Home / Land, dacha, construction / Documents and legislation / Land plot / Inheritance

Back

Published: 02/08/2018

Reading time: 7 min

0

813

It is possible to fully dispose of inherited real estate only after going through the legal procedure for entering into an inheritance and registering ownership rights. Inheriting a house with a plot has a special procedure, which depends on the number of potential heirs and the presence of a will.

- Concept and regulation of inheritance of real estate

- Rules for inheriting a house with a plot

- Procedure

- Possible difficulties and costs

Procedure for registration of inheritance rights

Registration of ownership of an inherited plot of land with residential and non-residential buildings occurs by contacting a notary at the place of registration of the deceased owner of this plot with a house (testator).

There are two main methods of inheritance:

- By will;

- In law.

Inheritance by law occurs in the absence of a testator's will certified by a notary.

There are queues of heirs defined by the Civil Code,

consisting of groups of relatives formed on the principle of close relationship to the deceased owner, such a group lays claim to the inherited plot with the house in equal shares.

Before contacting a notary's office, it is necessary to prepare certificates confirming the relationship of the heirs with the deceased, as well as documents for the land plot and buildings on it.

The set of documents may vary slightly depending on the specifics of a particular inheritance case, but the required set must include:

- Death certificate of the owner-testator of the property;

- Certificate from the last place of registration of the testator;

- Passports of persons claiming inheritance;

- Certificates confirming the relationship of the applicants with the testator;

- Title documents and certificates of ownership of real estate;

- Cadastral documents for the land plot and buildings on this plot;

- Certificate of the appraised value of the property determined as of the date of death of the testator;

- Will (if any).

If the testator goes missing, then after a certain time the court may decide to consider the missing person dead.

In this case, instead of a death certificate, the notary is presented with a court decision, in accordance with Art. 1113 of the Civil Code of the Russian Federation.

A family relationship with the testator can be confirmed by requesting certificates from the civil registry office or by presenting entries in the birth certificate where the parents are indicated. For distant relatives, extracts from several civil registry offices or additional documents may be required.

If the plot of land was acquired by the testator not through privatization, but through a transaction with private property, then it is necessary to attach a document of title, which may be a purchase or donation agreement in the name of the testator.

It is important to remember that if the privatization of an inherited plot of land was carried out before the creation of the Unified State Register in July 1997, then there may be no document on ownership, and a certificate of ownership of such real estate by the deceased must be requested from the archives of the local administration or from the board of the dacha cooperative.

In the absence of a cadastral document for registration of inheritance, such a document can be issued according to a simplified procedure, that is, without carrying out land surveying.

When the inheritance opened

The law says: in order to enter into an inheritance, you must accept it. Within six months after the death of the testator, the applicant for the inheritance must appear at the notary's office with an application for its acceptance. It is from this step that the process of decorating a house begins. In order to open an inheritance case, the notary will need the following documents:

- heir's passport;

- death certificate;

- a will (if one was drawn up);

- evidence of family relations, for spouses - a marriage document;

- papers confirming the right of the deceased to the house (certificate of inheritance, property, contracts of exchange, donation, purchase and sale, rent, etc.);

- an extract from the house register (you need to take it from the passport office, presenting a death certificate);

- certificate from the testator's last registered address;

- power of attorney of the representative (if the inheritance is formalized through a proxy).

Don't panic if you don't have any document. The law provides the heir with time to collect and formalize them. All of the above documentation is provided in originals and photocopies.

Procedure

The procedure for accepting an inheritance may differ in the presence of special circumstances, but in general the procedure consists of the following points:

- Preparation of documents by heirs;

- Carrying out an independent assessment of the value of the inherited plot with a house;

- Payment of state duty;

- Handling documents to a notary and opening an inheritance case;

- Verification of documents by a notary and maintaining a period of 6 months from the date of death of the testator;

- Issuing a certificate of inheritance to heirs;

- Carrying out land surveying for the production of a new cadastral passport for the land plot and for the residential building, as well as technical passports for all structures on this plot;

- Applying to the registration chamber with a certificate of inheritance and all documents for the land and buildings on it, including prepared cadastral and technical documents;

- Receipt from the registration chamber of a certificate of ownership of a plot of land with a house thirty days after the application.

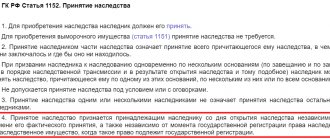

The time of opening of the inheritance must be considered the moment of death of the testator, according to Art. 1114 of the Civil Code of the Russian Federation.

Inheritance of a share in the right of common ownership of land plots

The inheritance of a private residential building is inextricably linked with the inheritance of the land plot on which it is located. In this case, the plot must be owned by the testator or belong to him on the right of lifelong inheritable ownership. Paragraph 4 of Article 35 of the Land Code (LC) clearly states that the alienation of a house located on a plot of land owned by the same person is carried out together with it.

When inheritance takes place by law, no conflicts arise, which cannot be said about cases of inheritance by will. In practice, it often occurs when a testamentary disposition is made only for a residential building. As a result, it passes to one person, and the land is inherited by another person - the heir at law. Or the house and land are bequeathed to different heirs.

Without going into details of the contradictions contained in civil and land legislation, we can say that judicial practice in this matter is based on Article 130 of the Civil Code, which treats a land plot and a building on it as independent objects of ownership. Therefore, the courts recognize these wills as valid, and they find a way out of such situations either in determining the procedure for using plots of land, or in the acquisition by the owner of one of the real estate objects of another, or vice versa.

Attention

To register the inherited house and land by law or by will, the heir must, within the six-month period established by the Civil Code, calculated from the day the testator died, contact the notary’s office with an application. It could be

application for acceptance of inheritance

, or

on the issuance of a certificate

about the right to it.

