Features of the gift agreement

A gift agreement is a document according to which one citizen voluntarily transfers his property or part or share to another. The agreement is bilateral, that is, it is signed by both parties - the donor and the donee.

The document has several distinctive features that are important to consider before signing it:

- Property is transferred as a gift, therefore neither the donee nor the donor can demand material compensation from each other.

- If the transaction is executed correctly (legally), it will be impossible to refute it in court.

- By signing the agreement, the donee indicates his consent to accept the donor’s property as a gift. This is an important condition of the deal. No one can force a citizen to accept a gift of property or part of it belonging to another person.

- Unlike a will, when a citizen enters into an inheritance six months after the death of the owner, under a gift agreement the donee becomes the owner of the property after the conclusion of the agreement. The contract comes into force and the donee immediately becomes its legal owner.

- When dividing property during a divorce, the donated apartment or part thereof remains the property of the spouse to whom it was given as a gift.

- When registering a deed of gift for a close relative, the 13% tax is not charged.

Features of donation

In some cases, this transaction has some peculiarities. Let's look at them briefly.

https://www.youtube.com/watch?v=ytcreatorsen-GB

If the apartment is mortgaged, any transactions with it, including donations, require the consent of the bank.

In addition, you must specify who will make the mortgage payments. This can be either the donee or the donor.

We invite you to read: Loan during divorce, taken during marriage: how is it divided in 2020?

Read about how to issue a deed of gift for an apartment with a mortgage and if it is pledged to the bank.

Form of agreement for the donation of an apartment under a mortgage.

The donor can include in the text of the contract a clause stating that he can live in the apartment even after transferring it to another owner. His registration is also preserved. This right remains during the further sale of the property or its rental.

You can learn about the conditions and rules for drawing up a deed of gift for an apartment with the right of lifelong residence of the donor from our article.

Form of gift agreement with the right of lifelong residence of the donor.

Other people may also be registered in the apartment, for example, relatives of the donor. If they are not the owners, their consent is not required. It is necessary to indicate in the contract whether they retain the right to use the housing.

We talked in more detail about how to donate an apartment if another person or a minor child is registered in it in a separate article.

Form of agreement for the donation of an apartment in which third parties live.

If the donee dies before the donor, in general the apartment is included in the inheritance, which is passed on by will or divided between the heirs by law.

But you can include a condition in the donation agreement that in this case the apartment will return to the donor.

If the donor died before registering the transaction, the apartment is considered his property. Accordingly, it passes not to the donee, but to the heir or heirs.

You will find more information about who gets the donated apartment after the death of the donee or donor here.

Donation of a share

You can donate not only the entire apartment, but also a share in it. Such transactions have some differences from the gift of entire real estate. It is imperative to indicate exactly what share is being donated - both as a percentage and by the number of square meters. If this is a room, you also need to indicate which one.

From June 3, 2020, a deed of gift for a share of an apartment or house must be certified by a notary. This is evidenced by changes in law N 122-FZ of July 21, 1997. The cost of registration consists of two parts:

- for work of a legal technical nature (that is, for drawing up an agreement) you will have to pay from 5 to 10 thousand rubles, depending on the prices of a particular office.

- Fee for certifying the transaction. It is 0.5% of the apartment’s value indicated in the donation, but not less than three hundred and not more than twenty thousand rubles.

The apartment can be in joint or shared ownership. Fractional ownership means that it is determined exactly what share each person owns. In this case, the owner can freely give it as a gift without asking the consent of the co-owners or even notifying them.

In joint ownership, the consent of the other owners is required. It is drawn up and certified by a notary. The cost of registration will be about a thousand rubles for legal and technical work and 500 rubles for the notary fee.

Form of agreement for donation of a share in an apartment.

Form of spouse's consent to donate a share.

A donation gives any person the right to transfer something to another person completely free of charge. The recipient receives property rights and can dispose of the thing. If there is a deferred execution, title only accrues upon the occurrence of a specified event or date.

Such a deed of gift is considered valid if it:

- Properly formatted;

- Contains a correctly formulated promise to transfer ownership of a thing to a certain person in the future, free of charge;

- The subject of the agreement must be clearly stated.

If the donor dies and the contract that contained the promise has not been fulfilled, this obligation is transferred to the heir. Transfer of property or rights can be carried out in the following way:

- Presentations;

- Symbolic transmission;

- Transfer of title papers.

The new owner, whom the deed of gift indicates, receives the property according to the donor’s instructions.

