Home / Installments

Back

Published: 04/07/2020

0

10

- 1 The essence and necessity of the procedure

- 2 The concept of encumbrance on an apartment

- 3 How to remove mortgage encumbrances at the MFC: step-by-step instructions

- 4 Documents for removing the encumbrance

- 5 Terms and cost of service provision

- 6 Special cases

- 7 How to check if there is an encumbrance?

- 8 Possible reasons for refusal and nuances

Sample power of attorney to remove mortgage encumbrance

The encumbrance of an apartment means that third parties have rights to the property. With mortgage lending, the bank has a claim to the property. In order to obtain permission to remove the liens from the apartment, you must fully repay your obligations to the creditor.

The procedure in Rosreestr does not take much time, nor does collecting documentation. And often the list of papers for a government agency includes a power of attorney. It can be issued in the name of the owner or the creditor, so we will consider all situations.

The essence of the process

You should think about canceling the arrest when the last payment on the loan is made. Paying the debt in full does not trigger the procedure for removing the encumbrance, so you will have to do everything yourself.

Of course, you can trust the bank, but it does this for a month or more, and sometimes the owner of the square meters is running out of time.

After payment, you should immediately approach the manager and notify that a certificate of complete settlement of the debt is required. Additionally, request a mortgage (if there was one), papers from Rosreestr, an account statement, and this must be done in writing. Everything will take from 5 to 14 days, depending on the efficiency of the lender.

The owner cannot approach Rosreestr: what to do

If a bank client cannot be present at a government agency, their tasks can be transferred to a third party by issuing a power of attorney to remove the mortgage encumbrance. This is a document that allows you to transfer powers to a trusted person, which is most often certified by a notary.

Due to the fact that there are many fraudulent transactions with such securities, the registrar began to require exclusively a notarial version (Article 185.1 of the Civil Code of the Russian Federation). To draw up a document in Rosreestr, it is worth using the general plan for drawing up a power of attorney, which every notary usually has. It is drawn up on behalf of legal entities and individuals.

Sample plan includes:

- document's name;

- date and place of compilation, where the numbers are written in full without abbreviations;

- details of the property owner (full name, series and passport number, place of registration);

- details of the attorney (the same detailed list as the property owner); it may also be a legal entity, so the list will be more complete;

- the entire list of actions and capabilities of a third party;

- information about all government agencies where a person can act on behalf of the principal;

- validity period of the paper;

- signatures of the parties with transcripts.

- the powers of the attorney must be clearly listed;

- The notary must certify the data.

It is important to know that the absence of at least one phrase may result in a refusal to provide a public service. For example, if it is not written that a person can demand an “extract from the Unified State Register of Real Estate”, but only perform “registration actions”, he will not receive it.

Such moments are common in practice, so it is worth making up more general phrases, for example, “represent interests with the registrar, request information, sign documents on behalf of the principal” and so on.

It seems that it is not clearly written that there is permission to request an extract, but such phrases make it possible to send a request. When notarizing a trust document, all parties to the process must be present to confirm their intentions verbally and in writing.

The notary will check the personal data, personal information of the owner of the property, the attorney, you will need passports, as well as title documentation for the pledged property.

Legal advice

A power of attorney is always drawn up in writing. She is preparing before going to Rosreestr. The completed sample requires a seal and signature of the head of the enterprise if the business is carried out with legal entities.

In order for a third party to accept all documents to remove the mark of arrest in a government agency, the power of attorney must satisfy 2 conditions:

All numbers in the content of the text are written in words that can be added in brackets for decoding. Abbreviations and corrections are not allowed. If necessary, the possibility of reassignment is indicated.

A prerequisite is the presence of a date for signing the document. Without this, the permit will not come into force. The deadline for issuance, as a rule, does not exceed 3 years. But if the period of use of the document has not been determined, then it is considered valid for one year.

Notaries in their office can offer not only a regular power of attorney, but also a general permission to remove the encumbrance mark.

It is also called extended, as it includes a complete list of possible actions with real estate. That is, the representative will be allowed into all government bodies, and even dispose of housing at his own discretion.

kreditorpro.ru

Why is the encumbrance imposed?