We have already noted that the two types of applications are equivalent, since in the first version, at the end, the applicant’s request for the issuance of a certificate is still indicated.

Based on the submitted application, the notary opens an inheritance case and issues the applicant for the inheritance a document confirming this. Next comes the collection of various documents, certificates and extracts, which are provided to determine the legality of the transaction, the composition of the inherited mass, the circle of possible heirs and the shares due to them in the inherited property.

Submitting an application to a notary to accept an inheritance consisting of a land plot and a house located on it requires the heir to provide a number of documents:

- evidence:

- about the death of the testator;

- on the ownership of both real estate objects;

- documents:

- identification of the heir (passport);

- confirming the degree of relationship between the heir and the testator (in case of inheritance by law);

- a certificate of the last permanent place of residence of the deceased, which must indicate all citizens registered at the time of his death, as well as the date of his discharge;

- testamentary disposition (in case of inheritance under a will).

To register and issue a certificate of inheritance, you will additionally need the following documents:

- cadastral passport for the house and land;

- an extract from the Unified State Register confirming the absence or presence of an encumbrance on it (arrest, pledge);

- and others (at the request of the notary).

A certificate of the right to inheritance is issued to the heir upon his application after he has accepted it (Article 1162 of the Civil Code). The right itself comes earlier - on the day the inheritance opens. This document only confirms the fact of acquisition of inherited property. Therefore, even if the heir has not received a certificate, he has the right to use the house and land as inherited property.

We invite you to familiarize yourself with Termination of an agency agreement unilaterally by the principal

This document is issued after the expiration of the six-month period established by the Civil Code for accepting the inheritance. This applies to cases of both inheritance by law and by will.

For your information

The certificate may be issued earlier than the specified period if there is a need to dispose of inherited property. This is possible only if the notary has indisputable evidence that there are no other heirs.

A certificate of inheritance can be issued one for two real estate objects or two documents - separately for a house and a land plot. If there are several heirs, they can be issued either one common certificate, or, at their request, a separate document for each of them, which will indicate:

- all property that is inherited;

- the share due to the heir receiving this certificate;

- information about the remaining shares that were issued according to separate documents to other heirs.

The certificate is a rather comprehensive document, as it contains a lot of information, such as:

- date of issue;

- details of the notary who executed and issued it (last name and initials);

- the basis for extradition with reference to a specific article of the Civil Code - by will or by law;

- data of the testator (full last name, first name and patronymic) and date of his death;

- data of the heirs, their place of residence, in the case of inheritance by law - the relationship of the testator with them, their shares in the inheritance;

- the composition of the inherited real estate (house and land), its location, estimated value, sending to title documents, as well as an indication that the transfer of ownership of it is subject to state registration;

- number of the inheritance file and registration certificate;

- the amount of state duty collected from the heirs for issuing the document;

- a notary's signature certified by his seal.

The issuance of a certificate of ownership of the inheritance is preceded by payment of the state fee, which is calculated by the notary based on the value of the inherited property and the closeness of the family relationship of the testator with the heirs.

Information

Having a receipt for payment of the state duty makes it possible to register the transfer of ownership of the house and land.

Receiving a certificate of inheritance does not make the heir the rightful owner of the inherited property. That is, he will be able to use the house and land, since he has legal grounds for this. But he will not be able to manage the property, for example, sell it, donate it, or make any legal transaction with it. Such a right is acquired only through state registration of inherited real estate with the Rosreestr authorities.

https://www.youtube.com/watch?v=ytpressru

We have already noted that a plot of land and a house, in accordance with the Civil Code, are two independent real estate objects. And although they must be alienated as a whole, with the exception of certain cases of inheritance under a will, registration of rights to them is carried out separately. As a result, the heir is issued two certificates of ownership: one for the house, the second for the land.

The procedure for registering real estate, the list of necessary documents, issuing a certificate - all this is regulated by the relevant Federal Law “On State Registration of Rights to Real Estate and Transactions with It.”

Registration actions begin with the submission and acceptance of registration documents. The first step is to draw up an application for the transfer of ownership of the objects of inheritance, which is signed by the heir and, together with a package of documents, is submitted to the registrar.

The registrar also has the right to demand the provision of additional title documents, cadastral passports for both objects, and other certificates and information.

Attention

After checking and examining the submitted documents, within a predetermined period, the heir is issued a certificate of ownership of the house and separately for the land plot.

From this moment on, his rights to them gain legal force. The heir becomes the owner of the inherited property in front of third parties and has the right to carry out any transactions with him that do not contradict the law.

In cases where a share of a land plot in common shared ownership is inherited, this occurs without any special features. This also applies to land shares.

If a participant in the common joint property dies, the heir cannot formalize the right of inheritance until the share that the deceased had in the common property is determined.

According to the law, inheritance without determining shares is possible only in cases where the heirs are members of farms or spouses (Articles 256, 257 of the Civil Code of the Russian Federation).

The regulation of controversial issues regarding the distribution of shares between heirs occurs according to the rules of legislation that regulates legal relations between the subjects of the dispute.

An assessment of the cost of the allotment is necessary to calculate the mandatory state duty

The period from opening the inheritance (six months) is necessary for the possible identification of other heirs who can lay claim to the land plot with the house. In case of such detection, the notary reviews the inheritance case.

Certificates of inheritance issued to heirs contain information about the share of land and/or house that they can claim.

When calculating shares, the notary takes into account the following factors:

- Will data;

- The presence and number of disabled close relatives of the testator or dependents;

- Possible refusal of inheritance by some heirs.

According to Art. 1149 of the Civil Code of the Russian Federation, disabled close relatives and dependents who were supported by the testator must receive at least half of the inherited property for all such dependents, regardless of the text of the will.

