Assignment of the right of claim, or similarly called assignment, is one of the forms of a transaction in which one party transfers to the second (other) party the right to demand the fulfillment of its obligations from a third party. If we rely on Article 382 of the Civil Code of the Russian Federation, then the assignment of a claim is a transaction between enterprises in which the initial lender (one party) cedes to another creditor (the other party) the right to collect its contractual obligations from a third party.

To briefly describe this procedure, it is a concession of the right of claim to replace the creditor in the contract.

Can an assignment take place without the consent of the debtor?

The procedure for obtaining the right to claim naturally takes place on the basis of official documents, that is, no one can verbally transfer to a third party the right to claim from the debtor the fulfillment of his obligations.

The transfer of the borrower's rights to another person requires the consent of the debtor himself. If you are one, then in such a situation the first thing you need to do is refer to the original contract. It may state that if the lender is replaced, the debtor cannot do anything, that is, the procedure will take place without the consent of the latter. Thus, we see that the borrower cannot influence the situation.

But in any case, the new or previous creditor must notify the debtor about changes in the agreement so that the funds go to the correct account.

Unilateral termination of the assignment agreement

- invalidity of the transferred claim - the assignee only has the right to demand compensation for losses from the assignor (clause 1 of letter No. 120);

- impossibility of transferring the claim (clause 8 of resolution No. 54);

- transfer of rights of claim under an obligation that the debtor may have only before a special entity, for example a credit institution (clause 2 of the letter of the Supreme Arbitration Court of the Russian Federation No. 120);

- an indication of the transfer of rights of claim only after they have been paid (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 30, 2010 No. 16283/09 in case No. A34-571/2009);

- lack of indication of the amount of payment for the right - in this case, the payment is determined according to the general rules of clause 3 of Art. 424 of the Civil Code of the Russian Federation (clause 3 of resolution No. 54);

- absence of registration of assignment of the right of claim arising from an agreement that is subject to state registration - the transaction for the transfer of the right of claim in this case will have consequences for the assignor, assignee, duly notified debtor, but has no legal force for three persons (see paragraph 2 of Resolution No. 54).

We recommend reading: Sample Complaint of Perjury

Who must notify the debtor about the assignment of the claim?

If a situation arises when the assignor changes, everything happens with the preparation of written documents. If the original agreement prohibits a change of creditor, then with such a prohibition it is also necessary to obtain the debtor’s consent to assign rights. That is, the creditor sends a notice to the debtor that he wants to transfer his rights to another creditor.

But if the debtor does not agree with the change of lender and for certain reasons is against changing the original one, then the debtor has the right to transfer funds to the account of the first lender. You can refer to Article 388 of the Civil Code of the Russian Federation, which states that the debtor, in case of disagreement in the procedure for transferring the right of claim, can transfer money to the first creditor. And the newly arrived assignor cannot make any demands on the borrower.

Assignment of rights under an assignment agreement

Initially, the agreement from which the obligations between the parties arose is studied. If this document does not contain a clause in which the assignment agreement is prohibited or the debtor’s consent must be obtained, there are no obstacles to the assignment. However, in any case, the most important condition for concluding such an agreement is that the debtor must be officially notified in writing.

Interesting: How many meters are allowed per person in an apartment when calculating the young sevench program

If the tenant received a property for a certain long period, but before its expiration the need for it disappeared, there are two solutions:

Should collectors provide an assignment agreement to the debtor?

It must be remembered that the assignment agreement and the notice are different documents. The notification must reach the debtor, but the assignment agreement does not. Collectors are not obliged to provide it; they must submit it to the court, where a ruling on procedural succession will be made; it is in court that the borrower can familiarize itself with it.

The bank is also obliged to notify the debtor of the fact of the assignment. The assignment agreement does not even indicate the names of the bank borrowers, but only their loan agreement numbers.