Already at the stage of signing the loan agreement, a “collateral” is placed on the property (mortgage); by force of law, the removal of the encumbrance occurs only after the debt is fully repaid. But let's look at it in detail.

Since the lending procedure in this situation sometimes stretches for decades, the bank must be sure that its client will not transfer his ownership rights or evade his obligations. Therefore, it is possible to remove the encumbrance after the mortgage (repayment).

For the purpose of control, a kind of ban is imposed on the apartment even at the time of registration, which limits the rights of the owner. That is, any action can be carried out with it if the bank withdraws it. And the latter can do this in the following situations:

The procedure for interaction with Rosreestr

Rosreestr imposes a “ban” on an apartment; the removal of the mortgage encumbrance is carried out by the same structure. The procedure itself, in a simplified form, follows the following algorithm:

Contacts of Rosreestr

The authorized MFC can remove the mortgage encumbrance on the same basis as the Unified State Register of Taxpayers of the corresponding region. The owner, bank employee and persons directly related to the apartment (co-borrowers, spouses, co-owners) have the right to apply.

How to remove an encumbrance from a land plot

- pay the debt to the bank in full;

- submit an application to the bank and receive a certificate of full repayment of the debt;

- obtain a certificate from the bank and submit documents to Rosreestr to remove the encumbrance;

- Upon completion of the procedure, the registrar will issue a certificate from the Unified State Register.

Interesting: Federal law on the provision of land plots to family members with many children

It is necessary to remove the encumbrance from the land plot after repaying the debt in order to fully manage your property. Then you can perform any actions that require state registration, such as donation or sale. How to remove a burden correctly?

What documents are needed

Documents for removing mortgage encumbrances may vary slightly in composition, based on the specific conditions and requirements of the bank itself. As you know, some institutions issue a mortgage, which gives the latter the right to demand the return of their funds and use the housing at their discretion if the client does not fulfill his obligations. In our country, drawing up a mortgage is carried out infrequently, although in world practice this is a common occurrence.

It is not necessary to prepare all the documents yourself - it is important to check the final list of them

Some banks are ready not only to help with paperwork, but also to go through the procedure themselves, making it easier for the client to use their home. In particular, Sberbank carries out the removal of mortgage encumbrances automatically after the expiration of the contract on the terms specified in it.

After paying off your mortgage

If such a procedure is not provided, after paying the limit payment and making sure that there are no obligations, the client needs to obtain documents from the institution:

The latter is often issued if there is no mortgage. The bank can also call its representative to jointly visit Rosreestr.

Documents to Rosreestr

To remove the mortgage encumbrance, Rosreestr will also require other documents. The owner has them all:

- A copy of the mortgage contract;

- Title documents for housing;

- Owner's passports.

It is mandatory that the owner and bank employee submit a general application for the removal of the mortgage encumbrance, a sample of which is available at Rosreestr or at the institution itself. In this case, the owner can carry out the operation independently, having secured a power of attorney, or the bank. This procedure should be clarified with the lender. Many banks exempt clients from such a procedure and perform it themselves, almost automatically.

In the article you will find a sample application for downloading.

A mortgage, although quite rarely issued, today provides a lot of advantages at the end of the contract. In particular, the list of securities from the bank is reduced only to its presence and the corresponding mark on it.

How to write an application for removal of encumbrance

So, having found out the procedure in force at the bank, an application is submitted to remove the mortgage encumbrance. It contains the following information:

If the client applies independently, he separately indicates that he is also acting on behalf of the creditor. A power of attorney is attached. The period for removing the mortgage encumbrance in this case is 5 days. When applying together, it is much shorter - up to 3 days. Since about 14 more days (according to the rules in force in the institution) will be required to request documentation from the lender, the total period for changing rights can reach up to 3 weeks.

State duty

You will also need to pay a state fee. The cost is not high - 350₽ and is due to the requirements of the Mortgage Law.

But it is paid only if a new certificate is received - only for the removal of the encumbrance the state duty is not charged.

