The procedure for registering and using a testamentary disposition for a deposit in Sberbank

Any depositor of Sberbank of Russia can take care in advance about who will receive the rights to dispose of his deposit after the death of the deposit owner.

A testamentary disposition makes it possible to accurately identify the sole heir of the money in the account or distribute the funds among a group of people according to the wishes of the depositor. Important! A bank client can bequeath money in the account not only to relatives, but also to strangers, acquaintances and even legal companies. This banking service is characterized by simplicity in the distribution of funds and the absence of priority. If a testamentary disposition is properly executed, there are no grounds for its non-execution or change, even if the relatives of the deceased express disagreement with the order of inheritance of the deposit

If such persons wish to challenge the established procedure for the distribution of inherited money, a check can be made for the presence of later versions of the document

If a testamentary disposition is properly executed, there are no grounds for its non-execution or change, even if the relatives of the deceased express disagreement with the order of inheritance of the contribution. If such persons wish to challenge the established procedure for the distribution of inherited money, a check can be made for the presence of later versions of the document.

Subtleties to consider

Many heirs want to know how to withdraw money from their accounts without waiting six months for the bank’s decision. Funerals require expenses, so financial institutions accommodate clients halfway.

The only thing that needs to be done is to present a passport, card or details, rights to inheritance and an application for receiving money indicating the reason, certified by a notary.

However, the law sets a limit on withdrawals - from 2020, you can withdraw money in the amount of 40 thousand rubles, but no more.

There are situations when the heir does not know whether an account has been left for him at Sberbank. In such cases, bank employees do not look for third parties, relying on the fact that all existing valuable property becomes known to relatives.

If you do not know whether the deceased still has accounts and deposits, check with a notary. No information? Contact the department yourself. The only point is that you must provide the details or account number for the search. For these purposes, Sberbank has.

Deposits that are not found become state property - you should hurry up with the search and re-registration.

Rights of a widow or widower to receive a bank deposit

The Civil Code of the Russian Federation establishes such a concept as common property of spouses. It includes property earned or acquired by a husband and wife during marriage (except for those received as a gift or inheritance). Spouses, regardless of the ratio of their income and acquisitions, own this property equally.

Therefore, after the death of one of them, the other has the right to allocate his half of the property from the inheritance mass. This also applies to funds from bank deposits.

This point should be paid attention to both the widower or widow himself and the rest of the legal successors

The right to a spousal share and the right to inheritance exist separately and are not mutually exclusive: the surviving spouse may not be an heir (under a will), but receive half of the funds deposited by the deceased. At the same time, the allocation of part of jointly acquired finances does not deprive him of inheritance rights if they do not contradict the last will of the testator.

On the way to acquiring the deposit of a deceased relative, the heir faces many difficulties, which cannot be described in one article. But even in standard situations, not everything is as transparent and simple as it seems at first glance.

To resolve problems that have arisen or prevent their occurrence, theory alone is not enough. This requires practice and many years of experience, which, along with impeccable knowledge of the law, the lawyers of the site ros-nasledstvo.ru possess. It's easy to contact them. It is enough to enter the essence of your question into the electronic feedback form, and within a few minutes you will receive relevant advice that can determine the further development of the current situation or become the beginning of productive cooperation.

What is the will expressed and how to document it

To draw up a will for a deposit in Sberbank, you must first make several important decisions for yourself.

You need to determine:

- circle of heirs;

- ratio of shares between them;

- list of obligations imposed on heirs (if any).

Next, you need to choose a convenient method for making orders on your deposit. There are two options.

Visit to a notary

Many Sberbank depositors use this method. Drawing up a will with a notary follows the usual procedure. The testator comes to the specialist along with his passport, as well as documents on the deposit. They include a deposit agreement and a savings book. The notary keeps copies of these materials.

Then, in the presence of a specialist, the text of the will is drawn up.

In relation to the deposit, it must necessarily contain:

- Name of the branch (branch) of Sberbank where the deposit is placed.

- Details of the deposit agreement, data on the savings book.

- Information about heirs indicating their place of residence.

- The size of the deposit and the proportions by which the savings will be divided among the heirs.

The notary certifies the will in two copies. One is returned to the testator, and the other remains in the notary's office.

Contacting Sberbank

After death, it is possible to leave money in the bank to your relatives in the form of a testamentary disposition. All you need is a passport for a bank employee to verify the depositor’s identity.

At the Sberbank branch, information similar to that present in the notarized will is indicated in writing. An employee of the financial institution also puts his marks, certifying them with the organization’s seal.

