Is it legal to charge penalties for utilities?

In accordance with [K=8;T=Housing Code of the Russian Federation], residents who have lately and (or) not fully paid for housing and utilities are required to pay penalties in the amount of one three hundredth of the refinancing rate of the Central Bank of the Russian Federation, valid for moment of payment. In accordance with the Housing Code of the Russian Federation, payments for residential premises and utilities must be paid monthly by the 10th day of the month following the end. Penalties are accrued from the 11th day of the month following the end.

If payment is made on time, but partially, penalties will be charged on the remaining amount of the debt. First of all, funds are received to pay for housing and utilities. The remaining funds go towards paying penalties.

What to do with the name of goods (works, services) in a cash receipt

— What wording should be in the cash receipt when accepting an advance from the buyer on account of future purchases (the name of the product for which the advance was made, or simply “Advance under contract No.”)? And if at the time of receiving the money there is no connection to a specific product range, is it enough to indicate “Buyer’s order no. " or "Agreement with buyer no. "?

The updated version of the Law on CCP contains a requirement to indicate the name of goods (work, services) in the cash receipt. It is mandatory to print this detail on the receipt from 07/01/2020 or from the moment of switching to the online cash register, if this happened earlier than the specified period. However, for some individual entrepreneurs other deadlines are provided.

We recommend reading: How many years do you need to live in America to obtain citizenship if you are studying to become a lawyer?

Free legal assistance

The amounts of penalties and debts for consumed housing and communal services products are not accrued separately. For example, if a subscriber owes 1.5 thousand rubles for consumption and a penalty of 300 rubles, then he needs to pay 1,800 rubles on the same subscriber account. How to write off, cancel penalties Penalties are the prerogative of the creditor and are assigned or canceled at his discretion.

- Art. 317.1 of the Civil Code establishes the possibility of calculating interest on obligations that have direct monetary value;

- Article 330 of the Civil Code of the Russian Federation establishes such a type of security for the fulfillment of contractual obligations as a penalty;

- In addition, Article 332 establishes a type of security such as a penalty.

Housing fines 2019 with a separate receipt

What is included? The standard list of utilities provides for payment for: hot and cold water supply; drainage; expenses for maintaining common property; payment for major home repairs.

Nizhny Novgorod region Novgorod region Novosibirsk region Omsk region Orenburg region Oryol region Penza region Perm region Primorsky region Pskov region Rostov region Ryazan region Samara region St. Petersburg Saratov region Sakha (Yakutia) rep. Sakhalin region Sverdlov Skye Sevastopol region, North Ossetia - Alania, Smolensk region, Stavropol region, Tambov region, Tatarstan, Tver region, Tomsk region, Tula region, Tyva, Tyumen region, Udmurt region, Ulyanovsk region, Khakassia, Khanty-Mansiysk region. env. - Yugra, Chelyabinsk region, Chechen Republic, Chuvash Republic, Chukotka Autonomous Region. vicinity of the Yamalo-Nenets Autonomous District. okr. Yaroslavl region. Do you want to become a project expert? If you are a lawyer, human rights activist, or simply a qualified specialist in one of the areas of law, you can send us an application to join the team of Experts.

Penalty on Housing and Utilities Receipt Is It Legal?

In paragraph 159 of the Rules for the provision of utility services to owners and users of premises in apartment buildings and residential buildings, it states “Consumers who have lately and (or) incompletely paid for utility services are required to pay the contractor a penalty in the amount established by part 14 of Article 155 of the Housing Code of the Russian Federation ". We look at Article 155, Part 14 of the Housing Code of the Russian Federation. “Persons who have lately and (or) not fully paid for housing and utilities (debtors) are obliged to pay the creditor a penalty in the amount of one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at the time payment, from amounts not paid on time for each day of delay, starting from the next day after the due date for payment until the day of actual payment, inclusive.

We recommend reading: Can bailiffs take away a donated car?

Registration date: 12/16/2017 Messages: 2 Re: question about housing and communal services: debt and penalties Thank you for your answer! The fact is that all the amounts were paid before they went to court, or rather, it turned out that I paid, and the next day I received a summons! But there’s also a question about the statute of limitations, debts haven’t accumulated for years, I paid, if not every month, but every six months, 20-30 thousand at a time, and I can’t understand whether it’s possible to accept the statute of limitations here, it seems like it’s necessary so that there has been no payment for 3 years?? And how can I spell this out correctly? I consider the tax in the amount of such and such to be canceled because the statute of limitations has passed? Edited 1 time(s). Last time 2017-12-18 20:39 by Lk.

Mandatory details of cash receipt and BSO in 2020

As for the mandatory BSO details, if the organization is located in a hard-to-reach area, the last three items from the list of mandatory details for an online cash register receipt may not be indicated. In addition, the Government of the Russian Federation warns in the law that it may supplement the list with another mandatory requisite - a product nomenclature code - if it is defined. Otherwise, all BSO details are no different from the details of an online cash register receipt.