3 ways to get a free legal consultation 01

Online chat bottom right, lawyer consultant is always in touch

02

Free hotline 8 (Moscow and regions of the Russian Federation)

03

Help from a lawyer on the free legal advice page

Decor

A deed of gift is drawn up independently or with the help of a notary, which contains basic information about the donor, the donee and the gift:

- Full names of both parties, passport details;

- purpose of the transaction;

- all data about the gift (if it is an apartment, then cadastral number, area, address, etc.);

- cost of the apartment;

- place and date of signing the contract.

The deed of gift is drawn up in free form, in triplicate (for each party and Rosreestr). When visiting a notary, you must have a set of documents with you:

- passports of both parties;

- documents confirming the donor's rights to property;

- extract from the house register and EIRC;

- cadastral passport;

- consent to the transaction (in writing) from other family members, if necessary.

The same set of documents is needed for registration (plus a prepared deed of gift in triplicate). Documents are submitted to Rosreestr directly or through the MFC.

Legal meaning of the gift agreement and its duration

A donation is a gratuitous transaction, as a result of which the rights to real estate or another object are transferred from one owner to another. There are two parties involved in the transaction:

- donor – owner of property;

- donee – the one who receives the gift.

Any property can act as a gift. This can be real estate, for example, an apartment, house, land, or movable property - a vehicle, a collection of paintings, etc. It is not forbidden to draw up a deed of gift for your share in an apartment that has several co-owners.

The rules for drawing up and the relationship between the donor and the donee are regulated by the Civil Code of the Russian Federation. The agreement is drawn up in writing and, if necessary, certified by a notary. The mere presence of a deed of gift does not make the donee the owner of an apartment and other objects; the ownership transferred to him under the agreement must be registered with Rosreestr.

About the deed of gift

A deed of gift or deed of gift is a legal formal procedure for transferring housing as a gift.

After the donor prepares a deed of gift for the donee, the latter becomes the owner of the gift and can dispose of it at his own discretion. This distinguishes this document from a will, according to which the use of property is possible only after the death of the owner.

Expert opinion

Tarasov Dmitry Timofeevich

Legal consultant with 7 years of experience. Specializes in the field of civil law. Member of the Bar Association.

When does the deed of gift come into force? This agreement is considered to come into force after it is signed by both parties and after the re-registration of ownership of the housing. The deed of gift has no expiration date. That is, it is considered unlimited.

What does a deed of gift look like and what is written in it? This document must contain the following information:

- FULL NAME. the one who gives the apartment and the one who receives it as a gift.

- Passport details of both parties.

- The right of ownership of the home to its current owner.

- Address of housing, its name and detailed characteristics.

- The real cost of housing (if the parties do not want to include it in the contract, this is not necessary).

No compensation should be mentioned in the deed of gift. The document can only be drawn up in a gratuitous transaction. Otherwise, such a deed of gift may be cancelled.

Both parties must be present at the transaction to sign the contract being drawn up. A representative may be present instead of one of the parties, in which case a power of attorney will also be required. Also, when transferring an apartment as a gift to a minor, his presence is not required. One of the parents may represent his interests.

Validity period of the deed of gift for real estate

- Specifics of the gift agreement

- Making a deed of gift Deed of gift by hand

- Registration by a notary

Transfer of property is possible through will and sale, but many prefer to draw up a deed of gift. Like any other transaction, a deed of gift has its own characteristics.

Attention

People are often interested in the validity period of a gift agreement. Is it possible to change or challenge a deed of gift? For what period of time is it valid from the moment of registration? Specifics of the gift agreement Issues of donation, inheritance and sale of property are regulated by the Civil Code of the Russian Federation.

According to the law, a deed of gift is a bilateral transaction concluded by the donor (the owner of the gift) and the donee (the one who receives the property).

Negative sides

Despite the large number of advantages, there are also disadvantages to registering a deed of gift. These include:

- The donor and his family have the opportunity to challenge the document through the court, even in the event of the donor’s death. In this case, it is much more difficult to challenge the purchase and sale agreement.

- The tax amount is quite high for persons who are not close relatives of the donor (13% of the cost of the apartment) and foreigners (30% of the cost of the apartment).

- The recipient has the legal right to evict all residents from the donated apartment, not without the exception of the person who gave him the housing.

The above indicates that it is better to draw up a gift agreement with a notary. Thus, it will be more difficult to challenge the document, to recognize it as erroneous or illegal. In addition, the specialist will be able to suggest in which case which points would be advisable to add to the document in order to avoid troubles later.

