Providing information in the form of certificates defining the cost characteristics of the object (as of cost indicators up to 12/31/2013 inclusive)*

– 1118.64 rub.

*Since 2014, the State Budgetary Institution MosgorBTI has not prepared certificates on the inventory value of real estate objects, due to the fact that the conversion factor for the replacement cost used in calculating the inventory value is not established by the regulatory legal acts of the city of Moscow. At the same time, the State Budgetary Institution MosgorBTI prepares and issues certificates on the inventory value of real estate objects according to the state of cost indicators until December 31, 2013 inclusive.

Relevance of the article: March 2020

Due to its characteristics and high value, real estate is classified as a special category of property. Real estate, and especially housing, are involved in many relationships of an economic and social nature.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please contact the online consultant form on the right or call the numbers below. It's fast and free!

PRO new building (Moscow)

- Direct visit to the Rosreestr branch. It is this institution that is engaged in the formation and issuance of various extracts and certificates related to all kinds of real estate. It is important to contact the branch that is located at the location of the apartment itself. To do this, you need to draw up a special application indicating the address of the property.

- Additionally, a passport is presented to the employee of the institution. Next, you need to wait about 5 days to pick up the certificate.

- Sending documents by mail. If it is not possible to visit Rosreestr in person, you can send the necessary documents to this institution by mail.

- Apply online. To do this, you can use the Rosreestr website, for which you fill out the form available on the resource, and the necessary documents are sent in scanned form.

- Contact the MFC. This institution acts as an intermediary between private individuals and various government bodies, so you can apply for a certificate at its branch.

Often, in order to carry out various transactions, for example, transferring real estate as collateral or applying for a mortgage, you need to know what cadastral value the housing has. This information may be contained in an extract from the Unified State Register or can be requested online, and a special certificate can also be obtained from Rosreestr.

Estimated value of the apartment: inventory according to BTI, cadastral, market

- Property tax calculations;

- Notarial actions;

- Determining the amount of rent for real estate owned by the state;

- Accrual of compensation payments;

- Determination of the initial sale price of real estate by the state.

Taking into account changes in legislation and a decrease in demand for technical inventory of the housing stock, BTI bodies, in addition to the previous powers for technical inventory, examination, issuance of certificates and duplicate documents, carry out on a commercial basis :

The procedure for obtaining a certificate from the BTI on the inventory value of a property

- an application filled out in the prescribed form;

- original passport (photocopies are made of certain pages);

- title document of the owner or tenant (social tenancy agreement);

- power of attorney certified by a notary - for representatives (in the original for making a copy);

- birth/adoption certificate – to represent the interests of minors.

Often citizens are faced with the need to calculate the inventory value of a real estate property. This calculation refers to the estimated value of the living space, which is determined by an appraiser from the public service organization Rosreestr (BTI).

Let's get acquainted with the nuances

To sell an apartment, each owner must prepare a list of certain documentation. This is due to the fact that without these papers the transaction will not be formalized by the Rosreestr authorities. In addition to this, before the transaction, a potential buyer should familiarize himself with all the nuances on the basis of which the price of the property was determined.

- Lack of necessary documents.

- Errors, blots and corrections in the application.

- Transfer of false and unreliable information to employees of an authorized institution.

- If the applicant is not the owner of the property about which he is requesting information.

- Expired identification document.

Cadastral value: assess fairly

According to the new algorithm, the price of a property will be influenced by many more factors. Previously, only wear and tear was taken into account. Now this list has expanded:

- location;

- object area;

- material used in construction;

- year of construction of the building;

- proximity to water bodies;

- distance to the nearest center of the subject of the Russian Federation;

- market prices for the property;

- distance to the railway station, platform, station;

- other important pricing factors in the region.

Now you know the difference between cadastral and inventory values.

How and where can you order and receive a certificate of cadastral value of an apartment?