The testamentary disposition is also drawn up in two copies: for the depositor (testator) and the bank.

How to bequeath a bank deposit

Regardless of the method of bequeathing funds, the testator must meet the following requirements:

- full legal capacity;

- personal presence when drawing up the document;

- existence of ownership rights to the transferred property.

Heirs can be any person, both individuals and legal entities. In addition, funds can be transferred to the state.

In the bank

Each client of a banking institution can draw up a testamentary disposition for his deposit. The process of creating an order is regulated by legislative norms and internal regulations of the bank.

To issue a document, the client must contact any branch, presenting his passport. This is the only document that will be needed to complete the procedure.

The bank employee will issue the applicant a testamentary disposition form, which includes the following items:

- passport details of the testator;

- day of compilation and place;

- details of the bequeathed deposit;

- an indication of the circumstances of the transfer of funds (in this case, the death of the owner);

- size of the amount;

- personal data of the successor;

- number of copies of the order;

- date and signature.

The testator has the right to designate several successors at his disposal, distributing funds among them as a percentage. If the document does not indicate shares, then the division will occur equally.

After filling out the form, the testator hands it over to a representative of the financial institution. He indicates the following information in the document:

- Full name and position of the bank employee;

- date of registration of the order;

- depositor's passport details.

The organization's stamp is placed on the document. The order is made in two copies: one of them is taken by the depositor, and the second will be kept in the bank.

In a testamentary disposition for a bank deposit, you can specify the conditions under which the money will be transferred to the heir. This could be marriage, graduation from university, reaching adulthood, etc.

At the notary

When drawing up a will for a bank deposit, the applicant must have the following documents with him:

- passport of a citizen of the Russian Federation;

- savings book;

- documents confirming the presence of a deposit in the bank.

The will can specify several deposits held in different banks.

As mentioned above, there is a fee for creating a document in a notary office. The total amount includes several payments:

- state duty;

- payment for notary services (technical and legal work);

- surcharge for urgency, work on weekends or away.

The amount of the state duty for bequeathing bank deposits is fixed and amounts to 100 rubles.

The text of the document contains the following paragraphs:

- testator's data;

- details of the bequeathed contribution;

- place of document preparation and date;

- data of the heir (or heirs);

- the amount in the bank account;

- conditions for receiving funds (if any);

- number of copies of the document;

- signature and date.

The will is drawn up in two copies, which are subject to mandatory notarization. One document is received by the testator, the second is kept by the notary.

What you need to do to get a cash deposit in Sberbank

There is a list of documents that must be provided to the bank. First of all, you should go to a notary. At the same time, there is a procedure according to which entry into inheritance is carried out in letter order. Notaries conduct inheritance cases based on the first letter of the surname of the person who left the inheritance.

Mandatory are:

- Identity document or passport.

- If the heir is a foreigner, a visa or passport is required, and they must be translated into the state language of Russia.

- A document confirming the death of the investor.

- If there is a will, this must also be provided.

- Documents from the bank, savings book, agreement on opening a deposit, bank card.

- Evidence of relationship if there is no will.

In the event that an inheritance has been transferred by will, it is necessary to provide the financial institution with a certificate that confirms the right to it. It must be certified by a notary. In the event that there is no will, to prove the right, you need to provide the bank with a certificate of inheritance based on the law. Funds stored on a deposit account can be received six months after the opening of the inheritance.

However, you will need a package of documents:

- identity document, passport;

- documents from the bank;

- death certificate.

http:

Taking into account the fact that laws tend to change, more accurate information can be obtained from a bank or notary. In some cases, documents certified by a notary are required.

At the same time, Sberbank’s responsibilities do not include searching for depositors and heirs. Very often people do not know about the existence of a deposit, so they do not contact banks. Based on the law, unclaimed deposits become the property of the state. In some cases, you can receive part of the inheritance earlier than six months.

Testamentary disposition

Nowadays, many investors, especially if they are elderly, try to take care of the future in advance so that the inheritance of their deposits will not be a problem for relatives. Sberbank itself offers a special service, according to which you can then register a deposit and immediately draw up a specific testamentary disposition. This is an official document; once completed, it is signed by the bank manager. This document, in its legal force, is practically equivalent to a full-fledged will, which then significantly facilitates the inheritance procedure for future heirs. The investor himself stipulates in the document the order and amount of amounts that he wishes to transfer to one or another relative. After death, the people indicated in the document only need to visit a notary to enter into inheritance rights.

In the case where the deceased leaves a will to relatives in advance, the document will detail the receipt and amount of the inheritance. The heirs just need to contact any notary, he will help draw up a special document on the acceptance of inherited funds. The specialist will also explain to the relatives what to do next.

