Car valuation report for a notary

- the need to deliver a car;

- arrival of an appraiser to the location of the car;

- how much this model is in demand in the Russian car market;

- an upgrade that was installed by the previous owner. Its presence leads to a more thorough inspection of the car;

- the market price for cars of this kind, as well as its dimensions, affect the amount of state duty;

- at what time the expert assessment was carried out;

- transfer of documents to the customer of the examination.

Why do you need an apartment appraisal for mortgage lending?

When receiving a mortgage, the bank issues a loan secured by the purchased apartment. If the borrower cannot repay it, the apartment will go to the bank. The bank must be sure that by selling this apartment, it will return the funds it provided to the borrower.

Banks do not issue mortgages without insurance for the loan period. Insurance is needed in case a fire, domestic gas explosion, flooding, or other incidents that could cause damage to the apartment occur in an apartment that is pledged to the bank. The insurance company wants to determine the fair amount it will have to pay the bank.

To summarize, an assessment is needed to determine the final amount of the mortgage loan and the amount of insurance payments. For many, it will be a discovery that the assessment affects the amount of the loan issued. If the apartment is valued cheaper than the seller demands for it, the buyer may not have enough money issued by the bank. The bank will not give money more than the market value of the home.

Property Valuation Certificate

- assessment certificate;

- dates characterizing these procedures (start and end dates of the assessment, validity period of the report);

- information about the object of assessment;

- purpose of the event;

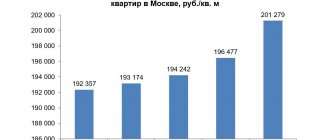

- overview of the market to which the property belongs;

- regulatory legal acts according to which the property was assessed;

- the methods, methodology and evaluation procedures that were used;

- conclusions about the value of property;

- necessary attachments (copies of documents, photographs, drawings, tables);

- any additional information;

- signature of the appraiser and seal of the appraisal company.

In what cases is an apartment appraised?

As previously stated, real estate valuation can be carried out using a variety of manipulations with it.

Let's take the following points as an example:

- Applying for a loan. In order to obtain a large loan from a bank or other financial institution, you often need to provide a list of property and its estimated value. In the future, the property may be considered as collateral. In some cases, the appraisal is performed by a specialist from the lender.

- Registration of a mortgage. Mortgage lending has recently become widespread, as it allows you to purchase your own home in the absence of the required amount. To confirm solvency, a list of movable and immovable property, as well as their confirmed value, is indicated.

- Selling or buying a home. In order for the specified amount to be reasonable, you can also order an assessment. When carrying out the procedure, a variety of factors are taken into account; an expert’s opinion can be attached to the package of documents.

- Prenuptial agreements are also drawn up taking into account the value of the property.

In addition, we note that each owner can order an expert assessment to be carried out at almost any time.

Evaluation procedure

When assessing real estate, its next value can be determined:

- Market.

It is determined in order to obtain reliable information about the optimal and competitive price of a property at which it must be put up for public sale. Investment .

This value is determined based on the investment goals pursued by the owner or owners of the property.

Such a price does not represent the real value of real estate on the open market, but only reflects the feasibility of the investment.

- Cadastral . The procedure for determining cadastral value is carried out in strict accordance with legal requirements. Its data is necessary to determine the amount of tax payments, etc.

- Liquidation . This price is calculated based on the degree of negative impact of various emergency circumstances on the cost of the subject of research.

Read more about what documents are needed to evaluate real estate.

Features for individual banks

Banks set their own requirements for assessment and organizations providing the service. Let's take a closer look at the conditions of mortgage lending leaders.

See the same topic: What is a “children’s mortgage”? Conditions for issuing preferential children's mortgages at 6 percent

Sberbank

Sberbank has its own list of appraisal organizations, which you will find on its website. The bank does not have the right to impose a specific appraiser, therefore there is a clause in the requirements for the report. You can order an appraisal from an organization or person not from this list, but the appraiser must meet the bank’s requirements for appraisal organizations.

Sberbank's main requirements for the procedure:

- An assessment is impossible without an in-person inspection and identification of the object by the appraiser.

- Increased requirements for photographs (color, high-quality, showing the object from all sides, including the surroundings, views from windows, places for connecting plumbing equipment, all existing defects, etc.).

- An analysis of the market in the segment to which the object belongs is required, with links to sources of information (phone numbers of agents, links to pages on the Internet).

VTB 24

VTB24 has its own list of appraisers it trusts. Like Sberbank, it allows the use of the services of appraisers not from the list, but it is difficult to say what this will lead to and whether such a report will be accepted.

On the bank's website there is a link to a partner service where you can order an assessment. VTB24 promises that the procedure will not take more than 1-2 days.

Gazprombank

Gazprombank has its own list of trusted organizations and a document with requirements for an assessment report, which resembles the requirements of Sberbank. The estimates for Gazprom differ by indicating the exact timing:

- The period from the date of inspection to the date of drawing up the Report should not exceed 3 months.

- An analysis of market prices regarding the location and segment of the real estate market to which the property belongs must be carried out no earlier than 9 months before the valuation date.

Typically, real estate appraisals are ordered for resale properties. For new buildings, it is rarely required, since the developer already has several partner banks from which you can take out a mortgage. But when refinancing a mortgage taken on a new building, you will have to make an appraisal, even if very little time has passed since the date of purchase. If you are faced with such a need, I would like to wish you patience in preparing documents and good luck in finding a competent and inexpensive appraiser.

