How a will is drawn up for a house and land is of concern to both the testator and the recipients of the inheritance. A testamentary deed is intended to transfer the house and land of the deceased to his heirs. Often the testator is directly involved in it, however, in some cases, successors are also involved in organizing this procedure due to the incapacity of the first. Anyone interested in the inheritance process should take into account that a will for a house and a plot of land acquires legal force only if certain standards are observed.

What is a will

A will is a person's written statement of will regarding the distribution of property among beneficiaries after his death. A valid copy presupposes a de facto compulsory certification. The best option would be the initial creation and certification of a will for a built or unfinished house in a selected licensed company.

According to the legislation that has come into force, every person is free to give away his house on the site, valuables and assets in a testamentary manner. This is carried out regardless of the presence or degree of family ties and in an amount determined independently for each heir. This way, you can deprive close people and relatives of your house and land plot by assigning it and the property to others who want it.

Where can I make a will?

No one forbids drawing up a testamentary order on your own without the presence of commissioners for inheritance land and real estate matters. However, for it to be valid, it must be certified by an official. A professional will check that the will for the individual home and land is written correctly and may require amendments (or re-drafting in the correct format).

Since the commissioner bears administrative (and sometimes criminal) responsibility for his actions, it is not profitable for him to indulge the parties in realizing their interests outside the legal framework. To avoid delays and increase the amount of paper work, it is recommended that you initially contact a notary to draw up and have a will for your own home certified here.

The initial appeal to the guardian of the law is also important due to the fact that it may be necessary to comply with certain procedural specifics. For example, it is sometimes relevant to involve witnesses or those responsible for drawing up and signing a will for a plot of land with a house instead of the testator himself (if he has the ability to express his will, but does not have the physiological potential to fix it).

Depending on the age and actual state of health of the testator, as well as if there are suspicions about his mental incapacity, the responsible notary will require a medical report before drawing up a will. Based on its results, he has the right to refuse to participate in the case. With this situation, it is almost impossible to achieve a drawing up and you will have to divide the house with the plot according to the law (within the boundaries of the priority).

Drawing up a will: form and procedure

In order to draw up a will, the owner of the property must contact a notary. As a rule, this means a visit to a notary’s office, however, if such a visit is physically impossible, a notary may visit the maker of the will. The mandatory documents that must be presented to the specialist in both cases include only a passport: the notary is not obliged to require from the applicant papers confirming his ownership of the property indicated in the order. However, identification of certain types of assets after the death of the testator may require obtaining additional information about them. For example, for a car such identification information is the state number, for a land plot - the cadastral number, and so on. Therefore, indicating this information in the will is useful in order to facilitate the future distribution of property. In turn, to ensure that all identification information is correct, it is advisable to have with you the title documents for the property in respect of which the disposal is being made.

It would be useful to add that a citizen has the right to dispose only of the property that belongs to him as property. Thus, before contacting a notary to draw up a will, you should make sure that you have all the necessary documents on hand confirming the person’s right to dispose of assets at his own discretion. Quite often there is a situation when, having owned any property for a long period, a citizen suddenly discovers that there are no correctly executed title documents for it. In this case, before contacting a notary's office, you should complete the necessary paperwork. The form and procedure according to which it is necessary to draw up a will do not actually depend on the nature of the property transferred to the heirs. As stated in Article 1120, the owner has the right to dispose of any property belonging to him, leaving a house, land, apartment, car, bank deposit or other items or valuables to any persons at his discretion.

In fact, differences associated with the nature of the property thus transferred arise only at the next stage, when its recipient or recipients begin to formalize the inheritance. So, depending on what type of property is to be transferred, various documents will be required to issue a certificate of inheritance. For example, to inherit a land plot and the house located on it, you will need to provide the notary with title documents for this property (for example, a purchase and sale agreement), a cadastral passport for the land plot, cadastral and technical passports for the house, a certificate of absence of debts on the house and land from the tax office and an extract from the Unified State Register of Rights to Real Estate and Transactions with It. However, depending on the specific circumstances of the inheritance case, the notary may require the provision of additional documents.

What is important for the testator to know?

In addition to allowing the desired heirs to bestow their property to varying degrees, the testator should also be aware of his obligations to them and the law. For example, during certification, each notary explains to the testator the principle of isolating a mandatory share in the inheritance for individuals.

Thus, at all stages of the case, the notary (as well as the judge in potential lawsuits) proceeds from the wishes of the testator and the rights of successors of any rank. To do this, he uses in his work mainly the Civil Code of Russia, namely, section 5 on the law under discussion.

To whom can property be bequeathed?

