When purchasing an apartment, many buyers, wanting to save on the services of a realtor, look for options and undertake the preparation of documents and subsequent support of the transaction on their own. However, not everyone achieves what they want, and as a result, the case ends up in the courtroom. More than 90% of real estate litigation is primarily due to buyers wanting to save money on a lawyer. Let's consider the reasons for such statistics and determine what risks exist when buying an apartment on your own.

Risks when buying an apartment on the secondary market

The secondary market, like the primary one, is also full of surprises for those who first set foot on this path. For those who want to purchase living space in an apartment building, first of all, it is worth carefully studying the history of the apartment, under what circumstances it was acquired and by whom, and why the seller decided to sell it. It is necessary to pay attention to the title documents for the apartment, as well as whether among the owners there are minors, incapacitated, declared dead or missing persons, and whether the property has been seized.

If the apartment has been privatized, you should find out whether all participants exercised their right to privatize the part of the apartment entitled to them. At the same time, if the apartment was inherited, donated, or transferred to the owner under a rental agreement, you need to find out whether there are any third parties left who could lay claim to it in the future.

The buyer should not be tempted by the clearly undervalued price of the apartment; he needs to find out what is the reason for such a price and whether there is a catch later.

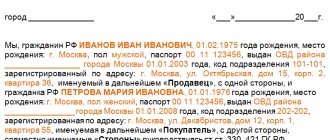

The risk of buying an apartment using forged documents is primarily associated with concluding an agreement by proxy. There is a high probability for the buyer to be deceived, since the power of attorney can be revoked at any time, or the principal can die suddenly, which entails the invalidity of this document.

All these risks when buying an apartment, which are not limited to the above list, can lead to the recognition of the purchase and sale transaction as invalid and, as a result, wasted time and money. In order not to waste time and not become a victim of attackers, you should seek help from qualified specialists who are not new to this type of decision. difficulties. The Etazh real estate agency has not only the resources to identify risks, but also the ability to effectively overcome them. Order a lawyer to check the documents for the apartment.

Risks and pitfalls when buying an apartment on the secondary market.

Secondary real estate has its advantages: the house has already been built, the area is inhabited, the infrastructure is developed. But the risks when buying an apartment on the secondary market are perhaps even greater than in the case of new buildings.

1. Purchase using a false power of attorney

Black realtors do not sleep; their victims can be lonely old people, people addicted to alcohol or drugs, or orphans. It’s their apartments that the scammers re-register as dummies and put up for sale; they turn them into owners and move them to the wilderness. Since scammers need to act quickly, they usually lower prices. Although the low cost of housing is only the first sign for the buyer.

The second reason to be wary is selling by proxy. Not only can it be fake, but the document is also valid until it is cancelled. The purchase and sale agreement comes into force only after its registration with Rosreestr. If the seller cancels the power of attorney earlier, the transaction may be declared invalid.

2. Illegal privatization

Each apartment on the secondary market has its own history. The inspection should begin from the moment of privatization of housing. The fact is that everyone who is registered in the apartment had to participate in this procedure. And if the rights of one of the family members were forgotten, for example, the mother privatized the property while her son was serving his sentence, then in the end you as the buyer will suffer. The deal may be declared invalid due to illegal privatization. Be wary if, at the time of the transaction, the spouse of the apartment owner is declared missing. An absent relative may show up in a few years and claim his rights to the apartment.

3. Unauthorized sale

Find out how many owners the apartment has. Both spouses (or former spouses who were married at the time of purchasing the apartment) must agree to the sale. If there are minor children among the property owners, the transaction must be approved by the guardianship and trusteeship authorities. In other words, absolutely all apartment owners must say a resounding “yes.” If one of them does not do this and after the transaction declares his rights, it will be declared invalid.

4. Unaccounted inheritance

Check how many times that apartment was bought and sold, how it got to the last owner. The apartment could be donated or inherited. You should clearly check the documents to see if other relatives may also be heirs to this apartment. If the rights of these people are violated during the sale of real estate, the transaction may be declared invalid.

5. Utility debts

Finally, after purchasing an apartment, it may turn out that the previous owner owes a decent amount for utilities or telephone calls. You will have to pay the bills. Therefore, check for any debts before completing the transaction. In addition, some home sellers, when leaving the apartment, take with them not only door handles, light bulbs, but also the doors themselves, and sometimes even plumbing fixtures. Therefore, it is better if you discuss with them in advance what the former owners plan to take and what to leave.

To avoid risks when buying an apartment on the secondary or primary housing market, contact a professional realtor. Everyone decides for themselves whether to pay for the services of a realtor or take big risks...

