The definition of the inheritance mass must be understood as the entire volume of property, rights and obligations that belonged to the deceased during his lifetime. The entire specified totality is subject to transfer to the ownership of the heirs.

Certain difficulties may arise for the descendants of the deceased in obtaining property that was not properly registered by the original owner. Problems may be associated with the re-registration of real estate for which ownership has not been fully registered, or with the return of debt accumulated during the life of a relative.

This indicates that not every item used by the deceased can be included in the totality of the inheritance mass.

What can be included in the inheritance?

The distribution between legal successors is subject to:

- the whole list of things, incl. cash;

- the existing range of property rights arising as a result of concluded agreements, legal relations of an intellectual nature, etc.;

- a fixed list of property obligations expressed in the form of debts to creditors.

The legislator limited the obligations of the recipient of the inheritance in terms of fulfilling the obligations that arose during the life of their bearer. Such a limitation is established within the price of the property that was received by the heir. This means that the performance of the duties of the testator must be performed exclusively at his expense.

Most often, citizens inherit immovable and movable things belonging to the deceased, rights and those obligations that arose during his life and were not fulfilled on the day of death.

Who has the right to inherit property

Obviously, children primarily receive property rights to their parents' real estate upon their death. However, there are other relatives who can also claim the right to inheritance and property claims after the death of a loved one. The shares of the heirs may not be equal. It all depends on which circle the heirs belong to, as well as on the will in the notary’s office, if one was previously drawn up by the deceased person. According to the law, the property of the deceased first goes to his immediate blood relatives. If there are 2 or more such persons, the shares of the heirs are equal by law, unless otherwise established in the will. How to enter into an inheritance without a will? This procedure is regulated at the legislative level.

In order to understand how to receive a share in the inheritance and what share in the inheritance is determined for each specific relative of the deceased, it is necessary, first of all, to determine whether there is paper confirmation of the will of the deceased. If a will was left, it will usually indicate to whom the deceased decided to leave the right to an apartment, car and other movable and immovable property. There will be no problems with the division of property between heirs if the will of the deceased has been officially documented. Although this does not exclude the possibility of challenging the will. Learn more about how to enter into inheritance rights for an apartment and how much does it cost to register an inheritance for an apartment?

Important

Having a will plays an important role in the distribution of inheritance. However, there are a number of people who have the right to claim division of property, even if they were not included in the will.

If a wife dies, having bequeathed all her property to her husband or other relatives, her children who have not yet turned 18 years of age have the right to inherit part of the property without being included in the will. According to the will, she also has the right to leave everything to them, but a wife or husband cannot leave minors without property rights after their death. In this case, the interests of persons under the age of majority will be defended by the guardianship and trusteeship authorities.

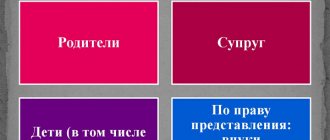

If a will has not been drawn up, the question of how to divide the property of the deceased will be decided in court. An assistant in such a situation is the heirs scheme. Having examined this scheme, you will be able to understand which relatives are the heirs of the first stage, and how the property is divided between the heirs of the first stage.

When dividing housing or any other property belonging to a deceased citizen, the order of succession by law is as follows:

- First priority heirs by law

They are the husband, children, and parents of the deceased. The law determines that a granddaughter or grandson is not an heir of the first category. The above-mentioned persons are the first to register a share in the inheritance, and their share, as a rule, constitutes a larger percentage than the inheritance shares of other persons. If disputes and disagreements arise between persons of this category, the decision on how the inheritance is distributed among the first-priority heirs will be made in court. By the way, selling a share of the inheritance to another heir will help resolve many issues.

- Second line of inheritance

This group includes siblings and grandparents of the deceased. It is important to note that even the sister or brother of the deceased is not the first-degree heir, despite the close blood relationship.

- Third group of inheritance

After the death of the mother, her children, parents and other close relatives, more distant relatives, for example, uncles and aunts, have the right to inherit. After their death, the inheritance is passed on to their nephews.

The question of how the inheritance is divided between the first-degree heirs is resolved through legal proceedings after the death of a close relative. This issue is regulated by the Civil Code of the Russian Federation. It is in it that it is determined to which line of inheritance various groups of related persons belong.

By the way, it is important to remember that there is a right to an obligatory share in the inheritance.

What can't be included?

The mass distributed among the relatives of the deceased can only include those items that were in the legal possession of the latter.

Based on this rule, the following are not subject to transfer to new owners:

- buildings erected without permission;

- plots of land that were seized;

- rights to receive alimony, as well as obligations to pay them;

- arising on the basis of an agreement on gratuitous use, assignment, legal relationship.

Inheritance and property considered jointly acquired by spouses cannot be recognized as a component of the total volume.

The law limits the possibility of transferring to the heirs those responsibilities and opportunities that had a direct connection with the deceased himself.

Testamentary disposition - what it is and its features

Each owner of a deposit or current account can draw up a testamentary disposition at the bank. This document has the same legal force as a will and does not interfere with its execution.

