What is acceptance of inheritance?

What is receiving someone else's property through inheritance? This is a procedure that involves the transfer of rights to property from the testator to the heir, subject to compliance with the articles of the law on inheritance.

The procedure for a person to enter into inheritance rights involves acting on one’s own behalf, with the ability to agree, accepting property rights that came with the death of a relative, or to renounce them.

Important! The succession of the inheritance occurs only in full; the person receives savings, other valuables, and debt obligations left unfulfilled by the testator.

Legislative norms determine a person’s rights to receive valuables. If desired, the subject refuses to receive succession (if he does not agree to pay the debts of a deceased relative). The successor simply does not visit the notary within the six months required to obtain such rights, as a result of which the valuables are transferred to other legal successors, according to the queue established by law.

The acquisition of valuables under any conditions is prohibited; a person receives absolute rights to all objects or nothing.

Ways to accept an inheritance

Obtaining the opportunity to own the property of a deceased relative is possible after the subject has acquired the actions provided for by the legislative framework.

Methods for accepting an inheritance vary:

- notarial, in the presence of a will, or according to the methods established by law;

- through actual management and ownership of values.

When there are several legal successors, each of them has the right to independently exercise their will: agree to formalize the succession, or renounce this power. The person receives property, as well as debts, if any.

By will

Notarized wills are considered the best way to confirm the powers of the successor according to the property left to him by the testator.

The testator, when creating such a document, determines the conditions that are significant for him:

- to which successors the values will go (any persons are indicated who do not necessarily have family ties with the testator, having any gender, age, citizenship of any country): cases are not uncommon when completely strangers become heirs, while relatives are deprived of the right to inherit. An exception will be made for subjects who have the authority to acquire the obligatory part of inherited values, amounting to more than half of the share provided by law (for minor relatives, as well as persons who do not have the opportunity to work due to certain circumstances);

- what kind of property will go to a specific person;

- proportions of division of objects in the presence of several heirs;

- conditions for obtaining possessions.

Obtaining property according to the grounds of a will is possible when there is a notarized document reflecting the last will of the deceased person. Several such documents can be left; the last one will be considered legitimate. The paper must be in written form, supported by the signatures of the testator and the authorized person, and the seal of the notary’s office.

Restrictions on the testator’s freedom of expression of his own will relate to the following conditions:

- allocation of a mandatory portion of property to persons under the age of majority;

- mandatory acquisition of a share of the succession by persons who are disabled during the last year, living together with the testator, when they were completely on his financial support (spouses, parents, other dependents).

The will is irrevocable; if the rights of these categories are violated, the receipt of values, according to the document, becomes possible after the distribution of a share to the relatives, determined according to legal grounds.

In law

The Civil Code reserves the right to divide the property of a deceased person among several heirs, according to the law, subject to the following conditions:

- the deceased person did not write a will;

- the document left by the testator was declared invalid;

- the paper contains orders only regarding part of the property of the deceased;

- the heir indicated in the text does not agree to receive such rights;

- the heir under the will died before acquiring inheritance rights.

The legislation of the Russian Federation determines the totality of persons who have hereditary powers:

- First priority: children, relatives or those who have undergone the adoption procedure, as well as those born after the death of the testator, spouses, parents or adoptive parents of the testator. Management of assets inherited by minor successors is carried out by their legal representative.

- The deceased subject's siblings and grandparents. This queue receives rights on the condition that no one from the first was able to obtain rights, refused them, or was deprived according to legal grounds.

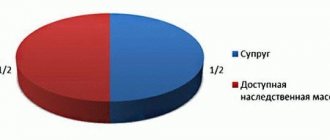

- Uncles and aunts, great-grandparents. Each person has the same rights and acquires equal shares of the inherited property. With the exception of the inheritance received by the spouse of a deceased person, when his share is initially established, then the remainder is divided equally among other legal successors.

Who is the actual recipient of the inheritance?

» To help the heir September 09, 2020

Home > Inheritance > Inheritance procedure > Actual acceptance of inheritance: step-by-step actions of the heir and features of paperwork

Actual acceptance of inheritance: step-by-step actions of the heir and features of paperwork

After submitting an application to the court to accept the inheritance (see an example example here), in the absence of difficulties and other persons presenting rights, the inheritance is actually accepted and the rights are entered into.

However, there is another way to accept inherited property - to become an actual heir. That is, to act as if the rights have already been issued and the property is his property.

Becoming the actual owner of the property left behind does not necessarily mean living in the testator’s living space; it is enough to start (or continue) using things from the inheritance within the time limits prescribed by law.

There is no need to fuss and try to be very active in relation to the rest of the property, since the law stipulates that you cannot inherit only what you liked and leave the rest to the mercy of fate.

By accepting what was left by the deceased, even in the form of a symbolic object, the potential heir thereby expresses the desire to become a very real owner of everything else.

To inherit an apartment where the testator lived, it is not necessary to quickly register there. It will be quite convincing if you do at least:

- minor repairs

- pay off utility debts

- Replace the locks on the front door.

- takes possession or manages the abandoned property

- pays the testator's debts, loans, utility debts from his own pocket

- carries out repairs and solves problems arising during property maintenance

- prevents claims, takes measures to ensure the safety of property,

- living in an inherited house, updating furniture, plumbing

- use of books, equipment, personal belongings, etc.

- caring for domestic plants and animals (including farm animals: rabbits, goats, chickens)

- planting on a plot owned by the testator, making a profit from the land, caring for the garden

- use of vehicles that do not require registration (mopeds, bicycles)

- construction of new buildings on the site, for example, a garage

- using the testator’s garage is a very common practice, and it’s good if there are witnesses to this fact

- using the postal address of the ancestral home for your own correspondence.

- on establishing the fact of acceptance of an inheritance, in a special proceeding, is submitted by the sole heir (we suggest that you familiarize yourself with a sample application)

- if there is disagreement between the heirs, a statement of claim. Here there are special cases, for example, it is necessary to determine the shares of property or to include additional property in the inheritance mass (an approximate sample application for the inclusion of property in the inheritance mass is presented here).

- Direct ownership or management of inherited property. This action implies, for example, actual residence in a house that is the object of inheritance, or the use of a car on a permanent basis

- Carrying out actions to ensure the safety of property, its integrity and inviolability. Such actions include the costs of installing fences in the local area, installing locks and security alarms

- Payment of property maintenance costs (payment of housing and communal services, mandatory taxes and fees, costs of cosmetic or major repairs, fees for the use of other resources, etc.)

- Repayment by an heir of the testator's debts. which are directly related to the inheritance object.

- Information certificates from housing departments or local government bodies about the heir’s residence in a residential property that is the object of inheritance

- Copies and originals of payment documents confirming payment by the heir of utility bills, costs of maintaining or repairing the property of inheritance

- Contracts and other agreements indicating the performance of work or provision of services at the property of inheritance.

- took possession or management of inherited property

- took measures to preserve the inherited property, protect it from encroachments or claims of third parties

- made at his own expense expenses for the maintenance of the inherited property

- paid at his own expense the debts of the testator or received funds due to the testator from third parties.

