Free land plots for labor veterans

This regional law establishes cases of provision of land plots in state or municipal ownership, the disposal of which in accordance with the Federal Law “On the Enforcement of the Land Code of the Russian Federation” is carried out by local government bodies, into the ownership of citizens free of charge.

Article 1. The provision of land plots in state or municipal ownership into the ownership of citizens free of charge can be carried out in the following cases:

3) provision of land plots for private farming and livestock farming to parents with many children who have three or more dependent children, disabled people, parents with a disabled child;

4) provision of land plots for individual housing construction to parents with many children who have three or more dependent children, disabled people, parents with a disabled child, labor veterans, citizens exposed to radiation due to Chernobyl and other radiation accidents and disasters, citizens who lost their housing as a result of natural disasters, citizens who have a living space per family member of no more than 6.5 sq.m.;

5) provision of land plots for running a peasant (farm) economy for the first time to citizens from among adoptive parents, parents with many children, having three or more dependent children.

Article 2.

We recommend reading: return of household appliances under warranty

Benefits for Labor Veterans in Gardening Partnerships

Considering that for a number of categories of citizens, social support measures are established by laws and other regulations of the constituent entities of the Russian Federation , we were recommended to contact the Ministry of Social Protection of the Population of the Moscow Region, which told us the following: “The issue of providing social protection measures for paying for housing and utilities at the place of temporary residence of citizens is not regulated by law. Federal Law No. 66-FZ dated April 15, 1998... provides for the following concepts: entrance fees, membership fees, targeted contributions... which are not provided for preferential payment in accordance with the law." Thus, you can raise the issue of the availability of funds for the maintenance of your site only before the state, and not before a group of gardeners . In addition, the presence of ballast in a gardening partnership that is unable to pay targeted fees leads to the disruption of measures to resolve general social and economic issues of gardening, i.e. to the disruption of the achievement of the statutory goals of the non-profit organization for the sake of which it was created. As we see, any benefits must be established by the state in the form of a Law, which, among other things, must provide for a mechanism for reimbursing the costs of providing such benefits. And in conclusion, I would like to remind the “beneficiaries” of the words of the Holy Scripture: “ Do not covet... anything that is your neighbor’s.”

.My personal opinion is that the obligation to provide benefits is the duty of any state to its people. In damned America they say World War II veterans receive 5 thousand dollars in addition to their old age pension. I consider it an immoral attempt by some individuals to shift state obligations for benefits additionally (except for tax payments) onto the shoulders of other citizens. The Russian people are warm-hearted and sympathetic by nature; certainly, such calls on SNT are from good intentions. But today’s situation is when there is rampant capitalism and money is not so easily earned and does not fall from the sky , and the worst thing is that a person is not sure of the future . The day has passed and thank God. Therefore, taking additional expenses from the family budget for the maintenance of certain categories of gardeners is also immoral . I personally want to offer a general benefit for all gardeners and their minor children for travel during the summer season. Because the plot does not feed the gardener, I would not say so, since almost all of Russia lives off the harvest from the plot. In the Moscow region, this is less pronounced, a large percentage of vagrants. Therefore, I am against benefits at the expense of my neighbor in the area.

We recommend reading: Deduction from the Cash Register by Bailiffs

Question answer

For land tax, the tax base is reduced by a tax-free amount of 10 thousand rubles. per taxpayer in the territory of one municipality in relation to a land plot owned, permanent (perpetual) use or lifetime inheritable possession of disabled people with disability group I, as well as persons with disability group II established before January 1, 2004, disabled people from childhood, veterans and disabled people of the Great Patriotic War, as well as veterans and disabled people of combat operations (clause

