Based on the requirements of the Housing Code, every citizen who owns or rents residential premises is obliged to pay utility bills.

In some cases, depositing funds is impossible due to certain circumstances, which leads to the formation of debt.

The management company notifies defaulters about the existence of a debt by sending a written notice. One way to resolve this situation is to restructure housing and communal services debt.

How to start restructuring your utility debt?

Debt is formed as a result of failure to pay the required amount or not paying it in full, which leads to the accrual of fixed penalties. The penalty is calculated from the date of delay until the debt is repaid.

If the amount of debt accumulates, a citizen can expect eviction from the apartment if he is not its owner, but this decision is made exclusively by the court, in accordance with Article 90 of the Housing Code of the Russian Federation.

Another punishment for having a significant debt is the disconnection of utilities until the entire amount of the debt is repaid, including penalties. In this case, the management company must notify the debtor in advance about this decision.

There are 2 ways out of this situation:

- a citizen’s appeal to the court for debt restructuring or write-off;

- an individual’s application to a branch of an organization providing housing and communal services with an application to restructure the debt for utility services.

In both cases, the applicant must have compelling reasons to carry out the procedure for writing off or reducing debt, supported by documentary evidence.

Such significant reasons may include the difficult financial situation of the debtor due to layoffs at work, deteriorating health, the emergence of family problems, etc. First of all, it is recommended to try to resolve the situation peacefully.

Useful article : Loan debt restructuring.

Registration procedure

The restructuring procedure involves the following sequential actions on the part of the debtor:

- contact the service provider with a corresponding application, citing the impossibility of urgent and one-time repayment of the debt due to the lack of necessary income, health problems and other circumstances;

Application for debt restructuring for housing and communal services - if the utility organization makes a positive decision, an agreement is concluded in writing, one copy for each of the parties;

- the payer, in accordance with the schedule in the agreement, makes payments in a timely manner in the required amount, indicating in the column about the purpose of the transfer the fact of debt repayment.

Agreement on the gradual repayment of debts for housing and communal services

Documents attached with the application

If the home owner does not comply with the terms of the contract, the service provider has the right to unilaterally terminate the agreement, demanding repayment of the debt through the court.

File for printing the application (after opening the file, right-click and select “Save image as...”):

The procedure for restructuring debt for housing and communal services

To change the procedure for repaying debt, the interested person and the organization to which the citizen has an unpaid debt enter into an appropriate agreement. Based on this document, the parties come to a consensus regarding the amount and options for paying a specific amount.

Conventionally, the process of restructuring utility debts can be divided into the following stages:

- collection of necessary documentation;

- drawing up a simple written application;

- provision of papers to a branch of an organization providing housing and communal services;

- waiting for a decision and concluding an appropriate agreement with the institution.

The application can be submitted to the department either by the debtor himself or by his legal representative in person or by post. The document does not have a clearly established form, but it must be supplemented with certain papers proving the identity of the applicant and whether he has grounds for carrying out the procedure.

Such documents include:

- debtor's passport;

- a valid power of attorney and identification card of the representative (if necessary);

- papers confirming that the debtor has reasons for restructuring the debt (for example, a medical certificate of temporary incapacity, a work record book with a notice of dismissal, etc.);

- certificate of family composition;

- documents confirming the title to the apartment (or other documents on the basis of which a person lives in the premises, for example, a social tenancy agreement);

- certificates containing information about a person’s income.

The organization providing housing and communal services to a citizen, after approval of the application, can proceed as follows:

- increase the deferment for making a monthly payment or the entire amount of the debt;

- exempt the citizen from paying penalties for the entire period of delay.

Writing off a utility debt is possible only if there are significant violations on the part of the organization providing housing and communal services, or in connection with a court decision on the cancellation of a citizen’s debt.

Completing an application and agreement

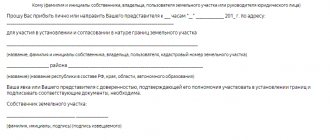

The application does not have a strictly established form, but is drawn up in writing and contains the following information:

- Full name and residential address of the debtor;

- information about the composition of his family and rights to reside in the apartment;

- information about the organization providing housing and communal services;

- description of the reasons for contacting;

- justification for the need to restructure the debt (for example, illness of the payer, confirmed by a medical report);

- options for getting out of the situation (payment in installments, exemption from paying penalties and fines);

- date of document execution;

- applicant's signature.

