What benefits for paying for housing and communal services are provided for military pensioners?

- Article 5 of Federal Law No. 5 on obtaining the title of military pensioner;

- Article 1 of Law No. 4468 - 1, which regulates the provision of social benefits, including discounts on utility bills. It is worth noting that the law regulates the possibility of receiving state assistance when paying for used housing and communal services for widows of military pensioners.

- original and copy of all completed pages of the passport;

- a certificate of family composition (who lives in the same living space as the military pensioner);

- any documents that can confirm the degree of relationship with a military pensioner (required for those family members who live with him);

- documents capable of confirming ownership of a residential property. If the apartment is rented, a rental agreement is required;

- certificate of income for the last six months;

- a document confirming the right to receive discounts on housing and communal services (military pensioner certificate);

- a certificate from the housing office confirming the absence of debt for utility services.

Benefits for paying utility bills for military pensioners

Advice from lawyers:

1. I am a military pensioner, a retired officer. As a participant in combat operations (Afghanistan), I receive a cash supplement to my pension. Combat veterans are entitled to benefits in paying utility costs. How to achieve the real effect of this benefit? Where and what documents should I apply? Nikolai Nikolaevich.

1.1. Hello. Benefits in Russia are of a declarative nature, that is, without contacting the competent authorities, the benefits do not apply. In your case, you need to contact the social protection department at your place of residence, the department that provides benefits to combatants. In general, the algorithm is approximately this: collect a package of documents (passport, certificate of ownership of residential premises, certificate of family composition), come to the social protection department, fill out an application, wait for a decision. Then the benefit begins to apply if the body makes a positive decision. Good luck.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

2. I am 68 years old, a military retiree and a military veteran. He served in the Army and Armed Forces of Ukraine until 1994 in Crimea, after his dismissal he received a pension in the Russian Federation. In August 2014, he registered in his apartment in Kerch and transferred his pension here. Am I entitled, as a military veteran, to a 50% discount on utility bills? To me on social media The service explains that only those who received a military pension in Crimea before the referendum in March 2014 have the benefit. Where is social justice then?

2.1. You need to receive the title “Veteran of Labor” from the social security authorities and register as a beneficiary. They cannot refuse to award you this title. Only after this you will be entitled to benefits.

Did the answer help you?YesNo

3. They want to raise the retirement age for men to 65 years. Military pensioners, VETERANS of the armed forces born in 1960 will receive their benefits for utility bills only in 2022 instead of 2020. These funds will be used to provide raises to older pensioners. Will they take it from some and give it to others?

3.1. Dear Tatyana Petrovna, tell me why share “the skin of an unkilled bear”? They won’t take anything away from you, don’t worry. And for information, raising the retirement age is not currently adopted at the legislative level.

Did the answer help you?YesNo

4. They want to raise the retirement age for men to 65 years. Military pensioners born in 1960 will receive their benefits for utility bills only in 2022 instead of 2020. These funds will be used to provide raises to older pensioners. Will they take it from some and give it to others?

4.1. Greetings Tatyana! If you have a combat veteran certificate issued before January 1, 2005, then you are entitled to a free plot of land at your registered address. If you want to exercise this right, please contact me by phone number listed on my page.

Did the answer help you?YesNo

5. My father is a combat veteran, a military pensioner. I bought an apartment with a mortgage, he is the only owner. What benefits for utility bills is he entitled to as a combat veteran? Where to go for recalculation? What documents are needed?

5.1. You need to contact your management company with a B DB ID. Compensation is provided for the cost of paying for residential premises in the amount of 50 percent: rent and (or) payment for the maintenance of residential premises, including fees for services, work on managing an apartment building, for the maintenance and current repairs of common property in an apartment building, based on from the total area of residential premises occupied, respectively, by tenants or owners (in communal apartments - occupied living space); contribution for major repairs of common property in an apartment building, but not more than 50 percent of the specified contribution, calculated on the basis of the minimum amount of contribution for major repairs per one square meter of total living space per month, established by a regulatory legal act of a constituent entity of the Russian Federation, and the occupied total area residential premises (in communal apartments - occupied living space). Social support measures for paying for residential premises are provided to persons living in residential premises, regardless of the type of housing stock, as well as family members of military veterans living with them Art. 16 of the Federal Law “On Veterans”.

