Taxes on private houses in the Moscow region. Property tax for individuals on a residential building. Property tax on a dacha in the Moscow region. Do they pay property taxes on garages and parking spaces? What are the tax benefits for personal homes? Where to find the inventory value of your own home. How to calculate the deflator coefficient for 2014. Property tax calculation for 2015. Recalculation of physicist's property tax for 2013. Tax rates for owners of residential buildings in areas of the Moscow region. New property tax in the Moscow region. How to find out the cadastral value of your home. Do pensioners pay house tax?

| Taxes on private home owners |

| Tax on a residential building and other taxes on real estate in Russia: Land tax Tax on apartment ownership Road tax on a car Tax payment issues Lunar conspiracies for wealth and money State defense order prices |

|

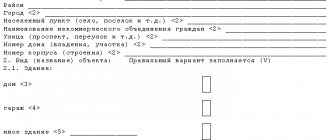

How to find out what is included in the living space of a private house, and how it can be calculated

- Area of premises. This is a calculation of the size of the room, determined by the distance between the walls without taking into account the baseboards. If a stove or fireplace is installed in a private house, its dimensions are excluded from the area of the premises during calculations.

- The total area of the building is the total area of all residential and non-residential premises, which includes rooms, kitchen, vestibule, corridors, hallway and built-in closets. Previously, when calculating the total area, verandas, terraces and outdoor areas, balconies and loggias were taken into account, but now this rule has ceased to apply.

- Living area is the total size of living rooms; in documents they are taken into account as rooms intended for permanent residence of people. These are the kitchen, living room, bedroom, children's room, study, and this concept also includes dressing rooms.

- Usable area (in foreign standards it is designated as “used”). This is the total area of all premises; the area of stairs and staircases, as well as elevator shafts and ramps is excluded from this value.

The living area must be indicated in advertisements when selling, since this parameter allows you to estimate the actual size of the living space. So in a large house a spacious hallway or vestibule can be equipped, but the rooms themselves will be small and cramped. The decision must be made not only after evaluating the documents, but also after a visual inspection of the house.

Tax on a house with an attic

When building, buying and renting a house, you should take into account that the cost per square meter of an attic is less than the cost of living space in a two-story house. Consequently, the tax rate for attic premises is much lower compared to second floor premises. When calculating the tax, the attic is taken into account only if the distance from the attic floor to the lowest point of the ceiling is at least 2 m. If this distance is less than 2 meters, then the attic is not taken into account for tax purposes. Calculating tax on a house with an attic

, the area of the attic is conditionally assumed to be equal to 50% of the area established in accordance with Part 2 of this article. Thus, to reduce property taxes, it is more profitable to build a one-story house with a low attic.

Let's look at an example of calculating tax on a house with an attic

. Technical inventory authorities estimate the cost of a house in accordance with special collections, and then multiply the resulting value by a coefficient established for each region. According to the information contained in these collections, the estimated cost of 1 m³ of a one-story brick house with an attic is 24.5 rubles. To simplify the calculations, let’s take the area of a one-story house to be 100 m², and the height of the first floor to be 2.5 m. The cubic capacity of the attic floor is calculated individually. In any case, the volume of the attic will be less than the volume of the first floor. Let the total volume of the house with the attic be 450 m³. Thus, the inventory value of the house will be equal to:

Interesting: Sample house purchase and sale agreement with deposit

How to calculate property tax according to the new rules

On January 1, 2020, Federal Law of the Russian Federation of October 4, 2014 N 284-FZ comes into force, according to which property tax for individuals will be calculated based on the cadastral value of real estate. However, the law provides for a five-year transition period, during which two methods of calculating the tax are provided. The first is based on the cadastral value, which is close to the market value. The second is based on the inventory (as it is now). In five years, by 2020, there will be only one calculation left - from the cadastral value.

How to - calculate, clarify - or reduce the area of the house

When it comes to regular payments, many property owners consider it advisable to clarify: is the area of the house indicated in their documents correctly? Is there any error? In addition, some are looking for a way to reduce this amount one way or another in order to save on taxes. We will consider all the identified issues by contacting a specialist.

But it should be remembered that it is possible to exclude any areas from the total area of a residential premises, without carrying out work on the reconstruction of this house, if previously this area was mistakenly included in the area of a balcony, loggia, veranda or terrace, or areas premises not intended to satisfy citizens' household and other needs related to their residence in residential premises, for example, the area of a garage, experts note.

