Home / Collections

Back

Published: 03/15/2020

Reading time: 12 min

0

11

- 1 Estimate of HOAs and housing cooperatives: purpose, procedure for preparation and approval

- 2 Determine the structure of the future budget of income and expenses

- 3 How to create an estimate of HOA income and expenses for 2020

- 4 Approve the estimate of income and expenses at the general meeting of HOA members

- 5 Who and when approves the estimate of income and expenses in the HOA

- 6 Estimate and tariff changes

- 7 Is it necessary to include heating in the HOA estimate?

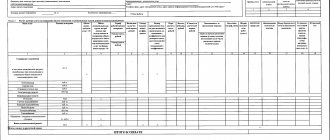

- 8 Samples and examples of estimates of income and expenses of HOAs and TSNs

- 9 Submit an estimate of income and expenses for inspection by the audit commission

- 10 How to fix errors

- 11 How to work with paper?

- 12 Place the finished estimate in the GIS Housing and Communal Services

- 13 When is a document required?

- 14 What is income?

- 15 Report

Estimates for HOAs and housing cooperatives: purpose, procedure for preparation and approval

Homeowners' associations and housing cooperatives are types of consumer cooperatives. They are created in order to accumulate the finances of citizens for the joint ownership and use of their property or the creation of new objects of civil circulation.

Since these entities are legal entities, they must keep records of their activities by drawing up various documents, for example, estimates, declarations, protocols, etc.

The estimate of income and expenses is intended to identify the finances attracted to the consumer cooperative and legitimize their further expenditure for certain purposes. The rules for preparing estimates are fixed by internal local acts of the organization. An HOA, as a way of managing an apartment building, does not have the right to engage in entrepreneurial activities that generate income.

The estimate is usually prepared by the organization's accountant as part of accounting. Its approval is carried out by the head of the HOA or housing cooperative, TSN and other organizations.

In a situation where there is no accountant in the cooperative, it is the board of the consumer cooperative that is responsible for drawing up and at the same time approving such a document.

Estimated documentation drawn up for the next year requires approval before the start of the new period. In accordance with the Housing Code of the Russian Federation, the highest governing body of the partnership is the meeting of members of the HOA. The norm is enshrined in clause 8.1, part 2, article 145 of the RF Housing Code.

The estimate is considered approved if 50% of the HOA members supported the announced expenditure and revenue parts. In accordance with Article 150 of the Housing Code, at the end of the reporting period, the implementation of all planned items is checked by the audit commission. Based on the results of the inspection, the commission draws up a report, which is also considered at the general meeting and approved by its members. This approach allows you to track inappropriate spending.

The preparation of estimate documentation and its approval can be controlled by higher authorities of state housing supervision. They also have the right to initiate the mandatory preparation of a financial report for the past period.

HOA estimate: what is it?

The HOA estimate reflects the movement of revenues and expenditure of targeted funds. The document serves as the basis for justifying the amount of contributions and payments of society members, calculating the annual budget, and the legality of specific expenses. His absence violates Art. 148 Housing Code of the Russian Federation.

Partnerships independently develop the form and record it in the statutory documentation. The annual budget is calculated in advance. Then it is approved at the general meeting of participants. The drawn up plan is subject to financing during the next reporting period.

The HOA's cost estimate is of primary importance. The form records funds spent for specific purposes:

- modernization, maintenance of proper condition of property;

- expenses planned by the company's Charter;

- replenishment of the reserve fund;

- reconstruction of individual parts, the whole house.

Determine the structure of the future budget of income and expenses

Approval of the estimate of income and expenses of the owners' association for the next year falls within the competence of the general meeting of HOA members in accordance with Part 8.1 of Art. 145 Housing Code of the Russian Federation. This issue is one of the mandatory issues for discussion by members of the partnership at the PSC.

The form of this document is not fixed at the legislative level, therefore each HOA draws up its own estimate of income and expenses. The structure of the estimate is dictated by the content, which is also not clearly stated in the regulatory legal acts.

