Share

Are you buying a plot of land and want to protect yourself as much as possible from troubles from a potentially dishonest seller? In this case, in addition to the purchase and sale contract, you must draw up a receipt confirming the delivery of the deposit to the seller. A purchase and sale agreement is a binding document that confirms the transfer of property from one party to another. The law does not require you to draw up a receipt - this is entirely your initiative. However, even a receipt that is not notarized is full proof that you are right.

Why do you need a receipt? By drawing up this document, you will insure yourself against possible claims from the seller about the lack of payment.

Conditions of receipt

It is similar to a mortgage, but instead of borrowing money from a lender or bank, the buyer makes payments to the property owner or seller until the purchase price is paid in full.

The buyer and seller sign a document covering the agreed upon terms of sale. Once all terms of the contract are met, including payment of the purchase price within a certain period of time, legal title to the property passes from the seller to the buyer in the form of a warranty deed used to transfer title.

Types of contracts

When carrying out transactions for the purchase and sale of real estate, a corresponding document is drawn up, which can be of two different types. One of them has a more or less simple scheme. So it contains information about the parties to the transaction and the subject of the transaction, as well as about what type of transfer of property is used, be it the alienation of property or its full acquisition.

But the transaction amount is not stated in this document. However, today the legislative norms of the Russian Federation oblige to indicate the transaction amount when buying and selling real estate due to the fact that this financial transaction is taxable. The need for a receipt in this case is due to the fact that even if the transaction amount is indicated, the fact of transfer of money is not recorded in any way.

The second type of purchase and sale agreement involves some combination of elements of the first with the addition of a clause on the amount of the transaction, and also specifies specific information about the timing of the transfer of money from the buyer to the seller. Often, between people conducting transactions for the purchase or sale of a land plot, or residential real estate, receipts are still drawn up, regardless of the amount or the terms specified in the contract certified by a notary.

Sometimes the initiator of drawing up a receipt is the buyer himself, indicating in it that he has paid the full amount and does not owe anything else to anyone. From the seller's point of view, the presence of a receipt does not matter as much as he has already signed the purchase and sale agreement, which states that the entire amount has already been received by him. The only exception may be long-term financial payments.

The above types of contracts essentially determine the need to write a receipt. In any case, when drawing it up, it is necessary to observe some formalities. This is necessary so that this document is valid and can even be used as evidence in court. Therefore, among other things, it must meet the following requirements:

- written in ink on paper by hand by the seller himself or by a person who has the legal basis to fill out such documents on behalf of the seller;

- ink color is blue, since the use of black ink in documents is very limited;

- a specific date for transferring the amount of money in full, if the money is transferred in parts - you must indicate the exact date of payment of each individual part;

- absence of any corrections or inaccuracies in the text of the receipt. This also includes calligraphic accuracy, which is due to the impossibility in the future of interpreting the same phrases in two ways, replacing some letters with others.

The original version of the receipt is necessary if, during the trial, an examination of handwriting is organized, due to the seller’s refusal to be involved in writing the document.

The same procedure for writing receipts also applies when carrying out alternative transactions, and their legal force also remains in effect.

A receipt for receipt of funds for a house and land can be of two types - simple and complex:

- In the first type, information about the parties carrying out the transaction is recorded. Moreover, the name of the type of property is entered. Real estate can be transferred into ownership, alienated, etc. The financial component is also prescribed. The amount contained in the receipt of funds for the house and land is subject to tax. However, in order for the fact of transfer of money to be confirmed, it is better to draw up the document in front of witnesses. Of course, if the funds are transferred in cash. Otherwise, a photocopy of the payment receipt is required.

- The second type of receipt is drawn up according to a slightly different scheme. For example, in addition to the amount of transferred funds, the schedule and terms of repayment of payments are entered.

What is it for?

The document not only records the moment of transfer of the sum of money, it also states the conditions of the debtor and the lender. When it comes to debt securities, interest, terms and amounts of payments are often recorded on it.

Often, the buyer or debtor first gives an advance payment, and only then takes the receipt. The document itself is more important for the person who gives the amount of money.

In case of illegal termination of cooperation, with such a debt promise, you can go to court, where they will provide assistance and put forward an adequate solution.

The document must be in written form, which states the fact of transfer of funds from one person to another - payment for a product, service, loan, etc.