- continues to live or moves into the testator’s apartment

- pays all expenses related to the inherited property (utility payments, taxes and fees, fines)

- repairs or maintains property in proper condition

- protects the inheritance from encroachment.

- The place of opening of the inheritance is determined by

- Can a mother disinherit her son?

A person who has spent his personal funds, in the absence of claims from other heirs, is considered to have declared his inheritance right and becomes the full owner of the home.

How legal is it to actually take over?

There is no need to worry, the actual inheritance is as legal as receiving the relevant papers from a notary.

If there is an heir who disposes of the property, but has not submitted the necessary petitions, he has equal rights with the heir who, without living in the living space and without using anything from the inheritance, received documents on the sole ownership of the property. In this case, the property will be divided equally, in equal shares.

This is important: taking possession of the testator’s property is fraught with risks, since after repairs and all expenses a person may appear who will demand his share, or even the entire inheritance.

In this case, the problematic inheritance is resolved through the court.

According to the law, if the deceased did not have title documents, this does not mean at all that there were no rights to the property. If parents actually inherited a home that was owned by their parents and did not register it properly, they still became its owners.

That is, by living in his parents’ apartment, a citizen becomes its owner, even if his parents do not have the necessary papers. To recognize ownership rights to it, you will have to go to court.

Actions indicating actual acceptance of inheritance

In order to become an actual heir, it is necessary to perform certain, almost demonstrative, actions that will make it clear that a person treats the property as his own and is ready to bear the costs and hassle of maintaining it.

If the person with inheritance rights:

we can say with complete confidence that the applicant for the inheritance accepts it in the same way as if he acted by legal (formal) actions, i.e. I would write at the notary's office an application for acceptance of the inheritance or an application for the issuance of a certificate of inheritance.

You can specify the above a little to understand that the list of possible actions can be much wider. Here is a list (not complete) of measures:

The list of actions necessary to recognize a person as an heir is specified in Art. 1153 of the Civil Code of the Russian Federation, it can be clarified that for each case, the establishment of the fact of entry into inheritance rights is carried out individually.

It is better to carry out these actions within the period prescribed by law - six months are given for this (Article 1154 of the Civil Code of the Russian Federation). If this deadline is missed, then the heir can file a claim to restore the deadline for accepting the inheritance (Article 1155 of the Civil Code of the Russian Federation).

In any case, whenever the rights to the property of the testator that arise are formalized, and whenever the fact of entry into property rights is established, they belong to the heir from the moment the inheritance case is opened with a notary (Article 1152 of the Civil Code of the Russian Federation). It is not uncommon for people to live for years, for example, in an inherited apartment, without registering their rights, but potentially having them.

Take note: after all, it is better to formalize the rights to inherited property, since without the appropriate documents it is impossible to make transactions with real estate, for example, rent it out, or draw up a will.

What documents to provide

You must apply to the court:

It is good if the fact of use of the testator’s property is confirmed by eyewitnesses, as well as photo and video materials, documents (checks, receipts).

Once you start using property or living in the testator’s house, it’s a good idea to enlist the support of relatives, friends, neighbors - anyone who can confirm the fact of using the inheritance.

If documents evidencing acceptance of the inheritance in fact are missing, have not been collected, or have been collected in inconclusive quantities, you should file an application with the court to establish this fact - acceptance of the property into ownership (Chapter 28, Civil Procedure Code of the Russian Federation), and also apply to an experienced lawyer.

Of course, all this applies to the person who has rights to the inheritance left. All of the above does not mean that anyone can take ownership by chance. This may be the heir of the first line - close relatives. if there are none, then the second, third stages.

In any case, a citizen who can be recognized as an heir from the point of view of the law can enter into actual inheritance.

From the following video you will learn what actual acceptance of an inheritance is:

08/13/2016 at 12:11

Please tell me. I lived in the same city with my grandmother and always helped her. She died and did not formalize the inheritance for anyone. I moved into her apartment, made repairs and everything else in the hope that she had no one but me and the apartment would become my property. But suddenly my cousin arrives from Italy and claims the apartment. Does she have any rights if she is not registered there, and she hasn’t seen her grandmother for seven years?

Actual acceptance and entry into inheritance

In accordance with the Civil Code of the Russian Federation, registration of inheritance rights is also possible in the case of inheritance by default. In this situation, the actual entry into the inheritance is considered from the position of the presumption of inheritance, i.e., unless otherwise proven, the heir is considered to have accepted the inheritance and is its full legal owner under certain conditions.

Conditions for entering into inheritance by default

In accordance with paragraph 2 of Art. 1153 of the Civil Code of the Russian Federation by the actions of the heir confirming his actual acceptance of the inheritance. are:

List of required documents

The main package of documents to be submitted to the notary and confirming the fact that the heir has actually accepted the inheritance consists of:

Practice shows that the process of registering an inheritance, provided that the heir actually enters into it, does not require the participation of a human rights activist or lawyer. The standard procedure does not contain any difficulties or problems in registration. All the main procedural work is carried out by a notary, and the heir is only required to provide certificates and other necessary documents.

In the case when the notary refuses to formalize the actual acceptance of the inheritance for lack of a complete evidence base, or there are other objective reasons that prevent the registration of the inheritance. then you should seek qualified legal assistance. Specialists in this field will be able to competently draw up a statement of claim and carry out a number of activities necessary to submit it to court.

Actual acceptance of inheritance

It is recognized, until otherwise proven, that the heir has accepted the inheritance if he has performed actions indicating the actual acceptance of the inheritance. in particular, if the heir (clause 2 of Article 1153 of the Civil Code of the Russian Federation):

The list of these actions is open, i.e. may be supplemented by other actual actions indicating that the heir has an intention to accept the inheritance.

What does “until proven otherwise” mean? - If, for example, the heir paid the testator’s debts at his own expense or, on the contrary, received money from the testator’s debtor, then it is assumed. that he did this not out of altruistic motives or, on the contrary, out of greed, but in order to express in this way his will to accept the inheritance. However, this assumption can be refuted, and the burden of refuting it rests with the person interested in this, for example, with another heir.

Subsequently, notarized acceptance of the inheritance is possible

Acceptance of an inheritance by actual actions does not exclude the subsequent application of the heir to a notary with an application for the issuance of a certificate of the right to inheritance. If the inheritance is actually accepted, then to notarize its acceptance, you can contact a notary at any time, the period is not limited by law.

However, often the heir does not have sufficient evidence for the notary to accept the inheritance through actual actions, therefore the fact of acceptance of the inheritance has to be established in court (Article 264 of the Code of Civil Procedure of the Russian Federation). In such cases, based on a court decision, the notary issues a certificate of inheritance.

What other actions are regarded as actual acceptance of the inheritance?

Let us give further examples of actions regarded by judicial practice as the actual acceptance of an inheritance. Let us emphasize once again that the list of such actions is open, i.e. may be supplemented by other actions.

If the heir takes specific things from the testator's house and keeps them for himself, if the heir cultivates the plot of land and harvests from it - all this is regarded as actual acceptance of the inheritance.

The residence of the heirs after the death of the testator in the same residential premises that he used is always considered as acceptance of the inheritance, since the heirs actually take possession of things belonging to the deceased. The duration of such residence after the death of the testator does not matter.