On the issue under consideration there is Art. 1116 Civil Code. It notes the variability of persons who can compete in the distribution of a house and land in their favor. The intended successors are the same regardless of the categorization of testamentary or legislative regulation of all ongoing processes.

There is a list of those who are included in the circle of heirs to a house with a plot of land (and who can also challenge the measures taken in the future):

- Alive at the discovery stage.

- Conceived before this date.

- Born after.

Categories of heirs by subjects of citizenship and territorial definition, as well as by political form of organization:

- physical and legal entities;

- states: Russian and foreign;

- individual regions of the Russian Federation, as well as municipalities;

- international structures.

According to the testator’s intention, relatives and other people important to him, with whom he has official relationships (for example, spouses), as well as strangers, can join the division. The alleged participants in the division acquire the status of unworthy as a result of a thematic trial initiated by an applicant interested in this issue.

What property can be bequeathed?

Posthumous distribution is subject to any material assets (including a house with land), as well as financial assets, securities or rights. The main principle of their transfer is confirmation of ownership status. That is, the house and plot must officially belong to the person who transfers them (legally).

Usually the existence of property is confirmed by the presence of documentation. If papers for a shared tandem (acres of land with a house) are lost, the participants will have to start restoring them. When forming a will, it is recommended to list in detail the objects transferred to each applicant in whole or in part with accompanying characteristics (for example, their location).

To include material assets in the list, it is easier to use title documentation (in this case, documents for land and house are required for the will). However, it is not prohibited by law to compile it only from the words of the testator, listing the objects: house, land area. The actual ownership of the house (residential and non-residential) with the plot will be clarified posthumously.

Number of wills, division of shares

There must be only one formally certified will, valid after death. Until this time, it can be rewritten several times at the request of the testator. There cannot be two legally valid variations, since the witness enters information into a narrowly targeted database according to the drafted regulatory legal act.

If the testator comes to the second notary officer and demands to draw up a will, he will check the availability of entered information in a specialized database and refuse the request. In such an incident, the applicant will be advised to contact the primary office and issue a new certified version there.

If several options are discovered that are not notarized, we may be talking about forgery of documents by interested opponents or the mental illness of the testator himself. It is worth noting that an uncertified version, in principle, cannot participate in the section in full format. It will serve as additional material during the legal proceedings.

When distributing the portion due to each person, the testator can sign away the right of ownership either entirely or in a shared format. A share can relate to a specific object, thing, right or securities, etc. In the first case, a frequent example is the allocation of shares in real estate. In the second - the right to own shares in percentage terms, etc.

Who should not be left without an inheritance?

The allocation of a mandatory share is necessary to ensure the rights of citizens who are in the position of dependents during the life of the alleged testator. Children (natural and adopted) are automatically given dependent status. Spouses and relatives of a citizen may have documented status on legal grounds.

So, it is mandatory to allocate a share to children. This rule applies to them before adulthood, as well as after 18 years of age due to the presence of a non-working disability. In extreme cases, when deciding on the allocation of a mandatory share, the justice system will take into account related issues. For example, the topic of pre-emptive rights is of great importance.

The specified privileges on the basis of Articles 1168-1169 no longer refer to the testamentary division of the division, but to the legal one (in turn). But in this case, the supposed privileged heir may even initiate a lawsuit in order to cancel the current will (challenge it).

According to the type of exception, the heir claiming the obligatory part will be deprived of it by resolution of the judge. This is permissible when correlating the importance of the transferred share in the name of a dependent or other heir (for example, the primary heir). As an example, the following situation is considered: a dependent has a third-party income, and for another applicant this house or plot serves as the only source of income.

Step-by-step instructions: how to apply correctly?

You can bequeath property to whomever you want. The heir does not have to be a relative. Even if there is absolutely no one to leave the inheritance, there is a way out. You can bequeath a house to a charitable organization, for example. In order to draw up a will, first of all, you should contact a notary office.

Contacting a notary

Notary offices are quite often found on city streets, so there shouldn’t be any problems finding them. No additional information is needed; an experienced notary will tell you what to do and how to do it. You just need to tell him about your intentions, and then most of the worries will fall on his shoulders.

What papers should I prepare?

In order to write a will for a house, the owner will have to present a fairly large number of documents :

- passport;

- documents proving that he owns the house;

- certificate of state registration of property rights;

- privatization/exchange/donation agreement, etc.;

- certificate of full payment of the share of the housing cooperative (or housing cooperative).

Form and procedure for drawing up the document

Making a will is not a very difficult task, but:

- It is necessary to very carefully indicate the shares of the property if it passes into the hands of several heirs (that is, you cannot write “the largest part is for my daughter Mary, and the smaller part is for my son Mikhail,” you need to indicate specifically: 1⁄2 - so-and-so, 1⁄4 – to another, 1⁄4 – to a third).