This is interesting: Application to establish the fact of acceptance of inheritance: sample and rules for drawing up

Documentation is necessary when the amount of debt exceeds 1000 rubles. But on the other hand, this is not mandatory.

If the borrower's good faith is fully guaranteed, the agreement can be drawn up by hand. When there is a possibility of fraud, it is best to confirm your own rights through a notary.

Benefits of a receipt

As with other types of seller financing, a receipt for cash on the home and land can benefit both the buyer and the seller.

Benefits for buyers. There may be a buyer interested in selling the property but who, due to their credit history or other reasons, cannot get approved for the mortgage they need. The parties may enter into an agreement for the buyer to make monthly payments directly to the seller.

Benefits for sellers. The seller does not receive the full purchase price up front as if the buyer had used a mortgage or paid all cash. But the seller may have more options for potential buyers. Moreover, the seller can negotiate a higher purchase price for the property by offering a sale under a land contract. The seller may also require and receive a large down payment in cash.

As long as the buyer makes payments to the seller, he is considered to have “equitable title” to the property. As an equitable titleholder, the buyer has an interest in the title to the land contract, and the seller is not permitted to sell the property to a third party or subject the property to liens or encumbrances that would interfere with the buyer's interest in the property.

The concept of a receipt as a document with legal force

A receipt is a document that, after signing by all parties to a financial transaction, acquires legal force and is a guarantor of the completed transaction.

We invite you to familiarize yourself with Cases of provision of land plots without bidding

For any transactions involving the transfer of money, this fact must be recorded with checks or receipts. It should be borne in mind that the sale of real estate involves the payment of income tax. Therefore, recording the receipt or transfer of money is also necessary from a legal point of view.

If several people, called shareholders, have the rights to real estate, then the signatures of each shareholder must also be on the receipt. Notarization of the receipt is not mandatory. This document is filled out in two copies, and its signing gives it legal force.

When completing purchase and sale transactions, it is necessary to document the subject of the transaction, the amount of the transaction and set deadlines. The subject of the transaction is a real estate object. This is an apartment or a house, or a non-residential property, as well as a country house or just a plot of land. This object must be located at a specific address or have a corresponding cadastral number.

The price issue is considered to have already been agreed upon, so the transaction amount must be entered in an up-to-date form. The term means a specific date on which or after which, the buyer undertakes to transfer the specified amount in full to the seller of the property. Therefore, a receipt, as a legal document, can be located among all the papers for the property and with its help you can confirm at any time that the financial transaction was carried out successfully and no one has any claims, and that the exchange of money for property was completed.

Otherwise, this document may serve as the basis for filing a lawsuit due to failure to comply with certain points specified in the receipt. However, it is worth taking into account that the court will accept the receipt and attach it to the case materials only if it is relevant in terms of the limitation period, which is 3 years from the date of its signing, otherwise this document will be declared invalid.

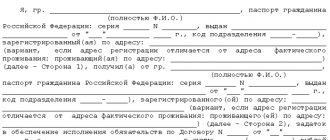

As mentioned above, the legislation of the Russian Federation does not provide for a rigid receipt form. However, legal practice, for its part, has identified some elements and points that can significantly affect the acquisition of legal force by a document. Thus, among other things, the receipt must have the following list of details:

- place of receipt, city, district center or village;

- information about the seller, his full name and passport details;

- registration and actual place of residence of the person acting as the seller;

- information about the buyer, his full name and passport details;

- registration and actual place of residence of the citizen who is the buyer;

- subject of the transaction. Full address of residential or non-residential property or cadastral number for a land plot or privatized summer cottage.

- the total amount of the transaction. This parameter is indicated in foreign currency and is duplicated in the currency of the Russian Federation. First, the amount is indicated in numbers, and then duplicated in words in parentheses;

- further, on behalf of the seller, it should be indicated that “the specified amount of money was received in full and there are no claims against the full name acting as the buyer”;

- date of signature. Here, as in many other official papers, the date and year are written in numbers, and the month in words;

- directly the signature itself, indicating the full name of the citizen signing the receipt.

The receipt is written immediately after the transaction is completed. Basically, this happens right in the notary’s office. The bottom line is this: the buyer transfers money to the seller. The seller has guarantees - this is a sum of money and a signed purchase and sale document. Now the buyer wants to protect himself and issues a receipt indicating that he no longer owes the seller anything and all issues are closed.

