Entering into inheritance after the death of the mother without a will

When a deceased relative did not draw up a testamentary document during his lifetime, the law provides for a strict order of inheritance that must be observed.

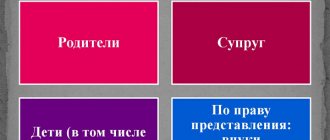

For example, after the death of a mother, priority of inheritance is given to her children, husband, and parents.

In addition, they have the right to claim equal shares of the inheritance mass.

Registration of inheritance after the death of the mother according to the will

A will is a document that is drawn up by the testator during his lifetime. It indicates the circle of heirs who can accept the inheritance after the death of a loved one. The indicated document significantly simplifies the inheritance procedure, if it is drawn up correctly. The only thing that can cause disputes is the failure to indicate in the will the persons who are legally entitled to an obligatory share.

When does one enter into inheritance after the death of the mother?

The timing for opening an inheritance case is very important, since the regulations indicate that within the allotted period the heirs must enter into their immediate rights, otherwise the succession passes to other heirs according to the order. That is, it is necessary:

- Accept the inheritance within six months from the date of the mother’s death. The date of death is fixed on the basis of a clinical conclusion or by a court decision when the person was declared dead.

- If none of the first-line successors applied, or refused it, or were found unworthy by the court, then the next line of successors is also given 6 months to enter into inheritance rights.

- When the right to inheritance arises only as a result of non-acceptance of the latter by other legal successors, then the bequeathed property can be received within 3 months after the end of the 6-month total period.

Important to know : After 1 year, the state can accept the inheritance mass (escheated inheritance), if the existing list of queues has not entered into its inheritance rights.

Where to register an inheritance after the death of a mother?

The opening of an inheritance case is carried out at the last place of residence of the deceased relative, if his property is located on the territory of the Russian Federation.

When the place of residence is not clear, a notary can open an inheritance case where the property inheritance or its most valuable part is located, if it is located in different places.

The same applies to property located outside the country. This provision is regulated by Article 1115 of the Civil Code of the Russian Federation.

How to enter into an inheritance without a will

As with inheritance under a will, the heirs will have to contact a notary firm.

The notary prepares all the necessary documentation so that the heirs can acquire rights to the property of the deceased. Here we note that both a group of potential heirs and each of them individually have the right to contact a notary. Be that as it may, the procedure for registering inheritance of the property of a deceased person without a testamentary document requires the heirs to collect and provide a package of necessary documentation. It includes documents such as a certificate confirming the death of the testator, his ownership rights to objects of inherited property, documents confirming family ties between the testator and the applicant for the inheritance, and others. There is another way to enter into inheritance of the property of the deceased, which does not require notarial intervention. To do this, the heir must confirm his inheritance rights to the property by his actions.

In other words, if the heir in fact already owns the property, protects it, takes on debt obligations to secure it and other concerns, he thereby confirms his rights to inherit it.

Documents for inheritance after the death of the mother

To enter into inheritance rights, successors need to collect the required documents and provide them directly to the notary who opened the designated case. The following are considered mandatory:

- mother's death certificate;

- passport details of the heir(s);

- a certificate indicating the last place of residence of the deceased;

- documents certifying family ties (birth certificate, where the surname of the deceased is written in the “Mother” column);

- if there was a change of surname, then you need to provide documents certifying it (marriage or divorce certificate).

In addition, the successors must provide the notary with other documents, which will be the basis for confirming the rights of inheritance.

Required list of documents:

| Name | Description |

| When inheriting a house or apartment |

|

| When inheriting a plot of land |

|

| When inheriting a vehicle |

|

| When inheriting securities, cash deposits |

|

Property valuation evidence

In order for the procedure for registering an inheritance for land or an apartment to follow all the rules, it is necessary to provide all the papers to a notary. If the numbers in the documents differ, then the certificate with the lower value will be used as the main one. This will serve as the basis for calculating the state duty.

Video: HOW DO HEIRS LOSE AN INHERITANCE OUT OF IGNORANCE OF THE LAW?

Video: ACCEPTING AN INHERITANCE IN 2020 | New rules

Who gets the discount?

At the stage of inheritance, a citizen can count on benefits, but only certain categories of persons can take advantage of this right:

- A citizen with disability of 1st and 2nd groups;

- Citizens who issue a certificate of inheritance for:

- A house or land plot, provided that it contains real estate that was the place of residence of the heir and testator at the time of the death of the latter and which will continue to be used in the future;

- Property of a person who died while performing a civic duty, performing state and public duties;

- Deposits and funds in accounts, as well as copyrights, compensation for royalties, pension payments.

- Persons under the age of majority, as well as citizens with mental disorders who are under guardianship. The law eliminates the need for this category of heirs to make any payments at the stage of registration of the inheritance, regardless of what property the inheritance is registered for, what its volume and value are.

- Heirs of citizens who have death insurance;

- Heirs of citizens obliged to military conscription, for whom insurance is issued at the expense of the state and who died while on duty.

The state fee is not the only fee that the heir must pay. This should include notary services . An exact rate has not been established for this expense item, so in each case this issue is resolved on an individual basis. Citizens should be offered only necessary notary services, otherwise there is a violation of the law.

