When donating an apartment, it is very important to strictly follow all formalities. Firstly, it is necessary to correctly register the transaction itself. Secondly, prepare the documents correctly so that other relatives or interested parties cannot challenge it in any cases. Taxation is also an important point. It is necessary to correctly submit all required forms to regulatory authorities in a timely manner in order to avoid sanctions and fines on their part. After all, as a result of a donation, the recipient receives income, which means that tax must be withheld from him. However, in the case of close relatives, the cost of the apartment is not taxed, but the degree of relationship must be proven.

Registration of ownership of real estate by gift

Before you figure out whether a 3rd personal income tax declaration is needed when donating an apartment to a relative, you need to decide on the registration of the transaction itself. When receiving ownership of real estate or any other property, you must be sure to register everything correctly. There are often situations when parents simply transfer their property to their children, believing that now they will own a house or apartment. But until such a transaction passes the registration procedure with government authorities, it will be considered invalid.

Registration of rights is required for the following reasons:

- Firstly, only the reflection of a transaction in a special state register will mean that an individual is the owner of real estate, which means that his right cannot be violated by anyone, it can be defended in any court. Otherwise, various unscrupulous persons may take advantage of a person’s legal illiteracy and deprive him of his property.

- Secondly, this is a state requirement. Every citizen who owns property is required to pay property tax, so it is very important for regulatory authorities to know what kind of real estate individuals own. They can get this information from the state register. Failure to register a transaction in a timely manner may be regarded as tax evasion, which is an offense for which certain penalties are provided.

Do I need to submit a declaration when donating an apartment to a relative?

The donor is also recommended to submit a declaration on the fact of donating the apartment, and not just to the person to whom the apartment was given, since after filing such a declaration, the tax authority relieves him of the obligation to pay the property tax provided for owners of real estate.

When do you not need to pay tax on a gift?

The court pointed out that the Tax Code does not clearly state on what value taxes must be paid when donating real estate. But there is a Review of the judicial practice of the Presidium of the Supreme Court of the Russian Federation on October 21, 2015. Paragraph 6 of the Review states that either the market value of the apartment, which was determined by a licensed appraiser, or the cadastral value can be considered.

When donating an apartment, it is very important to strictly follow all formalities. Firstly, it is necessary to correctly register the transaction itself. Secondly, prepare the documents correctly so that other relatives or interested parties cannot challenge it in any cases. Taxation is also an important point. It is necessary to correctly submit all required forms to regulatory authorities in a timely manner in order to avoid sanctions and fines on their part. After all, as a result of a donation, the recipient receives income, which means that tax must be withheld from him. However, in the case of close relatives, the cost of the apartment is not taxed, but the degree of relationship must be proven.

Is it necessary to submit a 3rd personal income tax declaration for a donated apartment?

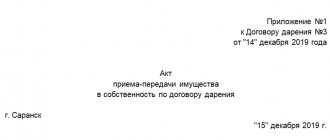

The content and form of the apartment donation agreement are regulated by the Civil Code of the Russian Federation. Firstly, the document must be drawn up in simple written form, the donor and the donee must be indicated, the object of the transaction must be described so that it can be easily identified, and the rights of all parties must be stated. The agreement must be certified by a notary, who will confirm the legal capacity of the parties, which means their understanding of the consequences of the transaction.

The main feature of donation is its gratuitousness. In other words, property passes from one owner to another without any payment. However, according to tax law, the donee generates income, which means he must pay tax. At the same time, a separate article of the Tax Code of the Russian Federation contains a list of persons who are exempt from paying personal income tax (in particular, these are immediate, close relatives). The Family Code includes parents, children, grandparents, grandchildren, brothers and sisters as such persons. The rest of the relatives will have to pay tax after receiving the gift.

Consequently, after the gift agreement is registered, each party has the obligation to file a tax return 3 personal income tax, in which either calculate the tax or prove that the property was received from a close relative, which means there is no obligation to pay a fee.

Do I need to submit a declaration when donating an apartment to a close relative?

Non-relatives include all citizens other than those listed in the Family Code. If a woman wants to give an apartment to her mother as a gift, the latter will have to pay tax, since according to the code, mother-in-law and daughter-in-law are not close relatives or family members.

How to determine the value of a gift and the amount of tax?