The estimate of the HOA is developed and submitted for approval by the general meeting of members of the partnership by its board (Part 3 of Article 148 of the Housing Code of the Russian Federation). This must be done annually. At the same time, the audit commission of the HOA must also present its conclusion on the compiled estimate (clause 2, part 2, article 150 of the Housing Code of the Russian Federation).

Income and expenses under the simplified tax system

A homeowners' association is a non-profit organization with the right to carry out entrepreneurial activities, the profit from which is not intended to be divided between the organizers and members of the partnership.

Therefore, the community can make tax payments according to a simplified scheme (STS)

.

To do this, you initially need to create a special ledger for recording target income/expenses, and not enter all funds transferred to the HOA accounts into the main ledger.

The income and expenses of the HOA under the simplified tax system for income include the previously specified list of cash receipts and expenses of the partnership. Even the absence of entrepreneurial activity on the part of the HOA does not relieve the partnership from taxpayer obligations that arise if the organization receives certain types of income.

The following income of HOAs entered into separate accounting books for income and expenses is not subject to taxation:

- Funds transferred from HOA members for technical support for the condition of the house and repair work. They are classified as membership fees for internal needs and to ensure the statutory activities of the partnership.

- Donations from individuals related to the HOA who wish to financially support community projects regarding any type of renovation of common property.

- Free services from legal entities and individuals.

Income entered into the general ledger of incoming and outgoing funds that are subject to taxation:

- Funds for technical support of the condition of the house and repair work from persons not related to the partnership.

- Income from business activities.

Important!

If all income of the HOA is recorded in a single book of funds, then tax will be levied on all funds received from the owners of the premises.

How to create an estimate of HOA income and expenses for 2020

It is recommended that estimates be drawn up even for HOAs that do not have outside income. This form allows you to avoid conflict situations with the owners of residential premises, and in a controversial situation it is easy to rely on it, justifying this or that expenditure.

The preparation of estimate documentation falls on the shoulders of the accountant. This specialist generates data on the following positions:

- Initial data.

- Expenditure part.

- Revenue part.

Information about the MKD is entered into the source data section:

- area of residential and non-residential premises in m2;

- total area of the entire house in m2;

- number of elevators, entrances, apartments, non-residential premises in pieces.

As for cash receipts, they can be anything and not limited to contributions from members of the partnership. There are no restrictions in this regard. The income item usually includes:

- Contributions from members of the partnership.

- Cash for renting common property by third-party organizations or individuals.

In terms of expenses, everything is becoming stricter. Expense items are approved in advance at a general meeting of owners and included in the HOA Charter. When drawing up estimate documentation, you will have to rely on the points laid down in the Charter. You cannot add additional expense lines without permission.

The consumable part contains the following parts:

- Ensuring economic activities regarding the common property of the apartment building - maintaining the house and its maintenance.

- Repair - major, current.

- Reserve fund.

- Contents of administrative resources – management.

Starting from 2020, the estimate must necessarily include such an expense item as major repairs.

General information:

- The area of residential premises is 20,388.8 m2.

- The area of non-residential property is 6,995.3 m2.

- Total area – 27,384.1 m2.

Income (rub): contributions from members of the partnership - 5,783,521.92.

Expenses (RUB):

- To control:

- wages 1,676,363;

- legal services 240,000;

- office expenses 12,000;

- unforeseen expenses 18,000;

- communications (landline and mobile phones, postal services) 38,568;

- service travel 18,000;

- maintenance of office equipment 18,000;

- software 68 004;

- organization of meetings and sessions 5,160;

- payment for the work of the audit commission 50,689.20;

- banking services 60,000.

- Maintenance and repair of common property:

- comprehensive service and technical maintenance 2,268,714.76;

- maintenance of car gates 39,600;

- elevator maintenance 36,000;

- maintenance of video surveillance systems 157,200;

- call a plumber 6,000;

- consumables (spare parts, detergents) 68,400;

- landscaping of the local area 36,000;

- current repairs (1 rub per m2) 328,609.20;

- maintenance of metering devices in ITP 75,000;

- major repairs (reserve) 588,416.

- Total – 5,777,524.16.