The agreement must also include information about the parties to the transaction, the amount of debt, methods of repayment, the grace period and other nuances agreed upon by the debtor and the management company.

The document can be drawn up by any of the co-owners of the property or a family member who has permanent residence in the apartment. The agreement continues to be valid until the debtor fulfills his obligations.

Interesting article : Bankruptcy procedure for individuals.

Judicial method of conflict resolution

At the moment, the law does not oblige the management company to enter into an agreement with debtors on the restructuring of utility debts.

If a citizen has good reasons for which he was unable to pay receipts for housing and communal services, he has the right to go to court (depending on the amount of debt - district or world) with a statement of claim for payment in installments. The claim is supplemented by a similar package of documentation required when applying to the Criminal Code.

Useful video:

Every citizen living in his own or rented apartment or room must pay utility bills on time.

But sometimes this is impossible to do for various reasons. As a result, debt accumulates, which becomes increasingly difficult to pay off over time.

One way to solve this problem is to carry out debt restructuring.

Video about utility debts

Most citizens are familiar with the situation when there is no money to make regular utility payments. In this case, non-payment leads to an increase in the amount of debt, which ultimately can cause a shutdown of electricity, water, etc.

. The ideal way out of this situation is to carry out debt restructuring, as a result of which the payer will be able to repay his debt in installments.

What it is

Every home owner or tenant needs to take care of timely payment of utility bills. This is his direct responsibility.

If payment is made later than the time established by law or contract, penalties are charged for each day of delay.

But in some situations, a person cannot make a payment due to unexpected unfavorable circumstances.

The resulting debt for utility bills will only increase over time.

As a result, repaying the debt becomes difficult or impossible. But the problem with him will have to be solved. After all, the management company can go to court and demand its forced collection.

One option for a fairly peaceful solution to the problem is debt restructuring.

In fact, the restructuring of utility debt is an agreement on the procedure for repaying the debt.

But first, the debtor must agree on all aspects of the procedure with the management of the management company.

The debtor may contact the management company (housing association, other service organization) with a request for restructuring. They will have to consider it.

The company may refuse to carry it out, for example, if the debt arose due to the negligence of the owner (tenant) or repaying the debt of a particular person cannot but cause financial difficulties.

Legal aspects

The obligation of owners and tenants of residential premises to make timely payments for utilities is provided for by the Housing Code of the Russian Federation.

The norms of the Civil Code of the Russian Federation also apply to contracts between the management company and residents.

But these legislative acts not only do not provide for the procedure, but also do not even include the concept of restructuring the utility debt.

However, there is no need to worry; all necessary tools are provided for in the legislation and the procedure can be carried out completely legally.

Many management companies go for it, realizing that even through the court it will be difficult for them to achieve payment of the debt; in the best case, a person will also agree with the bailiffs on installment payments, and in the worst case, a legal dispute can drag on for a year or more.

But they have the right to refuse such a request, especially if the owner (tenant) does not have the appropriate grounds.

For what reasons is it necessary

If the debt has accumulated due to the careless attitude of the owner of the residential premises to his responsibilities, then he should not count on the management company meeting halfway and agreeing to restructuring.

This procedure does not provide any particular benefit to the service organization, other than the need to prepare additional paperwork. There must be sufficiently serious reasons for its implementation.

Let's consider what reasons are usually considered suitable for restructuring housing and communal services debt:

| Serious illness of the debtor | due to which he could not work for a long time or became completely incapacitated |

| Job loss | due to staff reduction or liquidation of the organization |

| Death of the immediate debtor | and transfer of debt to heirs who might not even know about its existence |

| Other valid reasons | independent from the owner (tenant) of the property |

Whether or not the management company agrees to conclude an agreement for restructuring the rent debt depends only on whether the debtor is able to, i.e. the owner (tenant) of the property agrees with her.

Limitation periods

The management company can collect debts through the court for any period. But at the request of the tenant, the court will have to apply a general limitation period of 3 years.

The management company will be able to collect only debts for the last 3 years.

