The passing of a loved one is undoubtedly painful. The hardest thing is for a person who has lost his mother. However, children should not forget about the emerging right to inheritance.

In accordance with the law, it is possible to accept an inheritance within a limited period. If you do not visit the notary on time, you may lose the property that belonged to the deceased parent, including an apartment.

Who inherits the apartment after the death of the mother

There are two ways to inherit your deceased mother’s apartment:

- In accordance with the will expressed in the will;

- According to the provisions of the law.

As a rule, there is a conflict between these options. In other words, in her last will, the mother can declare that the children (who are the primary heirs) are deprived of the opportunity to inherit her living space.

The property that is to be inherited may become a cause of conflict between the heirs, since physical division is not possible.

In addition, the fact of registration of title documents for living space plays an important role.

If the mother initiated the procedure for privatizing the apartment, but at the time of death she did not have time to complete it, then in order to establish his rights to non-privatized housing through legal inheritance, the heir will be forced to go to court.

Having registered the apartment left by the mother, the heirs acquire not only the rights to it, but also the obligation to fulfill debt obligations, since the obligation to pay the shares passes to the heirs.

Maternal will

The mother can include anyone she wishes as an heir in her will. However, she is not obligated to include her children in it.

Only citizens who are entitled to a mandatory share in it cannot be left without an inheritance. The minor children and dependents of the woman who left an inheritance will receive no less than 1/2 of the property that they would have received in accordance with the law.

When a will is drawn up, in some cases it is necessary to include sub-heirs in it. They can receive an inheritance in the event of refusal of housing by the main heirs, or their death.

It is possible to recognize the complete nullity or partial invalidity of the mother's will. To do this, relatives often go to court to challenge the will for living space or to establish its invalidity.

In order for such a decision to be made, the following inaccuracies or erroneous actions must be present when drawing up the document:

- There was duress when the will was made;

- If the testator is incapacitated;

- Unreliability of witness signatures, or if they are missing;

- If later versions of testamentary documents were drawn up.

For clarification regarding the provisions of the will, please contact:

- To a notary's office;

- To the person appointed as the executor of the will of the testator (if any);

- If there is a trial, the judge can give clarification.

It is permissible to indicate any heirs in the will.

Inheritance by law

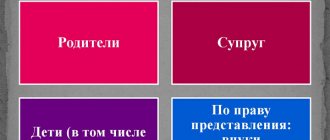

If a will has not been drawn up, the right to inheritance first accrues to the closest relatives of the deceased:

Their shares in the inherited property are considered equal. However, by contacting the judicial authorities, their sizes can be changed if it is proven that the applicant made the greatest contribution to the purchase of the deceased’s living space. All of them have the right to count on inheritance in equal shares.

A child does not have the right to inherit from a deceased mother if:

- on his part there were illegal acts against his mother;

- if he evaded the obligation to support the deceased.

Such circumstances must be confirmed in court.

Heirs of subsequent orders are called to inherit when the primary heirs:

- lost the right to inheritance by decision of a judicial authority;

- failed to accept the inherited property;

- officially refused to accept the property.

It is also necessary to mention the right of representation. Its essence is the transfer to the descendant of the heir, according to the law, of the right to his share if his death occurred before the mother died, or at the same time as her.

What to do if the heir of the first stage has not entered into the inheritance?

How to register an inheritance without a will, read here.

The children (grandchildren) of the deceased applicant for the inheritance receive the part due to him in equal shares. However, if a citizen who has not received an inheritance has lost the right to inherit, his descendants will not have the right to inherit by proposal.

Citizens whose turn to inherit is the eighth also have the opportunity to receive part of the deceased’s apartment (as well as legal successors):

- in the event that they are not included in the conscript queue, but are heirs by law and have been her dependents for 12 months or longer (it does not matter whether they lived together or not);

- when they are not legal heirs, but lived in her apartment for at least 12 months and were her dependents.

If children and other heirs refuse their part of the inheritance, or the court deprives them of this right, the property is considered escheated and becomes the property of municipal or state bodies.

Hereditary transmission

It differs from the previous situation in that the heir was alive at the time of death, managed to declare his rights, but soon died without having time to accept the inheritance. In this case, the right of inheritance is transferred to the successors of the deceased heir (Article 1156 of the Civil Code of the Russian Federation). Everything is exactly as if the heir had time to accept the inheritance.

