DDU and housing cooperative: difference in contracts, pros and cons for the buyer

Buyers of real estate in new buildings are often faced with a choice - what to buy, an apartment for a special education or a housing cooperative. For those ignorant of the topic of primary real estate, it may seem that these are just different ways of completing a transaction - in fact. The first option seems more secure for the shareholder, the second – more profitable. Let's figure out what the difference is.

What is the difference between preschool and housing cooperative?

Important! Please keep in mind that:

- Each case is unique and individual.

- A thorough study of the issue does not always guarantee a positive outcome. It depends on many factors.

To get the most detailed advice on your issue, you just need to choose any of the options offered:

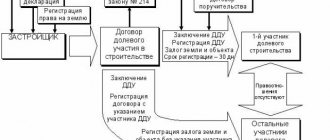

The differences between housing cooperatives and housing cooperatives lie in the legal plane. Thus, work with shared participation agreements is regulated by Federal Law-214 “On shared participation in the construction of apartment buildings...”, and work with housing construction cooperatives is regulated by Federal Law-215 “Law on Housing Construction Cooperatives”. In addition, to understand the work of housing cooperatives, we recommend studying section five of the Housing Code of the Russian Federation before purchasing.

- Equity Participation Agreements (EPA) are a scheme in which future apartments in new buildings are sold through the registration of a document with the Rosreestr authorities. When you register the agreement, you become an investor in shared construction, a shareholder.

- Housing-construction cooperative (HCC) agreements are a scheme for the sale of square meters that have not yet been built using so-called shares, or share contributions. In fact, we are talking about joining a community of people who are going to build a residential building. When you enter into an agreement with a housing cooperative, you become a member of the housing cooperative, or a shareholder.

| Participation agreement under 214 Federal Law | Agreement with housing cooperative under Federal Law 215 |

| Registration of residential property in Rosreestr - this eliminates the double sale of apartments | The contract for taking ownership of the apartment is registered in Rosreestr - after the construction of the house. Therefore, there is a possibility of falling for the tricks of scammers and buying an apartment that has already been sold to someone - the so-called “double sales”. |

| The full cost of the purchased property must be stated. She cannot change legally. There is a loophole - the developer may offer to conclude an additional agreement, but you are not required to agree, and the developer will have to give you the apartment for the amount specified in the agreement. Or - terminate the contract and return the money plus pay a penalty. | The chairman of the housing cooperative, in agreement with the members of the cooperative, can increase the price of the apartment at any time. The reasons are the rise in price of building materials or other circumstances that led to the impossibility of building a house for the original amount. You need to carefully study the agreement that you entered into - a respectable developer will include a clause banning increases, but Federal Law 215 does not regulate the impossibility of increasing the amount. |

| There is an exact date of construction. The developer has an insurance period of two months from this date, which, judging by judicial practice, is given to resolve paperwork problems with delivery. Delay - a penalty will be collected in favor of the shareholder, if you wish. Again, the period is increased by an additional agreement, but you are not required to sign it | There is no clear deadline or punishment for increasing the construction period in the law. |

| Installment payments are possible until construction is completed | The law regulates the provision of installment plans for a period longer than after the completion of the house. You need to look at each contract with housing cooperatives separately |

There are still a lot of controversial issues that may influence the choice of a shareholder between a pre-employment building and a housing cooperative. What's better? Let's look at each scheme in more detail.

Advantages and disadvantages

In order to choose between a residential building or a housing cooperative, a future investor needs to understand the main differences in the rights and responsibilities of one or another form of interaction with a developer. Especially after January 1, 2017, when significant changes were made to 214-FZ.

DDU

If we consider buying an apartment under 214FZ and choosing a housing cooperative or a residential building, then the answer to the question of which is better can be given as follows:

Pros of buying by DD:

- There are permitting documents, there is a project declaration - all this is spelled out in the contract.

- The contract specifies the cost; it will not increase during the process. And you don’t care about the problems of builders who suffer from rising prices for mortar.

- The house will not suddenly become several floors larger

- The house will not have extensions and other strange buildings that were not in the advertising brochures

- A transparent scheme for terminating the contract and paying compensation for losses to shareholders

- There are clear terms of the developer’s warranty for different types of work

Unfortunately, there are also disadvantages:

- The cost is usually higher. And in new facilities it will increase by another 1-1.5%. After all, the law introduced the creation of a compensation fund, which will be formed from contributions from builders from each apartment sold. Naturally, these costs will be added to the price of the property.

- The process of registering a contract is quite long.

