Purchasing agricultural land: features

One of the fundamental aspects of the transaction is the obligation of the owner of the territory to use it strictly in accordance with the established category and type. The purchase of agricultural land is recorded in the Unified State Register of Real Estate Transactions. The procedure in accordance with which the transfer of an object to a new owner is carried out is established by Federal Law No. 122. One of the essential conditions that this law establishes is the preemptive right to purchase agricultural land by municipal and state bodies. In accordance with this provision, the seller of the plot must obtain a waiver from the specified organizations. This procedure is similar to a transaction with common shared ownership.

Donation of lands for agricultural purposes

Guarantees of no future claims from both parties.

- Rights and obligations of the parties. The donor and the donee must fulfill the terms of the contract. In this case, the person who receives a land share as a gift becomes the owner of the share in accordance with the terms specified in the Donation and Transfer Act.

- The procedure for transferring a share. The share is transferred into the ownership of the donor from the moment the donation agreement is signed.

- Dispute resolution. Disputes are resolved by agreement of both parties, and can also be resolved in case of disagreement by a court decision.

- Final provisions.

- Addresses and signatures of the parties.

A sample land share donation agreement is presented here.

Land as a gift - what conditions are met?

Attention Advantages The advantages of donating a plot include: the presence of relaxations in terms of paying taxes; the property for which the gift agreement is executed is not included in the inheritance mass, the document cannot be canceled after the death of the donor, since during his lifetime he can freely dispose of the property, with the exception of situations where the rights of specific individuals are violated; Part of the land area can be donated. Mandatory conditions When drawing up a gift agreement in 2020, it is necessary to take into account the mandatory conditions. Donation agreement for an agricultural land plot If the number of participants in shared ownership of a plot of agricultural land exceeds five, the rules of the Civil Code of the Russian Federation are applied taking into account the specifics established by this article, as well as Articles 13 and 14 of this Federal Law.

Sale or donation of agricultural land

Without allocating a land plot on account of the land share, such a participant in shared ownership, at his own discretion, has the right to bequeath his share, renounce the right of ownership of the land share, contribute it to the authorized (share) capital of an agricultural organization using the land plot that is in shared ownership, or transfer it your land share in trust, or sell or donate it to another participant in shared ownership, as well as an agricultural organization or a citizen - a member of a peasant (farm) enterprise using a land plot that is in shared ownership. Donation of a land share For other owners, the issue of their alienation, including through.

The procedure for donating a land share

Only after receiving a certificate of ownership and other title documents, in accordance with clause 2 of Art. 223 of the Civil Code, the donee becomes the full owner of the land plot. Conclusion Shares and plots allocated from them are very often the subject of a gift agreement, even despite all the difficulties of their civil circulation.

This state of affairs is dictated by many factors, ranging from the simplicity and convenience of registering donations themselves to the decline in citizens’ interest in the use of agricultural land. In any case, the alienation of shares and plots under gift agreements requires a much more thorough and scrupulous approach than the registration of deeds of gift for other forms of real estate.

Subject to compliance with all legal requirements, donation will become an excellent and effective legal tool for citizens to realize the right to own land.

Donation of agricultural land

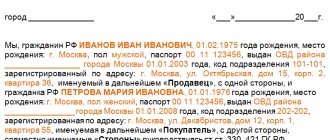

Civil Code of the Russian Federation). The contract must indicate: - information about each party to the transaction (full name).

Donation agreement for a citizen's land plot in full, date of birth, type and details of identification document), issued (date of issue, name of the authority that issued the identification document), residing at the address (address of permanent residence or primary residence) , hereinafter referred to as the “Donor”, represented by (if the agreement is concluded by a representative of the Donor, then it is necessary to indicate the above information about the citizen), acting on the basis of (type and details of the basis document, for example, a power of attorney, trust management agreement) on the one hand, and (full name. Conclusion of a land share donation agreement. This is the main distinguishing feature.