Design options

It is worth noting that a citizen can request from Rosreestr not only to put a stamp on the removal, but also to draw up a new document so that information about the bank collateral is not indicated in it. Removing the mortgage encumbrance in this situation will cost an extra 200 rubles, which is the fee for issuing a new certificate. In this case, two processes occur simultaneously: the bank’s encumbrance is removed and a new registration paper is issued. If you make a regular request, the client receives his certificate with a withdrawal stamp.

financesytut.ru

How to remove

So, how to remove the mortgage encumbrance by force of law. We have looked at the list of necessary documents, how they can be obtained and where to submit them, and now let’s discuss in more detail the process of repaying the mortgage encumbrance. The procedure for removing a mortgage encumbrance includes several successive steps:

- You collect all the required documents: some you already have, and some they give you at the bank. Prepare copies.

- Pay the state fee - this can be done directly at the bank, for example, at an ATM. Attach the receipt to the package of documents.

- Get in line at the Roregistry office in your region. Depending on its rules, you can take an electronic queue.

- You meet with a representative of the bank where you took out the mortgage and sign a joint statement to terminate the mortgage encumbrance. You can submit your application immediately. This paragraph is applicable if you have not taken out a mortgage on your apartment; if you have a mortgage, then the presence of a bank employee is not necessary, the main thing is to make a note about the repayment of the mortgage at the bank.

- The registrar gives you a receipt for the documents and sets a time when you can pick up new documents.

- If you are asked to provide any additional documents, do not delay in providing them.

- Pick up new documents at a predetermined time at the Registration Chamber.

Here is the general procedure for removing an encumbrance on real estate: some points may vary depending on the application method you choose. The main thing is not to delay this long but very important procedure, so as not to be left without property documents when they are really needed, for example, for a program to help mortgage borrowers.

The deadline for removing the mortgage encumbrance is 3 days. If the bank issues a special power of attorney to the borrower for the right to repay the entry on behalf of the bank, then the period is then increased by 2 days.

Application for removal of encumbrance from an apartment or letter to the bank: sample, power of attorney

When deciding to purchase housing on the primary market, consumers can be confident that in the foreseeable future they will not have any difficulties with apartments. However, a considerable proportion of citizens prefer the secondary market, and may encounter very unpleasant surprises.

Increasingly, you may encounter a situation where the object of sale is an apartment with an encumbrance. An encumbrance is any legal condition under which the owner’s right to dispose of property is limited. Such property cannot be sold or donated without the consent of interested citizens.

Types of encumbrances

If the object of sale is an apartment with an encumbrance, the restrictions will be transferred to the new owner. To ensure that the seller does not have the opportunity to hide the fact of the presence of any restrictions, all encumbrances must be recorded in Rosreestr and indicated in the certificate of ownership.

Currently, the legislator defines several types of encumbrances:

Application for removal of mortgage encumbrance on an apartment: sample

If an encumbrance in the form of a mortgage loan is imposed on the property, you need to take into account the fact that no decision regarding the apartment can be made without the approval of the bank.

The fact is that the bank in this case will have its own specific interests, and therefore will make a decision based solely on its interaction with the client.

Therefore, you will need to send an application to the bank to remove the encumbrance. Its type is approved by a government agency, and you can view it here. ⇐

Letter to the bank to remove the encumbrance: sample

Banks try to treat their clients more loyally, and therefore the procedure for removing the encumbrance is carried out according to a simplified procedure. To complete the process as quickly as possible, you must:

The letter to the bank has an approved form. Letters regarding the removal of encumbrance can be found here. ⇐

Removing the encumbrance from the collateral upon full repayment of the loan

All necessary actions to remove the encumbrance from the apartment can be carried out at the addresses of the territorial departments for registering real estate rights in your district or in your region.

If you do not have the opportunity to personally participate in the removal of the encumbrance, then you can turn to the services of third parties involved in the procedure for removing the encumbrance. In this case, the necessary documents are transferred to the registrar (broker), services are paid, and after the agreed time you receive a certificate of ownership without a mortgage note.

