Buying an apartment in a building under construction before July 2020 was a kind of lottery: people paid developers directly, and there was practically no guarantee that the house would be completed and delivered on time. Since July 2020, everything has changed: according to the law, equity holders now transfer money to escrow accounts, and construction companies receive it only after the houses are put into operation.

The rights of shareholders are now more reliably protected, but many still have not figured out what escrow accounts are, whether equity participation agreements (hereinafter referred to as DPAs) are valid, how calculations occur, what the purchase scheme looks like and what pitfalls can await the buyer. Let's look at it in more detail.

Legislation

- Contents and sample agreement

- Contents and sample agreement

- Documentation

Before you buy an apartment in a new building, you need to study the features of such a purchase. They are regulated by several laws:

- Federal Law of December 30, 2004 No. 214 “On participation in shared construction...”. The procedure for settlements, conclusion and termination of the contract, and the deadline for transferring the property to the shareholders by the developer are indicated here.

- Federal Law No. 177-FZ dated December 23, 2003 “On insurance of deposits in Russian banks.” The amount of the insured amount transferred to the escrow account under the DDU is 10,000,000 rubles. If the bank goes bankrupt, the funds will be returned in full.

- Art. 860.7 of the Civil Code of the Russian Federation “Escrow account agreement”. Determines the procedure for opening an escrow account and obligations under it.

Important! DDUs are now concluded in the same way as before. But the calculation procedure has changed. If until mid-2020, during the transitional stage, developers could take money from shareholders through escrow or directly, but now payments are made only through special accounts. They open for each kindergarten. The bank acts as a third party, and its participation minimizes risks for shareholders. They can be sure that their money will not go anywhere, and even if the developer goes bankrupt or freezes construction, they will be returned the entire amount.

Take the survey and a lawyer will tell you for free how to avoid mistakes in an apartment purchase and sale transaction in your case

Contracts for the purchase of an apartment in a new building

In real estate market practice, several schemes are used for purchasing apartments in new buildings , each of which has its own type of contract :

- Equity Participation Agreement (EPA);

- Housing-construction and Housing-Accumulative Cooperatives (HSC and ZhNK) (banned from July 1, 2020, but there are exceptions, see the link for more details);

- Housing certificate of the Developer (banned from July 1, 2020, more details at the link);

- Investment agreement;

- Contract of assignment of the right of claim;

- Preliminary purchase and sale agreement (PPSA);

- Preliminary equity participation agreement (PADA);

- “Promissory note scheme” for purchasing an apartment (banned from July 1, 2018, see the link for more details).

more about all these schemes for purchasing a new building (which of them are “white”, which are “gray”, and which no longer work) and about the corresponding types of contracts using the links provided - in the Glossary.

Here we will proceed from the fact that we don’t need unnecessary problems, so we will focus on the most reliable and safe type of contract for purchasing an apartment in a new building. It is also the most common type of contract in the primary real estate market today.

The safest option (relative to other schemes) for the Buyer is to buy a new building by concluding an Equity Participation Agreement (DPA) . The DDU scheme is transparent, understandable, and clearly regulated by law. It is this type of agreement that corresponds to the concept of “equity participation in construction” , described in 214-FZ. And it is he who imposes a number of certain obligations on the Developer, in case of violation of which he will face serious fines and sanctions from supervisory authorities.

♦ Example of the Developer’s obligations under the DDU ♦

The same responsibilities are imposed on the Developer in the event of the sale of an apartment under an Agreement for the assignment of rights of claim , if these rights are assigned under the DDU. Then the Developer is obliged to fulfill all the conditions of the original DDU to the new shareholder who acquired these rights.

The terms and main provisions of equity participation and assignment of claims (including samples of these agreements) can be seen at the links above.

What are the risks in purchasing an apartment based on the assignment of rights of claim? What should the Buyer pay attention to?

In practice, the Developer may well, putting on an innocence on his face, offer the Buyer a bill of exchange and/or a Preliminary Agreement (PDKP or PDDU), and ask to pay money for the apartment against these documents. There are a lot of legal subtleties here, but they have the same essence: all these “workaround schemes” (bypassing Federal Law-214) enable the Developer to avoid strict requirements for running their business, and shift their risks onto the Buyer’s shoulders.