The estimate is drawn up based on the expenses and income of the previous year.

It should be noted that the preparation of these documents is not an obligation, but a right of the organization. However, many consumer cooperatives draw up estimates in order to avoid conflicts and controversial situations in the future.

The estimate is prepared separately for each calendar year. It fully reflects the entire budget of the company. It includes the following items:

- Revenue part.

- Expenditure part.

In the first case, all possible income of the company is indicated, which may include finances for renting out common property, contributions transferred by cooperative members, etc. In the second case, the costs of maintaining an apartment building, its major and current repairs, office expenses, and payment expenses are included according to concluded contracts, etc.

Although the law does not contain specific rules for approving estimates, recommendations may be made by separate resolutions of authorized government bodies. For example, it is recommended to include the following elements in expense items:

- administrative expenses;

- technical expenses;

- other expenses.

The last group of expenses is not included in all estimates. As a rule, these are expenses aimed at insuring the home and its general property.

The estimate may also include housing tax, estimated savings, utility payments to various services, etc. The document must be in writing, properly certified and signed.

We suggest you familiarize yourself with What needs to change when getting married

The document can also include possible annual risks. This is done in a separate line, since the probability of their occurrence can be either low or high. Future expenses will depend on this. As a rule, if risks are included in the estimate, then the expenditure part may have several separate items that will be implemented depending on the occurrence of these same listed risks.

Items of income and expenses in the estimate can be divided into mandatory, which are dictated by law, and optional, which are included in the estimate depending on the areas of the partnership’s activities.

In the “Revenue” section, all HOAs must indicate the main source of cash income: contributions from owners for the maintenance of residential premises.

Additional income, which each owner’s association will have its own, is considered to be:

- fee for agency services if the HOA collects fees for utilities under an agreement with the RSO;

- payment by tenants for the use or rental of common property of the house: providers, advertisers and others;

- owner fees for additional services: security, concierge, video surveillance, maintenance of automatic locking systems;

- penalties, fines, damages to the HOA by residents of the house or third parties;

- interest accrued on funds placed on deposits.

Approve the estimate of income and expenses at the general meeting of HOA members

The content of the estimate, which dictates the structure of the document, is not directly regulated and not enshrined in one legal act. The estimate of income and expenses includes work and services for maintaining the house specified in the Housing Code of the Russian Federation, RF PP No. 416, No. 491, No. 290, 410, and Resolution of the State Construction Committee of the Russian Federation No. 170.

Clause 33 of RF PP No. 491 states that the estimate of income and expenses includes the maintenance of the common property of an apartment building, as well as utility resources for the maintenance of the property owners. Utility resources supplied to the house to provide utilities to residents are not included in the estimate from 2020.

The Housing Code of the Russian Federation provides a wider list of items for the estimate. According to Art. Art. 137, 145, 150, 158 of the Housing Code of the Russian Federation, the estimate of expenses and income of the HOA includes work and services for managing the house, maintaining and routine repairs of the common property of the apartment building, including the supply of utility resources for its maintenance.

Targeted financing funds are not included in the estimate: for example, payments for major repairs of apartment buildings and subsidies allocated from the budget (clause 14, clause 1, article 251 of the Tax Code of the Russian Federation).

The structure of the “Expenses” section in the estimate of income and expenses of a homeowners’ association will be more complex, since the HOA performs a wide range of work and provides many services for the proper maintenance of the common property of the owners of premises in an apartment building.

All HOAs include in their expenses funds that are planned to be spent next year on:

- carrying out work on the maintenance and repair of the common property of the apartment building in accordance with the requirements of the Housing Code of the Russian Federation, RF PP No. 416, No. 491, No. 290, Resolution No. 170;

- provision of housing services for the supply of CR to SOI;

- expenses associated with the work of the owners' association: office, transport, personnel, housekeeping, payment for services of banks and payment centers, etc.;

- taxes, fees, and fines paid by the HOA itself.

The HOA's expenses may include funds to resolve unforeseen situations if they have happened before and there is no guarantee that they will not happen again. These are optional expense items, such as, for example, payment for the services of a security company, intercom maintenance, and additional landscaping of the yard.