Donation agreement for agricultural land

According to Art. 13 Federal Law No. 122, the first stage of state registration of rights to land plots is the submission by applicants of an application and documents necessary for registration in at least two copies, the list of which consists of:

- Copies of documents identifying the parties to the transaction;

- Gift agreements;

- Certificates of ownership and other title documents;

- Cadastral passport of the plot;

- A boundary plan fixing the boundaries of the site.

If necessary, other documents may be required:

- Notarized consent of the second spouse for the gift;

- Consent of the guardianship authority;

- Certificate of absence of encumbrances and arrests;

- Certificate about the presence or absence of buildings on the site, etc.

After submitting the documents, the applicant receives a receipt indicating the date of their acceptance.

Donation of agricultural land

Methods of disposal Methods of disposal of shared land include the following:

- Using the share for planting agricultural crops, building or any other things.

- Possibility of donating land.

- Rent out a plot of land for a fee.

- Sale of shares.

Is it possible to donate a land share? As it was found out earlier, agricultural land can be sold, leased, or inherited. Donation of land shares is also permitted. For example, if the owner wants to give part of the land to his children.

To a third party If the owner wants to donate a plot of land or the entire plot to a third party, then this must be agreed upon with other land owners, if any. If there is only one owner of the share, then the donation procedure is simplified to the point of impossibility. All necessary papers must be signed and certified.

Donation of agricultural land

I have an agricultural plot of 11 hectares.

Hosu should give it to a relative, but I don’t know whether when donating it is necessary to comply with (that is, notify the administration) the requirement of the law (for sale): “Along with the mandatory documentation for agricultural land, which must be completed by the seller and the buyer (including a cadastral passport of the land plot and a certificate of state registration of property rights, without which the sale of agricultural land is impossible), Article 8 of the Federal Law “On the Turnover of Agricultural Land” establishes the seller’s obligation to notify in writing the highest executive body of state power of the constituent entity of the Russian Federation (regional administration) of the intention to sell the land plot.

Source: https://departamentsud.ru/darenie-zemel-sh-naznacheniya/

How is the purchase of land processed?

The procedure for concluding a transaction is established by regulations. The main documents required for the purchase of land are a certificate of state registration of rights, a cadastral passport. The law also requires notification to the executive authority of the intention to sell the plot. The notification must be in writing. It indicates the cost of the plot, coordinates and size. In addition, the seller sets the period during which the offer is valid. According to current regulations, this period is no more than 3 months.

If the administration refuses to purchase the plot or does not notify the seller in writing of its intention to buy it, then the owner receives the right to sell his plot within a year at a price not lower than that indicated in the notification. If the essential terms of the transaction change, the owner is obliged to send a new notice. The purchase of agricultural land in violation of this procedure is not permitted. If such a transaction is concluded, it will be considered void. This provision does not apply to territories intended for private household plots, as well as to allotments that are formalized by donation or exchange agreements.

Registration of land ownership: general information

The law provides several ways to acquire ownership of a land plot, depending on how you acquire the land:

- in the order of inheritance, donation, under contracts of sale and exchange;

- by privatizing a land plot owned by the state or municipality (for example, when registering ownership of the land under a house);

- by transferring a land plot as authorized capital to a new legal entity.

Concluding a transaction to acquire ownership of a land plot is only the first stage. The moment of execution of such a transaction, as a general rule, is considered to be state registration of land ownership, which is mandatory for transactions with land.

The procedure for registering ownership of a land plot is slightly different in each individual case, depending on how the ownership right was acquired: by concluding a transaction with a land plot, privatization or transfer. Let's talk about the features of each specific case in more detail.

Is it possible to carry out residential construction in such areas?

It was said above that legislative norms require the new owner to use agricultural land in accordance with the established permitted category. These include, in particular, gardening, gardening, and gardening. A way out of this situation may be to register the owner as an individual entrepreneur who will engage in farming. In this case, the plot can be used not only for private plots, but also for the construction of a residential building with the possibility of living and registering in it.