- We must try to describe as accurately as possible the property that is bequeathed. This is necessary so that later there are no problems with understanding the text.

- If the author of the will wants to disinherit someone, this should be indicated in the will (approximately “to leave such and such without an inheritance”). Or divide the property between the remaining heirs (it is implied that you need to write their names, surnames, who they are and their share in the inheritance), without mentioning this person.

To correctly prepare this document, you need to know the following things:- You cannot bequeath the house itself or, for example, a garage separately. Everything that is located on a specific plot of land is considered as a single object.

The will must be drawn up in writing and notarized (Part 2 of Article 1124 of the Civil Code of the Russian Federation).

IMPORTANT: a will can be changed at any time or canceled altogether. But you will need to draw up another document - a cancellation order; it also needs to be certified by a notary office. However, if for any reason the order is declared invalid by the court, then the inheritance will be distributed according to the will (specified in Article 1130 of the Civil Code of the Russian Federation).

Rules for making a will

The regulations for registration are prescribed in Section 5 of the Civil Code of Russia. Art. 1124 declares the rules of presentation and the format of the will itself. It is impossible to find approximate text developments here. However, the presented list of principles is quite comprehensive and allows you to draw up a will even with your own hand.

Let's look at how to make a will for a private house and plot and what are the basic principles of drafting:

- Written format.

- Certification by authorized persons in accordance with the law.

- It is mandatory to indicate the place and date of certification of the will for a land plot with buildings.

Special conditions for drawing up and certifying a will sometimes provide for the presence of witnesses at this procedure. A person competent in the field of jurisprudence will inform you about this in advance. In these circumstances, there are a number of prohibitions for attracting observers to the circle. The list includes a notary or other authorized person, purchasers, incapacitated or illiterate citizens, as well as citizens who do not know the language.

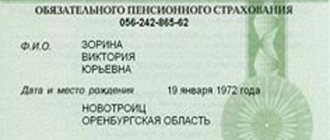

Identification

Since, according to Federal Law No. 146, a will must be written personally, the citizen will have to confirm his identity with a notary or his deputy. This can be done by presenting your passport. Heirs who come to the notary's office to obtain a certificate of their right of inheritance will also have to verify their identity.

For citizens of the Russian Federation

When initiating a will on the territory of Russia, the most common situation is the will of property to individuals with Russian citizenship. Although there are no restrictions in the law on the appropriation by testamentary means of the property of a deceased person by legal entities, as well as government agencies (to the federal and regional budgets).

According to the law, applicants can include both living and unborn persons. If on the opening day the birth of one of the heirs is only expected, then all procedural work is frozen until his birth. The newly-minted beneficiary can lay claim to the constructed house and plot of land under the will or be included in it to receive a mandatory share.

For foreign residents

In Russian legislation there are no restrictions on claims to inheritance if one of the claimants is a foreigner. In this situation, he may have an indirect relationship with Russia with a residence permit or permanently reside at the place of his existing citizenship. Such situations are usually regulated by international regulations.

For stateless persons

Since the testator has the right to bequeath his property to anyone, the prohibitions on receiving a plot of land with a residential or non-residential building do not apply to people without belonging to any country. They can, in a similar manner for Russians or foreign residents, participate in the division, having a will as a basis or within the framework of priority.

Confirmation of legal capacity

Capacity in inheritance matters is needed on the part of the testator, a possible witness to the writing and certification of the will. In the absence of a citizen’s mental capacity, it is impossible to take into account his opinion on the distribution of the house and land area among anyone. Physical inability is mitigated by the participation of witnesses and assistants who contribute to the compilation.

How to make a will for your own house and land if there are doubts about your legal capacity:

- Pass a medical commission or get a conclusion from one doctor (it all depends on the situational specifics).

- Provide the notary with a medical certificate along with your passport at the time of your appointment.

Persons who are incompetent (with mental pathologies), who have lost physical health, or who are illiterate also cannot act as witnesses. However, incapacity is not a reason for deprivation of a home or land. Rather, on the contrary, they are in a state of dependents and these persons are entitled to a deduction of a property share.

When can a notary refuse?

The refusal of a specialist to draw up a will with a specific testator is often explained by the latter’s incapacity. It can be caused by a variety of circumstances: acquired health problems, age-related changes, etc. It should not be ruled out that a will has already been registered in a single information database. In this case, you must first cancel the old one.

Choosing the form of a will

The will can be handwritten and certified by a specialist. Wills written under extreme conditions are equivalent to notarized wills: on a long voyage or expedition, while undergoing treatment for a serious illness, etc. The main condition is their certification by the person responsible for the activities carried out during this period.

