify several heirs, indicating the property assigned to them. In the absence of allocated shares, the testamentary estate is divided equally among all heirs. A citizen can leave a will not for all of his property, but for a certain part. In this case, the part not included in the will is divided between relatives according to the law.

The absence of a will means the transfer of ownership by law, in which only relatives participate. Legal inheritance considers seven lines of family ties. Close relatives: children, spouses and parents are the main applicants and belong to the first line of kinship. Entry into rights under any form of inheritance can be rejected at the request of the heir. If the applicant refuses to make a will, the inheritance is distributed according to the law, and the will loses its force. If a relative refuses to become an heir, applicants of a lower level are considered by law.

If within six established months no one contacts the notary with a statement of their rights, then the property is considered escheated and goes to the state. In controversial cases, when a judicial review of the issue is necessary, the term of the case is extended until the time established by the court.

You can also challenge the division made by a notary within six months after the issuance of a certificate of inheritance.

When applying to a notary, heirs declare their rights by providing a will or a document certifying the relationship. In addition, you will need a death certificate of the testator, a certificate from his place of residence and documents for the inherited property. The notary has the right to request other documentary evidence confirming the status of the applicants and the property rights of the testator.

After the established period, the heirs receive a certificate of right to inheritance. The act is the basis for applying to the registration authorities to register ownership of real estate, as well as to receive cash deposits and securities. There is no tax on inheritance received, but you will have to pay a state fee. Its size for relatives is 0.3% of the estimated value of the inheritance, the rest of the acquirers will need to pay 0.6%.

Inheritance by registration

Registration in the inherited apartment is not the basis for entering into inheritance rights. When an inheritance case arises, the notary reviews the certificate of ownership of the testator. If the heir becomes a person already registered in the living space, then the entire area or share of the testator goes to him.

If the registered person is not a relative and is not included in the will, he does not acquire rights to the apartment and residence in it. The heir, who has become the new owner of the living space with the tenant registered there, has the right to discharge him with consent or through a court order within the time limits established by law or the court.

Exceptions are the cases described in Article 1148 of the Civil Code of the Russian Federation. Disabled dependents who have been registered in the testator's apartment for more than a year and who were supported by him have the right to inheritance. The dependent may not be related to the deceased, but has the right to a mandatory share of the inherited apartment. If the dependent is a relative, then in order to claim his rights he does not have to be registered with the testator.

It is enough to prove that the citizen supported a disabled relative at his own expense for a year before his death.

Is it possible to live in an apartment before entering into an inheritance?

Tweet on Twitter

It is considered to be the “safest” way for someone who disposes of their property in favor of relatives. But is this method always convenient? The law provides for two options for transferring real estate by inheritance. This is inheritance by law and by will. Inheritance by law occurs much more often in life than inheritance by will. Heirs by law are persons who are closely related to the deceased, most often those who were part of the same family with the testator. That is why the first priority heirs are children, spouse, and parents. Today there are eight lines of succession by law. If there are heirs of a higher order, then lower heirs do not participate in the inheritance. Particularly noted as possible heirs by law are persons who, although not related to the deceased, were members of the same family with him - dependents of the testator.

Question answer

Firstly, the registration process is not burdensome: visiting a notary, drawing up a will without the presence of an heir. The procedure takes about half an hour and costs from 150 to 250 rubles. Secondly, the testator remains the owner of the property until the end of his life and is not tormented by doubts about the fact that he may lose his apartment.

Thirdly, a will can be revoked and made in favor of another person countless times, but only the last one is valid. In the event that the testator really has serious intentions to transfer the apartment only to the only heir, but there are heirs who have rights to the obligatory share, this method of disposing of the apartment is not acceptable. The disadvantages of transferring an apartment by inheritance concern mainly heirs.

5 stages of inheriting an apartment

Often in legal practice there are cases when a citizen has just submitted documents for the privatization of an apartment, but died before becoming the owner of the apartment. Do the heirs have legal rights to this apartment? Yes, they do. Judicial practice is on the side of future heirs, because the citizen (testator) expressed his will to privatize the apartment as his property.

Inheritance by will. The fundamental difference between transferring an apartment by will is that the testator can make a will for his property not only to relatives, but also to any other person of his choice. A will is a transaction, i.e. legal action of a citizen. Article 1126 of the Civil Code of the Russian Federation provides for a closed will.

Registration in an apartment before inheritance

An analysis of judicial practice shows that such contracts are easily terminated if your relative suddenly files such a claim in court. In order for the rent payer to insure against termination of the contract, it is recommended to keep receipts for purchased medicines, receipts for payment of utility bills, receipts for the delivery of money, etc. It is better to enter into such an agreement only with close relatives, because it is trustful and close relationships that can be the best guarantees.