Notification of the debtor about the assignment of the right of claim

Civil Code of the Russian Federation). For example, with an obligation to provide personal services (execute instructions, requirements of the principal to the commission agent or the principal to the agent). Assignment of claims against a citizen without his consent entails the obligation of both creditors to jointly reimburse him for expenses associated with the assignment (appeal ruling of the Stavropol Regional Court dated 02/09/16 in case No. 33-483/2016). QUESTION 4. Can the debtor file a counterclaim against the assignee to invalidate the assignment? The court will most likely refuse. The fact is that an assignment agreement is a bilateral transaction; a claim for its invalidity must be presented to both parties to the agreement. It would be wrong to present it in the form of a counterclaim in such a dispute (resolutions of the Volga District Arbitration Court dated October 30, 2015 in case No. A65-408/2015, Moscow District Arbitration Court dated April 28, 2015 in case No. A40-28840/2014).

What the notice should include

First, you need to refer to Article 382 of the Civil Code of the Russian Federation, which outlines how to notify the debtor and then generate documents for the transfer of rights.

According to the law, the creditor transfers the debts owed to him to any legal entity after concluding an assignment agreement.

For this type of transaction, there is no need to obtain the consent of the person who is evading fulfillment of his obligations - this is described in the second paragraph of Article 382 of the Civil Code of Russia. However, the law does not oblige the debt holder to inform him of this fact.

However, it is necessary to warn the debtor - without notification, the one who borrowed the money will not be able to pay off with the new transferee. It follows that the recipient can be notified by both the newly arrived creditor and the previous one.

It should be noted that there is no template established by law, so the notice can be drawn up in free form. In this case, it is necessary that the document contain the following information:

- name or organization name of the borrower;

- contacts and position of the authorized employee;

- notification of the fact of assignment indicating all the details of the document;

- data of the previous creditor;

- data relating to the new lender;

- the date on which the transfer of rights took place;

- a certain list of additional documents (usually a copy of the assignment agreement is sent).

The notice must be signed by the person responsible for it and the employee on whose behalf it is sent.

Below is a notification of the debtor about the assignment of the right of claim, an example sample.

The procedure for drawing up an agreement for the assignment of the right to lease a land plot

- For citizens - a passport, for legal entities - an extract from the Unified State Register or Unified State Register of Legal Entities;

- Confirmation of registration with the tax office;

- A stamped certificate indicating the code of all-Russian classifiers (for legal entities only);

- Original and copies of the lease agreement;

- Cadastral map of the allotment;

- A certified copy of the certificate of registration of land rights;

- Plan of the ceded area, made on a scale of 1:500.

- Statement;

- Passport;

- When a representative acts instead of an individual, a power of attorney on the basis of which he acts must be presented;

- Title documents for land;

- Papers confirming that the issue has been agreed upon with the Land Resources Committee (needed when transferring agricultural land on which the harvest will be harvested);

- Two signed versions of the assignment agreement;

- Consent of the spouses of the parties to the disposal of the site;

- Confirmation of the fact of notification of the owner of the allotment or his consent (executed in the form of an application reviewed by us earlier);

- Consent of the pledgee (in the case where the plot becomes pledged).

04 Nov 2020 hiurist 174

Share this post

- Related Posts

- Are there discounts on air tickets for pensioners in 2019?

- Can bailiffs seal an apartment?

- Honorary Worker of Transport of Russia Benefits and Payments

What you need to know about the assignment agreement: concept, types, judicial practice

Reading time: 8 minutes(s)

It often happens that an individual becomes unable to repay the debt on a previously taken loan. This is followed by late payments and transfer of the loan to a collection agency. It is also possible to assign debt between legal entities, an organization and an individual, and all these cases are regulated by a special document - an assignment agreement.

In this article we will look at the concept of an assignment agreement and tell you what it is in simple words.

What is an assignment agreement in simple words?

In the modern economy, collecting debts through the court is time-consuming and unprofitable, so the most common practice is to sell the debt to a third party. The process is governed by an assignment agreement (AC), or in simple words, the assignment of the claims of one person to another. A transaction agreement may be concluded during a reorganization of a legal entity, a change of creditor, and in other cases.

According to the loan agreement

It is legal to assign or sell the right to collect a loan to a third party. This is how banks often transfer problem loans to collection agencies. A prerequisite is the conclusion of an assignment agreement, which will specify changes in the creditor, terms of the debt, and details of the new party.

