Free legal consultation by phone:

8

In cases where one party to an official marriage survives the other, the entire property estate that belonged to the deceased must go to his immediate relatives. Here it is appropriate to talk about the typical process of accepting an inheritance. And the fact that the inheritance mass consists of joint property will not play a significant role in this case.

The deceased's share must go to his relatives. How inheritance rights will be implemented in this case, and exactly how the division will take place, will be explained in detail below.

Division of property after the death of one of the spouses - prenuptial agreement

Judicial practice shows that the presence of a marriage contract can quickly resolve such an issue. As a rule, the prenuptial agreement deals with the division of the entire jointly acquired property. Therefore, if the deceased directly renounced his legal part while still married, then the dispute with relatives and all other heirs will be excluded by default.

Moreover, in such cases, the marriage contract will have legal force commensurate with the will. Therefore, any claims of all other heirs will be groundless. Division between relatives after the death of one of the spouses will be possible if he did not dispose of his share in any way after death. How to avoid division of property after the death of one of the spouses will be discussed below.

Division of property after the death of one of the spouses between the heirs

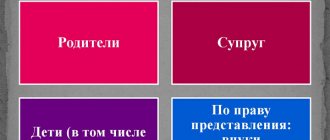

According to the dispositions of the relevant law, after the death of the owner, who did not leave any disposition regarding all of his property, it is the heirs of the first priority who will have the right to acquire a certain part of the inheritance mass.

But in this case, it is necessary to take into account that the second party, by default, is the owner of 1/2 of the object. Therefore, only 50% will be included in the hereditary mass. It is this part that will be distributed among relatives by all heirs of the first stage.

The division of property of former spouses after the death of one of them does not apply to donated property, and does not apply to citizens after the divorce procedure has been completed.

Division of donated property after the death of one of the spouses

If there is no agreement, then during life all property must be divided between the current spouses in equal shares.

Therefore, after the death of one, the second party automatically becomes the owner of 50%. But by way of inheritance, he can also claim a certain part from the other half. But this rule does not apply to donated property.

According to the law, donated objects should not be divided, because their sole owner is the donee. After death, the surviving spouse will have rights to a specific share on an equal basis with all other relatives and heirs. The division of property after the death of one of the spouses may provide children and all other heirs with a specific share of the property right.

The procedure for preparing and submitting documents to a notary

To obtain grounds for issuing a certificate of inheritance, a notary must receive certain documents confirming certain information (see clause 14 of section IX of the Methodological Recommendations dated February 28-28, 2007 and articles 72 and 73 of the Fundamentals of the Legislation of the Russian Federation on notaries ):

- A death certificate from the registry office, from this document the notary will take the fact of death, the place and moment of death of the testator.

- If the inheritance is by will, the will is the basis for calling for inheritance. If inheritance is by law - other documents confirming the rights of the heirs, such as a marriage certificate, birth certificate, etc.

- A document confirming the value of property transferred by right of inheritance. It will be enough to provide documents from the BTI confirming the inventory value.

- Confirmation that the property belonged to the testator by right of ownership. Certificate of ownership, or an extract from the Unified State Register of Real Estate (formerly the Unified State Register of Real Estate). The notary independently requests a document from the Unified State Register three days after the heirs apply.

- Accordingly, the notary has no right to demand the provision of documents on property rights from the heirs (see Article 47.1 of the Fundamentals of the Legislation of the Russian Federation on Notaries, Part 14, Article 62 of Law No. 218-FZ of July 13, 2020).

The issuance of a certificate of the right to inheritance is subject to a state duty, the amount of which is proportional to the heir’s share in the ownership of the property (see Article 22 of the Fundamentals of Legislation on Notaries, paragraph 3, paragraph 1, Article 333.25 and paragraph 22, paragraph 1, Article 333.24 of the Tax Code RF).

How much is the state fee (or notary fee) for issuing a certificate of inheritance?

- For the first stage of inheritance - natural children, adopted children, spouse and parents, brothers and sisters, the state duty is set at 0.3% of the value of the property being inherited. However, the duty cannot exceed 100,000 rubles.

- For all other heirs, the duty is 0.6% of the value of the property, but not more than 1,000,000 rubles.

Who has the right not to pay state duty when entering into an inheritance?

Minor heirs and those heirs who lived together with the testator and live in his apartment even after his death have the right not to pay the fee (clause 22, clause 1, article 333.24, clause 5, article 333.38 of the Tax Code of the Russian Federation).

If the notary has questions that cannot be resolved with existing documents, he may require other documents to be provided.

Judicial practice on the division of property after the death of one of the spouses

In such cases, it should also be taken into account that in practice, usually the parents of the deceased and all other relatives either sign an inheritance waiver or simply do not take any action so that the inheritance mass passes to the children, one child, or the surviving spouse.

The problem is that most disagreements concern real estate that can be divided in kind.