Amendments to the Land Code will allow farmers to build houses on agricultural land

If the loan is repaid early, the bank will return part of the insurance to the borrower. This is the essence of the new bill, which will be considered in the government, Dmitry Medvedev announced this at a meeting of the Cabinet of Ministers. We are talking about the insurance premium for the unexpired period of the contract, for example, if you took out money for a year and repaid the debt a month later.

We recommend reading: What incentives are there for enterprises for pregnant women in 2019?

Another document is intended to prevent the appearance of counterfeit medicines on the market. It simplifies control in the field of public procurement and tightens the responsibility of inspection experts. Finally, another bill protects the interests of owners - changes to the Land Code.

Pricing

The cost at which agricultural land will be purchased is determined in accordance with various factors. The most significant of these is the permitted category. Since the markets of territories belonging to different groups develop in their own way, accordingly, the cost of plots located nearby, but having different types, can vary significantly. The purchase of agricultural land is carried out after assessing the terrain, soil composition, and water regime. The value of the land is determined by its fertility and factors of possible use (as arable land, pasture, and so on). Of all the possible options, the one that will allow obtaining the maximum economic result is selected.

Reasons for purchasing

The purchase of agricultural land is made after assessing its fertility. To determine it, a comparative analysis of indicators is carried out under similar climatic and agronomic parameters and the same intensity of cultivation of the area. This procedure is called soil grading. It is quite complex and labor-intensive. In this regard, the purchase of agricultural land is carried out using already existing scales. They highlight the main characteristics that affect productivity.

In particular, these include the thickness of the humus layer, the level of clay fractions in the arable land, the nature of the reaction of the soil solution medium, and so on. Once the fertility and future use of the site have been determined, a profitable agricultural production model is being developed. It takes into account the likely costs of organizing the process and income from the sale of grown products for a specific time period (year, quarter, month, week). The indicator of the positive difference formed between expenses and income is discounted into current parameters and indicates the market price of the plot. Costs in this case include the purchase of equipment, wages for all employees, including the owner himself, interest on the use of capital and business income.

Reasons for reducing the cost

The price will be significantly affected by the presence of a dilapidated structure, even if it is owned. In this case, it is necessary to take into account the possibility and cost of restoring the building for its subsequent operation or the necessary costs of demolishing it and removing the resulting construction waste. At the same time, the presence and condition of communications is taken into account. They can act as a set-off and increase the cost or, conversely, reduce it because they require repair or dismantling. The same applies to clearing arable land of bushes, uprooting trees, or leveling the landscape and filling holes and pits. In these cases, there are grounds for reducing the value of the territory in proportion to the expected costs. In this regard, determining the amount of required or necessary additional costs is of the same importance as assessing undeveloped plots.

The procedure for purchasing a land plot from the owner

A plot of land is acquired for various purposes: individual housing construction, farming or organizing a gardening partnership.

Procedure: purchasing land from the owner

First, a search and selection of suitable land is carried out. Before concluding a transaction, the territory is preliminarily inspected. To register land ownership, you must go through the following steps:

- Concluding a preliminary agreement, which prescribes the obligations of the parties;

- Establishing the necessary deadlines for the preparation and collection of documents by the buyer and seller;

- Drawing up a purchase and sale agreement;

- Terms of payment (one of the reliable methods is to use a safe deposit box);

- Official registration in Rosreestr.

The agreement is signed by both parties involved in the transaction. It must be prepared in triplicate . One of them remains with the owner, the other is issued to the buyer, and the third is sent to the Rose Register branch.

Documents are provided without prior certification by a notary. The contract must contain information about the location of the site, the method of its use, as well as the cadastral number.

The date of registration of the site by the owner in the Unified State Register and other information are indicated here.

What documents are required when purchasing a plot of land?