At the same time, income received as a gift is exempt from taxation if the donor and donee are family members and (or) close relatives in accordance with the Family Code of the Russian Federation (spouses, parents and children, including adoptive parents and adopted children, grandfather, grandmother and grandchildren, full and half (having a common father or mother) brothers and sisters).

However, there is an exception here. The tax is not paid if the transaction was carried out between close relatives. We emphasize that this exception is directly related to the degree of relationship.

How to fill out a tax return?

There are two ways to prepare a document. The first is to contact specialists. This method is effective if the donor or recipient has never encountered legislation on taxes and fees before and does not know the procedure for issuing a certificate 3 of personal income tax. Contacting a specialized organization will significantly save time and be sure that all documents will be accepted by the regulatory authority the first time without additional modifications. In addition, specialists clearly know what documents need to be attached to the declaration in order to avoid paying personal income tax when donating an apartment to close relatives. It must be remembered that the services of specialists are paid.

The second way is to do it all yourself. This will save a certain amount of money, but will require significant time expenditure, especially if the declaration is being completed for the first time. You can get a sample of filling out 3 personal income tax on the Internet, but it is better to contact the tax office at your place of residence and fill it out in accordance with the recommendations, which are usually posted on stands in the reception hall for individuals.

Instructions: how to fill out the new form 3-NDFL 2020

There is no need to fill out all the sheets. Indicate information only on those sheets of the tax return that are necessary to reflect income received, expenses incurred and tax deductions that are due to an individual in the reporting period.

We recommend reading: What bailiffs take from the debtor’s wife

Where to submit 3-NDFL

Income from the sale of residential houses, apartments, rooms, including privatized residential premises, dachas, garden houses or land plots or share(s) in the specified property, determined based on the price of the object specified in the agreement on the alienation of property

It's time to consider a sample of filling out 3-NDFL for a gift. The situation will be considered from two angles: between individuals and when the donor is an organization (legal entity or individual entrepreneur), and the recipient is an individual. As a rule, in the second case, the organization (most often it is the employer) independently pays personal income tax on the gift. If the tax is not paid, the employee is warned about this and this responsibility falls on his shoulders.

Instructions for preparing a declaration under an apartment donation agreement

Filling out and submitting 3 personal income tax should be done in several stages:

- The first step should be to collect the necessary documents. The taxpayer will need a passport, a certificate of ownership of the apartment, a gift agreement, and documents confirming the relationship with the donor.

- The second step is to directly fill out the declaration. Here you must indicate the number of the inspection where the document will be submitted. This can be obtained directly from the regulatory authority. It should also indicate who submits the declaration - the taxpayer himself or an authorized representative. The recipient indicates civil contracts and transactions as the source of income. In conclusion, the source of personal income tax payment should be indicated. If the relationship is close, this fact should also be reflected in the appropriate section of the form.

- The third step is to provide a package of documents to the Federal Tax Service. This can also be done either by the taxpayer himself or by his authorized representative.

After this, all that remains is to wait for the test results. If the regulatory authority is satisfied with all the documents, there will be no messages. In the future, demands for payment of property taxes will only come. If errors are found during the verification process, a letter will be sent demanding that they be corrected and a correct declaration be provided.

Features of taxation when drawing up a gift agreement

The first thing to remember is that when transferring an apartment on the basis of a deed of gift, personal income tax declaration 3 for individuals must be submitted. Of course, there is no clear requirement in the law in this regard, however, in this case, it is better to provide documents than to later give explanations to the Federal Tax Service employees about the reason for late submission.

The second important point is that a tax deduction when donating an apartment to a close relative is not provided. Since such a transaction is not subject to personal income tax, the benefit does not apply to it. The list of close relatives is indicated in the Family Code. However, this norm applies only to the recipient. If the donor did not exercise his right to a property tax deduction earlier, and has already donated an apartment, he retains this right, and he can at any time collect the necessary package of documents and send it to the Federal Tax Service to receive a personal income tax refund.

The described norms and rules apply not only to any entire housing, but also to a share of the apartment, the donation of which is duly formalized. In such a situation, it is also recommended to fill out and submit a declaration, indicate the degree of relationship and, if possible, receive a tax deduction.

Is it necessary to submit a declaration to the donor when donating a residential building to a distant relative?

