How to draw up a receipt for an advance payment for an apartment: sample

An advance payment when purchasing an apartment in 2020 is a sum of money that one of the parties transfers to the other towards a future payment. The need to transfer an advance is usually stipulated in the main purchase and sale agreement, however, the buyer transfers the advance to the seller before the main transaction is completed (that is, first the parties sign the agreement and one of the parties transfers the advance - and only then the remaining money is transferred and the apartment is transferred). A sample purchase and sale agreement can be downloaded here.

Deposit when purchasing an apartment (sample receipt)

Civil legislation (Article 558) provides that the validity of an apartment purchase and sale agreement begins from the moment of its state registration. In accordance with this, obligations to transfer the apartment, on the one hand, and pay its cost, on the other, arise after state registration is completed. It follows from this that the security of a transaction, which is a pledge, can only be applied after its parties have registered it with Rosreestr.

The result of such disputes, as a rule, is a decision according to which the person who unjustifiably enriched himself is obliged to return the amount received as a deposit. In addition, the court can also collect interest from such a person for the use of other people's money. The legislation provides that these interests are calculated in accordance with the refinancing rate of the Central Bank of the Russian Federation. If the amount is not sufficient to cover all losses (if any), then an additional recovery may be made for the difference between the amount of interest calculated and the amount of losses incurred. What to do, not make any calculations at all before the contract is concluded?

Interesting: How to Use Maternity Capital to Buy an Apartment Without a Mortgage

What is an advance?

An advance payment is used to confirm the seriousness of the buyer's intentions, as well as to partially repay the main payment . The main purchase and sale agreement must include the following points regarding the advance payment:

- full market value of the apartment;

- date of transfer of advance money;

- advance amount;

- information about whether the advance money will be used to partially repay the main payment for the apartment or not.

- separation of responsibilities of the buyer and seller (notary services, payment for safe deposit boxes);

- the procedure for returning the advance in the event of failure of the main transaction;

- liability of the parties and force majeure.

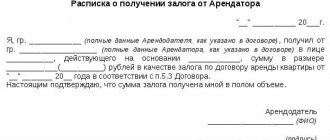

Receipt for advance payment when purchasing an apartment: sample

I, gr. ________________, __________ year of birth, place of birth: __________________, citizenship Russia, passport ____________, issued __________, _____________, registered and residing at: _______________________________________, received an advance from the city. ________________, __________ year of birth, place of birth: __________________, Russian citizenship, passport ____________, issued __________, _____________, registered and residing at the address: _______________________________________, towards the execution of a purchase and sale agreement for a house located at the address: _______________________________________ in the amount of __________ (_______________ ) rubles. The total cost of the house is ___________________ (________________) rubles.

The money was transferred in the presence of witnesses: gr. Alexandra Andreevna Gurova, born May 30, 1990, place of birth Moscow, maternity hospital No. 3 and gr. Georgy Georgievich Morozov, born on May 5, 1980, place of birth: Moscow City Clinical Hospital named after A.K. Yeramishantseva, maternity ward No. 1.

Advance and deposit - the difference

In its meaning, a deposit is very similar to an advance - it also represents a certain amount that the buyer transfers to the seller as part of the main payment, the deposit is also used to confirm the seriousness of the buyer's intentions. The difference lies in the amount of money that must be returned if the main transaction fails:

- If a purchase is made, an advance has been made and the transaction is cancelled, the seller must return the money to the buyer. This does not take into account the fact of guilt of either party;

- If a purchase is made, a deposit has been made and the transaction is cancelled, then several situations are possible depending on whose fault the cancellation occurred. If the deal falls through due to the fault of the seller, then he must return the deposit in double amount. If the buyer is the culprit, the seller may not return the money to him.

In other words, the difference is that the deposit provides certain guarantees to both the seller and the buyer, while the advance payment only performs a payment function and does not provide any guarantees. In practice, buying an apartment usually means making an advance payment.

Deposit or advance payment when purchasing an apartment sample receipt

In addition, the receipt guarantees a double refund in the event that the transaction fell through due to the fault of the seller. A receipt confirming receipt of an advance is not the same as confirmation of payment of a deposit. It is not regulated by the Civil Code of the Russian Federation.

This is necessary so that neither the seller nor the buyer would have the desire to call the advance an earnest money deposit. Here is a sample of an advance payment agreement for the purchase of an apartment. Earnest Money In accordance with the current norms of the Civil Code of the Russian Federation, an earnest money deposit is the amount of money given by the buyer in payment of payments due to it.

Receipt for advance payment - sample

When transferring an advance payment for an apartment, it is recommended to draw up a receipt to confirm that the seller has received the money. The receipt can be either an appendix to the contract or an independent document.