Example No. 6. The man lived with his second wife and stepson (a step-son for one of the spouses). After his death, the apartment was to go in equal shares to his daughter from his first marriage and his wife. However, the wife died before accepting the inheritance. Who has the right to inherit if there is no will? In this case, the apartment that was supposed to go to the mother goes to the stepson.

If a person is a disabled dependent, then his obligatory share does not pass to his heirs (see example No. 5).

Documents for inheriting an apartment

When starting the procedure for entering into an inheritance, as well as in the future, visit the notary office where the inheritance case was opened and provide the employee with a set consisting of the following documentation:

- a certificate confirming the fact of death of the person who left the inheritance or a judicial act that has entered into legal force, and confirming this circumstance;

- certificates from his last residential address (such information, among other things, will be required to find out who lived in the deceased’s living space and can claim the inheritance);

- passports of the person wishing to receive the inheritance in order to identify his identity;

- power of attorney for a representative when another person is involved in registering the inheritance (notarization is required);

- in the case of acceptance of an inheritance by young children under the age of fourteen - documents that certify the identity of the parents, and if the heir is a citizen deprived of legal capacity - documents confirming the authority of the legal representative;

- documents that show the presence of family ties between the applicant and the person who left the inheritance (marriage certificates, birth certificates, etc.) or a will, on the basis of which one can lay claim to the property;

- documents that establish and confirm the deceased’s rights to living space (certificate of ownership, gift agreement, purchase and sale, privatization);

- cadastral passport and document on the assessment of living space on the date when the inheritance opened;

- extracts from the Unified State Register of Rights (Unified State Register of Rights) containing information about the owner of the property and that there are no encumbrances on it;

- other documents that are necessary for the notary in connection with the circumstances of the inheritance case.

The inheritance may even go to the state

If no one accepts the inheritance within 6 months, the property is declared dead and becomes state property.

Housing and land are transferred to the ownership of the municipality in whose territory they are located (and in cities of federal significance they become regional property). And all other property is recognized as federal property.

Therefore, you should not delay registering an inheritance, believing that you are already the legal heir. It may turn out that, despite the fact that you are an heir, the property has already become state property.

The cost of registering an inheritance for an apartment

To replace the tax that was paid upon inheritance until 2006, tax legislation introduced a state duty.

Heirs who wish to receive an inherited apartment and contact a notary will need to pay this tax in order to issue a certificate of inheritance.

The tax is paid before the notary begins the notarial actions. Its magnitude is determined by several circumstances. Firstly, this is the cost of the inherited housing, and secondly, what kind of family ties exist between the testator and the heir.

pp. 22 clause 1 of Article 333.24 of the Tax Code establishes that if there are close family ties between the heirs and the person who left the inheritance (husbands, wives, children, mother and father, brother and sister), then the amount of the state duty for them will be 0.3% of living space prices.

It must be remembered that the amount of tax paid cannot be more than 100 thousand rubles. Other heirs not included in those listed above will have to pay 0.6% of the cost of the housing, but not more than a million rubles.

It should be noted that the heir is not forbidden to independently decide how to determine the cost of living space.

The notary does not have the authority to influence the choice of the heir when choosing the type of cost of housing left as an inheritance to determine the amount of the state duty.

There are certain categories of persons whom the Tax Code exempts from the obligation to pay fees.

The benefit is provided according to the law:

- war participants and disabled people;

- minor children;

- citizens with mental disorders;

- citizens who lived in the apartment with the deceased until the day of his death, and who currently live there;

- citizens who inherit living space from a person who died while performing his state or official duty.

In addition, the state duty is reduced by 50% for disabled people of groups I and II.

There are often cases when notaries receive intrusive offers to provide legal advice, as well as technical preparation of documents on the right to inheritance for a fee.

Persons registering an inheritance must remember that they are not obliged to use these services, and they have the right to be required to pay only for the services of a notary.

In addition, how much it will cost to register an inherited home is influenced by the number of certificates confirming the right to inheritance if more than one heir receives it.

For this reason, it is recommended that heirs decide whether each of them needs a certificate, or whether they can get by with one, and add this information to the application.

Contacting a notary to obtain a certificate of inheritance

No matter how simple everything may seem at first glance, familiarize yourself with the main points of this procedure.