The presence of bonds or a letter of credit addressed to the testator in the heir's hands is regarded as evidence of acceptance of the inheritance.

Filing a claim with the court for the division of inherited property or with a statement to establish the fact of a family relationship with the testator in connection with the need to formalize inheritance rights is regarded as evidence of acceptance of the inheritance.

Actual acceptance of inheritance

FIRST CAPITAL LEGAL CENTER

Phones: (495) 649-41-49, 64-911-65

Actual acceptance of inheritance

Almost all of us are potential testators and heirs, and questions such as where to go, what to do and in what time frame are important for everyone to know. Knowledge of some rules of inheritance law, in particular those related to accepting an inheritance, methods of accepting an inheritance, and deadlines for accepting an inheritance will help you avoid many problems, as well as resolve problems that have arisen. There are times in life when a relative living with you dies (in legal language this is called the time of opening of inheritance). Many people think that if at the time of opening the inheritance they lived in the same apartment as the deceased, then there is no need to enter into an inheritance and issue a certificate of inheritance. But then the moment comes when you need to make some kind of transaction related to the alienation of real estate, for example, its sale, and not everything is in order with the documents for this real estate, i.e. a previously deceased relative still appears in them. In this situation, you cannot do without going to a notary. From the date of opening of the inheritance, the heirs have the right of inheritance. This right provides heirs called to inherit an alternative opportunity to accept the inheritance or refuse it. By virtue of the direct instructions of the law, in order to acquire an inheritance, the heir must accept it. Of course, this does not mean imposing any obligation on the heir; he is free to accept the inheritance or refuse it. But if he wishes to accept the inheritance, then his will must be expressed one way or another, since the acceptance of the inheritance, both for the heir himself and for other persons, is associated with a number of legal consequences. Current legislation provides for two ways to accept an inheritance: 1. Legal acceptance of an inheritance by submitting an application for acceptance of the inheritance to a notary at the place where the inheritance was opened. In this case, you must contact a notary within six months from the date of death of a relative with whom you jointly owned an apartment or owned and lived together in it. 2. Actual acceptance of an inheritance. In life, situations often arise when the heir, for one reason or another, does not apply to the notary at the place of opening of the inheritance within the 6-month period established by law for accepting the inheritance. However, he continues to live, for example, in an apartment that is part of the inheritance estate, takes measures to preserve this property, pays utility bills, etc. i.e. commits such actions that clearly indicate his attitude towards the inherited property as his own and, therefore, his intention to acquire the inheritance. In this case, taking into account all the circumstances, we can talk about the actual acceptance of the inheritance. In accordance with the norms of the current legislation, it is recognized, until otherwise proven, that the heir accepted the inheritance if he performed actions indicating the actual acceptance of the inheritance, in particular if the heir: 1. took possession or management of the inherited property 2. took measures to preserve the inherited property property, protecting it from attacks or claims of third parties. These measures include, for example: installing a lock or equipping the testator’s apartment with a security alarm; moving certain things from the testator’s apartment to one’s place in order to preserve them - contacting a notary or other official with an application to take measures to protect the inherited property; filing a claim by the heir against persons , who unjustifiably took possession of the inheritance, etc. 3. made at his own expense expenses for the maintenance of the inherited property 4. paid at his own expense the debts of the testator or received funds due to the testator from third parties. The actual acceptance of the inheritance by the heir also occurs in cases where the heir did not live together with the testator, but he has inherited property in joint or shared ownership with the testator, that is, when the inherited property is in common ownership of the heir and the testator, based on the norms of the Civil Code Russian Federation, participants in common property (including shared ownership) jointly own and use common property. After the death of the testator, the heir retains the same rights as a co-owner in relation to the inherited property that was in their common ownership. Evidence of the heir's actual entry into possession of the inherited property may be a certificate from the housing and communal services authority or local administration stating that the heir at the time of the testator's death lived together with the testator, a certificate from the tax authority stating that after the opening of the inheritance the heir paid the appropriate taxes, a certificate from the local administration that the heir used the inherited real estate, as well as other documents indicating the actual entry of the heir into possession of the testator's property. If the heir has committed actions indicating the actual acceptance of the inheritance, then in this case the law does not require the heir to submit an application for acceptance of the inheritance. However, it should be borne in mind that actions for the actual acceptance of the inheritance must be performed by the heir within the period established for acceptance of the inheritance (the total period is within six months from the date of death of the testator). The time limit for applying to a notary to obtain a certificate of the right to inheritance by the heir who actually accepted the inheritance, as well as by the heir who accepted the inheritance upon application, is not limited by law. Even if the heir who accepted the inheritance by performing certain actions does not appear to the notary in person, but in the inheritance file there are documents confirming his acceptance of the inheritance, the notary is obliged to take into account his share when registering the inheritance by other heirs, i.e. leave it open. I would also like to note that the actual entry into possession of at least part of the inherited property is considered as acceptance of the entire inheritance, no matter what it consists of, no matter where it is located. There are also cases when the heir actually accepted the inheritance, having performed one of the above actions, but cannot provide the necessary supporting documents, and the deadline established for accepting the inheritance has been missed, the notary explains to him that in this case he has the right to apply to the court on recognition of the fact of acceptance of the inheritance in accordance with paragraph 9 of Art. 264 of the Civil Procedure Code of the Russian Federation, which is considered by the court in a special proceeding

If you have any questions, we recommend making an appointment with our specialists by calling:

8 (495) 64 911 65 or 8 (495) 649 41 49 or 8 (985) 763 90 66

Attention! Consultation is free of charge.

You can get a free consultation in the Lawyer section On-Line

How does the actual acceptance of an inheritance take place?

The actual acceptance of the inheritance means that the citizen has entered into ownership rights by performing any actions that prove this. The law allows two ways of inheritance: actual acceptance of the inheritance and submission of a corresponding application to the notary.

What are the actual actions?

Almost all citizens are potential heirs. But sometimes the death of a loved one unsettles relatives. For various reasons, they cannot contact a notary in time to submit an application, and miss the period allowed by law, equal to 6 months.

If there is actual entry into inheritance, then it can be proven by any actions confirming this. For example, it is considered that the heir has actually assumed his rights if:

This list is very arbitrary. In fact, establishing the fact of acceptance of an inheritance can be confirmed by many actions, including testimony.

We must remember that accepting part of the inheritance is unacceptable. You can accept either all of the inherited property or nothing. For example, a grandson took one book from his deceased grandfather’s library. By this action, he automatically becomes the owner of all his grandfather’s property, even if the latter, in addition to the library, had three more apartments and two cars. But if the grandfather had debts, then the grandson inherits them too.

Judicial practice shows that situations where there are two or more heirs are more common.

And it happens that one heir submitted an application to the notary to take ownership, and the second actually accepted it. For example, a daughter lives with her father in his apartment, a son lives separately in his own home. Father dies. The son submits an application to the notary's office, and the daughter continues to live in the same apartment, pay utilities, and maintain the housing in proper condition. The 6 months allotted by law have passed. The son receives a certificate of inheritance for all of his father's property. The daughter has the right to apply to a notary to accept ½ share of the inherited property. If the notary refuses to establish the fact that the second heir accepted the inheritance, then the daughter has the right to go to court.