It is advisable to carry out land surveying after receiving a certificate of inheritance right, since the actual boundaries of the inherited plot may differ from the boundaries indicated in old documents.

As a result, the certificate of ownership will indicate the wrong area, while the land surveying carried out allows, in some cases, to significantly increase the legal area of the inherited plot of land in the absence of disagreements with neighbors.

Availability of a permanent structure

According to land law, the land under the house follows the fate of the house, that is, it is inherited along with the house.

If there is a capital structure located on the land plot that belonged to the testator, this land, which belongs to various forms of ownership, is transferred along with the house. The land plot could be registered in the name of the testator with the following rights:

- registered as property;

- on the rights of lifelong inheritable ownership (more information about the difficulties of obtaining the right of lifelong inheritable ownership of a land plot can be found here);

- permanent (unlimited) use;

- leased from the municipality.

If there was a will

If the deceased lived in a house that is being inherited, then the question of opening the will should be addressed to the territorial notary office at the location of the house.

To open a probate case you will need:

- death certificate;

- certificate of residence of the deceased in the specified house (in another place);

- applicant's passport;

- a notarized copy of the will.

When registering the inheritance of a house, since notarized copies of the title document were attached to the will, you will only need:

- a certificate from an appraiser about the value of the house and land;

- certificate of absence of arrest and encumbrance.

The inheritance must be registered within 6 months. The cost of technical work is charged for registration, according to the price list of an individual notary. As a rule, the registration fee for the house and land is paid together.

Attention: The state duty when entering into an inheritance will be 6% of the total cost of the house and land, if the land is registered as a property. For other types of rights to own a local area, only the cost of the house is taken into account.

In any case, this amount should not exceed 1,000,000 rubles. Close relatives are provided with a benefit in the form of a tax reduction.

On our website you can find out what is better to choose - a will or a deed of gift for land and a house, as well as how to correctly draw up a will for a plot with a house.

Close relatives or other persons contact the notary office at the location of the house to open an inheritance, with a package of documentation:

- death certificate;

- a certificate of the place of last residence of the testator;

- passports of all applicants for inheritance;

- birth certificates of children under 14 years of age with inheritance rights;

- documents confirming relationship with the deceased owner.

When registering the right of inheritance, it is additionally required to submit to the notary:

- title document for the house and plot;

- an extract from the Unified State Register of Real Estate (certificate of the form of title) for the house and plot;

- cadastral or inventory certificate about the value of the site;

- a certificate from the BTI about the cost of the house;

- or an assessment report of the land and house by an independent appraiser;

- cadastral certificate confirming the absence of collateral and seizure of property.

The registration period is 6 months from the date of death of the testator. The cost of notary services is equal to that established for the execution of wills, but it is paid jointly by all recipients of the inheritance.

The state duty is also paid jointly - on the amount of inheritance received by each participant. If these are persons of the first line of kinship, then they pay 3% of the value of the received share of property, but not more than 100,000 rubles.

Paying taxes

https://www.youtube.com/watch?v=upload

Important: According to the provisions of tax legislation (clause 18 of Article 217 of the Tax Code of the Russian Federation), tax on inheritance received is not levied, regardless of the value of the property received, since it is included in the state duty.

After registering ownership of the house and plot based on the registration of property rights in Rosreestr, a property tax is assigned to the house, and a land tax is assigned to the plot.

Application deadlines

To obtain inheritance rights, persons applying for inheritance must contact a notary with documents no later than six months from the date of death of the testator.

Otherwise, such persons may lose the right to inheritance , which will be registered as property by the heirs who apply to the notary in time or will be recognized as escheat with subsequent transfer to the ownership of the local executive authority.

If the applicant for the inheritance had valid reasons due to which he did not contact the notary within the established time frame, then such applicant can go to court to obtain the right to apply for inheritance rights after the expiration of the legal deadlines, in accordance with Art. 1155 of the Civil Code of the Russian Federation.

The following circumstances may be considered valid reasons:

- The heir did not know about the death of the testator;

- The heir did not assume the existence of any inherited property from the deceased;

- The heir could not contact the notary on time due to illness;

- The heir was in prison;

- The heir could not contact the notary due to force majeure circumstances.

Possible heirs are not informed about the death of the testator when these persons live in different regions, especially if they are distant relatives.

In case of illness, the court must submit the relevant medical certificates, and in the event of force majeure or subjective circumstances, which are valid reasons in the opinion of the heir, it is necessary to present all available evidence to the court, including testimony of witnesses and various certificates.

An applicant for an inheritance who has not contacted a notary within the prescribed period can be included in the list of full heirs without a court decision, if all other heirs who have already received a certificate of inheritance right agree. Then the notary recalculates the size of the inherited shares of the property and issues new certificates of inheritance to all heirs.

Registration of a house by inheritance without a will

»What should the heir do?

September 09, 2020

- home

- Politics news events comments

- Recommendation Problem Overview

- Review of legislation comments

- Review of legislation

- Social issues

- Arbitrage practice. Court decisions

- Inheritance and its registration

- Legal consultation

- News

- Photo album

- Search

- Contact

- Questions about inheritance

How to register an inheritance after death without a will for real estate

How and where to register an inheritance with a notary after the death of a relative. How much does it cost to register an inheritance? How to enter into an inheritance correctly.

Very often people find themselves in a situation where a relative dies without leaving a will. In such a situation, the heirs face the question: how to receive an inheritance from such a relative?

You need to know that there are two ways to enter into inheritance - according to the will left by the testator, or, in the absence of one, in the order of priority determined by current legislation. Thus, if the testamentary document has not been executed and notarized, the inheritance will be formalized in accordance with the legal order of inheritance.