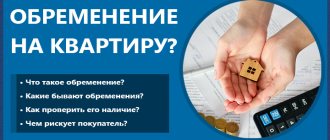

Grounds for suing donated property

When concluding a gift transaction through a power of attorney or in person, it is necessary to understand that the gift should not be encumbered with debts, arrest, mortgage fines, etc., because then the agreement will not be valid. The recipient may be a relative. Quite often, children decide to draw up a sample deed of gift for their mother or father, since this allows them to transfer rights to property, but save on paying taxes. When a transaction is concluded with an outsider, he is subject to a tax rate of 13% of the market value of the property. When concluding an agreement with a non-resident of Russia, you need to understand that the tax amount will increase to 30%. In such a situation, a non-resident will be considered a person who, due to circumstances, resides in Russia for less than 183 days a year.

Sample donation agreement for an apartment

10.7 KiB 21 Downloads Details

| Category: | Donation |

| Date of: | 27.02.2016 |

Quite often, Russian citizens think about selling their home, but not conducting the transaction as a purchase and sale agreement. The parties draw up and register the deed of gift, but the donee gives the seller a receipt confirming the fact of the transfer of funds. Such a transaction is called imaginary. It violates the legislative order of the Russian Federation and is a reason for the relatives of the donor to file a claim in court and take away the apartment donated by receipt. In addition, the reason for starting legal proceedings in order to cancel the gift agreement may be:

- incapacity of the donor;

- pressure from the donee on the primary owner and members of his family;

- errors when registering a document or an uncertified power of attorney for a transaction;

- contradictions of the deed of gift to the current legislation.

Sample claim for cancellation of deed of gift

40.5 KiB 22 Downloads Details

| Category: | Donation |

| Date of: | 27.02.2016 |

It is important to go to court with not only the grounds for filing a claim, but also evidence of your position. The evidence base may include witness statements, certificates, receipts, audio and video recordings, etc. The process will be carried out in accordance with all the rules of Civil Law. To win a case or defend your rights, you need to enlist the support of an experienced lawyer in time. The expert will build a line of defense or prosecution, help prepare and correctly present facts, receipts, certificates, and assess the risks of the case.

Read also: Donating funds in Russia

Features of the document

The gift document has many features. Most often, citizens are interested in the question of whether this document has a reverse side.

There are a number of features in the presence of which a deed of gift may be cancelled. These include:

- The document is executed incorrectly or illegally (there are errors, the necessary information is missing, there is no state registration).

- Recognition that the donor was incapacitated when signing the document.

- The donor or his family was subjected to criminal acts by the donee.

- Fictitiousness of the document. The deed of gift was concluded in order to conceal the financial transaction in order to avoid paying tax on the purchase and sale.

- The donor was forced to sign a deed of gift by threatening him and his family.

- The donor's signature was affixed illegally. The documents were substituted, and the donor did not realize that he was participating in the gift transaction.

- The second spouse, who has the right to the apartment due to its relation to jointly acquired property, did not give his consent to the transaction.

- Irresponsible attitude of the recipient towards the housing received as a gift, the condition of which noticeably suffers for this reason (fires often occur, the apartment is constantly unsanitary, etc.).

- The donee died prematurely (only if this clause is included in the contract).

There are often questions about whether it is possible to redo a gift agreement or whether it is possible to change the text of the document?

Note: In order to make significant adjustments to the contract, it is recommended to challenge it in court, and then enter into a new one.

Where does the registration take place?

You can draw up a deed of gift yourself, or you can also seek help from a notary, realtor or lawyer.

Next, it and other documents must be submitted to the MFC, cadastral chamber or registry chamber. Here the rights of the recipient to the property will be registered.

If the deed of gift was not drawn up by a notary, it can be signed right in front of the employee who will accept the documents. In addition, before submitting documents you will need to pay a state fee. Its size will depend on whether the donor and the recipient are related, and in what kind.

How long will the deed of gift be? Re-registration of rights takes 10 days.

What documents should I prepare?

To register ownership of a new owner, you will need to submit to the registering organization:

- Passports.

- Deed of gift.

- Property ownership document.

- Consent from the donor's spouse (if the apartment belongs to jointly acquired property).

- An extract from the house register and a copy thereof.

- The original and a copy of the power of attorney when applying instead of one of the parties to its representative.

- Consent to the transaction of the guardian (if the donee is a minor or incapacitated).

- Receipt of payment of state duty.

Before taking documents to the registry office, it is recommended to make copies of them and keep them with you.

It is possible to request other documents. It all depends on the specific case. It would be better if you inquire in advance about the required package of documents by phone, or look at the information on the official website of the registering organization.

Donation of real estate to a minor

Transferring housing to a minor is permitted by law. However, his presence during the conclusion of the contract is not necessary. One of the parents can represent his interests. The last one also signs the deed of gift.

When the donee reaches 14 years of age, he can already sign, but in addition to this, the signature of a parent or guardian will also be required.