- The prescribed grounds for terminating the contract - if they are not followed, it is quite difficult to terminate the contract and return all the money

- There are problems with obtaining installment plans from the developer, which means that the price of the property will increase significantly due to obtaining a mortgage, if necessary.

Housing cooperative

The scheme for purchasing an apartment from a housing cooperative also has its pros and cons:

- The positive thing is that there are good discounts on not very popular apartments

- The price differs from DDU on a smaller side due to a small number of additional fees

- De jure, the shareholder takes part in housing cooperative meetings and decides how the house will be built

Negative points:

- You will have to pay an additional fee for joining the housing cooperative - usually 1-3% of the cost of the apartment

- There is a danger of double sales

- In fact, the shareholder has fewer rights to housing than the buyer under the DD

- You cannot resell an apartment to anyone, even by assignment. The buyer will have to join the housing cooperative

- There is a risk of an increase in apartment prices

- There is no responsibility of the developer for failure to meet deadlines

Important! You purchased an apartment under a shared participation agreement, the house has been completed and you are planning a new renovation. But before obtaining ownership of the property, the developer carries out mandatory measurements of your apartment with the help of BTI employees.

And it turns out that the housing is actually larger. The developer offers you to pay for additional meters.

Now the authorities are preparing changes to the law that will regulate this process in favor of the shareholder, but until they come into effect, you have several options for interacting with the developer:

- You can simply refuse to receive a certificate for the apartment and demand money and a penalty

- You can pay the difference and receive a penalty

- You can find flaws in construction and demand from the developer a discount on the amount of the difference (the most popular option in practice)

In the case of housing cooperatives, you will have to pay for additional meters.

Management agreements and agreements with housing cooperatives

When concluding an equity participation agreement (), pay attention to some of its mandatory clauses:

- All details of the developer's company must be indicated. Check whether the company actually exists using online tax identification number verification services. Read the company's charter, find out the size of the authorized capital and founders

- The DDU should be called that way, and not “investment agreement” or “preliminary equity participation agreement”

- In a residential building, unlike a housing cooperative, there should be information about delivery dates up to a month - that is, for example, “before November 2020”

- The contract contains all the characteristics of the property - its number of floors, the area of the house, the area of your apartment

- Developer's warranty obligations - terms

- Amount in numbers and words

In the contract with the housing cooperative (), you need to check the following information:

- Study the shareholder's risks in the event of a construction failure. The contract must stipulate what will happen if it is impossible to transfer the apartments

- Study the details of the housing cooperative, check what exactly this housing cooperative and its members built

- The contract must indicate the number of floors and area of your apartment

- Check whether there is a process of financial recovery of the company and whether there are prerequisites for the final bankruptcy of this housing cooperative

- Find out how many housing cooperatives the chairman of the company has - it often happens that one person starts the construction of several objects, and after construction they freeze until better times

- Please note whether the algorithm for increasing the cost per square meter is prescribed - this must be possible only by decision of the general meeting

- How much will be withheld each month for the functioning of the housing cooperative itself - similar to the article for the maintenance of housing in management companies

- Study the data on the land plot specified in the contract - its cadastral number, ownership, ownership, legal relations. Often problems for housing cooperatives begin precisely because of the land.

- You also need to find out more about the building permit from this particular housing cooperative and on this particular land. If permission is not received, it is better not to enter into an agreement with this housing cooperative

Transition from housing cooperative to residential building and vice versa

We can say that in modern Russia, housing construction processes are aimed at reducing the number of housing cooperatives at the expense of large developers. An agreement with housing cooperatives and housing cooperatives is the subject of in-depth study of not only legal subtleties, but also the reputation of the developer.

- Also, over the last few years there has been a tendency, especially in large regional centers, for large developers to completely switch to housing cooperative agreements. In fact, this is due to a decrease in the level of responsibility of the developer for the entire construction as a whole - after all, in the case of a housing cooperative, the developer is responsible for only one house. This legal form has its own current account, its own authorized capital and very little money to return to shareholders. Therefore, in the case of housing cooperatives there are actually many risks.

- There are also situations where the process of transition from housing cooperatives to residential buildings occurs. This is a fairly pleasant process for the shareholder - by becoming a shareholder, he has more rights. Legally, this process is a simple termination of an agreement with one organization and the conclusion of a new agreement with another, often with a tripartite agreement on the obligation to conclude this agreement.

The transition from residential building to housing cooperative usually occurs in a situation where the developer goes bankrupt or otherwise terminates its activities. In such a situation, laws adopted in each region often come into force related to improving the general situation with defrauded shareholders.