Did the answer help you?YesNo

5.2. Hello, Daria, not all regions of Russia have such benefits. Find out on social media. protection at your place of residence, which is what you are entitled to. I wish you good luck and all the best!

Did the answer help you?YesNo

6. I am a military pensioner, I have a group 3 disability, I worked until I was 60 years old, and received a supplement to my military pension. Question: are there any benefits for paying for utilities, etc.?

6.1. Hello! Social protection will tell you about your right to benefits, and they will also provide you with a set of necessary documents. Judging by your appeal, there is a right.

Did the answer help you?YesNo

6.2. Yes, you have the right to 50% of the payment for utilities due to disability for the occupied living space. Provide the social security department with a certificate of disability and an F-10 extract from the house register.

Did the answer help you?YesNo

7. I am a veteran of the Russian Armed Forces, a military pensioner for 53 years. Do I have benefits on utility bills? If yes, then which ones?

7.1. Hello! Until you reach 60 years old, you have no luck.

Did the answer help you?YesNo

8. I am a labor veteran of the Russian Federation (federal status), a military pensioner due to length of service, I am now 48 years old. Should benefits apply to me, for example, for utility bills? Sincerely, Larisa.

8.1. YES. Measures of social support for labor veterans, as well as citizens equated to them as of December 31, 2004, are determined by laws and regulatory legal acts of the constituent entities of the Russian Federation.

Did the answer help you?YesNo

9. Do I have a benefit for paying utility bills if I am a military pensioner (age limit for military service)

9.1. For these reasons alone, there are no benefits at the federal level.

Did the answer help you?YesNo

10. I am a combat veteran, a military pensioner since 2009, please explain whether I have benefits for paying for utilities and electricity and on the basis of what laws! Best regards, Sergei!

10.1. Hello! Yes, you have benefits in the amount of 50% per person. services, according to Federal Law No. 5 “On Veterans”

Did the answer help you?YesNo

11. Good afternoon. I, Vladimir Nikolaevich, retired from the armed forces in 1995. Military pensioner. Age 57 years. Service in the armed forces for more than 20 calendar years. I have a certificate of a veteran of the armed forces. In accordance with the Veterans Law, my wife and I are entitled to benefits for utility bills. This is true?

11.1. If you and your spouse are pensioners, you are entitled to housing and communal services benefits.

Did the answer help you?YesNo

12. I am a military pensioner, a veteran of military service, I am 55 years old, am I entitled to receive benefits for utility bills.

12.1. Federal benefits are not provided in this case.

Did the answer help you?YesNo

13. What benefits do military pensioners with more than 25 years of service enjoy when paying for utilities?

13.1. Compensation for housing and communal services is not provided. BUT there is a benefit for paying property and land taxes.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

14. I am the wife of a military retiree. I am not a labor veteran. Are there any benefits for paying utility bills?

14.1. Hello! Unfortunately no.

Did the answer help you?YesNo

15. I have a question. I am registered and live in St. Petersburg. I am a military and combat veteran, retired for 66 years. Tell me what benefits are available for this category of citizens in paying taxes for motor vehicles and whether additional payments are paid when paying for utilities (housing and communal services) and in what amount? Preferably with a link to the original source. Thank you.

15.1. Good afternoon Combat veterans are exempt from paying transport tax provided that the vehicle has an engine power of up to 150 hp. inclusive or more than 15 years have passed since the year of its release. Social support measures for family members of deceased (dead) disabled war veterans, participants in the Great Patriotic War and combat veterans - payment in the amount of 50 percent of the occupied total area of residential premises (in communal apartments - occupied living space), including members of the family of the deceased (deceased) who lived with him. Social support measures for housing payments are provided to persons living in houses, regardless of the type of housing stock; - payment in the amount of 50 percent of utilities (water supply, sewerage, removal of household and other waste, gas, electricity and heat - within the limits of consumption standards for these services established in accordance with the legislation of the Russian Federation); persons living in houses without central heating - fuel purchased within the limits established for sale to the public, and transport services for the delivery of this fuel. Providing fuel to the families of the deceased (dead) is carried out as a matter of priority. Social support measures to pay for these services are provided regardless of the type of housing stock. These social support measures are provided regardless of which family member of the deceased is the tenant (owner) of the residential premises;

Did the answer help you?YesNo

16. I am a military pensioner, I am 55 years old, am I entitled to benefits for utility bills?

16.1. I am a military pensioner, I am 55 years old, am I entitled to benefits for utility bills? - only upon reaching the retirement age of 60 years.