USEFUL INFORMATION: How to revoke and annul a will

Receiving an inheritance from Sberbank is carried out in two ways:

- According to the testamentary disposition, which is drawn up in advance by the investor himself. According to it, the deposit will then be divided between designated persons.

- According to an official (notarized) will.

How to inherit a deposit in Sberbank if there is no will or testamentary disposition? A common situation, because most people live peacefully without thinking about death. Therefore, when a tragedy occurs, relatives have only fragmentary information about the property and funds of the deceased. Fortunately, the law comes to the rescue here.

Other payments to heirs and/or investors

If a citizen had a deposit in the Sberbank of the USSR (valid and not closed until June 20, 1991), then monetary compensation is due on this account.

If a depositor was born before 1945 (inclusive), and on his account as of June 20, 1991 there was an amount of at least 2,000 rubles, and before that he did not apply for compensation, then his deposit is entitled to a compensation payment in the amount of 6,000 thousand rubles

It is also important that this account is not closed before December 31, 1991. If a depositor was born before 1945 and closed the account in 1992 (even in the absence of a savings book), provided that he did not receive any compensation, compensation in the amount of 3,600 rubles is due. If a depositor was born before 1945 and closed the account in 1993, under the same conditions, compensation is due in the amount of 4,200 rubles. If a depositor was born before 1945 and closed the account in 1994, under the same conditions, compensation is due in the amount of 4,800 rubles. If a depositor was born before 1945 and closed the account in 1995, under the same conditions, compensation is due in the amount of 5,400 rubles. If a depositor was born before 1945 and closed the account from 1996-2015, under the same conditions, compensation is due in the amount of 6,000 rubles. For the accounts of depositors born from 1946-1991, with the account balance as of June 20, 1991 - 800 rubles. The deposit is valid (there is a savings book)

The investor has not previously received compensation. The payment is equal to 1600 rubles. If this deposit was closed in 1991, then compensation for it is not due. For the accounts of depositors born from 1946-1991, with the account balance as of June 20, 1991 - 800 rubles. The account was closed in 1992 (no savings book), the depositor did not receive compensation, compensation in the amount of 960 rubles was due. Under the same conditions, upon closing the account in 1993, compensation in the amount of 1,120 rubles is due. Under the same conditions, upon closing the account in 1994, compensation in the amount of 1,280 rubles is due. Under the same conditions, upon closing the account in 1995, compensation in the amount of 1,440 rubles is due. For the accounts of depositors born from 1946-1991, with the account balance as of June 20, 1991 – 800 rubles, the deposit was closed in 1996-2015. (there is no savings book), the investor has not previously received compensation - the compensation is 1600.

Based on my practice, on average, citizens receive compensation for old accounts of testators in the amount of 6,000 rubles. For more detailed information, please contact the notary handling the case. The notary will make a request to the banks and clarify what amounts are due to the heirs.

Cancellation and amendment of a testamentary disposition

The will for the contribution cannot be adjusted. If the testator decides to make any changes to it, he will need to draw up a new will. In this case, the previous document will be cancelled.

The deposit holder can contact the bank at any time and cancel his will.

The will for the contribution is of unlimited duration. It will be valid as long as the deposit is active.

If the depositor closes the deposit and withdraws the money, then, accordingly, the will on him ceases to be valid.

Documents for receiving a contribution by inheritance

Heirs who know about bank deposits left by a deceased relative should contact a notary to clarify the list of required documents. The lawyer will issue relatives with certificates of the right to receive inheritance on the basis of the laws of the Russian Federation. The package of documents for registering the right of inheritance is the same as in the case of inheritance “by will”. But you will need evidence of a close relationship with the owner of the inheritance. Relationships and documents are verified by a notary.

Basically, to register the rights to inherit a contribution, it is enough:

- Passports

- Visas or identity card of a foreign citizen with a translation into Russian (for non-residents).

- Death certificates of the deposit owner.

- Wills (if any).

- Bank documents (passbook, agreement, card) confirming ownership of the deposit.

- A document confirming the family ties between the heir and the owner of the deposit (if there is no testamentary disposition or will).

If a citizen has a testamentary disposition in his hands, written in a bank before March 2002, then we advise him to first contact the bank, where employees will suggest the required list of documents. Maybe this will save money on notary fees. In other cases, a visit to the notary’s office cannot be avoided. Since even if there is a will, a certificate of inheritance is required, without it the contributions of a deceased relative cannot be obtained.

