Purchasing an apartment in a building under construction by assignment of rights is a procedure during which the shareholder transfers the right to claim the property to another person. It will not be possible to draw up a regular purchase and sale agreement, since the real estate actually does not exist yet, it has not been put into operation. Let's consider what an agreement for the assignment of a right of claim is, when it is possible to formalize it, the features of the transaction in individual cases, potential risks for the buyer, all the nuances and step-by-step instructions.

What is an agreement for the assignment of claims?

- Contents and sample agreement

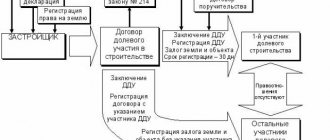

An assignment agreement is a document according to which the shareholder transfers the right to claim a non-existent apartment to another person under the DDU. The specifics of the transaction are regulated by Ch. 3 Civil Code of the Russian Federation. The actual seller acts as an assignor under the contract, and the buyer acts as an assignee.

In simple words: if a person has registered a shared ownership agreement with a developer, made contributions for some time, but then realized that he does not need the apartment, he can sell the right to claim it from the construction company to another person. Standard purchase and sale is possible only after commissioning. The assignment agreement (assignment) is concluded before this moment.

Take the survey and a lawyer will tell you for free how to avoid mistakes in an apartment purchase and sale transaction in your case

Assignment of rights under a mortgage agreement

The law governing the transfer of rights under a mortgage sets out different rules. They provide for both an assignment under the security agreement and under the main agreement (credit or loan). Replacing a party in any agreement entails consequences for their composition in another transaction.

If we are talking about cases where a mortgage has been issued, a different procedure is provided. The replacement of the creditor and pledgee is carried out on the basis of transactions with it. The corresponding actions are stipulated by law.

The debtor's consent to replace the creditor is not required. At the same time, the latter is obliged to notify him of the acquisition of rights under the agreement or mortgage. Otherwise, execution in favor of the previous counterparty will be considered properly carried out.

When is it possible to assign the right to claim an apartment?

Most often, an assignment agreement is concluded for several reasons:

- Investors who decide to make money. At the excavation stage, apartments under DDU cost minimal money. At each stage of construction, the developer increases prices according to plan.

- Contractors with whom the developer paid with apartments that do not yet exist. In the future, they need to be sold, and this can be done under an assignment agreement.

- Individuals who purchased square meters at a minimum cost and decided to sell them after the developer’s next price increase.

- Shareholders who entered into a pre-term care agreement, but after some time realized that they needed other housing.

Example: A woman entered into a contractual agreement with a construction company. According to the agreement, after completion of construction and full payment of fees, she must receive a one-room apartment with an area of 40 sq.m. After some time, she had two children, and she realized that the family would be cramped in a one-room apartment. The construction has not yet been completed, but she decided to sell the right to claim the property after putting the property into operation to another person.

The initial price of the apartment was 3,000,000 rubles, at the time of sale – 5,000,000 rubles. The shareholder has paid the entire amount under the DDU in full. The profit after the assignment of the right of claim will be 2,000,000 rubles.

Assignment of the right of claim in certain cases

Sometimes the assignment of the right of claim is impossible or difficult. For example, if the apartment was purchased with a mortgage, maternity capital was used, or when the owner is a minor child.

Important! The specifics of the assignment of rights must be specified in the agreement on shared participation in construction. Some developers require that shareholders obtain their consent before selling, since in fact one shareholder is being replaced by another. If there is no such clause, it is enough to notify of your intentions.

Mortgage apartment

Banks rarely approve mortgages for apartments under DDU, and if they do, it is only when purchasing real estate from friendly companies. To formalize the assignment agreement in the future, you need to repay the mortgage debt in full. The bank will remove the encumbrance, and only after that the agreement can be registered.

The second option is to replace the borrower. Lenders are reluctant to do this. It is important for them that the other borrower meets all the requirements for credit history and income level. If the bank approves the replacement, a mortgage agreement is drawn up with the new borrower, and the DDU is re-registered in his name.

If maternity capital was used

It is impossible to sell an apartment that has not yet been built, for the purchase of which maternal capital was used, due to Part 4 of Art. 10 Federal Law dated December 29, 2006 No. 256-FZ. By law, the owner of the certificate is obliged to allocate shares to all family members within six months after the housing is put into operation. But, if the apartment has not yet been built, the allocation of shares is impossible, as is the sale without this.