Benefits for paying taxes to SNT

If residents are absent for more than one month, utility bills will not be charged during their absence. To recalculate payment for utility services, it is necessary to submit to the housing authorities a certificate from the gardening association about the time of residence on the garden plot in SNT . Absent persons are not exempt from paying for telephone and heating bills. The procedure for applying these rules is determined by local government bodies (see subparagraph “d” of paragraph 9 of the “Rules for the use of residential premises, maintenance of a residential building and adjacent territory in the RSFSR”, approved by Resolution of the Council of Ministers of the RSFSR No. 415 of September 25, 1985, as amended by 07.23.93)

In accordance with paragraph 6 of Art. 12 of the Law of the Russian Federation “On Payment for Land”, participants of the Great Patriotic War, as well as citizens to whom the legislation extends social guarantees and benefits for participants in the Great Patriotic War, are completely exempt from paying land tax. According to paragraph 2 of Decree of the President of the Russian Federation dated April 4, 1992 No. 362, benefits for participants in the Great Patriotic War are extended to citizens of the Russian Federation who performed military or official duty in the Republic of Afghanistan or in other countries in which hostilities took place.

I got on the waiting list, but they didn’t give me a plot of land.

I have a question of this nature. In Voronezh, there is a rule on providing free land to military veterans on the basis of the following laws.

I think it would be logical to start solving this issue at the federal level, that is, with the Federal Law “on veterans.” This law does not establish the right of combat veterans to receive land.

This circumstance does not deprive veterans of the right to acquire free ownership of a plot of land, due to the fact that Art.

Benefits for labor veterans in Tatarstan in 2020

Over the past 3 years, the amount of benefits has changed taking into account the level of inflation. Veterans of labor are entitled to a single monthly social pass for all types of urban transport and suburban vehicles. The cost of an unlimited travel pass in 2016 is 427 rubles.

Within 35 calendar days, the applicant will receive a written notification with the decision of a special commission under the Ministry of Labor and Employment. If a positive decision is made to award the title “Veteran of Labor,” the applicant applies to the local branch of the Social Insurance Fund to receive a certificate.

Allocation of land plots to labor veterans

I heard that now labor veterans are given plots of land within the city. I don't know all the details. Maybe someone has already encountered this? Mom will go to the administration on Monday, we will ask.

According to clause 2 of Article 28 of the Land Code of the Russian Federation (hereinafter referred to as the Land Code of the Russian Federation), the provision of land plots into the ownership of citizens and legal entities can be carried out in cases provided for by the Land Code of the Russian Federation, federal laws and laws of the constituent entities of the Russian Federation.

We recommend reading: Eviction of a tenant

Benefits for paying for electricity in 2020

Payment for housing and communal services falls heavily on the shoulders and wallets of the majority of the country's citizens. The amounts on receipts are growing, but income is not keeping up with them. Therefore, benefits for electricity and other types of housing and communal services are now in demand, as are subsidies.

We recommend reading: How Penalty is Calculated for Late Payment of Utilities Example

It is necessary to understand that part of the payments falls on the budget. For example, if a citizen is given a preference of 50%, then the state is obliged to reimburse the service provider. Moreover, the payer is the region, not the federal budget.

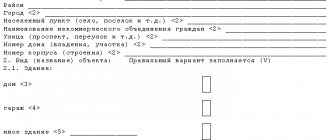

Application for provision of land sample

The applicant is a labor veteran. The applicant learned that he, as a labor veteran, has the right to receive a free plot of land. When the applicant tried to get information on this issue at the council, he was not even allowed there. They simply said that there was no land and there was simply no need to contact us about this issue. The applicant wants to exercise his right to receive a land plot. The applicant requests to be provided with a land plot in accordance with current legislation.

I, ______________________, am a labor veteran, in accordance with certificate No. ________.