Did the answer help you?YesNo

17. Can I receive benefits for travel on public transport (plastic card), as well as 50% of the payment for housing and communal services. I am an honorary donor of Russia and a labor veteran, I am 46 years old, I live in the Ivanovo region, a military pensioner. Social security denies these benefits, citing the fact that I am not yet 60 years old. Are they right, what legal documents regulate this? Please clarify. Thank you in advance.

17.1. No you don't. Social protection rights. Legal document at the link Read more>>>

Did the answer help you?YesNo

18. I am an honorary donor of Russia and a labor veteran, I am 46 years old, I live in the Ivanovo region, a military pensioner. Can I receive benefits for travel on public transport (plastic card), additional monetary compensation, as well as 50% of the payment for housing and communal services. They say we should sue social security, in some areas they are already suing and winning. What legal documents regulate this, if so, what to do. Please clarify. Thank you in advance.

18.1. Those awarded the “Honorary Donor of Russia” badge (it is issued to those who have donated blood at least forty times or plasma at least sixty times) are entitled to the following benefits: priority treatment in state or municipal healthcare institutions; free production and repair of dentures (except for dentures made of precious metals) in state or municipal health care institutions; preferential purchase of drugs (with a 50 percent discount on their cost) according to prescriptions from state or municipal health care institutions; priority purchase at the place of work or study of preferential vouchers for sanatorium and resort treatment; provision of annual paid leave at a time convenient for them; free travel on all types of public transport (except taxis) for urban and suburban traffic and in rural areas also on public motor transport (except taxis) for intercity traffic in the manner and under the conditions determined by the government of the Russian Federation; reduction of utility bills by up to 50 percent; obtaining preferential loans for individual housing construction.

Did the answer help you?YesNo

19. Does a military pensioner have benefits on transport tax and utility bills? Military veteran, age 50?

19.1. Benefits are provided only to disabled people.

Did the answer help you?YesNo

20. I am a military pensioner, discharged to the reserve in November 1996 with 23 years of service due to organizational and staffing measures with the military rank of “major”. All the past years I have had benefits on utility bills and telephone payments in the amount of 50%. Question: in connection with the increase in salaries for employees and the abolition of a number of benefits, will I still have benefits for utility bills? Thanks in advance for your answer, best regards.

20.1. Unfortunately no. If you have other benefits - “Afghanistan”, disability, etc. take advantage of them.

Did the answer help you?YesNo

In connection with the entry into force of new legislation on July 1, 2002, I ask you to clarify

We live in a non-privatized apartment. The responsible tenant is a long-service pensioner (former military man).

Is a retired lieutenant colonel, who is a military pensioner and receives a pension in accordance with more than 20 years of service, entitled to

Who is entitled to benefits for utility bills and how to get them

Group 3 - This group includes families with disabled children. There is a single rule in this group - the amount of benefits provided for housing and communal services to disabled people of group 3 cannot be lower than 50% when paying for utilities.

To pay for household services, taking into account benefits, such families or the disabled person himself will need to contact the institution that is responsible for collecting payments for housing and housing and communal services. The main document is a certificate confirming the fact of disability, which is issued based on the results of an examination conducted in a hospital or at home.

Benefits for pensioners living alone 2020 for paying for housing and communal services in the Nizhny Novgorod region

- single pensioners;

- disabled people living alone;

- minor orphans who own apartments;

- families that include only disabled people or pensioners and children under 16 years of age;

- large families who live in low-rise buildings owned by the city.