The apartment that was gifted to the child will be used and disposed of by his representative until the child reaches adulthood. However, a parent representing the interests of a minor child does not have the right to sell an apartment unless there is consent from the guardianship council.

The deed of gift does not give the minor the right to sell the home without the consent of his representative and the guardianship authorities.

After reaching adulthood, the child can already fully dispose of the donated property.

Gift to a relative

A deed of gift for a relative is issued under slightly different circumstances when compared with that issued for people who are not related.

The main difference is the amount of state duty and tax on real estate received as a gift.

For recipients represented by the son, daughter, husband or wife of the donor, the duty is 0.3% of the cost of housing (minimum 300 rubles). The remaining categories will pay 1% for the cost of the apartment up to 1 million rubles, and if the value of the gift is 1-10 million rubles, the duty will be 0.75% plus 10 thousand rubles.

Payment of the above amounts is the responsibility of the donee. But in practice, this amount is often paid by both parties or only by the donor.

For recipients who are not relatives of the donor, they will need to pay a tax of 13% of the price of the gift. Close relatives do not pay this tax.

Is there a validity period for a deed of gift for real estate?

It could be:

- moment of registration of the agreement;

- the moment of occurrence of the condition specified in the contract (for example, the death of the donor;

- the moment of occurrence of a certain date specified in the deed of gift.

The following persons have the right to cancel the gift agreement:

- A recipient who does not want to accept an apartment as a gift for personal reasons (for example, if large debts for housing and communal services or other encumbrances are transferred to him along with it);

- The donor, if the donee has violated the terms of the transaction prescribed by law;

- Relatives of the donor who will challenge the gift agreement in court, based on legitimate grounds (for example, proving the donor’s insanity at the time of the transaction).

Cancellation of a transaction also occurs in the following cases:

- Death of the donee.

Features of tax payment

Let's consider the rules according to which tax in the amount of 13% of income when donating must be paid:

- If the contract indicates the cost of an apartment that is 70% lower than the cadastral price, it will be considered invalid. In this case, the tax percentage will be calculated from the cadastral value.

- The tax rates for donating a share of real estate are the same as for donating an entire apartment.

- Direct relatives of the donor (husband, wife, grandmother, grandfather, brother, sister, mother, father, daughter, son, grandson, granddaughter) are exempt from paying this tax.

- Persons who must pay the above tax include second-degree relatives of the donor or persons unrelated to him.

- If real estate is transferred to a foreign citizen or non-resident of the Russian Federation, the tax rate is not 13%, but 30% of income.

The main differences between a gift and a will

The donative share of an apartment to a relative is formalized in the same way as in the general case. The only difference is that close relatives are exempt from paying tax. These, according to Article 217 of the Tax Code, include:

- children and parents;

- grandparents and grandchildren;

- brothers and sisters who have at least one common parent;

- adoptive parents and adopted children;

- spouses.

We suggest you read: After a divorce, a child does not want to communicate with his father - how to establish contact during visits

Other relatives, such as nephews and cousins, pay tax on a general basis. It is 13% of the value of the donated share. We talked in more detail about the basis on which the tax on an apartment with a deed of gift is paid here.

Reference: Inventory, cadastral or market value may be taken into account. It is specified in the contract.

Read about the specifics of donating real estate between relatives here, and in this article we talked about how much it costs to make a deed of gift for an apartment with a notary for close relatives and what the cost of drawing up an agreement is for other persons.

Sample agreement for donating an apartment to a daughter.

| Donation | Will | |

| Possibility of cancellation | In rare cases | Eat |

| Do I need to pay tax | Gift tax is paid by everyone except close relatives. | No |

| Are there any restrictions | No | Some heirs are entitled to a mandatory share |

| Transfer to new owner | In life | After death |

| Time period for taking ownership | From a week | In 6 months |

As you can see, both forms of real estate transfer have certain advantages and disadvantages. Therefore, in each case you need to choose the most suitable one for specific conditions. We talked in detail about the pros and cons of registering a deed of gift in this article.

What to choose?

Donating a home is a convenient and profitable transaction for many people.

It is recommended to resort to it in the following cases:

- Close relationship between the donor and the recipient, when the transfer of housing is considered a formality in order to re-register ownership of it.

- The donor has other housing and a desire to transfer other property in the form of an apartment as a gift to another person.

- The presence of registered citizens in the apartment, whose eviction by other means did not produce results.

- The donor has confidence that after the rights to the apartment are transferred to another owner, he will not lose the right to live in the donated apartment.

In situations where the owner of the apartment does not have full trust in the person to whom he wants to transfer the housing, and his desire to receive during the transaction some kind of “insurance” regarding the further use of the housing or benefits from the transaction, it is better to use other documents rather than a deed of gift .