But if the tenant contributed even a small amount to repay the old debt, then the statute of limitations will begin to run from that moment.

Quite often, management companies try to use a trick and use current payments for utilities to pay off old debts.

But such actions are illegal, and the tenant (homeowner) may demand, when making payment, that it be taken into account against current, and not past payments.

If the case has gone to court, and the debt has been accumulating for many years, then you should definitely use the statute of limitations. This will significantly reduce the amount of debt.

Terms of agreement

In Russia, management companies have no obligation to carry out debt restructuring.

There are no requirements in the legislation of the Russian Federation for the agreement that is concluded during this procedure between the tenant and the management company.

This means that any conditions can be included in it if they do not violate the requirements of current legislation, and in particular the provisions of the Civil Code.

Typically, under an agreement, the management company agrees to write off penalties and fines, and the tenant undertakes to pay off long monthly payments within a certain period in accordance with the drawn up schedule.

According to general rules, the amount of payments to pay off debts should not exceed 25% of the tenant’s income, and if he is a pensioner or disabled, then the maximum payment amount should not exceed 20% of his income.

What is debt restructuring?

Debt restructuring for housing and communal services is the ability of a Russian to change the total amount of debt for the services of a management company through an agreement (conclusion of an agreement by the parties).

According to the law, this procedure can only be carried out until the Criminal Code files a statement of claim in court. Valid reasons for reviewing the debt for the services of the management company:

- Death of the debtor (when the debt passes to the heirs).

- Having a disability or serious illness that prevents you from paying bills.

- Availability of dependents.

- The emergence of various circumstances beyond the control of the debtor.

- Other reasons.

After considering the application from the citizen, the management of the management company decides to sign a consent or refusal to apply this program. No one can predict how the situation will turn out. According to the law, the Criminal Code independently resolves this issue. The company can reset the amount to zero, reduce it or leave it unchanged. Each situation is individual and is resolved directly with the management company.

Debt for the debtor can result in the following troubles:

- Application of psychological influence on the residents of the house by placing the amount of debt on a special stand. All citizens passing by will see the initials of the owner, as well as the amount of debt.

- Application of penalties - penalties, penalties. They have the right to accrue for each day of late payment. In a few months, this may become an unsustainable figure for a Russian.

- Complete refusal to provide services (if possible). Management company employees have the right to turn off the valves. Thus, the citizen finds himself in a difficult situation.

- The management company has the right to transfer, by agreement, the obligation to collect the debt to a collection agency. Today there are a lot of such companies, and their employees are afraid of exceeding their powers. Russians often complain about the illegal use of force or other measures of pressure by debt collectors.

- The most severe method (rarely used in practice) is eviction from the living space. Instead, they may be given housing of a smaller area or nothing at all.

Restructuring of utility debt

Restructuring utility debt is a fairly common way to solve the problem.

Indeed, in most cases, litigation is just an additional waste of time, both for the management company and for the tenant.

It is the debtor who must write to the management company with a request to carry out the procedure.

It must include the following information:

| Destination details | name of the management company, full name, position of manager |

| Information about the applicant | Full name, address |

| Request for restructuring | indicating the reasons |

| Proposal on the desired restructuring scheme | and a list of attached documents |

The application must be signed. Otherwise, he will not only not be considered, but will not be accepted at all.

Sample agreement

You cannot agree on restructuring simply in words, even with the management of the management company.

Oral agreements will not have any legal force until the corresponding agreement is concluded.

Usually it is drafted by the management company’s lawyers, and the debtor only needs to study it carefully. A sample of such a document can be downloaded here.

Description of the procedure

After receiving an application from the debtor with a request to consider the issue of the possibility of restructuring and a complete package of documents, the management company must consider it within 30 days.

The debtor is notified in writing of the decision made. If the consent of the management company is obtained, the parties must agree on all the terms of the procedure and enter into an agreement.

If a person violates the terms of the agreement and again fails to make a timely payment under it, then, according to the terms of the agreement, the debt can be collected by force, and with interest.

Video: what to do if the debt for housing and communal services has not been written off

Package of documents

It will be necessary to submit along with the application documents confirming the existence of valid reasons for restructuring.

Other papers may be required. Their specific list can be clarified in advance with the management company.