True, the use of “circumventive sales schemes” does not mean at all that the Developer is deliberately committing a scam and is trying to deceive the Buyer. He may have completely objective reasons for this. For example, the complexity of land legislation in the Russian Federation sometimes physically does not allow the Developer to draw up a long-term lease agreement for a land plot, and therefore does not give him the opportunity to work within the framework of Federal Law-214.

Therefore, even large and reputable developers are periodically forced to use “workaround schemes” in their practice.

Agreeing to purchase a new building bypassing Federal Law 214 may only make sense in cases where:

- the risk of unfinished construction is low (that is, when the house is almost built and the pace of construction is high),

- when the Developer’s image inspires confidence (i.e. he has been on the market for a long time and has a number of successful completed projects), and/or

- when the proposed purchase scheme is dominant in the local market (i.e. you can’t buy it any other way).

What to do if the Developer invites the shareholder to sign an additional agreement to the DDU to postpone the delivery date of the house? – see in this note.

What is an escrow account?

Escrow is a special account opened in a bank for settlements under DDU when purchasing housing in a building under construction. The investor transfers money there, but the developer receives it only after the house is put into operation. For construction, he finds money from his own budget or attracts funds from outside: for example, takes out a loan.

When paying through escrow, the risks for the shareholder are reduced to a minimum. If the construction company does not comply with the terms of the agreement and delays the deadlines, it can terminate the contract and then get the money back from the bank.

Is it possible to buy an apartment without an escrow account?

The main purpose of introducing escrow accounts for settlements on real estate transactions was the safety of equity holders. But reliable construction companies can still accept money from them directly; they just need to meet a few requirements:

- The first contractual agreement was concluded until July 1, 2019.

- The house is at least 30% complete, more than 10% of the apartments have been sold.

- The company can confirm the degree of readiness with a conclusion.

- The shares sold by the company will be checked in Rosreestr along with the project declaration and registered agreements.

- If the developer has received the right to work without an escrow account, he is obliged to transfer money to the fund for the protection of shareholders. In the future, compensation is paid from there if the company does not fulfill its obligations under the DDU. The contribution is 1.2% of the cost of housing.

Important! In some cases, the requirements for the minimum degree of readiness are reduced. For example, 6% is enough if the company is systemically important, builds more than 4,000,000 apartments, and there are social facilities on the site. 15% is enough if entire microdistricts are being built up according to territory development programs, schools, clinics and kindergartens are being built.

What you need to pay attention to when buying a finished apartment in a new building

The entire process of moving into a new apartment can be divided into three main stages:

1. Payment of the cost of the apartment according to the BTI measurements with the preparation of the corresponding act; 2. A complete inspection of the residential premises with the participation of a representative of the developer, it is also documented in a document; 3. Signing the acceptance certificate; 4. Transfer of funds to pay for utilities and conclusion of a service agreement; 5. Key acceptance.

It seems that there is nothing complicated here. This will only be true if the developer managed to satisfy all the client’s requirements specified in the contract. But, unfortunately, this happens quite rarely. If the buyer does not receive what he planned, experts advise inspecting all the rooms and recording any deviations identified on paper.

What to check first?

The most important thing to check first is :

• Quality of door installation; • Condition of sewerage and water supply systems, check the functioning of ventilation; • Inspect the electrical wiring, check its functionality.

If construction defects were found in the apartment, you cannot sign the acceptance certificate. Violations of contract clauses such as the installation of a wooden entrance door instead of a metal one, lack of suspended ceilings, or smaller rooms must be documented. Subsequently, they are eliminated by the developer or the sales price is adjusted downward.

If deficiencies are detected, it is necessary to draw up a defect report in which all identified deviations are clearly described. Windows, seam insulation, heating connections are checked. If pipe leaks, doors are not closed tightly, or glass cracks are detected, all these points are described in the report.

In cases where the contract did not provide for a fine finish, the screed in the bathrooms is checked to ensure that it is even and free of cracks. If the finishing was specified in the contract, it is necessary to check the presence of entrance and interior doors, how smooth the walls are, the quality of the wallpaper, the quality of the electrical wiring and the functionality of the plumbing. If the finishing is specified in the annex to the contract, you can compare each item with the actual results.

Deserves close attention:

• Ventilation system; • Electrical wiring; • Seams between walls; • The evenness of the walls is checked with a special level; • Floor screed must be a uniform gray color, without cracks.

For greater confidence, you can invite a specialist who will thoroughly evaluate all the existing shortcomings and enter them into the document. If possible, identified defects are recorded on a photo or video.