When selling land, the owner is required to present the following documents:

- Your passport;

- Document confirming registration;

- Cadastral passport for land;

- The agreement on the basis of which he received the plot and the right to own it;

- Official information about the value of land;

- If there is a house on the territory - information about the state registration of rights to it;

- Site plan received from the land committee;

- A document where the cost of the plot is officially stated;

- A certificate of the exact cost of the house on the territory, if any, as well as an act of acceptance of the building for operation;

- Certificate issued by tax authorities;

- A statement from the spouse with his consent to conclude the transaction.

To conclude an agreement, you will also need copies of the seller’s and buyer’s passports. If there is a house on the site, its registration certificate may be required. If construction is still underway on the territory, you should request a document from the District Architecture Department. It must contain permission to carry out construction.

Attention! If the sale of the plot is not carried out by the owner himself, but by his representative, a power of attorney certified by a notary is also required. In addition to an identity card, an entrepreneur provides a certificate of state registration, and a legal entity provides the necessary constituent documents.

If a plot is purchased for individual housing construction (IHC) , then the following list of documents is collected:

- A statement establishing the transfer of ownership of the plot to the buyer;

- Agreement for the sale and purchase of a land plot, drawn up in triplicate;

- Cadastral passport;

- Documents confirming the seller’s right to the plot (certificate of inheritance, gift or previously concluded purchase and sale agreement);

- Confirmation of the consent of the other spouse to transfer the plot with its certification by a notary (if the land was acquired during marriage);

- The act of acceptance and transfer of territory.

Additionally, the buyer pays a state fee, but he may not provide a receipt.

To sell real estate, it is also necessary for the subject of the Russian Federation to refuse to purchase the site. When purchasing a plot of land along with a house , you need to make sure that there are no registered persons there .

Important! The purchase and sale of a plot is valid provided that it has previously been subject to state cadastral registration.

To carry out the procedure for state registration of rights to a land plot, the following documents are required:

- Identification;

- A special act of a government body on the existence of these rights;

- Cadastral passport;

- A purchase and sale agreement or other certificate officially confirming the basis of ownership;

- Certificate of payment of state duty;

- Documents establishing certain features of the transaction.

All documents are submitted to the Russian Register. The applicant submitting documents for registration receives a receipt.

Registration of the transaction: deposit when purchasing a land plot

All important terms of the transaction are agreed upon between the land owner and the buyer in advance. A decision is also made on the need to make a deposit and its cost. Typically this amount is a certain percentage of the total cost of the site. The conditions for providing the deposit are specified in the preliminary agreement concluded by the parties.

The deposit can be presented in several forms. This is cash or non-cash money, as well as an object of real estate or movable property. When paying in cash, the buyer pays and receives a receipt confirming receipt of the amount of money by the seller. In case of non-cash payment, the money is transferred to the seller’s account with the specified details.

Rules for verifying the authenticity of land seller documents

The seller's passport , a valid document of ownership of the land plot , the cadastral number and the land passport , where its category and other information are subject to mandatory verification

You may be interested in: How to protect yourself from fraud when renting apartments?

If the sale takes place in the presence of a trusted person, then it is necessary to check whether he has the right to sign and receive money .

The extract from the cadastre is also carefully checked , and existing encumbrances on the territory are taken into account.

In addition, the buyer can additionally view the master plan for the development of the territory. The history of the site is important, namely documents on the primary right of ownership of the property . As a result, the legality of the land purchase and sale agreement must be checked. The slightest mistakes can cause problems.

What risks are there when purchasing a plot of land?

The main reason for the risk is the seller’s dishonesty. In this case, he can sell land that does not correspond to its intended purpose . Such land may belong to the forest fund , which makes the subsequent construction of buildings on it impossible. Also, such a plot of land is not subject to resale .

Cases of land squatting are common . The acquisition of such plots may be considered illegal.

Therefore, the buyer must request an official extract from the Unified State Register confirming ownership.

of land that have been subject to seizure or restrictions on use pose a danger when purchasing

The second group of risks are various inaccuracies during the preparation of documents.