- Will. According to this document, property will be transferred only after the death of its owner.

- Barter agreement. Under such an agreement, something is given in return for the transferred apartment.

- The purchase and sale agreement is the sale of an apartment and the receipt of payment for it.

- Rent agreement. According to such a document, the apartment is transferred to the new owner with the condition of paying its cost in installments or maintaining the former owner.

Expert opinion

Tarasov Dmitry Timofeevich

Legal consultant with 7 years of experience. Specializes in the field of civil law. Member of the Bar Association.

Thus, it is advisable to choose a deed of gift in cases where there is a high level of trust and family ties between the donor and the recipient.

Transfer of property under a gift agreement with deferment

Any transfer of property rights is reflected in the corresponding act, which serves as an integral part, as well as an important component of the gift agreement. It serves as confirmation that the donation was carried out as a fact, and the recipient received the property. Several copies of the act are always drawn up, each party receives it.

The recipient receives all rights to the apartment received as a gift. He can live in it, he can donate it, exchange it, sell it, etc. The donor will no longer be able to dispose of the property.

It is imperative to register the transfer of ownership of the apartment in Rosreestr. Only after this can it be freely disposed of (read about how to register ownership of an apartment using a deed of gift and what documents you will need here).

The procedure takes about a week (up to two if applied through the MFC).

The application must be completed on site. You will need to pay a state fee for the deed of gift - 2 thousand rubles. If there is more than one new owner, the amount is divided between them.

We talked in detail about registering a gift agreement with the MFC and Rosreestr here.

Where to draw up an agreement

For the gift agreement to come into force, it must be registered with Rosreestr. To do this, the parties indicated in the document must appear at the territorial office of this organization with personal documents.

If the deed of gift is drawn up through a notary, this procedure falls on the shoulders of a lawyer. Please note that the deed of gift is drawn up in several copies, one for each participant in the transaction.

In addition, the donor must provide title documents for the property being donated. The package of documents is supplemented by the written consent of other owners (if any), extracts from the EIRC and the house register.

Registration of a deed of gift takes 10 days. On the specified day, the parties to the transaction come to Rosreestr and receive a copy of the agreement. The recipient receives title documents for the property.

Please note that termination of the contract is possible within strictly defined periods. For 2020, this is 12 months from the date the document entered into legal force. Termination of the contract is also possible in cases where the recipient threatens the donor.

Possible costs

When registering papers with a notary, close relatives pay a fee of 0.3% of the value of the property being donated. Donees who are not related to the donor pay 1% of the cost. In addition, you will have to pay for the services of a notary to draw up the document.

When it becomes necessary to make a choice - to draw up a deed of gift or a will, you need to take into account all the nuances of both procedures. You should also take into account the timing of when the deed of gift for an apartment comes into force, and when you can inherit it.

When does the deed of gift for an apartment come into force?

Unlike entry into inheritance rights, which is possible six months after the death of a relative, a deed of gift is valid 18 days after its execution and registration. This procedure greatly simplifies property relations between close relatives.

There are several advantages of a deed of gift for an apartment over the inheritance procedure:

| Minimal risk of cancellation of the gift agreement | A deed of gift for an apartment may be invalidated in extremely rare cases - drawing up a deed of gift for those who are already incapacitated at the time of paperwork; as well as in cases of threat to the life and health of the potential donor of the apartment, if this is proven. |

| Quick transfer of property into the ownership of the donee | There is no need to wait 6 months; the apartment becomes a property within 18 days from the moment the ownership is registered by a notary. |

| Relatively inexpensive registration costs | Unlike the preparation of inheritance documents, you will have to pay only 1000 rubles for a deed of gift - a state fee. |

Is it possible to challenge a deed of gift for an apartment by relatives or the donor?

You need to know that the procedure for registering a deed of gift differs significantly from the process of inheriting an apartment. The donor transfers his property during his lifetime. There are many risks associated with the relationships between close and not so close relatives. After the donation agreement is drawn up and registered with Rosreestr, the previous owner of the apartment loses ownership of his home.

We suggest you read: How to collect a debt under a writ of execution through bailiffs

An important nuance is that the gift agreement is not valid after the death of the donor; it is necessary to enter into ownership rights during the lifetime of the former owner of the apartment.

Such actions facilitate the procedure for future inheritance of an apartment; now receiving property after the death of the donor is much easier and faster.

In the event that the gift deed is not registered with Rosreestr immediately and the donor dies, relatives may appear claiming the abandoned apartment, and the deed of gift is considered invalid.

After completing the deed of gift and registering it with Rosreestr, you need to register the ownership of the donated apartment.