Benefits in SNT

You had to reduce the tax base for land tax by the cadastral value of 600 square meters of land area. This is not a benefit, but a procedure for determining the tax base: sub. 8 clause 5 art. 391 Tax Code of the Russian Federation. The tax authority had to independently calculate the tax base (clause 4 of Article 391 of the Tax Code of the Russian Federation). However, according to clause 6.1. of this article, the reduction of the tax base in accordance with paragraph 5 of this article (tax deduction) is made in relation to one land plot at the choice of the taxpayer. A notification about the selected land plot in respect of which a tax deduction is applied is submitted by the taxpayer to the tax authority of his choice before November 1 of the year, which is the tax period from which the tax deduction is applied in respect of the specified land plot. A taxpayer who has submitted a notification to the tax authority about the selected land plot does not have the right, after November 1 of the year, which is the tax period from which a tax deduction is applied to the specified land plot, to submit an updated notification with a change in the land plot in respect of which in the specified tax period tax deduction applies. If a taxpayer entitled to apply a tax deduction fails to provide notice of the selected land plot, the tax deduction is provided in respect of one land plot with the maximum calculated amount of tax.

We recommend reading: Mortgages for Young Professionals Under 35

17.1. Good afternoon, first you need to establish who owns this object (organization), then go there and get those. conditions for connection. It is not clear from the question why the chairman of SNT is demanding money?

Land plot

Since 2005, the right to free privatization has been legislatively abolished. or free use. Since January 1, 2005, all land has been owned by someone. not registered physical persons - owned by the municipality (village council administration). The administration also paid money for the documentation of these (in fact ownerless) lands (otherwise it would be impossible to sell the plots).

There is simply no law on free allotment of plots of land! There is a program to allocate construction sites for large families.

Rules for free receipt of land from the state

The Moscow region very rarely indulges its residents with free land holdings. But there are also exceptions (as in any rules), for example, individual young families received their own territory for construction, although not in Moscow, but in nearby areas - about 70 km from the capital.

- veterans and disabled people whose disability was caused by the Second World War;

- veterans and disabled people who are participants in any military action;

- citizens who lost their ability to work completely or partially due to the accident at the Chernobyl nuclear power plant;

- citizens classified as victims of political repression and subsequently rehabilitated;

- persons caring for 3 or more minor children;

- citizens whose place of residence is recognized as unsafe and unsuitable;

- families in which each person is entitled to less than 10 square meters. m. living space.

We recommend reading: To whom does the State pay 1,000,000 rubles Income

Benefits for pensioners and labor veterans when registering a summer cottage

It also contains mention of land tax as a form of payment for land. However, it does not provide details regarding who pays this tax, its amount, etc., but refers to other legislation. It is the Tax Code of the Russian Federation that establishes the possibility for some people to receive land tax benefits.

n. The concept of land tax is discussed in. The land plot that is subject to taxation must be located in the territorial district where local authorities have established such a payment. Its size is determined taking into account the tax base equal to the cadastral price of the land.

Garden plot tax 2020

The tax on property of individuals does not apply to the site, but to residential buildings located on its territory. Initially, its amount was formed from the inventory cost of the building. However, in 2020, amendments were made to the tax code, and now the tax is calculated based on the cadastral value of housing. The latter, by the way, is as close as possible to the market one.

We recommend reading: Young Family Program 2020 Ufa

Back in 2014, a new algorithm for calculating the cost of an object when paying fiscal contributions began to be used. If previously a balance sheet (inventory) valuation was used, which was much less than the market price, then in the last few years a cadastral valuation close to the market price has been used. But the transition to the new taxation system was envisaged to be gradual: the increase in the fiscal base took place over 5 years, increasing by 20% annually.

What benefits can labor veterans still count on?

The list of benefits for labor veterans varies depending on the region of the Russian Federation, therefore, all available preferences should be clarified with the territorial social protection authorities. As practice shows, labor veterans can count on the following types of benefits:

- free travel on public transport within the region;

- exemption from land taxes;

- registration for improvement of living conditions;

- additional leave at your own expense in the amount of 14 days;

- annual leave at the expense of the employer at any time convenient for the veteran;

- extraordinary services in pharmacies and clinics.

