A testamentary disposition assumes that the future recipient of the inheritance is not a stranger to the author. They usually bequeath their property to close and reliable people, distributing things at their own discretion. But over time, something may change both in the relationship and in the inheritance itself (for example, the property has acquired debts that the heir cannot afford to pay.

What will happen to the inheritance if the heir under the will did not enter into the inheritance? Let’s look into this material.

How to enter into rights

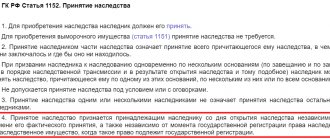

The process of transferring rights to own objects is regulated primarily by the Civil Code. It states that heirs are divided into two groups: by will and by law.

The first group includes any citizens, regardless of their place of residence, the presence of family ties, family and social status - the main thing is that the author appointed them as legal successors. The second group includes the testator's closest relatives. Reasons why both groups may not inherit property:

- They are recognized as unworthy, since they caused harm to the health, property of the testator, or were even guilty of his death. The testator himself can indicate those who are unworthy in his will.

- They visited the notary and notified in writing that they were giving up their share.

- They did not show up within the allotted time, they did not write either acceptance or refusal.

For the rest, successors from the testamentary disposition are called upon first. Then the relatives of the first priority - if the will does not cover all the property left by the author, or is declared invalid.

Why do they refuse?

Is it possible not to enter into an inheritance? The successors named in the will can also renounce their share, as can the next of kin. Usually they refuse due to:

- Inability to pay the debts of the deceased . It happens that the debt is urgent and large, and if the heir does not pay it within a certain period of time, he will be held responsible for it. Some may not want such a burden. In this case, you will have to write a refusal.

- Dilapidated condition of objects . The heir does not want to or cannot restore them, or considers it inappropriate for himself.

- Simply by unwillingness to receive your share.

Only persons who fall into the category of dependents of the deceased cannot write a refusal. If during the division of property it turns out that someone is owed an obligatory share (it does not always arise), then no one will be able to influence the transfer of this share - neither the person who died with his will, nor the heirs, nor the recipient himself.

If a person voluntarily renounces the share bequeathed to him, the notary will divide it among the remaining applicants . He can write a refusal in favor of one of those called to inherit - then his part will go to the appointed successor in full.

Important! If someone was nominated as an heir, then the refusal can only be written in his favor.

Right of inheritance by law

The period of time during which the successor can exercise the authority to accept bequeathed property is limited to 6 months. The procedure is completed step by step and is completed six months later with the issuance of a certificate of inheritance.

The reasons why a claimant may miss the chance to receive a bequest are varied. Some relatives deliberately hide the fact of the testator's death so as not to share property. Therefore, one of the co-heirs may not know how to enter into an inheritance after the death of his father or mother.

Obstacles to entering into inheritance rights include serious illness or long rotational business trips. Whatever the reason for missing the inheritance period, the successor has the right to find out how to enter into the inheritance if many years have passed. This may be an appeal to the courts or a peaceful settlement through a mutual agreement between relatives.

We invite you to read: How to send a child to a boarding school without depriving parental rights

Usually, if the heirs have not entered into the inheritance within 10 years, but have valid reasons for their inaction, it is proposed to make a compromise decision on the division of property between the remaining successors. The refusal of citizens who have already assumed their powers becomes the reason for going to court to restore their rights.

A positive court decision in favor of the plaintiff-applicant is possible if good reasons are provided, including:

- a painful or helpless condition that does not allow the citizen to function fully;

- business trips without regular communication;

- illiteracy.

If the applicant filed a claim in court, he only needs to provide valid reasons for missing the inheritance. Some successors, based on the right of first-priority inheritance, hope for an easy victory, providing reasons that are not valid as valid reasons. The following cannot serve as valid reasons:

- surgical interventions or long-term hospital stay in a clinic;

- ignorance of the law (does not exempt from liability for missing the statute of limitations);

- lack of knowledge about what constitutes inherited property.

When there are no reasons and no firm confidence in their legality, it is better to try to agree with the remaining successors on an equal or fair division of property.