Separately, mention should be made of such an expense item as the maintenance and current repairs of the common property of the owners. The homeowners' association, along with an estimate of income and expenses, draws up an annual plan for the maintenance and repair of residential apartment buildings.

Like the estimate of income and expenses, the annual plan is drawn up by the board of the HOA and approved at the general meeting of members of the partnership (clause 8, part 2, article 145 of the Housing Code of the Russian Federation). The form and structure of the plan are not established by law: in general, they correspond to the structure of the estimate in terms of the partnership’s expenses for routine repairs of the facility.

Thus, the plan is a list of works and services for maintenance and repairs that the HOA plans to implement in the house. The plan indicates the name and type of work, unit of measurement, cost and frequency. If the work is performed with the involvement of a contractor, then you can indicate its name.

The amounts and list of work included in the cost line of the HOA estimate for routine repairs of common property must correspond to the amounts and work specified in the annual plan for the maintenance and repair of the OI MKD. Typically, such a plan is fully included in the estimate of income and expenses of the HOA.

After the HOA board has drawn up an estimate of income and expenses, and the audit commission has checked it and made a conclusion as a result, the documents are submitted to the general meeting of members of the homeowners association.

The PSC of the owners' partnership is convened in the manner prescribed in the Charter of the partnership (Part 1 of Article 145 of the Housing Code of the Russian Federation). In order for the general meeting of members to take place, members of the HOA must take part in it, having 50% of the votes of the total number of votes of the members of the partnership.

The number of votes of each participant is determined in accordance with the area of the premises owned by him, in relation to the total area in the house owned by all members of the HOA.

In order for the estimate of income and expenses presented by the HOA board to be accepted, a majority of the total number of votes of the HOA members present at the general meeting must be cast “for” (Part 4 of Article 146 of the Housing Code of the Russian Federation).

Additional expenses and the reserve fund of the HOA

Additionally, if necessary, expenses unrelated to the maintenance of common property are included, with the general consent of the owners. This sample estimate of HOA expenses does not contradict Art. 145 Housing Code of the Russian Federation.

If actual expenses exceed those planned according to the document. The board of the partnership prepares corrective figures and convenes an extraordinary meeting of participants. New amounts are approved by unanimous vote.

Forming a reserve fund helps avoid misunderstandings. The right is secured by Art. 151 Housing Code of the Russian Federation. For the changes to take effect, two conditions must be met:

- the decision to create an additional asset is made at a meeting of the partnership;

- financing of statutory purposes is carried out.

Contributions from owners used to create a reserve fund are not considered earmarked. They are included in the HOA income estimate, sample, regardless of the chosen taxation system (Article 251 and Article 346.15 of the Tax Code of the Russian Federation).

At the end of the reporting period, a verification commission is created that evaluates the implementation of the document (Article 150 of the RF Housing Code). The prepared report is certified at the general meeting of the partnership participants (Article 145 of the Housing Code of the Russian Federation).

Income can include

the following receipts to the partnership account (clause 2 of Art.):

- entrance fees, the amount of which is fixed in the organization’s Charter;

- obligatory payments;

- results from business activities - rent for renting premises in basements or ground floors, providing emergency plumbing services to the population, construction of premises, etc.;

- assistance under subsidies for programs aimed at modernizing utility networks and introducing innovations for the overhaul of apartment buildings;

- contributions to your own fund, which can be organized with the approval of the homeowners (charitable contributions).

It turns out that an HOA is not prohibited from having additional income (clause 3 of Article 152 of the RF Housing Code), which can be spent on other purposes of the partnership’s activities, if such fall under the regulations of Chapter. 14 of the Housing Code of the Russian Federation and the charter of the HOA.

Who approves the estimate of income and expenses in the HOA and when?

As noted above, the contents of this type of report are approved by the HOA board. Sometimes such a consumer cooperative may hire third parties to carry out this type of work - an accountant.