How to prove your inheritance?

Proving the actual acceptance of an inheritance will not be difficult if you take care of it in advance. It is necessary to obtain all documents that can confirm this fact in the future. When paying taxes, utilities, repair costs, etc., you must save all receipts or paid bills. Any money spent on inherited property must be documented.

The fact of living in the inherited apartment is confirmed by a certificate from the housing maintenance office.

You can obtain the testimony of those people who saw that the heir actually entered into the inheritance.

For example, an elderly woman dies, whose only heir is her granddaughter living in another city. Having buried her grandmother, the heiress makes minor cosmetic repairs to the apartment without having time to submit an application for accession to inheritance rights. But by contacting a notary, even after exceeding the time allotted by law, she will definitely receive recognition of her rights. This will happen, of course, provided that the heiress provides documents or testimony that it was she who carried out the renovation of the apartment.

How to get a certificate?

It is not necessary to contact a notary's office to certify the fact of acceptance of the inheritance. However, if a citizen wishes to receive a certificate of the established form, i.e. If everything is formalized according to the law, then a trip there cannot be avoided.

State notary offices handle inheritance matters. But now there are more and more private notaries and fewer and fewer public ones. Therefore, in those regions of the country where there is no public notary, the notary chamber, together with the territorial executive authorities, instructs one of the private notaries to deal with matters in the field of inheritance. You can find out where such a person receives from your local administration.

After collecting all the necessary documents, the heir can submit an application. If the evidence is obvious and satisfies the notary, then recognition of the actual acceptance of the inheritance will follow and the future owner will receive the appropriate certificate.

If the notary refuses to confirm the fact of acceptance of the inheritance, then you can contact the notary chamber of the entity where the inheritance was opened, or the court.

For example, after the death of her parents, the daughter actually accepted an inheritance in the form of an apartment, but did not formalize it. After some time she dies. The son of this heiress (i.e., the grandson of the daughter’s parents) submits an application to the notary’s office, where he is denied a certificate of inheritance. citing the fact that the mother did not have title documents for the apartment. But the court to which the heir applies recognizes his mother’s actual acceptance of the inheritance and, accordingly, his right to this apartment.

Sources: naslednik.guru, www.nasledconsult.com, vashenasledstvo.ru, portal-law.ru, nasledstvo03.ru

Next:

No comments yet!

Share your opinion

You might be interested in

Is it possible to sell a share of a minor child's inheritance?

Is it possible to drive a car before entering into an inheritance?

Cost of filing an application for acceptance of inheritance

What is needed to register an inheritance

Popular

Is it necessary to do land surveying when entering into an inheritance (Read 190)

Is it possible to register an inheritance with different notaries (Read 83)

Entry into inheritance in Lithuania (Read 83)

Divorce about inheritance by mail (75 read)

The procedure for accepting an inheritance

The procedure and terms for accepting an inheritance are specified by legislative acts; they can be established by testamentary disposition. The procedure has minimal differences in the documents submitted:

- heirs receiving rights under the will must provide this paper;

- legal successors - confirm the presence of family ties, these are the determining grounds.

Legal, testamentary successors can follow the algorithms established by law: property can be received on legal (by contacting notaries), factual (during the performance of actions confirming the very fact of accepting the inheritance) grounds.

Persons established by the order of inheritance, as well as other applicants, after receiving a written will, begin collecting supporting documents to present their own powers.

Submitting an application to a notary

First of all, a subject who has expressed a desire to obtain property rights must contact an employee of a notary office. This will be an institution related to the place of residence of the deceased subject or the area where his property is located.

An application for acceptance of possession must be in simple written form and contain information:

- name of the notary institution;

- surname, name, patronymic of the heir, testator, as well as their place of residence;

- dates of birth and death of the testator;

- place and date of opening of the inheritance case;

- description of the property constituting the estate, its estimated parameters, characteristics (provided that they are known to the successor);

- intention to alienate possessions, property rights;

- designation of methods (legal or testamentary) of inheritance of values;

- time, date when the document is submitted;

- successor's signature.

The application can be submitted not only in person, by directly contacting a notary, but by sending a registered letter (when the office is located in another city) or transferring the right to represent oneself to a trusted person (with notarization).

Actual acceptance of inheritance

The fact of acceptance of an inheritance is not necessarily formalized by law; some cases make it possible to confirm the fact of inheritance by performing actions recognized as the actual acceptance of an inheritance.

Legislative practice allows you to obtain powers in two ways:

- legal transaction : a citizen performs the actions necessary to acquire the appropriate certificate from a notary, after which he receives the authority to own property;

- by actual actions the subject confirms that he owns and manages the property transferred to him after the death of the original owner. The path involves acquiring a court decision with the provision of certificates and invoices confirming his actions in property management.

If a case arises when the existing deadlines for acquiring the inheritance have already passed, the subject still has such a right. The main thing is to provide documents confirming that the missed deadlines occurred for valid reasons:

- within six months, after the death of the testator, the successor must take actions confirming his desire to become an heir. This includes moving into a deceased relative’s apartment, repaying the deceased’s loan obligations, repairing a garage, and more. Such actions can be carried out by the subject, as well as third parties;

- preserve any documentation confirming the activities related to the actual receipt of the inheritance (agreements, paid bills, certificates);

- submit documents to a notary, submit an application for a desire to receive a certificate of inheritance;

- pay the state fee;

- receive the document.

Important! The expired entry period can be extended according to a court decision; to obtain the latter, you must submit a statement of claim and submit the necessary documentation.

Acceptance procedure

According to the order, the acceptance procedure looks like this:

- prepare documents and provide them to a notary (passport, certificate confirming the death of a relative, certificates of his last place of residence, deregistration, will, documents on family ties, title documentation of property - cadastral, appraisal, technical, registration);

- assess the value of the property;

- pay the duty, it is based on the valuation of the property: close relatives pay 0.3%, and distant relatives - 0.6% (when the heirs lived with the testator before and after his death, they are exempt from paying the duty);

- receive a document;

- register the right to property, obtain an extract from the Unified State Register of Real Estate.

From the moment the succession is opened, the citizen becomes a full heir, provided that he has not formalized a refusal of the inheritance.

As a general rule, an inheritance can be accepted within

» Controversial issues September 09, 2020

Inheritance law. Test 2

1. A certificate of the state’s right to inheritance is issued on the day the will is announced three days after the death of the testator after 6 months from the date of opening of the inheritance on the day of opening of the inheritance

2. Heirs of the second priority are called upon to inherit by law if there is an expression of will of the heirs of the second order, if there is a will by agreement between the heirs, in the absence of heirs of the first order or if they do not accept the inheritance, and also if the heirs of the first order are deprived by the testator of the right to inherit

3. Extension of the established period for accepting an inheritance can be done by the court, carried out by a notary at the request of the heirs, not allowed if such a condition is in the will

4. The state to which the inherited property was transferred is not liable for the debts of the testator; it is responsible within the limits of the value of the entire estate determined in the will; it is liable with all its property; it is liable within the limits of the actual value of the property transferred to it.