Persons who are not heirs, but who are organizing the funeral, can also count on a certain share of the deposit, without receiving a document on the right of inheritance, without waiting for the end of the six-month period. Here the notary draws up the necessary decree for the credit institution to reimburse expenses for organizing the funeral. In some cases, recipients of an inheritance can withdraw up to 200 minimum wages from a relative’s contribution for organizing his funeral without such a resolution.

Execution of testamentary instructions by Sberbank

Inheritance of the deposit occurs on a general basis. To receive it, the heir must provide a certificate of right to inheritance, that is, go through the inheritance procedure by submitting an application for inheritance of property to a notary within 6 months and providing all the necessary documents.

To receive cash savings, submit to a bank branch:

- passport or other identification document, and for foreign citizens - passport and visa;

- a notarized copy of the death certificate of the owner of cash savings;

- a certificate of the right to inheritance (as well as about the division of property, about the right of ownership of a share) or a copy of the court decision on the division of the property of the deceased;

- a passbook or agreement indicating the availability of funds in the bank;

- a document issued by a notary regarding reimbursement of costs associated with the death of the testator.

Important! If the contribution was bequeathed to the organization, it must provide an account where the funds are transferred, certified by the manager and chief accountant.

At Sberbank branches you can receive deposits left by USSR depositors. To do this, you need to contact a notary with documents. The amount paid on deposits made before 1945 increases 3 times, and before 1991 - 2 times.

Inheritance of Sberbank deposits on the basis of law

The procedure for registering inheritance according to law

It is possible to register inherited savings that remain after the death of the owner of a bank deposit not only by will, but also on the basis of law. The Civil Code of the Russian Federation provides for the possibility. If the testator does not indicate the share of each heir, then the inheritance passes to them as common shared property. They have the right to independently decide how to dispose of the common inheritance. The procedure for inheriting Sberbank deposits is regulated by general laws that deal with inheriting them. For example, according to the current instructions regulating the procedure for carrying out operations by institutions of the Savings Bank of the Russian Federation, the deposit left by the deceased is issued. This instruction, as amended on December 27, 1995, adopted on June 30, 1992 (No. 1-r), is valid on the basis of a will drawn up by the testator. A will certified by a notary must have a clause about the contribution and the persons to whom it is inherited. A testamentary disposition drawn up on a personal account is the same basis for paying the deposit to the heirs. The procedure for Sberbank of the Russian Federation to pay deposits to the heirs does not depend on the period of application for them by the persons specified in the will or testamentary disposition. It is determined by the date of their compilation. The heir legally has the right to use the savings transferred to him by inheritance after a period of 6 months after the death of the testator. It is from the date of death of the investor, according to documentary evidence, that the period for the entry into force of the right to dispose of the inheritance begins. The structural unit of Sberbank where the testator's deposit is kept must use the list of necessary documents established by the instructions to make payments of savings. Namely:

- Savings book or deposit agreement.

- A copy of the death certificate of the testator-investor, issued by the district department or registry office, which is certified by the notary authorities.

- Heir's passport.

- A copy of the will, if it was drawn up by a notary, bearing a notarial authority’s mark on the absence of changes and data on its cancellation.

- Documents confirming the family ties of the heir and the testator.

With the first three documents, the person who has the right to inherit property must first contact the notary at the place where the will was executed. If there is no savings book, then you need to know the Sberbank branch number and its address. Specialists of the Sberbank structure carry out a search by branches if this data is not known. If there is an agreement under which a bank deposit is made, then a will can be drawn up in accordance with it. Based on the agreement, you can receive funds by proxy.

USEFUL INFORMATION: Absence of an application for the allocation of a spousal share in an inheritance matter

Features of inheriting a deposit in Sberbank

You can receive up to 40,000 rubles from the testator’s contribution before 180 days have passed since his death. To do this, you need to contact a notary and draw up a special decree. It follows from it that the submitter has the right to a one-time transfer of up to 40,000 rubles for organizing the funeral of the deceased.

Readers leaving comments on our website are often interested in the size of future expenses when the time comes to formalize an inheritance. In the case of inheriting a bank deposit, there is no direct inheritance tax. Receivers of money will only have to pay a state fee, the amount of which will depend on the amount received:

- heirs of the first and second priority pay 0.3% of the inherited money, but not more than 100 thousand rubles;

- all others – 0.6%, but not more than 1 million rubles.