This paper allows future buyers to understand the state in which they are purchasing housing and, if possible, to think about the correctness of the decision they are making. And you can easily stand your ground when setting the price and not give in to buyers’ persuasion to lower the price.

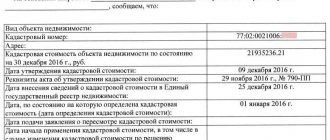

- At the top is the name of the service that issues this document.

- Next is the name of the document.

- Then the date the document was completed is indicated.

- A special cadastral number is assigned.

- If there were previous certificates, their numbers must be indicated.

- We indicate the address of the property.

- The value of the cadastral value at the current moment is indicated.

- We write the details assigned to the document on the basis of which the decision on cost was made.

- If there are special marks and nuances, they also need to be indicated.

More to read: Kbk on penalties on VAT in 2020

Where to get a certificate of appraised value of an apartment?

As for the inventory, we can say unequivocally that this type of apartment assessment is several times less than the previous assessment method. Why is this so?

The certificate is an extract from the cadastral chamber with information about the value of the apartment assigned by government agencies during the assessment process. The paper has a clear form and official force. At the same time, it is important that the document is drawn up taking into account the rules of the law, because otherwise it has no legal force.

The document states the cost established at the time of the last revision. After the next revaluation, the previous information loses its relevance. I was solving a problem with the transfer of ownership of an enterprise; we asked for help in drawing up and processing documents. Everything was done promptly and competently, specialists were present at the negotiations, and as a bonus I received accurate advice regarding the amount for the enterprise. I recommend.

How and where to get a certificate of the cost of an apartment

A certificate of the cost of an apartment in one of two values is issued by the relevant government agencies after providing a specific list of papers. In some cases, civil service employees have the right to refuse a citizen’s application to issue these certificates.

- through the online help desk on the Unified State Register website (https://rosreestr.ru/wps/portal/p/cc_ib_portal_services/cc_ib_ais_fdgko) (you need to know the cadastral number or address);

- using a public cadastral map (https://maps.rosreestr.ru/PortalOnline/) (information should be contained in the information panel that appears when you click on a specific area on the map);

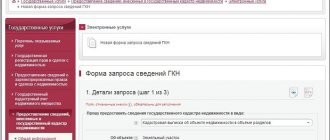

- by filling out a request on the Unified State Register website (https://rosreestr.ru/wps/portal/cc_gkn_form_new) for the issuance of a cadastral extract for a specific property or a cadastral passport.

Methods for estimating the inventory value of an apartment

Three assessment methods are applicable:

- Comparative. In this case, the appraiser compares information about transactions carried out on the real estate market. Based on the data obtained, the apartment belongs to one or another group.

- Expensive. The appraiser takes into account the cost of engineering systems, the cost of land, communications. Applicable to a greater extent for new buildings during the construction stages.

- Profitable. Based on data on the cost of renting the premises and the costs required to maintain it. The method is used if there is no information about real estate transactions.

The method is selected depending on market conditions and circumstances, as well as depending on the type of premises (residential or non-residential, new building or secondary market).

It is important to understand that:

- Data concerning only information on the cost of residential premises is transmitted to Rosreestr. The sum of all buildings in the yard is not taken into account.

- In an apartment building, the actual cost per square meter is taken into account, multiplied by the area of the apartment. It is impossible to objectively take into account the finishing, decorative elements and quality of repairs.

- For calculations, comparative data obtained on the basis of construction documents and actual measurements are used.

A certificate of the inventory value of an apartment is issued only to the owners of the apartment or residents of a non-privatized apartment (in fact, rented from the state), as well as to their official representatives according to notarized documents.

To obtain a certificate, the applicant must bring to the territorial BTI:

- statement;

- passport;

- social rent agreement or documents on ownership of the apartment.

A certificate is issued for a fee.