This receipt is kept by the buyer. Quite often, it is customary to draw up this document in several copies, indicating the number of copies. This allows both parties to the transaction to have an official document that has legal force and use it for the purpose of legal protection of legal rights and freedoms in the event of disputes regarding the ownership of a land plot, residential or non-residential real estate. But it is worth considering that the second copy is not written using a carbon copy, but must also be filled out with one’s own hand.

When signing a receipt for a large amount, it will not be superfluous to have witnesses, whose details will also be included in the document.

In matters of deposit, before making an official transaction with a notary and drawing up papers, you should make sure that the property is not under arrest and is not subject to alienation from the seller. After transferring the deposit, you must also issue a corresponding receipt. Usually, if a deal breaks down at the buyer’s initiative, the deposit is not returned to him. All these points must be discussed in advance, and what requires recording must be recorded on paper.

A receipt is an official financial document that confirms the legality of the transaction for the sale of real estate and the absence of any claims on the part of one of the parties, including the financial side of the matter.

Thus, the receipt allows you to protect yourself from dishonest and dishonest citizens. Often, even well-known people can be participants in the receipt. But when large sums of money are involved, you should not look at how well the other party to the transaction is familiar, but feel free to issue a receipt to avoid unnecessary worries.

Legal title to the property remains with the seller until the buyer makes final payment. When final payment is made and all conditions of the receipt are met, the title deed is filed with the appropriate government agency. Such as a county register listing the purchaser as the new owner of the property.

If the buyer does not make monthly payments, the seller files a lawsuit. The statement of claim includes a request for confiscation of the land contract. Forfeiture ends by extinguishing all money paid to the seller for the property pursuant to the note and the buyer's fair title. In other words, if the buyer doesn't pay, the seller keeps all the money received, plus the property.

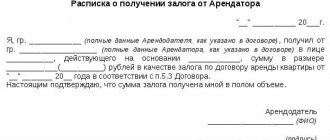

How to issue a receipt for receiving a deposit when purchasing a land plot

It is important to protect yourself from negative consequences as a result of incorrect transaction execution.

The receipt is a measure of responsibility confirming the existence of a deposit received from the buyer in the form of money when booking the selected property.

Additionally, the document provides official proof for the seller and buyer of the prepayment for the property in connection with the creation of a guarantee to prevent possible misunderstanding or fraud. A receipt when registering the purchase and sale of an apartment will also be required to refund the 13% property tax based on the provisions of the Tax Legislation.

The concept of a deposit is defined in the Civil Code of the Russian Federation by Article No. 380 and this legal issue of advance payment to the owner for the real estate or land plot sold by him is regulated by Article No. 381.

When providing funds in the form of an advance payment, you need to understand the importance of confirming this fact, draw up a correct receipt and attach it to the official contract.

Legal advice should be obtained before entering into a written earnest money agreement.

Before submitting a deposit, you should check:

- original versions of documents confirming rights to the house and land;

- when viewing real estate papers, you need to make sure that when concluding a preliminary agreement with one of the owners or other persons indicated in the certificate, they are not married or divorced earlier than 3 years before the date of their acceptance of the deposit;

- request a certificate from the seller about all currently and previously registered persons in the premises. Clarify whether permission from the guardianship authorities is required for pre-sale if a minor has a residence permit;

- technical papers on the subject of illegal planning;

- compliance of the list of owners in the extract from the Unified State Register and directly in the certificate for this premises.

Additionally, before generating receipt items, a check will be required to verify the imposition of a debt encumbrance on the premises by government agencies.

Before proceeding with the official part of concluding the transaction, it is worth making sure that the deposit agreement is not perceived as a pledge or an advance, since these terms carry different legal meanings. It is worth noting that the deposit differs in that it is not refundable, with the exception of a double return of its monetary amount in a situation in which the seller violated the terms of the agreement.

When entering into civil legal relations when registering a transaction for the sale and purchase of an apartment, you must take into account the following:

- make sure that there is a pre-drafted purchase and sale agreement with information about the procedure for crediting money for a residential building through a deposit;

- you need to check whether all owners appearing in the original papers are present and registered when transferring funds;

- the data in the receipt is written in exact accordance with their spelling in the source documents, taking into account abbreviations, if any;

- The owner writes the document in his own hand, directly in the presence of all interested parties who have the right of shared ownership, including the document filled out by them in accordance with the information about each person’s share.