In addition, the procedural format can be open or closed. The second hides the will of the testator from prying eyes as much as possible. In each of these cases, specific circumstances (motivation for choosing the form) and clear rules that must be followed to complete the procedure are required.

Handwriting

Handwritten registration is assumed in any option: secret or public. The exception is cases where the citizen is physically incapacitated. Then the responsibility for writing the text and even signing for it falls on the shoulders of another representative chosen for this.

Written by a notary

An alternative to writing it in your own hand is to perform this action by a notary on the words of the testator. At the end of the execution of the will for the house and land, the text is read out loud to the latter, and he can also read it personally. At the end of the procedure, the property owner is required to sign the compiled text.

Closed form

The format of a will can be public or hidden. The first is organized by joint reading of the document by the client and the contractor. There may be outside witnesses present. In contrast, the non-public option involves manually determining the content and composing the text without reading it by a notary.

Such a secret will is kept in an envelope. His certification takes place on an envelope in the presence of a couple of witnesses. After the death of the originator, the envelope is opened within 15 days, also in the presence of witnesses and applicants for inheritance by law. The autopsy procedure is recorded. The listed aspects are regulated by Art. 1126 of the Civil Code of the Russian Federation.

Who signs

Most often, the certification function is performed by notaries (from the public or private sector) and other authorized representatives of government agencies. In certain events they are replaced by citizens responsible for the whereabouts of the testator at the present time. The latter must initially sign the document with his own hand.

Testator

The authority to sign a document rests primarily with the person drafting the document. This rule (if the person is in full health) is approved by Art. 1124 FZ-146. The conclusion of an inheritance contract through a representative is prohibited by the same law, but Art. 1118.

However, the drafter’s signature alone does not allow the document to come into full force and distribute the inheritance upon its opening in accordance with the stated expression of will. An uncertified will can be taken into account by rivals voluntarily, as well as in an additional mode by the court. The order signed by the testator must be legally confirmed.

Confidant

If you are physically unable to draw up text and sign documents for the testator, this can be done by specially appointed citizens. This procedure is accompanied by a mandatory explanation of the reasons for such signing, as well as the provision of personal and contact information of the third party. This operation is performed only with the assistance of the witness and may be accompanied by the presence of witnesses.

Who certifies the will

According to the general standard, certification takes place solely by a selected specialist. This can be either a private practitioner or a representative of the government apparatus. Often the choice falls on a nearby office, tied to the residential address or to the place where the inheritance was opened. The law does not provide clear requirements for making a choice.

You need to know how to draw up a will for a house and land or where to go if there is no notary in the locality. This right is vested in:

- an employee of local government bodies or a consular post (if appointed to the appropriate position with suitable powers);

- the head physician when the testator is in serious condition in the hospital;

- the captain of a ship or the head of an expedition who draws up a will for a subordinate before his expected imminent death;

- the commander of a military unit when serving as a citizen or the head of a prison where a dying criminal is located.

Simplified certification is also permissible in the event of a threat to the life of a citizen who cannot use the legal services of a probate commissioner. In such a situation, a will drawn up in writing without certification can be considered valid (if the fact of foundation is proven).

Changing or canceling a will

Adjustments before the opening of the inheritance are not prohibited by the testator himself. He can do this by changing the contents on various issues: including or excluding inherited objects or assigning shares differently, as well as changing the list of heirs. The same applies to his personal revocation of the will. The distribution of the house and land will take place according to the law.

The heirs themselves also have permission to cancel a notarized will by initiating legal proceedings. In this case, it is considered unrealizable for various reasons: fraudulent preparation (for example, coercion of the owner or forgery of a document), violation of the property rights and interests of recipients (for example, dependents), etc.

At the same time, a will that is not signed by a notary is void and does not have to be challenged through court proceedings. Nevertheless, the party interested in this may request the use of this document as one of the proofs of the will of the testator.

Disinheritance

In Art. 1117 of the Civil Code provides a separate list of participants who cannot lay claim to the property of the deceased. The heir may acquire a reputation for being unworthy due to his targeted offenses against any of the parties to the division. By awarding such status, both the testamentary and the legal successor may be disinherited.

Main differences

When registering a will, the owner can be sure that ownership of the bequeathed property will pass only after his death.

This means that he can use his home without restrictions. And bequeath it to whomever he wishes.

The potential heir may not be aware of the bequest plans for the home. The document can be changed or revoked at any time.

When concluding a donation agreement for a house and a plot of land, ownership of them will pass to the donee immediately after registration of the transaction, and not after the death of the donor.