Land tax benefits for pensioners The legislation of the Russian Federation has assigned the establishment and collection of tax payments for the use of land to the regional level. The body that implements state policy in this area is the authorities of a particular region.

We recommend reading: Can a bailiff seize housing and communal services subsidies?

Benefits for paying utility bills in 2020-2020

- Heroes of the Soviet Union or Russia;

- full holders of the Order of Glory;

- blockade survivors, family members of deceased WWII participants/disabled veterans;

- citizens awarded the title “Hero of Socialist Labor”;

- disabled people, veterans of the Great Patriotic War;

- their close dependent relatives;

- disabled relatives of military personnel who died in combat or as a result of diseases acquired in service;

- people affected by radiation who participated in the liquidation of accidents at nuclear power plants;

- disabled people of all groups;

- including disabled children;

- families caring for disabled children.

Pensioners in general are not classified as such. However, most of them have the opportunity to reduce their expenses. So, if a couple of pensioners live in an apartment, then it is worth applying for a subsidy. This type of support is assigned if spending on housing and communal services exceeds 22% of total income.

Benefits for pensioners on utility bills

Veterans, disabled people and other categories of citizens in Russia regularly receive assistance from the state when paying bills for apartments and utilities. Do ordinary citizens from the retirement age group have similar privileges and guarantees?

- Russian citizens of the retirement age category;

- only registered at the same address at which the application for preference is submitted;

- those who do not have debts for rent and utilities (but otherwise, there is still a way to receive a monetary concession from the state if you enter into an agreement on the timing of debt repayment and comply with its terms);

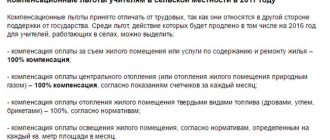

What benefits for housing and communal services are available to military pensioners?

Well, if a serviceman dies, then his family has the right to a pension. The amount of such benefits is calculated individually, depending on the conditions of death of the family breadwinner and the number of its members who were supported by him. But in most cases, the benefit is several times larger than the standard pension. And this is a lot, even for a wealthy family.

We recommend reading: Repeated Income Tax Refund When Buying an Apartment in 2020

According to the current legislation, there are benefits for paying utility bills for military pensioners. Additionally, this category of the population has a number of benefits that allow significant savings in the family budget.

Benefits for military pensioners

As noted above, a whole system of benefits is provided for retired military personnel, which can be divided into:

- tax;

- social;

- related to payment of utilities;

- provided in terms of medical care.

Also, this category of pensioners regularly receives various types of additional payments and supplements to the basic pension. There were no innovations noted in 2019.

Tax

Having analyzed the provisions of the Tax Code of the Russian Federation, we can identify the following main types of tax benefits provided to retired military personnel:

- Exemption from personal income tax – in accordance with clause 2, part 1) of art. 217 income received by individuals in the form of pensions is not subject to taxation. It should be noted that this benefit is widespread and applies to all pensioners.

- Reduced transport tax rate or complete exemption from this type of payment – such a benefit is provided to citizens who have retired from military service only in certain regions of the Russian Federation. For example, in the Amur Region, pensioners, WWII veterans and other categories of persons enjoy a 100% discount when paying transport tax (Law of the Amur Region dated November 18, 2002 No. 142-OZ).

You can obtain accurate information about the validity of such a benefit in a particular region of the Russian Federation on the Federal Tax Service website in the section “Reference information on rates and benefits for property taxes.”

- Reduction of land tax - in accordance with clause 5 of Art. 391 for veterans, disabled combat veterans, pensioners and other persons, when calculating payment for land, the tax base is reduced by the cadastral value of 600 sq.m. land owned by the taxpayer.

- Exemption from paying state fees (when applying to the courts, in the case of notarial actions, etc.) - this is written in subparagraph. 11-12 clause 1 art. 333.35.