Thus, at a meeting in the regional executive body, shareholders will be offered to independently organize a housing construction cooperative and begin to complete the construction of the house.

In such a situation, the new housing cooperative will be given the property of the previous developer and given land or other opportunities for completion.

But even with the help of the authorities, shareholders will often still have to contribute significant funds to complete the construction of the property.

Still have questions on the topic Ask a lawyer

Source: https://viplawyer.ru/osobennosti-i-otlichiya-ddu-i-zhsk/

What is the difference between buying an apartment in a new building under the DDU, housing cooperative and gray schemes?

The safest scheme for purchasing apartments in new buildings is signing a DDU, or equity participation agreement.

The norm, which is regulated by Federal Law No. 214, protects the buyer from double sales and gives a better chance of getting a profitable mortgage.

However, you can buy an apartment in Moscow using DDU only in 60% of new buildings. What sales schemes do other developers use? And why do they choose them?

The funds of the shareholders are directed to a specific object, permitting documents guarantee that the construction is legal and that the project has passed all approvals and examinations. But issuing a building permit is a complex and often delayed process, so many companies prefer to open housing sales without yet receiving the document.

In addition, the DDU to some extent “ties the hands” of development companies, and this situation is not suitable for everyone.

| Not everyone is ready to switch to working under 214-FZ, because this is an additional responsibility of the developer to the shareholders, since the buyer can terminate the contract at any time if the deadlines are not met. The developer must be as open as possible and must report regularly, which does not suit everyone. Alexey Kharitonov, YIT City Stroy |

In addition, each equity participation agreement must be registered with Rosreestr. And this procedure also takes time. As a result, the shareholder’s money gets stuck on the way to the developer, who is forced to look for other sources of construction financing. Therefore, companies resort to other sales schemes.

DDU: the developer’s liability is regulated

DDU is a scheme that best protects the rights of the buyer. Sales by DDU confirm that the project has been approved by all authorities. If the developer fails to complete the task, the shareholder can terminate the contract and claim a refund and a penalty.

Pros: mandatory state registration. Guaranteed protection against double sales. Opportunity to take out a profitable mortgage (banks regard new buildings with sales under DDU as low-risk objects and are willing to lend to them).

Cons: you cannot arrange installment plans for the period after construction is completed. DDU does not guarantee that the project will be completed. Such an agreement does not protect against violation of construction deadlines.

| DDU is not able to protect the buyer, for example, from surcharges for “extra meters” that appeared during the construction process, poor quality of the apartment recorded during the acceptance of work, as well as failures in construction deadlines, which the developer has the right to shift an unlimited number of times, having warned the shareholder in advance. Alexey Kharitonov |

Housing cooperative: more freedom - less guarantees

Another legitimate scheme for the sale of apartments, provided for by 214-FZ. About 5-6% of new buildings in Moscow and the Moscow region are sold through housing cooperatives. The scheme is popular with large developers (PIK Group, Vedis Group) and has proven its viability in the real estate market.

Pros: the register of shareholders protects against double sales. Possibility of long-term installments (even after putting the house into operation). The ability to influence the progress of construction (for example, to complete a house on your own in the event of bankruptcy of the developer).

Cons: the agreement is not subject to state registration. Ownership is registered only after full payment of the share. Compliance with construction deadlines is not monitored. The developer cannot be held liable in case of violation of agreements.

| The disadvantage of the scheme is the lack of liability of the housing cooperative for violation of the deadlines for commissioning and transfer of the facility to the shareholder. And if the house is not completed due to insufficient funding, the buyer will only be able to make a claim against the housing cooperative. This means that he himself, as a member of the housing cooperative, will have to additionally finance the construction. Konstantin Plyukhin, Est-a-Tet |

Certificates: almost never used

The developer issues securities (certificates), the denomination of each of which corresponds to the price of the apartment. The developer undertakes to transfer the apartment to the certificate holder later.

Pros: the developer must register the title to the land and obtain a building permit. The state controls the activities of the developer as a participant in the financial market.

Disadvantages: in general, it is inconvenient for both the developer and the buyer, so the scheme is used extremely rarely.

Gray schemes for selling housing

They are used along with legal sales mechanisms. The most popular is the conclusion of a preliminary purchase and sale agreement. This in itself is not a violation of the law, but it has nothing to do with legitimate real estate sales schemes.

The rights of the buyer in this situation are not protected at all, since the preliminary agreement only records the intentions of both parties, but does not oblige them to carry out what is planned. That is, such an agreement does not oblige the developer to transfer the housing into ownership of the buyer.

In case of unfinished construction, the buyer will only be able to return the security deposit.