Note! Many sellers “forget” about the obligation to allocate shares to spouses and children. After the sale of real estate purchased with maternal capital without allocating shares, there is a chance that the transaction will be challenged by the guardianship authorities, spouse or children upon reaching adulthood.

If a minor is indicated in the DDU

If a minor child is included in the child protection system, the assignment of the right of claim or sale of real estate is possible only with the permission of the guardianship authority. Parents must receive it after finding another replacement home that will meet all the requirements.

Are you planning a deal to buy or sell an apartment?

Lawyers will answer any question regarding the transaction free of charge and in detail. Ask a question so you don't waste time reading!

Agreement on assignment (assignment) of rights to an apartment during shared-equity construction

1.2. The volume of assigned claims under this agreement is a share in the volume of one one-room apartment (hereinafter referred to as the Apartment), project number: No.____ (Apartment number according to PIB: ___), located in a building at the construction address: St. Petersburg, ______________ district , block _____, total area ____sq.m. (according to the above agreement ____sq.m.) taking into account the area of the balcony, costing _______________________________________ rub.

1.1. The Assignor, guided by Article 382 of the Civil Code of the Russian Federation, cedes to the Assignee its rights and obligations under agreement No._____ dated "__" ___________ 20__ "on shared participation in investing in the construction of a residential building", concluded between LLC "Developer" and the Assignor, the subject of which is shared participation in the construction of a residential building located at the construction address: St. Petersburg, ____________ district, block _____.

26 Jun 2020 stopurist 434

Share this post

- Related Posts

- Explanations of Part 2 of Article 228 of the Criminal Code of the Russian Federation

- One Works Officially The Second Doesn’t Work Is It Possible to Get Compensation

- Dismissal at your own request during a probationary period

- What changes will there be for prisoners under Article 228 in 2020?

Buying an apartment by assignment of rights: pros and cons

There are several advantages and disadvantages of purchasing real estate under an assignment agreement for the buyer:

| pros | Minuses |

| If the seller urgently needs money, you can save up to 20% of the real cost on buying an apartment | Construction may be frozen, the developer may go bankrupt. Often companies do not meet deadlines for commissioning facilities. |

| There is a chance to earn money if you draw up an assignment agreement and then sell the finished housing under a sales agreement. Depending on the market situation, the profit will be up to 30% of the money spent on the purchase | There is a possibility that the assignor has debts to the developer |

| There is a chance of running into fraud - double sales, when assignment agreements are concluded simultaneously with several citizens |

There are also benefits for the seller. He can make money on the difference between the money invested in the purchase and the amount of the subsequent sale of the claim. But there are also disadvantages. Firstly, you will have to negotiate with the developer, which complicates the procedure. Secondly, personal income tax of 13% is required to be paid (Article 208 of the Tax Code of the Russian Federation).

Risks for the buyer

We will separately highlight the risks that the buyer may face:

- Delays in construction deadlines, complete freezing of construction. If a developer has a bad financial situation, he usually pays contractors with apartments. In the future, such real estate is sold by legal entities under an assignment agreement, and it is not a fact that the assignee will receive it within the established time frame.

- Buying an apartment with debts. The assignor may not fully pay the construction company under the DDU, and then the debt obligations will have to be borne by the new shareholder - the assignee.

- Execution of an assignment agreement using forged documents by the assignor. This also happens. The assignee may be left without an apartment and without money if he pays the full cost before registering the transaction with Rosreestr.

- Challenging the deal. For example, if the property was acquired during marriage and the assignor did not receive the notarial consent of the spouse.

A court may also recognize an assignment agreement for another reason.

For example, if the assignor is declared bankrupt. In this case, all transactions for the past three years are canceled.

Elena Plokhuta

Legal expert. 6 years of experience. I specialize in civil disputes in the field of family law.

Do you need a purchase and sale agreement?

We’ll show you how to draw up a contract correctly and avoid mistakes.