If a group of heirs applies for the issuance of a certificate, they can receive this document together or separately, depending on their desire. In some cases, notaries may require a separate fee for processing each copy of the certificate. But such actions are considered illegal.

If a citizen decides to cooperate with a private notary office, then the costs of notary services will increase than if they contact a state office. However, when visiting the latter, you may encounter huge queues .

Is it worth entering into an inheritance?

It should be remembered that as the value of the inherited object, for example, an apartment, increases, the costs that the heir will have to face when registering an inheritance for the apartment also increase.

If the object of research is a plot of land and a private house located at a considerable distance from the official office, then this may create a certain difficulty in registration. In some cases, it makes sense for the heir to consider resolving his issue in court. There are situations when a citizen who has the right to inherit an apartment does not want to use it for the reason that its cost is low . However, before making such a decision, you need to think carefully, since registration requires less paperwork and the cost of services is lower.

Keep in mind that your decision determines whose hands the apartment will pass. Moreover, it should be accepted solely at one’s own request.

Duration of the procedure

In law

The inheritance procedure lasts only six months from the moment of opening of the inheritance on the basis of providing the notary with a death certificate of the testator.

During this time, the legal successors must show up and collect all the necessary documents. But the heirs can receive a direct document certifying the right to the property of the deceased mother (daughter, spouse) only after the end of the six-month period. Next, you will need to re-register the documents at the registration authority.

What if the registration period has passed?

The legislation specifies a period within which legal successors undertake to send an appeal to a notary and confirm their right to inheritance. It is required to enter directly into inheritance rights within six months from the date of death of the testator. Proof of the fact of death is a death certificate or by decision of a judicial authority.

If the heir missed the deadline for accepting the inheritance, then he loses his right to it and the latter will be transferred by right of priority if the inheritance is carried out according to law. But the same legislation stipulates that the renewal of the inheritance period is allowed if strong evidence is provided in court of the impossibility of timely contacting a notary.

Cost of the procedure

Until 2006, when receiving an inheritance, successors were required to pay tax. Today this obligation has been abolished, and it has been replaced by the need to pay state fees.

The amount of the fee for registering an inheritance depends on several factors:

- the cost of the inherited apartment;

- degree of relationship with the deceased.

The Tax Code of the Russian Federation establishes that the state duty when registering an inheritance by the children of the testator is 0.3% of the value of the inherited property. However, its size should not exceed 100,000 rubles.

Tax legislation also establishes a list of persons exempt from paying state duty.

These include:

- participants and disabled people of the Second World War;

- minor children;

- persons declared incompetent;

- citizens living together with the deceased at the time of her death and continuing to reside at this address at the time of registration of the inheritance;

- persons registering inheritance rights after a citizen who died in the performance of official or public duty.

Remember! Persons with group I or II disabilities receive a 50% discount on state fees.

Also, the amount of expenses for registration of inheritance rights depends on how many certificates are issued to the successors. If there is no need for each heir to receive a separate document, then when contacting a notary, the application should reflect a request for the issuance of one certificate for all legal successors.

What to do if one of the heirs dies

Life is so unpredictable that no one can predict the further development of events.

For example, a situation occurred that the heir dies after the death of the testator or at the same time as him. In this case, it is provided:

In law

If the successor died at the same time as the testator or after him before the expiration of the six-month period from the date of opening of the inheritance case, without accepting the inheritance, then the heirs of the order designated by law can take advantage of the right.

By will

According to the will, the shares of all heirs are distributed in accordance with the will of the deceased, but if the designated successor died before accepting the inheritance, then close relatives can enter into inheritance rights in accordance with the law, taking into account the approved order. If the inheritance was nevertheless accepted, but the successor soon died, then hereditary transmission comes into force.

A very important point is the fact that the transmission will be carried out if the citizen who accepted the inheritance died before the end of six months from the opening of the inheritance case.

Right of inheritance after the death of the mother

In the event of the death of the mother, the closest relatives become legal successors:

Children

It is worth noting that after the death of a mother, her children can enter into inheritance rights; these are relatives; these include illegitimate children, as well as adopted children.

Spouse

The spouse of a deceased wife is rightfully considered the heir of the first priority, but in addition, the legislation states that in the presence of an official marriage, all property acquired in it is considered their joint property.

Therefore, after the death of the spouse, the spouse is allocated half of it, and he can also claim a share of the inheritance mass, which is divided among all first-line applicants.

Parents

Parents also receive equal shares corresponding to all first-degree successors. It is also worth noting that not only biological parents, but also adoptive parents have the right to inheritance.

It is important to know : parents deprived of such rights in court have no rights to inherited property.

From the information provided above, it follows that after the death of the mother, her relatives can legally receive an inheritance directly from her, unless otherwise stipulated in the will. But there is an exception, namely that minors and disabled children have the right to an obligatory share even if they are not specified in the will.

Grounds for inheritance

The procedure for registering an apartment after the death of the mother and the distribution of shares between the legal successors of the deceased depends on the basis of inheritance.

Russian civil legislation distinguishes two grounds for hereditary succession: by law and by will.

If the deceased reflected in her will her will regarding the disposal of the apartment belonging to her, and appointed a certain person (even a stranger) as her heir, the legal successors may not receive anything after the mother.

To understand the procedure for registering an inheritance after the death of the mother, it is worth considering each basis of succession in more detail.