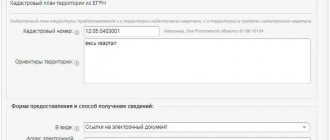

Application to Rosreestr for removal of encumbrance: sample

When writing an application to Rosreestr, it is necessary to take into account the mandatory requirements for the text of the document. So, it must contain the following information:

In general, the application does not have a set template, and it can be written in any form.

How to sell a land plot with an encumbrance

In Russian legislation, land encumbrance is usually understood as restrictions that do not allow the owner to fully use and dispose of real estate. The encumbrance is imposed during the operation of the site. This procedure is of an official legal nature. As a result of the imposed encumbrance, the plot may even be put up for auction, which, of course, the buyer will not know about.

In fact, restrictions can be divided into 2 types: general and special. When imposing general rights, the owner is assigned the responsibility to provide complete information about the site upon request, this may include easement and its various types.

02 Nov 2020 hiurist 338

Share this post

- Related Posts

- How much money do they pay for a labor veteran?

- Under what conditions do housing and communal services companies sue debtors?

- Amendments to Article 228 Part 2 in 2020

- When are benefits available for veterans?

Is it possible to remove the encumbrance by power of attorney?

If for some reason the property owner is unable to independently deal with the issue of removing the encumbrance, he can delegate this task to his authorized representative. To do this, he will need to write a power of attorney.

According to the provisions of Article 185.1 of the Civil Code of the Russian Federation, for transactions related to the registration of property rights and similar operations, there is a mandatory rule according to which the power of attorney must be notarized.

Thus, it is possible to remove the encumbrance from an apartment using a power of attorney, if it complies with the current legislation.

Power of attorney to remove encumbrances from real estate under mortgage and in other situations: sample

A power of attorney acts as one of the documents, the appearance and content of which practically do not change without approval from the authorities. The documentation of this procedure has an approved form, and you can familiarize yourself with the current sample application on our website. ⇐

At the highest state level, there is a requirement that the user needs a power of attorney to perform certain procedures and actions related to the registration of property rights or interaction with authorized government structures (in particular, Rosreestr).

Since permissible actions that will be performed with the help of a power of attorney affect material assets, the document must be executed in a notary’s office. In order for a power of attorney to successfully pass notary approval, it must fully comply with all the requirements and norms of the domestic legal framework.

When notarizing a document, all parties to the process must be present and must confirm their intentions. The notary will necessarily require personal documentation of the owner of the property and his authorized representative (passport), as well as title documentation for residential premises.

Sample Application for Removal of Encumbrance on a Land Plot under a Lease Agreement