Pre-trial settlement is possible with close relatives who want the case to be done fairly, or when the situation for restoration has a serious basis for a judgment in favor of the plaintiff. In this case, claimants who disagree with the division may lose not part, but the entire mass of property.

Unpredictable circumstances may result in the heir learning about the property left to him 5 or more years later. There is a high probability of receiving an inheritance 20 years after the death of the testator. The statute of limitations begins to apply from the moment the heir becomes aware of the violation of his rights. The limitation period is set for three years after the applicant is notified of his powers.

The court does not determine the limitation period without a corresponding application from the defendant. If the latter provides a document confirming the expiration of the allocated period, the decision will be made in his favor.

Hello.

My mother died, half of the apartment went to me right away..

The second half was written to me in the will, I didn’t enter into an inheritance for 5 years, I pay for everything myself. services and apartment. Can I inherit now?

Ekaterina, Moscow

How to receive an inheritance if many years have passed, 10, 20 years

Hello! In 2009, my sister died, in 2011 a death certificate was issued (my sister was considered missing, they found her in 2011, FOR her apartment, I look, and I have been paying the apartment fee since 2011, Now I am drawing up documents for ownership

Elena Nikolaevna, Apatity

How to receive an inheritance if many years have passed, 10, 20 years

The rule for accepting an inheritance according to the law is based on the principle of priority. The procedure is regulated by the Civil Code of the Russian Federation. According to the state act, inheritance is determined by degrees of relationship. The first category consists of immediate family members: parents, children, spouses. When cases arise of refusal of persons in the first line or the absence of such a group alive, the baton passes to the second stage of heirs. The total number of degrees of relationship is eight.

Heirs of the same priority category expect to receive property in equal parts. If a descendant of the testator died at the same time as him, then the property values will be distributed among his legal successors.

The testamentary act is drawn up by the testator only with the help of consultation and certification of the paper by a notary. Having a last will document facilitates the process of transferring property to the heirs of the deceased.

Situations that challenge a will arise from time to time. The descendants of the deceased are taking steps to invalidate the document and then seek a review of the distribution of residential real estate and other valuables.

The obligatory category of persons applying for the property of the deceased is dependents. If incompetent, disabled citizens were in the financial care of the owner, but were not included in the will, they are entitled to an undeniable part of the inheritance. Dependents are set to receive half of the deceased's estate.

The basis for inheritance by law can be consanguinity and more. There are 8 queues of heirs:

- first – this includes the children of the deceased, spouse, parents;

- the second – brothers, sisters of the testator, his grandfather and grandmother;

- third - aunts and uncles;

- fourth - great-grandparents;

- fifth - cousins and granddaughters, grandparents;

- sixth - cousins, great-grandchildren, nephews and nieces, uncles and aunts;

- seventh - stepsons and stepdaughters, stepmother and stepfather;

- eighth – persons who have been dependent on the testator for 1 year or more.

Every citizen can make a will. The testator, during his lifetime, decides who, after his death, will receive all or a share of the acquired movable and immovable property.

The testator may include in the will:

- people who are not relatives;

- private companies;

- state organizations.

Even with a will drawn up, a certain part of the property - the obligatory share - is entitled to minor children, disabled spouses, parents and dependents not specified in it.

In addition to the right of inheritance, heirs have the right not to enter into an inheritance. If you do not want to inherit property, it is enough not to actually accept it and not to claim your rights to it within a 6-month period.

Do not forget that if the inheritance is not accepted by any of the heirs, it will be considered escheated and transferred to the balance of the state.

The answer to the question whether it is possible not to enter into an inheritance is always affirmative: it is permitted not to accept the required portion of the property for any reason or motive.

Since, along with the apartment, car and everything else, the debts of the deceased can go to the heirs, if you do not want to pay the amount of money owed by the testator, you can not accept the inheritance or refuse it altogether.

Missed deadlines

If the heir under the will has not entered into the inheritance within the allotted period, he may proceed as follows:

By agreement

Restore the missed deadline by agreement with the remaining participants. If all successors agree to review the shares, then the matter is resolved pre-trial through a notary.

