APPLY FOR A MORTGAGE AND FIND OUT A DECISION QUICKLY After a suitable housing option has been selected on the primary or secondary market, the potential buyer needs to deposit a certain amount as a guarantee of his intentions. If an apartment is purchased with your own funds, then there are no problems with registration, but situations involving the use of credit funds often cause concern among the participants in the transaction. Next, we will consider how the deposit is transferred when purchasing an apartment with a mortgage.

How to draw up a deposit agreement when buying a home with a mortgage

The deposit agreement should be drawn up taking into account the fact that the housing is purchased with a mortgage. For the buyer, this nuance is of fundamental importance, since the bank counts the deposit as a down payment, and if the mortgage is refused, the possibility of its return remains possible on the basis of clause 1 of Art. 381 Civil Code of the Russian Federation. It states that if the obligation is terminated due to the impossibility of its fulfillment, then the deposit must be returned. At the same time, there is no clear definition of what constitutes a loan refusal falling under this formulation. Therefore, in the deposit agreement it is necessary to indicate the conditions for return in the event of a negative credit decision of the bank .

In addition, when signing the contract, it is necessary to check the following information in the text:

- Full names of all property owners;

- passport data of all participants, residential addresses;

- cost of the apartment;

- deposit amount;

- descriptions of the technical characteristics of the apartment (address, area, floor, etc.).

If necessary, the agreement should be supplemented with a clause indicating any details that are significant for the participants. The document is drawn up in 2 copies. It is not necessary to have it certified by a notary. A sample deposit agreement can be downloaded from this link.

Found documents on the topic “Form agreement on collateral when exchanging an apartment”

- Sample. Agreement on the exchange of apartments Agreement on the exchange of real estate, securities → Sample.

Agreement on the exchange of apartments on the exchange of apartments agreement city of Moscow on the eighteenth of July one thousand nine hundred and ninety-one. we, gr. Bazarova Vera Ivanovna living in ... - Sample. Agreement about exchange residential building on apartment

Agreement for the exchange of real estate, securities → Sample. Agreement on the exchange of a residential building for an apartmentagreement on the exchange of a residential building for an apartment city, . (day, month, year - in words ) we, gr. , passport series, (full name...

- Sample. Agreement collateral apartments, belonging to to the borrower to ensure repayment of the loan amount agreement loan from collateral providing

Pledge and pledge agreement → Sample. An agreement to pledge an apartment owned by the borrower to ensure repayment of the loan amount under a secured loan agreementcontract no. pledge of property ( apartment ) "" 20 closed joint-stock company, (name of company) named...

- Sample. Application for renaming a phone due to exchange (purchase, receipt) apartments

Statements from citizens → Sample. Application for renaming a phone number in connection with the exchange (purchase, receipt) of an apartmentI ask the head of the Soviet telephone center to rename phone no. , established at the address in my name, in connection with ( exchange , improvement of living conditions, demolition...

- Agreement collateral privatized apartments

Pledge and pledge agreement → Pledge agreement for a privatized apartmentpledge agreement privatized apartment , n "" 20, commercial bank, hereinafter referred to as the " mortgagee ", represented by...

- Sample. Agreement O pledge property (apartments)

Pledge and pledge agreement → Sample. Agreement on pledge of property (apartment)contract no. on the pledge of property ( apartment ) in “” 20, hereinafter referred to as (name of organization, bank) “ pledge ...

- Sample. Agreement collateral apartments, belonging to pledgors, to ensure repayment of the loan amount agreement loan

Pledge and pledge agreement → Sample. Pledge agreement for an apartment owned by the mortgagors to ensure repayment of the loan amount under the loan agreementcontract no. pledge of property ( apartment ) "" 20 closed joint-stock company, (name of company) named...

- Agreement collateral property on apartment(s) in a house under construction (approximate scheme designed for the Moscow region)

Agreement of pledge and pledge → Agreement of pledge of ownership of an apartment(s) in a house under construction (approximate diagram designed for the Moscow region)agreement for the pledge of ownership of an apartment (s) in a house under construction ( approximate diagram designed for the Moscow region) “...

