general information

Valuation of an apartment as a service is a determination of the market price of ownership , as well as other proprietary rights to real estate.

This type of activity is regulated by the Federal Law (FL) “On Valuation Activities in the Russian Federation” and the Federal Valuation Standard (FSO) “General Concepts of Valuation, Approaches to Valuation and Requirements for Valuation”.

Agencies specializing in real estate assessment take into account all the features of the apartment they are working on and, to obtain the most objective result, use three main approaches:

- expensive;

- profitable;

- comparative.

The more approaches professionals use, the more accurate the assessment result will be.

Assessment procedure

The stages of assessment do not depend on the goals and the subject being assessed. It does not matter whether the assessment is ordered by a party to the litigation or whether it is carried out by virtue of a court ruling - only the grounds for the assessment will differ. Otherwise, the general procedure for assessment activities is identical and consists of 5 stages:

- Receiving an assignment from the customer, interviewing, determining the purposes of the assessment, establishing property rights and the date on which the assessment is carried out.

- Concluding an agreement and drawing up an assessment plan: agreeing on sources of information, assessment methods, calculating costs and discussing the cost of appraiser services.

- Collection and analysis of information for assessment: analysis of title documents, information about encumbrances, study of technical and operational information, qualitative and quantitative characteristics, inspection of the object and study of its features. According to the law, it is permissible to evaluate real estate for the court without visiting the site.

- Analysis of the information received, application of valuation methods and calculation of the final cost.

- Preparation of an assessment report: entering into it data on the methods used, the information used, the sources of its receipt, the appraiser’s conclusions.

We invite you to familiarize yourself with: Tax on the sale of an apartment received by inheritance in 2020

When it is necessary?

Most often, an apartment may need to be appraised in the following situations:

- if the apartment is planned to be used as collateral;

- if the owner is going to sell the apartment;

- if there is a resolution of certain property disputes;

- to enter into inheritance ;

- when declaring property;

- to sign an insurance contract .

In addition, an assessment may be required if it is necessary to assess the damage caused to the apartment (for example, if you were flooded by your neighbors ) in order to obtain compensation through a claim in court. This procedure will also be required when dividing property.

Since the procedure for appraising an apartment is very complicated and requires a certain level of knowledge and qualifications, you should not try to do it yourself . A more reasonable and correct decision would be to turn to professional appraisers . This will allow you to find out the real cost of housing.

Retro appraisal: date of determination of appraised value

The peculiarity of judicial proceedings is that years can pass from the moment a legally significant event occurs until a decision is made. In this regard, the facts arising from the moment the subject of the dispute arises until its resolution are irrelevant.

Simply put, if spouses filed an application for division of property in January 2020, then compensation will be calculated at the price of the divided property valid in January 2017.

We invite you to read: What a parent has no right to do

The increase or decrease in the value of such assets will not be taken into account for the resolution of the dispute. Therefore, it is advisable to carry out an assessment within the framework of a trial at the time a dispute arises between the parties, regardless of the date of the assessment actions.

To carry it out, you can only use the comparison method, analyzing the cost indicators of similar real estate properties put up for sale in a specified period.

If we are talking about five years ago, it is difficult to apply this method, because searching for up-to-date information is often not possible. Therefore, if the appraiser does not have his own database of offers on the real estate market, the assessment may be biased. An alternative method is to use the current price index to calculate prices in the past. But federal appraisal standards do not allow the appraiser to use information about events that occurred after the appraisal date.

In practice, the appraiser could calculate an objective price, but documenting this is not always possible. The report entered into evidence will be subject to scrutiny, and any irregularities may determine the outcome of the proceedings.

One of the most common cases of appointing an independent appraisal examination as part of a trial is challenging the cadastral value. This is due to the imperfection of the mechanism for determining the cadastral value, within which the mass valuation method is used, which does not allow taking into account the individual characteristics of the object.

Since the cadastral value determines the amount of property tax, the amount in the declaration is often significantly overestimated. This infringes on the interests of citizens, therefore Art. 24.18 Federal Law No. 135 and Art. 22 Federal Law No. 237 of 07/03/2016 allows you to challenge the results of a cadastral valuation in a special commission or directly in court.

Such disputes fall within the jurisdiction of arbitration courts. A claim to an arbitration court for recalculation of the cadastral value of a building can be filed during the entire validity period of the cadastral valuation, until information about the next revaluation is entered into the Unified State Register of Real Estate.

Most often, the basis for challenge is the determination of market value. The owner, as a rule, orders a market assessment from an independent expert and submits a statement of claim to the court with a report on its results.

A sample claim to challenge the cadastral value of a building can be viewed below.

If, according to the results of an independent assessment, the market value turns out to be significantly lower than the cadastral value in the Unified State Register of Real Estate, this will raise doubts in the judge’s mind, and he will order a new independent assessment of the property.

It is possible that its results will differ from the results of the assessment ordered by the owner by 20-50%. Given this, it is important to use the services of reputable, proven appraisers.