Tayana Vasilievna Mamontova, a specialist in urban real estate, an expert in the secondary housing market, is always ready to help in a difficult housing situation. Contact number 8-903-170-13-84 Call. Always happy to help.

Risks when buying an apartment in a new building

In accordance with Russian legislation, it is allowed to attract funds from citizens on the basis of a share participation agreement of a DDU, an organization in the form of housing construction and housing savings cooperatives, which operate within the limits specified by law.

DDU is subject to state registration and of all the listed alternatives, it is less risky and most popular when purchasing an apartment on the primary real estate market. If suddenly the developer asks to pay the contract amount before registration, then this option is questionable.

The legislator has prohibited resorting to other schemes for purchasing apartments in a new building, including the use of promissory notes, investment contracts, concluding preliminary agreements, etc. Therefore, if you are offered an option for attracting financing not provided for by law, you should be wary, perhaps the chosen developer is a fraudster.

However, such restrictions do not eliminate the occurrence of risks, but only minimize them. Even with the most secure option, situations like this may arise:

- construction has not started or the house is not completed;

- the quality of construction is lower than provided for in the contract;

- the layout of the apartment differs from that previously agreed upon;

- the contract was terminated at the initiative of the developer and the money was returned to the buyer;

- deadlines for delivery of the house are delayed, etc.

Among others, there may be an intentional or unforeseen delay in the execution of the deed of transfer of the apartment from the developer, the absence of which slows down the further registration of ownership of the apartment. Our recommendation: you should not save 20,000 rubles to support a transaction for the purchase of an apartment in a new building.

Risks of buying an apartment by inheritance

So, what risks can the buyer bear when purchasing an apartment inherited by the seller? There are only two of them:

- Fake will. If a citizen claiming real estate proves in court that the will was fake, then the purchase and sale agreement will be canceled.

- The emergence of extraordinary heirs. In this case, the agreement to purchase the apartment

will be terminated or its validity will be suspended until the situation is clarified.

Important! The purchase of an apartment by inheritance can also be canceled if the seller, after concluding the purchase and sale agreement, was found unworthy.

Risks when buying real estate

Possible risks

One of the most common risks today is collateral fraud.

. It is known that the deposit is not returned to the buyer if the buyer of the property for some reason changes his mind about purchasing the living space he likes. And some circumstances may force him to change his mind, for example, if he finds out that the seller was provided with collateral by several potential buyers at once. This is exactly the case when it is useless to show dissatisfaction and start a scandal.

One of the most common criminal frauds in use today is forgery of documents or their theft.

, the collection of documents may contain invalid powers of attorney for the apartment, fake or non-existent people may be provided, and many other tricks.

Such schemes are perpetrated by swindlers to sell housing that does not belong to them

.

the sale of fraudulently appropriated living space can be included.

. There are many ways to do this - embezzlement using threats, extortion, deception or using one's official position. Be that as it may, buying such an apartment is not legal and the buyer could easily end up on the street if its real owner suddenly turns up.

Even if there is confidence that the property is being sold by the owner

, then you still need to make sure that the seller has the right to perform such an operation. This question contains many details.

- • First, the seller must be legally capable;

- • Secondly, at the time of the transaction he must be sane and of sound mind;

- • Third, any of his actions should in no way be aimed at infringing on the rights of minors, heirs, or a spouse with whom he is divorced at the time of the transaction, but who has ever contributed a share of the funds for the purchase of housing.

But still, the most important thing is to clarify what concerns family members and spouses who have not reached the age of majority. A child living in such an apartment must be provided with living space commensurate with what he had in the housing being sold. It may be smaller in area, but the area to live in, in this case, should be good. If such conditions are not met, the transaction will not be considered valid.

A transaction will not be considered legal if any errors were made during its execution by a notary.

, because they, by prior agreement with the seller, can be admitted intentionally.

However, this already refers to real fraud

.

The notary is obliged to correct mistakes made unintentionally free of charge.

, if, of course, this is part of his fault. If the culprit is one of the parties to the transaction, then after the rework everything must be paid for again.

Debt for housing and communal services

It can also be a problem when preparing documents.

The debt for housing

must be taken into account, and the price of the apartment must decrease accordingly. If for some reason this is hidden, the transaction will also be considered invalid, since the information that will be indicated in the contract will not correspond to reality at all.

Conclusion

The most important and most pleasant thing about purchasing an apartment

- this is a dream come true about further living in a new apartment and an unbearable desire to finish the red tape as quickly as possible.

But it is she who requires special attention. It’s better not to waste money and contact a competent notary

so that he can check all the documents and confirm that the transaction was completed legally.