- Sample. Agreement collateral rights property on apartment(s) in a house under construction (approximate scheme designed for the Moscow region) (association of Russian banks)

Pledge and pledge agreement → Sample. Agreement on pledge of ownership of an apartment(s) in a house under construction (approximate scheme designed for the Moscow region) (Association of Russian Banks)contract no. pledge of ownership of an apartment (s) in a house under construction ( approximate scheme designed for the Moscow region) g...

- Sample. Agreement collateral property to secure loan obligations agreement (pledge goods in stock)

Pledge and pledge agreement → Sample. Agreement on pledging property to secure obligations under a loan agreement (pledge of goods in a warehouse)pledge agreement no. "" 20 Savings Bank of the Russian Federation (hereinafter the mortgagee ), represented by Mr. ...

- Sample. Agreement about exchange engines

Agreement for the exchange of real estate, securities → Sample. Engine Exchange Agreementagreement (place and date of conclusion of the agreement in words ) we, gr. , living at the address: and gr. , living in a...

- Agreement purchase-sales apartments. Act reception-transmissions apartments

Real estate purchase and sale agreement → Apartment purchase and sale agreement. Apartment acceptance certificatecontract for the sale and purchase of an apartment "" 20, hereinafter referred to as "Party-1", on the one hand, and ...

- Sample. Product specification ( application To agreement collateral property (pledge goods in stock)

Pledge and pledge agreement → Sample. Product specification (annex to the property pledge agreement (pledge of goods in a warehouse)appendix to the property pledge agreement specification of goods to pledge agreement no. from "" 20 year +-+ name of contra...

- Sample. Typical agreement O pledge with transmission subject collateral to the mortgagee (mortgage)

Pledge and pledge agreement → Sample. Standard pledge agreement with transfer of the pledged item to the pledgee (mortgage)standard agreement on pledge with the transfer of the subject of pledge to the pledgee (mortgage) "" 20 (place of conclusion) (full name or ...

- Sample. Agreement rental of non-residential premises for accommodation exchange point

Lease agreement for non-residential premises, buildings and structures → Sample. Lease agreement for non-residential premises to accommodate an exchange officecontract no. rental of non-residential premises "" 20 joint-stock company, hereinafter referred to as the "lessor", represented by...

Registration procedure

Having agreed on the key terms of the transaction, the parties sign an agreement taking into account the agreements reached. The buyer pays a deposit in the agreed amount and receives a receipt that the seller has received the funds. A distinctive feature of this type of transaction when purchasing a home with a mortgage is the need to provide the bank with copies of the agreement and receipt. Funds can be transferred by bank transfer, in which case a payment order will be required from the bank. A sample receipt can be downloaded here.

Apartment as collateral - consequences

There is hardly a person who does not dream of having their own roof over their head. However, not every person has enough money to buy an apartment. Therefore, in our time, most often people take out a mortgage on their home, which subsequently becomes the object of collateral in case of default.

The apartment is also used as collateral in other loan obligations not related to the purchase of housing.

Hello.

Often, when pledging property as collateral, people are not sufficiently aware of how dire the consequences can be. And there is only one reason for these consequences - the inability to pay a loan or mortgage, and, as a result, you can easily be left without a roof over your head. It should be understood that when the property is pledged, a person is more like a user of his own apartment, and this will last until the loan is repaid.

What to expect in case of loan default or regular delays.

In such a situation, the following consequences may occur:

– a high probability of transfer of property to a financial structure (bank, credit institution);

– lengthy litigation, since eviction is possible only by court decision. By the way, during court proceedings, you will have to additionally fork out money for the provision of legal services and the assistance of a lawyer in court proceedings;

If the situation has reached its climax and financial difficulties are inevitable, you should not fall into despair and create new problems against this background, as an option - hide from the bank and ignore letters, believing that the debt will evaporate into thin air and the creditor will forget everything that happened.