Methods

Valuation of an apartment includes the following procedures:

- assessment of the market value of apartments;

- assessment of the cadastral value of apartments;

- estimates of the cost of apartments by independent experts.

Market

The procedure for assessing the market value of an apartment is in many ways similar to the assessment of any other estate . It is produced in accordance with certain standards that have been developed by the Society of Appraisers in close cooperation with international unions.

A variety of factors . First of all, we are talking about such significant points as:

- apartment location;

- condition of the residential building;

- functional characteristics of the apartment.

It is no secret that every locality has its own popular and unpopular areas. And the fact in which specific area the apartment is located largely depends on its market value .

Accordingly, real estate in elite areas will be valued much higher than real estate in remote industrial areas.

It also matters whether there is a forest and park area or a body of water near the house The appraiser will also be interested in the following points:

- distance from metro and bus stops;

- when was the last time a major renovation of the house was carried out;

- what material are the walls and ceilings of the house made of?

- in what year the house was put into operation;

- number of floors of the house.

No less attention will be paid to the condition of the apartment .

Cadastral

The assessment of the cadastral value of an apartment is carried out in several stages.

Stage 1

A factor analysis is carried out to identify the main pricing factors. Among the main factors that are taken into account when conducting a cadastral valuation are:

- level of development of transport infrastructure;

- level of development of production infrastructure;

- level of development of engineering infrastructure;

- state of the environment;

- engineering and geological conditions;

- the historical or architectural value of the development in which the apartment is located.

Stage 2

Clusters are identified on the territory of a constituent entity of the Russian Federation, according to which test objects . And based on the selected test object, the analytical relationship between the transaction prices for apartments and the main pricing factors is determined.

Stage 3

Taking into account the test objects of the cluster, the final calculation of the specific indicators of the cadastral value of the apartment is made. And, accordingly, a cadastral valuation is carried out.

Assessment by independent experts

An independent examination of the cost of an apartment has recently been in high demand .

It may be required in cases where the owner does not agree with the assessment results that were previously made.

It will be useful to carry out this procedure in case of damage to the apartment and in a number of other situations .

The certificate, which is issued by the appraiser upon completion of the work, is an official document . It can be legitimately used in court.

How is a mortgage appraisal done?

The appraisal process can only begin after you have chosen a property and agreed with the seller. However, to begin the procedure you will need a certain package of documents. It includes:

- Title documents: certificate of ownership of the apartment, purchase and sale agreement. When applying for a mortgage on a new building, a copy of the equity participation agreement is required.

- BTI plans with an explication of the apartment: this document provides a detailed description of the living space, exact dimensions and floor plan of the building. The appraiser will need to compare the actual and documented plan of the property. If there is a redevelopment, registration of the changes made is required.

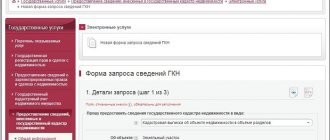

- A copy of the cadastral passport. The passport is issued to the owner of the object in the BTI.

- For secondary housing - a certificate stating that the building is not included in the plans for demolition.

- Certificate of floor slabs for buildings built before 1960. It is necessary because old buildings are built on wooden floors, and therefore are more fire hazardous. Therefore, insurance companies refuse to cooperate with the bank, and the bank, in turn, cannot issue a mortgage without an insurance agreement.

- A copy of the applicant's passport and contact details.

The collected documents must be submitted to the appraisal company. There you can agree with a specialist on the examination, its date, time and place. The appraiser will arrive on site at the appointed time and conduct an assessment using one of the following methods.

The first method is comparative or market. The specialist evaluates the property from the point of view of already closed transactions on the housing market. At the same time, the result is influenced by various coefficients, which are calculated based on various real estate indicators. These include the age of construction, size of living space, transport accessibility and distance of the building from significant city facilities (hospitals, kindergartens, schools, etc.), quality of finishing and much more. This method allows you to determine the market value of real estate.

The second method is expensive. An apartment is assessed for a mortgage based on the costs that would be required to build the same property. The result of the assessment is the liquid value of the apartment.

The third method is used most rarely - profitable. It involves the appraiser determining the potential income from the use of the property, for example, for rental purposes.

As mentioned above, the comparative valuation method allows you to find out the market value of housing, and the cost method allows you to find out the liquid value. However, they differ, as a rule, slightly.

In addition, the assessment takes into account factors such as:

- Ecological situation of the area;

- Location of bus stops, kindergartens, schools, hospitals and other infrastructure in relation to the building;

- The “age” of the house does not apply to new buildings;

- Materials used in the construction of the building;

- Number of floors;

- The condition of the yard adjacent to the house.

When assessing the apartment itself, experts also pay attention to:

- Its area

- Number of rooms

- layout,

- The floor on which the apartment is located is

- Condition of finishing and communications,

- Defects or breakdowns.

How much does it cost?