If a lot of defects are identified

There is no standard form for a defective statement, as well as a mandatory list of details; it is allowed to draw up an inspection sheet and make an entry in a special journal. In any case, as long as the buyer is not satisfied with the quality of the home, he may not move in and sign the deed until the defects are eliminated. Typically, the construction company is given a period of 45 days to eliminate identified defects, or a longer period specified in a written agreement. The acceptance and transfer certificate is signed only after all defects have been eliminated, otherwise the buyer will have to go to court.

The procedure for a shareholder's actions in the event of an apartment being sold to him of inadequate quality is regulated by Law 214-FZ. What should be done?

• Require the construction company to sign the defect sheet and eliminate all defects noted in it. It is possible that when the result of the construction of a particular company does not suit the client, then subsequent alterations will not correct the situation. Many companies deliberately delay the process of eliminating defects, extending the time until the end of the five-year warranty period. After this period, it is unlikely to achieve justice even in court. If the company does not want to comply with the buyer’s requirements, he invites an independent specialist, who makes his conclusion and goes to court with him. As a rule, such disputes are resolved pre-trial, but sometimes there are cases when the court rejects a claim because it considers the claims contained in it to be unfounded. It turns out that it is better not to bring the matter to trial.

• You can draw up a document about the identified defects and bring the home to a satisfactory condition yourself. At the same time, demanding that the developer compensate for the costs. Here you will need to carefully collect all payment documents.

• Sign the acceptance certificate, having previously agreed with the developer to reduce the payment amount. This option may seem acceptable to many clients.

There is also an extreme way to solve the problem - refusing to accept the apartment and terminating the contract, but in this case it is quite difficult to get your money back in a timely manner and in full. You will have to spend a lot of time in the courts.

The main difficulty is that until the acceptance and transfer certificate is signed, the buyer cannot register ownership. If complications arise, you can contact Mosgorstroynadzor, the housing inspectorate, or the prosecutor's office.

When the deed has already been signed, the buyer still has the opportunity to make claims to the developer. You will have to act through the management company, which will review the submitted claim and study the facts described in the application. After comparing the warranty periods for the identified discrepancies for expiration, she will independently send a letter to the developer and will monitor the process of correcting the defects.

If the construction company meets the customer halfway and promptly corrects everything that was done improperly, the new owner of the apartment can sign the document. This document must contain several mandatory details:

• Number and date of the purchase and sale agreement; • Address; • Square; • The price of the purchased object.

If the buyer is not satisfied with the apartment in some way, no one can force him to complete the transaction. When concluding a contract, everyone has the right to demand fulfillment of obligations under it and to receive the property in its finished form within the agreed time frame.

Ways to buy an apartment in a new building

As a standard, all transactions with new buildings are carried out according to the DDU. But some developers offer people to buy apartments in installments.

In general, there are several ways to buy an apartment in a new building:

- According to DDU. It is concluded at any stage of construction before the house is put into operation.

- Under an agreement of assignment of rights of claim, when one shareholder sells the right to claim an apartment that has not yet been built from a construction company. Shareholders are being replaced.

- Preliminary installment purchase agreement. The riskiest option for the buyer, which is often used by developers to avoid concluding a DDU and paying through escrow accounts. An initial payment is required, the remaining amount is paid by the buyer in several payments. After full payment, the main DCT is drawn up and registered with Rosreestr.

- Purchase of a new building with the inclusion of secondary housing. An unfavorable option for the buyer: the resale property will be valued at the minimum cost, and it will be offset against the price of the new building. Usually, two DCTs are drawn up: one by one the company buys a secondary home, and the second one is used to sell a new apartment. But there may be a different scheme of the deal.

Legal advice: it is better not to experiment and buy an apartment using a regular DDU with payment through escrow. The developer may offer discounts on installment plans, but in this case the seller’s money will not be insured. If problems arise, it will be difficult to get them back.

Elena Plokhuta

Lawyer, website author (Civil law, 6 years of experience)

Are you planning a deal to buy or sell an apartment?

Lawyers will answer any question regarding the transaction free of charge and in detail. Ask a question so you don't waste time reading!