Neither the preliminary purchase and sale agreement (PDPA) nor the so-called preliminary DDU actually have anything to do with 214-FZ and are not registered with the Registration Chamber. And at the same time, no one can stop an unscrupulous developer from selling one apartment several times.

| The conclusion of preliminary agreements allows you to attract money from shareholders and begin construction already at the stage of developing project documentation. This does not comply with the requirements of 214-FZ and is very risky, but both shareholders and the developer agree to this: the shareholder buys real estate at the best price, and the developer gets the opportunity to start work. Irina Dobrokhotova, BEST-Novostroy |

Realtors' opinion

Real estate agencies prefer to sell those new buildings that are sold under 214-FZ. The optimal option for Moscow realtors is the DDU, because this scheme is transparent, understandable to the buyer and clearly regulated by law.

It is the easiest for agencies to work with. Also among the favorites are sales through housing cooperatives.

Although in the case of cooperatives, developers themselves become sales organizers and most often sell apartments on their own, without the involvement of real estate agencies.

But the realtors themselves clarify that in the end, when deciding whether to work with a developer or not, not only the scheme for selling apartments is important, but also the agency’s margin, the portfolio of projects for sale, and exclusive rights to sell.

Publication date October 28, 2013

An equity participation agreement (DPA) implies that the customer invests his own money and has the right to subsequently demand an apartment from the developer in the amount of paid square meters.

Concluding an agreement with a housing construction cooperative (HBC) is a more risky method, since the money contributed is a share payment for membership in this cooperative and does not guarantee the receipt of an apartment in it as a result of the completion of construction.

Agreements with housing cooperatives or public housing cooperatives have the only similarity - the desire of the citizens who signed them to obtain ownership of an apartment.

We invite you to familiarize yourself with the Notarized Fund Loan Agreement

Shareholder versus shareholder. Housing cooperatives, housing cooperatives, preschool institutions - what to choose?

September 18 at 20:01 2737 Olga Ermakova

In order to buy cheaper housing, people are willing to take risks. Of course, we will not discuss dubious schemes for purchasing real estate; we will talk about options within the framework of the law. Housing cooperatives, housing cooperatives - how does it work? Where should a buyer go - to a cooperative or to an ordinary developer? N&C magazine will look at the pros and cons with the help of experts.

People buy units here, not meters...

Any construction company operating within the framework of the law, that is, in accordance with 214-FZ, has the right to raise funds for the implementation of the project under an equity participation agreement (DPA), as well as through housing cooperatives and housing cooperatives - housing construction or housing savings cooperatives. The first one is known to us more, the second one less. “In general, the mechanisms of housing cooperatives and housing cooperatives are similar, since in these schemes the buyer purchases shares, not square meters,” explains Pavel Lepish, General Director of Glavmosstroy-Nedvizhimost OJSC.

Registration of ownership of housing in a housing cooperative occurs only after the cost of the share has been paid in full. A buyer can live in his apartment for years, but still not be able to sell it, donate it or exchange it.

What's the difference then? Firstly, shareholders unite according to different principles. “The housing cooperative is aimed at the participation of citizens in the construction of real estate. Such a cooperative is the direct developer of the house, and it owns the land, says Vladimir Zimokhin, deputy head of the legal department.

“ZhNK are created to acquire real estate or participate in its construction, but by concluding agreements with developers.”

That is, savings cooperatives are not intended for construction, but for the acquisition (investment), reconstruction and further maintenance of an already completed or under construction apartment building, clarifies Sofya Lebedeva, general director.

And although, according to the expert, the legal regulation of the activities of both types of cooperatives is generally identical, there are some differences. For example, to create a housing cooperative, at least 50 people are needed, while for a housing cooperative, five are enough; Only individuals can be members of housing cooperatives, and members of housing cooperatives can be both individuals and legal entities.

Cooperatives also differ according to some other characteristics, which are mentioned by Vartan Poghosyan, director of the marketing department of TEKTA GROUP. Thus, a housing cooperative is created for the construction of a specific house, and therefore the number of participants in it does not exceed the number of apartments, and a housing cooperative can include up to 5 thousand shareholders.

If a housing cooperative has the right to take out a loan from a bank as a legal entity and all members of the cooperative will pay for it, then the housing cooperative actually uses the financial pyramid method: the apartments of those who joined earlier are paid for from the contributions of recently joined participants.

In other words, there is a queue in which you can stand for several years.