When concluding a contract, you should check whether the dimensions and description of the land correspond to the actual information specified in the documents.

A mandatory document is the consent of one of the spouses to alienate the plot , as well as the permission of the guardianship authorities if the right of ownership belongs to a minor.

The third group of risks is the inattention of the buyer himself. In this case, the buyer may not first check and inspect the site , receiving ownership of a completely different territory.

Do I need to order the services of lawyers?

A newcomer who acquires land ownership risks being deceived. To prevent this from happening, it is best to seek help from a lawyer. He will provide competent consultation and help you avoid risks.

You can contact our online consultant via chat. He will advise you free of charge.

https://www..com/watch?v=CWLHFEgkN4I

Calculation of tax when purchasing land

Calculating the amount accurately is not an easy task. For example, if there is a building on the land, the buyer has the right to receive a tax deduction. However, this amount should not exceed two million rubles.

For the owner of a land plot, a mandatory tax rate is set at 13%. But for non-residents it increases to 30%.

Source: https://oformi.su/poryadok-pokupki-zemelnogo-uchastka/

Common Misconceptions

The population's ideas about existing prices for plots are based on information provided in the media and the Internet about plots of similar location and area. However, in most cases, these data do not reflect the actual market value. The difference between the transaction price and the offer is called bargaining. Determining the adjustment indicator acts as one of the stages of any assessment using comparative approach methods. In this regard, it is not at all surprising that the transaction price and the initial cost of the property put up for sale may have significant differences. There are many reasons for the difference. One of the most important is the expected market dynamics. If it is growing, then even a five percent discount will be quite large. However, in the absence of forecasts for market growth and in the case when the decline is of a fundamental nature, the difference between the cost of the offer and the transaction itself can amount to several tens of percent.

Land donation agreement between relatives

Typically, loved ones prefer to transfer property free of charge.

In order to simplify the conclusion of the transaction, the law allows the preparation of a land donation agreement between relatives in 2020.

By drawing up the document, the parties will be able to change the owner of the property without paying a fee. In a number of situations, it is possible to avoid paying tax to the state treasury. The land donation agreement must be drawn up correctly.

The donor and the donee are obliged to follow the provisions of the current legislation. Papers executed with violations can be challenged in the future.

Therefore, it is necessary to familiarize yourself with the rules for registering a deed of gift in advance. Thus, not all property owners have the right to transfer it to another person.

If the donor is incapacitated or a minor, such a transaction will subsequently be declared invalid. There are a number of additional restrictions.

We’ll talk further about how to correctly draw up a deed of land, what documents are required to conclude an agreement, and in what cases it is necessary to pay taxes.

Rules for drawing up a gift agreement

The conclusion of a land donation transaction begins with the execution of an agreement. It is drawn up in writing and signed by the donor and the recipient. The deed of gift must contain a number of mandatory information. Their absence will lead to the paper being invalidated. The contract must describe in detail the subject of the donation.

In the case of a land plot, you will need to provide the following information:

- the name of the property being donated;

- location of the land plot;

- category of land;

- cadastral number;

- availability of permission to use;

- land area.

Additionally, the deed of gift must indicate the existence of an encumbrance, the rights and obligations of the parties, as well as other restrictions. If the text of the deed of gift lacks mandatory clauses, it will be declared invalid. To make a donation, it is not necessary to draw up an act of acceptance and transfer of land.

The parties have the right to include additional clauses in the agreement. The deed of gift can indicate the validity period of the document, the rights of heirs and other features.

If additional items are missing, this will not be a reason for refusal of registration. Doing the paperwork yourself can be problematic. Experts recommend using a ready-made form. Agreements for donating a plot of land between relatives can be done online.

Preparation of deed of gift

If the land owner wants to transfer property free of charge to relatives, he will need to prepare a package of documents. The list is regulated by the current legislation of the Russian Federation.

The parties will have to provide:

- Completed application. The paper is drawn up by each of the participants in the procedure. The donor indicates that he wants to transfer the land free of charge. The recipient states that he accepts the gift.