Let's consider what documents are usually attached to an application for debt restructuring for housing and communal services:

| Documents confirming the existence of reasons for restructuring | medical certificates, a copy of the work book or order, etc. |

| Title documents for the apartment | or social tenancy agreement |

| Inquiries | about the composition of the family and the income of all family members living in the apartment |

| Debtor's passport | and power of attorney (if necessary) |

What are the benefits of this operation?

As part of the restructuring procedure, it is often possible to write off already accrued penalties and fines.

The debtor is also not deprived of the right to receive subsidies for utility bills; he simply attaches a copy of the agreement instead of a certificate of no debt.

Well, the main advantage of restructuring is solving the debt problem without litigation.

The housing and communal services debt restructuring procedure helps a person who finds himself in it due to unfavorable circumstances and financial difficulties to get out of a debt hole.

But you need to take responsibility for all its stages, from preparing the application to making the last payment under the contract.

Every person living on the territory of the Russian Federation, in accordance with the norms of current legislation, is obliged to pay utility bills on a regular basis. However, quite often situations arise that can affect the timeliness of payment, resulting in the formation of significant debt obligations.

In this case, it is recommended to contact an institution that is a provider of housing and communal services and draw up an agreement on restructuring the debt on utility bills. This is one of the most effective ways to solve a problem situation.

To understand the main procedural features, it is necessary to familiarize yourself with the current regulations, the possibility of write-off, the list of documents, the procedure and places of application, key advantages, as well as objective cases when refusal is possible.

Benefits from debt restructuring

Debt restructuring benefits both parties. For utility workers, this is an opportunity to receive their money, albeit in parts, later than the deadline.

The consumer benefits are as follows:

- the amount does not have to be found in full immediately, since the money is paid gradually and in parts;

- the debtor eliminates the risk of accrual of penalties and penalties, since the utility company voluntarily provides a deferment;

- the owner of the property is protected by the terms of the contract signed by the parties.

We recommend: Electric meter replacement procedure

By agreeing on a restructuring, the consumer has the opportunity to continue making current payments without further increasing the amount of debt.

Regulatory acts

In the field of housing and communal services, the main regulations are the following:

- Housing and Civil Codes of the Russian Federation;

- Federal laws;

- Regional and local laws.

Based on the above legal documentation, the activities of all housing management organizations, energy service providers and other participants in the relevant process are organized.

In addition, these regulations fully define the duties and responsibilities of all citizens consuming public services.

Sample certificate of incapacity for work

Is it possible to write off

Authorized employees of management companies often independently offer persons with debt obligations a similar payment option. However, in any case, such a solution to the problem becomes relevant only when both parties reach consensus.

It is worth noting that housing organizations have legal grounds for refusing applicants in cases where it is believed that the restructuring of obligations cannot lead to a solution to the problem.

The concept itself involves dividing the amount of debt into equal parts, which are paid monthly. Another important point is taking into account the circumstances preceding the occurrence of debt.

Debt can be written off only for those categories of citizens who find themselves in difficult life situations due to, for example, layoffs at an enterprise.

An agreement between the parties, if reached, is documented in each specific case.

How is debt restructuring for utility bills carried out?

First of all, those categories of citizens who have debt obligations to the relevant companies must enter into an agreement on the restructuring of debt on utility bills. Only this can help in organizing phased payments.

The amount of obligations will be distributed over a period of up to 18 months. It is important to remember that in each case an individual approach to the debtor is applied.

One of the characteristic advantages of the process in question is that penalties for late payments are not charged. After drawing up an agreement, you need to find out whether you are eligible to receive a subsidy for utility bills.

. It is recommended to use this opportunity to minimize housing and utility costs in the future.

As background information, we can cite the fact that the total debt of Russians for utility services to local management companies reaches 400 million rubles. By 2020, about 800 corresponding phased repayment agreements worth more than 30 million rubles had been concluded.