Apartment: inheritance or alienation

To acquire the right to inherit as a dependent, it is necessary to establish that such a person is disabled at the time of the death of the testator. The law classifies as disabled women who have reached 55 years of age, men - 60 years of age, disabled people, persons under 16 years of age, and students - 18 years of age. The share of an heir by law who died before the opening of the inheritance or at the same time as the testator passes by right of representation to his descendants. For example, citizen K. had two sons. The eldest son died before the death of his mother, but had a child (son). After the death of citizen K., she was left with two legal heirs: a son and a grandson (the child of the deceased eldest son of citizen K). In such cases, the grandson by right of grant will participate in the division of the inheritance instead of his father.

Entry into inheritance

Credit Hello! My name is Olya, my husband and I bought a house in the village, registered the house in the name of my husband, the house was built in 1948, we have been living in it for three years, we decided to take out a loan for Severance pay upon the onset of incapacity for work. Having worked for several years as an auxiliary worker (in fact, as a loader) for same company, got intervertebral disc disease. reproach to mother-in-law about accommodation. Hello. My name is Maria. I have been living in a three-room apartment with my husband and two children for 7 years. The apartment belongs to the mother-in-law. In the apartment Vacation in May Hello, the month of May is considered a summer month for vacation? I am the mother of three children 14 years old, 8 years old, 6 years old, I go on vacation in May. I would like it any time

Inheritance law

What unites them is the fact that the owner of the property during his lifetime transfers this ownership right to another person. Let's consider the possible, most common, real estate transactions. Purchase and sale of real estate. If there is a trusting relationship in the family, in my opinion, this is the best way to transfer an apartment to close people. The question arises: what to do if parents want to leave this apartment to their two children equally? Draw up a purchase and sale agreement for two children, each of whom will be the buyer. This method of transferring an apartment has its advantages. In contrast to the transfer of an apartment by inheritance, the property is transferred to a relative immediately upon execution of a real estate transaction. Therefore, you will not have to undergo any additional procedures after the death of your grandfather, grandmother or parents.

Enter the site

Changes in the Civil Code of the Russian Federation On March 20, 2020, a new edition of the third part of the Civil Code of the Russian Federation came into force. The right of heirs to receive an increased amount of funds to organize a decent funeral for their deceased relative is established by law. The FSS explained how an employer should act in the event of the death of an insured person. The Social Insurance Fund of Russia reminded that if the insured person did not receive temporary disability benefits during his lifetime, the employer is obliged to pay it to the relatives of the deceased.

The procedure for such payment is explained separately. 11:06 The Ministry of Justice will help Russians refuse their inheritance Password is someone else's computer Forgot your password? Experts of Day 1 Irina Shlyachkova Order a lawyer's consultation Legal topics: Administrative liability and offenses Civil law. Contracts.

Registration of inheritance through a notary:

Transactions Labor law and social security Biography: 35 years old, higher education in law, work experience in the specialty for more than 13 years. From 2001 to 2014 - assistant judge. From 2014 to the present - private practice on legal issues (arbitration, courts of general jurisdiction). 2 Lyubov Zorina Order a legal consultation Lawyer's topics: Labor law and social security Biography: Education: higher, graduated in 1981 from Lomonosov Moscow State University with a degree in History. Area of interest: labor law, judicial practice in labor disputes. I specialize in the field of labor law and social security.

I have over 15 years of experience in the field of labor law; in my professional activities I have constantly encountered the protection of the rights of both employees and employers. Therefore, I can tell you about the most important labor rights that

Is it possible to live in an apartment before entering into an inheritance?

Adopted children, after the death of their adoptive parents, have equal rights with their natural children. If, by a court decision, adopted children have maintained a relationship with a biological parent or blood relative, they have rights of inheritance after the death of blood relatives and adoptive parents. The interests of children under 18 years of age are borne by guardians and legal representatives.

Non-privatized inheritance The inherited apartment must belong to the testator. However, a non-privatized apartment belongs to the municipality. The testator will have the right to own and use the apartment, but will not be able to sell, donate, or bequeath it. To inherit a municipal apartment, you need to privatize it by filing a claim in court to recognize the apartment as an inheritance. If the tenant of municipal housing was single, the state has the right to move new tenants into it.

MegaSlav May 13, 2009

Hello, dear forum participants

I would like to ask a question that interests me, I hope the topic is not a button accordion, I did not find it by searching.

My wife's mother died in March. After her, a four-room privatized apartment was left in Karelia, in which only she was registered. She did not leave a will. At the moment there are three heirs - the wife, her sister, and her brother. I repeat - none of them are registered in the apartment.