Registration of the transfer of rights under an assignment agreement in Rosreestr

The rules for registering an assignment, i.e. the assignment by the assignor (original creditor) to the assignee (new creditor) of the right of claim against the debtor, depend on the form in which the initial agreement was concluded between the assignor and the debtor (Article 389 of the Civil Code):

- if the transaction was concluded in simple written form, it is enough to draw up the document on paper;

- if powers are transferred under an agreement in notarial form, for example under an annuity agreement, you will have to contact a notary for certification of the assignment agreement;

- if rights are assigned under a transaction subject to state registration, one of the stages of the assignment will be an application to the registering authority.

NOTE! In accordance with Art. 164 of the Civil Code, the legal consequences of a transaction for which there is a requirement for state registration occur only after it. Accordingly, failure to submit an assignment agreement to Rosreestr will mean that the agreement between the assignor and the assignee does not give rise to legal consequences.

In this case, the parties need to take into account the position of the Supreme Court, which indicated that failure to comply with the established procedure for state registration of a transaction does not entail negative consequences for the debtor, who, having received a notice of assignment from the assignor, provided the new creditor with execution (clause 2 of the resolution of the Plenum of the Supreme Court dated December 21, 2017 No. 54).

We invite you to familiarize yourself with the Product Quality Acceptance Certificate

In addition to registering the agreement itself, the assignor and assignee must register the transfer of rights under it.

The transfer of rights is subject to registration not only in cases where the original agreement concerned the lease of real estate and participation in shared construction, but also in cases where the creditor changes in agreements relating to:

- sale or donation of real estate;

- alienation of real estate for payment of rent;

- rental of a property complex (enterprise);

- and in other cases provided for by law.

In this case, there is no need to go through the transaction registration procedure; the key will be the fact of transfer of rights recorded in the Unified State Register of Real Estate.

How to buy an apartment by assigning the right of claim? Step-by-step instruction

First, the seller needs to obtain permission to assign from the developer, if required. After this, a complete package of documents for the transaction is collected.

The procedure consists of several stages:

- Conclusion of an assignment agreement between the assignor and the assignee. It is issued in triplicate. One goes to the parties to the transaction, the third is transferred to the registrar.

- Registration of the agreement in Rosreestr. The registrar will make changes within 10 days, after which the buyer will be issued a certificate of changes in the DDU.

Finally, you need to wait until the developer puts the house into operation. They will assign him an address and issue cadastral passports for each apartment. As a result, the shareholder will be given a permit to put it into operation and a transfer and acceptance certificate will be drawn up. After this, you should contact Rosreestr to register ownership.

Contents and sample agreement

Sample contract

There is no unified form of the agreement, but to register changes it must contain complete information about the transaction:

- Date, place of registration.

- Full name, date of birth, passport details of the parties to the transaction.

- Information about real estate, technical characteristics.

- DDU details.

- A reference to the permission received from the developer and its details.

- The responsibility of the developer under the DDU to the shareholder so that the buyer, if necessary, can demand a penalty for failure to meet construction deadlines.

- Transfer cost (the price to be paid by the buyer to the seller).

- Payment procedure: before, during or after registration. Most often, a small deposit is paid before registration, the rest of the amount is paid after.

- Payment method: cash, bank transfer, via safe deposit box, letter of credit.

- Documents that the seller must transfer to the buyer.

- Rights, obligations and responsibilities of the parties.

- Signatures of the parties to the transaction.

Documentation

To conclude an assignment agreement, the seller must provide:

- Original DDU.

- Passports of the parties.

- Developer's permission for assignment (if required).

- A certificate confirming the repayment of the debt to the developer, or the balance of the debt.

- Notarized consent of the assignor's spouse to the transaction.

If the seller has children, a certificate of non-use of maternity capital for the purchase under the DDU will not be superfluous. This or a certificate of capital balance can be ordered from the Pension Fund.

When the contract has already been drawn up, it must be submitted to Rosreestr along with the documents presented above and a receipt for payment of the state duty.

Note! If you submit documents to the MFC, the fee can be paid on the spot using a bank card.

Expenses

The state duty for making changes in Rosreestr is 350 rubles, it is paid to buyers. If the parties contact a lawyer to draw up a contract, payment for his services is determined by agreement.

We check the documents from the developer

A green signal for the transaction is the availability of permits from the developer company.

What documents need to be requested from the company office?