We invite you to familiarize yourself with Donating a share in an LLC: what is important to know when donating a share to another LLC participant, relative or third party

You can draw up a deposit agreement in any form, but the receipt itself is not an agreement, but only an annex to it.

A properly registered receipt is a guaranteed way to protect against claims by the seller against the buyer and vice versa.

The deposit agreement when purchasing an apartment is filled out in stages. First of all, information about the participants in the process should be listed, after which data on the subject of the agreement, the terms of the transaction and the market price should be filled in.

The stages of completing a transaction include:

- self-deregistration of the seller;

- then the contract is drawn up and concluded;

- the transfer of ownership rights is recorded through re-registration;

- funds are transferred in rubles by the buyer.

In some cases, money transfer is carried out using the bank’s services of providing safe deposit boxes. In this case, the amount is verified by a bank employee. Once the bank receives the completed transaction document, the final transfer of funds will take place.

To do this, it is enough to make formal changes to the clause of the main agreement on the method of transferring money.

Legal advice

To evaluate a residential building or apartment, it is appropriate to invite an expert with extensive experience in this field.

The real market value of the living space should be displayed, since this action will serve as a guarantor for both parties for the lawful resolution of conflict situations.

If one party violates the requirements, and the other party refuses to acknowledge their violation, you should seek legal advice to file a claim in court.

(full full name)

passport ………. No………………… issued …….……………….………………………………… “……” ……………….. 20…. city, subdivision code ………………………………………………………registered at the address: city ………………… street …..…………..….……… ..… house ……….… building ………… apt. …………

hereinafter referred to as the “Buyer”, and ……………………….………………………………….…………………………………………. ,

(full full name)

passport ………. No………………… issued …….……………….………………………………… “……” ……………….. 20…. city, subdivision code……………………………………………

registered at the address: city …………………… street …..…………..….………..… house …….

…… building ………… sq. …………

Subject of the Agreement

1.1. The Buyer makes a deposit to the Seller in the amount of

………………………………………………………….……………(…………………..) rubles. (in words / numbers)

to secure the purchase and sale agreement concluded by the Parties for a land plot owned by the Seller by right of ownership. 1.2. Land plot: located at: …………………………………

…………….………………..………………., cadastral number …………………………………………………..…………. .………………total area …………………………………………………………………………

square meters,

(in words)

permitted use: …………………………………..……………………….category of land: ………………………………………….. …………………………..

There are no buildings, structures or structures on the land plot.

1.3. The price of the Land Plot is determined by the Parties in the amount

….………………………………………………………………………………………(……………) rubles. (in words / numbers)

and remains unchanged until the purchase and sale agreement is signed.

1.4. The deposit specified in clause 1.1. of this agreement is not subject to value added tax (VAT).

1.5. The land purchase and sale agreement must be concluded on time

………………………………………………………………………………………………………………… (date or event upon the occurrence of which the contract will be concluded )

2. Payment procedure, receipt of a deposit 2.1. Buyer ……………………………………………………………………………………

(transfers the deposit in cash / transfers the deposit to the Seller’s bank account)

the entire amount of the deposit specified in 1.1. of this Agreement upon signing this Agreement.

2.2. Payment of funds as a deposit is carried out personally by the Buyer.

2.3. The date of payment of the deposit is considered to be ……………………………………………………….(date of transfer of the deposit to the Seller in cash / date of receipt of the deposit amount to the Seller’s bank account)

3.1. The Buyer is obliged to conclude a purchase and sale agreement for the Land plot with the Seller within the period before “…..” …………………. 20….. inclusive.

3.2. Transferred in accordance with Article 1.1. of this Agreement, the amount of the deposit is counted against future payments by the Buyer.

3.3. In case of failure to fulfill the deposit agreement by the Seller (refusal, evasion from concluding a contract for the sale and purchase of the Land plot on “…..” ….…..….……. 20… inclusive), the Seller pays the Buyer within …………… ………… banking days amount in the amount of

in accordance with Art. 381 of the Civil Code of the Russian Federation remains with the Seller.

The parties act voluntarily, are fully capable, are not under guardianship, trusteeship or patronage, do not suffer from illnesses, including mental ones, or are in any other condition that deprives them of the opportunity to understand the meaning of their actions and manage them.