Collecting a package of documents for applying to a notary

Before paying a visit to a notary, you need to take care of the preliminary collection of documents that should be presented to the notary as evidence that you are an heir. This package of documents, in particular, includes:

- death certificate of the testator;

- documents that can confirm your relationship with the deceased;

- applicant's passport;

- will (if available).

You can learn more about how to obtain these documents from the article: What documents are needed to enter into an inheritance.

If you have reason to believe that you are not the only one who has the right to claim an inheritance, and an inheritance case has already been opened, it is recommended to use the “Search for Heirs” service. Since an inheritance case can only be conducted by one notary, the Federal Chamber of Notaries has developed a register that allows you to track whether an inheritance case has been opened and which notary is in charge of it.

Application for acceptance of inheritance

The above list of documents must also be accompanied by an application signed by the heir for acceptance of the inheritance. Such an application must be made in writing and signed by the applicant personally or by his representative by proxy.

You can submit such a statement directly to a notary or send it by mail.

Choosing a notary

If the inheritance case has not yet been opened, you need to contact a notary at the place where the inheritance was opened. Typically, this place is the last place of residence of the deceased. In practice, this means that if you live in Moscow, and your testator lived in St. Petersburg, then you need to contact a St. Petersburg notary.

At the same time, the good news is that it is possible to contact any notary within the notarial district in which the inheritance was opened. You can read more about notarial districts in Art. 13 “Fundamentals of the legislation of the Russian Federation on notaries.”

Not just any notary can open an inheritance case.

Government duty

Of course, notary services are not free, and you will need to pay a fee to perform notarial acts.

The duty is calculated based on the value of the inherited property, and its size will vary depending on the degree of relationship.

Thus, for heirs of the first stage, as well as for siblings of the testator, a rate of 0.3% of the value of the inherited property is established, but not more than 100,000 rubles. But for other heirs, the rate will be 0.6% of the value of the property that is inherited, but not more than 1,000,000 rubles.

The legislator also took care of unprotected categories of citizens and established that the following are exempt from paying duties:

- heirs who have not reached the age of majority;

- persons who inherit an apartment lived together with the deceased and continue to live in this apartment.

The final stage is obtaining a certificate of inheritance.

Provided that all documents are collected correctly and in full, the final result will be the issuance of a certificate of inheritance. You will also find everything about the types of such certificates and the nuances of obtaining them in the above article.

Registration of ownership of an apartment received as an inheritance

The powers to register property rights are vested in the management departments of the Federal Service for State Registration, Cadastre and Cartography.

To register your right, provide the following documentation to the government agency:

- A written request to register ownership;

- Certificate confirming inheritance rights;

- A document allowing to identify a citizen;

- A check confirming payment of the state duty;

- Technical documentation describing this property (technical passport or extract from it).

The law stipulates that registering ownership of an apartment should not take more than a month. Accordingly, after 30 days from the day the documents were submitted to the authorized body, the apartment becomes the property of the heir.

Spouses can allocate shares both during marriage and during divorce. To do this, you need to contact a notary and receive a contract that will assign exactly half of the apartment to each spouse. In the event of the death of one spouse, the other part will go to the second if there are no applicants for it from the first and second groups of relatives.

How is the inheritance divided after death if there is no will?

The estate is distributed in equal shares among all heirs. Each subsequent line of heirs can assume their rights only if there is no previous one or the heirs are recognized as unworthy, did not assume their rights in a timely manner and did not extend the terms in court.

In this case, the apartment privatized by the other spouse becomes his personal property. This is due to the fact that property received free of charge during marriage (including as a result of privatization) is the personal property of the person.

The point is that the mother herself determines in the will not only the circle of applicants for the property, but also the composition of the property that will go to each of them.

There may be cases where there are no first-degree heirs. Then the question arises: if there is no will, who has the right to inheritance?

Drawing up a testamentary document is not common in Russia. People prefer to act within the law, in accordance with the articles of the Civil Code of the Russian Federation.

An inheritance can be accepted in two ways: actually and formally. In the latter case, the successor must perform certain legally significant actions indicating his intention to receive the property of the deceased.

In the absence of primary heirs, ownership of the deceased's property assets goes to the brothers, sisters, and grandparents of the deceased. Sisters and brothers acquire equal rights to receive a share of the inheritance, regardless of whether they are related to both parents or only one (mother or father).