General provisions

The procedure for receiving an inheritance based on deposits was used back in the Soviet Union. Then Soviet citizens received money that was kept in the accounts of the deceased on the basis of a legal successor. This procedure changed in 2002; currently, you can withdraw money from your account if certain conditions are met:

According to the will. This is the will of the deceased, drawn up in his right mind and certified by a notary. The document indicates to which heirs the property goes. The will has a number of features. For example, according to the last will, property may go to a person who is not related to the deceased by family ties. In addition, the law provides for the allocation of a mandatory share to minor heirs. In this case, it does not matter whether they are mentioned in the will or not. In law. If a will is not left, the property is inherited on a general basis. In this case, the inheritance is divided equally among all claimants. Testamentary disposition. This document is drawn up at the bank (free of charge), it indicates which persons can withdraw money from the account by inheritance

Please note that the number of applicants mentioned in a testamentary disposition is not limited. This order is most preferable to the heirs.

Registration process

Receiving an inheritance is possible in two ways: by registering your right with a notary or by actually accepting it. In the first option, you, as the receiver, need to prepare a package of documents and contact the notary office at the place of last residence of the testator.

The actual entry into inheritance does not require the recipient to register his right to property with a notary. It is enough to use and bear responsibility for the property of the deceased, having demonstrated his actions within 6 months from the date of death of the testator. But if you can live in an apartment without registering property rights, then receiving an inheritance from Sberbank without registering an entry is impossible.

Step one: contact a notary

How to receive an inheritance from Sberbank? In order to formalize your rights to the property of a deceased relative, you must contact a notary office. The recipient of the deposit and other property needs to fill out an application for entry. This can be done either with a notary or by sending a certified document by mail if it is impossible to contact the right specialist.

You must contact a notary no later than 6 months from the date of death of the testator.

To register inheritance rights, you need to prepare the following package of documents:

- Passport of the applicant, application for membership.

- Death certificate of the testator, certificate of his last place of registration.

- Documents on the ownership of the property of the deceased, including bank agreements for opening a deposit or account.

- A will or documents indicating the degree of relationship.

In the absence of a banking agreement, the notary can independently make a request to the financial institution, receiving all possible information about the accounts and the place of their storage from the receivers.

The process of reviewing an inheritance case by a notary lasts six months from the moment it is opened. After this period, the lawyer will issue to all recognized receivers a certificate of inheritance indicating the share due to each.

Remember that any citizen may not accept an inheritance by missing the deadline for entry or writing a refusal.

Step two: contact Sberbank

After confirming your right to inheritance, you can contact the bank branch where the deceased opened a deposit or account. Receiving deposits by inheritance at Sberbank requires the recipients to have documents, the set of which may vary depending on the situation:

- Applicant's passport, certificate of inheritance.

- Document on division of shares if there are several recipients.

- A court decision if the inheritance took place in court.

- Bank documents of the deceased - if available (agreements, passbooks).

You can receive funds from the deposit of the deceased on the basis of a notary’s decree if the heir needs to reimburse his funeral expenses.

If there is a will drawn up earlier than March 1, 2002, the recipient can receive money from the account by inheritance without a certificate of entry.

What is a deposit in Sberbank by inheritance?

The funds in the bank account are the property of the deceased. They are included in the total amount of property subject to division. Consequently, relatives have the right to claim these funds. Features of inheritance are determined by laws.

According to its rules, the following persons have the right to receive a deposit in Sberbank:

- The persons specified in the will have the right to receive money from the account and register it. Even if they are not relatives of the deceased, they will be the ones who will be able to receive the funds. However, children and spouse have an unconditional right to a certain share of the property. This is a mandatory legal requirement. Consequently, close relatives will also be able to receive these funds, but in a certain part;

- The persons specified in the special order have the right to receive it. His bank document, which is drawn up during the lifetime of the owner of the deposit. This order means that it will be possible to receive a contribution without having to comply with a lengthy entry procedure. This opportunity to receive money from Sberbank allows you to reduce time and simplify the procedure. At the same time, document preparation is a free service;

- When receiving money on the basis of the law. This procedure applies when a will has not been drawn up. In this case, the standard entry procedure applies. Documents should be drawn up in the order of priority established by the Civil Code of the Russian Federation.

Thus, you will be able to get savings in any case. Money placed in accounts with Sberbank or any other bank cannot become the property of a credit institution and no one except the heirs will be able to use it.

Who can receive a deposit in Sberbank by inheritance?

The procedure for receiving Sberbank deposits by inheritance involves two options. The successor can apply for and receive the money directly after completing the entry procedure. By law, such a person can issue a power of attorney to another person. He should not be a successor. But on the basis of a power of attorney issued by a notary, such a person is vested with the rights of a principal. Consequently, a power of attorney from a notary will become the basis for issuing the document.