For a deed of gift to have legal force, it must be registered in a legal or notary office. You cannot hide the nuances associated with the apartment that is being donated. For example, if the property is leased, then this must be formalized. Such information is needed so that the lawyer does not refuse to register the deed of gift for the apartment, and the heirs do not have problems in the future.

The procedure for donating an apartment is most often discussed in advance between relatives who trust each other; the apartment becomes the property of the heir after registration of the deed of gift, so after the death of the donor there is no need to enter into an inheritance.

As for the validity period of the deed of gift, such a document has no restrictions in the time period. In accordance with the legislation of the Russian Federation, a gift agreement has no statute of limitations, either before registration, or even more so after it. In fact, this is an irreversible transaction: once the contract is signed, it can only be annulled in court.

It is clear that these actions are possible with the participation of 2 parties: the donor (owner of the property) and the recipient. To be more specific, in this case the owner of something irrevocably transfers (donates) or promises to transfer something to the person being gifted. You need to understand that the subject of the gift can be any valuables or “trinkets”, the main thing is that their essence is clearly described in the contract.

Hello, Pavel! If the donation agreement stipulates that the apartment has been donated to you in its entirety, as an isolated residential premises, then the difference in indicating the area in different documents will not affect the validity of the transaction. Moreover, the period for appealing the deal has expired, which greatly limits the scope of your father’s claims to the apartment.

- after the death of the donee, that is, the donor outlived the donee

- when the object of donation (gift) is kept in poor condition - for example, the recipient has set up a hangout in the donated apartment or does not comply with sanitary standards

- if there is a risk to the health and even life of the donor on the part of the new owner of the apartment or house

The law sets a minimum threshold of 300 rubles and a maximum that should not exceed 50,000 rubles. For distant relatives, the deal will cost a little more. So, for a property price of less than a million rubles, you will need to pay 0.4% and 3,000 rubles, up to 10 million - 0.2% and 7,000, above that - 0.1% plus 25 thousand rubles. The maximum amount in this case will be one hundred thousand, the minimum remains unchanged.

The power of attorney must strictly regulate the actions of the third party. In this case, this is the collection of documents and registration of the act with the relevant government agency. The power of attorney must contain information about to whom and what is being presented as a gift. Particular attention should be paid to the correctness of filling out the personal data of the person who will be involved in the registration. After all, if the slightest discrepancy is detected, civil servants will simply refuse to accept such a power of attorney.

Is it possible to issue a deed of gift for an inherited apartment?

An apartment inherited after the death of a relative can be donated to anyone by drawing up a deed of gift for it. In order to enter into an inheritance, you must bring to the lawyer:

- passport;

- cadastral passport of the inherited apartment specifying the amount to be paid;

- death certificate of the former owner of the property;

- documents confirming the relationship with the deceased.

If you need any additional documents, you need to find out specifically from the notary. Next, you need to carry out the procedure for registering ownership of the apartment with a notary.

The following documents will be required:

- heir's passport;

- documents on the right of inheritance;

- a receipt confirming payment of the state duty.

Duration of the apartment donation agreement

To complete a transaction, you will need to prepare a package of necessary documents. You will need

- - passport of the donor and recipient;

- — documents for the site;

- - agreement.

Instructions 1 If you are going to donate a plot of land, prepare an extract from the cadastral passport and a copy of the cadastral plan. You can obtain these documents from the land committee on the basis that your plot is registered with a single cadastral register, has a number, a passport and a plan. 2 You will also need a certificate of ownership of the land plot, a certificate of cadastral value, a marriage registration certificate, if available, notarial permission from all owners if the land plot is jointly owned by several persons (Article No. 244 of the Civil Code of the Russian Federation).

Who can't give an apartment to?

There are several situations that prohibit issuing a deed of gift for an apartment:

- The donor may not be a person serving as an official at the local or federal level in connection with his position.

- The donor cannot be a minor or incapacitated person. Even if such a donor was able to draw up a deed of gift, it can easily be declared invalid.

- If the donor of an apartment is the owner of a commercial organization and tries to donate property to the same owner of another commercial organization, then such manipulations are prohibited.

- If the donor is a client of medical clinics, educational institutions and other social institutions, then issuing a gift deed for his living space is prohibited by law.

Sometimes, after registering a deed of gift for an apartment, relations with relatives may change, not for the better. Donating real estate is a very serious step for the donor.

In this case, a will for inheriting an apartment protects the owner of the home more. Before you issue a deed of gift, you need to think several times.

After all, it is almost impossible to cancel this step after the deed of gift is registered in Rosreestr, and the recipient is in no danger, even if he decides to drive his donor out onto the street.