Calculate total area

The design of individual houses is carried out in accordance with SP 55.13330.2011 “SINGLE APARTMENT RESIDENTIAL HOUSES”. According to SP 55.13330.2011, clause 4.7, the Rules for calculating the area of premises, determining the volume and number of floors of a building and the number of floors are adopted according to SP 54.13330 “Residential multi-apartment buildings”. Let's look there. Appendix B (mandatory) paragraph B.1.1 The area of a residential building should be determined as the sum of the areas of the floors of the building, measured within the internal surfaces of the external walls. The floor area includes the area of balconies, loggias, terraces and verandas, as well as landings and steps, taking into account their area at the level of a given floor.

B.2.1 The area of apartments is determined as the sum of the areas of all heated premises (living rooms and auxiliary premises intended to meet household and other needs) without taking into account unheated premises (loggias, balconies, verandas, terraces, cold storage rooms and vestibules). The area occupied by a stove and (or) fireplace, which are part of the heating system of the building (and are not decorative), is not included in the area of the apartment premises. The area under the flight of an internal staircase in an area with a height from the floor to the bottom of the protruding staircase structures is 1.6 m or less is not included in the area of the room in which the staircase is located. When determining the area of rooms or premises located in the attic floor, it is recommended to apply a reduction factor of 0.7 for the area of parts of the room with a ceiling height of 1.6 m - at ceiling angles of up to 45°, and for the area of parts of the room with a ceiling height of 1.6 m. 9 m – from 45° or more. The areas of parts of the room with a height of less than 1.6 m and 1.9 m at the corresponding ceiling angles are not taken into account. A room height of less than 2.5 m is allowed for no more than 50% of the area of this room. B.2.2 The total area of the apartment is the sum of the areas of its heated rooms and premises, built-in closets, as well as unheated rooms, calculated with reduction factors established by the rules of technical inventory.

Interesting: Does the child’s father have the right to maternity capital during a divorce?

Calculating house taxes using a calculator

For RBC Real Estate, realtors previously calculated that the updated tax would have a greater impact on owners of luxury real estate. Owners of an apartment with an area of 206 square meters, for example, on the Ostozhenka metro station, will have to pay more than 170 thousand rubles, taking into account the tax deduction. in year.

- residential premises and houses;

- objects of unfinished construction if a residential building is the intended purpose of these objects;

- real estate complexes, if they include at least one similar premises, namely a residential building;

- garages and parking spaces equipped for housing.

What is included in the tax calculation calculator for a private home: tax deductions in the amount of 20 sq. m for houses, 10 sq. m for rooms in houses and 50 sq. m for individual housing construction objects.

How is property tax calculated?

The responsibility for calculating the amount of tax in Russia rests with the Federal Tax Service, after which the information is communicated to taxpayers by sending tax notices to the postal address.

As already mentioned, Chapter 32 of the Tax Code of the Russian Federation provides for the calculation of tax based on cadastral value, the value of which is approved at the local level by each of the regions of the Russian Federation.

However, taking into account Russian realities, the full transition to the new payment system is postponed until January 1, 2020. During this time, all subjects of the Russian Federation are required to switch to assessing property at cadastral value.

Calculation of property tax based on cadastral value

The amount of tax, taking into account the cadastral value of the object, is calculated using the formula:

How to find out the cadastral value of an apartment or house?

Today you can find out the exact cadastral value of your property on the Internet, having in hand the cadastral number of the property or simply its address. In the first case, just go to the Federal Tax Service website, select property tax, your region, enter the number and get information about the value of the property.

There you can also clarify the amount of tax for the current tax period, as well as find out by what method it is calculated: by cadastral or inventory value. In the latter case, the program will prompt you to enter not the cadastral number, but the inventory value.

If the cadastral number is unknown, you can find it on the Rosreestr website in the reference information section at the registration address of the property.

Definition of tax deduction

Each taxpayer has the right to reduce the tax base (cadastral value of property) by the amount of the tax deduction:

| Object of taxation | Deduction |

| Room | Cost of 10 square meters |

| Apartment | Cost of 20 square meters |

| House | Cost of 50 square meters |

| A single real estate complex, subject to the presence of residential premises in it | Fixed deduction of 1 million rubles |

At the same time, municipalities and cities of Federal significance (Moscow, St. Petersburg, Sevastopol) received the right to increase tax deductions at their discretion. In cases where the deduction amount exceeds the cadastral value, the tax base is considered equal to zero.

Share size

If real estate has several owners, then the tax amount is calculated proportionally based on the ownership rights of each taxpayer to this object. If the property is in the status of common ownership, then the total amount of tax is divided equally between the owners.