The legislation of our state determines which of the relatives wishing to receive an inheritance should receive the property of the deceased first. But do not forget that in such a case one must follow the procedure established by law. The process of registering an inheritance consists of several stages, which will be discussed in this article.

How to enter into an inheritance without a will

As with inheritance under a will, the heirs will have to contact a notary firm. The notary prepares all the necessary documentation so that the heirs can acquire rights to the property of the deceased. Here we note that both a group of potential heirs and each of them individually have the right to contact a notary.

Be that as it may, the procedure for registering inheritance of the property of a deceased person without a testamentary document requires the heirs to collect and provide a package of necessary documentation. It includes documents such as a certificate confirming the death of the testator, his ownership rights to objects of inherited property, documents confirming family ties between the testator and the applicant for the inheritance, and others. There is another way to enter into inheritance of the property of the deceased, which does not require notarial intervention. To do this, the heir must confirm his inheritance rights to the property by his actions.

In other words, if the heir in fact already owns the property, protects it, takes on debt obligations to secure it and other concerns, he thereby confirms his rights to inherit it.

Inheritance of real estate without a will

Often, applicants for inheritance have questions about the design of an apartment or house, in cases where the testator did not leave his last will. It should be noted that this process is not too different from registering an inheritance for any other property of the deceased. But, as in any business, there are some subtleties.

Let's look at an example. Suppose you inherit an apartment that is physically impossible to divide among all legal heirs. In this case, one of those claiming the inheritance can register it in his name through the court, thereby securing his rights to the property. Other heirs, in turn, can turn to the judicial authorities to receive material compensation for their share in the inherited real estate.

Another important point when registering an inheritance for a property is the need to provide documents confirming the testator’s ownership of this property. In addition, you need to submit to the notary documents confirming the appraised value of the apartment, because based on this figure, he will determine the amount of the fee that must be paid for issuing a certificate of inheritance.

Queue of inheritance without a will

In many former republics of the USSR, incl. in the Russian Federation, there are only 2 options: entry

- according to the will drawn up in advance by the deceased,

- by law (no one has a will for the property of the deceased).

- according to Article 1153 of the Civil Code of the Russian Federation, the first one comes into force if there is no will or it has been declared invalid

- Inheritance by law occurs on the basis of division of the property of a deceased person between his relatives, divided into several stages depending on the degree of family ties with the testator.

- The first group includes the husband (wife) of the deceased, his children (including adopted ones)

- the second group includes grandparents, brothers and sisters

- the third group includes uncles (aunts), cousins and brothers

- to the fourth group the heirs of the third generation

- to the fifth group are heirs of the fourth generation, etc.

If after the death of your relative there is no will, and during his lifetime he did not dispose of the accumulated property in favor of relatives, third parties or organizations, inheritance will occur according to law.

It is envisaged that all relatives (by proximity of relationship) will enter into the inheritance rights of the deceased. The order is regulated step by step. The closer you are in blood to the deceased, the greater your chances of becoming the legal heir. First priority heirs:

Everyone has equal rights: entering into inheritance and refusing it. If a refusal is declared, or there are no first-degree relatives, the right is vested in other heirs in order:

When they are absent, the aunt/uncle is called to inherit. After them, great-grandparents have rights. They are followed by cousins: grandchildren, grandparents. If these heirs do not exist, cousins receive the inheritance: aunts/uncles, nephews. The following become applicants: stepmothers, stepfathers, stepdaughters and stepsons.

Only in the 7th place the right is given to dependents. Confirmation of the fact that the disabled person was supported by the deceased for the last year. It is not at all necessary for him to live together with the testator. Any heir, in the absence of heirs from the line preceding him, is given the right to receive the inheritance of a deceased relative.

The procedure for entering into an inheritance without a will

Every person faced with the need to register an inheritance must understand that contacting a notary is only the first step towards the procedure for registering the right of inheritance. In order to go through this procedure correctly and in accordance with the legislation of our state, it is necessary to understand the further steps that will have to be done to register an inheritance for the apartment.

So, after the death of the testator, you need to wait six months, after which you need to visit the notary again. He must issue a certificate that confirms the right to inherit. If there are several heirs, they may ask to issue either a certificate for each of them according to their shares of ownership in the inherited property, or one certificate for all of them.

After receiving this document, a new stage of inheritance begins. Now the acquired rights to own the testator’s property must be secured by law. This must be done by re-registering the property in the name of the heirs. To re-register ownership of real estate or a car, heirs must apply to the registration service or the State Inspectorate, respectively.

It should be noted that in the process of re-registration of property rights it is also necessary to pay government fees and duties. Thus, to re-register ownership of real estate, the fee will be about two thousand rubles. When the property is re-registered and documents confirming this are received, the process of inheritance can be considered closed.

If this procedure raises too many questions and you cannot understand all the nuances on your own, you should seek advice from a competent and experienced lawyer. You can do this completely free of charge. You just need to use the online consultation mode on our website. Here, experienced lawyers will competently and clearly explain to you all the nuances and subtleties of the procedure for registering an inheritance without a will.

Registration of inheritance without a will

How to register the right to inheritance without a will? This question has remained relevant for a long time for a large number of people.

Its complexity lies not only in a previously unknown area of law, but also in the difficult moral state caused by the loss of a close relative.

Legal regulation of the issue

It is worth noting that the Civil Code of the Russian Federation establishes two ways to receive an inheritance - by law and by will:

Chapter 3 of the Civil Code of the Russian Federation establishes the deadlines for entering into inheritance. the procedure for receiving it, recognizing heirs as unworthy, the concept of compulsory right and the right to receive an inheritance by grant.

Who should?

Inheritance by law occurs in accordance with the categories (Article 1141 of the Civil Code of the Russian Federation):

Interestingly, the number of queues is not limited by anything.

This virtually eliminates the possibility of property being declared escheat and, as a consequence, its transfer to the state.