General information about purchasing an apartment in a new building

Future developers of apartments are trying to sell even when the general foundation of the house is just being laid. Therefore, it often happens that you have to wait up to several years for a happy event. Naturally, as with any transaction, in this case there are a number of features that you need to know about and pay attention to. The fact that future housing costs much less than ready-made housing is a strong argument in favor of purchasing it. At the same time, there are many disadvantages to this. Therefore, in order to make a final decision, you should calmly consider all the pros and cons of this option.

In addition to low cost, the advantages of housing under construction include the following:

- absence of any occupants prior to purchase;

- receiving a completely new apartment, with all necessary communications that are in perfect order.

Of course, this is very nice. But it is necessary to highlight what to pay attention to when buying an apartment in a new building, these are the disadvantages, namely:

- moving in immediately after the transaction is concluded is impossible, if only because the apartment simply does not exist yet;

- the transaction is accompanied by high risks, since the project may be built longer than the specified time or even be suspended for an indefinite period;

- if you do not clarify all the points and do not indicate them in the contract, then as a result you can get 4 walls that are clearly not what you expected to see initially;

- Proof of ownership may be required if the entire process is not completed as required.

Registration of the property itself can take a long time.

Buying an apartment from a developer: procedure

The scheme for buying an apartment in a new building for cash looks like this:

- Developer check. This is the most important stage.

- Conclusion of the DDU.

- Opening an escrow account. The bank is chosen by the developer. Typically, an account is opened with the bank that issued the construction loan to the company.

- Registration of preschool education in Rosreestr. An application from the developer and shareholder will be required. Everything is filled on the spot. You can contact the registrar directly or submit documents through the MFC.

- Payment according to DDU.

After this, you need to wait until construction is completed and accept the apartment, then register ownership.

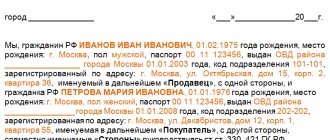

Contents and sample agreement

When purchasing a new apartment, developers provide the DDU themselves; they already have developed samples.

What information should be reflected in the contract:

- Name and address of the organization, position of the person authorized to make the conclusion, details of the power of attorney, TIN, OGRN,

- Full name, passport details, date of birth of the shareholder.

- Construction permit details.

- The deadline for transferring the object to the shareholder.

- Conditional apartment number for the duration of construction.

- Information about the apartment: area, number of rooms, floor, house address.

- Rights and obligations of the developer.

- Rights and obligations of the shareholder.

- The developer is responsible for violating construction deadlines, and the shareholder is responsible for failing to meet payment deadlines.

- Payment order.

- Dispute resolution.

The developer will need the signature of an authorized person and a seal, while the shareholder will only need a signature. The agreement is drawn up in three copies: one remains with the parties to the transaction, the third is transferred to Rosreestr.

Agreement on shared participation in housing construction (ddu)

Documentation

To conclude a DDU and register with Rosreestr you will need:

- Shareholder's passport.

- Power of attorney from the developer's representative, passport.

- Constituent documents.

- Extract from the Unified State Register of Legal Entities.

- A document confirming the ownership or lease of the land participant by the developer.

- Project declaration with all changes.

- Construction permit.

- DDU.

- Plan of an apartment building under construction.

- Developer liability insurance contract.

- Certificate from the bank about opening an escrow account.

Expenses

The fee for opening and servicing the escrow is paid by the developer according to the tariff. On average this is 0.5-0.7% per year.

The state duty is 350 rubles. The parties independently determine who will pay for it.

Important! You can issue a power of attorney to a company employee, and he himself will submit all documents for registration. This is paid additionally, on average 20,000-30,000 rubles.

Advantages of buying an apartment from a developer

Apartments in new buildings usually cost less than secondary housing , this is their main advantage, although their layout and communications are new. But , despite these favorable conditions when buying an apartment in a new building, there are great risks of being deceived .

That is why you need to carefully study all the documents and read all the clauses of the contract quite carefully .

How to buy an apartment in a building under construction with a mortgage?

The algorithm for buying an apartment in a new building with a mortgage is slightly different:

- The buyer finds the developer, checks the documents and clarifies the terms of the transaction with him.

- A bank is selected and a mortgage application is submitted.

- After the application is approved by the bank, the DDU is concluded and registered with Rosreestr.

- A mortgage agreement is concluded with the bank, then the money is transferred to the escrow account.

Legal advice: to increase your chance of getting your mortgage approved, you should take a closer look at the bank’s partner developers. Before executing a mortgage agreement, the lender carefully checks the construction companies, and he will have more confidence in the partner.