If the deadline has expired

You have six months to submit an application to accept the inheritance.

But what to do if this time has passed, and you have not declared your intentions to receive an inheritance?

If the time for filing an application was missed due to unavoidable circumstances, the right to inheritance will be restored.

Such issues can be resolved both in court and in pre-trial proceedings. It is possible to do without a trial only if all other heirs write written consent. In practice, this almost never happens, because then the share received by each heir will be significantly reduced.

When going to court, you need to collect a number of documents that are proof that there were reasons for the late filing of the application for the right of inheritance.

Take note: good reasons in such cases include illness of the heir, inability to travel abroad, and lack of information about the death of a relative.

Who will get the apartment after death without a will?

If there are no heirs at all, then, according to Article 1151 of the Civil Code of the Russian Federation, the inheritance is recognized as escheat and becomes the property of the municipality. The same happens in the case when the heirs abandoned the property or did not enter into their rights - the apartment passes into the hands of the state with all encumbrances, if any.

The written will of the successor must be submitted before the expiration of six months from the date of death of the testator. After this notarial act is completed, the application is sent to the notary in charge of the inheritance case after the deceased. It is advisable to send the document by registered mail with notification.

The only difficulty with privatized housing may arise if several persons were involved. Then the apartment will have several owners who are obliged to manage it jointly. If there is only one owner, then he alone decides what to do with his home.

How does the transfer of inheritance rights occur?

Situations when one has to deal with the procedure for transferring the right to inherited property can be called special in legal practice.

The exercise of such a right occurs in the case when a person who is an heir dies, but he could not or did not have time to accept the inherited property during his lifetime.

If he manages to accept the left property before his death, then it becomes part of his common property for his relatives according to generally accepted rules.

But if before his death a person did not express his desire to accept the inheritance due to him, then it is considered that he lost this right during his lifetime, and it is inappropriate to talk about his inheritance here.

Registration of ownership

According to federal law, privatized living space owned by one or more persons is subject to inheritance after the death of the owner in one of the following ways:

- in order of priority, when a person is the legal heir of the deceased;

- according to the will drawn up by the deceased owner of the apartment and necessarily certified by a notary.

In the first case, a person has the opportunity to dispose of his property at his own discretion. The citizen himself decides who will get the privatized apartment and in what shares. Russian legislation does not provide for the full will of the citizen when deciding the fate of acquired values.

If the successor does not have the opportunity to personally appear at the notary’s office where the inheritance case is being conducted, he should contact any other notary to certify the authenticity of his signature on the application for acceptance of the inheritance.

In the first case, a person has the opportunity to dispose of his property at his own discretion. The citizen himself decides who will get the privatized apartment and in what shares. Russian legislation does not provide for the full will of the citizen when deciding the fate of acquired values.

If the successor does not have the opportunity to personally appear at the notary’s office where the inheritance case is being conducted, he should contact any other notary to certify the authenticity of his signature on the application for acceptance of the inheritance.

To become an heir to an apartment, a simple will and confirmation of your own identity are not enough. It is necessary to carry out a number of actions, collect a package of documents and formalize everything in accordance with the legislation of the Russian Federation. In addition, the process involves a short time frame - no more than six months.

How to receive an inheritance without a will?

Inheritance cases can be opened and conducted exclusively by public notaries .

To register an inheritance, you need:

- within the required time frame, contact the state notary to open an inheritance case ;

- collect and provide the required documents ;

- receive a certificate of inheritance .

Sample application for acceptance of inheritance.

Thus, the heirs must visit the notary at least 3 times . If additional documents are required, an assessment, examination, etc. is required, the number of visits to the notary increases .

After receiving a certificate of inheritance, the heirs can fully exercise their property rights . For example, if it concerns real estate , then it must be registered with the Rosreestr branch .

After this, the heirs become full owners of the inherited property .

How to inherit property according to law, watch the video:

Who will get the apartment after the death of the owner if there is no will?

The right to receive an apartment after the death of its owner passes sequentially: from the heirs of the first stage to the second and so on. The general time period for accepting an inheritance is 6 months. For persons entering into legal succession due to the refusal of applicants in the previous queue, 3.

Consequently, the answer to the question of who inherits privatized housing depends on the presence or absence of a will. Absolutely anyone can sign away their property under a will. The presence of family ties between the testator and the heir is not necessary.

