Normative base

There are two options for entering into an inheritance - by will and by law.

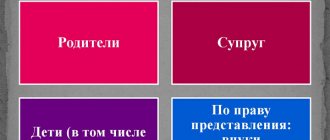

In the first case, it is important to draw up the document correctly and include persons who are entitled to a mandatory share. In this case there are usually no problems. If there is no will, according to Art. 1142 of the Civil Code of the Russian Federation, the inheritance is distributed by a notary taking into account incapacitated and minor persons and the presence of jointly acquired property. The first priority includes not only the wife and children of the testator, but also his parents.

The Civil Code of the Russian Federation establishes the following norms:

| Art. 1152 | Regulates the procedure for entering into inheritance. |

| Art. 1153 | Determines the procedure for accepting inheritance. |

| Art. 1154 | Determines the period of time when you can submit documents for inheritance. |

| Art. 1157 | Provides for the possibility of refusing to accept the testator's property. |

How to enter into an inheritance after the death of a husband

1 . Find out whether a will has been drawn up. If yes, then you need to contact the notary who drew up the will to get a mark on it that the will has not been changed or revoked. For more information about the division of property under a will, see the article How to inherit under a will. Mandatory share.

If there was no will, then all property is divided between the first-degree heirs (spouse, children, parents) according to the law.

Let me remind you that property belonging to the testator before marriage and part of the jointly acquired property are inherited. The surviving spouse's share is not included in the estate.

2. Determine which notary is handling the case and submit an application for inheritance. You can read the procedure for contacting a notary in the article “How to enter into an inheritance: list of documents.”

3. Submit documents to accept the inheritance. To do this, you must provide the notary with the following:

- death certificate;

- marriage registration certificate;

- documents for jointly acquired property (certificates of ownership, purchase and sale agreements, etc.);

- documents for other property belonging to the testator;

- Additionally, documents from an independent expert on the market value of the property may be required;

- other documents at the request of the notary.

4 . After six months, receive a certificate of inheritance.

5 . If desired, we register rights to real estate in Rosreestr. You can read more about registration in our article “How to register ownership of an apartment - 5 simple ways.”

What property is entitled to the wife and children after the death of the spouse?

According to current legislation, the property of the deceased is distributed in equal parts among all persons from the first priority.

But if he was married, the following types of property are distinguished:

- Personal . This is property purchased before marriage, received as a gift or by inheritance. It is personal and goes into the general hereditary mass.

- A joint . This is the property that was acquired during marriage. Even if it was bought with the husband’s money and registered in his name, ½ belongs to the wife. The remaining part is classified as general, which allows it to be distributed in equal parts among the heirs.

What is a wife supposed to do?

Only the woman who was married to him at the time of his death can claim the property of the testator. We are talking about a marriage that was duly registered with the registry office. If the divorce occurred the day before the death of the testator, she is no longer a spouse and has no opportunity to count on the inheritance.

It is a common belief that the wife is entitled to a larger share compared to other relatives.

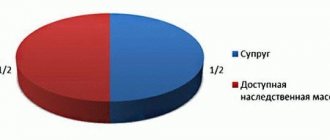

She does receive more property, but we are not talking about inherited property. According to the law, she is entitled to half of the jointly acquired property, and only then the inheritance is distributed, part of which she is entitled to in equal shares with other persons .

Children's rights

Not only joint children have the right to inheritance.

An application can be submitted on behalf of children:

- Born in a joint marriage.

- The testator's unborn children after their birth.

- Born in a previous marriage.

- Adopted or adopted.

- Illegitimate children.

Can children from a first marriage inherit property?

The question of whether children from a first marriage can claim an inheritance becomes relevant when the testator enters into repeated unions. Whether a child from a first marriage has the right to inherit property depends on many factors.

The husband's children from his first marriage claim to inherit according to the law on an equal basis. According to the rules of inheritance, the existence of a child’s right to inheritance is determined by a number of circumstances:

- Children's age;

- Availability of a will;

- The health status of the heir;

- Is the legal successor a worthy contender?

Young, disabled sons and daughters apply for a compulsory share, regardless of the principle of inheritance. Upon reaching the age of majority, provided that the son and daughter do not have disabilities, the testator can specify the conditions for the distribution of property by will.

The applicant may be deprived of inheritance rights and be recognized as an unworthy successor. Persons who have committed unlawful acts in relation to the deceased, who have not fulfilled the duty of care or guardianship, if the testator needed such actions, are recognized as unworthy.