3.6. The Parties guarantee that they are not entering into this Agreement due to a combination of difficult circumstances or on extremely unfavorable conditions for themselves and that this Agreement is not an enslaving deal for them.

4.1. This Agreement comes into force on the date of its signing and is valid until “…..” …………………. 20….. g.

4.2. The deposit agreement is terminated when the deposit amount is returned to the Buyer in the case provided for in Article 3.4. actual agreement.

5.1. Disputes that may arise during the implementation of the terms of this Agreement will be resolved by the Parties through negotiations. If it is impossible to reach agreement, controversial issues are resolved in ……………………………………………………..

(district court / arbitration court of the city ……………….) 5.2.

For failure to fulfill or improper fulfillment of their obligations under this Agreement, the Parties are liable in accordance with the current legislation of the Russian Federation.

https://www.youtube.com/watch?v=-VjDpBfpGQg

6.1. This Agreement is drawn up in two original identical copies having equal legal force, one copy for each of the Parties.6.2. Any changes, additions, or agreements to this Agreement are valid if they are made in writing and signed by both Parties.

7. Addresses and details of the Parties

……………………………………….… ………….………………………………

(full full name) (full full name)

(signature) (signature)

“……” …………………. 20….. “……” …………………. 20….. g.

Hello, can I register a house with a plot of land if the first owner sold the house with a handwritten receipt? And this owner who bought the house did not register it and died 8 months ago, he lived there alone, gave me the documents for the house and the plot and the receipt is the one that the previous owner wrote to him

But it's better to rewrite it completely. A copy of the receipt is not valid.

Therefore, the receipt is written in two copies and remains with both parties. The receipt must indicate the surnames of both parties without abbreviations, their full passport data, the amount in numbers and in words, the purpose of the money (advance for an apartment, as a loan, etc.), the fact of receiving the money (“I received...”), date and signatures, like in a passport. The parties sign in the presence of each other.

Recommendations for filling out and content of the receipt. Document details

An example of how a receipt for receiving funds for a house and land is filled out:

- Place and address of the financial transaction.

- Seller's passport information.

- Information about real estate, possibly using the description found in public records.

- Transaction price.

- Monthly payments.

- The date of each month until the entire payment amount is satisfied.

- If the amount was received in full, this must be indicated.

- Signatures of the parties.

We suggest you familiarize yourself with How to issue a duplicate sick leave certificate

A receipt for receipt of funds for a house and land is usually filled out by a notary. The buyer agrees to pay the monthly installment when due. If the buyer does not pay on time, the seller has the right to declare default on this contract.

After final payment, when the entire purchase price has been paid in full, the buyer agrees to provide the seller with title or land documents. The seller also agrees to waive any claims to the land. The Buyer agrees to relieve the Seller of any liability with respect to matters arising after the date of transfer of title. The buyer agrees to accept full responsibility, financial and otherwise, for the land upon transfer of title.

Receipt for receipt of funds for land

The sale of land is subject to the laws and practices of the jurisdiction in which the land is located. The transfer of real estate into ownership is regulated by contracts.

Real estate contracts are typically two-way contracts. Also, when a transaction is carried out, a receipt is drawn up confirming the receipt of funds for the land.

An example of filling out the form and a sample template are given below.

Money is paid or received whenever you buy, sell a product or service. Paying in cash provides proof that you purchased the product and paid for it. This may be partial or full payment at one time.

A land receipt is a tool that shows when, where, why, and by whom payment was made and received. A receipt for receipt of funds for a plot of land can be useful for many purposes.

For example, from record keeping to inventory storage and ledger maintenance, from filing tax returns to tracking shipments and refunds, etc. The information displayed on the land cash receipt receipt may vary from company to company as well as from company to company. purpose and method of payment.

The receipt template must contain the following information:

- Name of the company buying/selling the land (or full name of the individual).

- Address of the parties.

- Date of payment.

- Reason for payment.

- Amount of payment.

- Was the payment made in one go or in installments?

- Payment method: cash, check or credit card.

- Signature of the person receiving the payment.

- Company seal confirming payment (if available).

In all jurisdictions there is a legal requirement that contracts for the sale and purchase of land must be in writing to be enforceable. Various provisions regarding fraudulent transfer of money also require a receipt. For greater security, the transfer of money is registered in writing before a notary.

https://www.youtube.com/watch?v=P952pT5tOhI

A receipt for receipt of money for land can also be drawn up by one party transferring the money and another party accepting the offer.