Advantages, disadvantages and possible risks

Let's consider what the use of a deposit gives. For both parties, this is a certain guarantee that the deal will not fall through at the last moment due to the fact that one of the parties simply changed its mind about concluding it. This is especially important in the case of a mortgage, since this is sometimes a long and labor-intensive process of collecting documents. In turn, for the seller, failure of the transaction may be fraught with the loss of another potential buyer and a delay in the sale.

This is important to know: What to do after buying an apartment on the secondary market: registration

For bona fide participants in the transaction, the risks are minimal. The main problem when buying an apartment with a mortgage is the bank’s refusal to issue a loan (more details: about popular reasons for refusal of a mortgage from Sberbank). Typically, housing is selected in parallel with the submission of an application, and you don’t want to miss out on a good property while the bank is considering it. The seller pays a deposit, and after that the bank refuses the loan. Refunds can be a problem if you don't plan for this situation in advance. Next, we will consider popular questions regarding the use of a deposit when purchasing a home with a mortgage.

If the bank refuses a mortgage

When purchasing a home with a mortgage, any actions must be taken taking into account the fact that the bank will refuse the application. This point is best discussed in advance with the seller and reflected in the agreement on the transfer of the deposit. There are two possible scenarios when a mortgage is rejected:

- The agreement was signed before the bank made a decision to issue a mortgage loan. In this case, the seller may refuse to return the deposit, citing lost time and loss of other buyers. If this situation is not specified in the deposit agreement, the buyer will have to try to claim the money through the court.

- The bank rejects the mortgage transaction if the seller has any problems with the documents for the apartment. In these circumstances, the buyer has the right to demand a double refund of the deposit. Read more: about which housing is suitable for a mortgage.

How to use a deposit as a down payment

The buyer can use the earnest money as a down payment. But in practice, the amount of the deposit is significantly less than the amount required by the bank. The credit institution must be notified of the settlements made and provide documents confirming the transfer of the deposit: a preliminary agreement and a receipt.

In this case, the purchase and sale agreement must specify in detail from what funds the buyer will pay the full cost of the apartment:

- own funds;

- deposit;

- mortgage loan.

Thus, the deposit can and should be taken into account when making payments to the bank.

Purchasing through a real estate agency

Registration of the transaction through a real estate agency does not fundamentally change the procedure for signing an agreement on the transfer of the deposit. The parties enter into an agreement in the presence of an agent, and the receipt is drawn up in the same way. By agreement of the parties, the deposit amount may remain for temporary storage at the real estate agency. In this case, the agency representative provides a receipt for accepting funds.

In the modern real estate market, both financial instruments appear - both an advance payment and a deposit. The choice of one or another prepayment method in most cases depends on the seller. At the same time, he does not always agree to accept the deposit - after all, the mortgage transaction is long-term, and a buyer with cash may appear at any moment. Therefore, in the case of a mortgage, the presence of a deposit is more beneficial to the party purchasing the apartment, especially if it is transferred after the bank has made a positive decision on the loan.

How to prepare a deposit when buying an apartment with a mortgage

When a deposit is paid when purchasing an apartment, the bank is notified about this. After this, the credit institution deducts its amount from the amount of the down payment. Transfer of funds is carried out either in cash or through a wire transfer.

A deposit for a mortgage is drawn up identically to a deposit without a mortgage:

- The contract is signed in two copies, one of which is given to the seller and the other to the buyer.

- A copy is made for submission to the bank.

- The buyer transfers funds in the amount specified in the contract.

- The seller writes an official receipt confirming the transfer.

- A copy of the receipt from the seller is made for the bank, in which he confirms receipt of all funds provided for by the deposit.

- The agreement comes into force.

From a legal point of view, the contract comes into force if it contains the following necessary information:

- the owners of the apartment that is for sale are indicated;

- buyers are indicated;

- information confirming the identities of the parties to the transaction is noted;

- the transaction value is indicated;

- the deposit must be written both in numbers and in words;

- information relating to the apartment is noted;

- responsibility for non-compliance with the contract is indicated.

In addition, experienced realtors advise that along with the contract, attach a certificate from a psychiatrist, which confirms that the transaction was completed by the participants in sound mind and memory. This allows, in the event of an unfavorable development of events, to avoid litigation on this issue.