Next week the wife will file an application for inheritance. But at the moment there is a problem - within a few days after the death of his mother, his wife’s brother moved with his family from his dorm into this apartment, and began rearranging there, throwing out the things of the deceased, as well as my wife and her sister, started renovations, and in private in conversations he declares that the apartment is now his, and he will do whatever he wants in it. The indignation of the other heirs at these actions is ignored, they say, you actually live in St. Petersburg, why do you care what I do in my apartment

In this regard, a number of questions have arisen that I would like to ask dear participants:

1. Can a wife evict her brother and his family from the apartment before all heirs enter into inheritance rights? Of course, having first described all things with the help of a notary and sealed the door to prevent access to the apartment for all heirs? Does one of the heirs (who has not officially entered into inheritance rights) have the right to violate the integrity of the sealing in any legal way? And if sealing is possible, what documents must be on hand to ensure this procedure? (you have a document for the apartment).

2. What to do if, after entering into an inheritance, two heirs want to sell their shares in the apartment (or exchange them for other housing), and the third does not agree to this? What would be the most successful way to solve the problem - to sue for the division of the apartment into shares? Or offer to buy out both of your shares at the market price?

3. Can the wife’s brother be temporarily legally registered in this apartment AFTER the death of his mother?

I hope very much for your help.

Almazeg 13 May 2009

2. What to do if, after entering into an inheritance, two heirs want to sell their shares in the apartment (or exchange them for other housing), and the third does not agree to this? What would be the most successful way to solve the problem - to sue for the division of the apartment into shares? Or offer to buy out both of your shares at the market price?

If I’m not mistaken, the rules of Chapter 16 of the Civil Code, Article 250 apply - the brother has a pre-emptive right to purchase, it is necessary to notify him in writing of the intention to sell to a third party, indicating the price and other conditions in the notice. If within a month he does not buy on the specified conditions or refuses, then he can safely sell. You can also donate a small part of your share to the buyer, he will become a co-owner and then sell it to him without applying the rules of Article 250

MegaSlav May 13, 2009

Thank you, point 2 is now clearer.

Alderamin May 13, 2009

My wife's mother died in March. After her, a four-room privatized apartment was left in Karelia, in which only she was registered. She did not leave a will. At the moment there are three heirs - the wife, her sister, and her brother.

within a few days after the death of his mother, his wife’s brother moved with his family from his dorm into this apartment, and began rearranging there, throwing out the things of the deceased, as well as my wife and her sister, started renovations, and in private conversations declares that now the apartment is his , and he will do whatever he wants in it. The indignation of the other heirs at these actions is ignored, they say, you actually live in St. Petersburg, why do you care what I do in my apartment

1. Can a wife evict her brother and his family from the apartment before all heirs have acquired inheritance rights?

No brother. The brother accepted the inheritance through actual actions, thus he is the owner of the apartment. As for his family, moving his family members into the apartment is possible with the consent of all owners. In this regard, your wife has the right not to allow his family members to use the apartment. However, if the case goes to court and it turns out that the wife permanently resides in St. Petersburg and has no interest in using this apartment, then it is not a fact that the court will prohibit the brother’s family members from living in the apartment.

Of course, having previously described all things with the help of a notary and sealed the door to prevent access to the apartment for all heirs?

Since the service is paid, the notary may agree to do this, but, generally speaking, it does not follow from the law that such actions are permissible in the situation under consideration.

Does one of the heirs (who has not officially entered into inheritance rights) have the right to violate the integrity of the sealing in any legal way?

Of course. By any legal means he can think of.

2. What to do if, after entering into an inheritance, two heirs want to sell their shares in the apartment (or exchange them for other housing), and the third does not agree to this?

The question is unclear. Either realize your intentions, or refuse to realize them.

What would be the most successful way to solve the problem - to sue for the division of the apartment into shares?

What do you understand by dividing an apartment into shares?

Or offer to buy out both of your shares at the market price?

There is nothing stopping you from making an offer. It’s just not clear how to understand both of yours.

3. Can the wife’s brother be temporarily legally registered in this apartment AFTER the death of his mother?

What is temporarily legally registered? Being the owner of the apartment, he has the right to have registration in this apartment.

none of them are registered in the apartment

It makes absolutely no difference.

Next week the wife will file an application for inheritance.

Not about entering into an inheritance, but about accepting an inheritance. Inheritance is property. There is no need to submit any applications to take ownership of the property. In this case, come up, open the door and enter.

Buutch May 13, 2009

I want to leave a will for an apartment that I own under a rental agreement (with an encumbrance). Is it necessary to have the consent of the rentee? If so, in what form should he express his consent? Further.

Olga Valerievna! Thank you very much for the complete answer. Only one thing remains unclear. If the deadline has passed, she has entered into an inheritance, then why is she calling and so urgently demanding that her ex-husband refuse. Further.