Important! Individual entrepreneurs using the PSN, simplified tax system and UTII, with the exception of those who trade in excisable goods, may not indicate the name and quantity of goods or services purchased on their receipts. This relief for small businesses is given until February 1, 2021 (Federal Law dated July 3, 2020 N 290-FZ). After this date they must operate like all other businesses. Read more about the timing of when you will need to start indicating goods on your receipt, as well as about the postponement of online checkouts until 2020 here >>

Penalty on Housing and Utilities Receipt Is It Legal?

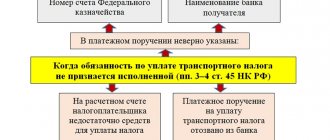

By virtue of clause 70 of the “Rules for the provision of utility services to owners and users of premises in apartment buildings and residential buildings” (approved by Decree of the Government of the Russian Federation of May 6, 2011 N 354). The amount of penalties (fines, penalties) determined by law or an agreement containing provisions on the provision of public services for violation by the consumer of the terms of such an agreement is indicated by the contractor in a separate document sent to the consumer. Your organization includes the amount of the penalty in the payment document for the month following the unpaid one, without waiting for the debt to be repaid, does not comply with the provisions of the law, since the calculation of the penalty uses the refinancing rate in effect at the time of making the payment. To calculate the amount of penalties, it is necessary to establish the period of delay. Concept of penalties: In accordance with Art. 330 of the Civil Code of the Russian Federation: a penalty (fine, penalty) is a sum of money determined by law or contract, which the debtor is obliged to pay to the creditor in the event of non-fulfillment or improper fulfillment of an obligation (in particular, in case of delay in fulfillment). The amount of penalties for late or incomplete payment of utility services cannot be increased, which is directly provided for in clause 14 of Art. 155 Housing Code of the Russian Federation. The order of repayment of the main and additional claims of the creditor In a situation where the management organization imposes a penalty on the overdue debtor, it is necessary to be guided by clause 2 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 20 N 141. This paragraph explains that Art. 319 of the Civil Code of the Russian Federation does not regulate relations related to holding the debtor liable for violation of an obligation, but determines the procedure for fulfilling the monetary obligation that the debtor accepted upon concluding the contract. When applying Art. 319 of the Civil Code of the Russian Federation, one should proceed from the fact that interest repaid earlier than the principal amount of the debt means interest for the use of funds payable on a monetary obligation (in particular, interest for the use of the amount of a loan, credit, advance payment, etc. Conditions of the management agreement apartment building, according to which the debtor fulfills a monetary obligation not in full, the requirement to pay penalties is repaid earlier than the amount of the principal debt, contradicts the meaning of Article 319 of the Civil Code of the Russian Federation and is void (Article 168 of the Civil Code of the Russian Federation). Interest for non-fulfillment or delay in fulfillment of a monetary obligation provided for Article 395 of the Civil Code of the Russian Federation, are repaid after the amount of the principal debt. The requirements of the management organization for the payment of penalties can be voluntarily satisfied by the debtor both before and after repayment of the principal debt. According to the receipt for personal account No. 11 for April 2020, the amount of payment for services provided was unlawfully divided utilities for March 2020 in the amount of 983 rubles. 18 kopecks to pay for utility bills in the amount of 486.68 rubles. and for payment of fines in the amount of 496.50 rubles. (without the voluntary consent of the owner). According to the receipt for personal account No. 11 for August 2015. The amount of payment for utility services provided for July 2020 was improperly divided. in the amount of 585 rubles. 26 kopecks to pay for utility bills in the amount of 575.28 rubles. and to pay a Penalty in the amount of 9.98 rubles. (without the voluntary consent of the owner). As of December 11, 2020, all amounts of utility bills (for the period 2014 and from January 2020 to November 2020) have been paid. Based on the above, I ASK: Return the amount wrongfully attributed to the payment of penalties in the amount of 506 rubles. 48 kopecks to pay for utility bills in 2020. Write off the amount of penalties on the personal account. Provide a separate document for calculating penalties for the amount of unpaid utility bills with a specified period of delay.

We recommend reading: Taxes When Selling a Land Plot by an Individual in 2019

A certain owner had rent arrears and paid the rent irregularly, and therefore arrears arose and penalties were accrued. At some point, the owner appeared and paid the debt along with penalties. This happened several times. At the same time, the owner did not say when paying that he was paying the amount of the debt and would not pay penalties. Recently, the owner brought a statement that allegedly all this time he was paying only the amount of the debt and was not going to pay the penalties and that the management company illegally distributed this money, including to pay off the penalties, and that the penalties should be billed as a separate payment document and not included in the rent receipt. The justification is provided by references to legislation. How to explain that the owner is wrong. The text of the statement is given below.