Registration of inheritance for a deposit in Sberbank

A power of attorney to receive a deposit in Sberbank by inheritance, executed by a notary, gives the person the same rights as the principal. In this case, a power of attorney can be issued to any person at his discretion. There are no restrictions on this matter. Along with a correctly executed power of attorney, the person must have documents indicating the entry into the right of a principal. In addition, he will need identification documents.

What documents are needed to receive a deposit in Sberbank by inheritance?

It is possible to issue funds from an account only upon presentation of several documents. They must confirm the validity of the person’s claims:

- The applicant's passport or temporary identity card is required;

- You need to fill out an application for the issuance of funds;

- It is necessary to provide documents on the right to the property of the deceased account holder;

- Document confirming the death of the investor.

After reviewing the submitted documents, the bank will process the withdrawal of funds by inheritance.

Deadline for issuing a deposit by inheritance in Sberbank

The deadline for withdrawing funds is not expressly specified in the law. This period is established by the internal rules of the bank. In practice, verification of submitted papers occurs directly on the day of application. Funds are withdrawn on the same day. After all, they actually belong to the heirs. Therefore, the period is one or at most several working days. In this case, individuals can leave funds in the account by transferring it to their name.

As usual, money is bequeathed to a bank

Funds that a person deposited during his lifetime into his deposit account may be the subject of a will to his heirs. In this case, a citizen can make a will, either only for money, or include the contribution in the list of other property.

If the subject of the will is a contribution to a savings book, then it can be signed not only by a notary, but also executed directly at the Sberbank branch where the account is opened. We will talk about this procedure below.

The testator has the right to inform relatives and other persons about who will receive the deposit after his death. A closed (“secret”) will, executed by a notary according to a separate procedure, is also permitted.

The deposit amount, including interest accrued on it, can be distributed among several heirs. However, the distribution of shares is not necessarily the same.

In addition, funds in the bank are subject to the rule of mandatory share in the inheritance. Let us remember that it says that disabled relatives or dependents should receive at least half of the share that would be due to them by law. The content of the will itself does not matter in this case.

How to bequeath a deposit in Sberbank?

The procedure and basic rules of procedure are specified in Decree of the Government of the Russian Federation dated May 27, 2002 N 351 “On approval of the Rules for making testamentary dispositions of rights to funds in banks.”

Procedure

To bequeath money savings in a bank, you must:

- Contact a branch of a financial credit organization with an identification document.

- Write the document by hand or print in 2 copies.

- Certify documents. Each copy is certified by the signature of the bank’s responsible person and its seal.

Upon completion of registration, the authorized person of the bank makes a note on the applicant’s account that a testamentary disposition has been left.

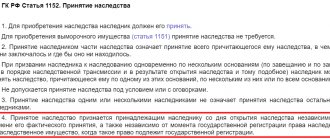

During the registration process, the bank employee must explain that:

- the document has the force of a will and is subject to a number of requirements (Article 1128);

- it can be canceled;

- the testamentary disposition concerns only the funds in the account or deposit;

- Regardless of the presence of a document, the amount may be claimed by minors and disabled heirs (parents, children, spouses), disabled dependents who lived with the testator for at least 1 year;

- in case of opening of an inheritance, the spouse has the right to half of the jointly acquired property;

- receipt of funds is possible only after receiving the right to inheritance (except for cases of allocation of money for funeral arrangements).

The testator of a bank deposit can specify the conditions under which the heir will receive the savings. This is, for example, reaching a certain age or performing any action that is not contrary to the law.

The share of each heir may or may not be determined. In the latter case, the funds are divided between the applicants in equal parts.

The owner of the deposit has the right to nominate an heir who can claim the money if for some reason the primary heir under the will was unable to accept the inheritance.

Important! Drawing up a testamentary disposition does not require making any additional payments.

Document form

A testamentary disposition is drawn up in compliance with the following rules:

- registration in writing;

- indication of the place of residence of the manager;

- indication of the full name of the owner of the deposit and the heirs to whom the funds are bequeathed, and if it is an organization, its name;

- presence of the manager's signature;

- indication of the date of compilation;

- presence of a certificate by a bank employee who is authorized to carry out such operations.

The document will lose its validity if it contains erases, blots, or corrections.

Sample testamentary disposition for deposit

When drawing up a testamentary disposition, you can use the sample below.