Thus, having received a house as a gift, the new owner can dispose of it at his own discretion. If desired, he can sell the house, rent it out, or give it to others. And most importantly, he can write out the former owner and deprive him of access to the donated property.

You can cancel a donation if there are compelling reasons. As judicial practice shows, the procedure for canceling a donation occurs in the rarest cases.

What is the fundamental difference between a will and a deed of gift?

Both legal structures are much more diverse than is commonly believed. Let's find out how a deed of gift differs from a will. A gift may consist in releasing the donee from fulfilling a demand addressed to him to pay a debt. After concluding such an agreement, the recipient does not become the owner of a new benefit. Its benefit lies in the absence of loss.

A will changes the order of inheritance specified by law and allows:

- exclude any of the relatives from the heirs;

- leave property to a selected person or organization;

- distribute assets between future successors in ideal shares (for example, 1/5) or according to a list (indicate what will go to whom);

- make inheritance subject to the condition of performing a certain action in favor of a third party, group of persons or territorial community (testamentary refusal and assignment);

- to appoint a sub-heir, thereby determining who will receive the assets if the main heir dies, turns out to be unworthy, refuses the inheritance, or passively does not accept it.

A will does not always establish the transfer of a certain benefit to the heir or the release of him from an obligation. The content of the document may be limited to a testamentary refusal or deprivation of the inheritance rights of a spouse or one of the relatives.

The main difference between a will and a deed of gift for real estate is the moment of transfer of assets into the ownership of the person chosen by the alienator. The recipient becomes its owner immediately after the state registration of the agreement in the Unified State Register of Real Estate, the heir - at the end of the life of the testator.

The legislator allows agreements that combine the characteristics of several independent transactions. However, this does not apply to gifts and wills. A deed of gift, in which the transfer of assets into the property of the donee is postponed until the death of the donor, is void. A will or deed of gift is a question that worries many.

Deadlines for completing both documents

The will is drawn up in a notary's office, where the lawyer himself will draw up the document, based on the wishes of the owner of the property being bequeathed. Next, the document will be signed by the testator. One copy will be issued to the owner, and the other will remain in the notary’s archives.

A gift agreement can be drawn up in two ways: independently and with the help of a notary.

- Independent drawing up of a contract is allowed in writing. And it does not require mandatory certification by a notary.

- Notarized drafting is preferable, as practice shows. The notary will be able to certify that both parties to the contract are legally capable and sign the document without coercion. Next, the completed document will be certified by a notary.

In any case, the time required to draw up a deed of gift or will is the time spent on drawing up the document. And it will take no more than one or two days.

Deadlines for obtaining ownership rights

Speaking about the timing of entry into ownership under a will, it is necessary to consider the entire process of its registration:

- Contacting a notary to write an application for acceptance of inheritance.

- Formation by a notary of an inheritance file, including information about all heirs.

- Payment for notary work and state fees.

- Obtaining a certificate guaranteeing the transfer of ownership to the applicant.

Reference! To avoid problems in obtaining ownership of real estate, you must contact a notary within six months from the date of death of the testator.

If the official right to receive property is proven, then the inherited property automatically becomes the property of the heir after six months. Next, you need to register ownership with the Federal Registration Service of the Russian Federation (Rosreestr).

Legal ownership of the deed of gift comes after registration in Rosreestr. The duration of the process of registering rights based on a gift agreement is 10 days, after which the new owner receives title documents. Only after this will he be able to fully dispose of the received property.

What is more profitable and cheaper - a will or a deed of gift?

Legally significant actions, such as a testamentary transaction and a gift agreement, are not valid without certification by authorized bodies, which provide such services only after payment of the state duty.

The amount of the monetary fee is established by law and regulated by the Tax Code of the Russian Federation, in particular, Articles 333.24 and 333.33.

The amount of the state duty for accepting an inheritance depends on the degree of relationship between the heir and the testator and the estimated value of the property:

- close relatives (legitimate children, parents, brothers, sisters, spouse) must pay 0.3% of its current market value for the inheritance;

- other heirs - 0.6%.

The fee for issuing a certificate of inheritance is paid by each recipient under one will.

But the following persons are exempt from collecting the fee:

- heirs of an apartment or house who lived in it at the time of opening of the inheritance and after the death of the testator;

- minors and incompetent legal successors;

- disabled people of groups 1 and 2 (50%);

- heirs of citizens who died as a result of saving a person, protecting property and law and order, while performing public or state duties;

- heirs of persons subjected to political repression.