Receiving a gift of residential or any other premises is recognized as income, that is, the economic benefit of the person who received this property (in kind, not in cash). In this case, the legislator recognizes as income the benefit received by the donee by saving money that he would have had to spend on purchasing the relevant property.

Do I need to file a tax return for a gift agreement?

The issued certificate will become a guarantor of the transaction, which can be canceled only in exceptional cases and only in court. If the recipient decides to skip this step, then he can at any time lose the apartment, which, in fact, does not officially belong to him yet.

According to Art. 119.1 of the Tax Code, in case of violation of the established form for filing a tax return or violation of the method of filing a declaration in electronic form, such a taxpayer may be subject to a fine of 200 rubles.

At the same time, income received as a gift is exempt from taxation if the donor and donee are family members and (or) close relatives in accordance with the Family Code of the Russian Federation (spouses, parents and children, including adoptive parents and adopted children, grandfather, grandmother and grandchildren, full and half (having a common father or mother) brothers and sisters). For persons not named in this paragraph of Art. The list of close relatives is indicated in the Family Code. However, this norm applies only to the recipient. If the donor did not exercise his right to a property tax deduction earlier, and has already donated an apartment, he retains this right, and he can at any time collect the necessary package of documents and send it to the Federal Tax Service to receive a personal income tax refund. The described norms and rules apply not only to any entire housing, but also to a share of the apartment, the donation of which is duly formalized.

What are the consequences of late declaration?

Since the gift agreement comes into force only after it is registered with the territorial bodies of Rosreestr, these bodies, in the order of interdepartmental cooperation, transmit information about transactions of this kind to the tax office. Therefore, tax authorities have information both about the receipt of income and about the degree of relationship between the donor and the recipient. If this information is not available from the tax office for some reason, you need to provide it to the tax authorities yourself. Documents confirming the degree of relationship include birth certificates, passports, marriage registration certificates, certificates of change of surname, etc. To certify belonging to the same family, you will need to present a certificate of family composition, an act of cohabitation, etc. Gift to a close relative: is a declaration submitted? As already mentioned, the need to file a return arises as income is acquired that will be taxed. This is a very important element! If the type of income received is included in the list established in the tax code as a tax-free type of income, then a declaration does not need to be filed.

In the form you will need to indicate a special code that indicates the type of profit received. To receive real estate as a gift, this is code 4900. But if you are in doubt about how to fill out the form correctly, it is better to seek help from the inspection staff or fill it out together with a specialist in this field.

If real estate is transferred from a legal entity to an individual, the state in any case may demand from the latter a percentage of the income received. It is calculated in exactly the same way as when receiving property from an individual.

Methods for submitting a tax return

Form 3 personal income tax is a special type of declaration. It is needed to provide information when making transactions. From the point of view of the legislation of the Russian Federation, this form is a special document. It is transferred to the department of the relevant authorities at the recipient’s place of residence, so that the state has information about the latter receiving a certain profit.

This is interesting: Responsibility for failure to issue an invoice for an advance payment

At the same time, income received as a gift is exempt from taxation if the donor and donee are family members and (or) close relatives in accordance with the Family Code of the Russian Federation (spouses, parents and children, including adoptive parents and adopted children, grandfather, grandmother and grandchildren, full and half (having a common father or mother) brothers and sisters). For persons not named in this paragraph of Art. Donation of an apartment to a relative: gift tax The law establishes the obligation of the recipient to pay tax on income in the form of accepted property. The only exception is the donation of an apartment to a relative.

Rosreestr usually carries out registration within 10 days. But if the application was submitted through the MFC, then the period may be two weeks. The specified monthly period must be calculated from the moment of receipt of the certificate of ownership.

Tax return for a gift transaction

Tax Code of the Russian Federation, filing a tax return after a transaction for donating property subject to taxation (clause 18.1 of Article 217 of the Tax Code) is carried out before April 30 of the current or next year occurring after the transaction. Let us note that if the donee misses the specified deadline, the legislator regards it as a tax offense for which liability is provided. Attention According to Art. 119 of the Tax Code of the Russian Federation, a recipient who has missed the deadline for filing a tax return will be subject to penalties, the amount of which is tied to the amount of tax payable and the period of delay. If the deadline is missed for less than six months, the fine will be 5% of the tax amount for each month of delay. If the filing deadline is missed by more than six months, the tax authority has the right to apply penalties in the amount of 30% of the tax amount.