Upload sample image

Download download sample

How to register an inheritance with money in Sberbank

Many Sberbank clients are interested in how to receive a deposit by inheritance? To exercise your right to inheritance under the depositor’s will, you must, six months from the date of death of the testator, contact the bank office where the will for the deposit was drawn up. To inherit a deposit in Sberbank you need to have with you:

- a deposit agreement signed by the deceased depositor and a representative of Sberbank or the savings book of the deceased;

- a notarized copy of the death certificate of the investor;

- the original (if the document was drawn up in a bank) or a copy (if the document was drawn up by a notary) of the testamentary disposition (the copy must have the corresponding mark of the notary);

- citizen's passport;

- a document confirming the relationship (if the heir is a relative of the deceased).

USEFUL INFORMATION: How to force the father of a child to pay child support?

Important! If the heir does not have the bank documents of the deceased (deposit agreement or passbook), he has the right to resolve this issue by contacting a notary at the place of residence of the testator, who must do everything to ensure that the heir has the opportunity to enter into inheritance rights.

After an official statement from the heir, the notary sends a corresponding request to all banks to find out the place of drawing up the testamentary disposition and opening a deposit account in which the bequeathed funds are stored. After the financial institution in which the deposit is located has been identified, the heir applies there with a package of documents.

Poll: are you satisfied with the quality of services provided by Sberbank in general?

Not really

All inherited contributions for which testamentary dispositions were drawn up before 2002 inclusive are not considered inherited property and to receive them by disposition there is no need to provide a notarial certificate of the right of inheritance, unlike those contributions for which a testamentary document was drawn up later than 2002.

In the case where the deposit relates to inherited property, the procedure for receiving an inherited deposit from Sberbank is as follows:

- The heir approaches the notary's office with a package of documents.

- The procedure for registering the rights to inheritance with a notary is underway.

- With the certificate and other documents received from the notary, he goes to the bank where the order was drawn up.

- Receives his inheritance in the form of a deposit or funds in other bank accounts.

The legislation of the Russian Federation does not establish specific validity periods for a testamentary document, that is, it is valid until:

- the owner of the cash deposits will not die, and the heirs will not express a desire to receive the inheritance;

- the term of the agreement for opening a deposit with Sberbank will not expire and the depositor will not withdraw all funds from the account;

- a new testamentary document will not be drawn up, which automatically cancels the previous one.

According to the Civil Code of the Russian Federation, there are exceptions in the form of a new administrative document for the inheritance or a change of heirs (or their share in the inheritance). Such a document can only be drawn up for the period established by the legislation of the Russian Federation, which is 6 months. If after this time the heirs do not present their rights, the funds are automatically credited to the state account.

How to make a contribution to an inheritance?

The law provides for the possibility of inheriting bank deposits on the basis of:

- Wills. This is an official document drawn up by the owner and certified by a notary or other authorized person. In it, the owner can transfer the contribution to any relative, third party or organization. But in order to enter into an inheritance under a will, you need to know that a notary has drawn it up.

- Testamentary disposition. This is a document that is drawn up at the bank where the deposit is opened. The good thing about creating a testamentary disposition is that you don’t have to pay for it. And after the death of the owner, the heir will be able to register the property as a property in the same way as under a will. Accordingly, the heir will be able to exercise the right to receive funds if he knows about the existence of a testamentary disposition.

- In law. If the owner of the deposit has not drawn up a will or testamentary disposition, then the right to the property is transferred to the heirs by law. This option of succession is based on family ties. 7 inheritance queues are installed. The primary right to the property of the deceased is vested in his children, parents and official spouse.

For the bank to issue funds from the account, it is not enough to provide specialists with a will or testamentary disposition. It is imperative to obtain a certificate of inheritance rights from a notary.

Snezhana Pogontseva

Practicing lawyer. 11 years of experience. Specialist in the field of civil and family law.

Step-by-step instruction

The process of transferring the rights to use the accounts of a deceased Sberbank client is carried out according to the principle of succession (Article 1112 of the Civil Code of the Russian Federation), since this type of property belongs to the hereditary mass.

General procedure

To receive inherited money, perform the following actions within six months:

- They open an inheritance case with a notary.

- Drawing up documents.

- Receive a certificate of the due share.

The deposit is received in one of three ways:

- According to the will of the deceased - a will.

- Testamentary disposition.

- According to the law, the total amount is divided equally among all heirs.

Deposit search

If the heirs do not have information about a specific branch of Sberbank, then they ask the notary to submit a request or contact the organization themselves.

Sberbank is obliged to provide a response with information about the status of the deposit: size, address and number of the branch where the deposit was opened.

The notary may require an additional fee for this service. When searching on your own, contact any department. The citizen presents his passport, the death certificate of the investor and the right to receive an inheritance and writes an application.