The first method is more common because it is safer and emphasizes the legality of the transaction. If the seller refuses to return the money or says that he did not receive an advance payment, then to protect his interests the buyer needs to go to court, and a receipt will serve as solid proof of the fact of transfer of money.

A receipt for an advance payment when purchasing an apartment can be drawn up on any sheet of paper . The sample should include the following items:

- passport details of the parties;

- reference to the main agreement in accordance with which the money is transferred;

- address of the apartment and brief technical data about it;

- full name of the payment (deposit or advance);

- amount of money;

- signatures of the parties and date of preparation.

A receipt must be drawn up by the seller at the time of transfer of money . The document can be certified by a notary, however, this is not necessary (except for cases where the receipt is drawn up in printed form - such a document must be registered with a notary).

In the absence of a receipt, it is much more difficult to prove the fact of receiving an advance.

Sample receipt for advance payment when purchasing an apartment

It is carried out exclusively in front of witnesses. The recalculation of funds can also be entrusted to an uninterested person.

- Drawing up a receipt indicating the amount and other data.

- The document is signed by the seller, the buyer and all owners of the apartment or third parties who have a share of the living space or are registered on it.

If the property has several owners, then all of them must be present during the transfer of money and the execution of the transaction as a whole. Transferring money to a bank account does not require a receipt, since transfers in the bank can be easily tracked by receiving the necessary statements. An advance payment when buying an apartment is used quite often. To avoid becoming another victim of fraud, you should be well prepared: draw up a contract correctly, write a receipt in front of witnesses.

Interesting: Plot in Snt How to Register Property

Receipt for repayment of advance payment - sample

If the purchase of an apartment falls through, then it is necessary to return the advance payment. To legally secure the fact of transferring money back, it is recommended to draw up a receipt for the return of the advance . A sample of such a document should include the following information:

- passport details of the parties;

- reference to the terminated contract;

- information that the seller returns money due to cancellation of the agreement;

- amount of money;

- signatures of the parties and date of preparation.

The return receipt must be drawn up by the failed buyer, to whom the money transferred to him in the past is returned . If a receipt for the transfer of money was previously drawn up, then on the reverse side of it, the buyer of the apartment must indicate that the seller, according to this receipt, returned the money to him in full. The return receipt is also not subject to mandatory registration with a notary. You can download a sample receipt here.

Receipt for advance payment when purchasing an apartment sample

A deposit or advance made under a preliminary agreement or without it at all is recognized by most experts as unjust enrichment, since the receipt of money is not confirmed by any agreement. In this case, the amount of money must be returned to the Buyer. Therefore, it is best to avoid transferring funds to the Seller before concluding an agreement. The procedure for purchasing an apartment should be as follows: first, the Seller checks out, then an agreement is concluded, then the transfer of ownership rights is registered and, finally, the Buyer pays for the apartment. But the Seller also wants to have certain guarantees, so many try to avoid exactly this sequence and receive part of the funds before registration.

Interesting: Tariffs for Housing Maintenance in Nizhny Novgorod in 2020

It is not recommended to draw up a document in the form of a receipt for receipt of money. If the seller is dishonest, you will not be able to prove that the money was transferred as a deposit. Relatives will appear who will say that the seller is registered in a psychoneurological dispensary and was not responsible for his actions at the time of drawing up the document.

Features of the document

The receipt of receipt has a number of features that are regulated by the civil code. The first difference is in the form. The document itself, drawn up between the seller and the buyer in receiving part of the contribution, does not have a clear form established by law. However, the Civil Code notes what details must be indicated in the paper for the paper to have legal force.

The buyer's and seller's receipt must be certified with signatures as in a passport from each party. Each party to a future transaction must leave their initials in the guarantee of receipt of funds. It is important to consider that there are cases in which the transferred contribution will not be returned.

If the buyers, after transferring the money, subsequently refuse to purchase the property, this will be a complete reason for the seller not to give them the deposit. This is due to the fact that the guarantee contribution is an interim measure that makes it possible to subsequently conclude a purchase and sale agreement. If there is no sale transaction due to the fault of the buyer, the seller suffers losses.

As a result, the deposit under civil law must cover losses. Another case is when the deposit transferred by buyers is returned in double size. This situation is permissible if the payment on the receipt was transferred, and later the seller himself refused the transaction. Then, based on the current articles of the Civil Code, the seller must return it in double amount.

Types of deposit receipt

Types of contribution transfer guarantees are not limited to real estate. When selling an apartment, this form is common if buyers do not have the required amount at the time of concluding the purchase and sale agreement.

Then, based on the agreement of each of the parties, a period can be established by which the seller undertakes to delay the sale of his real estate. The motivation for this is the down payment in the form of an amount of money, which is also agreed upon by the parties.