According to the general rule of tax legislation, it is not the specific benefit of the donee that is taxed, but the cost of the transaction. This value is determined according to the market or cadastral price of the donated property. For this reason, the law does not precisely determine who must file the declaration - the donor or the donee. But in practice, the tax is paid by the donee.

Deadline for filing a declaration

A very important point is to comply with the deadline for sending 3 personal income taxes to the Federal Tax Service. Only one month is allotted for this from the date of receipt of the certificate of registration of property in the property. Violation of the deadline entails a fine, therefore, this obligation to the tax authorities of the donee, established in the Tax Code of the Russian Federation, should be approached as responsibly as possible.

Thus, when executing a gift transaction, it is necessary to carefully study its tax consequences. Thus, when transferring housing or property to a close relative, a property deduction is not provided. At the same time, the transaction is not subject to personal income tax. If the relative is not close, then he will have to pay 13% of the value of the object received as a result of a gift, but he will also be able to receive a refund of part of the personal income tax (a more detailed example of the taxation of a real estate gift transaction can be found on specialized websites on the Internet). In other words, in this case, the amount of tax payable will also be zero. However, this calculation must be submitted in Form 3 of personal income tax to avoid penalties from regulatory authorities.

How to give an apartment to a relative

A person unaware of this issue may think that executing a contract for donating real estate to a relative is a simple procedure. However, this is not the case.

Difficulties begin already at the stage of collecting and preparing the necessary documents, as well as in the process of registering the deed of gift. The problems are of a legal nature, and therefore it is recommended to seek help from an experienced lawyer to solve them.

However, the greatest difficulties arise precisely in the issue of taxation of these transactions. Of course, here it is also better to trust a qualified specialist, however, if you yourself navigate this issue, it will definitely not be superfluous.

So, let’s take a closer look at the process of concluding a housing donation agreement. Some time ago, this document could not be recognized as legal without notarization.

Today, this norm is no longer mandatory. You have the right to choose: draw up the contents of the agreement on your own or seek the help of a lawyer or notary.

In order for the contract to be executed within the framework of the law, the following package of documents is required:

- Passport of the donor and recipient;

- Documentary confirmation of the right of ownership, use and disposal of the alienated apartment.

If a notary is involved in drawing up the agreement, he may request the following papers:

- Technical passport of the residential premises;

- Information from Rosreestr confirming the absence of restrictions on the apartment (arrest, pledge, etc.).

After completing the process of drawing up the document, you should register the fact of transfer of ownership in the local office of Rosreestr.

To do this, it is necessary that both parties to the agreement arrive at this institution at a certain time, sign the agreement, pay the state fee and submit the necessary documents for further registration.

Tax calculation when donating an apartment and payment procedure.

How to avoid paying tax when donating an apartment, read here.

Read about taxes when selling an apartment at the following link:

The list of these documents includes:

- Passports or other identification documents of the parties to the agreement;

- The contract itself;

- Documents confirming relationship;

- Information from the house register;

- Receipt for payment of state duty;

- Permission from the guardianship and trusteeship authorities (if one of the parties is represented by a minor or incapacitated person);

- Written consent of the spouse to alienate the apartment (if any);

- A power of attorney to execute a transaction, if there is a person who acts on it.

According to the law, two new documents must be issued by the registration authority. The donee receives a certificate of registration of ownership, and the donor receives a canceled document. These papers must be issued no later than 14 days after registration.

It happens that sometimes the period still extends to one month. Information about the deed of gift is also required to be sent to the tax authorities in order to withhold the corresponding tax.

Domestic civil law states that a gift is a gratuitous transaction and does not contribute to the emergence of any obligations for each party in relation to each other. The only obligation is the transfer of the apartment by the donor and its acceptance by the donee.

By the way, the recipient relative has the right to refuse the gift. It remains with him until the documents are signed. If the transaction has already been concluded, the donee still has the opportunity to cancel it. To do this, you need to submit a written application with mandatory state registration. In this case, the donor will be able to claim compensation for damage received as a result of the refusal.

Another unique feature of a gift deed that sets it apart from other real estate transactions is the possibility of a future gift. That is, you can conclude a kind of preliminary agreement.

It can be terminated by the donor if the transfer of this property would put his family in a difficult situation. Also, the preliminary agreement can be canceled if the donee has committed a crime against the donor or members of his family.