Read also: Amount of disability pension

Social

Retired military personnel can also count on receiving the following types of social benefits:

- training on a free basis at universities - this right is given to military personnel who worked under a contract and left due to reaching the age limit, for health reasons, or due to organizational and staffing measures - OSH (Part 2, Clause 5, Article 19 of the Federal Law of the Russian Federation “On the status of military personnel);

- obtaining living space (if the service life is at least 10 years). This is written in Part 2, Clause 1, Art. 23 Law No. 76-FZ;

- granting the right to join a housing cooperative out of turn;

- If, after retirement, a serviceman continues to work, the employer is obliged to annually provide him, in addition to paid leave, with unpaid leave of up to 14 days (for WWII participants, this period increases to 35 days). This rule is enshrined in Art. 128 Labor Code of the Russian Federation;

- granting the right to free travel (clause 5 of article 20 of Federal Law No. 76-FZ), etc.

In addition, social protection is also provided to family members of a pensioner who died after leaving military service (Article 24 of Law No. 76-FZ).

Benefits for housing and communal services

Military personnel who have retired from work are also entitled to receive a discount on housing and communal services. However, this type of benefit is established at the regional level . In most constituent entities of the Russian Federation, the discount provided to military veterans when paying for services in the housing and communal services sector is 50% . However, by decision of local authorities it can be changed.

Medical benefits

In accordance with the provisions of Art. 16 Federal Law of the Russian Federation “On the status of military personnel”, officers who have retired from service (with more than 20 years of service), as well as members of their families, have the right to count on the following types of benefits for services in the field of medicine:

- free provision of medical care;

- production and repair of dentures;

- provision of necessary medicines and medical products.

Read also: Reduction of an employee of pre-retirement age

In addition, this category of pensioners has the right to purchase vouchers to sanatoriums, holiday homes and tourist centers with a 25% discount. At the same time, for their family members the cost of the trip will be reduced by 50%.

Additional payments and allowances

Within the framework of Art. 17 of Law No. 4468-1 provides for the following types of allowances for military pensions:

- Pensioners with disability group I or who are over the age of 80 are entitled to a supplement in the amount of 100% of the accrued pension (provided for the care of such citizens).

- Unemployed persons who are dependent on disabled children. The pension supplement in this case will have the following amounts:

- 32% (if there is one family member of this category);

- 64% (if the pensioner supports two disabled persons);

- 100% (for three or more non-working family members).

- WWII participants are provided with a bonus of 32% (if the latter do not have a disability) and 64% (if the age is 80 years).

A military pensioner who received injuries during military service is also entitled to a state pension, which is determined as a percentage of the social pension:

- 300% (in case of assignment of disability group I);

- 250% (if there is group II);

- 175% (for group III disabled people receiving a pension).

Certain categories of military pensioners also have the right to count on receiving a monthly cash payment (MCV). According to clause 1 of section 1 of the Order of the Ministry of Labor of the Russian Federation dated January 22, 2015 No. 35n, the following categories of persons are granted this right:

- veterans;

- Heroes of the Soviet Union and Russia, etc.

State support for widows of retired military personnel: benefits for housing and communal services and medical services

What benefits are entitled to the widow of a military pensioner after his death? Wives, due to the nature of their husband’s work, are forced to move frequently. This affects their length of service required to qualify for a pension. It often happens that by the time a woman retires, she does not have enough years to qualify for a pension. In this situation, the state allows up to 5 years of the period without work to be counted as length of service.

The state allows widows of officers to combine 2 payments at the same time. For example, your civil pension and survivor's benefit. But a woman cannot remarry and must prove her need for these payments. Otherwise, she will be denied the right to combine payments.

What documents are needed to receive benefits for utility bills for the widow of a military pensioner?

In this paragraph, we will consider only options that provide for the retirement age of the widow of a serviceman. Upon reaching retirement age, the widow of a serviceman can apply for pension payments in accordance with her own length of service or switch to her spouse’s pension. In both cases, she can take advantage of the benefits provided by law.

If a widow lives in a private house, once every 10 years she can exercise the right to repair a residential building. Repairs in state-owned apartments (houses, cottages) are carried out in accordance with the housing and communal services schedule.

Benefits for Military Pensioners for Housing and Utilities Payments in the Nizhny Novgorod Region

Unfortunately, no benefits are assigned automatically, even if a citizen has every right to them. Receipt of assistance is formalized at the social welfare department or at the subsidy payment center. Please note that some categories of pensioners are required to regularly confirm their right to receive government assistance. As a rule, confirmation is required every six months. It is also necessary to remember that debts to pay for housing and communal services will in any case become an obstacle to obtaining a subsidy. When submitting your application you will need the following documents:

- passport;

- documents for living space;

- documents confirming the right to receive benefits.