- Company registration certificate

- Charter and founding document

- Certificate of registration with the tax authorities

- Cadastral passports for land (certificate of lease or ownership)

- Permit for construction work

- Accounting report for the last quarter

- Documentation of funds used for construction

- Certificate of obligations of the construction company (project declaration)

- Construction projects that include rights to land, building permit, completion date of construction work, purpose of the project, construction stages and commissioning of real estate

Lawyer's answers to frequently asked questions

How to check the developer before drawing up an assignment agreement?

To minimize risks, the buyer can check the construction company for bankruptcy through the service of the Unified Federal Register of Bankruptcy Information. If the company goes bankrupt, if it is likely that the construction will never be completed.

You can compare the project declaration with the real state of affairs. If there is no doubt that the developer manages to deliver the project on time and construction is in full swing, the company can be trusted.

Another verification option is the FSSP database of enforcement proceedings. If the developer is listed as a debtor, this should alert you.

It is recommended to read reviews about the company. If there are too many negative ones, this is a reason to be wary and think carefully about whether it is worth drawing up an agreement.

Will Rosreestr register an assignment agreement if permission has not been received from the developer?

With a high degree of probability, the transaction will not be registered. But even if registration does not occur, the developer himself will not re-register the DDU for the new shareholder, so there is no point in violating the provision on obtaining permission.

What objects can be sold by assignment?

It is possible to sell apartments under DDU or shares in housing cooperatives. If the property is already ready, a regular DCT is drawn up.

Is it possible to sell an apartment by assignment with the transfer of debt to the assignee?

Yes, you can, but with the consent of the developer.

I bought an apartment under a transfer agreement. The house has not yet been built, although the developer was obliged to deliver it two months ago. What kind of penalty can be collected for violation of deadlines?

The amount of the penalty is equal to 1/150 of the rate of the Central Bank of the Russian Federation for each day of delay, it is calculated from the total cost of the DDU. You can recover it through the court, or by sending a pre-trial claim to the company.

Are you entitled to a tax deduction when buying an apartment?

Write to us and we will provide free advice on obtaining a tax deduction

Algorithm for drawing up an assignment agreement

An assignment of ownership agreement is an assignment agreement (assignment of rights) that formalizes the rules for transferring the right of claim from the developer from the seller to the buyer to transfer ownership of the paid apartment upon completion of construction and delivery of the house to the state commission.

This is the most common type of assignment at present and often the object is the rights to housing under construction. The third party is the developer (developer).

Buying an apartment through assignment of rights is one of the riskiest ways to purchase an apartment.

Find out about the risks when buying an apartment by transfer

Drawing up an agreement for the assignment of ownership rights to an apartment. The agreement specifies and transfers:

- rights that belong to the former owner;

- documents on the basis of which the previous owner received his right.

List of transferred documents:

- A share participation agreement or an agreement on inclusion in a housing cooperative or an investment agreement;

- Receipts or payment orders for full payment of the cost of housing;

- Previously signed assignment agreements.

The assignment of rights of claim is formalized through the Rosreestr body only if there is a right to claim an apartment in a house being built in accordance with Federal Law No. 214. When constructing in housing cooperatives and investing in construction not in accordance with Federal Law No. 214, registration of the assignment agreement is not carried out, which entails the risks of double sales.

Study a sample agreement for the assignment of ownership rights to an apartment

- Concluding an agreement on equity participation, investment or joining a housing cooperative;

- Making payments for the purchased property;

- The owner’s decision to transfer (assign) the rights to the apartment to another person;

- Concluding an assignment agreement (assignment of rights) with anyone who wishes to become the owner of an apartment after the delivery of the house.

Essential conditions specified in the agreement for the assignment of the right of claim:

- Subject of the transaction, information about the property - floor, number of floors, area, number of rooms, ceiling height, condition (rough, fine finishing or without finishing);

- Cost - the price of the apartment in the assignment agreement, usually several orders of magnitude higher than at the “pit” stage;

- The validity period of the contract is limited by the moment of acceptance of the house by the state commission and the signing of the transfer and acceptance certificate by the new owner;

- Rights and obligations of the parties - obligations to transfer documents by the former owner and a list of these documents).