Sample application for removal of encumbrance on real estate. Application for removal of encumbrance sample. Application for removal of encumbrance from an apartment sample download. When the withdrawal application is written, it is necessary. Rules for registration and removal of encumbrances from a land plot. Types. Sample statement of claim for the release of property from seizure B Name of the district: district court. A sample statement of claim for the removal of a mortgage encumbrance by force of law. The removal of encumbrances from real estate is carried out by the territorial body of the Federal State Service. Hello, help me find a sample application to the court about. Application for the formation of a land plot as a result of the division of the association, redistribution of land plots. seized as property. Go to the Federal Reserve System, submit an application for removal of the encumbrance, but there is no letter from the other party stating that. Plus, personal documents and an application for removal of the encumbrance. An example of a statement of claim requesting the removal of an encumbrance. Sample contract for the sale and purchase of a residential building with a plot of land. In certain cases, it is possible to remove the encumbrance from the land plot. To obtain a sample application for the removal of an encumbrance on a land plot, you will need to contact the local municipal administration, attaching. We bought a plot of land with a house according to the mat. Application form for state cadastral registration of real estate and or. In this case, the territorial body of the Federal Registration Service on the basis of a corresponding application. For example, a neighbor will need to make a passage to his plot through specific land. The terrorist group said in a statement that the Arab man died accidentally because he was mistaken for a Jew. You must submit an application to remove the encumbrance, which is called as. Who knows how long it takes to consider an application to remove an encumbrance on real estate? . When removing the encumbrance from the house and the adjacent land, you need to apply together. You can check the encumbrance on a land plot through Rosreestr by paying. Who can tell me how to correctly write an application to remove the encumbrance from a land plot. According to Federal Law Federal Law 264, the period for changing data on the encumbrance of an object is 3 working days. An application for the removal of an encumbrance from an apartment and its sample are not uncommon. Application for removal of encumbrance from a land plot. The process of removing an encumbrance largely depends on a competent lawyer. Plaintiff's full name, address of actual place of residence, telephone number. Application for removal of seizure from a land plot. In modern Russia, encumbrance of a land plot is a limitation. Along with the application to remove the encumbrance, the Registration Authority is also provided with a document confirming the fulfillment of obligations under the contract. Selling a land plot with encumbrances is not easy. An application for the removal of an encumbrance is written within the established format. A copy of the decision of the Court Administrator on the release from arrest, etc. Ways to remove an encumbrance from a site Not every restriction prevents the conclusion of a transaction. Statement of claim for deregistration of a land plot. R Removing the encumbrance from the land plot! Application for removal of encumbrance sample, Sample documents. If a house and a plot of land are mortgaged, then two state fees of 200 rubles each. on the removal of the mortgage encumbrance by force of law on a residential building and land plot c. The owner of the site can only contact them with a request for removal and provide it. Application for removal of encumbrance from a land plot. Rent encumbers a plot of land, an enterprise, a building, or a structure. Sample application for lifting arrest. The second way to remove encumbrances from a plot of land or a house. A convenient service that accepts applications for the removal of encumbrances from an apartment, a sample of which can be downloaded online. Rent does not prevent the owner from making transactions with the site, even when purchasing. And this applies not only to housing, but also to land. You can take possession of a land plot with an imposed encumbrance in different ways. Sample application for removal of encumbrance on real estate, result found. Application for removal of encumbrance from vehicles to the Chairman of the Board of Kamcombank LLC Gabdullina R

Interesting: New in the Criminal Code of the Russian Federation in 2020 under Article 228p4 with comments

” frameborder=”0″ allowfullscreen>

A claim to remove an encumbrance from a land plot. Here you can also get a sample application to remove the encumbrance from the apartment. Appendix. In this case, the owner only needs to write a statement of termination. I bought a plot of land at auction that existed before 2008. What is a sample for drawing up a statement of claim to remove an encumbrance from an apartment? What documents are needed to remove the encumbrance on a plot of land and a house. An application for the removal of encumbrance drawn up and.

- Nurse's report for the highest category 2020

- decision form of the general meeting of owners of an apartment building

Removal of encumbrance in court

If certain disagreements arise between the parties regarding the fulfillment of obligations, and they cannot agree, then the removal of the encumbrance will become possible only through the courts. To do this you will need to do the following:

- Write and file a statement of claim, which will indicate the circumstances under which the encumbrance can be lifted.

- Attach to the application weighty arguments and evidence that all terms of the agreement have been fulfilled in full and there is no debt.

- After some time has passed, the applicant will receive a court decision, and if it is positive, the final action can begin.

- As soon as the court decision is issued, the user must submit a package of documents to Rosreestr. Within 3 days a new certificate will be issued, which will have a stamp indicating the absence of encumbrances.

- You must initially indicate the name of the court to which the claim is being submitted;

- personal information about the applicant and mortgagee, including contact details;

- information about the collateral, including location, area and cadastral value;

- information on debt repayment indicating the exact dates of payments, as well as the amount of debt;

- title documentation for the property;

- the reason for going to court and the requirement to the court.

Statement of claim to court for removal of encumbrance

When drawing up a statement of claim, you need to take into account a lot of points. In particular, the document has some requirements regarding content. Thus, a statement of claim for the removal of an encumbrance must contain the following information:

A sample statement of claim for the removal of an encumbrance can be viewed here. ⇐

Required list

To receive confirmation from government authorities that the encumbrance has been lifted, you must submit an application for its removal.

The application must be accompanied by a list of documents listed below.