For certain categories of beneficiaries, partial compensation for telephone payments is possible. You can also receive compensation for expenses such as garbage removal or antenna fees. The conditions for providing assistance depend on the category to which the pensioner belongs. The total amount of compensation can be up to half of all utility bills.

Benefits for widows of military pensioners for utilities

- Passport with registration

- Prescription

- Serviceman's personal file

- Military ID.

If there is no military ID, then you need to submit another document that will confirm the fact of service, the fact of surrendering weapons and dismissal. The military commissar of the region, Major General Nikolai Glinin, said that, in his opinion, the law stipulates that this bonus should be paid only to war participants. Military registration and enlistment offices have corresponding instructions from the financial department of the Ministry of Defense. They say that the commissariats are not to blame for the massive non-payment of widow's pensions. A similar excuse “not to pay” is used in other law enforcement agencies.

Are military pensioners and active military personnel entitled to benefits for housing and communal services?

Details of a military or pension certificate.

The serviceman can calculate the size of the benefit and the final amount independently. To do this, he needs to know the amount of the discount provided and the amount of utility bills for the month. The amount is divided by one hundred and multiplied by the benefit percentage. Then, the resulting value is subtracted from the total amount.

Benefit for military personnel on payment of utilities in a service apartment

Upon dismissal from military service of military personnel who lose the right to these benefits, commanders of military units are obliged to notify the organizations providing benefits about this. Certificates for preferential payment in the amount of 50% of the total area of residential premises (in communal apartments - living space), utilities by military personnel and citizens are annually provided to housing maintenance organizations, housing construction (housing) cooperatives, partnerships of owners of residential premises (condominiums) and other enterprises, institutions and organizations providing these benefits, as well as collecting payments from citizens for the listed services.

In accordance with this paragraph, these persons pay in the amount of 50%: the total area of the residential premises they occupy (in communal premises - living space). In addition, tenants of residential premises pay 50% for the maintenance, repair and rental of residential premises, and owners of residential premises and members of housing construction (housing) cooperatives pay for the maintenance and repair of common facilities in multi-apartment residential buildings; utilities (water supply, sewerage, removal of household and other waste, gas, electricity and heat) regardless of the type of housing stock; use of radio broadcasting points and collective television antennas.

Benefits for military pensioners on utility bills 2020

Benefits for military pensioners and active military personnel are under special attention in 2020, especially in the field of housing and communal services. What subsidies for utilities are available to the military and what is required to apply?

It is important to pay attention to this nuance. The right to this application for registration of benefits is exclusively available to military pensioners who have reached the age of retirement for old age generally established at the level of the legislation of the Russian Federation, in other words, 55–60 years. And one more thing: each region includes different services in the list of benefits for housing and communal services - this must be clarified in its regional inspectorate. For example, they can provide a discount for using a home phone or recalculate payments for major repairs.

Features of providing utility benefits to military pensioners

- Application of the established form for receiving benefits. It can be written directly to the institution where the citizen applied to receive benefits.

- Military pensioner certificate.

- Identity document. It is served by a passport or a paper replacing it (for example, a temporary identity card, which is issued when a passport is replaced).

- Certificate of absence of debts for housing and communal services. If the package of documents is provided directly to the management company, such a certificate is not required.

Under what conditions can I get it?

The concept of “military pensioner” is quite broad and includes not only persons who retired due to length of service after serving in the Armed Forces, but also some other categories of civil servants. In accordance with the provisions of Article 1 of the Law of February 12, 1993 No. 4468-I “On pensions for persons who served in military service”, the following are also equated to this category of persons:

In 2020, retired military personnel with long years of service can receive a number of preferences from the state. Benefits for military pensioners relate to housing, medicine, education and transport. We will list the reasons for receiving benefits and tell you how and where to get discounts on various services.