Expert opinion

Tarasov Dmitry Timofeevich

Legal consultant with 7 years of experience. Specializes in the field of civil law. Member of the Bar Association.

1.1. St. Petersburg! Unfortunately, when the ownership rights are transferred under a gift agreement, the donor’s ownership rights are terminated.

Good luck to you Vladimir Nikolaevich Ufa 09/14/2016

1.2. You can save it. But the owner can then recognize you as having lost the right of residence through the court.

2.1. Such changes are allowed and, moreover, they are necessary on the basis of a court decision, if it has entered into legal force under Article 13 of the Code of Civil Procedure of the Russian Federation.

3.1. An agreement on the gift of property between spouses, Article 572 of the Civil Code of the Russian Federation, of course, can be drawn up. But this agreement will come into force from the moment of its conclusion; the entry into force of a gift agreement with a delay is not provided for by law.

3.2. Yes, of course, you can draw up a gift agreement with a suspensive condition in accordance with the Civil Code of the Russian Federation. Contact a notary. Good luck and all the best to you.

4.1. The contract will be valid. Until the day the court decision comes into force, the spouses are married; there is no need to pay tax on gift income.

4.2. The gift agreement will have legal force. Personal income tax on donations also does not arise, since the court decision has not yet entered into legal force.

4.3. Considered legal. If the car belonged to one of the spouses solely (i.e. it was not joint property), then he has the right to dispose of it at his own discretion. There is no tax here, because the termination of the marriage will take place only after the decision has entered into legal force.

5.1. If an agreement has been concluded but has not yet been submitted for registration of rights to Rosreestr, then it must be certified by a notary.

5.2. Julia.

Do not do this. For contracts concluded before the entry into force of this law, the requirements of the law that were in force before the specified date are applied.

Transactions for which a mandatory notarial form was not previously required and concluded before 06/02/2016 in simple written form are legally valid, regardless of the date of application for state registration of rights.

6.1. Svetlana. Rosreestr will not register a share donation agreement that does not comply with current legislation. Contact a notary.

Expert opinion

Tarasov Dmitry Timofeevich

Legal consultant with 7 years of experience. Specializes in the field of civil law. Member of the Bar Association.

6.2. You can try, but most likely you will be refused, since there are many such cases, and a lot of time has passed since the law came into force.

6.3. Svetlana! They will not register it in the Russian register. The deed of gift will have to be notarized by a notary.

6.4. No, I will not register the transfer of ownership of a share on the basis of such an agreement. For registration, you must provide an agreement in accordance with current legislation, i.e. notarial form.

7.1. In practice, the bank will most likely not be involved in proving an invalid car sale transaction. After all, this is only through the court, and in court you can still win. Therefore, act, it certainly won’t get worse.

7.2. When a bank or bailiff applies to the court to declare such a transaction invalid, a decision may be made and restitution may be applied (consequences of invalidity of the transaction)

8.1. Registration of the gift agreement will be suspended, since the gift agreement is not notarized. Next, they will offer to provide the draft contract with a notary certification.

8.2. Since ownership rights arise from the moment of state registration, and the transfer of rights was not registered, the mother is still the owner of her shares. At the moment, you can only complete a transaction through a notary.

9.1. Agreements on the alienation of property are not registered; the transfer of ownership under agreements is registered. These articles apply (for donations, Article 574), except for the clauses on registration of contracts.

10.1. , or is it not retroactive? It is possible to challenge a gift agreement or any other agreement if you entered into it under the influence of deception, threats, delusion, or were incapacitated and did not understand the meaning of your actions. Everything must be proven naturally.

10.2. “she filed for divorce immediately after the contract was entered into” is not a basis.

11.1. The period will be calculated from the moment you receive the apartment.

12.1. If they have entered into legal force, then ask, don’t ask, nothing will happen. It should have been done earlier. Now everything has passed and relatives can do whatever they want. The courts will not impose anything.

12.2. Read in the cassation appeal to impose a ban on registration actions.

13.1. Only if the term is restored through the court.

14.1. The procedure is usual - through a notary within 6 months. after the death of the testators. Donation agreement - also through a notary, but registration of ownership of the donee immediately during the life of the donor.

14.2. It’s better to draw up a gift deed right away, Evgeniy.

14.3. If relatives (grandparents) agree, it is better to write the donation now. It will be easier and cheaper this way.

15.1. No, he can not. Then draw up a rental agreement.

15.2. No, such an agreement will be void.

16.1. The gift agreement comes into force from the moment of state registration.

17.1. Yes you can.

In accordance with Article 572 of the Civil Code of the Russian Federation, it is stipulated that instead of a gift agreement, a promise to donate something in the future can be drawn up. Article 572 of the Civil Code of the Russian Federation: 2.