It is worth noting that more detailed information about the restructuring procedure can be obtained by each interested party from the territorial housing company at the place of actual residence. You can also request a sample contract from the competent employees of the institution for preliminary review.

debt restructuring agreement for utilities

Required documents

To restructure debt obligations for housing and communal services, it is necessary to prepare the following documents:

- civil passport of the Russian Federation;

- notarized power of attorney, if the legal representative of the interested party applies to the organization;

- a certificate from your place of employment confirming the fact of incapacity for work resulting in no ability to pay the debt;

- certificate of family composition;

- any evidence confirming ownership of the residential premises;

- certificate of income, if any.

It is important to remember that even if a more complete set of documentation is presented, the outcome of the process may be different.

Sample certificate of family composition

Where to contact

In the vast majority of cases, debt restructuring services are provided by a local housing organization.

The procedure for concluding an agreement with service providers has the following operational algorithm:

- drawing up an application with a request to initiate the process - a sample will be provided in the office of the organization acting as a direct supplier of energy services;

- provision of the necessary documentation, including a civil passport of the owner or tenant of the premises, a certificate of income, and so on;

- drawing up an agreement on the redistribution of payments.

It is worth remembering the fact that the decision to provide the service in question is always made by the management of the service provider company. The verdict can only be changed through a trial, but often the competent authorities remain in a more advantageous position.

Among other things, to minimize tension with clients, it is the pre-trial procedure for resolving the problem that is used, and service providers make concessions.

Sample income certificate

Agreement and contract

In 2020, the current Housing Code of the Russian Federation and the established Rules for the provision of services in the utility sector do not contain a clear concept of debt restructuring. However, quite a large number of management companies are ready to meet their clients halfway and conclude an appropriate agreement

. At the same time, concluding an agreement is a right, not an obligation of the institution.

The execution of such a document allows you to effectively resolve the issue of repaying existing debt obligations in pre-trial proceedings:

- conditions are strictly individual;

- is given the opportunity to repay the debt as quickly as possible and without worsening the current financial situation of the payer;

- the debtor can continue to count on receiving subsidies and other government guarantees even after the conclusion of the contract.

In most cases, the repayment of obligations does not occur in a lump sum, as in the case of a court decision, but in stages. This takes into account the amounts that a citizen can theoretically pay and the terms acceptable to the management organization.

Certificate of state registration of rights

Useful tips from experts

Experts advise:

- It is recommended that you contact the management company to conclude an agreement immediately after the need arises. The debt will only increase in amount over time. If there are really compelling reasons, you should file a claim with your local service provider office.

- It is recommended to indicate in the application all the circumstances of the current situation. The information must be reliable. It is also better to attach attachments to the document (copies of certificates, extracts confirming any legal facts).

- In case of refusal, you should carefully study the motivation part and resubmit the application along with the complaint. The complaint can set forth demands regarding the actions or inactions of authorized employees.

- The company must consider the application within 30 days from the date of its submission (registration). Here you should be guided by federal rules of law on the consideration of citizens' appeals. It is best to write the application in several copies. The person accepting the document must be asked for immediate registration (1 copy must remain in the applicant’s hands). This is necessary in case the management company employees subsequently point out the absence of an application.

These tips will help you avoid making common mistakes and save time, effort and money.

Video about debt restructuring:

Citizens who have penalties and fines are recommended to use this service. The procedure does not require a trial. In this case, the Russian does not lose anything, including various subsidies and benefits for utility bills.

See also Phone numbers for consultation Sep 30, 2020 Victoria M. 229

Share this post

Discussion: 3 comments

- Ivan says:

10/01/2019 at 18:57What generally awaits a person who has no official income if he does not pay rent (paying for electricity, gas and water)? Suppose we are talking about his only home, and its footage is close to the maximum minimum?

Answer

- Oleg says:

05/26/2020 at 15:17

I understand that both parties may be interested in agreeing on a payment schedule in such a situation. But what to do in a situation where there really is no money to pay for utilities? Is it possible to completely write off debts?

Answer

- Dima says:

08/30/2020 at 17:03

What can possibly await a person who admits the existence of a debt, regularly makes payments, but does so in an amount significantly less than the amount of the actual debt?

Answer

What is the advantage

Restructuring debt for housing and communal services has specific advantages. For example, the payer retains the legal right to receive benefits, subsidies and other material compensation. In addition, he is given the opportunity to repay obligations at any convenient time without deteriorating his current financial condition.