“In addition to existing federal benefits, labor veterans can count on a number of regional measures aimed at improving their lives and lives. There are benefits for the purchase of firewood; you should check with regional municipalities. It is there that complete and reliable information must be provided, and if such a benefit is granted, then the applicant must be notified of how to obtain it, what documents may be required, by what rules the calculation is made, and in what time frame the application must be submitted.”

Vasilyeva M.I., chief specialist of the social protection agency, Moscow

Tax on the sale of land: what has changed since 2020

By April 30 of the year following the year of sale of the land plot, the owner must submit a declaration to the tax authorities. Moreover, the payer will have to calculate the personal income tax independently.

- The only living space was sold specifically to purchase another.

- If the object has been owned for more than three years and its value does not exceed 5 million rubles.

- If the price at which the living space is sold is less than or equal to the one at which it was purchased. To do this, you must provide the relevant documents.

We recommend reading: Maternal Capital for 2 Children in 2020

Are labor veterans exempt from land tax in 2020 - payment

Are labor veterans exempt from paying land tax in Russia in 2020? Basic concepts, benefits provided at the state and regional levels, the procedure for their registration and the nuances of their provision in the Moscow region - these aspects are discussed in the proposed article.

The government of our country provides for the possibility of providing benefits to many categories of Russian citizens. Some of them are also valid for pensioners with the status of a veteran of labor activity.

This title has been awarded to citizens for more than twenty years for special labor and service merits to the state.

general information

On the basis of federal legislation, labor veterans are not exempt from paying land tax, however, the right to reduce the amount of contributions can be granted by local governments in a specific subject of the Russian Federation.

As a result, compensation for expenses will be covered by the local budget. Therefore, this benefit is not provided in all regions of the country due to the difficult economic situation.

Citizens who are included in the preferential category of people may qualify for a deduction from the total cost of a plot of land or an exemption from paying land tax.

Definitions

| Privileges | These are additional rights that are granted by the state to certain vulnerable categories of citizens. These include, in particular, labor veterans |

| Land tax | This is a financial payment made in favor of the regional budget, which is assigned to the owner of the land plot |

| veteran of labour | This is an honorary title of the Russian Federation, which is awarded to citizens for many years of conscientious work for the benefit of the state. |

| Payer | This is a citizen who is the owner or indefinite use of a land plot and pays a certain tax |

| Cadastral value of a land plot | This is the equivalent of the cost of the plot, which is taken into account when calculating land tax, redemption value, rent and other payments |

Who is included in this category of citizens?

The decision to assign the status of a labor veteran is made by the social protection authorities. According to current legislation, at the federal level, labor veterans are citizens who:

| Were awarded orders and medals | For labor services to the state |

| Have a certificate | "Veteran of labour" |

| Carried out labor activities during the war of 1941-1945. before reaching 18 years of age | Confirmed by entries from the work book, archival notes, while the total experience reaches 35/40 years |

| Have certificates and gratitude | From the government of the USSR, RSFSR and Russian Federation |

In addition, at the regional level, their own conditions for obtaining this status may be adopted. They may consist of a certain period of service of the employee, which differs in the constituent entities of Russia.

According to current legislation, social support for labor veterans rests entirely with the regional budget of each subject. In this regard, in different regions of the country the list of benefits provided is somewhat different.

necessary steps to obtain a labor veteran's certificate

Also, the conditions for assigning status are adjusted by the constituent entities of the Russian Federation, so the list of required documents may differ in different regions of the country.

Legal regulation

The issues of providing benefits for the payment of land tax are regulated by the following legislative acts:

| Federal Law of January 12, 1995 No. 5 “On Veterans” | Establishes the procedure for conferring an honorary title and measures of social assistance to this category of the population of Russia |

| Tax Code of the Russian Federation (Articles 387, 390, 391, 395) | It establishes the rules for granting tax benefits. According to this legislative act, labor veterans do not have the right to a reduction in the amount of land tax at the federal level. These changes can only be established by regional and municipal authorities |

| Land Code of the Russian Federation (Article 65) | This resolution regulates the issue of providing benefits in the land sector |

Basic moments

Land tax is established at the regional level by local governments, so the size and nature of assistance varies in different regions of the Russian Federation. If the economic situation in the region is stable, a benefit is provided for the state to pay 50% of the amount of land tax.