5. As a general rule, an inheritance can be accepted within ten years from the date of opening of the inheritance twelve months from the date of opening of the inheritance five years from the date of opening of the inheritance six months from the date of opening of the inheritance

6. A foreign citizen cannot be an heir under a will; can only be if there is an appropriate international agreement; can only be if there are family relations with the testator

7. The clause on the irrevocability of a will is a valid, voidable, imaginary transaction void

8. Is a “closed will” allowed under current legislation, when the testator does not provide the notary and other persons with the opportunity to familiarize themselves with its contents, yes only if the testator is fully capable no

9. Of the listed methods of making transactions, a will can be executed by the following(s) by proxy through a representative acting in person on the basis of the law

10. The heir by law can be legal entities, adult citizens, individuals and the state, any person

11. A. bequeathed his house to M. and all other property - O. M. renounced the inheritance in favor of the state. The house passes to the heirs of the first stage O. state heirs by law

12. The imposition by the testator of the responsibilities of property order on the heir is called inheritance by representation of the testamentary refusal of the estate by hereditary transmission

13. The rules on restoring the statute of limitations for the time limits for filing claims by creditors of the testator do not apply; apply if we are talking about inheritance by will; apply; if we are talking about inheritance by law; apply

14. Partial renunciation of inheritance is allowed if we are talking about inheritance by law; allowed; allowed; if we are talking about inheritance by will; not allowed

15. Can intangible benefits be the subject of inheritance? No, but they can be protected by relatives

no Yes

Other entries from the category

Article 1154. Time limit for accepting an inheritance

1. An inheritance can be accepted within six months from the date of opening of the inheritance.

If an inheritance is opened on the day of the expected death of a citizen (clause 1 of Article 1114), the inheritance can be accepted within six months from the date of entry into legal force of the court decision declaring him dead.

2. If the right of inheritance arises for other persons as a result of the heir’s refusal of the inheritance or the removal of the heir on the grounds established by Article 1117 of this Code, such persons may accept the inheritance within six months from the date on which their right of inheritance arises.

3. Persons for whom the right of inheritance arises only as a result of non-acceptance of the inheritance by another heir may accept the inheritance within three months from the date of expiration of the period specified in paragraph 1 of this article.

Commentary to Art. 1154 Civil Code of the Russian Federation

1. After the opening of the inheritance, the property that belonged to the testator becomes subjectless. Therefore, there is uncertainty about whose things the testator now owns, who is the bearer of his rights, who should fulfill his duties. Accordingly, the debtors of the testator and his creditors experience difficulties. This situation should not exist for long, because due to the noted circumstances it has a negative impact on civil circulation as a whole. This is on the one hand. On the other hand, a certain period of time is necessary for the heirs to learn about the opening of the inheritance, for their will to become legal successors of the testator to be formed, for actions to be taken indicating acceptance of the inheritance (filing an application or actually accepting the inheritance - Article 1153 of the Civil Code).

The article in question establishes a period during which heirs who wish to become legal successors of the testator must express their will to accept the inheritance. This is the period during which the right of inheritance can be exercised. After this period, as is commonly believed, the right is terminated (preventive period). True, this is a strange termination of rights. Firstly, the court can restore the term. Secondly, with the consent of all heirs who accepted the inheritance, an heir who missed the deadline can accept the inheritance without going through the judicial procedure (Article 1155 of the Civil Code).

2. As a general rule, the period for accepting an inheritance is six months from the date of opening of the inheritance.

As is known, when a citizen is declared dead, the inheritance opens on the day the court decision enters into legal force, and if the day of the citizen’s death is recognized as the day of his presumed death, then on the day of death specified in the court decision (clause 1 of Article 1114 of the Civil Code). However, in both cases, the period for accepting the inheritance is calculated from the date of entry into force of the court decision declaring the citizen dead and is also equal to six months. At first glance, such an establishment of the moment when the period begins to run appears illogical for those situations where the inheritance opens on the day of the expected death. However, there is legal and everyday logic in this. Until the court decision to declare a citizen dead comes into force, the day of his expected death has not yet been established and he has not yet been declared dead. Consequently, the heirs cannot yet accept the inheritance (before the court decision comes into force). And if the period for accepting the inheritance was calculated from the date of the alleged death, then the heirs would generally be deprived of the opportunity to accept the inheritance, since in appropriate cases a citizen can be declared dead only after six months after he disappeared under circumstances threatening death or giving reason to assume his death from a certain accident (clause 1 of article 45 of the Civil Code).

3. For some heirs, the right of inheritance arises not from the date of opening of the inheritance, but later.

Thus, inheritance by law takes place when and insofar as it is not changed by a will, as well as in other cases established by the Civil Code of the Russian Federation (Article 1111). Therefore, if all the property of the testator is bequeathed in favor of one or several persons, then, as a general rule, only these persons have the right of inheritance. If these persons refuse to accept the inheritance, the rules on inheritance by law begin to work, and the right of inheritance appears to the heirs by law. They can accept the inheritance within six months. The period must be calculated from the date their right of inheritance arises. Such a day in this case is the day of refusal of inheritance by the person to whom the property was bequeathed.

The same rules apply in other cases when someone has the right to inherit as a result of the heirs’ refusal to accept the inheritance (if the heir specified in the will refuses the inheritance, then within the specified period the inheritance can be accepted by the designated heir if, when inheriting by law, all heirs of the previous line have refused the inheritance, then the right of inheritance of the next line arises, which can be exercised within the specified period).

It seems that it is more difficult to determine the beginning of the period for accepting an inheritance if there are circumstances provided for in Art. 1117 of the Civil Code of the Russian Federation, which is referred to in paragraph 2 of the commented article. In paragraph 1 of Art. 1117 of the Civil Code of the Russian Federation names persons who do not inherit either by law or by will. Consequently, they do not have the right of inheritance; such a right from the date of opening of the inheritance arises for other heirs (sub-designated heirs, successive heirs). From this day the six-month period for accepting the inheritance begins. If the court excludes from inheritance by law citizens who have maliciously evaded fulfillment of duties to support the testator, then in the absence of heirs in the same line as the citizen excluded from inheritance, the right to accept the inheritance arises from the heirs of the next line. This right arises from the moment the court decision on exclusion from inheritance comes into force. It is from this day that the six-month period for accepting the inheritance should be calculated.

4. Non-acceptance of an inheritance occurs when the heir is inactive (he does not refuse the inheritance, but does not accept it either) (see commentary to Article 1152 of the Civil Code). The heir may accept the inheritance at any time within six months from the date he acquired the right to inherit, including on the last day of this period. This means that it can be stated that the heir did not accept the inheritance only after this period had expired. The right of inheritance arises for other heirs: for a sub-designated heir under a will, if the heir under the will did not accept the inheritance from the heirs by law, if the heirs by law did not accept the inheritance from the heirs of the next priority, if the heirs of the previous order did not accept the inheritance.

These persons can accept the inheritance within three months from the end of the six-month period from the date of opening of the inheritance.