It is this person who will be responsible for drawing up the estimate. Approval of the document is within the competence of the board. In a situation where there is no accountant in the organization, the approval of the preparation is carried out by the board itself. So-called forums (in other words, meetings of owners of residential premises) can be held regarding the preparation of expenditures and the conclusion of contracts with management companies.

Estimate and tariff changes

In a situation where a homeowners’ association, through its direct representatives, enters into contracts with resource supply organizations in the housing and communal services sector, the cost of payments to them may also be included in the estimate.

We invite you to familiarize yourself with the Water consumption rate per person per month

Utility tariffs change very often, usually once a year. Sometimes rates may change several times over the course of a year. That is why periodic changes have to be made to the estimate. Some partnerships include the proposed increase in tariffs in the “risks” column. Therefore, in their cost estimates, expenses include separate items that come into effect when tariffs for a particular service increase.

There are situations when the Government of the Russian Federation announces in advance an increase in tariffs and the size of such an increase. In this situation, numbers are entered into the document in advance that will be put into effect for a certain period of time. It is necessary to correct or make changes to the estimate correctly by holding a meeting between the owners who are part of the HOA.

Changes in tariffs affect these estimates only if the HOA enters into agreements with organizations working in the housing and communal services sector for the supply of resources. The documentation also includes expenses for payments to resource supply companies. However, the estimate does not include the cost of utilities supplied to apartment owners. It includes only those amounts that are spent on the common property of the members of the partnership.

Utility tariffs are changed regularly. They directly depend on such economic indicators as the price of oil and the level of inflation. Depending on the current situation, tariffs may be increased or decreased one or more times a year.

Price jumps require changes to the estimate papers. Each HOA resolves this issue in its own way. In order not to revise the document several times a year, you can create a separate expense item “risks”. The amounts included there will cover the expenditure side when tariffs increase.

If changes during the year were planned in advance by government decrees, then the form should be prepared taking into account future price increases.

All changes made during the year are approved at the general meeting of members of the partnership in the standard manner. Based on the voting results, a protocol is drawn up and an act is issued, which specifies all the adjustments made.

Is it necessary to include heating in the HOA estimate?

So, if premises belonging to common property are heated, then such costs must be included in the estimate. If there is already information that tariffs will increase, then this must also be indicated in the document.

In a situation where we are talking about heating supplied to specific apartments that are part of an apartment building, such expenses are not subject to inclusion in the list of expenses according to the estimate. If we are talking about Moscow, then the tariffs set by the government of the city apply. The same applies to other regions of Russia.

In SNT, heating is not included in the estimate. This is due to the fact that gardening partnerships are seasonal organizations and simply do not have heating.

Samples and examples of estimates of income and expenses of HOAs and TSNs

The estimate, as one of the important documents in the activities of this type of consumer cooperatives, is published in writing. It can be either handwritten or printed using technical means.

The estimate, as noted above, should include such elements as:

- The income part.

- Consumable part.

- Approximate deadlines for fulfilling obligations.

- Payment purposes.

- Services for the current maintenance of housing.

- Tax accounting forms.

- Typical calculations, etc.

The first sheet of the document includes the name of the organization, the location of the apartment building, its actual address, an indication of the persons managing the board of the HOA, etc.

Submit an estimate of income and expenses for inspection by the Audit Commission

In accordance with clause 2, part 3, art. 150 of the Housing Code of the Russian Federation, at the general meeting of HOA members, together with the estimate of income and expenses and the annual plan for routine repairs of common property, the audit commission of the HOA must present its conclusion on the estimate.

The Audit Commission must present at the general meeting of HOA members a report on the implementation of the estimate of income and expenses for the past year and an analysis of the estimate drawn up for the next year. To do this, the chairman of the partnership must transfer the prepared documents to the members of the audit commission.

The Audit Commission is obliged to check whether an estimate of income and expenses for the next calendar year has been drawn up, the validity of the calculations made for each item of income and expenses, and the validity of the calculation of the amount of payment for the maintenance of residential premises made on the basis of the estimate.