Elena Plokhuta

Lawyer, website author (Civil law, 6 years of experience)

Contents and sample agreement

A DDU with a mortgage contains almost the same information as without it. But it must indicate the procedure for settlement with the developer and the details of the lender.

Documentation

To apply for a mortgage for a new building you will need:

- Borrower's passport.

- Help 2-NDFL.

- A certified copy of the work record.

- DDU.

Note! If maternity capital is used, a certificate and a certificate of the balance of funds on it from the Pension Fund are submitted to the bank. To confirm the down payment, you will need a payment order and a bank account statement.

Do you need a purchase and sale agreement?

We’ll show you how to draw up a contract correctly and avoid mistakes.

Features of the transaction when buying an apartment in a new building

When purchasing a new home, you should carefully read all the documentation. When signing an agreement, it is necessary to take into account the mandatory points that must be specified in the document. Among them:

- Details of both parties.

- Full characteristics of the object.

- Timing of construction work and commissioning of the facility.

- Price.

- Form and procedure of payment.

- Warranty conditions.

- Force majeure situations.

- List of documentation.

- Validity.

Having agreed on the terms of the contract, it can be signed. However, not everyone can shell out a large sum at once, so there are several ways to purchase real estate.

Applying for a mortgage for a new building

If you are purchasing a new living space using loan funds, you should choose a developer who has been accredited by banks; in this case, the borrower has a number of benefits and advantages in obtaining a loan. If the construction of the house is completed and the construction organization has received all the necessary title documents, then the apartments receive the status of secondary housing. Accordingly, when completing the transaction, a purchase and sale agreement will be signed.

There are situations when a house has been built, there is a certificate of commissioning for it, but the construction company has not received a certificate of ownership. In this case, upon receipt of a mortgage, a preliminary purchase and sale agreement is signed.

Important! Not all banks offer such a lending scheme.

There are several ways to take out a mortgage to buy an apartment in a building under construction.

Upon assignment of rights

In this situation, the property is purchased under an equity participation agreement from the previous buyer. Not all banks offer such a lending program, as there are a number of difficult issues. Among them:

- The collateral is the rights of claim against the construction company, and not the actual object.

- The lender receives less income from this program compared to other, more popular ones.

- Mortgage assignment is more risky for banks, as there is a possibility of housing being frozen or the deadline for delivering the house being missed.

Under a share participation agreement

The peculiarity of this type of mortgage is that the object of collateral is the DDU, which is regulated by 214-FZ.

It is important to take into account that first a loan agreement is concluded with the bank, then the potential buyer and the developer sign a share participation agreement, which must be registered with Rosreest.

After the house is put into operation and the developer receives title documents for it. The shareholder for the apartment will receive an extract from the Unified State Register of Real Estate and sign an additional agreement with the lender on the change of collateral, which will become the new living space.

Important! If a construction company offers you to enter into a preliminary contract for remote control, then you should not do this. Since this type of transaction comes from unreliable developers whose goal is dishonest business: work is not according to the law. Thus, you can invest your money in a long-awaited apartment, but never get it.

Under an agreement with a housing construction cooperative

When purchasing an apartment from a housing cooperative, as a rule, agreements on share contributions or accumulation of shares are concluded. This is a completely legal transaction, which makes it possible to begin construction. The activities of such organizations are controlled by Articles 110-123 of Chapter 11 of the Housing Code of the Russian Federation, as well as the regulations on consumer cooperatives, paragraph 2, § 6 of the Civil Code of the Russian Federation. However, in this case, liability is minimized, and prices for apartments are quite low in relation to market value, which, of course, attracts potential buyers. All transactions are recognized as legal, but it is quite difficult to obtain a mortgage for such construction.

In addition to the above options for purchasing a new home, there are others.

Purchasing real estate from the owner

Buying an apartment in a new building from the owner is a great option. The living space is actually “clean”, but you may encounter some difficulties:

- Registration of minor children.

- The apartment is pledged to the bank.

- Illegal redevelopment.

- Errors in title documents.

We purchase housing from a contractor

It is quite a fair opinion that it is most profitable to buy a new building from a contractor. He is interested in quick sales, in receiving real funds, and therefore does not inflate the price of the apartment. However, such transactions are quite risky, as they do not guarantee the final result.