- A receipt confirming payment of the state duty. The original and a copy of the document are provided.

- Passports of participants in the procedure.

- Donation agreement. If the parties independently draw up an agreement, three copies of the paper can be prepared. If a notary is involved in the procedure, an additional copy will be required.

- Papers confirming the existence of land rights. A copy must be provided along with the original. Specialists can independently request data from Rosreestr.

- Consent of the guardianship authorities, if one of the parties to the transaction is a child. The document is provided in 2 copies.

- Permission from the donor's spouse if the plot is joint property. The paper is presented in the form of an original and a copy.

Land rights can be transferred either to a close relative or to another citizen. The law does not establish restrictions. However, there are a number of conditions that serve as grounds for declaring a transaction invalid.

land donation agreement between relatives:

A concluded agreement is recognized as such in the following situations:

- real estate is donated to a commercial organization;

- the donor is a child under 14 years of age or a person declared incompetent;

- persons working in government organizations who accept property as a gift from a ward, client or visitor;

- the donor is a person who does not have permission to turn over the land.

If there is a permanent structure on the site, you cannot donate only the land. The property is donated along with the building. The parties involved in the transaction must be personally present during the execution of the contract. If such an opportunity is not available, the law allows the delegation of powers to a representative. For this purpose, a power of attorney is issued.

Registration of donation of land

When the deed of gift for land between close relatives has been drawn up and the package of documents has been prepared, you can proceed directly to the procedure for registering the transaction. To do this, you need to contact Rosreestr or MFC. You must have a prepared package of documentation with you. If papers are provided in the required quantity, they will be accepted for consideration.

The analysis procedure takes 10 days. When the period ends, authorized specialists will register the transfer of ownership or temporarily suspend the registration process.

If the registration process has been suspended, participants have the right to correct the mistakes made and re-apply to Rosreestr. The maximum period for stopping is one month. At the initiative of the donor, the period can be extended by another 3 months.

If the parties do not have time to correct the documentation within the established period, they will be denied re-registration of property rights.

To avoid wasting time, it is recommended to consult a lawyer or download a ready-made sample land donation agreement.

Features of taxation when donating

If land is donated, a tax will be required to be paid to the state treasury. If relatives are involved in the procedure, payment of the fee can be avoided. Privileges are granted only to persons who are close relatives.

In accordance with Article 14 of the Family Code of the Russian Federation, these are:

- brothers and sisters;

- husband and wife;

- parents and children;

- Grandmothers and grandfathers.

Single-parent or adopted children, as well as adoptive parents, are also recognized as close relatives. Persons entitled to donate land on preferential terms will only have to pay a state fee.

Its size in 2020 is 2000 rubles. Additionally, you will have to pay money for the transfer of rights to the land. The amount is 350 rubles.

The need for the above payments is regulated by the Tax Code of the Russian Federation.

If the state fee has not been paid, the documentation will be returned to the applicant within ten days. The deed of gift will not be considered.

If the parties to the transaction are not close relatives, you will need to pay tax. Its size is 13% of the value of the donated land. If a person does not know how to draw up a standard contract, it is recommended to use a ready-made template as an example of filling it out.

Consequences of donating land

When land registration is completed, the former owner loses the right to a garden, dacha or other plot. The donee becomes the owner of the property.

However, the current legislation of the Russian Federation contains a number of conditions under which a transaction can be cancelled. The donor himself has the right to challenge the conclusion of the agreement.

His demands can be satisfied if the citizen’s financial situation and health have deteriorated significantly.

The transaction can only be challenged in court. The claim will need to be supplemented with documentation confirming the applicant’s correctness.

The Civil Code of the Russian Federation sets out additional conditions under which a transaction is cancelled. Such a decision is made if the contract was signed under physical or moral pressure, or the plot with the house has fallen into disrepair as a result of the actions of the donee. This decision is made depending on the individual characteristics of the current situation.