The form of such a document is similar to the form of the original agreement concluded between the bank and the lender.

The banking organization is obliged to inform the borrower in writing about the transfer of the right to the loan. Otherwise, he may not comply with the requirements under the assignment agreement, referring to Art. 385 of the Civil Code of the Russian Federation until it receives written notification.

According to OSAGO

When an insurance company refuses to pay insurance or delays the payment process, the policyholder may turn to a third party for help.

The law allows you to enter into a DC with an individual or legal entity, who will subsequently solve problems with the insurance company and receive monetary compensation. With such a transfer of rights, the insured person receives 70-90% of the amount of insurance compensation for material damage.

An agreement can be concluded without the consent of the insurance company, unless other conditions are specified in the contract.

If such a contract is signed, the insured person receives the following benefits:

- does not negotiate with the insurance company;

- does not participate in the court case;

- does not pay fees for processing payments and conducting legal proceedings;

- quickly receives monetary compensation.

The third party who has received the right of claim also receives his profit from the insurance companies.

When buying an apartment in a new building

You can purchase an apartment in a new building at a favorable price thanks to an assignment agreement. This is a type of assignment of rights when apartments are sold to third parties legally, if:

- real estate in the new building was bought up by firms and real estate agencies in the early stages of construction;

- the plans and circumstances of persons who purchased housing through shared construction have changed;

- there are no funds to pay the mortgage loan for an apartment in a new building.

The procedure allows buyers to save money, firms to sell housing profitably, and former owners of an apartment in a new building to avoid fines and litigation with the general contractor.

The assignment agreement, concluded at the final stage of construction, allows you to begin making mortgage payments after moving into the home, that is, when the house is finally put into operation.

An agreement on the assignment of rights is considered legal if:

- the full amount of the cost of housing under the contract has been paid;

- the developer has given written permission to assign rights (if this condition was stated in the first share agreement);

- the developer is notified in writing of the transaction;

- The bank that issued the mortgage signed the release.

In the event of termination of the contract, the buyer will deal with the selling company and not with the general contractor.

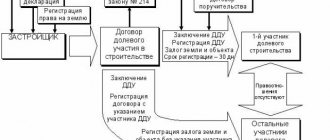

For an apartment in shared construction

Another type of assignment of rights of claim is the conclusion of an assignment agreement when purchasing real estate under construction. The basis is the agreement for participation in shared construction.

The most common cases of concluding a DC when purchasing such housing:

- The seller of the apartment assigns to the assignee (second party) the rights provided for in the shared construction agreement. Often the assignment agreement is concluded at the very first stage of construction, when housing prices are minimal.

- Buyers of real estate under construction assign the contract with the developer to a third party. This allows you to avoid sanctions and fines and get your money back.

- Investors buy real estate from the developer.

The procedure is beneficial to both buyers and sellers of real estate. One of the mandatory conditions is that the contract for the transfer of claims must be concluded in writing and registered with government agencies.

How is it different from an assignment agreement?

An assignment is a concession of the right of claim. When not only rights, but also obligations are transferred, an assignment comes into force. The difference in concepts is also disclosed in the Civil Code of the Russian Federation.

The main differences between an assignment agreement are that with this type of agreement between an individual entrepreneur and an individual entrepreneur, an individual and an organization, responsibilities are also transferred (payment of fines, tariffs, rent).

Almost all debts can be transferred to the assignee (new creditor), except those that are associated with the debtor’s personality (alimony, moral damage, etc.). Unless other requirements are specified in the original document, the debt can be transferred without the consent of the person being credited. Under a debt transfer agreement, the assignee receives all the rights specified in the original document.

What types are there?

Russian legislation provides for several types of DCs.

Based on the number of sides , two-sided and three-sided are distinguished. Under a bilateral agreement, the borrower will receive written confirmation of a change in the lending entity; under a tripartite agreement, the borrower himself enters into an agreement with the participation of the debtor.