How are penalties calculated for late rent in 2020?

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

Law on penalties for utilities

The process of calculating fines (penalties) begins after the end of the established payment period, immediately the next day. The penalty will be accrued until the entire debt is repaid.

The debt collection process itself is not regulated at the legislative level. That is why it often happens that when collecting debts from debtors, the Housing Office has to go to court. The law allows such actions. This option for dealing with debtors is very effective today.

Procedure for paying taxes through Sberbank Online: step-by-step instructions

- You need to go to your Personal Account.

- Select the card from which funds will be debited.

- In the payment card column, select the type of operation by clicking on the “Operations” button.

- In the menu that appears after clicking it, select the “Payment” section.

- Next on the page, in the “Payment for services and purchases” tab, find the block “Taxes, duties, traffic police”).

- Here you should select a government organization that regulates the calculation of specific payments and fines.

- In the page that opens, click the “Payment of fines/penalties” button.

- After selecting a service, information about everything that has not been paid (debts) will appear on the page.

- From the list, select the payment that you need to make now and click the “Next” button.

- In the form that opens, indicate the required amount.

- The next step is to check the correctness of the entered information. If it is correct, you need to confirm the operation by entering the code from the SMS message.

- Log in to the system.

- In the menu, go to the “Payments” section, indicate the item regarding taxes.

- Select the same option as on the official website - search and pay taxes.

- The service will offer three search parameters: document index, TIN, arbitrary data.

How can you avoid paying rent penalties?

Paragraph 66 of Government Resolution No. 354 states that citizens must pay for utility services monthly, and if, for example, March passes, people must deposit the appropriate amount into the account of the management company by the tenth of April.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

How to issue a correction check using an online cash register

- I sent a check for more than the client bought. For example, a buyer bought for 70 rubles, and the seller accidentally punched a check for 700 rubles, and this was discovered only at the end of the shift.

- The check for the amount that the buyer paid did not go through at all.

- I punched the “return of receipt” check instead of the correction check.

The correction check is processed if at the end of the shift there is more money in the cash register than there should be. At the same time, the cashier also writes a statement and an explanatory note. These documents are needed to explain the tax reasons for the adjustment and to prove that the extra amount at the checkout was accidental. The refund check cannot be punched in this situation.

Housing and communal services issues

The mailbox needs to be enlarged urgently! The number of pieces of paper in it is growing day by day. And this despite the fact that almost no one subscribes to newspapers anymore. What's there? Yes, these are housing and communal services receipts

and to pay for other services: telephone, Internet, intercom, etc. Will we pay without looking? No, let's figure out what they write there.

Note: Failure to indicate in the payment document the values of tariffs for services, social norms of consumption, units of measurement is grounds for bringing the organization to justice under Part 1 of Article 14.8 of the Code of Administrative Offenses of the Russian Federation in the form of a fine of 5,000 to 10,000 rubles (resolution of the Federal Arbitration Court of the Far Eastern District dated July 29, 2008 No. F03-A73/08-2/2736).

Electronic check: in what cases and how it should be sent to the buyer

There have been no instructions from the regulatory authorities regarding exemption from the obligation to issue a paper copy of the cash receipt, provided that the document is sent to the buyer electronically. The current version of Law No. 54-FZ does not exclude the obligation to issue a paper check to the buyer, even if he asked to send it via SMS or e-mail. We recommend that you provide the buyer with a paper cash receipt along with the electronic document.

- The buyer informs the seller of the phone number or email address to which he wants to receive a document confirming the payment made.

- The seller enters the data specified by the buyer on the cash register and generates a payment document in electronic form.

- The check is sent as an SMS message to the specified phone number or by letter to an e-mail address.

25 Jan 2020 etolaw 898

Share this post

- Related Posts

- A child born from a Chernobyl victim: how to obtain a victim certificate

- What Documents Are Re-Provided for Subsidy?

- Discounts on train tickets for pensioners 2020 after 60 years

- Certificate of free travel on Russian Railways through Chernobyl

Should I pay according to the receipt for major repairs? Is it possible to refuse services?

Major repairs are a topic that worries almost all citizens. In any case, those who pay utility bills. After all, such a penalty has appeared in payments for apartments since 2012 in Russia, but it began to take effect in 2014. Many people wonder whether to pay on the receipt for major repairs? This question is really very important. It causes a variety of reactions from the population. Some people obediently run to pay the next payment, while others line up and go out to demonstrate against this payment. So what is the right thing to do? You will learn more about major repairs and related payments further.

The area of the home is also taken into account. And no matter how strange it may sound, the presence of an elevator in the entrance. After all, it also needs to be maintained! It is not difficult to guess that citizens who have an elevator will pay more. The age of the building also plays an important role. The older the house, the higher the payments.