Acceptance of the object of donation (under an agreement) obliges the donee to pay only the state fee for registration, regardless of whether the donation of real estate is made to close relatives or other categories of persons. However, this expense is also relevant for state registration of inherited property, when the following amounts are added to the fee for issuing a certificate of inheritance:

- 2 thousand rubles. for the house;

- 200 rub. for the living space of an apartment building;

- 350 rub. for a plot of land;

- 850 rub. per car (without changing license plates).

The state fee for changing data about an object in the state register is the same for both the re-registration of inherited property and the object of donation. In addition, if the donee is not included in the circle of the first and second degrees of relationship of the donor (parents, spouses, children, grandparents, brothers and sisters), a tax is levied on him - 13% of the assessed value of the vehicle, real estate, share, shares or share.

It follows from this that it is more profitable to draw up a gift agreement in the following cases:

- The gift is an object that does not fall into the category of real estate, transport, or shares.

- The parties to the transaction are close relatives of each other.

- The donee does not belong to the group of persons entitled to benefits for the provision of notarial services.

Be sure to read it! Amendments to the collective agreement in 2020 (procedure and registration of changes)

What about debts?

When donating, no debts of the donor are transferred to the heir - neither for utility bills, nor for loans, etc. There is no such law. The only exception is that debts for major repairs will be transferred (Clause 3, Article 158 of the Housing Code). The gift agreement cannot indicate that the debts of the donor will be transferred to the donee. Such an agreement will definitely not be registered, because the donor does not have the right to demand anything in return - clause 1 of Art. 572 of the Civil Code of the Russian Federation.

With a will the opposite is true. All debts of the testator are transferred to the heirs by will or by law - Art. 1175 and 323 LCD. Either accept the property with debts or refuse the inheritance.

Which is easier to cancel?

Do not confuse the revocation of a gift/will with challenging it. These are different situations. I wrote about the challenge below.

After the heir becomes the owner of the property, the donor no longer has the right to simply cancel the gift agreement. He will not be able to come to the registration authority and say that he has changed his mind and demand that the property be given back. After registering the agreement, he is simply its former owner.

The donor has only two options - ask the heir to re-donate the property to him or cancel it only through the court. To win the case, he must have good reasons; mere desire is not enough.

The donor may cancel the donation through the court if the donee has made an attempt on his life, the life of his family and close relatives, or has intentionally caused bodily harm to the donor - clause 1 of Art. 578 Civil Code of the Russian Federation. The donor needs to prove all this, and in writing. As for bodily injuries, he must bring to the court a medical certificate about the beatings inflicted, a concluded examination, a court decision on an administrative offense or a sentence against the donee, and invite witnesses. If there was an attempt, then a court verdict.

The will does not oblige the testator to do anything. He can at any time and at will cancel or change the will. Or draw up a new will, and the old will is automatically canceled - clauses 1 and 2 of Art. 1130 Civil Code of the Russian Federation. He won't need anyone's consent. Also, during his lifetime, the testator can easily sell or donate the property that he previously bequeathed.

When making a gift or will, the owner of the apartment must prepare documents. For example, an extract from the Unified State Register and a technical passport for the apartment.

Which is easier and easier to challenge: a will or a deed of gift?

You can challenge a deed of gift or a will - this is regulated by the Civil Code of the Russian Federation in Art. 578 and 1131. But doing this in reality is equally difficult: the interested party will be required to provide irrefutable evidence and sufficient grounds to transfer the case to trial.

The act of donation is canceled in the following cases:

- the donee made an attempt on the life of the donor or his relatives, caused bodily harm to the donor or killed him (in the latter case, the relatives of the deceased receive the right to cancel the gift agreement through the court);

- a gift that is dear to the donor in an intangible sense may become unusable due to the careless handling of the new owner;

- a legal entity or individual entrepreneur entered into a deed of gift within six months before being declared bankrupt.

A will can be contested by recognizing its invalidity in situations where, during the preparation and certification of the act, the testator:

- in a state of limited legal capacity (by a court decision or due to not reaching 18 years of age) signed the transfer of inheritance without the consent of legal representatives (parents, guardians);

- was subjected to physical violence and threats;

- was unable to control his actions and was not aware of what was happening;

- was significantly mistaken about the circumstances that played a decisive role in his expression of will;

- set out illegal and unmoral provisions in the document;

- called for the signing of the will by unsuitable witnesses (participants in the transaction, persons who do not understand the essence of what was written, who are in an inadequate state);

- was not present in person.

Features of taxation

Differences in the procedure for re-registration of real estate entail a different approach to the resulting property:

- the inheritance tax is paid if the estimated value of the property according to the will exceeds 850 times the minimum wage;

- under a gift, property becomes taxable only when transferred into the hands of persons not closely related to the donor (in this case, a personal income tax is imposed in the amount of 13% of the value).