Read more: Where to apply for payments upon the birth of a child

Tax rate

The Tax Code gives each subject of the Russian Federation the right to independently determine the tax rate, the current value of which can be found on this page. The maximum bet amount is limited to the following limits:

| Property tax rate | Object of taxation |

| 0,1% | Residential buildings, apartments and rooms (including unfinished ones) |

| Unified real estate complexes if they contain residential premises | |

| Parking spaces and garages | |

| Buildings up to 50 sq.m. meters, erected on plots provided for gardening, truck farming, individual housing construction and other personal farming | |

| 2% | Administrative premises and shopping centers |

| Commercial real estate for trade, provision of services, placement of offices and public catering facilities | |

| Property worth over 300 million rubles | |

| 0,5% | Other tax objects not included in the first two groups |

In Moscow, St. Petersburg and Sevastopol, the tax rate of 0.1% can be either reduced to zero or increased to 0.3%, depending on the type, cost and location of the taxable item.

An example of calculating property tax based on cadastral value

The citizen owns half of the apartment with an area of 80 square meters. meters, which has a cadastral value of 6 million rubles and is taxed at a rate of 0.1%.

We calculate the cost per square meter: 6,000,000 / 80 = 75,000 rubles. Now you need to subtract the cost of 20 square meters from the total housing area. That is, the cadastral value of the apartment, taking into account the tax deduction, will be 60 square meters. meters ×75 thousand rub. = 4.5 million rubles, and the deduction amount, respectively, is 1.5 million. We substitute the data into the calculation formula:

Nk = (Cadastral value – Tax deduction) x Share size x Tax rate

Nk = (6000000 – 1500000) x 0.5 x 0.1% = 2250 rub.

Total: the amount of property tax calculated based on the cadastral value is 2250 rubles.

Calculation of property tax based on inventory value

If a subject of the Russian Federation has not established the cadastral value of objects as of January 1 of the current year, then the tax base at the end of the tax period will be determined based on the inventory value of the property, and the tax itself will be calculated using the following formula:

How to find out the inventory value of a property?

To calculate the tax, data on inventory value received by the tax authority before March 1, 2013, multiplied by a deflator coefficient, are used. You can obtain this information from your local BTI office. Unfortunately, the technical inventory bureau does not provide such information online, however, on the website you can check the address, work schedule and contact information of the regional office.

Tax rate

As with calculations based on cadastral value, the percentage of tax deductions is set at the regional level. Current information on the tax rate is published on this page. The maximum values of this indicator should not exceed the following restrictions:

| Inventory value of the object | Maximum tax rate |

| Up to 300 thousand rubles | 0,1% |

| From 300 thousand to 500 thousand rubles | 0,3% |

| More than 500 thousand rubles | 2,0% |

Please note that in some cases local governments have the right to apply differentiated tax rates.

An example of calculating property tax based on inventory value

As an example, let's take the same citizen who owns half of an apartment with an area of 80 square meters. meters, the inventory value of which is 400 thousand rubles, and the tax rate is set at 0.1%. We substitute the initial data into the formula and get:

Ni = Inventory value x Share size x Tax rate

Ni = 400000 x 0.5 x 0.1% = 200 rub.

Total: the amount of property tax based on inventory value is 200 rubles.

Features of calculating property tax during the transition period

Calculating property tax based on cadastral value significantly increases the tax burden, so legislators decided to soften the blow to taxpayers’ wallets by introducing a transition period. For four years from the date of establishment of new tax calculation rules in the region, a reduction factor will be in effect, and the final tax amount will be determined by the formula:

NK – tax calculated based on cadastral value.

Neither – tax calculated based on inventory value.

K is a reduction factor that allows you to regulate the tax burden.

- 0.2 – for the first year;

- 0.4 – for the second;

- 0.6 – for the third year from the date of introduction of the new rules;

- 0.8 – for the last fourth year of the transition period.

As a result of applying the reduction factor, the tax amount will gradually increase by 20% per year.

Garden house tax: studying the new tax code

- Heroes of the Soviet Union.

- Heroes of the Russian Federation.

- Disabled people (childhood, 1st and 2nd disability groups).

- Participants in the Civil and Great Patriotic Wars, and equivalent combat veterans.

- Liquidators of the accident at the Chernobyl nuclear power plant.

- Military personnel and military pensioners with more than 20 years of service.

- Family members of fallen servicemen.

- Pensioners, as well as people who have reached retirement age (55 years for women and 60 years for men).

- When calculating based on cadastral value, the tax rate for individuals cannot exceed 0.3%. Therefore, if the value of the property is 2 million per year, you will have to pay 2,000,000 x 0.003 = 6,000 rubles.