Creation of a list of works and services for the maintenance and repair of common property for 2020

The partnership must submit proposals for the maintenance and repair of the common property of the owners of premises in an apartment building to the general meeting of owners (hereinafter referred to as the GMS) of the apartment building (clause 4 of the Rules for the implementation of activities for the management of apartment buildings, approved by Decree of the Government of the Russian Federation of May 15, 2013 No. 416, hereinafter referred to as Rules 416).

This list of works is compiled by the HOA itself in accordance with clause 5 of Rules 416 p and justifies it at a meeting of the house. It must be remembered that the homeowner has the right to demand justification for the importance of carrying out services and work, to request certificates of inspection of the technical condition of the building or other documents containing information about identified defects (malfunctions, damages), and, if necessary, the conclusions of expert organizations (clause 5 of the Rules 416).

Unified program for housing and communal services

Accrual of housing and communal services, accounting, work with residents, exchange with GIS housing and communal services

To learn more

When compiling a list of works and services, you need to keep regulatory requirements in mind. For example, on Decree of the Government of the Russian Federation dated April 3, 2013 No. 290 “On the minimum list of services and work necessary to ensure proper maintenance of common property in an apartment building, and the procedure for their provision and implementation” (together with the “Rules for the provision of services and performance of work necessary to ensure proper maintenance of common property in an apartment building").

It is worth not forgetting about a small conflict. The OSS is responsible for coordinating the annual plan for the maintenance and repair of common property in an apartment building (clause 8, part 2, article 145 of the Housing Code of the Russian Federation). At the same time, according to Rules 416, the HOA board is obliged to formulate a list of works and services and approve it at the OSS. Today there is no consensus on whether the documents are the same: the list of works and services that the HOA creates in pursuance of Rules 416 and submits for approval to the meeting of owners, and the annual maintenance and repair plan mentioned in clause 8 of Part 2 of Art. 145 Housing Code of the Russian Federation. In such a situation, it would be quite reasonable to present the list to the meeting of owners. If the list is not agreed upon or a quorum of the OSS is not gathered at the meeting, it is recommended to approve such a list of works and services in the form of an annual maintenance and repair plan at a meeting of all members.

How to fix errors

When drawing up estimates, mistakes are often made. Basically, they are due to the fact that the established form is not used. People resort to drawing up such a document on their own, often resulting in confusion and inconsistencies.

Very often, people resort to drawing up estimates only when HOA members require it. But in fact, estimates must be maintained constantly, only occasionally giving it an official appearance.

Also, the main mistake is the fact that often HOA employees do not know what is related to income and expenses and what is not, therefore, often the most important data is simply not entered into this document. Such negligence leads to people getting confused, not knowing where their money went.

When drawing up estimate documents, major or minor errors are often made:

- The form contains data on payment and debiting of funds for the use of utilities in premises owned by homeowners.

- Expenditures do not include costs under agreements concluded with individuals or legal entities for the maintenance and repair of common property. Any payments for maintenance, repairs, security, management must be reflected in the form.

- The agreed amounts are included in the expense item, including VAT. This should be remembered, since unpaid VAT will skew the expenditure part and will be considered an unplanned payment.

- The board calculates certain indicators based on existing indicators in the state. Each household has its own needs, and therefore the indicators approved at the budget level cannot be the starting point. You should calculate your own standards that solve all the economic needs of a given HOA.

- The total amount of expenses is subject to VAT. This approach is unacceptable and is considered fundamentally wrong.

Errors made when drawing up estimates are corrected by making changes. To do this, you will need to issue a separate document indicating which clause is erroneous and subject to change, and why. Then the subparagraph is stated in the new edition.

Grammatical errors are corrected by retyping the document.

Drawing up an estimate for an HOA is a complex and painstaking job. The consumable part deserves special attention. It must be justified and cover all the current needs of the MKD.

If you find an error, please highlight a piece of text and press Ctrl Enter.

Various errors may be made during the preparation of estimates. These are both grammatical and counting arrears. In a situation where there were grammatical errors, they can be corrected very simply by retyping the existing text.

A separate issue is errors associated with calculations in estimates. If certain assumptions are discovered, any citizen who is part of the homeowners association has the right to appeal this or that point. In a situation where the HOA board does not make any concessions, a person has the right to contact the housing inspectorate or the prosecutor's office.