Why there is a downside to tightening MFO activities

The law, adopted in the third reading, must now pass the Federation Council, must be signed by the President of the Russian Federation and published, after which it comes into force 30 days later. It already bears the signatures of not only the authors of the amendments (including Vladimir Zhirinovsky), but also the Speaker of the State Duma of the Russian Federation Vyacheslav Volodin and the head of the Federation Council Valentina Matvienko - so the likelihood of the bill being approved in the Federation Council is almost one hundred percent. Moreover, the initiators of the bill itself were originally Matvienko and Volodin.

However, the first person to voice the need to tighten control over microfinance organizations was the head of the Central Bank, Elvira Nabiullina: back in April of this year, she proposed banning such organizations from issuing loans secured by housing. Matvienko then supported the idea: “A person, when he is in a difficult financial situation, he does not read, he does not think, he urgently needs to solve this problem. People are simply left without housing, their only housing, and there are children and families. We just need to ban it.” In the Volodin-Matvienko bill, however, there was no room for two other radical ideas of Nabiullina, who also proposed raising fines from 500,000 to 2 million rubles and introducing criminal liability.

On the other hand, some State Duma deputies say that they will seek a complete ban on the activities of MFOs in the country - experts are skeptical about this: the number of MFOs has already decreased over 8 years from 7 to 2 thousand, but their services are used by 7 million Russians. But the tightening of activity led to the activation of the “black market”.

The first person to voice the need to tighten control over microfinance organizations was the head of the Central Bank, Elfira Nabiullina: back in April of this year, she proposed banning such organizations from issuing loans secured by housing.

Deposit agreement for the purchase of an apartment

The deposit agreement is a type of preliminary agreement. It separately contains information regarding the loss or return of deposits.

This is due to the fact that the deposit is a special instrument that ensures the full implementation of all preliminary agreements regarding the apartment. The party that violates them loses the deposit in full.

agreement on deposit (download in .doc format):

It is important to understand the meaning of the definition of “deposit”. When there is no Deposit Agreement, if events develop according to a bad scenario, the court will officially consider it an advance.

There is a recommendation regarding this issue. You need to prepare two documents at once:

- Preliminary purchase and sale agreement

- Agreement on deposit

Important! It is necessary to carefully draw up a receipt regarding the receipt of funds. Its absence is fraught with problems in a possible trial. A sample is presented below.

Sample receipt for receiving a deposit (download in .doc format):

The problem of gray lenders

The situation is also aggravated by the work of unscrupulous lenders who are deprived of the right to issue microloans, but continue to conduct underground activities. Such players are no longer interested in making money on interest from the issuance of funds, but rather in receiving pledged property for next to nothing.

The borrower may be deliberately brought into default in order to start accruing fines and penalties. If a citizen cannot quickly repay the entire amount of the microloan issued, then the gray lender will begin the procedure for foreclosure of the pledged property.

The media have repeatedly reported on cases where citizens, without reading the agreement, signed and then sued creditors who, because of a debt of 150-200 thousand rubles, wanted to auction off a three-room apartment.

In some cases, it was not even about a loan agreement. Citizens were allowed to sign a real estate purchase and sale agreement. At the same time, clients were sure that this was just a loan secured by housing. In fact, they sold their apartment, receiving a small loan amount in return.

Features of an advance agreement when purchasing an apartment with a mortgage

“Advance payment” refers to agreements that regulate advance payment issues. Such an agreement must contain the following information:

- the object of the contract, which means an apartment;

- the exact time and date when the funds were deposited;

- the amount of finance contributed.

This is important to know: Maternity capital for the purchase of an apartment: conditions in 2020

In addition, situations are regulated in which the advance will not be returned.

Often, ordinary people consider the definitions of “deposit” and “advance” to be identical. However, there are certain differences between them. At the legislative level, the term “advance” is not mentioned. In practice, it is understood as an advance payment of a certain size. Its presence does not oblige you to fully comply with all the provisions outlined in the contract. Additions may be made to it. They must be agreed upon by all parties to the transaction.