But a civil marriage does not give rise to such rights in relation to the apartment and other property of the unofficial spouse.

The exception is cases when there are heirs who have the right to an obligatory share in the property of the deceased. These include his immediate disabled relatives (children, spouse, parents) or dependents.

Inheriting a privatized apartment is a complex legal procedure, for which you need to clarify legislative and legal nuances. After the death of the owner, a privatized apartment without a will passes to the closest relatives by court decision. Therefore, in order to inherit a privatized apartment, you need to be prepared and act within the legal framework.

If the heir is included in the circle of persons of the first priority, then this fact must be documented. In some cases, a court opinion may be required.

The main feature of inheriting housing without a will is that all applicants who have declared the right to receive real estate will, as a result of the procedure, have the housing area in equal shares, depending on the number of applicants.

Inheritance by law

According to the Civil Code, there is a sequence of inheritance. In general, there are 7 queues. But to these 7 queues you can safely add 2 more queues - the 8th and 9th (see diagram).

Why 2 more queues are being added will be discussed below.

If at least one representative of the closest queue accepts the property, subsequent queues lose the right to it. In this case, all heirs of the same line divide the property equally.

Example No. 1. How will the apartment be distributed after the death of the husband between his two children, ex-wife, daughter from his first marriage and mother? Who has the right to get an apartment? There are only 5 applicants. All of the listed persons (except for the ex-wife) are included in the circle of first-line heirs, including the daughter from her first marriage. Therefore, the property is subject to division between two children, a daughter from her first marriage and her mother, in equal shares of 1/4 share each. The ex-wife is not a family member and cannot claim the deceased’s apartment.

This is interesting! A child conceived during the life of the testator is also an heir, and his share is taken into account when dividing property.

Example No. 2. During his lifetime, the testator conceived a child in an unregistered marriage. He has no other relatives. The estate consists of a private house. Who has the right to a house? After death, the only successor will be this child. The mother of this child, who is not officially married, cannot lay claim to the deceased’s house. However, she can act as a manager (custodian) of this house.

If the successors of the first stage cannot (refuse) to accept the inheritance, the heirs of the second stage claim it, and so on.

The procedure for inheriting property

A privatized apartment is inherited by will and goes to the legal successors equally if the shares are not determined.

For example, first- and second-degree heirs (spouses, parents, children, grandparents, nephews) need to pay property taxes. The amount is equal to 0.3% of the cost of the apartment, which is indicated in the appraisal documentation. However, the upper tax limit should not exceed one hundred thousand rubles.

In the absence of the above persons from the first and second priority groups, the inheritance (privatized living space) passes in equal parts to the heirs of the third priority.

The procedure for registering an inheritance is divided into several steps:

- Collection of documents confirming the right of inheritance.

- Contacting a notary and providing the necessary package of documents, which gives the right to register an inheritance. The notary, in turn, will have to open an inheritance case and send the necessary requests to banks and other organizations to obtain information about the financial condition of the heir.

- Collection of documents for living space - technical documentation, estimated value and personal account information.

- Receipt of property after six months from the opening of the inheritance and subsequent application to the Registration Chamber to obtain title documents for the living space.

The order of priority for receiving an inheritance

In order to understand well how the distribution of inherited property if there is no will, you need to know what the line of inheritance is and who is first in line.

Video: Entering into an inheritance after death without a will – Civil Lawyer

Video: HOW DO HEIRS LOSE AN INHERITANCE OUT OF IGNORANCE OF THE LAW?

Lawyers understand by priority the division of legal successors into certain groups. Those who have the greatest rights to receive the remaining property are considered first in line. All subsequent groups have much less such rights.

Today there are seven known inheritance groups. If there is a refusal or there are heirs in the previous line, the right of inheritance passes to the next group. If there are several heirs in one line, then all inherited property should be divided between relatives in equal shares.

the group of priority heirs includes:

- Spouse;

- Parents;

- Children.

The law prescribes the right to receive property by the grandchildren of the deceased upon presentation. Thus, if a person who is an heir passes away before the opening of the inheritance, the descendants can take advantage of the right to receive his share.

Rules for entering into inheritance if there is no will

The division of property is carried out in equal parts between the heirs in line. There are no exceptions.