The terms of the concluded agreement are negotiated between the debtor and the employee of the institution individually without involving third parties in the process.

Can they refuse?

Not always a request for payment restructuring services can be satisfied by employees of an authorized organization. This leads to service providers quite often refusing. This may be due, for example, to the lack of obligations to implement the process in current regulations

. That is why the decision is made on a voluntary basis.

If representatives of the housing organization make concessions, the result will be positive. In such a situation, the likelihood of pre-trial regulation of the current problem significantly increases, since the debtor assumes obligations to repay the debt

. Persons with outstanding obligations cannot require utility providers to enter into the contract in question.

To minimize the number of possible conflicting payments, it is recommended to make payments no later than the 10th of each month. Otherwise, an additional penalty will be charged for non-payment, and the debt itself will grow steadily.

If the next payment for utility services is not made on time, the amount of obligations will grow almost exponentially. The rapid growth of penalties is determined by the accrual of a fine for each overdue 24 hours. When a large payment amount is reached, it becomes almost impossible for the debtor to repay the amount in full.

Among other things, other measures may be applied. For example, the service provider may temporarily limit the supply of energy resources to the apartment

. Practice shows that this operation is difficult to implement and is almost never performed.

If in the future the user of housing and communal services does not pay for the receipt of electricity, water and gas, then their supply will be stopped completely until the obligations are fully repaid. The debtor will be sent a written notification of this fact in accordance with all norms of current legislation.

Increase in utility tariffs

This is especially true in the autumn-winter period, when the heating season begins.

Find out here how utility bills are calculated.

If the owner of the apartment is a minor, who pays the utilities - we will tell you further.

Every apartment owner may find himself in a difficult economic situation. If, as a result, a significant debt on utility bills has accumulated, then you should not wait for the management company to sue.

It is much easier to conclude an agreement with her to restructure the rent debt.

Debt on utility bills

The law obliges citizens to pay for utility services on time and in full (Article 153 of the Housing Code of the Russian Federation). Unfortunately, this is not always possible.

The accumulation of debt occurs gradually, but one day its amount becomes truly unaffordable for the apartment owner.

For management companies, such debt means the inability to pay service providers, which will ultimately affect all consumers, not just the debtor.

Therefore, the law provides management companies with a wide choice of measures to influence defaulters:

- some of them are of a punitive nature;

- others, on the contrary, are intended to resolve disagreements regarding the payment of utility services to the mutual convenience of the parties.

Consequences

The first unpleasant consequence of late payment of utilities is a fine (Article 155 of the RF Housing Code). This is a punitive measure that should encourage the debtor to repay the debt as quickly as possible.

On the one hand, the size of the penalty is small - only 1/300 of the refinancing rate of the Central Bank of the Russian Federation for one day of debt. But if the rent is not paid for years, then the amount comes out to be substantial.

If such punishment was not enough to influence the debtor, then service providers have the right to limit or even stop providing them until the debt is fully repaid, for example, electricity.

This possibility is established by the Rules for the provision of public services to the population.

However, in order to make such a restriction, a certain procedure must be followed. In particular, you should notify the owner of the apartment about the debt he has incurred and the possibility of taking enforcement action against him.

A sample debt notice can be downloaded here.

At the same time, if rent is delayed for six months, the management company has the right to demand that residents repay the debt within a certain period of time. And then, if the demand is not met, file a lawsuit to collect the debt.

Moreover, if there is an agreement for the provision of housing and communal services, then consideration of the case:

- carried out without the participation of the debtor;

- ends with the issuance of a court order.

In the case where there is no agreement, the case is dealt with in the manner of claim proceedings. However, in any outcome, the decision is transferred to the bailiff service, who will collect the debt.

The most severe consequence of accumulating rent arrears is eviction. It threatens only those who occupy municipal housing under a social tenancy agreement (Article 80 of the Housing Code of the Russian Federation).

Eviction cases are resolved only in court and only by filing a lawsuit.

In this case, the owner of the apartment who insists on eviction is obliged to provide the tenants with other premises. But a much smaller area, according to hostel standards.

Despite the fact that the owner of an apartment cannot be evicted from it for debts even through the court, this is not a reason to neglect one’s responsibility to pay utility bills and other expenses for maintaining the property.