If the contract is terminated, if it is an advance, financial liability is incurred in a partial amount of the total amount of funds contributed. When agreeing on a deposit, issues relating to its termination are regulated by law. In practice, an advance is more often used due to greater flexibility and fewer potential sanctions.

Sample receipt for advance payment:

The process of obtaining an advance payment for a mortgage at Sberbank

Buying an apartment with a mortgage from Sberbank has some differences from other credit organizations. After receiving a loan decision, the bank gives a period of 4 months during which you need to find an apartment.

You should find a suitable living space, check all legal issues, collect the entire package of documents and sign a credit agreement.

Sberbank does not have strict restrictions regarding the building in which the apartment being purchased is located. The only prohibition concerns redevelopment. It must be legalized or the owner of the living space must confirm that he will return everything to its original form. In addition, Sberbank requires an officially executed preliminary agreement.

An advance or deposit agreement is signed, which describes the conditions in detail, as well as a preliminary agreement in the Sberbank form, which is a formal requirement.

The buyer must transfer the down payment to his own account with this credit institution. In the event that a certain amount has already been transferred to the seller, he provides a receipt. This protects against transactions of a dubious nature.

Deposit for the sale of real estate

The “deposit” refers to the portion of the total amount that will be withheld in the event of a violation of the terms of the transaction by the buyer. This is an additional guarantee that leads to the fulfillment of our obligations. It is very important to competently approach the issue of documenting the collateral. In today's unstable conditions, many different events can occur that could affect the transaction: the buyer will lose money, a financial crisis will break out, real estate prices will change, and as a result, one of the participants, the transaction will become unprofitable.

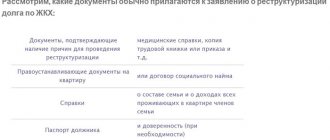

Return of the deposit if the bank refuses a mortgage

There is a serious risk that a banking organization will refuse to receive a loan. Based on this, the issue regarding the return of the deposit if the bank has not approved the apartment for a mortgage comes to the fore. There is no universal remedy for this. However, with the right approach, you can protect yourself.

As part of the mortgage transaction, you should carefully approach the issue of drawing up a preliminary agreement. It must indicate exactly the amount that will be paid for the apartment from your financial savings, and how much will be taken from the credit institution. All guarantees must be indicated, and if they are not met, the amount of compensation for losses incurred.

It is also noted that there is no legislatively uncoordinated redevelopment of residential space. Otherwise, the seller must independently resolve these issues and make the necessary changes to the documents when going to the BTI.

If he must provide the banking organization with documents confirming ownership of the residential premises, then an exact deadline should be indicated. If necessary, the consent of the spouse is indicated.

It is necessary to indicate that the deposit will be returned to the buyer if the bank refuses to issue a mortgage agreement.

Important! At the legislative level, according to the Civil Code of the Russian Federation, the deposit should be returned in full if the obligations under the contract were terminated before it actually began to be fulfilled. This may include the bank’s refusal to issue a loan for the purchase of an apartment with a mortgage.

Related documents

- Agreement on pledge of ownership of an apartment(s) in a house under construction (approximate scheme designed for the Moscow region)

- Sample. Temporary provision on the approval of collateral transactions

- Sample. Property pledge agreement

- Sample. Pledge agreement (securities)

- Sample. Agreement on pledging property to secure obligations under a loan agreement (pledge of goods in a warehouse)

- Sample. An agreement to pledge an apartment owned by the borrower to ensure repayment of the loan amount under a secured loan agreement

- Sample. Pledge agreement for an apartment owned by the mortgagors to ensure repayment of the loan amount under the loan agreement

- Sample. Mortgage agreement for a sea vessel

- Sample. Agreement on pledge of ownership of an apartment(s) in a house under construction (approximate scheme designed for the Moscow region) (Association of Russian Banks)

- Sample. Pledge agreement (with the transfer of the pledged property (thing) to the bank - mortgage)

- Sample. Agreement on pledge of property (apartment)

- Sample. Agreement on pledge of property (with the pledged property remaining with the pledgor)