Certificate of market value of the apartment

Olga, ask the guardianship to show you a sample that suits this particular guardianship. Because some OOiPs skip regular printouts, others require evaluation albums (“lightweight”), others require a printout with a company seal, etc., etc. Well, then move on to what they require.

So, from anyone?! For example, is the website for intimate services suitable for them too? )) Olga, you should at least ask them. What are they referring to - any real estate advertising site? Cadastral Chamber website? Or do you need to determine the cost on one of the many real estate price calculators? But in general, I don’t understand why they need MARKET value. We now have an official cadastral register. Since when did they start demanding the market? Previously, the BTI inventory value was generally enough for them, but now the cadastre is not satisfactory?

Inventory cost: obtaining a certificate

In addition to the claim, it is necessary to attach a certificate of the current inventory value of the real estate, evidence that the price was set incorrectly, documents confirming ownership in the name of the plaintiff, and a report on an independent assessment.

You should also take into account the time allotted for the preparation of the inventory certificate. So, if there is no need to order an additional assessment procedure, and the applicant simply needs to obtain the available information in documentary form, no more than ten days are allotted for this. When you need paper for several real estate objects at once, for which inventory work is needed, the period for issuing the document will directly depend on how long they will take and how busy the territorial structure is with work. The terms will be agreed upon with the applicant and recorded in preliminary agreements.

Also read: Isn’t it a violation for a court to seize a car that is several times greater than the amount of the stated demands?

○ What is inventory value.

Inventory value is an indicator that is used when assessing real estate and calculating taxes on transactions with it. In this case, the total area of the living space, the degree of wear and tear and the conditions for the provision of utilities are taken into account. In this case, other criteria that determine the market value of this property are not taken into account. In this regard, the state decided to introduce a new method for assessing residential and non-residential premises, which will take into account all the necessary indicators.

An assessment of inventory value is needed when privatization of real estate is carried out, its purchase, sale and any other transactions are planned. It is also used to calculate property taxes. This indicator was the only one until January 2015, when a new assessment method was introduced.

Certificate of cadastral value of the apartment

The cadastral value of an apartment is a conditional value of property valuation, which allows you to compare data for calculating taxes or calculating state duties in the event of sale or transfer of property by inheritance. In this case, a certificate of the cadastral value of the apartment, where a special information resource about the cadastral system in Russia will help you obtain it. Currently, there have been fundamental changes in the field of cadastre in Russia after the introduction in 2020 of Law No. 218 “On state registration and cadastre recording in the Russian Federation.” According to the provisions of the law, the cadastral value is reflected in a special document - an extract from the Unified State Register of Real Estate, and you can order a certificate of value, indicating the cadastral price, both on the day the report was generated, and on a conditional fixed date. Thus, you can order either a certificate of cadastral value in the past on a conditional date or an extract from the Unified State Register of Real Estate with the actual cadastral value on the day the report was generated (the current document replaces the document Cadastral certificate of cadastral value according to Law No. 218-FZ from 01/01/2020)

The inventory assessment of an apartment plays a decisive role in calculating taxes and duties when making any transactions. The owner of the property right may agree or disagree with the assessment of the value of the apartment. If you do not agree with the indicated price, you have every right to challenge the assessment in Rosreestr. If you refuse to challenge the cadastral value in Rosreestr, you must contact the courts.

Everything about BTI real estate valuation: where to find out the inventory value of an apartment

- have access to directories of prices for materials and work created in accordance with Order No. 87 of April 4, 1992 “On approval of the procedure for assessing buildings, premises and structures owned by citizens by right of ownership.”

- Find online Departmental building standards for accounting for wear and tear (VSN 53-86(r)).

- Obtain information on the coefficients for converting old prices into modern ones, taking into account inflation, in the corresponding region (they were regularly approved by each constituent entity of the Russian Federation until the end of 2013).

- Have perseverance and estimating skills, or at least experience in preparing generalized calculations, for example, for repairs or construction.

We recommend reading: Personal income tax refund when buying a house