Errors in the estimate are corrected by making changes. This happens by issuing a separate document, which states which item is to be replaced and why. After which the subparagraph is stated in the new edition. The procedure for punishing guilty persons may also be provided for in the Code of Administrative Offences. That is why you need to do the work of drawing up estimates in good faith.

We invite you to familiarize yourself with how to report to the police. They don’t get a job because of minor reports to the police, what should I do? They don't get a job because they reported it to the police, what to do?

In order to avoid possible mistakes, it is necessary, first of all, to take into account the experience in preparing similar papers in previous years. In some cases, you can get free advice from a specialist working in the housing inspection. He can help with drawing up estimates and give the necessary recommendations.

Thus, in order for the HOA to function normally and operate within the legal framework, it is necessary to prepare the necessary documentation. One of the most important documents is the estimate of income and expenses for the next year. This is a written act that includes different parts, both income and expenses.

Submit the register of partnership members to the State Housing Inspectorate

In the first quarter of 2020, the board must send the register of HOA members to the housing inspectorate in accordance with clause 9 of Art. 138 Housing Code of the Russian Federation.

The timely absence of data on HOA members and contacts in the Housing Property Index may threaten the partnership with administrative liability under Art. 19.7 of the Code of Administrative Offenses of the Russian Federation and entails a warning or the imposition of an administrative fine on citizens in the amount of one hundred to three hundred rubles; for officials - from three hundred to five hundred rubles; for legal entities - from three thousand to five thousand rubles.

Dmitry Burnyashev, legal services for HOAs and management companies throughout Russia

How to work with paper?

In order to create an estimate, you need to refer to examples.

For example, the estimate of the Lazurny Beach Homeowners Association, located in the city of Anapa.

A person’s income/expense estimate includes funds received as a result of business activities related to the rental of housing.- Also included in income is the receipt of funds from a lawsuit with another homeowners association.

- Income is receiving a discount from a resource-providing organization.

- Income includes a subsidy from the regional government, which awarded this HOA its grand.

- Expenses include labor costs for HOA participants, as well as staff.

- Payment for the services of a garbage truck and landscaping service is required.

- Costs include the cost of a lawyer who helped win the case.

- Since a major overhaul of this complex will be carried out in the near future, the HOA is purchasing materials, which is also reflected in the cost estimate.

Judicial practice and laws regarding this offense do not make it possible to accurately establish the degree of responsibility or form of punishment.

When rendering a verdict, the court may proceed from the amount of damage caused by the unlawful actions of the HOA.

Special bank services Do the accounts belong here?

Special bank services account is included in the expense item for HOA services? The fact is that the partnership has a bank account and has the right to apply for a loan. But to accumulate funds for cap. repairs HOAs must necessarily open a special service. an account for which maintenance services are charged to the costs of HOA services.

this is a right, not an obligation (clause 2, clause 1, article 137 of the RF Housing Code). Without an estimate, the partnership will not be able to seek repayment of debts from defaulters through the court. How to punish if they work without an approved estimate? There is no provision for punishment of the HOA for lack of income/expense estimates.

It is much easier for the accountant and the Board to work with the estimate in the HOA; moreover, this document can be adjusted. A partnership with an approved estimate will always be able to justify its expenses, as well as the correctness of paying taxes. A competent chief accountant will certainly convince the Board of the need for a financial plan, which is the estimate of income and expenses of the HOA.

Place the finished estimate in the GIS Housing and Communal Services

Drawing up an estimate of income and expenses for the year is mandatory for all HOAs and occurs in accordance with the requirements of the Housing Code of the Russian Federation and other legal acts:

- The HOA board draws up an estimate and sends it to the audit commission for inspection.

- Based on the results of the audit, the Audit Commission draws up a conclusion.

- The estimate and conclusion of the audit commission are submitted to the general meeting of HOA members.

- The general meeting of HOA members approves the estimate of income and expenses.

- The HOA places an estimate in the GIS Housing and Communal Services in accordance with clause 17 of Section. 10 No. 74/114/pr.