In some cases, exemption from paying land tax is possible. In accordance with the legislation of the Russian Federation, complete tax exemption is allowed only in sparsely populated areas (the Far North), as well as in the Moscow region.

Thus, to clarify current information, citizens need to get advice from the territorial tax office.

Preferential conditions

Labor veterans are provided with the following types of benefits:

| Free pass | On public transport |

| Payment of utility services | In the amount of 50% |

| The right to take leave at any time | For working pensioners |

| Free medical care | Including installation of dentures, testing |

| Receiving free medications | According to your doctor's prescription |

There are no benefits for labor veterans for paying land taxes at the state level. The Tax Code of the Russian Federation stipulates the right of municipal authorities to provide these reliefs for certain categories of persons.

Relief on the payment of land tax is divided into two main categories:

| Deduction from the cadastral value of a plot of land | The amount is set by local authorities, but not less than 10,000 rubles |

| Exemption from land tax | With sufficient provision for the region and the presence of special social programs |

The amount of land tax is established based on the characteristics of the region and economic circumstances. The amount of payment also depends on the cadastral value of the site. The tax deduction is set at ten thousand rubles.

Municipal authorities can increase its size in accordance with the capabilities of the region, but reducing this amount is prohibited.

Registration procedure

The procedure for calculating and paying tax on a land plot is established by the Tax and Land Codes of the Russian Federation. Benefits are provided to individuals upon presentation of a document confirming the right to social assistance.

Receiving support is of a declarative nature. The citizen must take care of collecting the necessary documentation and writing an application to the tax office.

The application must include the following information:

- name of the Federal Tax Service;

- authority address;

- Full name and position of the person in whose name the application is written;

- veteran’s personal data, contact information;

- statement of a request for benefits for the payment of land tax;

- list of attached documents.

A veteran of labor can find out detailed information about existing benefits from the regional tax service by providing an extract with the current amount of land tax.

You can also request a recalculation of the tax amount from this institution if the taxpayer contributed the amount without taking into account benefits. This procedure is possible if more than three years have passed since the payment of funds. There are cases when a payer, exempt from paying tax, contributes this amount.

In such cases, the recalculated amount (or the full amount of funds) will be returned to the citizen’s personal account. To do this, it must be registered on the website of the Federal Tax Service of Russia.

This resource provides all the necessary information about the existing tax amounts of the payer, as well as the provided exemptions for a specific citizen who is a labor veteran. The Federal Tax Service website also offers the opportunity to submit an application online.

Are labor veterans exempt from land tax in the Moscow region?

Preferential conditions for land tax in the Moscow region are established by Moscow City Law No. 74 dated November 24, 2004 “On Land Tax”. It specifies the categories of citizens who may qualify for land benefits and related taxes.

The Moscow and regional governments allow the following categories of citizens to be exempt from land tax:

- heroes of the USSR and the Russian Federation;

- heroes of labor and holders of the Order of Labor Glory;

- heroes of the Russian Federation.

The benefit is provided exclusively for one piece of land owned by the veteran. A tax deduction of one million rubles is also allowed, rather than the 10 thousand rubles provided for at the federal level.

Thus, veterans of labor activity are a preferential category of the population, but this does not exempt them from paying land tax at the federal level.

However, municipal authorities may provide for regional specifics in the provision of relief. They can be expressed in a reduction in the amount of payment or complete exemption from this type of payment.

Advice!

Since the issue of providing benefits to labor veterans is decided at the regional level in accordance with the economic situation in the subject, funding is provided from the local budget.

In the Moscow region, the tax deduction is set at one million rubles, while in Russia this benefit is ten thousand rubles. Regional authorities can only increase the size of the land tax deduction, but not reduce it.