Distribution of property

The distribution of property is carried out on the basis of several rules that must be taken into account:

- Heirs of the same line divide the property into equal shares.

- Subsequent heirs cannot receive property if there is at least one relative who is part of a higher group.

- Inheritance cannot be received by persons excluded from inheritance by a court decision or recognized as unworthy heirs.

How to register an inheritance without a will?

How to register an inheritance without a will. In this case, it is necessary to resort to inheritance by law.

This procedure has many nuances, for example, the transfer of property that was jointly owned by spouses, or the inheritance of a house.

After the death of her husband

After the death of the legal spouse, the surviving spouse is included in the first place as heirs.

However, the division of property will occur in a different order, since property transferred by inheritance is almost always joint.

It follows from this that the surviving spouse can register ownership of it.

For this you will need the following documents:

- Certificate of death.

- Certificate of marriage.

- Documents confirming the acquisition of property during marriage.

- Documents indicating joint ownership of property.

h3>For an apartment

If an apartment is inherited in 2020, it will be divided among the heirs of a certain order into equal shares.

You cannot give up a certain part of the apartment, but keep the other half.

It is first necessary to confirm that the property belonged to the testator by right of ownership.

On house

When registering an inheritance for a house, it is divided into equal shares between the heirs.

In some cases, not all real estate may be bequeathed, but only that part to which the testator had ownership rights.

To receive a house by inheritance, you must present title documents for it.

Entering into an inheritance without a will presupposes compliance with the order of heirs.

How to enter into an inheritance after the death of a father without a will? Find out here.

Step-by-step instruction

Before going to a notary to register the right to property, you need to determine how much of the inheritance you can count on.

After this, you will need to collect a certain package of documents and you can go to the notary.

You can do the procedure:

- in person - for this you will need an identity document (passport)

- with the help of a representative - a properly executed and valid power of attorney is required.

- written independently by the heir, with a notary present

- the document is drawn up using a special form, which is available in every notary office - it will be issued at the reception, so you don’t have to search for it first

- writing must be done with a ballpoint pen

- No blots, errors or cross-outs are allowed.

- firstly, it must be protected from attacks by third parties

- secondly, the heir must carry out management and, if necessary, contribute funds for its maintenance.

Contacting a notary

Contacting a notary is a step without which it will not be possible to obtain property.

The notary will need to draw up an application for acceptance of the inheritance, which is necessary to obtain a certificate of ownership.

There are several rules for drawing up a will:

The application will be considered only if the required package of documents is attached to it.

After submitting an application with documents and receiving a certificate of inheritance in accordance with Article 1162 of the Civil Code of the Russian Federation, it is necessary to actually accept the property.

What documents are needed?

To open an inheritance case, it is necessary to prepare a certain package of documents, which includes:

- Certificate of death.

- A document confirming the degree of relationship with the deceased citizen (birth certificate, marriage certificate, adoption certificate, etc.).

- A document indicating the place of opening of the inheritance (this is an extract from the house register drawn up at the place of official registration of the testator).

- Title papers for real estate if it is inherited.

- A document indicating the value of property transferred by inheritance.

- A receipt confirming payment of the state duty.

State duty

State duty is the amount of funds collected in favor of the state for conducting transactions.

Its size will depend on the degree of relationship with the testator.

Thus, relatives of the first and second groups pay 0.3% of the total amount of property received, but the maximum duty can be 100,000 rubles.

Relatives of the third group pay a duty equal to 0.6% of all property, but its total amount should not exceed 1,000,000 rubles.

Registration of an inheritance by a notary takes place in the manner established by the Civil Code of the Russian Federation.

How is inheritance carried out according to law? Read here.

What to do if the deadline for entering into inheritance by law has been missed? Details in this article.

What to do if the deadline is missed?

The legislation establishes a certain period for entering into inheritance - 6 months (Article 1154 of the Civil Code of the Russian Federation).

During this time, the heir can either draw up an application from the notary to accept the property, or write a refusal.

If deadlines are missed, it becomes necessary to go to court to restore the rights of the heir.

The claim will be satisfied only if it can be documented that you did not know about the death of a relative, were at that time on emergency service, in a hospital for treatment, etc.

In the video about the design features

How to properly register an inheritance for a house and land

Not a single person has ever been able to avoid death. If during his lifetime he owned a private house or plot of land, then it is they who most often pass to the new owners by inheritance. The procedure may seem confusing, but if you figure out the question in advance: “How to properly register an inheritance for a house and land?”, then everything is not so difficult.

Process

Notaries handle inheritance cases in the Russian Federation. To enter into rights, the heirs must contact the notary at the place of residence of the testator.

There are two design options:

In the first case, it will be enough to confirm your relationship when contacting a notary with the help of relevant documents, for example, a birth or marriage certificate. In the second option, the testator’s will, drawn up during his lifetime, will be a direct document giving the right to receive property.

The list of required documents will differ depending on whether the heir takes ownership by will or by law; we compare them in the following table.

Necessity for registration

0.6% of the value of the property, but not more than 1 million rubles

Additionally, you will have to pay for notary services, which will amount to about 5,000 rubles. You will also need to pay for the issuance of a certificate of ownership. Depending on the region, this will require 3,000 rubles or a little more.

Refusal to issue a certificate of inheritance

The procedure for entering into inheritance is quite standard and in most cases is completed simply.

But there are situations when a notary can temporarily postpone the issuance of documents on the right to inheritance:

Read the article, is it possible to arrange leasing for an individual entrepreneur with a zero balance?

How does Svoye Delo company issue leasing? The answer is in the link.

About Uralleasing in reviews, more details here.