We recommend reading: On the Basis of Which Document a Veteran of Labor is Deprived of Benefits for Utilities

What benefits on utility bills are provided for military pensioners?

Once the exact list of required papers has been determined, you will need to submit a corresponding application to the local Social Protection Fund or management company, since it is the employees of these institutions who are involved in processing the subsidy.

- persons who served in the troops of the USSR or Russia, holding an officer rank, as well as all kinds of sailors and soldiers who served on a contract basis;

- border guards, railway troops, as well as members of the government communications service or the Russian National Guard;

- persons who provide civil defense, work in the Federal Security Service, intelligence troops or state security;

- officers and ordinary employees serving in the police, fire service, as well as departments involved in the fight against drugs or the protection of prisoners.

We recommend reading: Get 13 percent back from your mortgage

The procedure for renting out a service apartment and paying for utilities

Good day, I am an active serviceman in 2020, I received a service apartment, the other day I received a receipt called: invoice - notice for the use of residential premises for the period from 2015, refer to Articles 153 and 154 of the Housing Code of the Russian Federation. Please tell me whether this receipt is legal or not? Am I obligated to pay or is it the responsibility of the military unit that provided me with service housing? Collapse Victoria Dymova Support employee Pravoved.ru Similar questions have already been considered, try looking here:

Ministry of Defense: a) bed type - to accommodate single military personnel and civilian personnel; b) room type - to accommodate family military personnel - students of higher military educational institutions, as well as officers, warrant officers, midshipmen and military personnel serving under contract as soldiers (sailors), sergeants (foremen), from among the personnel of formations ( military units), warships under construction and repair at the rate of 1 - 2 rooms per family. Persons living in room-type dormitories, as well as those occupying separate rooms in bed-type dormitories, are charged the rent established by law.

We recommend reading: Inspection of Auto Kosgu 2019

Benefits for military pensioners to pay for housing and communal services

In general, in order to make sure what benefits a pensioner can receive, you should study the law that regulates this procedure, or contact the local administration, social service and check this information with them.

But Federal laws provide for the assignment of status not only when serving in the internal, border, and railway troops, but also in the case of serving as a police officer, a fire service employee, government departments, institutions for the protection and control of law and order, an employee of the Federal Drug Control Service, and criminal enforcement agencies. .

Benefits for military pensioners to pay for housing and communal services in the Moscow region

To understand how strong the differences are, you can compare the preferences in the two largest cities - Moscow and St. Petersburg, because it is there that military pensioners are provided with the most comprehensive discounts on housing and communal services. St. Petersburg In St. Petersburg, a military pensioner is given a 50% discount on all housing and communal services.

Initially, you need to contact the local social security authority and find out what list of housing and communal services reliefs a pensioner is entitled to. The fact is that the legislative establishment and distribution of these conditions is entrusted to local authorities.

Benefits for widows of military personnel

Once a year, the widow of a military pensioner has the right to go to a sanatorium or health-improving complex (the institution must be state-owned). Depending on the available benefits and health status, the discount will range from 25 to 100%.

They come to the organization whose payment they are going to receive. If a standard pension is required, this is the Pension Fund, if the husband is in the military (a woman can choose which one she will receive if assigning two is impossible) - to the branch of the Fund that paid the husband. For various benefits and benefits, apply directly to the department of the Ministry of Defense at the place of registration.

Nizhny Novgorod life

The land use tax also belongs to the regional category, therefore it is established by the regional authorities of the Nizhny Novgorod region. The legislation provides for benefits regarding these payments, but those citizens who have reached retirement age are not included in the preferential category. Despite this, pensioners can still receive them if they apply to the administration at their place of registration and submit a document confirming their existing preferential status.

The transport tax belongs to the regional category of contributions, so it must be paid to the social structures at the place of registration, that is, in the Nizhny Novgorod region. The taxpayer is the person for whom the personal vehicle was registered. The following means of transportation are subject to tax:

We recommend reading: What is the Amount Per Person for a Subsidy in Tolyatti

Benefits and allowances for the widow of a serviceman

- identity cards (passports of citizens of the Russian Federation or birth certificates);

- documentary evidence of death (this may be a death certificate or a court decision declaring a serviceman missing in action);

- confirmation of family ties in the form of a certificate from the registry office confirming marriage or registration of children;

- confirmation of membership in a preferential category (certificate of disability or other documents).