: benefits for veterans

Rent of Land to Veterans of Labor

- Hero of the Russian Federation and the USSR, hero of labor, full holder of the Order of Glory;

- A person affected by radioactive exposure, a military personnel and a citizen who took part in the liquidation of such emergencies;

- Pensioner, low-income citizen (disabled).

- Free land plots for labor veterans

- Land plots for veterans

- Law of the Smolensk region of September 28, 2012 No. 66-z On the provision of land plots to certain categories of citizens in the territory of the Smolensk region

- Free land for a labor veteran

- Free land plots for labor veterans

- Portal for supporting urban planning activities

Labor veteran of the Moscow region

- certificate;

- written application;

- information about income;

- receipts for utility bills or medical care;

- work book;

- details of your account where the money will be transferred;

- social card (if you have one).

Within 10 days after the citizen submits the documents, the commission makes a decision on assigning status, then sends a copy of the protocol to the territorial division of the Ministry, which notifies the applicant of the verdict.

12 Jun 2020 uristlaw 192

Share this post

- Related Posts

- Housing Program St. How many meters per person

- Payments to labor veterans Moscow region

- How to Register a Veranda Attached to a House

- How to Legally Stop Spending Crelit If You Have a Large Family

Heating benefits

The area of housing is of no small importance . For persons with disabilities, the heated area will be taken into account in its entirety; for other citizens, it is possible to return funds only for heating 33 square meters of the apartment.

We recommend reading: Benefits for a Chernobyl certificate in Moscow with zone 4

By November, the pensioner paid off the debt and reapplied for benefits, which were accepted. In December, the woman received her first compensation payment. Of the 2,200 rubles actually paid for utilities , including 1,100 for central heating , Inna Makarovna returned 1,100 rubles.

Land tax for labor veterans 2018 – benefits, exemption, do they pay?

Now many citizens, especially those of retirement age, own plots of land of various sizes and purposes. However, we should not forget that for each such object a citizen is obliged to pay a certain tax.

General information

For many years of fruitful work in Russia, you can receive the title Veteran of Labor. At the same time, it is important :

the citizen has at least 40 years of work experience;

presence of state awards and honorary titles of the USSR and the Russian Federation;

work experience and residence in a certain region for the number of years established by law.

Get free legal advice by asking a question in the form below!

To support the category of citizens, local authorities allocate funds. They are provided from the regional budget. According to the Tax Code of the Russian Federation, there is no reduction in the amount of land tax for labor veterans in 2020. However, such a resolution takes place only at the federal level.

In fact, local authorities often pass certain laws that make it possible to either completely exempt this category of citizens from paying tax or reduce its amount.

Attention!

You should also know that if regional authorities take such a step to compensate for the funds lost in the budget, they will have to use the funds of municipalities.

Not every subject of the Russian Federation is satisfied with this scenario.

In addition to labor veterans at the regional level, they can also be at the federal level. These include citizens:

- have worked for more than 40 years;

- those who began working before the age of 18 during the Second World War.

The legislative framework

The collection of all taxes in the Russian Federation is regulated by Chapter 31 of the Tax Code of the Russian Federation. Operations related to land plots are regulated by the Land Code. The provision of benefits to certain categories of citizens is prescribed in the Tax Code of the Russian Federation.

Direct tax breaks are established in the administration of the region or federal cities. Various federal laws and regulations directly or indirectly relate to this topic. Property taxes are regulated by the Housing Code.

Land tax for labor veterans

Veterans of labor can count on relief from land tax or avoid paying it altogether. However, this is only possible if a certain amount has been allocated in advance for such purposes in the municipal budget.

As a rule, labor veterans have the right to expect to receive a certain deduction from the cadastral value and land plots that they own.

The amount that a citizen will have to contribute to the regional budget as land tax depends on the cadastral value of the property.

Federal legislation establishes that such a deduction cannot exceed 10,000 rubles. The legislation provides that local authorities can increase this amount, but they have no right to reduce it.