List of documents after the assignment transaction:

- assignment agreement signed by all parties;

- a document confirming the full financial settlement between the parties (deed, agreement between the developer and the current shareholder);

- all additions and annexes that appear in the agreement (originals);

- consent to the assignment of a third party (developer) in writing;

- a document confirming the transfer of these documents to you - an act;

- a document confirming the bank’s consent to the assignment if loan funds were used;

- equity participation agreement registered with Rosreestr (original);

- consent of the spouse to the assignment if the seller acquired the right during marriage.

The assignment agreement specifies the date and number of the agreement under which the rights are transferred (usually the details are indicated in the header of the equity participation agreement, investment agreement, etc.).

After state registration, the agreement becomes valid and the previous owner is deprived of all rights to the property in favor of the new owner.

When signing an agreement for the assignment of rights to an apartment, you must remember that housing is often “sold” in this way if there are suspicions of the insolvency of the developer and his imminent bankruptcy.

Attention: this is not a pattern, but it happens, so be careful, monitor the situation on the real estate market and carefully study the residential complex or railway that interests you.

The main risk is that having transferred the rights and obligations to you, the original owner no longer bears any responsibility to you for the actions of the developer.

That is, if construction is frozen, you will have to sue for the money paid and receive a penalty for late delivery of the house. And it’s not a fact that the money will come back to you.

It is possible to indicate in the contract that if the developer fails to fulfill his obligations, the original owner of the rights to housing will be liable to you. But the percentage of such transactions is extremely small; few people will do this.

Also, an agreement on the assignment of the right of claim may be declared invalid if the rights to develop an apartment were transferred at a deliberately reduced price, or this happened less than a year before the bankruptcy case was initiated for the developer.

Carrying out simple verification activities, careful preparation, and the involvement of competent lawyers will allow you to conclude an agreement and buy an apartment by assignment of rights, without risking your money and nerves in the future.

Today you learned about some of the nuances, risks and algorithm for drawing up an agreement for the assignment of ownership (assignment) of an apartment in a new building.

When a citizen has signed an equity participation agreement (DPA) with the Developer, he has the right to demand a certain apartment from the Developer within a certain period. The developer, in turn, is obliged to build an apartment building in the future and transfer this apartment to the shareholder. For this, the shareholder transferred a certain amount of money for construction.

The shareholder may assign his right of claim to someone - Art. 11 of Federal Law N 214-FZ. To cede not the apartment itself, but precisely the right to demand it from the Developer. Assigns the right for a certain amount, i.e. as if “selling”. To do this, you need to draw up a contract or assignment agreement. The equity holder will act as a assignor, and the one who buys the claim will be an assignee (Clause 1 of Article 388 of the Civil Code of the Russian Federation). For simplicity, I call them sellers and buyers.

After the assignment is completed, the previous shareholders are not liable on the part of the Developer to the new shareholders. For example, if the developer misses the construction deadline, the area of the apartment will not correspond to the documents, etc. — all claims are now made only by new shareholders.

Sellers can be individuals or companies. The seller may be an investor. He formalized the DDU with the Developer at the foundation pit stage. When the house is already or almost built, he can sell this apartment at a higher price. It happens that the developer himself issues a DDU for “his” person or company. There are many cases.

A small digression: if you need free legal advice, you can write online to a lawyer at the bottom right at any time, you can order a call at the bottom left, or call yourself: 8 (499) 938-45-06 (Moscow and region); (St. Petersburg and region .); (all regions of the Russian Federation).

Purchasing an apartment through the assignment of a DDU requires the conclusion of a special agreement. Most likely, you will have to conclude it at the developer’s office, according to their template. But even if so, instructions and a sample will not hurt.

- Check that the contract contains the details of all three persons - full names of the seller and buyer, details of the developer

- If there is a mortgage, the bank’s participation must also be registered

- The first point should indicate the developer’s consent to draw up such an agreement - if it is not there, then the buyer will not be able to demand a penalty from the developer, and the seller may receive an obligation to pay all the money back in the event of termination of the contract

- The date of signing the contract must be indicated

- The amount of money transferred by the buyer to the seller must be included in a separate paragraph. It should also indicate at what point payment occurs

If you pay before signing the agreement, then add a line that the Assignor (seller) guarantees that the assigned right to the apartment is fully paid, and is not the subject of a pledge or other obligations, and is not under arrest.