Thus, the difference between the transfer processes within the framework of a deed of gift or a will are quite different procedures, and the choice of the method of re-registration is made taking into account all the features.

So, what is more profitable - donating or bequeathing an apartment:

- for persons who are not close relatives of the owner of the property, it is more profitable to draw up a will;

- for close relatives, it is better to draw up a gift deed (here the recipients receive a great advantage, since it is very difficult to challenge the deed of gift).

Documents for a will for a house and land

To avoid mistakes with the identification of persons involved, as well as property objects or other valuables, when drawing up the paper, you should clarify what documents are needed for registration. First of all, these are passports and birth certificates of all persons involved, then – papers on ownership. Although the entire list is advisory in nature and only the testator’s passport is required.

Is it possible to bequeath land without a house?

This option is quite acceptable. Everyone has the right to alienate their property as they please. In this case, the land may go to one applicant, and the building standing on the site to another. However, indefinite use in the absence of an oral agreement may prevent the actual use of the property.

Therefore, this issue should be considered documented. This can be done voluntarily or through the court. The initiation of legal proceedings comes from the author of the statement of claim, whose interests are infringed by the prevailing circumstances. For example, the documented owner of a house or dacha is not able to enter them, since he is prohibited from using someone else’s land plot.

Sample document

There is no legally unified form or sample of a will for any house and land in Russia (regarding the contents). The standardized rule is that offices use a government-designed paper form on which the will is written. The use of such templates is regulated by Letter from the Federal Tax Service of 2010 No. 1448/07-17.

In terms of text and structure, the sample will for a residential building and land plot reproduces common semantic formulations, as well as standards for office work and document flow. After presenting the identity of the testator, there is usually a list of his conditions. At the end, the text is certified not only by a signature, but also by a notary’s seal. Each such document has an individual numbering (registration number).

Procedure for registration of inheritance

Knowing how a will for a house or land is drawn up, the testator will be able to determine the desired form of the document: open or closed. The notary will familiarize himself with the open will (however, he is obliged to keep its contents secret), the information in the secret will will remain a secret to everyone except the testator.

A document on the inheritance of land and houses is drawn up in the presence of certificates confirming the testator’s ownership of them. These papers are needed not so much by the testator as by his heirs, however, the notary has the right to request these papers during certification.

The testamentary document itself must contain the following information:

- FULL NAME. the testator, his passport details;

- Place and date of compilation;

- The testator's orders regarding his property, indicating the full names of the heirs and successors.

For each piece of property (or its share), a separate heir is indicated. Inheritance to land is also issued after the death of the owner. At the bottom of the document, the testator leaves a personal signature with a transcript. Read more about how to write a will for an inheritance here.

The will is drawn up in 2 copies, the first of which remains in the custody of the notary, and the second will be in the hands of the testator.

Land and house can be bequeathed to third parties.

How to keep everything secret

The topic of secrecy (for a house, a dacha with a plot or other real estate) is covered in Art. 1123 FZ-146. Persons present with the testator at the time of drawing up the will do not have the right to distribute the items listed in it before its opening. This applies to any informational component - persons involved, list and order of inheritance, etc.

At the same time, all accomplices who do not certify the will cannot talk about anything even after the death of the primary owner, if such steps violate the law on the protection of private life. In order to maximize the mystery of the procedure, the testator can ensure its closed nature, in which even the notary will not get acquainted with the text.

Distribution of inheritance according to law

In general, the legislation of the Russian Federation provides for two main options for the distribution of property between a citizen’s relatives after his death: inheritance by law and by will. Inheritance by law is a procedure that is applied in the absence of orders from a citizen regarding the property belonging to him at the time of his death. Article 1141 of the Civil Code of the Russian Federation establishes the principle of priority for relatives when entering into inheritance. In total, the Civil Code of the Russian Federation allocates eight queues, each of which has priority in relation to each other. In this case, the belonging of persons to each of the queues is determined by the nature of their relationship with the testator, which can be based on kinship, property or dependency. Thus, representatives of the first priority include children, parents, spouse of the deceased. Thus, if a deceased person has heirs of the first priority, all his property will be divided among them, regardless of the number of representatives of subsequent orders.

Statute of limitations

In this case, we can talk about the validity period of the will itself and citizens’ requests for its acceptance or refusal. There is no limitation period. However, in the absence of a testamentary disposition during the opening phase of the inheritance, distribution in the general legal field (order of priority) will start. After which, each new owner will be issued a certificate of ownership.

A will discovered after all these procedures is more difficult to implement both in terms of time and financial costs, especially after a long period. In addition, the long existence of a will does not mean that there are no deadlines for the procedure for its acceptance, refusal and challenge in court (including recognition of its invalidity).