The text must indicate the exact period when the purchase and sale transaction must be concluded and the dates for drawing up the paper and transferring the contribution to the buyer.

In addition to the purchase of real estate, this form of receipt is found when selling cars. An expensive vehicle is checked against documents before making a deposit.

It is important to remember that, according to current criminal practice under Article 159 of the Criminal Code “Fraud,” there are a number of cases in which vehicle owners mislead potential buyers, receive deposits from them and hide.

This becomes possible due to the inattention of the other party. Before drawing up the paper, it is important to check all the details and, if necessary, check the WIN numbers on the body and engine. It would also be a good idea to check by license plate whether the vehicle has been stolen and whether the car is encumbered in the form of an arrest.

The same actions should be carried out with all types of movable real estate before concluding an agreement in a receipt for the transfer of the established amount of the deposit.

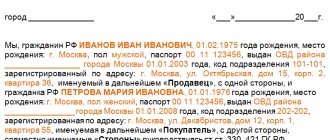

Sample and example of a receipt: how to write correctly

- Full name of two parties (drafter of the document and creditor);

- details of their passports, TIN, residential and registration addresses;

- the exact amount written in letters and numbers;

- the place, date and the fact of receipt of money are indicated;

- the deadline for the return of funds is indicated (if provided);

- the basis for the transfer of money is indicated;

- full and legible signature of the parties to the contract and potential witnesses.

There are also a few other points worth considering. The text of the receipt should not indicate the business purpose of the loan. If it is stated that the money was borrowed for business purposes, this may be regarded as a risk of which the lender was aware in advance. If the case does not work out, the funds may not be refundable.

23 Jul 2020 stopurist 562

Share this post

- Related Posts

- How much do workers pay for group 3 disability in 2020?

- Find out your tax code by tax identification number on the statistics website

- Are Preferential Mortgages Available for Chernobyl Families?

- Do I need to pay tax when selling a house with land?

Documents that are drawn up before receipt

Receiving funds on paper in the form of a deposit imposes certain obligations on each of the parties. As a result, they must comply with the stated points in the agreement. In addition to the receipt, documents can be drawn up before the purchase and sale transaction is carried out.

These include:

- Certificates confirming ownership of the property being sold. These papers should be checked immediately before completing the paperwork, since the apartment may be in shared ownership. Please note that the deposit must be divided between all homeowners, which must be indicated in the receipt.

- Extract from the Unified State Register of Real Estate. This type of certificate confirms that the owner of the property being sold has no debts or encumbrances on it.

- The BTI plan must be compared with the current apartment layout so that there is no illegal redevelopment, for which the buyer will have to pay in the future to re-register the details.

- Documents establishing ownership. These are papers in the form of a purchase and sale or gift agreement, which indicate that a given person or group of persons has received ownership of real estate.

- Passport of all owners.

Nuances

Now let’s move on to some important design nuances that will secure the transfer of funds in 2020:

- Before you can write a receipt, the purchase and sale agreement must be signed and recorded. The document clearly states that the first part of the money is transferred in the form of a deposit, the rest later within a certain period.

- The best way to write on paper is in person with a ballpoint pen . In this case, it will be easier to prove the authenticity of the document in court. The document should not contain corrections, deletions, or additions. In extreme cases, you will need to rewrite it again. A blank A4 sheet is often used for design.

- If there are several owners of the apartment, then information about each is indicated, and the deposit is divided equally.

- A minor or incapacitated seller cannot issue a receipt. He is represented by parents, guardians or guarantors.

- The document is drawn up only in the presence of both parties. It cannot be written in advance. It is better to transfer money in the presence of witnesses, both from the seller and the buyer.

- If the receipt is printed on a printer, then passport data, full name, address and amount are indicated in words . But in this case it is better to additionally have the document certified by a notary.

If desired, the receipt may indicate penalties for non-compliance with the rules. For example, set the amount of pennies that will be charged for each day of delay if the money is not paid within the specified period.

Before issuing a receipt for receipt of the deposit, you should pay attention to a number of circumstances . First, familiarize yourself with the original documents on the ownership of the property. Secondly, check that there are no other owners registered in the apartment. Thirdly, obtain a certificate from the Unified State Register of Real Estate about the possible alienation or seizure of housing.

Fourthly, study the documents from the BTI to avoid unauthorized redevelopment. If you wish, you can inquire about the amount of debt for utilities.

IMPORTANT! The buyer is not recommended to pay a large deposit. This is the first reason to review the contract and address the nuances of its design.

But a very low deposit amount should be alarming. 5 thousand

rubles are not the most money when buying an apartment and they are very easy to lose due to fraudulent activities. Therefore, the parties often have the receipt certified by a notary. This will not protect the buyer 100%, but an unscrupulous seller in most cases will refuse to visit a lawyer.