Widows and family members of deceased military personnel cannot be evicted from their occupied housing without providing space with appropriate conditions. For wives, this requirement has certain limitations. By remarrying, they lose the right to use this benefit. In addition, women have priority when installing apartment telephones, purchasing fuel for heating the home, and in a number of other cases.

Rent and payment of utilities by military personnel

With regard to payment of housing and utilities by military personnel living in office premises, the following should be noted. In accordance with Art. 106 of the Housing Code of the RSFSR dated January 1, 2001, a written rental agreement for the premises is concluded with a citizen who is provided with office premises for the entire duration of the tenant’s work, in connection with which he is provided with this premises. For military personnel, a type of contract for the rental of official residential premises is a housing contract, the conditions and procedure for concluding which are approved by Decree of the Government of the Russian Federation of May 4, 1999 No. 000.

The temporary absence of a person living in a bed-type dormitory does not exempt him from making all due payments. Military personnel, workers and employees permanently residing in the hostel, in case of leaving on vacation, a business trip or for treatment, are exempt from paying for water, sewerage, gas, electricity, washing bedding, if their temporary absence lasted more than 30 days and this was reported in a timely manner The head of the dormitory was notified. Absent military personnel and civilian employees are not exempt from payment for heating, radio broadcasting, depreciation of furniture and bedding, maintenance of cleaners to clean living rooms, as well as rent, unless their place in the dormitory was occupied by other persons (see Art. 89 Regulations on house managements, hostels and hotels of the Ministry of Defense).

We recommend reading: Cost of 1 Cubic Meter of Hot Water According to the Standard in the Moscow Region From July 1, 2019

What are the benefits for paying utility bills for pensioners?

Former military personnel represent a special category. Benefits for paying housing and communal services to military pensioners are assigned in the form of a discount. This right arises for former employees:

- armed forces and units of the Ministry of Defense;

- divisions of the Ministry of Internal Affairs;

- criminal investigation;

- Ministry of Emergency Situations and Fire Protection.

There are the following types of benefits for senior citizens:

- discount for pensioners over 70 years of age – 50% of the contribution amount;

- benefits for housing and communal services for pensioners after 80 years of age - 100% exemption from paying contributions.

Benefits for military pensioners to pay for housing and communal services - a complete list and procedure for registration

The state provides support for people who defended the country and retired.

Reserve officers are entitled to various benefits. Discounts on utility bills will help save money for older Russians who served in the military. To take advantage of the privilege, you need to know what documents are required to obtain compensation. Benefits for military pensioners for housing and communal services provide 50% discounts for the use of living space and 50% compensation for gas supply, drainage, water supply, garbage removal, hot and cold water supply, electricity supply, heating, and major repairs. If a citizen cannot independently go through the authorities to prove his right to subsidies, then members of his family, wife, and children can receive compensation.

Rent benefits for military pensioners

In this case, you should perform a number of simple steps. You should start by visiting the relevant structures that provide these services. After all, each organization requires a certain list of documents, providing which you can apply for this discount. The retiree should then contact their local organization or Social Security Fund. After all, this is where this subsidy will be issued.

- original/copy of passport;

- certificate of family composition;

- confirmation forms about the degree of relationship;

- housing ownership;

- information about income;

- pensioner's certificate;

- absence of debt, confirmed on the form of the Housing Office.

Benefits for paying utility bills in 2020

- 50-70% for non-standardized services;

- 50% of the rent for the entire apartment;

- the same amount for garbage removal.

We recommend reading: Can Bailiffs Describe the Only Housing Under a Deed of Gift

If there are no benefits for large families in the region, then you need to apply for a subsidy. Most often it is reserved for large families.

Thus, Article 28.2 of the Federal Law of November 24, 1995 No. 181-FZ “On social protection of disabled people in the Russian Federation” describes discounts for disabled people. According to this act, they apply to the entire family. These citizens receive a 50% discount on all types of utility bills. That is, the budget pays half of the amount for them.