One of the most common questions is how much does it cost to appraise an apartment for a mortgage? However, there is no clear answer to this question. The cost of an assessment depends on the region in which the procedure is performed. Thus, in Moscow, the price for the services of assessment companies ranges from 3,500 to 5,000 rubles. In St. Petersburg - from 3,000 to 4,000 rubles.

This amount includes both the procedure itself and the preparation of the report. In regions, the cost of appraising an apartment for a mortgage may also vary. As a rule, it is influenced by the distance of the locality in which the property being purchased is located from the regional center. In addition, time can also affect the price.

Evaluation report

The appraisal of real estate for a mortgage ends with the preparation of a report. What does it include?

- Data from the appraisal company and data from the customer;

- Information about the methods used to evaluate the apartment;

- Complete information received by a specialist about housing;

- Comparative analysis of the real estate market using the example of similar transactions;

- Liquid and market value of the apartment;

- Application - documents, photographs taken during the assessment, duplicate information about the cost of the apartment and conclusion - the bank's probable proceeds from the sale of real estate.

The report is prepared within 2-5 working days and looks like a printed document, 25-30 sheets in volume, with numbering and lacing. It must contain the seal and signature of the responsible employee of the appraisal company.

In what cases is recalculation made?

Since the market value is understood as the value at which the buyer acquires ownership of the property, there are situations in which it is necessary to recalculate the market value more relevant information

For example, this procedure will be required if significant changes . The construction of a new transport interchange, new shopping centers, etc. can significantly affect the market value of housing.

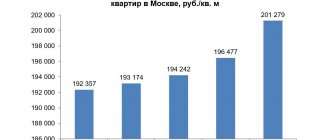

A recalculation of the assessment will also be required if a significant amount of time .

Considering the changes in the real estate market and the deterioration of the building in which the apartments are located, it is unlikely that the cost of the apartment has remained at the same level.

Why is the cost determined?

The concept of value cannot be clearly defined, but one must understand that the price of a property is created by 4 factors:

- demand for real estate

- its usefulness

- limited number of offers in relation to the object

- its alienability

Alienability is the ability to sell, mortgage, or donate a piece of real estate when this piece of property is not bound by obligations that could limit your rights to it.

Participants in real estate valuation activities are the appraiser (individual entrepreneur or legal entity) and the customer of services (individual or legal entity). All rights and obligations of the parties are clearly stated in Articles 14 and 15 of the Law “On Valuation Activities”. Based on this law, the only document that provides the basis for the assessment and confirms the relationship with the appraiser is the contract.

Article 8 of Federal Law dated July 29, 1998 N135 Federal Law establishes the obligation to determine the value of real estate when they partially or fully belong to the Russian Federation, a constituent entity of the Russian Federation or a municipality, and also when a dispute arises regarding the value of the valuation object. The article describes cases when real estate valuation is necessary. The need for real estate valuation arises when:

- purchase, sale or rental of an object

- corporatization of the enterprise

- cadastral valuation

- to determine the taxation of real estate (for example, buildings or land)

- secured lending

- insurance

- entering a property in the form of a contribution to the authorized capital of an enterprise or organization

- attracting investments

- entry into inheritance rights

- resolution of property disputes

- upon liquidation of an enterprise, organization

- to calculate the tax amount on real estate

- in other actions related to the implementation of the right to real estate.

The process of assessing real estate objects involves determining the value of the owner's rights to the property. The buyer needs to understand what the value of this property is to him and why. Valuation of a real estate property is important for those objects that actively circulate as an independent product on the market, that is, when they are bought, sold, or rented out:

- rooms and apartments

- premises and buildings for offices, shops, country cafes

- houses with land

- plots of land intended for construction

- warehouse and production facilities

Special cases

Share valuation

Valuing a share in an apartment is a rather difficult task even for professionals. There are two main assessment methods:

- If a specific residential premises is identified, which belongs to the owner, then the assessment is made of the specific premises taken. This is a simpler option.

- In some cases, the owner's share in the apartment is determined as a percentage. In this situation, the apartment as a whole is assessed, and the value of the share that is subject to the assessment procedure is allocated from the total amount.

Different types of assessments

As already mentioned, estimates may vary. An example of market valuation of housing was given above.

It happens that you need to derive the value of an object in a forced sale. Let's say you need to return a monetary debt to the mortgagee (bank). This means that the property must be sold within a limited period of time. In these cases, special formulas and coefficients are again applied to the already calculated base cost of the apartment, which take into account the price elasticity of demand, the exposure time of the object, the periods for calculating bank interest, etc. And in this case, our three-room apartment will cost 9 percent less - 7,199,000 tenge.

These are not all the features. If the purchase of an apartment occurs through a bank, then appraisers are asked to make a different assessment: using reduction factors. This is how banks insure themselves against credit risks.

In 2010, one of the large Kazakh banks used the following reduction coefficients to determine the collateral value of an apartment: Almaty - 50, Astana - 50, Atyrau - 40, Karaganda - 30, etc.

In the example of an apartment in Karaganda, the bank will accept the object as collateral for lending at a price 30% less than the market price, that is, for 5,523,000 tenge.