At first glance, the process of registering an inheritance may seem not only lengthy, but also labor-intensive. In practice, the procedure is already well established and, in the absence of disputes about rights, usually goes smoothly. But if you have any doubts, you should definitely consult with a competent lawyer to protect your own rights.

How to properly register the right to inherit a house, apartment and other real estate?

Registration of inheritance is a fairly standard procedure, but each specific case may contain many nuances and be replete with pitfalls.

In order to avoid unnecessary conflicts in the process of redistribution of property between heirs, it is better to register an inheritance for real estate with the assistance of professional lawyers.

How to become eligible?

According to the legislation of the Russian Federation, it is currently possible to formalize the right to inheritance in two ways: by will and based on current laws.

The first method has priority.

Only in the absence of a will, a document certifying the will of the deceased, is the second approach applied when distributing property among the heirs.

However, regardless of the information contained in the will, there is a legally defined circle of persons who have an undoubted right to their own share of the inheritance.

This category of citizens includes disabled parents. spouse, dependents, children under age.

Citizens of Russia do not have the opportunity to enter into partial inheritance.

Thus, upon entering into an inheritance, they inherit in full everything that is due to them, including debt obligations distributed to all participants in the inheritance in proportional shares.

How and where should I apply?

The first step when registering an inheritance should be a visit to a notary, who, at your request, will open an inheritance case.

Moreover, it is necessary to seek the services of just such a specialist who has the authority to conduct specialized cases of a hereditary nature.

The notary will assist in drawing up the text of the application for opening an inheritance case and the correctness of its execution.

He will also be sure to notify you of all the necessary documents required to obtain a certificate of inheritance.

Submission of an application to a notary's office for acceptance of inheritance of real estate is carried out within a period of six calendar months from the date of death of the person who was the owner of the apartment or house.

If your application to a notary took place more than twelve months after the death of the former owner who made a will for you, you must provide evidence of your ignorance of the death of the testator by contacting the judicial authority.

If your right of inheritance is recognized by the court, you can contact a notary.

Documentation

Proof of eligibility

In the absence of a will from the testator, the distribution of property is carried out legally.

According to current legislation, there are seven levels of family ties, based on which distribution is carried out.

That is, relatives of the first category, which include children, spouses, and parents, have the priority right to inheritance.

If for some reason they cannot enter into an inheritance or voluntarily refuse it, the right to inherit passes to the second category of relatives.

These are half-brothers/sisters, grandparents, and grandmothers of the deceased.

If there are no applicants in this group of relatives, the right to inheritance passes further, up to the seventh category of relatives (stepfather, stepmother, adopted children).

To confirm your right to inherit without a will, you must have one of the following documents:

To verify the right to inherit under a will, you must have a notarized original of this document or a notarized copy of the protocol containing the full text of the closed will.

For registration

To successfully and as quickly as possible register the right to inheritance, it is necessary for the notary (or the judicial authorities) to provide the following package of documentation:

If any of the above documents are drawn up in a foreign language (for example, Ukrainian, Belarusian), they must be translated and notarized.

Registration cost

In the case of a standard procedure. that is, to register the right to inheritance in the general manner, according to current legislation, it is necessary to pay a notary fee in the amount of 0.3 / 0.6 percent based on the value of the property current on the day of death of the testator.

A notary fee equivalent to 0.3 percent must be paid to first-degree heirs - children or parents, 0.6 percent - to everyone else.

You can also register an inheritance for a property yourself.

Just keep in mind that this procedure, when producing it for the first time, can take a lot of time, effort, and nerves.

If you have a highly paid job or any other permanent income, a much better option would be to turn to the services of specialists - lawyers in the field of civil law.

For a relatively small fee, they will professionally prepare the entire package of necessary documentation and will accompany the registration of the right to inheritance to its logical conclusion.

It is recommended that you study family law in more detail.

Rules for registration and entry into inheritance without a will

Inheritance of the property of the deceased is usually carried out according to the will left, and if there is no will, by law.

You can receive part of the inheritance in the absence of a will if the person has been recognized as the legal heir. All legal heirs can claim part of the property of the deceased in the order of priority determined by the articles of the Civil Code of the Russian Federation.

Rules of inheritance according to the legislation of the Russian Federation

Heirs in the next line have the right to claim an inheritance by law without a will only when there are no heirs from the previous line.

If there are close relatives, but they are deprived of the right to claim the inheritance, then this right is transferred to relatives from the next line.

Relatives of the deceased who are in the same line have the right to claim equal shares of the property, with the exception of only those persons who claim the inheritance by right of representation.

To date, the legislation of the Russian Federation has allocated only 8 queues. The first consists of close relatives, such as the wife or husband of the deceased, as well as his children and parents.

In addition, grandchildren can be added to them by right of representation, but only when the legal heir died before receiving his share of the inheritance.

If the deceased does not have close relatives, persons from the second stage, such as half and full sisters and brothers, including grandparents of the deceased, can claim the inheritance of the deceased.

If there are no persons included in the second and first priority, the inheritance of the deceased can be received by people included in the third priority, it consists of the sisters and brothers of the parents of the deceased person, including their children according to the right of representation.

The procedure for registering an inheritance without a will

Recently, cases have become more frequent that after the sudden death of one of the relatives, all his relatives discover that he did not leave a will.

According to the law, in such cases, the circle of persons who have the right to claim a certain part of the inheritance is clarified.

Before starting the process of registering an inheritance, the person who has the right to it must find out exactly what part of the property he has the right to count on, for this he needs to contact a notary (no later than six months after the death of the testator).

This can be done either in person or with the help of a representative. Typically, a certificate stating that a person has the right to part of the property is issued to the heirs after six months have passed after the death of the testator.

In legal practice, there is such a wording as a mandatory share, which is usually transferred to minors and disabled children, parents or spouses of the deceased, as well as his dependents.