Waiting for a response from the bank takes on average 30 days. But certain circumstances (search territory, how long ago the account was opened, its condition) sometimes reduce or increase this period. The notary will receive the information in 1-2 days.

Documentation

The notary is provided with the following documents:

- passport of the person opening the inheritance case;

- death certificate of the deposit owner;

- will, if any;

- documentary evidence of family ties with the deceased (marriage, birth, adoption certificates);

- agreement with Sberbank, passbook, plastic card or other documents.

Deadlines

More than six months pass from the date of death of the account owner until it is transferred to a new person. 6 months after submitting the petition and certified documents, the heir again comes to the bank with the same papers to re-register the account.

A deadline missed for a valid reason will be reinstated. The heir asks for permission from the remaining participants in the case who have entered into rights, or goes to court.

How to get a certificate?

As a result of consideration of the inheritance case, the notary issues certificates of inheritance rights to the recognized recipients.

Contacting Sberbank or another institution

The bank requires the following documents:

- certificate of inheritance rights in cases of a will or division of finances by law;

- agreements with the bank, passbook, plastic card and other documents;

- a copy of the death certificate of the investor;

- passports of heirs;

- confirmation of family ties: birth, marriage, adoption certificates;

- a notarized copy of the will;

- a copy of the court decision recognizing the right to inheritance;

- a certificate from a notary regarding reimbursement of funeral expenses.

Sberbank verifies the information within 3-5 business days. If the decision is positive, the contributions are finally transferred to the inherited part. Payments are made according to the shares established by the certificate.

If the will was drawn up before March 1, 2002, then confirmation of the right is not submitted and only the main documents are needed.

If a resident of another country applies for a contribution under a will, then his passport data is translated and certified by a notary.

The procedure for receiving funds by testamentary disposition

To receive funds, you must contact the bank before the expiration of six months from the date of death of the testator. If you apply after six months, you will face a number of difficulties. You will need to document a valid reason for missing this deadline (an extract from the medical history, etc.), which will delay the procedure for receiving funds.

It is also important to know when the testamentary disposition was made.

- If before March 1, 2002 , then the contribution is not considered inherited property. That is, there is no need to contact a notary and obtain a certificate of inheritance.

You must contact the branch where the account was opened and present:

- personal passport;

- death certificate of the investor;

- the original of the testamentary disposition;

- agreement with a bank or savings book.

After checking the data, within the period established by law, the money due is issued.

- If the testamentary disposition was drawn up after March 1, 2002 , then such property is included in the inheritance estate. In this case, you must contact a notary. The notary, within the period established by law, issues a certificate of the right to inheritance for funds. With this certificate, as well as a personal passport, death certificate, document confirming the existence of an account (card, passbook or agreement), we go to the bank branch where the account is opened and receive the money due.

How can you receive a contribution under a will in the event of the death of the investor?

Heirs can receive money under a will in the following order.

They must declare their rights to the testator's contributions. This can only be done after his death. First, the heir needs to clarify which notary is handling the deceased’s business. Next, an application is submitted to the notary's office to accept bank deposits.

Receipt procedure

You can receive funds from the account of a deceased relative (or even a stranger) in the general manner, both “by law” and by will. Notaries are engaged in registration of inheritance rights. If there is a will from the investor, only the persons specified in it can receive his money. In the absence of a will, the relatives of the deceased testator will inherit.

Without a will

Initially, without a will, the first-degree relatives of the deceased have the right to receive the contribution. Next, other relatives will be called upon to receive the money. Applicants for inheritance need to submit an application for its acceptance to a notary. He will check the documents, the rights of the applicants, the presence of kinship, and other heirs.

After the expiration of the six-month period, a certificate certifying the rights of the heirs is issued. With it, they can already go to the bank to receive money from the deposit. All you have to do at the credit institution is confirm your identity.

If there is a will

If the testator left a will for a deposit, then only the person named in it can receive it. At the same time, he will also have to go through the procedure of registering his rights with a notary.

Documents for receiving a contribution by inheritance

Funds invested in a bank can be inherited only upon provision of a certain list of securities. A person wishing to receive the deceased’s money submits the following list of documents to the notary’s office:

- application to take over your rights;

- certificate of death of the investor (if the case has not yet been opened);

- confirmation of kinship or will;

- deceased's savings book;

- documents confirming the identity of the applicant.

The notary verifies the authenticity of the specified papers and their sufficiency. But documents for inheritance are not issued before the established deadline. Therefore, the heirs will have to wait for its expiration.