Depending on the method of payment, you can distinguish between a paid or gratuitous assignment. Agreement on the transfer of a loan between the bank and the collection company is a paid transfer of rights. In this case, up to 10% of the loan amount is returned to the bank. Gratuitous agreements are often concluded during the reorganization of a legal entity.

According to the type of object of collection, debt can be either financial (monetary) or non-financial.

Based on the method of assignment of rights under writs of execution, paid and unpaid assignments are distinguished. Judicial assignment may be assigned to a third party.

Can it be free?

This form of agreement is not prohibited by law and is most often used when transferring ownership of a residential property or during the reorganization of a company.

When concluding a gratuitous assignment agreement, you should remember that if one of the parties applies to the judicial authorities, the transaction may be declared invalid.

How to reflect it in accounting and tax accounting?

If the person receiving the right of claim maintains accounting and tax reporting, then accounting entries are recorded and income tax is paid.

Incorrect reporting of profit amounts has tax consequences and may result in financial losses for the company.

Postings from the assignor

In accounting under an assignment agreement, the assignor indicates the purpose of payment in the payment order for which the money transfer is made:

- reflection of the transfer of creditor's rights Dt76 - Kt58;

- reflection of VAT accrual Dt91.2 - Kt68;

- reflection of debt write-off from the debtor Dt91.2 - Kt62.

Transactions with the assignee

The assignee's accounting records:

- accounting for the acquisition of rights;

- accounting for the payment of the amount for the right to the assignor Dt76 - Kt51(50);

- reflection of the amount repaid by the debtor Dt 51(50) - Kt91.1;

- reflection of debt write-off Dt58 - Kt91.2;

- accounting for VAT calculation Dt91.2 - Kt68;

- reflection of profit Dt91.9 - Kt99.

What is the risk of someone who assigns a debt?

Banks and other organizations bear risks when signing an agreement. The presence of the following clauses in a document may make the contract invalid:

- personal circumstances are specified (divorce, material and moral damage, alimony);

- the debt was transferred to a person who does not have the right to conduct banking activities;

- the original document does not stipulate the possibility of debt assignment;

- incorrect deadlines for debt payment are indicated;

- There are factual errors in the document.

In addition, there are other pitfalls. Example - in the absence of accompanying certificates, the absence of registration of the agreement, or the absence of notary seals on the documents, the court may rule on declaring the transaction invalid.

Can the debtor challenge the assignment agreement?

The credited person has the opportunity to challenge the assignment agreement and declare it invalid before the expiration of the limitation period. Experience shows that there is little chance of this happening. Often the documents indicate that the bank can, without the consent of the debtor, transfer rights to a third-party legal entity without a license to conduct banking operations (Civil Code of the Russian Federation, Article 384). In such cases, the contract cannot be challenged.

How to terminate?

The assignor and assignee may unilaterally or by agreement of the parties terminate the agreement. The process follows generally accepted rules for canceling contracts.

Unilaterally

When unilaterally terminating consent, the party wishing to complete the procedure may be guided by the following methods.

- The party wishing to terminate the relationship sends a notice indicating the desire to cancel the agreement and indicates the time frame when the agreement will cease to be valid.

- The court may rule on the annulment of the agreement when the terms of the document are violated or not fulfilled, causing damage to one of the parties (the assignee did not pay the assignor under the assignment agreement).

- The court makes a decision to terminate the contract in the event of changes in the circumstances specified in the document. As a rule, these are force majeure circumstances due to which one of the parties suffered damage without the possibility of compensation.

To terminate the document, the initiator collects a package of documents confirming the essential conditions for terminating the relationship. Then a written notice is drawn up and sent, indicating the desire to cancel the relationship.

The notice must have proof of delivery, which is retained as evidence of the other party's knowledge. Then an agreement to terminate the contract is drawn up. When one of the parties refuses to annul the relationship, the other party can go to court.

By agreement of the parties

Termination by agreement of the parties occurs in a similar way. If the other party is notified and has given consent, then the process of canceling the contract is carried out by agreement of the parties.

In case of mutual agreement, a peace agreement is drawn up to terminate further relations.