The order is signed at the bank, drawn up by an employee of this institution when making a deposit or at any time convenient for the client.

The heirs receive the amounts and in those parts that were indicated in the document. If there are no such conditions, then the contribution is divided in equal shares.

Making a testamentary disposition

The testamentary disposition must contain the following information:

- Full name and address where the testator lives.

- Heirs data.

- Date and place of execution of the document.

To create an order, you need:

- Take your passport to the bank.

- Draw up the document in two copies in writing.

- Sign the order.

- Wait for the document to be certified by bank representatives.

The order will include:

- Who will be the owner of the account if the heir dies before the testator?

- Various conditions for issuing a deposit. For example, when the heir reaches a certain age.

No changes or corrections may be made to the order.

Cancellation of a bank order

The testator may revoke such a document at any time. To do this you need to contact the bank.

You can draw up a regular will and make arrangements for the bank document in it.

The procedure for including property in inheritance

Anyone interested can declare to a notary the need to include a certain object or item in the inheritance to be distributed.

The notary himself can approve or refuse the application. If you disagree with his position, it is necessary to prepare and submit a claim to court.

A complaint sent to the Notary Chamber may not give the required result. As a result, it is impossible to do without the participation of the court.

Where should I go?

First of all, the question of including new property in the estate of inheritance must be raised before the notary. It is he who must decide whether to include the property in the list of inheritance. Only when the official refuses to satisfy the request can one proceed to filing a claim.

The claim must be transferred to the court that is located in the same territorial location as the Defendant.

Application for inclusion in the estate

The claim must comply with the standards defined in the Code of Civil Procedure. The main requirements are related to the reflection in the document:

- name of the court;

- information about the plaintiff and defendant;

- the name of the notary office, as well as information about the notary conducting the case;

- information concerning the testator, which must be indicated in the descriptive part;

- a list of those things that were not included in the inheritance;

- the grounds referred to by the notary when granting the refusal;

- indications of those documents that indicate that the listed property was the property of the deceased

The pleading part must contain the plaintiff’s reasoned request, based on the documents reflected in the application.

At the end of the document, the plaintiff puts the date of signing and his own signature.

There are no heirs who will receive the property after death

Description: A man died in a fire in a garage, the police could not find relatives to take the body and bury it. He still had a garage (registered in his name), the chairman of the GSK, taking advantage of the situation, decided to take over his garage, supposedly this garage should become the property of the GSK, so that the board, treasurer, etc. would supposedly sit there. but actually at his disposal.

This is interesting: What date do they pay benefits as a large low-income family in Perm, Sverdlovsk region?

Question: Who should get the garage if the owner has no heirs (or they have not declared their rights within 6 months)? Will the chairman be able to take possession of this garage himself, or somehow re-register it on the balance sheet of GSK? What articles, what law regulate this situation?

Sample statement of claim

Required documents

The collection of documents required for the consideration of the case by the court is the most difficult task assigned to an interested plaintiff who intends to include property in the estate. You can convince the judge of the need to make a decision to include certain objects in the estate of inheritance if you have title documentation and other papers that allow you to conclude that the deceased has property rights.

As a general rule, the following must be attached to the claim:

- additional copies, depending on the number of participants;

- initiator's passport;

- documents on the death of a relative and the existence of a relationship with him;

- will (if any);

- conclusions on the value of those items that have already been approved for distribution among the heirs.

A state fee will be required to be paid to the court hearing the case.

Heirs and debts

The most common situation in practice is that the debtor died, and his spouse or close relatives (children or parents) lived with him in the apartment. The apartment belonged to the deceased. The mentioned persons continue to live in the apartment and pay bills for the maintenance of the apartment.

In this case, the claim must be brought against the estate of the deceased debtor (defendant: “the estate of the debtor, full name, place of opening of the inheritance - place of death of the deceased debtor, city of Ensk, Lenin Street, building 1). In this case, the claim must be filed in court at the place of opening of the inheritance, which is the last place of residence of the debtor (Article 1115 of the Civil Code of the Russian Federation).

01 Sep 2020 lawurist7 199

Share this post

- Related Posts

- Alimony from sick leave is withheld or not 2019

- Can Bailiffs Not Give the Opportunity to Register Ownership Rights on DDU

- Benefits for disabled people of group 3 as a result of the Chernabyl disaster

- What payments are due to a young family with two children in a rural area?

Property exclusion

There is a certain list of property that cannot be part of the general mass and is subject to exclusion from it at the request of interested parties.

The notary has the right to exclude. If you disagree with his actions, the interested party has the right to use judicial protection.

The exception is the property that:

- was given as a gift;

- is not owned by anyone;

- does not have an official owner or such owner is not a testator.

State duty amount

When determining the amount of state duty required for consideration of a claim, it is necessary to establish that the claim has the status of a property claim.

The basic indicator used in determining the state duty can be established from cadastral and technical documents, as well as expert findings.

If the price of the property to be added to the inheritance does not reach 10 thousand rubles, the plaintiff will need to contribute 4%, but if it exceeds 500 thousand rubles, the percentage of state duty is reduced to 0.5%.