Important. By executing an agreement to purchase real estate in a new building directly from the contractor, you take a risk, since you only acquire the right to housing after completion of construction. The organization does not provide any guarantees and is only responsible for the authenticity and legality of the documentation provided to you.

How to register property rights?

Registration of ownership is possible only upon completion of construction, when the developer already has permission to commission and a technical passport.

How it all looks step by step:

- The company receives all the documents, and a protocol for the distribution of space is drawn up.

- The shareholder accepts the apartment and signs the transfer deed.

- Documents for registration are submitted through Rosreestr or to the MFC.

- As a result, the owner receives an extract from the Unified State Register.

Documentation

To register property rights you will need:

- Application (filled out on site).

- DDU.

- Transfer deed.

- Mortgage agreement and mortgage, if the apartment was purchased with a mortgage.

- Technical passport.

State duty

For registration, the buyer pays a fee of 2,000 rubles.

What to look for when buying a new building?

Most often, people are interested in what questions to ask the developer when buying an apartment. First of all, you need to ask if he has a construction permit and design documentation, then read the documents.

It is also recommended to clarify:

- How developed is the infrastructure, how are things going with transport links?

- Are there any plans to build new facilities nearby?

- Are there agreements with energy companies and other companies providing services?

- Does the developer work with mortgage investors if a mortgage is planned?

- What materials is the house built from?

Legal advice: the developer can answer anything. It is better to check all the information yourself by requesting documents and familiarizing yourself with the infrastructure of the area.

Elena Plokhuta

Lawyer, website author (Civil law, 6 years of experience)

Are you entitled to a tax deduction when buying an apartment?

Write to us and we will provide free advice on obtaining a tax deduction

DDU: what to look for when buying an apartment in a new building

Expert blogs

Dmitry Lutsevich What will happen in the fall in the real estate market in anticipation of the second wave of the pandemic?

The pandemic and self-isolation changed our lives this year and many people realized that everything could change...

Anna Khryukina Gatchina. Where to live and is it worth moving?

Overview of the city of Gatchina.

Ella Dvornichenko PUSHKIN AND PUSHKIN DISTRICT OF ST. PETERSBURG (post No. 2)

About the Pushkinsky district of St. Petersburg, pros and cons. And about why you should take a closer look at Pushkinsky...

Dmitry Lutsevich Where to look for apartments with views and what to look for when buying luxury real estate?

Nowadays, fewer and fewer new projects are entering the luxury real estate market, however, there are interesting...

HomeCity real estateNews and articlesBack

Article. 04/12/2016 Print version

According to statistics, every third real estate buyer does not carefully read the share participation agreement that he signed with the developer. Professional participants in the real estate market of St. Petersburg and Moscow told what to look for when buying an apartment in a new building.

Item of purchase

The first parameter that needs to be carefully studied is the actual item of purchase.

— The most important thing is to check and double-check what is ultimately purchased under the contract. The buyer needs to carefully analyze the subject of the contract,” notes Ekaterina Artyomova, director of the consulting and analytics department.

According to Evgenia Vladimirova, head of the Rambler.Real Estate project Rambler&Co, one of the most significant points in the equity participation agreement is the description of the apartment being purchased.

— The building address of the property, the apartment number, and the condition in which the housing is being rented out—with or without finishing—must be specified in the DDU. And the more detailed the characteristics of the object are indicated, the better,” she suggests.

In addition, it is important to pay attention to the square footage of the apartment. The contract specifies the project area, which may differ from the real one, which will become known after the house is put into operation, the expert emphasizes. Therefore, the contract must state that if the area differs from the declared area, the developer will return the money for the missing squares.

Fix price

After making sure that you are purchasing exactly what you wanted, you also need to make sure that the price of the object is fixed.

“The contract must stipulate that the price can change only if a discrepancy with the actual area is identified after measuring the BTI before putting the house into operation,” comments Vladislav Melnikov, senior vice president of VTB Bank, which finances the MatchPoint multifunctional complex project.

The head of the legal department of the Premier Group of Companies, Irina Mayevskaya, recommends checking what exactly is included in the price of the apartment and what hidden surcharges may be provided.

— Almost always, in addition to the price stipulated in the contract, you will be expected to pay for registering a child-care facility. Therefore, the buyer has to sign an additional agreement on the provision of paid services. The price of the developer's service for registering an agreement can vary from 20 to 100 thousand rubles (depending on the company and the location of the property). Therefore, it is necessary to evaluate the amount of costs and your financial capabilities in advance,” the expert warns.