The volume of this share is usually determined after identifying all relatives who have the right to receive part of the deceased’s property.

If one of those people who can lay claim to part of the property of the deceased did not have time to fill out the appropriate application within the time allotted for these purposes, then he will be able to receive his share only by contacting the judicial authorities.

How to receive an inheritance without a will

In accordance with the law, the heir, after identifying his part in the inheritance, must open a case stating that he accepts the inheritance, for this it is necessary to draw up an appropriate application.

In addition, according to the rules of inheriting property without a will, it is necessary to collect a whole package of documents, which includes:

- An extract from the house register, which reflects data about who exactly was registered with the testator at the time of his death.

- A certificate stating exactly where the testator was registered on the day of death.

- Documents that confirm the family ties of the heir to the testator.

If the client accepts part of the inheritance, then he also accepts all other property included in his share of the inheritance, no matter where it is located.

The most common cases:

If there are several such heirs, then if they have equal shares, then the living space can be sold or divided, if there are objective possibilities for this.

If the heirs have unequal shares, then they can independently agree on the fate of the living space, and if disagreements arise, they must be resolved by the court.

If there are several such heirs, then the house must be divided in such a way that each of them becomes the owner of an independent part and has its own separate entrance.

If none of the heirs has a priority right to inherit the car, then each of the heirs is entitled to an equal share of the car.

They must agree among themselves about the fate of the vehicle, but if any disputes arise, they can be resolved through court.

Questions and answers

- Tell me, how can I divide two houses and two plots of land into three heirs?

The best option would be to divide the inheritance with the consent of all heirs, but if it is not possible to achieve an option that suits everyone, then the disputes that arise can be resolved in court.

- My husband died suddenly, naturally, without having time to write a will, tell me, can his stepbrother receive part of his property or not?

You don’t have to worry, he cannot claim your husband’s property, since the wife, parents and children of the deceased have priority rights to the property.

- My husband died suddenly, he never wrote a will, how can I arrange an inheritance?

To register an inheritance, you need to take your passport, a document confirming death and come to a notary who works at the place of residence of the deceased. The notary office will give you a list of necessary documents and tell you exactly how to proceed.

- After the death of the husband, there was a bank account left, but there was no will, how exactly to enter into the right of inheritance?

You need to contact a notary at your place of residence and after the expiration of the period provided by law, you will need to accept the inheritance and the bank account will be at your disposal.

- After his husband passed away, he was left with two cars; he did not have time to leave a will. Tell me, how is it divided between his wife and two adult children?

In this case, it is best for you to agree among yourself about the fate of these cars. According to the law, you are all heirs of the first order and therefore have the right to equal shares of the inheritance.

How to register an inheritance will be discussed in the next video.

If it is not possible to reach an agreement among ourselves, then the disputes that arise can be resolved in court, which will determine the future fate of these vehicles.

What do people who have tested it think about the Audi Q5?

Sources: zavereno.com, nam-pokursu.ru, biznes-delo.ru, semya.guru, lyubimaya-moya.ru

The following consultations:

No comments yet!

Today the court will consider an appeal against the verdict of Yu. Lutsenko

Benefits to museums in St. Petersburg

Social benefits guarantee

Popular articles

Latest Published

- How to correctly write a report against a neighbor for littering

- How to write an application to a kindergarten for a child’s leave

- How to write an application to the garden for allergies

- How to write an application for maternity leave

Interesting:

The absence of an agreement is not a basis for refusal to deduct VAT

How to enter into an inheritance after death if many years have passed

Moskvich social card benefits

Costs and difficulties

When registering inheritance rights, an applicant for a house with a land plot incurs mandatory and secondary costs.

These costs include:

- State duty for inheritance law;

- State duty for registration of an inherited plot with a house in ownership (2 thousand rubles);

- Payment for land surveying and production of a cadastral passport;

- Payment to independent appraisers and other expenses.

The amount of the state duty paid when opening an inheritance case depends on which queue the heirs belong to. According to Art. 333.24 of the Tax Code of the Russian Federation, the amount of the duty for heirs of the first and second priority is 0.3 percent of the value of the plot of land with a house, assessed by experts before submitting the application to the notary, but cannot exceed one hundred thousand rubles.

The fee for the third and subsequent stages of heirs is 0.6 percent of the value of the inherited property, but not more than one million rubles.

According to Art. 333.38 of the Tax Code of the Russian Federation, an applicant for an inheritance is exempt from paying inheritance duty in the following cases:

- The applicant registers an inheritance in favor of local authorities;

- The applicant lived with the testator for the last year of his life and plans to live in this living space in the future;

- The testator died in the performance of official duty or civic duty to save the dead;

- The testator is recognized as a victim of political repression;

- The inheritance is claimed by a minor through legal representatives;

- The applicant is under guardianship due to mental illness;

- The testator is a military man or an employee of the Ministry of Internal Affairs who died for reasons related to his service.

Disabled people of the first and second groups must pay half the calculated cost of the state duty.

It must be remembered that with the acceptance of the land plot and the house into ownership, the heir also accepts all existing encumbrances on this property, in accordance with Art. 1175 of the Civil Code of the Russian Federation. Such encumbrances may include debt for land tax, utility bills, etc.

What to do if your application for lease of land is refused? Find out in our material! You will learn how to allocate a share in our feature article. How to take the extract you need from the house register, you will read in our material at the link.

How to confirm the right to inherited property?

It is possible to register a plot of land on which there are no permanent structures and have not previously erected them by inheritance only if this plot of land previously belonged to the deceased owner and was registered in his name on the following grounds:

- ownership;

- lifelong inheritable ownership.