- Sample. Agreement on pledge of property complex

- Sample. Agreement on pledge of property rights to the bank

- Sample. Agreement on the pledge of the right to royalties

- Sample. Agreement on the pledge of the right to receive the purchase price for the property sold

- Sample. Agreement on pledge of goods in circulation and processing

- Sample. Certificate of registration of mortgage of residential premises

- Sample. Product specification (annex to the property pledge agreement (pledge of goods in a warehouse)

- Sample. Standard pledge agreement with transfer of the pledged item to the pledgee (mortgage)

Deposit

After the buyer has found a property, he must obtain mortgage approval from the bank. As a rule, all further actions on the transaction are agreed upon between the buyer and a specialist from the lending bank, on the one hand, and also the seller and his realtor (if any) on the other. The buyer negotiates with the seller the amount of the deposit.

Next, the buyer must notify the bank that he intends to make a deposit and name the exact amount. This is taken into account when forming a mortgage loan.

To formalize the deposit, an additional agreement is used between the buyer and the seller, and the money is transferred against receipt.

Article 381 of the Civil Code of the Russian Federation. Consequences of termination and failure to fulfill an obligation secured by a deposit

- If the obligation is terminated before the start of its performance by agreement of the parties or due to the impossibility of performance, the deposit must be returned.

- If the party who gave the deposit is responsible for the failure to fulfill the contract, it remains with the other party. If the party who received the deposit is responsible for non-fulfillment of the contract, he is obliged to pay the other party double the amount of the deposit.

This is important to know: Buying an apartment by assigning rights in a rented or under construction house: risks

In addition, the party responsible for failure to fulfill the contract is obliged to compensate the other party for losses, minus the amount of the deposit, unless otherwise provided in the contract.

Agreement

It is not customary to have a deposit agreement certified by a notary, but this is not prohibited. The document must include :

- passport details of the parties;

- data on real estate parameters;

- deposit amount. Indicated in both numbers and words;

- full cost of the apartment;

- information that no one is registered or registered in the apartment. If the situation is the opposite, such information is also indicated;

- inventory value, which must correspond to the certificate issued by the BTI;

- section on the responsibilities of the parties;

- details and signatures of the parties with a transcript;

- date of the purchase and sale transaction;

- date of the agreement.

After signing, each party receives a copy. Money is transferred. The document comes into force.

Payment amount

When determining the amount, the parties are guided by conditional agreements :

- A percentage of the total cost of the apartment, which is usually 5%.

- A single amount agreed upon between the parties: 50 or 100 thousand rubles.

Receipt

Lawyers also advise the mortgage recipient to take a receipt from the seller for receipt of the deposit. It is drawn up on a blank piece of paper with a pen. It must reflect the circumstances of the transfer of money, personal data of the parties, data about the property, and the date.

As a down payment

The buyer has the right to use the deposit as a mandatory down payment . To do this, he must notify the bank of his intentions and stipulate the corresponding circumstance in the purchase and sale agreement.

The fact of transfer of the deposit on the day of signing the agreement at the bank is confirmed by relevant documents (preliminary agreement and receipt). Further, the purchase and sale agreement states:

- mortgage loan amount;

- own funds;

- deposit size.

“Banks have tightened requirements for borrowers, but the population’s need for loans has not disappeared”

Rumors and facts that microfinance organizations are increasingly entering the real estate market, offering microloans secured by apartments, appeared at the end of 2020 - beginning of 2020. Of course, all MFOs, both then and today, can be considered unscrupulous, but it was the latter that took advantage of the legal illiteracy of the population to achieve their goals (experts believe that no more than 15% of borrowers carefully read contracts and study documents).

The story of Yulia Kaplun’s family became scandalous: she and her three small children were evicted from their only home - all because Yulia’s mother had previously taken out a loan of 1.35 million rubles from an MFO secured by an apartment. Last spring, Pavel Medvedev (the financial ombudsman at that time) noted that MFOs have “sophisticated methods of cheating,” and although up to 60% of clients try to return microloans in a short time, some MFOs deliberately set high rates for the first days.