Housing cooperative: join and build

RICE. T. SOROKINA

Of course, the housing cooperative scheme is better known, convenient and understandable to both citizens and developers. According to Elizaveta Nekrasova, general director of the luxury real estate bureau Must Have, before the introduction of Federal Law-214, housing cooperatives were especially popular.

It was more profitable to pay off the cost of the share over many years than to take out a mortgage loan at high interest rates. Another advantage of the housing cooperative is that you can become a member at the age of 16 (no bank will issue a mortgage to a borrower of this age).

However, housing cooperatives also have many disadvantages. “All members of the cooperative are responsible for the risks associated with construction,” warns P. Lepish.

The shareholder is completely dependent on the charter. Neither the Housing Code of the Russian Federation nor other regulations state that the housing cooperative is obliged to fix the cost of the apartment, that is, the final price can be increased at any time by decision of the general meeting.

Cooperative members regularly pay membership fees.

“In addition, the charter may provide for other obligations and encumbrances: for example, personal participation in construction in the amount of 1000 working hours,” notes Vera Bogucharova, deputy head of the Legal Department of Est-a-Tet.

To join a housing cooperative, a passport and work book are enough; you do not need to confirm your income.

Registration of ownership of housing in a housing cooperative occurs only after the cost of the share has been paid in full. As E. Nekrasova says, a buyer can live in his apartment for years, but still not be able to sell it, donate it or exchange it. At the same time, it is possible to pay the share ahead of schedule only if this is provided for by the Charter of the housing cooperative.

Another danger is that a shareholder has the right to be excluded from the cooperative even without giving reasons, and this does not contradict current legislation.

The housing cooperative is not obliged to stipulate in the contract the exact date for putting the house into operation, so buyers can only trust in the professionalism and integrity of the board. In case of delay in completion of construction, shareholders cannot claim compensation for losses or penalties.

Housing cooperatives cannot be forced to eliminate identified shortcomings and defects, unlike a developer working under an equity participation agreement. The agreement between the shareholder and the housing cooperative is not subject to mandatory registration, which provides ample opportunities for fraud.

“The document is not registered in Rosreestr, which means double sales are possible when several people become the owners of one apartment,” warns V. Pogosyan.

OPINION

Maria Litinetskaya, General Director:

“I don’t think it will be possible to spread the practice of building cooperative housing everywhere. Still, this scheme is difficult and risky for ordinary citizens precisely from the point of view of organizing construction. Firstly, you must have certain knowledge and experience.

Secondly, there are quite a lot of cooperative participants, which significantly complicates the decision-making process. Thirdly, even if members of a housing cooperative independently hire a contractor, it must be constantly monitored.

It turns out that only by purchasing an apartment from a well-known developer, an ordinary buyer can calmly wait for the completion of construction, which cannot be said about a person who has joined a cooperative.”

ZhNK: save and buy

RICE. T. SOROKINA

Maria Litinetskaya, general director, explains the principle of operation of the housing and savings cooperative: “HNCs attract funds from citizens, and then invest them in the purchase of apartments both on the primary and secondary markets.

The shareholder accumulates a certain percentage of the cost of housing by making payments, after which the cooperative purchases an apartment for him. From this moment on, a member of the housing cooperative has the right to use the premises, but it remains the property of the cooperative.

Next, the shareholder pays off the remaining cost of housing, continuing to make payments. Only after this the property becomes his property.”

The activities of the cooperative are regulated by Federal Law-215, which describes in detail the interaction between the cooperative itself and its members. By law, all funds contributed by shareholders are kept in a separate account.

Accordingly, all transactions with depositors’ funds can be controlled.

The most important advantage of housing mortgages is that purchasing housing under this scheme is approximately half the cost of a classic mortgage.

In ZhNK, the method of a financial pyramid is actually used: apartments of previously joined members of the cooperative are paid for from incoming contributions from recently joined members.

However, there are also disadvantages, warns M. Litinetskaya. Firstly, you will have to wait - according to the law, the right to purchase residential premises arises only after two years of membership in the housing cooperative.

Secondly, in the event of bankruptcy of the cooperative, a shareholder at the accumulation stage risks losing all his housing savings (or being left without housing if it was purchased).

In addition, a person can easily be expelled from the housing cooperative if his actions contradict the charter. At the same time, the procedure for leaving the cooperative itself is complex and lengthy.

Pavel Lepish considers the housing cooperative scheme quite risky, since apartments for which shares have not been fully paid are the property of the cooperative, and it is liable for its obligations with all its property.

“The activities of housing cooperatives are regulated by several laws and controlled by government agencies, but this adds red tape rather than reliability, especially when selling and registering apartments,” the expert notes.