We recommend reading: Is it possible to buy a beautiful number in the traffic police?

How to pay penalties through Sberbank Online

- Log in to your Sberbank Online personal account (if it has not been created, then you need to open it).

- Select the card from which payment will be made.

- In the bank card field, select the type of operation using the “Operations” button.

- By clicking on the “Operations” button in the menu that opens, select the “Pay” item.

- On the page that opens, you need to find in the “Payment for purchases and .

- In this block, you need to select a government agency whose competence includes regulation and control over certain fines and payments. You can choose: State Traffic Safety Inspectorate, Bailiff Service, Federal Tax Service, Federal Migration Service, courts and other federal services.

- If you need to pay a traffic fine, you should follow the appropriate link.

- In the page that opens, select the “Fines” field.

- In the form that opens, you must select a service: pay by receipt or find the required fine. The search can be done by entering the driver's license number or vehicle registration certificate number. If you know the receipt number, you must enter its number. After entering the number, you need to click the “Continue” button.

- If you have unpaid fines, data about each of them will appear in the “Unpaid fines” field on the page that opens.

- From the list of fines you need to select the one you plan to pay and click “Continue”.

- In the form that opens for a specific fine, you need to enter the amount to be paid in the appropriate field and continue.

- On the transaction confirmation page that opens, you need to check the correctness of the data. If everything is correct, then confirm using the code from SMS or entering a one-time password.

One of the most popular and convenient functions available to users of the Sberbank Online service is the ability to pay penalties and fines to various government bodies. It is worth considering what actions need to be taken and what to pay attention to when paying fines through Sberbank Online.

About the possibility of avoiding paying penalties on utility bills

Most legal professionals assume that if there is a debt to pay for consumer services, a penalty is charged, because this provision is provided for by law. Paragraphs 1 and 14 of Article 155 of the Russian Housing Code establish the obligation to charge penalties for the provision of utility services to the population.

It must be remembered that this rule is valid only if there is no corresponding indication in the contract. According to the law, the priority is to regulate relations in the sphere of business under contracts, therefore the legal penalty is determined by the creditor himself, that is, the utility service provider.

Housing and communal services fine for failure to issue receipts

Do I need to pay penalties for utilities? Of course, penalties must be paid. The legislation does not establish the obligation of the creditor in any way to prove the validity of the penalty if its amount does not exceed the maximum values established by law. So even going to court is unlikely to ease the burden of payment. What happens if you don’t pay penalties? Failure to pay penalties leads to the formation of even greater debt. For such debts, utility providers can easily disconnect the subscriber from the supply lines of electricity, gas, etc.

According to Art. 153 of the Housing Code of the Russian Federation, citizens and organizations are obliged to pay for housing and utilities on time and in full. In accordance with Art. Art. 155, 156, 157 of the Housing Code of the Russian Federation, payment for residential premises and utilities is paid monthly before the tenth day of the month following the expiration of the month, unless another period is established by the management agreement for the apartment building. Persons who have lately and (or) not fully paid for housing and utilities (debtors) are obliged to pay the creditor a penalty in the amount of one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at the time of payment, from the amounts not paid on time for each day delays from the next day after the due date for payment until the day of actual payment inclusive.

How to legally avoid paying penalties for housing and communal services

Answering the question of how to avoid paying accrued penalties on rent, it should be noted that the most obvious solution is to pay utility bills on time. But even if, due to circumstances, it was not possible to pay on time, and the penalty has already been added to the total amount of the debt, it is still possible to write off the penalty. The easiest option is to contact the Criminal Code directly with an application. Having considered the application, the utility companies may well agree to a meeting by writing off excess amounts, and even provide an installment plan for the repayment of the principal debt.

- there are a number of essential requirements for documentation;

- presence of controversial situations;

- the possibility of the debtor filing an objection against the execution of the order. In this situation, the judge will usually overturn the order. If this happens, then you can only file a claim in the future.

Requirements for an online cash register receipt

To a frequently asked question from entrepreneurs: “Is it necessary to indicate the name of the product in an online cash register receipt?” It is worth noting that the legislation establishes certain benefits in terms of generating receipts at online cash registers for stores operating under the following tax systems:

- information about the taxation system used by the store (for example, UTII);

- payment indicator (here there are 2 main options - sale or return of goods);

- serial number assigned to the fiscal drive;

- the number set for the cash register during registration;

- fiscal data identifier, as well as fiscal attribute;

- shift number;

- e-mail or phone number of the buyer (if he agreed to provide them);

- e-mail of the store (if it has received the buyer’s contacts);

- website address for checking a check (as a rule, this is the address of the Federal Tax Service - nalog.ru);

- list of goods included in the receipt (indicating prices, discounts);

- the amount of accrued VAT;

- name of the fiscal data operator, address of its website.