During hereditary transmission, if after the death of the heir part of the period established for accepting the inheritance is less than three months, it is extended to three months (see Article 1156 of the Civil Code and the commentary thereto).

Deadline for accepting inheritance

1. Actions for accepting an inheritance are carried out within the time limits established by law; the period for accepting an inheritance begins from the day specified in the law.

General period for accepting an inheritance

As a general rule, an inheritance can be accepted within 6 (six) months from the date of opening of the inheritance (Part 1 of Article 1154 of the Civil Code of the Russian Federation).

The day of opening of the inheritance is the day of the citizen’s death. When a citizen is declared dead, the day of opening of the inheritance is the day the court decision to declare the citizen dead comes into force. In the case of the alleged death of a citizen, the day of death is recognized as the day specified in the court decision (Article 1114 of the Civil Code of the Russian Federation), and therefore is the day of opening of the inheritance, however, the calculation of the six-month period in this case begins from the day the court decision enters into force (Clause 1 of Art. 1154 Civil Code of the Russian Federation). It should be assumed that in this case the law establishes a special approach for calculating the six-month period.

General rules for calculating deadlines are provided in Chapter. 11 of the Civil Code of the Russian Federation.

In Art. 191 of the Civil Code of the Russian Federation provides for the beginning of a period defined by a period of time, which begins the next day after the calendar date or the occurrence of an event that determines its beginning. Consequently, the period established for acceptance of an inheritance, as a general rule, begins the day after the day of opening of the inheritance, and with special deadlines for accepting an inheritance - the next day after the occurrence of the event, i.e. after the day from which the heir's right of inheritance arose.

Since the period calculated in months, according to Art. 192 of the Civil Code of the Russian Federation (clauses 1 and 3), expires on the corresponding date of the last month of the period, the period for accepting an inheritance, as a general rule, expires on the corresponding date of the sixth month. For example, the testator died on January 18, 2010. The period for accepting the inheritance began on January 19, 2010. Therefore, the six-month period for accepting the inheritance expires at 24 hours on July 19, 2010.

If the end of the period established for accepting an inheritance falls on a month in which there is no corresponding date, then the period expires on the last day of this month (paragraph 3 of clause 3 of Article 192 of the Civil Code of the Russian Federation). For example, the death of the testator occurred on March 30, 2010. The period for accepting an inheritance begins to run on March 31 of this year, since the six-month period expires on the 31st, and in September there is no such date, which means that the last day of the period for accepting an inheritance is September 30, 2010 G.

If the last day of the period falls on a non-working day, the end of the period is considered to be the next working day following it (Article 193 of the Civil Code of the Russian Federation). Non-working days are considered to be weekends and non-working holidays (Articles 111 and 112 of the Labor Code of the Russian Federation). When accepting an inheritance on the last day of the term, the inheritance is recognized as accepted on time:

- if the application for acceptance of the inheritance is submitted personally to the notary before the end of his working day on the last day of the term

- if the postal item with the heir’s application for acceptance of the inheritance is delivered to the communications organization before twenty-four hours of the last day of the deadline, even if it was received by a notary after the expiration of the period established for acceptance of the inheritance (Article 194 of the Civil Code of the Russian Federation).

Special deadlines for accepting an inheritance

Special deadlines for accepting an inheritance are established by law for cases where the right of inheritance does not arise from the moment the inheritance is opened.

When can an inheritance be accepted?

Deadlines are one of the main components in inheritance law. In particular, if you do not comply with the time frame of the inheritance process, you can significantly complicate the process of its implementation. The legislation provides for different periods for accepting an inheritance, based on the circumstances affecting its duration.

Total term

The main principle of registering a legacy: its terms do not depend on how the succession is carried out - by law or based on the contents of the will.

If the successor is called to inherit on several grounds (according to the law, a will or as a result of transmission), he can exercise his rights under one of them or all at once.

The date on which the inheritance is considered open is the day following the day of death of the relative. This issue is regulated by Art. 1114 of the Civil Code of the Russian Federation. Representatives of the deceased are issued a medical report (certificate) containing the date and time of death, on the basis of which the exact date of opening the inheritance case becomes known. It is from this day that the report is taken, when the inheritance, as a general rule, can be accepted within six months.

If the testator was considered missing and his date of death was determined by the court, then the date of opening of the inheritance is set as the day on which the decision comes into force. The same rule applies when a judge sets the day of death of a relative.

Special dates

Rules of Art. 1154 of the Civil Code of the Russian Federation regulates the inheritance process in the event that the primary heir renounced his rights and was also removed by court as unworthy. In such a situation, the general period is extended by six months from the date the legal successor commits these actions.

An example would be circumstances where all participants in the previous line refused to participate and representatives of the next line are called upon by law to exercise their inheritance rights. In this case, the total period begins to count from the day when all participants in the first stage refused, or the last of them, if their refusals occurred at different times.

If the primary successor has not accepted his part of the inheritance, the duration of the exercise of the rights of the subsequent heir is 3 months from the date of expiration of the general period from the moment of death of the relative or the entry into force of the judge’s decision on his death.

Special deadlines also include the situation when the heir has not yet been born. The period of 6 months is then calculated from the date of his birth.

The duration of acceptance of property by inheritance transmission is equal to the remainder of the total period, but not less than 3 months from the date of opening the inheritance case.

Skip date

There are often cases when there is a will, but the deadline is missed. One of the reasons for this is the incorrect calculation of the period for accepting the inheritance.

The norms of the Civil Code of the Russian Federation establish that when a period consists of months, it ends on the corresponding date of the last month of the established period. For example, a relative died on January 4, 2017, then January 5, 2020 is the day the legacy was opened, therefore, 6 months expire at 24 hours on July 5, 2020.

If there is no suitable date in the month falling at the end of the term, then the period for accepting the inheritance ends on the last day of the month. For example, a relative died on December 30, 2020, the start of the period falls on December 31. There is no such day in June, so the end of the period will be considered the 30th of the month.

The last day for filing an inheritance application can only be a working day.

What to do if the deadline is missed? – Try to obtain the consent of other heirs to include another legal successor in the division of property.

If it is not possible to restore inheritance rights through conciliation, you can go to court, but only under the following circumstances:

- The presence of compelling reasons (serious health condition, being abroad with the inability to travel) or ignorance of the fact of death.

- No more than 6 months have passed since the reasons preventing the exercise of rights were eliminated.

Legal proceedings are opened based on a claim brought against all heirs participating in the inheritance case.

Acceptance algorithm

The implementation of inheritance rights is carried out through two methods, regulated by paragraphs 1-4 of Art. 1153 of the Civil Code of the Russian Federation.

The successor writes an application to the notary's office (another organization authorized by law) located at the place where the inheritance is being considered. The document can be drawn up as an application for receiving an inheritance or as a request for the issuance of a certificate confirming property rights to the inheritance.

Carrying out actions that will act as confirmation of acceptance of the inheritance:

If the heir submitted a corresponding application before the end of the last day of the term or took actions confirming the actual acceptance of inheritance rights, he is considered to have accepted it. From this moment on, the countdown of the allotted six-month period stops.