OPINION

Pavel Lepish, General Director of OJSC Glavmosstroy-Nedvizhimost:

“At various stages of construction, several schemes for formalizing the relationship between the developer and the buyer are recognized as legitimate. The most reliable and most popular is an equity participation agreement in accordance with Federal Law-214. Housing cooperatives, in which share purchase agreements are concluded, are also quite common.

However, when completing such a transaction, you should carefully study the documents of the cooperative: it must either be the owner of the site or be created before November 30, 2011 (the date of adoption of the relevant amendments to 214-FZ).

They do not contradict the law, but housing and housing certificates are gradually disappearing from the market.”

DDU: still out of competition?

RICE. T. SOROKINA

So, the main advantage of both “cooperative” schemes is that housing can be purchased cheaper through them. According to V.

Poghosyan, members of housing cooperatives receive money for purchases in interest-free installments, and members of housing cooperatives, acting as construction customers, purchase housing actually at cost (12–15% lower than the commercial price).

In addition, cooperatives are loyal in terms of checking documents and the solvency of members: a passport and work book are enough to join; there is no need to confirm income.

However, from this point on, the optimism in our story will diminish. There are numerous buts that experts mention.

For example, Philip Tretyakov, CEO of Galaxy Realty, warns: “If a developer sells apartments in new buildings not under equity participation agreements, then most likely he has problems with the property. And housing cooperatives and housing cooperatives are mechanisms that developers usually use to avoid precarious housing obligations.

In addition, if you look at the majority of projects in which real estate was sold according to different schemes, you will see that where transactions were carried out under DDU, the volumes have already been sold, but sales through housing cooperatives are still ongoing.”

Today, the scheme for concluding a contractual agreement in construction is the most reliable. Perhaps the only case when buyers under a DDU can seriously suffer is the bankruptcy of the developer. However, even in such a situation, shareholders are protected by law.

The main disadvantage of cooperatives is that in this case the buyer is less protected than when concluding a cooperative agreement and purchasing housing with a mortgage.

Federal Law No. 214, which establishes the rights and obligations of the parties when signing the DDU, requires that the deadline for the transfer of the property by the developer be indicated in the document, in addition, the price, terms and payment procedure must be strictly fixed.

There is nothing of the kind in the agreement concluded with the cooperative. “There are no guarantees that a person will receive his housing on time,” says V. Poghosyan.

According to M. Litinetskaya, today the scheme for concluding a contractual agreement in construction is the most reliable. Perhaps the only case when buyers under a DDU can seriously suffer is the bankruptcy of the developer. However, even in such a situation, shareholders are protected by law: they can still either return the invested funds (or at least part of them) or get an apartment.

Source: https://dmrealty.ru/rubrics/kvartira/payshchik-protiv-dolshchika-zhsk-zhnk-ddu-chto-vybrat/

Key points in contracts

Before signing a contract for shared construction of a residential building, it is important that:

- the form contained all the information about the developer, which is better to check;

- the agreement was called solely “Equity Participation Agreement”;

- it stated the month and year of delivery of the object;

- the text of the document contained details characterizing the construction project: the number of floors, the area occupied by the building, the total and residential footage of the apartment;

- a clause was provided defining the developer’s warranty obligations;

- the amount of the agreement was indicated not only in numbers, but also in words.

Both the contract that is signed with the housing construction cooperative and the cooperative itself should be carefully studied. Important information is:

- its details, which will help you find out about other controlled objects, the results of the cooperative’s work and its participants directly;

- the number of objects that the chairman manages simultaneously: the more there are, the higher the risks;

- the cooperative is in a state of financial recovery or on the verge of bankruptcy;

- whether he has permission to carry out construction work on this territory;

- complete information about the land plot for construction;

- preemptive right of the general meeting of votes on the issue of increasing the cost of 1 m2;

- characteristics of the object: number of floors, square footage of the apartment;

- the amount of the monthly contribution for the maintenance of the cooperative;

- consequences for the shareholder if construction is not completed.

At any stage, a transition from a share agreement to a share agreement is possible, the main reason for which, in most cases, is the bankruptcy of the developer company. Leaving the cooperative and concluding a DDU for the same object is extremely rare.

Tags: contract, main, feature, difference, represent, yourself

« Previous entry

Ddu or housing complex

Ddu or housing complex

: if you have ever thought about what new buildings to invest in, this question has probably arisen before you. Nowadays, an apartment in a new building can be bought either through participation in shared construction or through membership in a housing construction cooperative as shareholders.