Also, many developers provide for payment of utilities from the moment of signing the act of putting the house into operation until receiving the keys and drawing up the acceptance certificate for the apartment. This period can range from 3 months to six months, and the amount of “utilities” for this period can be from 10 to 50 thousand rubles (depending on the location in which the residential complex is located and the cost of services of the service organization).

Transfer of apartment

Of course, the deadline for transferring the shared construction project is also of great importance when signing the agreement.

— It is not uncommon for an advertising campaign to state a deadline for putting a house into operation, but the contract specifies a deadline for the transfer of apartments that is at least six months longer than stated. Therefore, when concluding an agreement, it is necessary to understand for what period the developer is legally responsible,” notes Vitaly Pravdukhin, head of the legal department of AAG.

In general, many buyers of housing in new buildings do not share such fundamentally different concepts as “putting a house into operation” and “transferring an apartment to a participant in shared construction.” Regional Director for Real Estate Sales of LSR Group in the North-West, Yulia Ruzhitskaya, explains what this leads to:

— When a house is put into operation, some shareholders, forgetting what is written in the contract, demand the keys to the apartments, although there is still a lot of time left before receiving them. And if the deadline for commissioning a property is postponed for some reason, buyers jump to conclusions that the developer has problems. Let me explain: the time for putting the house into operation is planned, the developer sets it for himself. In certain situations, these deadlines are subject to change, that is, postponement to a later date.

But the transfer of apartments to shareholders must be carried out no later than the date fixed in the share participation agreement, the expert emphasizes. Failure to comply with this deadline can be interpreted as a failure by the developer to fulfill its obligations to buyers and a violation of the law.

That is why developers, taking into account the possibility of force majeure, plan to commission the house in advance - in order to prevent violation of the conditions of the building permit. So, “LSR. Real Estate - North-West" usually plans to commission houses 6 months before the date of transfer of apartments to buyers.

Registration and responsibility

What else do you need to know when buying real estate under DDU? Before signing the agreement, it is worth studying the so-called organizational moments related, in particular, to the registration of the agreement, as well as legal issues relating to the responsibility of the developer to the shareholder.

— Please note how the procedure for registering an agreement is recorded in the DDU. If the developer himself submits the agreement for registration, then the agreement must clearly state the deadline for the developer to submit documents to Rosreestr and the obligation to transfer the registered agreement to the shareholder. And, if the developer does not submit registration documents in a timely manner, the shareholder will have the right to demand compensation for losses - for example, lost profits in the form of interest on the use of funds that he put on the letter of credit, comments Vitaly Pravdukhin from AAG.

It is also extremely important to check the points that relate to the responsibility of the developer in case of violation of his duties to the shareholder.

According to Evgenia Vladimirova from Rambler&Co, the contract must specify the conditions for payment of the penalty. According to the law, a penalty is charged in the amount of 1/300 of the Central Bank refinancing rate in effect on the day the obligation is fulfilled, of the contract price for each day of delay. If the participant is an individual, then the penalty is paid in double amount - 1/150 of the Central Bank rate.

Crisis changes

It is no secret that crisis phenomena are associated with financial difficulties in the activities of many companies, including developers. Therefore, today some parameters of preschool education should be given special attention.

— With the crisis, the likelihood of construction projects not being put into operation has increased, so it makes sense to carefully study the clauses of the contract reflecting ways to ensure the fulfillment of the developer’s obligations to transfer residential premises. 214-FZ, which regulates the transfer of property rights to purchasers on the basis of DDU and assignment of rights, provides several ways to ensure the developer’s obligations to buyers. These include a pledge of land or lease rights, a bank guarantee and civil liability insurance,” says director Natalya Shatalina.

In addition, it should be taken into account that against the backdrop of the crisis, developers are trying to be flexible and are making changes to standard contracts.

— Due to the general decrease in the solvency of the population, the situation in the real estate market is becoming more and more tense, and the number of potential buyers for developers is decreasing. Today, construction companies are increasingly ready to consider customer proposals for adjusting certain terms of the contract and are ready to change standard forms of DDU, notes Irina Mayevskaya from Premier Group of Companies.

However, changes in contracts are not always aimed at benefiting the buyer. Some developers are trying to introduce additional provisions that do not comply with the current law, warns managing partner of Metrium Group Maria Litinetskaya:

— For example, some DDUs provide for the possibility of changing the final transaction amount by the developer. The buyer needs to be aware that this can only happen by agreement of both parties.