A common practice is to "exchange contracts". First of all, this involves signing two copies. Each party retains one receipt for receipt of funds for the land.

However, it is usually sufficient that only the copy retained by each party be signed by the other party only. Moreover, this rule allows contracts to be “exchanged” by mail.

Both copies of the receipt become binding only after each party has a copy of the agreement signed by the other party. That is, the exchange is considered completed.

Writing rules

A receipt for receipt of funds for land usually contains:

- First of all, the full name of the participants. In a purchase and sale agreement, the parties are the seller and the buyer of the property, often called the principals. They should be distinguished from real estate agents, who are actually intermediaries and representatives in agreeing on the price. If there are any real estate agents handling the sale. They are usually listed as brokers as well, receiving commissions on sales.

- The address of the property is indicated.

- The amount of land price.

- Signatures of the parties.

However, a receipt for receipt of funds for a plot of land is considered invalid if, when drawing up:

- Illegal actions were used.

- People with mental disorders, drug addicts, etc. were brought in as witnesses.

- One of the parties is a minor.

- If there are real estate brokers/agents handling the sale of land, the buyer's agent will often fill in the blanks on the standard release form that the buyer and seller sign. A broker usually receives these forms from the real estate association to which he belongs. When both the buyer and seller have agreed to sign the agreement, the broker provides copies of the signed document to the buyer and seller.

Receipt for advance payment for land plot

It is logical that if the transaction is canceled due to the fault of the buyer, the money transferred towards the purchase will not be returned.

So, if the seller is found to be at fault for the purchase not being completed, the buyer receives 200% of the deposit amount, that is, double the amount.

Let's look at examples: The buyer has found housing, a two-room apartment on the third floor of an apartment building.

In order for the owner to stop searching for potential buyers, to remove the ad from the site, and to fix the price that was agreed upon, a deposit in the amount of 50,000 rubles was issued.

In addition, the party responsible for failure to fulfill the contract is obliged to compensate the other party for losses, minus the amount of the deposit, unless otherwise provided in the contract.

_______________, hereinafter referred to as__ “Party-1”, represented by ___________________, acting___ on the basis of ______________, on the one hand, and _______________, hereinafter referred to__ “Party-2”, represented by ____________________, acting___ on the basis of _______________, on the other hand, hereby confirm the issuance Party-2 and receipt by Party-1 of a deposit to secure the execution of the preliminary Agreement for the sale and purchase of non-residential premises dated "___"________ ___.

After all, if the buyer refuses the transaction, the deposit will remain with the seller, and if the buyer refuses the transaction, the deposit is subject to double reimbursement.

………… hereinafter referred to as the “Seller”, collectively referred to as the “Parties”, and individually – the “Party”, have entered into this agreement (hereinafter referred to as the “Agreement”) as follows: 1.

land category: …………………………………………….………………………….

There are no buildings, structures or structures on the land plot. 1.3.

RAA Law

If the obligation is terminated before the start of its performance by agreement of the parties or due to the impossibility of performance (Article 416 of the Civil Code of the Russian Federation), the deposit must be returned.

If the party who gave the deposit is responsible for the failure to fulfill the contract, it remains with the other party.

If the party who received the deposit is responsible for non-fulfillment of the contract, he is obliged to pay the other party double the amount of the deposit.

In addition, the party responsible for failure to fulfill the contract is obliged to compensate the other party for losses, including the amount of the deposit, unless otherwise provided in the contract. See other ... Appendix to the Agreement for the purchase and sale of non-residential premises in a residential building with the condition of prepayment and a deposit with notarization from "__"_______ ____

We recommend reading: Pension of the Ministry of Internal Affairs

N _______Deposit receipt (drawn up in two copies, one for each party) d.

Receipt for receipt of money for a land plot using mortgage funds

passport series….number… issued……who is registered…resides…;

In order for the receipt to serve as proof of receipt of money in the event of unforeseen circumstances, it must meet the following requirements:

- the receipt must not contain corrections, erasures or other blots.

- written by the seller himself (his representative under a notarized power of attorney), without the use of computer equipment;

- the receipt must necessarily contain the date of receipt of funds;

- preferably in blue ink, since black ink can be interpreted as a photocopy that does not have legal force;