The cadastral value of real estate is established by the state and affects many financial issues related to the use of real estate. It is often overpriced. Users and property owners are interested in real value for:

- establishing a smaller land tax;

- determining the lower redemption price for a land plot upon acquisition of ownership;

- calculating a lower rent;

- formation of a smaller amount of corporate property tax;

- other situations.

From the beginning of 2020, the tax on real estate for individuals is determined based on the cadastral value, so owners will have a direct interest in establishing an adequate price for apartments. True, not all regions have yet switched to this tax calculation, but by 2020 it will be throughout the Russian Federation. The same applies to land plots.

Sometimes, on the contrary, the owner is interested in increasing it (this is mainly due to legal disputes regarding rights to real estate, issues of lending and collateral, determining the amount of insurance payments, amounts of material damage, etc.). One way or another, an interested person can raise the issue of challenging the cadastral value, which may be:

- owner of the land plot;

- apartment owner;

- land tenant;

- apartment owner;

- owner of non-residential buildings, structures, structures;

- tenant of non-residential premises;

- an applicant for real estate rights (for example, a person who has applied to the municipality for the purchase of a land plot), a former owner of the land (who, for example, is reviewing the amount of taxes), etc.

As practice shows, most often the interest in contestation manifests itself in relation to land plots.

How to determine the need to challenge

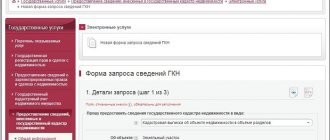

The cadastral value changes once every five years (maybe more often than once every three years, but not less often). In each region, the assessment is carried out by its own assessment organizations, and its results are approved by a resolution of the head of the subject of the Russian Federation. This resolution specifies the categories of land and, depending on a particular locality, establishes a specific unit of cadastral value per square meter of land. The date from which the new assessment is applied is also indicated. To confirm the feasibility of challenging, you first need to find out the current cadastral size of the land plot. It can be done:

- having received a certificate of cadastral value from the cadastral chamber;

- by logging into the Rosreestr website in the “Public Map” section (enter the cadastral number of the land plot in the search field, after which the plot will be displayed on the map with a description, including the cost);

- having calculated independently, comparing the information of your land plot (area, category of land and location) with the data of the governor’s decree approving the assessment results.

Next, you need to contact an appraisal company, where they will tell you approximately whether the price of the land corresponds to the market price or not. After this, you can decide on the advisability of reducing it.

Why is a revision of the cadastral value necessary?

If there is no information on the inventory value of real estate as of the requested date, then the market, cadastral or other (nominal) value of the specified property may be used at the payer’s choice to calculate the amount of the state duty (notary tariff). Also, at present, the current legislation does not establish a body authorized to verify the accuracy of the previously established inventory value of property. In this regard, such value of the property may be challenged in court.

The new rules for applying the cadastral value established by a decision of a commission or court are certainly more attractive and now provide taxpayers with a larger time interval to decide whether to challenge it in order to determine the taxable base.

The accounting procedure stipulates that state technical accounting of the housing stock is entrusted to specialized state and municipal technical inventory organizations - unitary enterprises, services, departments, centers, bureaus.

When challenging the inventory value of a building, individual premises or other object, independent experts who have the right to carry out such activities are also involved. Based on the results of the examination, appropriate documentation is drawn up and attached to the court case.

When contacting the Bureau of Technical Inventory, you will need to fill out an application according to the sample, present your personal passport and documents certifying ownership of the object of interest. Next, the BTI has the right to make a request to the state archive, where all information is stored.

The form is intended solely for reporting incorrect information on the website of the Federal Tax Service of Russia and does not imply feedback. The information is sent to the editor of the website of the Federal Tax Service of Russia for information.

Please do not answer anyhow, speed is not important to me, but really practical advice would be very useful! And an example, perhaps, of some kind from judicial practice. Were there similar proceedings (OF COURSE THERE WERE), but with a positive outcome for the plaintiff.

Control over the implementation of this decision is entrusted to the Committee of the Tambov City Duma of the sixth convocation on socio-economic development and budget (A.V. Rybas).7.

Ways to reduce cadastral value

According to the law, there are two ways to change:

- through the revaluation commission;

- judicially.

Looking ahead, we will say that the most effective way is to go to court, since the commission is essentially the same administrative body that is interested in leaving the previously approved cadastral valuation result. Although formally the law establishes that the dispute commission consists of independent and disinterested members.

Reducing the cost in commission

In each region of Russia, a special commission is created to challenge the cadastral value. Both legal entities and individuals - owners or other legal holders of real estate - can apply to this structure.

For organizations, contacting the commission before going to court is mandatory. There is no such obligation for citizens and individual entrepreneurs; it is their right. Therefore, in order to save time and effort, it is better for individuals to immediately go to court, bypassing the dispute in the commission. The application period is within five years from the date of approval of the results of the cadastral assessment and until the approval of the next assessment.

The cadastral value of land is disputed on two grounds:

- unreliable information taken into account during the cadastre assessment (most often this concerns buildings and structures rather than land plots);

- equalization of the cadastral value of land with its market level.

To begin the work of the Rosreestr commission, you need to prepare documents and submit an application. The application form for price revision is free. Attached to it:

- notarized documents for land (certificate of ownership, agreement of purchase and sale, donation, exchange, lease, etc., which confirms the applicant’s right to land);

- an appraiser's report, which clearly establishes the market value of the site and which differs from the cadastral value (in writing and in electronic form);

- examination of the appraiser's report both on paper and on disk (conducted by a union of appraisers and such examination confirms that the market valuation report is reasonable);

- information about unreliable information used in the cadastral valuation (provided if the cadastral valuation is appealed on this basis, and not on the level of market value);

- cadastral certificate about the value of the property.