This is important to know: Settlement agreement in civil proceedings: procedure for conclusion, sample draft 2020

Design rules

After a receipt for the deposit has been issued, it is necessary to prepare other documents in order to obtain ownership of the apartment in the future. There are also registration rules, according to which each party is obliged to perform certain actions.

These include:

- Drawing up a purchase and sale agreement. The text must be prepared when signing the paper and transferring the deposit. The contract must clearly reflect that the deposit transferred goes towards future payment of the cost of the real estate and all deadlines for transferring money.

- The citizen's passport must be fully indicated in the details. It is necessary to ensure that this document is not expired and is replaced on time. Otherwise, the transaction may subsequently be declared invalid.

- The data of representatives is registered only if the owners themselves are unable to complete the transaction due to certain circumstances. Here it is important to check whether these persons are acting under a power of attorney executed by a notary.

- When preparing a receipt, it is better to transfer the deposit in the presence of witnesses from each party. This will confirm the reality of the paper transaction.

- At the end of the text, signatures from each party are placed with a decoding of the initials.

Depending on the subject of the contract, such rules may vary. It is important to always check the original documents and issue a notarized receipt for the transfer of the deposit.

Receipt text

The text of the paper must contain a number of points that are necessary for the document to have legal force. If detailed information is not provided, the document is considered invalid.

Receipt items include:

- The amount is agreed upon by the seller and the buyer. Written in numbers and words.

- Buyer - his full passport details.

- Seller - passport details.

- Clause regarding receipt of funds with date and time.

- A detailed clause on the terms of a purchase and sale transaction when transferring an advance on a security.

- Dates and signatures.

- Signatures of witnesses.

It is important to indicate in detail the subject of the contract being concluded. Here you need full details of the real estate and its cadastral number with the number of the certificate of registration of ownership.

How to write a receipt if you still need to pay part of the money for the apartment

You can pay for the apartment in the following ways:

- Pay partially by prepayment.

- Transfer the entire amount (remaining amount) at a time after registering ownership to the buyer in cash, through a safe deposit box, letter of credit, escrow account or notary deposit (the most secure payment for a purchase).

- Pay in installments.

We suggest you read: How to choose an apartment to buy and what to pay attention to

You can view the DCT form through a safe deposit box here.

If the seller insists on making a deposit, and there is no possibility of making a payment after the transaction is completed, then it is best to transfer the money by receipt. It must be drawn up in writing, it indicates the passport details of the parties, the date of transfer of funds, the amount transferred and the purpose of the transfer of money - prepayment for an individually determined apartment.

The receipt should also indicate the planned date for concluding the contract and the conditions for the return of funds if the contract is not concluded on time, or the offset of the amount against the cost of the apartment if the transaction takes place. After drawing up the receipt, it is certified by the signature of the person who received the money. It is good if the receipt is drawn up in the presence of two witnesses who will confirm the fact of transfer of money by putting personal signatures.

Note: it is important to understand that if the sale of the apartment does not take place, you will only be able to return the amount paid, since such a payment does not oblige the seller to conclude an agreement. In other words, an unscrupulous seller will be able to continue searching for better options without any adverse consequences for himself.

Legal advice

If the transaction is disrupted due to the fault of the buyer, the advance payment is not returned. This is important to understand. Therefore, when drawing up paper, it is always necessary to indicate the validity period of such an agreement. It is not necessary to indicate the shortest possible period. It’s better to make it a few days longer so that in case of force majeure the money is not wasted

In the purchase agreement, always check all the details of the seller and the object itself in relation to which such document is concluded. This is to protect the person from fraudulent attempts.

The prescribed amount, which is indicated in the contract, is entirely at the expense of the seller. It is better to transfer money in cashless form. This will confirm the fact of transfer of the deposit and the subsequent purchase of the apartment.

Video on the topic:

Advance payment for an apartment

to transfer an advance payment for an apartment to real estate transaction support specialists. After all, it does not have security force and is simply returned to the buyer in the event of a failed transaction.

-Where do we go now with our suitcases? We have already taken a deposit for our apartment.

-Therefore, I recommend that you transfer a deposit, not an advance. Nevertheless, I answer your request.

Advance payment to the apartment seller

Since the advance is returned to the buyer in full, it is transferred in transactions, the result of which largely depends on third-party factors.

- the apartment buyer plans to use credit funds, but the mortgage loan has not yet been approved

- the buyer of the apartment plans to use credit funds, the mortgage loan has been approved, but there is a risk of bank refusal due to the high price of the apartment

- there are doubts whether the apartment will meet the requirements of the Pension Fund if funds from Maternity (family) capital are used

- there are doubts about obtaining permission to sell from the guardianship and trusteeship authorities if the owner of the apartment being sold (or a share in the right) is incompetent or a minor