A summons to court is the most common consequence of accumulating rent arrears.

The procedure for restructuring housing and communal services debt in Russia

Every month, all residents of apartment buildings and private buildings are required to pay utility bills. These include the provision of heating, electricity, hot and cold water, gas, and sewerage. All this is provided on the basis of concluded agreements between citizens and public utilities. According to the signed agreements, residents receive the necessary services in the required quantities, for which they, in turn, must pay for the services provided to them. If utility bills are not paid on time, these enterprises have the right to suspend the provision of services until the debt is fully repaid.

We recommend reading: How to fully repay your mortgage at Sberbank ahead of schedule

Rent debt restructuring agreement

To date, neither the Housing Code nor the Rules for the provision of public services have such a concept as debt restructuring.

However, many management companies are ready to accommodate apartment owners halfway and are ready to enter into an agreement with them on this.

At the same time, concluding an agreement on debt restructuring is the right, but not the obligation of the management company.

The conclusion of such an agreement allows you to resolve the issue of debt repayment out of court:

- conditions are negotiated individually;

- make it possible to repay the debt in the shortest possible time, but without a significant deterioration in the financial situation of the debtor, which is already not very rosy.

The execution of an agreement does not deprive the debtor of the rights to benefits, compensation or subsidies.

It’s just that repayment of the debt will not occur at once, as with a court decision, but gradually:

- in amounts that are feasible for the tenant;

- within a timeframe acceptable to the management company.

Where to go?

To formalize a debt restructuring agreement, you must contact your management company as soon as possible.

The application will have to:

- state the reasons for the debt;

- propose terms and procedures for debt repayment.

As a rule, management companies accommodate conscientious debtors and do not bring the matter to court.

Sample

A sample rent debt restructuring agreement can be found at the management company or downloaded from one of the legal portals.

The agreement is drawn up in two copies.

It must include a debt repayment schedule, which must be strictly adhered to in the future. Full payment of the debt cancels the contract.

Here you can agree on rent debt restructuring agreements.

Repayment procedure

The benefit of concluding a debt restructuring agreement is that from the moment it is concluded, the penalty for the amount of the debt ceases to increase. But only on condition that payments are made on time and in full.

The terms and amounts are indicated in the text of the agreement.

In addition to repaying the debt, the payer remains obligated to pay the current rent, accrued monthly. A receipt form with the amount of the next payment will be sent monthly, as usual.

Violation of this obligation, as well as the terms of debt payment, will lead to:

- termination of the contract;

- going to court to claim the entire amount at a time.

How to restructure utility debt

Two people live in the apartment and work at the minimum wage; we cannot pay the debt right away. And also, what could happen if the company sues us? Thank you for your attention. Answer: Hello. Before moving on to answering your question, I would like to immediately voice that you should not neglect the offers of online stores selling climate control equipment, such as https://www.klimatproff.ru/, which offer heating equipment at an acceptable price. price and, most importantly, having maximum energy-saving technologies.

We recommend reading: Income alimony

FAQ

Let's look at the questions that often arise among rent debtors.

Restructuring denied

There is currently no law in Russia obliging management companies to enter into an agreement on the restructuring of rent debt.

Service providers do this voluntarily, thereby increasing their chances of pre-trial settlement of the resulting debt.

Since this is a right, but not an obligation, it is impossible to insist on concluding such an agreement.

The refusal may not always be associated precisely with the reluctance of the management company to make concessions and extend the debt repayment period for the convenience of the payer.

An agreement can be concluded before the case is considered in court and a decision is made on it.

However, after the decision has entered into force and enforcement proceedings have been initiated on it in the bailiff service, it is possible to apply for a deferment or installment payment of the debt.

Granted for one year

There are no clear instructions regarding the deadlines for submitting installment plans to repay the rent debt.

Clause 75 of the Rules for the Provision of Utility Services states that this issue is resolved by agreement between the debtor and the service provider.

Also, the law does not oblige management companies to enter into such agreements.

In fact, a debt restructuring agreement is a voluntary concession by the service provider, with the goal of receiving the debt in full and not through the court.

Therefore, there is no point in insisting on extending the maximum period. In this case, the management company may demand repayment of the entire amount of the debt immediately in court.