DDU or housing cooperative - both of these schemes for investing money in a new building are legal, but the laws that regulate the relationship between the developer’s shareholder and the relationship between the shareholders of the housing cooperative are different. Therefore, what to choose: DDU or housing complex

– this is not an idle question.

Any developer who is going to raise funds for the construction and sale of apartments works through the DDU or housing cooperative

.

DDU is an agreement for shared participation in construction

.

According to it, the developer undertakes to build an apartment building within a certain period of time, put it into operation and transfer the apartments to shareholders, those citizens who invested money in the construction. An agreement on shared participation in construction is required to be registered.

Housing cooperative is a housing construction cooperative - a community of citizens that manages the construction of a house and collects funds for this construction. The housing cooperative agreement does not have to be registered with the Federal Reserve System.

To choose a preschool or housing complex

, you need to know the main differences between these agreements.

Differences between a DDU agreement and a housing cooperative agreement

Differences between preschool and housing cooperatives

There are five main differences between DDU and housing cooperatives:

- State registration of the DDU agreement is mandatory. State registration of an agreement with a housing cooperative

is optional. - The cost of building a residential building or housing complex

varies. According to the DDU agreement, the cost of building an apartment is fixed. It is fixed in the contract and the developer cannot unilaterally change the price of the apartment for the shareholder. The cost of an apartment in a housing cooperative may change, and, alas, upward. According to the housing cooperative agreement, the developer or housing cooperative has the right to unilaterally change the price of the apartment if the developer incurs additional costs. - The construction period under the DDU agreement is specified in the agreement. If the developer does not put the house into operation by the time specified in the contract, the shareholder has the right to collect a penalty from the developer, terminate the agreement for shared participation in construction, and receive back all the money invested in the construction. The construction period is specified in the housing cooperative agreement. But, if the construction deadline is postponed, the shareholder most likely will not be able to recover money from the developer in court. At the very least, we can say for sure that without a real estate lawyer

who specializes in

litigation with housing cooperatives

, the shareholder will definitely not be able to collect a penalty for missed construction deadlines. - Installment payments for the construction of preschool facilities are possible. Installment payment for construction in housing cooperatives is also possible, and even more, it can be issued for a long period. Interest on installment plans for shareholders is indicated in the agreement and is directly regulated by the charter of the housing cooperative.

- Termination of the DDU

is possible, and the shareholder will receive back all the amounts invested in the construction. Termination of the contract with the housing cooperative will result in the return of only part of the invested funds for shareholders. Shareholders should carefully read the charter of the cooperative and the housing cooperative agreement before investing money in construction. These two documents indicate that upon termination of the contract with the housing cooperative, shareholders will not be returned part of the contributions or the entrance fee, or some other conditions are specified: recovery from the shareholder for the terminated contract.

DDU or housing cooperative: pros and cons

DDU or housing cooperative: pros and cons

To summarize, participation in construction under a DDU agreement has a number of good opportunities for the shareholder:

DDU capabilities

- The developer's documents are checked and approved at the state level. The buyer of an apartment in a new building under the DDU is protected by law in the sense that the housing will not be secondary, exactly what is specified in the contract, in the project documentation.

- The cost of the apartment under the DDU agreement will not be changed by the developer without agreement with the shareholder. That is, if the shareholder does not agree to increase the price of the apartment, it will remain the same.

- The shareholder under the DDU has a guarantee for the quality of the housing constructed, a construction period has been determined, and there is an opportunity to collect a penalty.

Risks of the shareholder

- When registering an apartment, there may be red tape in the documents.

- The reasons for termination of the contract are described in it, and do not provide for termination of the contract at the initiative of the shareholder without obvious reasons: violation of the terms of the contract on the part of the developer.

If the shareholder terminates the contract on his own initiative, not because the developer has violated his obligations, he pays the damages to the developer. The shareholder may receive the amount back minus 6-8% of the cost of the apartment. - Installment plans for DDU are given for a period of no more than five years.

Housing cooperative - has its advantages

Quick execution of an agreement with a housing cooperative, construction control and access to housing cooperative documents, installment payments for an apartment for 5 years or more. If housing cooperatives are doing well, utility bills may be reduced.

Risks of shareholders and equity holders – which is worse?

Features of equity and share construction

The pros and cons of purchasing housing as a shareholder or shareholder are as follows:

- Registration of an agreement with Rosreestr before the start of construction is a lengthy process, but excludes the possibility of selling one apartment into the hands of several shareholders. The presence of two or more owners is not uncommon when making a transaction through housing cooperatives.

- The final price per 1 m2 from the shareholder does not differ from the initial one, but exceeds the cost of an apartment of the same area owned by a member of the cooperative.