The apartment was purchased during marriage in the name of the wife. The divorce took place 9 years ago, but there was no official division of property. The ex-husband is not registered in the apartment and never laid claim to it. Only the wife is registered in the apartment. Further.

I inherited 4/5 of the house and the land plot on which the house stands. 1/5 is not included in the inheritance, but is listed as belonging to my late mother, who had two children (me and my brother). The notary explained to me that I did not live with her, therefore I do not have the right to inheritance. Further.

Dad died. There was no inheritance. Mom was the only heir. The garage was registered to my dad. It was not registered as private property. How can a mother register a garage for herself? Is it really only through the court? Further.

In 2002, my father died. According to the will, I am the only heir (there are no other heirs of the 1st stage). According to the will: an apartment in Moscow and 1/2 of a house (and land, of course) in a village (near Moscow). I decorated the apartment. Further.

My mother died when I was 14 years old. In marriage with their father, they purchased an apartment, a garage, and a dacha. 4 years after my mother’s death, my father got married. He was married for 2 years, this year DarkCatalog.ru, a general thematic catalog of websites, died. articles on the topic. As a gift and inheritance from my mother, my father promised to register a garage and a dacha for me at my wedding, but he didn’t have time. Further.

Inheritance - questions and answers

Hello! Recently my husband died; we were in a civil marriage. We have a 3-year-old daughter. My husband owned an apartment. Who will be the first to apply for an apartment? My husband's parents are still alive. Further.

My husband has an apartment in Nab. Chelny Tatarstan, which passed to him from his mother. We live in Moscow Region. He wants to give it to me. How to solve this problem? Thank you. Further.

Dear lawyers. The father died, a privatized apartment remained, and the mother lives in it. What is better for the son: to write an application for renunciation of the inheritance or an application for acceptance of the inheritance? Further.

Is it necessary to enter into an inheritance upon reaching the age of majority? Can we wait? The entry period has expired. 4 years passed after death, but there were no 18 years and that’s why they didn’t join. Now third parties are being forced to join. Further.

In August 2008, my grandmother died. She did not leave a will. In the last year before her death, she was under constant treatment in the hospital. I have been living in her apartment for 3 years and am registered there, and I pay utility bills on time. Further.

Sources: my-accountant.ru, alljus.ru, leks74.ru, forum.yurclub.ru, pravo-nasledstva.ru

Next:

- Textbook: the right to an obligatory share in the inheritance

- What is the tax when inheriting a car?

Comments: 1

- 17.06.19, 20:30

Olegcan I bequeath to my caregiver lifelong residence in my apartment? I have relatives

Answer

Share your opinion

You might be interested in

Sale of a share in an apartment received by inheritance taxation

How long after entering into an inheritance can you sell an apartment after

How to write a letter to a notary about entering into an inheritance

Is it possible to disinherit compulsory heirs?

Popular

Within what period is a notary required to issue a certificate of right to inheritance (Read 663)

Inheriting an apartment with shares, new rules (Read 345)

How to inherit a car if there are several heirs (Read 285)

If the mother is deprived of parental rights, does she have the right to inheritance (Read 170)

Heirs by law without a will

The procedure for receiving an inheritance is prescribed in Articles 1141-1145, and Article 1148 of the Civil Code of the Russian Federation. They have 7 queues of legal successors. Each subsequent line can receive an inheritance when all the successors of the previous line:

- They officially refused to accept the rights and obligations of the testator.

- According to the law, they were recognized as unworthy successors.

- They did not contact the notary within the period established by law (6 months), i.e. did not enter into inheritance.

According to the law, first-degree heirs include the closest relatives of the deceased, namely:

- Children . The law does not separate natural and adopted children. Even a person who has been recognized as a child of the testator through a genetic examination has the right to a share in the property. The stepdaughters and stepsons of the deceased citizen are considered separately. They will not be considered first priority if the testator has not officially adopted them.

- Husband or wife . They belong to the first line if the marriage was officially concluded in the registry office.

- Parents . It doesn't matter biological or adoptive parents. A person deprived of parental rights will not be an heir.

- Dependents . Persons who have been supported by the deceased for at least one year.

The listed groups of persons have priority rights to the property of the deceased.

When the successor dies before or on the same day as the testator, then his son or daughter takes his place. This is called inheritance by right of representation . For example, the heir of the first stage (the son of the deceased) died before the death of his father, then his daughter, the granddaughter of the testator, can become the legal successor.

When one of the legal successors dies after the testator, without having time to accept part of the rights and obligations of the deceased, then his heirs by law will be able to do this - this is hereditary transmission .

If there are no heirs, then the property receives escheat status and becomes the property of the state.