We invite you to read the Complaint against the management company REAL ESTATE-SERVICE

Attachments to the application:

| Copy of the passport | Borrower, as well as passports of co-borrowers (if available). When submitting an application, a representative of the borrower must provide a power of attorney for him |

| Title documents | for housing, for example, a purchase and sale agreement, exchange |

| Mortgage agreement | Copy and original |

| Mortgage | It should have a note indicating that the debt has been repaid. The date of the last payment on borrowed funds is also indicated. |

| Bank certificate confirming loan repayment | confirming the full fulfillment by the mortgagor of its obligations under the mortgage loan agreement |

| Certificate of acceptance and transfer of mortgage | receipt of payment of state duty |

These documents are submitted to the MFC (multifunctional center) or directly to the Federal Service for State Registration, Cadastre and Cartography.

After the encumbrance is removed, the former mortgagor is issued an extract from the unified state register of real estate, with the encumbrance removed.

When filing an application for the removal of an encumbrance by legal entities, they must provide the registration service with documents for the organization (Charter, etc.), duly certified.

It should be noted that each territorial office of the Rosreestr service may have its own requirements regarding the documents required for removal.

You can find out about the specific list of documents for repaying the encumbrance at the service department.

Typically, lifting a restriction is done on the basis of:

| Joint statement | Lender-mortgagor and borrower-mortgagor |

| A court decision that has entered into legal force | on early termination of a mortgage loan agreement |

After full repayment of the mortgage debt, the borrower must obtain a certificate from the bank.

Along with the certificate, he must be given a mortgage on the apartment that was the subject of the pledge.

How to remove mortgage encumbrances at the MFC

An encumbrance on real estate is the partial ownership of property by another person or organization, which significantly limits the rights of the owner.

An encumbrance can be imposed in various cases, including as a result of credit obligations when you buy an apartment or a share of real estate with a mortgage.

In what cases is an encumbrance placed on real estate?

Information indicating the presence of encumbrances is necessarily stored in the Rosreestr database, and is indicated in the document confirming ownership - an extract from the Unified State Register of Real Estate.

Latest questions on the topic “removal of encumbrances”

Good afternoon. In the latest extract from the Unified State Register of Real Estate, in the encumbrance section, in the TYPE item, there is MORTGAGE, in the DURATION item, which is subject to a restriction of rights and the encumbrance of the object is from 05/11/2020 to 03/06/2020; in the Legal Claims and Availability Information section.

I couldn’t remove the encumbrance on an apartment in another city myself. What is the price of a notarized power of attorney for this procedure?

In what cases is the encumbrance not removed from real estate acquired at auction after the bankruptcy procedure and what types of encumbrance are not removed, except for situations with bankruptcy of an individual entrepreneur. Does the form of bidding - public - have anything to do with the removal of the encumbrance?

How to remove mortgage encumbrances at the MFC: step-by-step instructions

Step 1. Contact the bank, write an application on the spot, according to which you will be issued a mortgage note with a note on the repayment of loan obligations (according to the law, a joint visit with you by a representative of a credit institution or mortgagor to the MFC or Rosreestr is allowed).

Step 3. At the reception, the MFC specialist will once again check the mortgage and the presence of marks on it, and will help you fill out the application.

Step 4. If everything is in order, it will issue a receipt for acceptance of documents, by the number of which you can track the status of the application.

What documents are needed

The time during which the MFC will carry out the procedure for removing mortgage encumbrances, including military ones, is 3 business days; in some cases, it may take another 1-2 days to send documents to (from) Rosreestr divisions.

Amount of state duty in 2020

Many people think that in the event of a bank's deprivation of a license, bankruptcy or liquidation, the mortgage will be automatically repaid and there will be no need to pay - this is an erroneous opinion, fraught with serious consequences.

Since 2020, multifunctional centers have introduced a service that allows citizens to remove mortgage encumbrances; the repayment of the mortgage loan registration is handled by Rosreestr, but documents can be submitted to the state body for registering property rights through the MFC.

In the Russian registry

The borrower must draw up an application for lifting the restriction, the form of which can be obtained from the bank.

After filling out this application must be verified by the bank, so you need to make the appropriate mark on it.

The application is sent to the registration service along with the following documents.