- But when calculating by inventory value, the maximum rate can reach 2%, which for the same two million rubles will already give 2,000,000 x 0.02 = 40,000 rubles.

What area is taxed, general or residential?

New objects of taxation also appeared. The tax will have to be paid for a parking space, an unfinished construction project and a single real estate complex (a set of buildings and structures designated in Article 133.1 of the Civil Code of the Russian Federation).

How is tax calculated?

Just as now, tax will need to be paid on the basis of a tax notice sent by the tax authority. The tax payment deadline is no later than October 1 of the year following the year for which the tax was calculated (Article 409 of the Tax Code of the Russian Federation).

But the rules for calculating tax have changed.

Currently, the tax is calculated based on the inventory value of the property. The new rules provide two options for calculating tax: based on the cadastral value and based on the inventory value.

Calculation based on cadastral value

When calculating tax based on cadastral value, the cadastral value of the object indicated in the state real estate cadastre as of January 1 of the year that is the tax period is taken into account (clause 1 of Article 403 of the Tax Code of the Russian Federation).

It is reduced by the following tax deductions:

for an apartment - for the cost of 20 sq. m of its total area;

for a residential building - for a cost of 50 sq. m of its total area;

per room - for the cost of 10 sq. m of its area;

for a single real estate complex, which includes at least one residential premises (residential building) - by 1 million rubles. (Article 403 of the Tax Code of the Russian Federation).

For example, if a citizen is the owner of an apartment with an area of 78 square meters. m, apartments with an area of 50 sq. m and a country house with an area of 120 sq. m, he will pay tax on 58 sq. m of area of the first apartment, 30 sq. m of area of the second apartment and 70 sq. m of area of the country house.

Local authorities are given the right to increase the amount of tax deductions (clause 7 of Article 403 of the Tax Code of the Russian Federation).

Tax rates are set within:

2% in relation to shopping (office) centers and other similar property listed in Art. 378.2 of the Tax Code of the Russian Federation or having a cadastral value of more than 300 million rubles;

0.5% for other taxable items.

Local authorities have the right to reduce it to zero or increase it, but not more than three times (Clause 3 of Article 406 of the Tax Code of the Russian Federation).

Tax benefits

All current benefits remain in place. In addition, benefits have been added for the following persons:

who received or suffered radiation sickness or became disabled as a result of tests, exercises and other work related to any types of nuclear installations, including nuclear weapons and space technology (subclause 12, clause 1, article 407 of the Tax Code of the Russian Federation).

But the procedure for applying benefits has changed. Now beneficiaries do not pay tax at all. Starting next year, they may not pay tax only in relation to:

apartments or rooms;

garage or parking space;

premises specified in subparagraph. 14. clause 1 art. 407 of the Tax Code of the Russian Federation (creative workshops, studios, etc.);

utility buildings or structures with an area of no more than 50 square meters. m specified in subparagraph. 15. clause 1 art. 407 of the Tax Code of the Russian Federation).

At the same time, the benefit can be applied only to one object of each type at the choice of the taxpayer, regardless of the number of grounds for applying tax benefits (clause 3 of Article 407 of the Tax Code of the Russian Federation).

For example, a pensioner - a disabled person of group II is the owner of an apartment, room, cottage, garage and parking space. He is a beneficiary on two grounds - sub. 2 clause 1 (as a disabled person) and sub. 10 p. 1 art. 407 of the Tax Code of the Russian Federation (as a pensioner).

A garage and a parking space are classified as one type of taxable object; an apartment and a room are also one type.

Let's say a pensioner decides to apply the benefit to a garage, apartment and country house. He will have to pay tax for the room and parking space.

House tax

In reality, pensioners are beneficiaries. And they have special rights in tax obligations. House taxes are no exception. What can every pensioner count on? He is entitled to complete exemption from property tax. Moreover, regardless of your health or social status. In Russia, all people who have reached retirement age are completely exempt from paying this penalty. And it doesn’t matter where exactly a person lives. The main thing is that he lives on the territory of the Russian Federation. It follows from this that, as already noted, the payers of the payment under study are only able-bodied adult citizens. Children and pensioners do not pay this tax in any way. Every citizen should take this fact into account.

Interesting: What Amount Is The Tax On The Sale Of Land Plot Paid?

It all depends on the financial capabilities of municipalities. In the Moscow region, for example, the search operation has already been widely deployed; a large number of not just mansions, but huge properties with courts, swimming pools and saunas, have been found, the owners of which hide the fact of the existence of the property.