How long does it take to approve the law for registration of inheritance rights? – the period is not limited by time frame. The assignee may apply for a certificate of title to the property when he considers it possible or necessary. In this case, the property belongs to the heir, starting from the day the inheritance is opened.

Lawyer's comment

Article 1154. Time limit for accepting an inheritance

1. An inheritance can be accepted within six months from the date of opening of the inheritance. If an inheritance is opened on the day of the expected death of a citizen (clause 1 of Article 1114), the inheritance can be accepted within six months from the date of entry into legal force of the court decision declaring him dead.

2. If the right of inheritance arises for other persons as a result of the heir’s refusal of the inheritance or the removal of the heir on the grounds established by Article 1117 of this Code, such persons may accept the inheritance within six months from the date on which their right of inheritance arises.

3. Persons for whom the right of inheritance arises only as a result of non-acceptance of the inheritance by another heir may accept the inheritance within three months from the date of expiration of the period specified in paragraph 1 of this article.

At the time of opening of the inheritance, it is not yet known who will own it. The inheritance before its acceptance by the heirs or before its transfer as escheat into the property of the Russian Federation is a set of subjectless, i.e. rights and responsibilities that do not yet belong to anyone. A state of legal uncertainty arises that cannot be tolerated for long. An inheritance, if it does not have a real owner, can be stolen, no matter what measures are taken to protect it, the creditors of the deceased testator experience difficulties in exercising their rights, and his debtors often try to evade fulfilling their obligations. Ultimately, it is in the interests of civil law as a whole that the state of legal uncertainty that arose in connection with the death of the testator and due to the fact that no one took his place in the inherited rights and obligations should be overcome as soon as possible.

That is why the law establishes a relatively short period for accepting an inheritance. At the same time, the specified period, as a general rule, is quite sufficient for the heir to accept the inheritance or refuse it competently, having weighed all the pros and cons associated with a particular decision.

By virtue of the direct instructions of the law, the period for accepting an inheritance is six months, and its course begins from the day the inheritance is opened. In accordance with the general rules on the procedure for calculating deadlines, the six-month period for accepting an inheritance, as well as for refusing an inheritance, begins to run from the day following the day of the citizen’s death.

If a citizen is declared dead by the court due to his unknown absence, then the inheritance can be accepted within six months from the date of entry into legal force of the relevant court decision, at least the day of the citizen’s death is recognized in the court decision as the day of his alleged death.

In cases where the right of inheritance arises for other persons as a result of the heir’s refusal of the inheritance (for example, all heirs of the first stage of heirs by law have refused the inheritance and heirs of the second stage are called to inherit) or the heir’s removal from inheritance as unworthy by a court decision, these persons may accept the inheritance within six months from the date their right of inheritance arises. So, if we are talking about calling heirs to inherit according to the law of the second priority, then the right of inheritance arises for them from the day when all the heirs according to the law of the first priority renounced the inheritance. If their refusal of the inheritance occurred at different times, then the right of inheritance for the heirs of the second priority arises from the day when the last of the heirs of the first priority refused the inheritance. If the right of inheritance arises for other persons as a result of the exclusion of an unworthy heir from the inheritance, then the six-month period for accepting the inheritance begins to run from the day the inheritance is opened.

There may be cases when the right of inheritance for other persons arises due to the fact that the persons called to inherit did not accept it within the period established for accepting the inheritance. In other words, they did not directly refuse the inheritance, but at the same time they did not perform any actions that would indicate that they accepted the inheritance. In these cases, persons whose right of inheritance arises only after the expiration of the six-month period that the heirs initially called to inherit had for accepting the inheritance may accept the inheritance within three months from the date of the end of the specified six-month period.

Sources: dekane.ru, stgkrf.ru, www.delovoysoz.ru, prozaveshanie.ru, www.bez-nasledstva.ru

Next:

No comments yet!

Share your opinion

You might be interested in

Is it possible to challenge an inheritance after 3 years?

The obligatory share in the inheritance is at least

How much do you need to pay when receiving an inheritance under a will?

How to register an inheritance for your son

Popular

Within what period is a notary required to issue a certificate of right to inheritance (Read 663)

Inheriting an apartment with shares, new rules (Read 345)

How to inherit a car if there are several heirs (Read 285)

If the mother is deprived of parental rights, does she have the right to inheritance (Read 170)

Deadlines for accepting an inheritance

Acceptance of inheritance, methods and terms are clearly regulated by law. A citizen presenting such rights has six months to obtain them. This deadline begins to run:

- from the day the testator dies;

- from the moment when the court decision became legal (it may recognize the person as dead or missing).

When a person becomes a legal successor after the refusal of other heirs, by a court decision, after the exclusion of other subjects from participation in the inheritance, the deadlines are counted taking into account a number of circumstances:

- the day the other heir submitted the refusal application;

- the day the court decision to recognize another entity as an illegitimate heir or to remove him from inheritance comes into force;

- after the end of the six-month period, when other entities have not declared their rights (acceptance of the inheritance is carried out within 90 days).

Missing deadlines does not entail a complete loss of property; a person can always restore his rights:

- confirmation by the judicial authorities of the validity of the reasons;

- reaching an agreement with other subjects of inheritance on the redistribution of shares based on newly discovered circumstances.

What is the difference between accepting an inheritance and entering into an inheritance?

» Everything for registration September 09, 2020

Main similarities and differences between inheritance by right of representation and hereditary transmission

The Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation) distinguishes two independent concepts in inheritance law that characterize various types of legal relations - the right of representation and hereditary transmission.

Let's analyze their main characteristics.

So, within the meaning of Art. 1142 of the Civil Code of the Russian Federation, the right of representation refers to this type of legal relationship when the direct descendants of the deceased heir of the testator are called upon to inherit. This right can be exercised only if on the day of the testator’s death his direct descendant (son, daughter) is no longer alive. Consequently, on the day the inheritance is opened, there is virtually no connecting link between the testator and his grandchildren. However, if this condition is not present at the time of the testator’s death, i.e. his children are alive, and they are not considered unworthy and are not deprived of the inheritance by the testator, then the right of representation does not apply.

Inherited transmission, in contrast to the first concept, is applicable to legal relations in which, at the time of the death of the testator, the heir called to inherit died without having time to properly enter into inheritance rights. In such circumstances, the heirs of the first (deceased) heir will be called upon. At the same time, if the deceased heir bequeathed all his property, then in this case the heirs under the will are called upon to inherit.

Thus, the key difference will be the presence or absence of a direct heir on the day of death of the testator and the person to whom the inherited property subsequently passes.

Another fundamental difference between these concepts is the period specified for entering into inheritance.

In particular, if we are talking about the right of representation, then the general rule of six months applies to the time frame for accepting an inheritance.

Hereditary transmission is different in this aspect. For acceptance of inheritance by way of transmission, the law sets a period from the date of death of the heir until the expiration of six months from the date of death of the testator. However, if such a period is less than 3 months, then it is extended accordingly for this period of time.

For example . On January 10, 2015, citizen N. dies. According to the law, his daughter K. is called to inherit, who must apply to a notary to accept the inheritance within six months from the date of N.’s death, namely until July 10, 2015. Meanwhile, June 25, 2015 G.