Based on materials from the RosKvartal portal.

When is an HOA estimate necessary?

If the activities of the partnership are limited by the Charter, the source of funds is contributions from the owners of the premises. There is no need to create an estimate of HOA income. Financial receipts are determined by the amount of expenses.

When budget subsidies are present, agreed upon business practice, a sample estimate of income and expenses of the HOA is subject to approval. As profits exceed costs, the owners' investments are reduced.

The state of the partnership's economic activity is determined by conducting an analysis. Accounting data on actual expenses are compared with expenses regulated by the cost estimate for the year, as a normative document. This reveals the presence of overspent funds. The costs incurred are reviewed again and those that can be avoided are eliminated.

The document helps to avoid misunderstandings between participants. For each budget item there are supporting payment documents proving the validity of the payments made.

When is a document required?

Paragraph 3 of Article 148 of the Housing Code of the Russian Federation establishes that the functions of the HOA board include responsibilities for:

- drawing up estimates for the future period;

- preparation of historical financial statements;

- provision of all specified information to the meeting of members of the partnership.

Despite this, annual budget documentation is not always mandatory. It is not necessary to formulate income and expenses in the estimate if:

- the expenditure part fully complies with the points prescribed in the HOA Charter;

- the income portion is formed exclusively from contributions from property owners.

With this approach, expenses are always equal to income, which does not require budgeting, but does not cancel financial reports based on the results of the year.

You cannot do without the annual preparation of estimate documentation if:

- MKD income includes transfers from the state or municipal budget;

- The HOA conducts business activities from which it receives profit.

With third-party receipts, income exceeds expenses, which means that contributions from apartment owners are reduced. The income difference can be calculated by analyzing economic activity over the past period and comparing it with the current one.

Having a documented balance between income and expenses allows you to make reasonable calculations and recalculations.

Necessity

What is an estimate and why is it needed? It reflects in detail the financial life of the partnership

.

In case of financial problems, when there is a shortage of funds, the analysis allows you to consider which expenses are necessary and which can be avoided.

In addition, it is a reporting

and if the homeowners demand any explanations regarding certain expenses, then the board can report to the residents by providing the relevant documents for each item.

Let us remind you that what is written in the estimate must clearly correspond to any payment documents

.

What is income?

Issues regarding the income of a homeowners' association are within the purview of the Housing Legislation. Article 151 of the Housing Code lists what types of profit can be classified as income, which means that the income of these funds can be reflected in the estimate.

First of all, owners, when organizing their own HOA, must pay an entrance fee. It is necessary in order to form a financial cushion, from which, at first, funds will be spent on maintaining the house in proper condition. Therefore, these funds can be classified as income, which means their existence must be reflected in the estimate.- The second source of income appears at the moment when the homeowners association begins to carry out business activities.

This means that members of the homeowners’ association can rent out premises, mediate in advertising, and otherwise receive income through their activities in any way. At the same time, the funds received through such activities do not end up in the pockets of individual individuals, but must be directed to the general account of the Homeowners Association. And in the estimate it is reflected as income received. - The third source of income is from donations that some residents, third parties and entities may make to the Homeowners Association. At the same time, the funds must be transferred to the general account of the HOA and reflected in the estimate.

- Very often, the administration holds various competitions for the issuance of grants and subsidies for the management of an apartment building. These grants and subsidies are directed towards formed partnerships. Receipt of such assistance from the state should also be reflected in the estimate.

- The interest that is deposited on the account opened by the participants of the Homeowners Association is considered income and must also be reflected in the appropriate document.

In some cases, other sources of income are possible, however, only the most popular of them are reflected in this paragraph.

Report

An estimate report is a procedure that follows the preparation of this document. As a rule, HOA employees must convene a meeting at which the drafted act will be discussed.

In order to discuss the compiled estimate, it is necessary to accurately indicate the date of the meeting to the residents, and also give them the opportunity to familiarize themselves with the compiled document. The meeting is held in the form of a question and answer, but HOA employees must have evidence on hand in order to report on this or that line.