For example, if the parties are already divorced at the time of death, then in the absence of a marriage contract and in the presence of children, the surviving party and children together will have approximately 70% in equity equivalent. As a general rule, there is no point in challenging the rights to the remaining 30% in relation to other heirs.

Their rights are expressly stated in the law, so they can exercise them at any time. It will not be possible to achieve the abolition of hereditary preferences even through the courts. Here it would be more appropriate to try to negotiate with the applicant citizens, or provide them with a proportionate payment. A claim for division of property of former spouses after the death of one of them is filed against relatives.

Which child has the right to inherit after the death of the father?

Video: HOW DO HEIRS LOSE AN INHERITANCE OUT OF IGNORANCE OF THE LAW?

Video: ACCEPTING AN INHERITANCE IN 2020 | New rules

After the death of a father, his children are considered the most likely heirs of the property , for which they do not need to present any evidence. They can exercise this right regardless of whether they lived as one family in the same living space or did not have the opportunity to get to know each other.

Even in the absence of a will, the law gives the right of inheritance to children. First of all, this applies to property, which any direct heirs can dispose of after the death of the father:

- Natural children, regardless of what marriage they were born from;

- Children who were born out of wedlock. Proof is the presence of the father's surname on the birth certificate or confirmation of paternity in a peaceful magistrate or civil court.

- Children who were adopted by this family. They can be considered relatives provided that the family did not have children of its own. Otherwise, natural children will have the right of priority inheritance;

- Children in respect of whom the deceased man was deprived of parental rights. Despite the fact that the court decided to take away a citizen’s parental rights, his child can lay claim to the property of an irresponsible father.

Thus, it becomes clear that only the absence of mention of children in the will can serve as a basis for the children to be left without an inheritance. However, in this case there are exceptions.

Division of property after the death of one of the spouses - law 2020

The law has not undergone significant changes in 2020. Each family member, directly included in the first place, has the right to receive a certain share. Therefore, such issues can be resolved with the help of a marriage contract, even before marriage, or by dividing the object into shares.

It will not be possible to achieve anything contrary to the law in court. The courts will not infringe on the rights of some citizens in favor of others. The division of property under a will after the death of one of the spouses in the Russian Federation is carried out only in accordance with the will itself. Violating the will of the deceased is prohibited by law.

The procedure for obtaining a certificate of inheritance

To accept an inheritance, according to Art. 1153 of the Civil Code of the Russian Federation, the heir turns to the notary who receives in the notarial district the last place of residence of the deceased testator and submits to him an application for the issuance of a certificate of the right to inheritance or an application for acceptance of the inheritance. You can submit either the first or second application of your choice.

It must be borne in mind that when submitting an application for a certificate of the right to inheritance, this will be sufficient for the inheritance to be considered accepted by the heir even without filing an application for acceptance of the inheritance (see paragraph 1, section IX of the Methodological Recommendations for Registration of Inheritance Rights , approved by the Decision of the FNP Board of February 27-29, 2007 (Minutes No. 02/07), paragraphs 18-20 of the Methodological Recommendations for Registration of Inheritance Rights, approved by the FNP Board on February 28, 2006).

In the notary chamber of the district of residence of the deceased testator, you can clarify the contacts of the notary of the notarial district in which the testator was registered (see Article 123.16-3 of the Civil Code of the Russian Federation).

According to the Civil Code of the Russian Federation (clause 1 of Article 1114), during the day

opening of inheritance

is the date of death of the testator. A period of time of up to six months is allocated for accepting an inheritance from the date of opening of the inheritance (clause 1 of Article 1154 of the Civil Code of the Russian Federation and clause 42 of the Methodological Recommendations of February 28, 2006).

If it so happens that the deadline was missed, it is possible to acquire an inheritance through recognition of the right to inheritance in court, through the restoration of the missed deadline and through the recognition by the remaining heirs of the missed heir as having entered into the inheritance and by submitting the appropriate application to the notary on behalf of all heirs (Article 1155 of the Civil Code of the Russian Federation and paragraphs 43 and 44 of the Methodological Recommendations of February 28, 2006).

The deadline for issuing a certificate of right to inheritance is after the expiration of six months from the opening of the inheritance.

If the notary has no questions regarding the existing heirs who applied for the certificate and possible heirs, he has the right to issue the certificate before this six-month period (Article 1163 of the Civil Code of the Russian Federation).

We looked at the procedure for registering the right of inheritance to a share in the common property of spouses using real estate as an example, but the procedure is the same for all types of property. The only exception is property in the form of shares in the authorized capital of organizations. The specifics of this type of property are disclosed in the Methodological Recommendations on the topic “On the inheritance of shares in the authorized capital of an LLC.” This document was approved at a meeting of the Coordination and Methodological Council of Notary Chambers of the Southern Federal District, North-Kazakhstan Federal District, Central Federal District of Russia on May 28-29, 2010.