In conclusion, we note: to protect themselves, buyers should read the contract very carefully and check all the above parameters. And if any contradictions or questions arise, it is best to seek advice from a professional realtor.

Smart Real Estate

According to the portal. When using the material, a hyperlink to Razned.ru is required.

How to check the developer?

First you need to check the documents of the construction company:

- Charter

- Extract from the Unified State Register of Legal Entities.

- Certificate of registration with the Federal Tax Service.

- Construction permit.

- Project declaration.

- New building insurance contract.

It would be a good idea to check information about the developer using several services.

For example, on the website of the Russian Ministry of Construction you can find out the number of houses sold by a company, its registration data, information about the manager, email address and telephone number of the reception desk. If the developer is not registered anywhere, information about him will not be there. This should alert you, it is better to refuse the deal. There is a possibility that this is a scammer.

Another verification option is the FSSP database of enforcement proceedings. If a construction company has debts, they will be reflected there. The presence of debt negatively affects the reputation; such a transaction must be treated with caution: there is a possibility that the developer will soon go bankrupt.

Note: you can check the construction company by reviews. It is better to ask them from those who have already bought apartments there. Ideally, these will be relatives or acquaintances. On the Internet there is a chance to run into custom reviews.

A lawyer's answers to questions about buying a home in a building under construction

Is it possible to buy an apartment in a building under construction and then sell it after the price increases?

Yes, this is often practiced. But it is not the apartment that is being sold, but the right to claim it under the assignment agreement.

Is my husband's consent required to purchase an apartment in a building under construction?

Yes, consent is provided in simple written form, because General money is used for purchases. It is usually required by the bank.

Is it possible to register a private trust for two shareholders?

Yes, this is not prohibited by law. The contract specifies their details, as well as the procedure for distributing financial obligations to the developer.

I am in one city, I want to buy housing in a new building in another. How to do it?

You can issue a notarized power of attorney for another person. He will deal with the procedure and negotiate with the developer independently, but on behalf of the principal.

The father was a shareholder and died before the house was put into operation. I am the heir. Can I become a member of the DDU instead of him?

Yes. Within 6 months from the date of death, you need to enter into an inheritance, obtain a certificate from a notary, and then come to the developer and conclude an additional agreement to the DDU.

Are you afraid of making a mistake in a sales transaction?

Lawyers will provide free advice on every step of the transaction and help you avoid mistakes

Procedure for purchasing an apartment in a rented building

In addition to shared construction schemes, the primary real estate market is also saturated with offers for the sale of apartments in new buildings, which have already been put into operation and are almost completely occupied.

According to Art. 4 Federal Law No. 214-FZ dated December 30, 2004, the DDU can be concluded from the moment a building permit is received until the house is put into operation.

Purchasing an apartment from a developer in a rented house is possible either under a purchase and sale agreement, or under a preliminary purchase and sale agreement (until the property is registered with the construction company).

So, to purchase housing that has already been commissioned, you must adhere to the following procedure:

- Contacting the sales department of the selected developer . It is necessary to familiarize yourself with the available apartments, study the project documentation, the presence of a certificate of commissioning of the house, study the constituent documents of the developer, the investment contract and other documents.

- Visual inspection of the selected premises. Together with a company representative, a visit and inspection of the selected premises is carried out. It is possible to use the services of BTI specialists in measuring the area, compliance with the project, etc.

- Conclusion of an agreement with the developer . Carefully studying the signed contract is the key to avoiding problems in the future. It is most reliable to conclude a purchase and sale agreement with a notary. In case of concluding a preliminary transaction, the main document must be signed immediately after registration of ownership of the developer.

- Drawing up a transfer deed . According to Art. 556 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), the transfer of real estate is carried out according to an acceptance certificate. It indicates all the significant characteristics of the premises and describes in detail the condition in which the apartment is at the time of its transfer to the buyer.

- Registration of ownership rights to an apartment . Registration is carried out in the manner established by Art. 29 Federal Law No. 218 dated July 13, 2015, in local branches of Rosreestr. To carry it out, the new owner must submit the necessary documents (project documentation, cadastral passport, act of putting the house into operation, contract, application, etc.), and also pay a state fee (2 thousand rubles for citizens).