Existing heirs in the second line , as well as all subsequent ones, receive the right to formalize the inheritance if there is no first heir in the other line.

Video: Who has the right to an obligatory share in the inheritance

Video: Inheritance 2020 in Ukraine: heirs and the procedure for entering into inheritance by law and by will.

Who has the right to receive an inheritance if there is no will?

The following persons have this priority right:

- Blood relatives of the testator, regardless of the degree of relationship. This list includes grandparents, grandchildren and nephews.

- Adopted persons;

- Dependents of the testator. The conversation concerns persons who were in the citizen’s employ for a certain time before his death.

- Stepfather;

- Stepmother.

To become a legal successor, these people must apply to a notary to recognize their right to receive property for which there is no will.

Minor citizens are included in a separate group. They are also entitled to receive 50% of the estate if there is no will. Even if their names are not mentioned in the written will, they retain the right to receive half of the remaining estate, which can be divided among several people.

The nuances of receiving an inheritance if there is no will

Children who were adopted by the testator during their lifetime are considered blood relatives. They receive equal rights with other persons to register an inheritance, which is divided among the children in equal parts.

Persons living in a civil marriage do not have the right to receive property.

Video: ACCEPTING AN INHERITANCE IN 2020 | New rules

Video: Three cases when registration gives the right to inheritance even without a will

Disabled relatives who have been dependent on him for more than a year have the right to receive a share of the property, and it does not matter what priority group they are in, even if there is a first blood relative.

In the event that dependents are not relatives of the testator, in order for them to receive the right to inherit, they must have proof of their residence together with the testator. Such a document is confirmed by a court decision.

The court, according to current legislation, has the right to deprive the heir, even if he is first in line, from receiving the inheritance if it considers that the given citizen is unworthy of it. For example, if there is evidence of threats by this person to other heirs in order to receive a larger part of the inheritance.

In March 2002, a law came into force according to which certain persons who are among themselves heirs have the right to own the testator's real estate, however, the queue between them remains.

Such persons include citizens who previously lived together with the deceased , who also used these things.

But if such a preemptive right allows the heir to become the owner of the majority of the property that falls to him, the law obliges him to pay the difference to all other heirs.

Video: Who has the right to inheritance?

Video: Three examples when an inheritance can be lost by a first-degree heir

Who gets the house after the parents die if there is no will?

According to the law, inheritance of an apartment after the death of a spouse is possible by his wife even if the property is privatized by the deceased spouse, regardless of whether the property was previously registered by one spouse or jointly.

Next, we will consider the question of who will get the apartment after the death of the owner, if there is no will, who the obligatory heirs are and how to take over their rights on time.

However, you still need to understand that if there are no heirs of the first three stages, then the property goes to the heirs of the subsequent stages, which are: great-grandparents, great-grandfathers, children of nieces/nephews, cousins/granddaughters, stepsons/stepdaughters, stepfather/stepmother.

Inheritance of a cooperative apartment without a will

Let's talk about the features of accepting cooperative housing; there are some nuances here:

- It is necessary to comply with a mandatory condition for inheritance - to pay the share contribution in full. If it is not paid, then in fact the shareholder has not become the owner of the property, he can only use it for living;

- if the cooperative apartment was received during the marriage, and the spouses paid a share from common income, then after the death of the spouse one half will go to the wife. And the second part relates to the inheritance mass and is subject to division among all legal heirs;

- if the testator began paying the share before marriage, and continued to pay it together with his wife, then after his death the woman has the right to receive half of the money paid, but not half of the apartment.

Attention! Proof of housing ownership is a document issued by certain cooperatives stating that the share contribution has been repaid in full.

Inheritance of a share in privatized housing

For most of us, our mother is our closest person. And her death becomes an irreparable loss. But life does not stand still. Therefore, after the end of all the sad ceremonies, the need arises to inherit the apartment after the death of the mother.

A document confirming the ownership of the deceased, depending on how the living space was acquired by the citizen at one time - by inheritance, by privatization, by purchase.

After the death of the mother, the right to inherit the privatized apartment arises from her daughters A.G. Gromova and S.S. Svetikova. However, A.G. Gromova dies in an accident without having time to formalize the succession. Gromova was not married, but she was left with two sons, Ivan Nesterov and Andrei Nesterov, the only legal successors. How is a privatized apartment inherited and what to do in this case?