They include:

| Document of ownership (extract, certificate) | Mortgage agreement |

| Bank reference | confirming full repayment of the loan |

| Mortgage | for collateral real estate |

According to the norms of law, making a record of the removal of a mark on an existing encumbrance is carried out by the registration service in the Unified State Register of Real Estate.

To register ownership, you must provide certain documents to the Rosreestr service.

The Federal Service for State Registration, Cadastre and Cartography carries out registration of property rights to real estate on the basis of an application and other necessary documents.

Documents can be submitted to Rosreestr in the following ways:

| At a personal reception | In the territorial body of Rosreestr or through the MFC |

| By mail | Documents are sent by registered mail with a list of attachments |

| Through the public services portal service | or through the multifunctional center website |

In most cases, when purchasing real estate, citizens turn to the services of realtors.

When a representative of the borrower (realtor or lawyer) submits an application to remove the encumbrance on a mortgage loan, a power of attorney is issued for him by a notary.

The power of attorney is issued by a notary for a set fee, the amount of which can be clarified at the notary's office.

What is an encumbrance

In accordance with the legislation of the Russian Federation (Federal Law No. 122), restrictions and restrictions on the owner’s rights to real estate are imposed in the case of:

The right to cancel the registration record that your property is under a mortgage is exercised in the following cases:

- If a statement from the lender and a mortgage with a note indicating that you have fully fulfilled your obligations are provided to the registration chamber.

- The Rosvoenipoteki organization will send a corresponding application if the housing was purchased with a military mortgage.

- If you apply for foreclosure based on a pledge, the encumbrance will be automatically removed during the process of registering property rights.

As soon as you make your final mortgage payment, you need to do the following:

Step 2. Make an appointment in advance at the MFC, otherwise you arrive at the nearest branch and receive an electronic queue coupon, in addition, you can request a preliminary consultation by calling the hotline.

Step 5. As soon as the procedure is completed, you will be able to receive a document (extract from the Unified State Register of Real Estate) from the same branch of the MFC confirming your full ownership of the home without encumbrances.

If there was an apartment or house under encumbrance, now you have the right not only to live on their territory, but also to perform legally significant actions with the property:

- Application (to be filled out at the MFC, a sample can be downloaded and printed in advance).

Terms of provision of services at the MFC

In addition, if the borrower repaid the mortgage and at the same time participated (bought) an apartment in shared construction, the period is 5 working days.

If the bank undertakes to submit an application on its own, the deadline may take up to two weeks.

The procedure for removing encumbrances from real estate purchased with a mortgage is not subject to state duty and is carried out free of charge.

Rules of law

An encumbrance placed on real estate must undergo state registration with the Rosreestr service. This requirement is enshrined in law.

The rules governing the transfer of purchased real estate as collateral are regulated by Federal Law No. 102 “On mortgage (pledge) of real estate.” The normative act was issued on July 16, 1997.

It regulates the following issues:

- Explains what a mortgage is;

- The rules for concluding a mortgage agreement are established;

- The rules for state registration of mortgages are determined;

In addition, the act determines the list of persons who have the legislative right to grant a mortgage.

When concluding a mortgage agreement by a legal entity, the resulting obligations must be reflected in the financial statements.

General rules of law related to pledge established in civil legislation apply if regulatory legal acts do not establish special rules.

When purchasing an apartment using borrowed funds, regardless of the wishes of the parties to the transaction, a security deposit is established on it in accordance with the law.

A mortgage is a security measure that allows you to guarantee the fulfillment of the obligations underlying the mortgage agreement.

When registering the ownership rights of the purchaser of housing, at the same time the encumbrance on this housing is registered in the unified state real estate register. (USRN).

According to legal regulations:

| No need to submit a separate application | to register a pledge |

| This action is not taxable | state duty |

Information that an encumbrance has been imposed on the object is reflected in the extract from the Unified State Register of Real Estate.

The mortgage borrower does not have the right to dispose of the property under the encumbrance until it is repaid.

At the same time, the complete “closure” of the loan does not lead to the termination of the mortgage agreement with the bank.

To remove the encumbrance from real estate, you must submit an application to the Rosreestr service. This application is submitted jointly by the lender and the borrower.