Having set a price for 1 m2, the developer does not have the right to change it under the terms of shared construction. A proposal on his part to sign an additional agreement, which provides for an increase in the price of 1 m2, may be rejected by the shareholder on legal grounds. Moreover, in such a situation, the person who signed the DDU has the right to demand termination of the main contract, return of funds already paid and payment of a penalty.

According to the terms of the agreement with the housing cooperative, its chairman can increase the price per 1 m2 at any stage of the construction of the house by agreement with the other members of the housing cooperative.

- Violation of the deadlines for putting the house into operation is financially unprofitable for the developer when signing the DDU, since this gives the shareholder the right to demand payment of a penalty for each day of delay. The law provides for only 2 months beyond the agreed period under the contract, during which the developer is obliged to resolve all legal issues and provide the owners with their apartments. Signing an additional agreement to extend the deadline for handing over the house is the right of the shareholder, and not his obligation.

We invite you to familiarize yourself with the repayment of a mortgage with maternity capital: conditions and documents

In this matter, equity participation is better than joining a housing cooperative, since the agreement with the housing cooperative does not stipulate clear dates for the start and completion of the construction of the house. Accordingly, the developer also does not incur financial costs in the form of penalties.

- The difference between a shareholder and a shareholder also lies in the fact that good building cooperatives provide their members with installment plans, which do not depend on whether the house has been delivered or is under construction. The shareholder is limited in this right and is obliged to pay the entire amount upon completion of construction work.

- At the time of the start of construction of an apartment building according to the DDU, the project was approved and all permitting documentation was received. This is a guarantee that when the house is put into operation, the number of storeys and the presence/absence of extensions will correspond to the initially stated conditions.

What the cooperative house will be like is decided by its members by voting. However, if it is necessary to attract additional shareholders, the house may end up being one floor higher or one staircase larger than was originally agreed upon.

- The share agreement clearly defines the mandatory conditions for its termination and return of funds, which makes it difficult for the shareholder to terminate relations with the developer. When signing an agreement with a housing cooperative, other pitfalls arise: the resale of such property is burdensome, as it forces the new owner to join the cooperative.

What is DDU

The abbreviation DDU stands for equity participation agreement. When it is formalized, money for the project is provided by shareholders. This form of cooperation obliges the developer to complete the project on time, obtain consent to put the apartment building into operation and transfer it to the parties to the agreement. The benefit of the developer is that he builds apartments with the money of shareholders and makes a profit. And the shareholders themselves can acquire housing, the cost of which will be lower than the market price.

Important! The equity participation agreement is controlled by the provisions of Federal Law-214, which allows shareholders to defend their rights in court if there are any violations in the process of cooperation on the part of the developer.

What is included in the share participation agreement

When drawing up an equity participation agreement, it is necessary to carefully check the authority and reliability of the developer. All statutory documents and permits granting the right to construct residential properties are subject to verification. The share participation agreement must indicate:

- The actual address of the object being built (for each participant, the floor of the apartment, its area and layout).

- Type of materials used in construction.

- The exact date of commissioning of the finished facility.

- The final price, which can only change based on the results of the assessment by the Bureau of Technical Inventory.

- A money back scheme in case the commissioning of the facility is overdue.

- Guarantees of obtaining ownership rights to the object and the impossibility of transferring it to third parties.

The participant in the share participation agreement can request all documents from the developer at any time, and he is obliged to provide them.

Characteristic features of contracts

The significant difference between an agreement with a housing cooperative and a DDU lies in the consequences that occur after its signing: joining a randomly selected cooperative increases the risk of a shareholder becoming a victim of a fraudulent scheme. These agreements differ in other ways:

| Shareholder's agreement | Shareholder agreement |

| Regulated by Federal Law No. 214 | Regulated by Federal Law No. 215 |

| Must be registered with the FS GRKK | Registration in the FS GRKK only after putting the house into operation |

| The cost per square meter does not change | Possible increase in the cost of the apartment |

| Established start and end dates for construction | The construction time frame is not clearly defined |

| Legal liability for failure to meet deadlines for delivery of a residential building | The law does not provide for punishment for violation of construction deadlines. |

| Purchasing an apartment in installments is possible only until the residential building is put into operation | Installment payments are provided by law for a period that does not depend on the stage of construction of a residential property |

Important! The signing of additional agreements that do not comply with the terms of the main equity participation agreement is not mandatory. Before concluding an agreement with a housing cooperative, you should make sure that the developer has written down a clause that excludes the possibility of increasing the cost of 1 m2.