The party wishing to terminate the agreement must collect a package of papers proving the reasons and grounds for termination.

How to invalidate?

As a rule, the court rejects debtors who have filed a claim to invalidate the assignment of rights. But if the debt was purchased by a collection agency that does not have a banking license and is not responsible for disclosing personal data, the court may rule in favor of the debtor.

Arbitrage practice

In cases related to DC, judicial practice is based on the Civil Code of the Russian Federation, Art. 382 – 389, Resolution of the Plenum of the Supreme Court of the Russian Federation No. 54. The Supreme Court recognizes the contract as invalid when there is evidence that the assignor and assignee intended to cause damage to the debtor.

Payment under an assignment agreement with VAT or not?

According to the Tax Code, the assignment of claims under loan agreements and credit agreements is not subject to VAT (clause 26, clause 3, article 149 of the Tax Code).

Upon termination of the assignment agreement, claims for reimbursement of funds transferred to the seller for goods, services, VAT under the assignment agreement are not paid to the assignee. All subsequent assignments to assignees of monetary claims are subject to tax.

Is registration required with Rosreestr?

Not all transactions concluded with DCs require registration with Rosreestr. According to the Civil Code (Article 551), the assignment of rights to a loan when selling real estate and land does not require mandatory registration. It is necessary to submit an application to Rosreestr when changing the creditor, when the contract was concluded as the initial agreement:

- real estate rental;

- shared construction.

When registering, a package of necessary documents is collected (the current list should be checked with Rosreestr), the state fee is paid and an application is submitted. The procedure takes from 7 to 9 working days.

Is it possible to assign part of the debt?

Legal practice in recent years and the Civil Code allow the assignment of part of the claims. This includes such items of the contract as things and money. If the original agreement contained a provision on the inadmissibility of splitting the debt, then in this case it will not be possible to assign part of the funds.

How to buy back your debt from a bank under an assignment agreement?

Not only a collection company can enter into an assignment agreement with a bank. Individuals, such as friends, acquaintances or relatives of the debtor, also have the right to replace the claimant. Banking organizations want to resell a problem loan, and it does not matter to them whether it is a legal entity or an individual. The amount advanced by the bank increases - up to 30-50% of the debt amount. The process of drawing up an agreement remains the same: the assignor agrees to the transaction, notifies the debtor, and draws up documents with the third party.

The problem with concluding such an agreement is that banks do not have the right to disclose information about borrowers, so repurchasing the required debt will be problematic. Today, it is a common practice for collection agencies to buy debts from banks and then resell them to debtors.

Sample documents

Gratuitous

An example of a standard assignment agreement can be found here: https://yadi.sk/i/9TH5y9CN6DLFRw

According to the loan agreement

A template for a debt assignment agreement under a loan agreement looks like this: https://yadi.sk/d/fzRI1F9wPJTlOg

Agreement on termination of the assignment agreement

We have placed the form of this agreement here: https://yadi.sk/i/QuU8m93Xrl9w2Q

Notification under the assignment agreement

Sample notice of transfer of the right of claim under an assignment agreement: https://yadi.sk/i/8riKYlh_bGOEnQ

Additional agreement to the contract

Example of an additional agreement: https://yadi.sk/i/n5FbstjzGbRLeQ

Claim for debt collection under contract

A sample statement of claim for the recovery of a penalty from the developer under an assignment agreement is as follows: https://yadi.sk/i/wsCm5JZnk9cAZA

Certificate of acceptance and transfer of documents

You can view the template of the act at the following link: https://yadi.sk/i/N5P1Kjs4z81YBw

Statement of claim for invalidation of the assignment agreement

We offer you to download a template for such a statement here: https://yadi.sk/i/eW3JlUcs-p8TWA

This article describes in simple language a complex legal topic - an assignment agreement. When purchasing real estate under such an agreement, it is better to seek professional help from lawyers in order to avoid fraud on the part of unscrupulous companies. In other cases, the DC is issued by banks, firms, companies with a third party without the participation of the debtor.

Did this article help you? We would be grateful for your rating:

0 0