In some cases, a labor veteran is completely exempt from paying land taxes. However, a citizen should not count heavily on such a relaxation, since in this case the budget of the constituent entity of the Russian Federation almost completely covers all expenses associated with paying land taxes.

Find out what land tax benefits are available for veterans of labor by contacting any tax office.

Do they pay?

It is possible to find out information of interest to a person by:

- Personal contact with the tax office. Here the veteran will be given detailed information about many issues that interest him. To do this, you will need to present an identity document and a document confirming the citizen’s social status.

- Every year, a person receives a notification by mail from the Federal Tax Service office warning that the tax repayment period will soon come to an end.

- If a person claiming a benefit still missed the tax payment deadline, he must contact the tax department with an application to recalculate the payment.

If a citizen repays land tax with an already existing opportunity to carry out this financial transaction on preferential terms, the person has the right to claim the return of overpaid funds.

It is also possible, based on a written application from a citizen, to redistribute the amount to an advance payment for the next payment or to other taxes.

There is an easier way to get information. A citizen will need to visit his personal account on the official website of the Russian Tax Service. Any taxpayer in the country has the right to log in to an electronic resource.

Important!

The website contains detailed information about the funds that must be paid as land tax, as well as other financial costs that a citizen must pay. There is also similar information about all the benefits that a person may qualify for.

If the budget of a district or region is sufficiently stable, then a labor veteran may well qualify for a complete tax exemption.

Who else is exempt from paying?

The following categories of citizens are partially or fully exempt from paying land tax:

- Heroes of the Russian Federation and the USSR;

- Military Knights of the Order of Glory of all degrees;

- participants in the liquidation of consequences of accidents with atomic and nuclear components;

- participants in nuclear and atomic weapons tests;

- combatants;

- disabled people;

- pensioners;

- low-income families.

Procedure for applying for benefits

To receive benefits, a veteran must fill out an application requesting a tax break and provide the tax office with documents confirming his social status.

If a citizen, for various reasons, was unable to apply for a benefit within the established period, he must contact the tax service with an application for recalculation of the tax amount. The action can only be completed within the last three years.

If a citizen was exempt from paying land tax, but the funds have already been transferred by him, he cannot claim a refund. At the same time, the money will be distributed in full among other tax payments, from which the citizen is not exempt.

List of required documents

To receive benefits, a labor veteran will need to provide the following documents to the tax department:

- passport;

- a certificate confirming that a citizen has a special social status;

- confirmation of land ownership rights;

- application requesting benefits.

A sample application for land tax relief is here.

Features for residents of the Moscow region

In Moscow, complete tax exemption can be provided to Heroes of Russia and the Soviet Union, as well as Socialist Labor, Knights of the Order of Glory, Labor Glory and “For Service to the Motherland in the USSR Armed Forces.” This benefit applies only to one plot of land owned by a citizen.

Some residents of the capital can receive a deduction from the cadastral value of a plot in the amount of 1 million rubles. In Moscow, large families have also been added to the main list of tax benefits.

Veteran of Labor - tax benefits for land (garden plot)

When establishing a tax, the representative bodies of municipalities (legislative (representative) bodies of state power of the federal cities of Moscow and St. Petersburg) determine tax rates within the limits established by this chapter, the procedure and deadlines for paying the tax. When establishing a tax, regulatory legal acts of representative bodies of municipalities (laws of federal cities of Moscow and St. Petersburg) may also establish tax benefits.

Are there any benefits for labor veterans on land, real estate and taxes?

An application for housing allocation is also submitted. The law determines that an apartment cannot be provided to those who have already received housing from the state, even in another way. In addition, the applicant must not own any real estate.

- Study regional laws on social support for labor veterans.

- Select a building plot from those offered.

- Submit an application, details of the selected land plot and documents justifying your right to receive land.

- Wait for the commission's decision.

- Receive land ownership and begin construction.