The main thing is to prove a good reason for the absence (he did not know about the death, did not know that he was mentioned in the will, they could not find him, or he was away for a long time and could not entrust his powers to a representative).

If the notary considers the evidence unconvincing, he will explain further steps to restore the term in court.

Through the court

Recover lost time through court. There are two possible options here.

- The first is that the heir under the will does not claim the untested part. He writes not a lawsuit with a demand, but a statement with a request to restore the deadline. The court considers such a case in a special manner, restores the period if there is a good reason, and the heir receives what was indicated by the author of the will.

- The second option is if, in addition to the bequeathed part, the heir also claims a share by law. Then it is better to write a lawsuit in which you demand the restoration of the deadlines and the allocation of the share bequeathed and due by law.

If there are no applicants for the property. Let's say no one wanted to accept it. The notary only had the refusals of everyone who was called up. In this case it is possible:

- Recognition of actual acceptance of inheritance . If someone did not appear before the notary, but took actions to preserve and protect objects, incurred expenses, paid debts for the deceased, organized his funeral from his own funds, he can be recognized as having actually accepted the property of the deceased and receive a paper from the notary confirming this.

- Recognition of inheritance as escheat. Then it becomes the property of the state.

Obstruction in the use of inheritance

The situation with obstruction of property ownership looks rather ambiguous. On the one hand, if you have a Certificate of Inheritance in your hands, then you don’t need to ask the opinions of outsiders. But on the other hand, an interested person (or even another heir) can go to court in advance. And the judicial authorities will suspend inheritance. As a result, the property gets stuck.

Here everything will depend on the court’s decision and, as a result, on the professionalism of the lawyer. Theoretically, the process can be delayed endlessly, but an experienced lawyer will overcome this method of counteraction. And at the end of the court case, he will turn to the notary again for final registration.

Due to frequent updates to legislation and the legal uniqueness of each situation, we recommend obtaining a free telephone consultation with a lawyer. You can ask your question by calling the hotline number 8 (800) 555-40-36 or write it in the form below.

Acceptance by will: terms

The standard period is 6 months from the date of death of the testator. If this day is not known exactly and the fact of death is recognized through the court, then six months will be counted from the day the court decision enters into force.

The deadline is subject to change. If all known heirs have written a refusal, then six months will be counted from the date of the last refusal.

What to do if you didn’t inherit the inheritance on time because you didn’t know about the person’s death? Then you need to come to the notary within three months from the moment this fact was discovered and report the missed deadline.

In fact, the fact of death can become known to the heir both in a year and in five years. You can try to get what is due under the will. Most likely, the intervention of a judge will be required.

What if the heirs have not entered into the inheritance within 10 years

After a long time has passed after the established period for accepting the inheritance, there is a possibility of its restoration. Other heirs who accepted the property rights in time will be able to provide significant assistance to the applicant. The successors' agreement to divide the property will require written approval.

To perform the necessary action, you should contact a notary. The parties to the agreement unanimously sign the document. Next comes the process of redistributing inheritance objects. The support of other heirs will greatly simplify the procedure for acquiring legal ownership rights.

Tags: join, you can, inheritance, through

About the author: admin4ik

« Previous entry

Problems during recovery

If the heir under the will did not show up on time, the notary distributed his share among the remaining heirs. They could have time to receive papers from a notary, register something in their name at the registration authorities, and even sell some objects.

Litigation has several solutions:

- At the stage of obtaining certificates from a notary, the court will cancel the papers already received and distribute the property according to the new number of heirs. Of course, the testamentary disposition will be taken into account, the specified share will go to the successor at the will of the testator, and the remaining property will be distributed in new proportions.

- At the stage of formalized rights to property, the court cancels documents received for apartments, cars and other objects. And in the future it distributes property in a new way.

- If part of the property (or the entire estate) has already been sold , then most likely the defendants will be ordered to pay monetary compensation to the heir under the will for the property that was bequeathed.

All items are valued on the date of death of the testator. Any monetary compensation is calculated based on this assessment.