Tax notice from the Federal Tax Service

The Federal Tax Service of Russia annually sends out notifications to individuals about the calculated property tax. The document is sent to the payer's postal address and contains information about the object of taxation, the tax base, the accrued amount and the deadline for paying the tax.

As a rule, tax notices arrive between April and November, but no later than 30 days before the due date. More detailed information about the planned timing of distribution of tax notices can be obtained from the local Federal Tax Service.

What to do if the notification did not arrive?

Many taxpayers tend to regard this situation as an exemption from the obligation to pay property tax. This is a wrong position and the result of inaction may be extra late fees.

According to Federal Law No. 52-FZ dated April 2, 2014, in the absence of notification, taxpayers are required to inform the tax authority about the ownership of the property once before December 31 of the year following the tax period. The message is sent to the territorial Federal Tax Service with the attachment of documents confirming the ownership of the specified property.

Read more: How to check if a passport is valid online

If the property has been owned for a long time and previously tax notices were received regularly, it is worth taking the initiative and independently contacting the tax office to receive a calculation for property tax.

Notifications in the taxpayer’s personal account

Individuals who have registered a personal account on the Federal Tax Service website should take into account that the tax notice for 2020 will be sent electronically by default. However, standard notifications will not be sent.

If desired, the user can choose the mail option of receiving a notification, notifying the tax service. Individuals who do not have an electronic account will, as before, receive standard postal tax notices on paper.

How to calculate the area of a house calculation formula

Using the already known formula, we will obtain an indicator of the area of one of the walls. In the same way, we will calculate the area of all external walls of a residential building. After this, you need to add up all the obtained values and the result will be the area of the external walls of your house.

- When designing future housing.

- When carrying out direct construction work for the correct calculation of consumables.

- For finishing work.

- When registering home ownership with the justice authorities.

- To obtain the BTI technical plan.

- When renovating the interior.

- When registering the purchase and sale of housing.

- When renting out housing.

Private house tax

Private houses are most often defined as country houses, at least if they are located outside the urban area. And while this fact may affect the amount of tax, it does not affect the payment procedure. The first and main point for correctly determining a plan of action is establishing the circle of subjects. They are the ones who are required to contact the tax service and pay the annually considered tax option. Not every citizen who touches country houses, apartments, or buildings on a plot of land, even if he is the person who built it or left it unfinished, will pay tax.

When calculating, you should pay attention to the possibility of receiving benefits. For example, no matter how many people live in a house, only the area that exceeds 50 square meters will be taxed. That is, when a house has an area of 100 m2, then the tax will be charged only for half. A house with a smaller area is not subject to taxes. Other benefits for certain categories of persons, tax deductions and even complete exemption from tax obligations are also possible.

What buildings on a summer cottage are subject to tax in Russia?

- if a dacha plot is sold at the same or slightly lower price for which it was previously purchased, then the owner may be exempt from paying tax if he provides documentary evidence of the purchase and sale;

- if a dacha plot is sold at a slightly higher price and the owner has confirmation of this, then the amount of tax is deducted only from the difference between the sale and purchase price;

- if residential dacha properties are purchased, buyers may be provided with a tax deduction if its amount is equal to the value of the property and does not exceed 2 million rubles;

- the state is ready to provide a tax deduction even if the cost of the property being sold does not exceed 1 million rubles, which allows for a reduced amount of the tax base.

We recommend reading: Caring for a Pensioner After 80 Years in 2020, Moscow Region

If a summer cottage plot is purchased under a purchase and sale agreement, then you will not need to pay tax upon purchase. But if the dacha becomes the property of a close relative under a gift agreement, then the recipient will have to pay personal income tax, the amount of which is calculated from the value of the donated dacha plot.

In a year, the tax on houses and dachas could increase 125 times

“It is for this reason that our company was chosen to carry out the assessment work. The BTI archive stores information about about 10 million capital construction projects in the Moscow region. The technical passport, which is in the BTI archives, contains much more information than the State Property Committee. With the help of archives, we supplement the information of the State Property Committee, determine the percentage of wear in order to make the most transparent and honest assessment.

— But in order to use the services of the MFC, you must first register your property, put it on the cadastre, clarify the boundaries of the site, register the house, and “link” it to the site. A lot of fuss. Probably half of the property owners in the Moscow region have not done any of this. And for some - the whole thing.

22 Jul 2020 glavurist 4797

Share this post

- Related Posts

- Sale of property at auction by bailiffs

- Usn 6 percent 2020 for individual entrepreneurs how to pay

- How to order a cadastral passport for a land plot via the Internet

- Login to the pension fund personal account Sberbank