Documents for real estate valuation

The following documents must be submitted for real estate valuation:

- Title documents confirming that a citizen has legal rights to the object.

- Documents for land. These include title documents, cadastral passport, site plan, tax rate calculation, rent calculation (if the site is leased).

Next, let's talk about exactly what documents are needed to evaluate an apartment? There are quite a large number of them.

Documents required for appraising an apartment:

- Legal information. If there are several owners, then information is provided by each.

- Passport or other document confirming the identity of the citizen who ordered the service.

- A document confirming the identity of the owner (if the assessment is ordered by a citizen who is not the owner of the apartment). If there are several owners, a document from each of them is presented.

- Technical certificate.

- Data on existing encumbrances (for example, mortgage obligations).

Office premises

If you need to evaluate an office, you need to prepare the following information::

- Legal information.

- Documents issued by BTI. These include a technical passport (or an extract from it), an explication, a floor plan.

- Data on encumbrances (if any).

- Documents for land.

- Data on costs incurred in maintaining the property (taxes, utility bills, insurance payments, etc.).

- Additional documents (permits for redevelopment, estimates for repair work, etc.).

Buildings

What documents are needed to evaluate a house or building?

Must be presented:

- Documents confirming ownership.

- Data from BTI. These include a technical passport (or an extract from it).

- A certificate containing information about the initial balance sheet and residual value of the object.

- Documents confirming the owner's rights to the land plot.

- Cadastral plan.

- Data on encumbrances.

- Security certificate (if the building being assessed is an architectural monument or an object of cultural and historical heritage).

Passport of the owner (or the customer of the assessment and the owner, if the assessment service is not ordered by the owner of the building).

This paragraph applies only to individuals.

Unfinished construction

The following data is required to be collected:

- Owner's certificate, if this certificate has already been issued.

- Documents on the land plot.

- Construction permit.

- Project documentation.

- A certificate reflecting information about the stage of construction. The document indicates the level of readiness of the main structural elements of the facility.

- Balance sheet (for legal entities).

Who is doing

The market is flooded with offers for apartment valuation services. Organizations conducting assessments are divided into three types:

- Companies;

- Independent expert legal entities;

- Individuals registered as individual entrepreneurs.

Many banks have lists of accredited companies that they trust. It is better to order an assessment from approved organizations. Along with “white” lists, banks also have “black lists” of unscrupulous appraisers.

Before ordering the procedure, the candidacy of the selected appraiser is agreed with the bank. If the appraiser or his report is not satisfactory to the bank, you will have to order and pay for the procedure again.

When choosing an appraiser registered as an individual entrepreneur, check their liability insurance policy. It must be issued for at least 300 thousand rubles. The policy guarantees payments in the event of damage to the appraisal customer as a result of violation of the rules and standards of appraisal activities.

See the same topic: Conditions for issuing a military mortgage in [y] year

Inspection report and apartment assessment report

Documents for appraising an apartment include mandatory types of acts.

The apartment inspection report is a document that is drawn up based on the results of the inspection of the property..

This document records the state of the object at the time of the procedure and indicates all changes made.

An apartment inspection report is often drawn up in emergency situations (to record the fact of flooding, destruction, etc.), when moving into a new house (to record possible violations in construction by the developer), and during transactions.

An apartment appraisal report is a document that indicates the market value of the property, current at the time of inspection . The assessment report is the second mandatory document in the above cases of an emergency or detection of violations on the part of the developer.

It allows you to determine the specific amount of cash costs that the owner will need to make in order to eliminate existing problems.

The document must be drawn up in a single form established by law and contain all the necessary information about the property (purpose of assessment, address of the property, characteristics of the area, description of all details of the property, indication of the market price, etc.).

The need to evaluate an apartment or residential building may be caused by the following reasons:

- Registration of collateral (mortgage);

- Conducting transactions with apartments that affect the property interests of minor children (for guardianship authorities);

- Notarization of inheritance;

- Resolving a property dispute in court;

- Completion of a purchase and sale transaction;

- Extrajudicial division of property between spouses or heirs;

- Confirmation of the market value of the applicant's real estate when applying for an entry visa to certain countries;

- Purchase of housing owned by the state or municipality.

"Center for Independent Expertise and Assessment" carries out assessment reports for the following banks: Sberbank, VTB, Rosselkhozbank, Gazprombank, Khlynov, Norvik, Svyazbank, Sovcombank, Promsvyazbank, Dortransbank, Russia, AkBars, RosKap (DomRF), DeltaCredit (Rosbank), UBRIR , Raiffeisenbank.

Where can I get it? Where to submit?

The real estate appraisal report can only be drawn up by professional appraisers.

Such specialists can be invited from real estate agencies or from special appraisal bureaus.

The report must be drawn up on a special form with the seal of the organization conducting the assessment procedure.

The act is submitted at the destination. In the case of litigation on a property, it is submitted to the court, in the case of a mortgage, to the bank.

List of possible title documents

When applying for a mortgage, additional title documents may be required:

- certificate of inheritance, open will, which is the fundamental document for the successor to assume the rights and pay the state fee;

- information about other shareholders (degree of relationship with the applicant, gender, age);

- information about the repairs and decoration of the premises (receipts, materials used, actions and entities performing them);

- actual place of residence of citizens in certain circumstances;

- photographic materials, which are most often provided by a professional appraiser.