At the same time, there were also supporters of MFOs, pointing them to the target audience whom they help to survive: “banks have seriously tightened the requirements for borrowers, but the population’s need for borrowed funds has not disappeared.” But the problem is more likely related to illegal participants in the financial market (excluded from the Central Bank register). You can still borrow from microfinance organizations using real estate as collateral at 3-7% per month, a small package of documents (passport, documents on ownership, certificates from the BTI, the number of registered residents and the absence of encumbrances) will be issued in a couple of days. On average, a client can count on a loan of up to 1 million rubles - with collateral worth at least 2 million. However, both then and now there is a small “but”: lawyers say that the lender theoretically cannot take away the “only home”.

You can still borrow from microfinance organizations using real estate as collateral at 3-7% per month, a small package of documents (passport, documents on ownership, certificates from the BTI, the number of registered residents and the absence of encumbrances) will be issued in a couple of days. Photo: aizen-tt.livejournal.com

Pledge

Pledge (Article 339, Chapter 23 of the Civil Code of the Russian Federation) is another form of additional guarantee for the fulfillment of undertaken obligations . The collateral is not cash, but property.

It is executed by a notary. The agreement specifies information about the pledgor and pledgee, information about the pledged property, risks and responsibilities of the parties, requirements and validity periods.

After the terms of the pledge agreement are met and its validity period expires, the property is returned to its owner.

Prepaid expense

Unlike a deposit, the concept of “advance” is absent in the legislation of the Russian Federation, being essentially just a term from accounting . There are also no legal consequences regarding the advance.

If we talk about the amount of the advance, then in each individual case it is negotiated specifically with the seller. Usually the amount is much higher than the deposit and is about 30-40% of the cost of the apartment.

If the deal fails or is terminated for any reason, the advance must be returned.

Attention: Advance agreements are characterized by greater flexibility and the possibility of making changes during negotiations. In the case of a pledge, the actions of the parties and possible consequences are prescribed in the legislation.

Peculiarities

An advance agreement presupposes the establishment of regulations for the handling of advance funds. The contract specifies:

- information about the property;

- date and time of money transfer;

- advance amount.

Since there is no term “advance” in the legislation, the advance payment is often recorded by the parties as a receipt.

What rights do third parties have to the owner’s property?

According to the legislation in the field of mortgage lending, a borrower who has taken out a loan secured by real estate has the right to attract existing assistants - guarantors and co-borrowers - . What rights do they have to property taken on credit?

Co-borrowers are citizens who, together with the main borrower, repay the debt to the bank.

Co-borrowers must have a certain share of the apartment or house in the property (borrowers decide on their own which share). However, the amounts that must be given to the lender by each of the credited persons must be equal.

Loan guarantors are individuals or legal entities who assume obligations to repay the loan if the borrower stops paying the loan.

Guarantors, unlike co-borrowers, do not have any rights to the mortgaged property.

Agreement differences

Agreements on advance payment and deposit differ in that the first one is, for the most part, a joint creation of the seller and the buyer. The second is a strict, effective lever for returning funds in case of an emergency.

The concept and regulatory actions with a deposit are spelled out in Articles 380 and 381 of the Civil Code of the Russian Federation. In the case of an advance payment, the guarantee is not the law, but a personal agreement between the parties.

Also, the advance agreement may not specify the conditions for the return of money. These conditions are mandatory in the deposit agreement. However, the type of prepayment is usually determined by the seller. The buyer will have to agree one way or another if he is determined to buy this particular apartment.

Find out important details from the video:

What if the bank refused?

This circumstance is often not taken into account when drawing up preliminary agreements.

The seller, in case of refusal of a mortgage to the buyer, can always refer to the fact that he has lost clients and time. And the buyer will have to try to return the deposit through the court.

Important : if the contract does not stipulate the conditions for the return of money, the buyer may lose his funds.

Therefore, even at the stage of drawing up the preliminary contract, it is necessary to take into account and specify the terms of return. In particular, it should be a mandatory clause that if the credit institution refuses to carry out the transaction, the advance will be returned in full.