The will must be drawn up by the testator personally in a notary's office, where it is kept until the opening of the inheritance. Accordingly, you need to contact this notary office. As a rule, the testator informs in advance about the preparation of a will in favor of the heir, when it is executed.

https://www.youtube.com/watch?v=ytadvertiseru

If an interested person assumes that a will has been drawn up in his favor, but does not have reliable information about such a procedure, then contact the notary office at the place of last registration of the deceased.

IMPORTANT: A will can be canceled or rewritten, so the last copy of it comes into force.

To open an inheritance case in the presence of a will, you will need the following documentation:

- death certificate;

- certificate of last place of residence;

- will;

- the applicant's civil passport.

After the will is discovered, the inheritance is recognized, and then the procedure is as follows: the notary issues a certificate to the successor, on the basis of which he registers ownership of the land plot in his name. Since, when drawing up a will, the deceased presented the notary with a title document and an extract from the Unified State Register or a certificate of ownership, then it remains to additionally present:

- cadastral certificate about the cadastral value of the plot;

- or a certificate from the BTI on the inventory value, another certificate on the valuation of the property;

- cadastral certificate confirming that there is no lien or seizure.

Notarization of the transfer of property rights is a paid service. For technical work on conducting a hereditary case and preparing documentation in the regions, different amounts are charged, established by notaries.

The state duty is a fixed amount determined by Article 333.24 of the Tax Code of the Russian Federation; it will be within 0.6% of the cost of the loan, but not higher than 1,000,000 rubles. It is calculated based on the assessment information provided. Benefits are provided for close relatives.

In its absence

If a will has not been written, then to open an inheritance you should contact the notary office at the place of last residence of the testator. In this case, the real rights of the deceased pass to relatives who are close to the testator in ascending and descending lines of kinship.

Their inheritance rights, as well as in the case of the presence of a will, are determined in the context of the provisions of Article 1111 of the Civil Code of the Russian Federation and comply with the conditions set out in Article 1116 of the Civil Code of the Russian Federation. The list of documents here is as follows:

- death certificate;

- certificate of last place of residence;

- relatives' passports;

- documents confirming relationship with the deceased.

ATTENTION: Only relatives of the same line of kinship, indicated in Articles 1142-1145 of the Civil Code of the Russian Federation, can participate in the inheritance procedure.

To issue a certificate of inheritance by law in the order of priority of participants, you will need to submit:

- title document for the land plot;

- certificate of ownership or extract from the Unified State Register;

- certificate of the cost of the plot;

- cadastral certificate confirming the absence of a permanent structure;

- certificate of absence of arrest and collateral.

After six months, if no inheritance dispute arises, a certificate of inheritance will be issued. The cost of the technical work is similar to that paid under the will.

The state duty will be the same amount that is paid by the heir when receiving land under a will. The exception is for persons belonging to the first stage, specified in Article 1142 of the Civil Code of the Russian Federation, who pay 0.3% of the cost, according to the submitted assessment document. But the accrued amount for this category should not exceed 100,000 rubles.

We talked about the nuances of inheriting ownership of a land share by law and by will in a separate article.

The procedure for inheriting a land plot itself is not subject to tax in accordance with the norms of paragraph 18 of Article 217 of the Tax Code of the Russian Federation, with the exception of payment of the state duty, which is a notary tax fee. After registration of ownership of the land, the successor of the deceased testator will begin to pay land tax in accordance with the norms established by the tax legislation for the resulting category of land.

The right of ownership of real estate by inheritance allows the owner to fully dispose of the property, as well as:

- prove your right if disputes and attacks on the inheritance of third parties arise;

- sell and exchange residential space officially, with full compliance with all laws and registration of the transaction;

- register a spouse, as well as children and distant relatives in the apartment;

- bequeath property legally.

Late registration of property rights deprives the owner of this privilege. For subsequent registration, you need to go to court, prove ownership, wait for a court order, and only then register the property.

The statement of claim must indicate the reasons why the relative actually accepted the inheritance, but did not register it as property.

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

Extenuating circumstances for the court may be:

- business trip abroad for a long period of time;

- illness of the heir;

- significant change in family circumstances;

- living in another city;

- unreasoned refusal of registration by an employee of Rosreesra.

To confirm the right to inherited property, you must provide the court with a package of documents:

- statement of claim demanding recognition of the heir;

- plaintiff's passport;

- death certificate of the testator;

- a document confirming first-degree relationship;

- surviving documents of the testator for the immovable property;

- will (if any);

- receipt for payment of state duty (350 rubles).

In addition, the heir needs to remember that there are first-priorities who have the right to claim a share in the property, even if the persons are not indicated in the will. These citizens include:

- spouse, parents, children who are disabled people of groups 1 - 2 or are pensioners by age;

- disabled dependents who are on the lifelong support of the testator;

- a child who was born after the death of the father;

- minor heirs of the first stage.

Process

Notaries handle inheritance cases in the Russian Federation. To enter into rights, the heirs must contact the notary at the place of residence of the testator.

There are two design options:

- in law;

- by will.

In the first case, it will be enough to confirm your relationship when contacting a notary with the help of relevant documents, for example, a birth or marriage certificate. In the second option, the testator’s will, drawn up during his lifetime, will be a direct document giving the right to receive property.

The list of required documents will differ depending on whether the heir takes ownership by will or by law; we compare them in the following table.

| Document | Necessity for registration | |

| In law | By will | |

| Confirmation of the death of the testator (certificate or court decision) | Yes | |

| The heir's passport or other document confirming his identity | Yes | |

| Will with a notary's note indicating no changes or cancellation | No | Yes |

| Documentary evidence of the relationship between the heir and the testator | Yes | No |

| Sheet for deregistration of the testator due to death | Yes | |

Important! You must contact a notary to enter into inheritance rights within six months from the date of death of the testator. If the deadline is missed, then you will have to prove the right to accept the inheritance through the court.