Without the specified documents, the application will not be considered.

The participation of a citizen or legal entity at the commission meeting is not provided. She makes her decision within one month. The results of the commission's work can be:

- rejection of the application;

- change in value.

If the commission’s decision is positive, then it itself sends the necessary information to the cadastral authority, where changes are made to the cadastre.

A notification is sent about a negative result. After receiving it, the applicant can apply to the court with a demand to change the cadastral value (without referring to the commission’s decision).

Time limits for challenging cadastral value

The law limits the period within which you can challenge the cadastral value. You can challenge it within the period from the date of entry into the state real estate cadastre of the results of determining the cadastral value until the date of making changes to this register during the next state cadastral valuation or when challenging the results of determining the cadastral value, but no later than 5 years from the date of entry of the disputed results.

The procedure for determining cadastral value

The Federal Law “On State Cadastral Valuation” stipulates that a planned real estate valuation should be carried out every 5 years. At the same time, cadastral service specialists have the right to carry out an early revaluation on their own initiative or at the request of an interested person, but no more than once every three years.

The cost of an object according to the cadastre is determined by the following formula: the area of the land plot is multiplied by the specific cost indicator formed in a specific cadastral quarter. This is an average indicator that does not take into account the individual characteristics of the site:

- Economic value

- Legal history of the property

- Availability of easements and other encumbrances

- The significance of the property located on the site

Therefore, situations arise when the cadastral price of land is significantly higher than the market price, which is a violation of current legislation. The Resolution of the Plenum of the Supreme Arbitration Court explains that from the moment the market price of the object is approved, this indicator is taken as the basis. To establish it, you can contact an independent appraiser, who will prepare a report for further filing with the court.

Art. 24.18 of the Federal Law “On Valuation Activities” provides citizens with the opportunity to challenge the cadastral value of a land plot in an administrative commission or court if unreliable data violates their rights.

The number of such disputes increases every year, because land valuation is carried out to form the tax base for property tax, which is 0.3% of the value of the property according to the cadastre.

Therefore, reducing the cadastral value is a real opportunity to save money.

Conditions for challenging

Reducing the cadastral value of a land plot is permissible in the following cases:

- The main characteristics of the object have been changed;

- The land plot transferred from individual to shared ownership;

- An error or inaccuracy has been detected in the data entered into the cadastre;

- A public easement has been established on the site;

- The earth has lost its beneficial properties.

You can submit an application during the initial registration of the property for cadastral registration, as well as when conditions arise that lead to a decrease in the usefulness of the land.

In this case, the interested party must provide reasonable evidence.

Since the cadastral service conducts an inventory every 5 years and sets a new value for objects, the owner, if he disagrees with the approved indicator, can also submit an application for revision.

Normative base

The problem with the controversial cadastral value is resolved on the basis of:

- CAS RF (Code of Administrative Proceedings);

- Land Code (Land Code of the Russian Federation);

- Federal Law-237, adopted on July 3, 2020 (came into force in January 2017);

- Cabinet Resolution No. 316 concerning rules for land valuation;

- Resolutions of the Plenum of the Armed Forces of the Russian Federation dated 09.2016 No. 36 and 28 (developed on 06.30.2015).

- Resolution of the Presidium of the Supreme Arbitration Court, issued on 06.2011 (relates to case No. A27-4849/2010).

These are the main laws and acts that provide for the possibility of appealing against an inflated cadastral value.

Why is a revision of the cadastral value necessary?

Why do citizens try to change the price set by a specialist? After all, the cadastre is filled out based on data identified by a specialist.

According to the law, any property must undergo registration and cadastral value assessment. As a rule, it is established by a civil servant, an invited appraiser. He looks at the characteristics of housing, land or other property, the purpose and location of the object. After which it makes an assessment, guided by federal legislation.

Important: The Land Code of the Russian Federation gives regions the right to approve general average indicators suitable for each of the municipal districts.

Application for revision of the results of determining the cadastral value

If previously such a tax was calculated based on the inventory value of real estate, the new procedure provides for its calculation based on the cadastral value, which is usually as close as possible to the market price.

Before challenging the cadastral value, you need to find out how much your property was valued at.

For example, an application to the commission to revise the cadastral value of a land plot was submitted in September 2020. The negative decision of the commission had to be appealed in court. The court decision came into force in March 2020. At the same time, the market value was established as of 01/01/2015 (the date of determination of the cadastral value).

For the report, the parameters of the cadastral and inventory assessment of the object under study will be used. Based on the results of the assessment, the owner will receive a conclusion that can be used as evidence in court. If the value obtained as a result of the assessment turns out to be lower than the inventory value, it will be possible to challenge the inflated price level in court.

In a couple of years, the authorities want to make the cadastral value the reference point for calculating property taxes. According to calculations by the Federal Tax Service (FTS), fees in this case will increase more than five times. Market experts note that the changes will most significantly affect owners of luxury real estate. But first things first.

Taking into account all the above factors and nuances, the property inventory process will not cause you intractable difficulties that may hinder the successful completion of the process.

Report on the market value of the declared property (number of sheets) (original), in the form of an electronic document.