The listed heirs are given a six-month period to consent to or renounce the property of the deceased. The delay is subject to restoration by court decision also within six months after the elimination of the problem that previously prevented participation in the inheritance. Restoration of the period can be achieved by agreeing on this circumstance with all other applicants.

Who can challenge

Persons interested in appropriating part of a house or plot of land can appeal a will. They can be relatives or other people close (documented) to the deceased. Men, women and children who are perceived by the court as strangers (and who had no obvious contact with the deceased) must prove their involvement in his life and their importance.

Thus, according to the general standard, any applicants whose interests (in their opinion) have been violated can defend their rights in court. At the same time, their representatives: parents or other trustees (guardians, government agencies) keep their word for minors. The challenge must be supported by evidence of rights.

Can it be challenged and on what grounds?

Of course, it is possible, but to do this you will need to file a lawsuit in order for the will to be declared invalid (Article 1131 of the Civil Code of the Russian Federation).

BUT:

- minor errors in design do not invalidate the document.

- Only heirs by law have the right to challenge (whom they include is indicated above).

Grounds for challenge:

- the drafting rules are absolutely not followed;

- the authenticity of the signatures is questionable;

- not certified;

- the property specified in the will is not the property of the testator.

Which is better - a will or a deed of gift?

The choice between these two options should be made by the original owner of the plot with the house, who wishes to transfer it to other persons. It is worth remembering that a gift deed involves the loss of rights to property during your lifetime. If the issue of mandatory ownership of a house is fundamental for the donor during his lifetime (to ensure his interests and provide guarantees), then writing a will is more suitable for him.

Will

When determining subjects and objects, a will and a donation are identical. The donor or testator is allowed to give all existing property to any person. In the event of the impending death of the testator, it is still recommended to draw up a testamentary document. A gift agreement, which is drawn up in the event of an expected death, is allowed to be challenged in court by plaintiffs whose rights have been infringed.

Gift deed

The writing and registration of a deed of gift with government agencies, followed by the issuance of a certificate of ownership to the newly elected owner, also occurs during the life of the original owner. The difference is that the exercise of rights under a gift transaction occurs more often during the life of a person, and under a will - at the death of that person.

A deed of gift can be drawn up both upon the expected death of the donor, and as a gesture of goodwill during his health. The price for drawing up two options for transferring property from one person to another also varies. Typically, the cost of drawing up and certifying a document is higher than the previous one. However, the specifics of tariffs depend on the specificity of each episode.

Expenses

The expense portion when inheriting houses with land plots contains the following items: payment for notary services based on the code and, possibly, payment of state fees when applying to justice. In some cases, it is assumed that it is necessary to pay for services for the restoration of lost property documents (on ownership), if the heirs consent to inheriting a separate house and the plot under it.

At the same time, the legal services themselves imply the following: an individual consultation price, writing a text (if the testator has such an intention, who has the right to leave a will at his own discretion) or checking the written copy, as well as direct certification of the will to transfer the house and land. Pricing is determined by the region and the parameters of the lawyer’s work.

Pros and cons of a will

| For the testator | For the successor |

| pros | the bequeathed property will become the property of someone else only after the death of the donor; if a will is written, fraudsters will not be able to transfer the house to themselves; the testator has the right to change the conditions of inheritance at any time or cancel them altogether. |

| Minuses | conditions can be included in the will, the failure of which leads to the recognition of the will as invalid; If the will is contested by close relatives, the property may not go to the person assigned to it in the will. |

From the side of the testator

The testator has the right to change the terms of the will at any time without informing the heirs about it. Despite the existence of a will, the testator is the owner of his property and can dispose of it at his own discretion. This right entails the obligation of the testator to maintain the house and land, as well as pay taxes, until death.

Be sure to read it! What documents are needed to change your last name?

From the side of the inheritance recipient

Until the moment of inheritance, the heirs do not know the contents of the will. If the recipient of the inheritance is under 18 years of age, all actions under the will must be carried out by his legal representative. If he fails to fulfill this obligation, the heir may be left without an inheritance.

According to the Civil Code of the Russian Federation, a circle of persons is determined who can claim their rights to a share in the inheritance despite the fact that their names are not indicated in the will.

Risks under a will for the testator and heir

- The will may be drawn up in the wrong form (this risk exists only for closed wills, since the notary simply will not certify an ordinary will not in the form).

- The testator may ignore the recipients of the obligatory share, and as a result, the shares of the remaining heirs will decrease.

- The heir may be deprived of the right to inherit because he is included in the category of unworthy heirs.