When adopting children from a previous marriage, they also become applicants for a share. Another exception occurs if a son born in a previous marriage was adopted by the new spouse. All property relations with the blood parent are terminated in such circumstances. The father is not obliged to pay alimony; the son and daughter are automatically excluded from the list of heirs.

Features of the division of inheritance between wife and children

It is necessary to provide the notary with documents about all the property of the testator. It may include a house, apartment, cottage, car, securities, furniture and valuable collections. According to the will, the testator himself can allocate a share of the inheritance to his wife and each child.

If there is no will, inheritance occurs according to the law. The wife is allocated half of the joint property. Everything else is divided between the wife and children in equal shares.

The heirs can draw up a document on the division of property in an order to which everyone agrees. You can even transfer all the property to just one relative. But in this case, everyone must agree and sign the agreement with a notary.

How is the inheritance divided between wife and child?

Disposition is the easiest way to transfer property to relatives. The text indicates a list of values subject to alienation in favor of a specific person. The legal regime, on the contrary, regulates the order in which applicants enter into inheritance. In addition, the second method equalizes the shares of the deceased's assets. Thus, all beneficiaries receive equal shares.

Despite the presence of provisions in legal acts establishing a certain procedure for carrying out the procedure, heirs can regulate their relationships by drawing up a division agreement.

Providing a mandatory share

A will is a voluntary decision of a citizen, but there is a category of citizens who cannot be excluded from the inheritance:

- Minor children.

- Persons who were in the care of the testator and lived with him during the last 12 months.

- Spouse, parents and grown children, if they are officially recognized as disabled.

Such persons are entitled to ½ share of that which is due to persons entering into inheritance. The allotted share is allocated even if the heir is not included in the will or is allocated a smaller share than is due.

The video story will tell you what an obligatory share in an inheritance is.

Terms of inheritance

Exactly 6 months are given to submit the application and documents. During this time, you need to collect documents about the testator’s property and confirmation of relationship.

There are exceptions when the period can be extended:

- The calculation may begin not from the actual day of death, but from the moment the court makes a decision to recognize him as absent or dead.

- The period is extended by court decision if the heir was unable to submit documents for a valid reason.

- The child was not born, which is why the time until birth is extended.

If the heirs of the first stage have not submitted an application, after 6 months it becomes possible for those from the second stage to submit an application. They are given another 6 months to do this.

Thus, when inheriting by children and wife, the property will be divided depending on the presence of a will or its absence. We should not forget about the compulsory share assigned to incapacitated persons and the joint property of spouses.

The video will tell you about the nuances of inheriting property

The procedure for dividing inheritance after the death of a spouse

After the death of a spouse, the inheritance is divided only if the testator was in a registered marriage. These rights do not apply to former spouses and persons in a civil marriage (see exceptions below).

Regardless of the presence of a will, the surviving spouse has the right to receive a certificate of ownership in the common property of the spouses , for property acquired by the spouses during the marriage, unless there was a prenuptial agreement or a certificate of ownership in the common property of the spouses was not received during the life of the spouses. The certificate is issued for 1/2 share of jointly acquired property.

Let me remind you that this is a spouse’s right, not an obligation . The surviving spouse may receive this certificate or may refuse to receive it. In the latter case, the share of the surviving spouse is included in the estate of the deceased spouse and is divided among the heirs by law or by will. The surviving spouse cannot renounce his share in favor of someone else (for example, children)! Since his share is not included in the inheritance mass.

To obtain a certificate of ownership of the spouses' common property, the notary notifies all heirs. The heirs must give written consent to the surviving spouse receiving this certificate. If the heirs do not agree, they can appeal the receipt of the certificate by the surviving spouse in court.

For example: Spouses, using joint savings, purchased an apartment registered in the husband’s name. The husband is dying. His son, daughter and wife applied for a certificate of inheritance. In addition, the surviving spouse filed an application for the issuance of a certificate of ownership of a share in the common joint property of the spouses. The notary will issue a certificate of ownership to the surviving spouse for a share in the apartment, and the second half of the apartment will be inherited between the son, daughter and surviving spouse. This option is possible even if the apartment was registered in the name of the surviving spouse!

The certificate cannot be issued for property that belonged to each of the spouses before marriage, property received by inheritance or as a gift (both from the second spouse and from third parties); property received through other gratuitous transactions; as well as personal items (except for jewelry).