K. dies before he can enter into the inheritance. K.'s heir is her husband S.

According to the law, in order to exercise the right of hereditary transmission and receive the inheritance of N. gr. S. is obliged to contact a notary before July 10, 2015. However, due to the fact that the period from 06/25/2015 to 07/10/2015 is less than 3 months, it is extended until 09/25/2015 (i.e. for 3 months). At the same time, the period for accepting the inheritance left immediately after K. does not change and is 6 months. Therefore, the application to the notary (or its actual acceptance) must be carried out by S. no later than December 25, 2015.

However, if the application deadline has been missed, then it can be restored in court if there are good reasons for such an omission (Article 1155 of the Civil Code of the Russian Federation).

Please note that the right to a compulsory share through hereditary transmission does not apply.

Regarding the appeal to a notary when exercising the right of inheritance transmission and the right of representation, we note that in both the first and second cases it is necessary to apply for acceptance of the inheritance to the notary at the place of death of the first testator. Even if the place of death of the testator and the deceased heir is the same, it is nevertheless necessary to submit two separate applications.

The main differences between the inheritance rights under consideration can be outlined schematically.

Acceptance of inheritance: concept, methods, documents

What is acceptance of inheritance? This concept implies certain actions of the heir, designed to prove his good will regarding the acceptance of the inherited property. The procedure is preceded by the opening of the inheritance. It is carried out in the notary's office at the place of residence of the deceased. To open a case, you will need a number of documents, including a death certificate and a passport. As a result, the person is issued a certificate of right to inheritance.

Acceptance deadlines

The procedure and terms for accepting an inheritance are determined by law. According to it, registration of inheritance after death should be carried out within 6 months. Time is counted from the date of death of the testator. This period is established by Article 1154 of the Civil Code. This is a general rule that applies to most situations. However, there are exceptions to this.

For example, these are situations in which the exact date of death of the testator is determined in court. This is possible under the following circumstances:

- Plane crash

- Natural disasters

- Hostilities

- Other extraordinary circumstances.

- The man did not know about the opening of the inheritance

- Serious disease

- Long business trip.

- Traditional. Involves contacting a notary or other authorized person, as a result of which an inheritance certificate is issued

- Actual. To realize it, it is enough to actually accept the property. In this case, the person needs to prove that he is using the property. For example, a person bears the costs of maintaining an apartment and its security. In this case, he actually takes over the property.

- Death certificate

- If property is transferred by law, documentary evidence of kinship or other close connection with the deceased is required (marriage certificate, adoption certificate)

- Certificate about where the deceased lived (can be obtained from housing authorities)

- Extract from the house register.

- When the right to enter into an inheritance has been acquired by the heir as a result of the refusal of representatives closer to the testator, the period for entering into the inheritance can be extended by three months from the date of such refusal

- If one of the heirs of the first priority is a child who has not yet been born but has been conceived by the testator, then the inheritance is opened after his birth

- In the case where the testator was declared missing, the date of opening of the inheritance, from which the six-month period will be counted, is determined by the court.

- took possession or management of the inherited property, that is, lived, is living or began to live in the premises where the testator previously lived.

- took measures to preserve the inherited property, in particular, the heir has the right, until receiving a certificate of the right to inheritance, not to use the inherited property, but to seal it or limit access to this property to other persons.

- incurred expenses for the maintenance of the inherited property. For example, the heir pays utility bills and pays off credit debt to the bank.

- paid at his own expense the debts of the testator or accepted funds due to the testator.

- Sell an apartment after inheriting in Ukraine

- Missing the deadline for accepting an inheritance - judicial practice

The day of opening of the inheritance is established in court, but time does not begin to count from there. The deadlines are counted from the moment the decision made by the court comes into force. These rules are established by the 1st provision of Article 1154 of the Civil Code.

A person may receive grounds for accepting an inheritance as a result of the refusal of one of the heirs of the first priority of inheritance. In this case, the countdown is carried out, in accordance with paragraph 2 of Article 1154 of the Civil Code, from the date of occurrence of inheritance rights. This rule is conditioned by another rule - any of the heirs can abandon the property, as indicated by Article 1157 of the Civil Code.

A different procedure applies in a situation where the first priority heir has not accepted the property. In this case, the person from the next line must accept the property, for which he is given 3 months from the date of completion of the six-month period for acceptance of the inheritance by the previous person who renounced his rights. This provision follows from paragraph 3 of Article 1154 of the Civil Code.

In most cases, inheritance is accepted within 6 months. The only difference is the date from which it is counted.

You need to be careful and remember that the period begins not from the moment the case is opened, but from the date of death of the testator. Many people confuse these circumstances, which leads to missed deadlines and loss of inheritance rights.

Having a problem? Call a lawyer:

Moscow and Moscow region (toll-free call) St. Petersburg and Leningrad region

What to do if you didn’t manage to accept the inheritance on time?

Acceptance of the inheritance must be completed on time. If this does not happen, then the deadlines will have to be restored. There are two ways to do this: pre-trial and judicial.

Pre-trial method

The notary and other heirs participate in the procedure. A person claiming property must obtain consent from other heirs who have already received the property. Consent must be provided in writing and contain the signatures of the relevant persons, certified by a notary. It must be shown to a notary. After this, the inheritance mass will be redistributed. The procedure is quite complicated at the stage of obtaining consent. If it fails, the person can go to court.

How is judicial restoration of deadlines carried out?

To initiate legal proceedings, a claim must be filed. In court, the plaintiff is required to provide documentary evidence of valid reasons for missing the deadline. It is the weight of valid reasons that is the determining factor when considering a case. The court may take into account the following circumstances:

As evidence, you can provide a certificate from work, documentation from the hospital. The strength of the reasons will be determined at the discretion of the court.

Judicial restoration of deadlines, in accordance with paragraph 1 of Article 1155 of the Civil Code, can be carried out within 6 months from the date when the valid reasons that led to the failure to meet deadlines ceased to apply.

What does the concept of accepting an inheritance mean, and what should be the procedure?

Accepting an inheritance means that the heir has proven his desire to receive the property. The procedure is carried out on the basis of two principles - voluntariness and unconditionality. You cannot accept only part of the inheritance. A person can take either everything that is due to him by law, or nothing.

At the moment, the law includes some amendments, but, in essence, remains the same. It follows from this that if the testator had debts, they will be inherited. A person will have to accept both property and inheritance debts. He cannot refuse the debt and, at the same time, receive property.

To accept an inheritance, a person does not have to participate in the procedure personally. It can also be carried out by a representative. He will need a power of attorney certified by a notary. The representative, without fail, carries out the procedure in the event that there is an inheritance by minors by law or by will (the heir is under 14 years of age). Parents or guardians act in this capacity.

The concept of inheritance and methods of accepting an inheritance are specified in the Civil Code. You can accept property in the following ways:

You cannot accept only part of the inheritance.

After receiving the deed and registering the property, a person can dispose of the property at his own discretion. He receives full rights to the property.

Documents for entering into inheritance

The heir applies to an authorized person (notary) to carry out the procedure; he needs to submit an application for acceptance of the inherited property. The following papers will be needed: