Inheritance rights

The Civil Code clearly defines the order of inheritance. In accordance with Article 1142, first-degree heirs include the parents, children and spouse of the deceased.

All these claimants have equal rights to the property. So, if the deceased had some property and after his death his parents and spouse survived, then the inheritance mass will be divided into 3 equal shares. If only the mother and father remain (not counting the heirs of other lines), then they will also claim the objects in equal parts.

One of them has the right to renounce his share of the inheritance both in favor of another person and without specifying such a claimant. In practice, most often the refusal is made in favor of the second one in order to simplify the procedure for registration and inheritance.

In general, the testator's mother and father enjoy a standard set of inheritance rights. Some peculiarities arise when inheriting from a minor, and if the parents are pensioners or disabled for other reasons.

By inheritance, only the property that the testator had at the time of his death is transferred.

Grounds for inheritance

Mother and father can inherit after the death of their son both on the basis of law and on the basis of a will. In this case, you need to take into account some features:

- a minor does not have the right to make a will. Even a document drawn up by him in an extreme situation will not have any legal force, and the notary will completely refuse to certify it;

- disabled parents of an adult have rights to a compulsory share. It will be half of what they would have received by law;

- mother and father can inherit on two grounds at once, for example, if they are indicated in a will that does not contain a complete list of property;

- persons who adopt a child are equal to his parents and inherit property in the general manner.

The right to a compulsory share is enjoyed not only by those who are disabled for medical reasons, but also by those who have reached retirement age, even taking into account early retirement (for example, if they have “hot” service).

How to challenge your mother's will

Question:

My mother died. I lived with her, but she made a will, bequeathing all her property, including the apartment, to my sister.

What can I do in such a situation so as not to be left without everything?

Lawyer's response:

You can negotiate with your sister. If this does not work out, you have the right to challenge the validity of your mother’s will through the court (Article 1131 of the Civil Code of the Russian Federation).

What you need to know in order for the challenge process to have a positive outcome for you:

- Any properly executed will has an encumbrance (Article 1149 of the Civil Code of the Russian Federation). Without knowing your age, I will point out that minor (non-working) children and disabled dependents of the testator are entitled to a share equal to no less than half of what is required by law. This share is mandatory. The condition occurs if you have the status of the person indicated above and are not excluded from the list of heirs by the will (Article 1119 of the Civil Code of the Russian Federation).

- It is mandatory to comply with the requirements for proper certification of your mother's will - a notarized or equivalent certification (Articles 1124-1127 of the Civil Code of the Russian Federation). It must be signed exclusively by your mother. If you have any doubts about this fact, dispute it.

- When the mental state of the testator is in doubt. This is possible even when the person leaving the will did not have documentary evidence of incapacity, but you have information about his suffering from mental illness (documentary evidence and (or) testimony is required). A post-mortem forensic psychiatric examination will be necessary.

- There are also possible reasons why the rights of an heir can be challenged (Article 1117 of the Civil Code of the Russian Federation) - when a will was written under coercive influence (against the will of the testator, threat, deception, etc.). The intentional actions of the heir must be seen - the presence of information that the heir did not support the testator and evaded such responsibilities. To do this, you will need to provide the court with evidence that the testator needed guardianship and financial support, but such support was not provided by the heir. And, moreover, such functions were performed by you.

If any of the points is confirmed, then immediately file a claim in court and protect your interests.

Ask your question to a lawyer!

Some other answered questions from the section “Inheritance, wills”:

Contesting a will

My mother's brother died and left an inheritance to his neighbor. My uncle has no relatives except me and my mother. Is it possible to challenge this will?

Inheritance of an apartment in shares.

I live with my mother in her apartment. My adult son is also registered in it with me. I have two more older brothers. What share of the inheritance can I expect after my mother’s death if I have no other home?

Allocation of shares with payment of compensation to the owner of a minor share

I inherited part of a 2-room apartment, I own 4/5 of its share (after receiving the inheritance, we joined forces with my relatives). Father's last wife received 1/5 of the share...

How to challenge your mother's will

My mother died. I lived with her, but she made a will, bequeathing all her property, including the apartment, to my sister. What can I do in this situation?

What can a granddaughter expect from her grandmother’s inheritance after her death?

My ex-mother-in-law was left alone (her parents, husband, and son died). Among her relatives, she has aunts, cousins. There is a granddaughter, that is, my daughter from her son...

Do a mother and child have the right to receive an inheritance from her common-law husband?

After my husband, with whom we were in an unofficial marriage, died, I had an 8-year-old child from him. He has a twenty-year-old daughter from his first official marriage...

How to collect a debt from the debtor's heirs?

According to a court decision, my friend owes me a sum of money. Unfortunately, the debtor died without repaying the debt. The debtor had property: a car, an apartment in Moscow and maybe something else. He left behind a wife and children...

My father had a new family. Who are the heirs?

After my parents' divorce in 1992, I did not live with my father. He has a new family in Moscow, two daughters. He died in December 2011. Do I have a right to his property?

Is it possible to challenge a father's will?

My father died and left a will. He bequeathed the dacha, which he took possession of in 1998, to my common-law husband. However, I don’t want to continue my relationship with the latter. I am a disabled person of the 2nd group...

How to enter into inheritance rights?

My grandmother owned a house, which she bequeathed to one of her two sons, my father. My grandmother died in 2010. My father did not register the house in his name. He died last year. Can I be recognized as an heir and register the house in my name?

Does the granddaughter have a share in the inheritance?

My husband is a co-owner of a 4-room apartment. Also the owners are his father, mother and brother. There are 6 people registered in the apartment, including me and our daughter. Recently, my husband's father died without leaving a will. What can our daughter claim?

An heir who missed the deadline for accepting an inheritance.

My parents divorced twelve years ago, I lived with my mother. The father started a new family, he has children from his new wife. 9 months ago my father died. Am I entitled to a share in his property?

The father bequeathed part of the house to his nieces. Can a daughter refute a will?

Mom and dad divorced in 2001. The father filed a lawsuit in 2009 to divide the house. He was awarded his share, the house was divided. In 2011, he wrote a will for his nieces. And this year he died...

Is there an error in the distribution of shares of the inheritance?

I am the guardian of minor children. They inherited money from their grandfather in a savings book. Based on the certificate of inheritance, two children of the grandfather are entitled to 1/3 of the share, and two grandchildren are entitled to 1/6...

There are 8 people registered in the apartment. How will the share be distributed after death?

My husband was listed as a co-owner of a three-room Moscow apartment. The owners are also the mother, sister and father of the deceased spouse. In total, there are eight people registered there...

Entry into inheritance after fifteen years

My parents divorced quite a long time ago. Soon dad died, my mom’s friends told her about it. Of course, she did not go for the inheritance. Mom later told us that dad didn’t want communication. We recently learned the truth...

Inheritance rights in the presence of “dead souls”

I inherited 1/2 share of a house in the Moscow region according to a will from my grandmother. I learned that during her lifetime my grandmother registered two Armenian citizens in the house, however, they never lived in it...

Inheritance rights to unregistered real estate

My grandfather lived in a 3-room apartment, which he received at one time under a warrant. Already on the verge of death, he decided to privatize it, but since he himself no longer got out of bed, he gave me a power of attorney...

Other Q&A topics:

- Debts

- Credit

- Loan guarantee

- Mortgage

- Collectors

- Insurance

- Purchase and sale of real estate

- Buying and selling cars

- Divorce

- "Civil marriage

- Establishing paternity

- Alimony

- Inheritance, wills

- Exchange of living space

- Housing issue

- Privatization

- Agreements and powers of attorney

- Donation

- Administrative offenses

|

Rules for division of inheritance

The division of property in this case is carried out in the following order:

- if there is a will, the division is made on its basis, in accordance with the will of the testator;

- If there is no will, then the division of property is carried out in order of priority. First of all, the right goes to the mother and father, children and spouse;

- if the will ignores the obligatory share, then it must be allocated by redistributing the share of other heirs.

Parents will not receive property at all only when the testator was of age and capable, bequeathed all the property to other persons, and the parents themselves do not have the right to an obligatory share.

All first-priority applicants receive the same share of the inheritance if there is no will. Only if there are no heirs of a given line at all, the property can be transferred to the next line, and so on.

If one of the parties does not agree with the procedure for distribution or the volume of its share, including the composition of the property, it can either enter into an agreement with the other heirs or go to court.

The court may decide to sell the inheritance and distribute funds in accordance with the law and the legal status of the parties, or allocate the applicant's share from the inherited property.

Heirs by law

The current civil legislation of the Russian Federation provides for two ways to accept an inheritance:

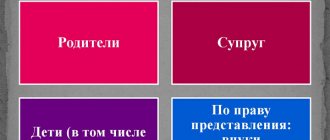

Chapter 63 of the Civil Code regulates the emergence of the right of inheritance by law. Thus, according to Article 1142 of the Civil Code, the main claimants to the inheritance are the children, spouse and parents of the deceased.

Upon the death of children - a son or daughter - those successors whom the law classifies as a certain line of heirs are called upon to inherit.

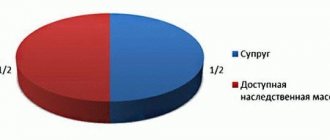

At the same time, you should remember an important rule of inheritance after the death of one of the spouses: the surviving spouse receives half of all inherited property if it is recognized as jointly acquired. So, if the testator is a son, then his parents, spouse and children are called upon to inherit.

The unborn child is in a special position. He has the right to an obligatory share. Therefore, the notary does not distribute shares in the inherited property until the birth of the child.

Attention! If there are no main contenders for succession, then the following circle of close relatives is called upon to inherit in accordance with Article 1143 of the Civil Code, which consists of:

Procedure for registration of inheritance

After the death of a son or daughter, inheritance rights are formalized in the following order:

- on any day after the opening of the case (from the date of death), the applicant must, within six months, contact a notary at the place where the inheritance was opened. The place is determined by the address of his last residence or the location of the property, if the address of residence is unknown;

- submit an application to a notary to enter into inheritance rights;

- at the end of the six-month period, re-apply to the notary for a certificate of title;

- re-register the specified property in your name if it is subject to registration.

Download the application for acceptance of inheritance (sample/form)

In addition to the application, the notary needs to submit some documents:

- passport or other document that confirms the applicant’s identity;

- confirming family ties with the deceased. In this case, it will be a birth certificate or, for example, a judicial act establishing paternity;

- death certificate of the testator;

- confirming ownership rights to property that is subject to transfer to heirs.

The mother and father can provide the notary with information about other heirs, but are not obliged to do so. However, in this case, their chance of reinstating the missed entry period increases.