A promise to transfer a thing or property right to someone free of charge or to relieve someone from a property obligation (promise of donation) is recognized as a gift agreement and binds the promisee if the promise is made in the proper form (clause 2 of Article 574) and contains a clearly expressed intention to make a gratuitous gift in the future. transfer of a thing or right to a specific person or release him from a property obligation.

17.2. You can, the gift agreement does not require notarization.

18.1. The gift agreement is NOT REGISTERED

in Rosreestr.

It's been three years already. The transfer of ownership is registered.

If it is registered, then the mother, as the owner, can move into the apartment and live in it, if the second owner does not mind. But the ex-husband, as the former owner, now no one can demand anything.

If against, then move-in is possible only by court decision. Which is not obvious, which will be in favor of the mother.

18.2. She will become the owner in the sense of Article 209 of the Civil Code of the Russian Federation only after registering the agreement with the Federal Reserve System and receiving a certificate of ownership.

18.3. The gift agreement requires mandatory registration with Rosreestr. Accordingly, after submitting documents and receiving a certificate, she is the owner of this share.

18.4. Register the agreement with the federal registration service.

Deadlines for donating an apartment after purchase – Legalists

Moreover, for a specified period of time, ownership of the apartment remains with the donor. A special type of agreement between the donor and the donee is a deed of gift, which is not executed immediately, but upon the occurrence of any condition stipulated by the agreement. Such conditions may include:

- the arrival of a specific date for the transfer of property rights from one person to another;

- fulfillment of any condition of the contract (graduation from college, birth of a child, adoption of a child and other conditions that do not carry a property benefit for the donor);

- the occurrence of any event (including the death of the donor).

Thus, a registered deed of gift is valid indefinitely, but its commencement will be limited to a specified period or condition.

It does not require re-registration, extension, payment of additional fees, etc.

Attention

In this case, the deed of gift can be canceled by:

- the gifted person at his own request;

- the donor, if there are reasons provided for by law to cancel the deed of gift;

- a court decision if the legality of the gift agreement is challenged by the relatives of the donor.

The last point is another reason why it is worth registering a deed of gift with a notary.

An authorized person will be able to confirm that the donor was fully capable and performed all actions voluntarily.

In addition, there will be no doubt about the correctness of the deed of gift.

After what time can I draw up a deed of gift for an apartment?

Lfirm.ru » Question - Answer » How long does it take to draw up a deed of gift for an apartment?

- Question:

- How long after can I draw up a deed of gift if the apartment was purchased in 2011?

Answer: The owner can issue a deed of gift at any time after purchasing the apartment. In this case, the law does not establish restrictions on the period of alienation of property.

From the point of view of taxation, when donating an apartment owned by a citizen: the donor (owner) does not pay tax, the donee, a close relative of the donor (spouse, parents, children, brothers, sisters, grandparents, grandchildren) does not pay tax (clause 18.1 Article 217

Important

Tax Code of the Russian Federation), the donee (not a close relative) - pays personal income tax of 13% of the cost of the apartment.

Our services

- Moscow+7 Orlikov lane, building 2

- Krasnodar+7 st.

Terms of execution of the donation agreement

Taxes and gift agreements According to the law, if an apartment was received as a gift from people not close to you, then you need to pay a tax for it to the state treasury.

The gift tax rate is set at 13%. There is no need to pay tax if the apartment was given to you by close relatives. Close relatives in this matter are considered: - spouses; - children; - grandchildren; - grandparents; - siblings.

Gift tax deduction When purchasing an apartment under a gift agreement, you will not be able to return 13% for it, as if you had entered into a sales agreement. The tax deduction for the purchase of an apartment is provided once, from an amount not exceeding 2,000,000 rubles. The maximum deduction is 260 thousand rubles.

The impossibility of returning 13% of the cost of the apartment can also be attributed to the disadvantages of purchasing an apartment under a gift agreement.

Is there a validity period for a deed of gift for real estate?

To give someone real estate, valuables, things means to give them away voluntarily free of charge, that is, without demanding anything in return.

The recipient of the gift acquires the right to full ownership of it.

In order to legitimize this right, a written agreement is drawn up between the donor and the recipient.

This document is called a real estate gift agreement.

After signing, it must be certified by a notary and registered in the register. A deed of gift for real estate has an almost unlimited validity period, with the exception of a few cases indicated by the Civil Code.

When a deed of gift is necessary A gift that costs less than three thousand rubles can be transferred just like that.

And if we are talking about an apartment, a house, or expensive property, it is necessary to draw up a deed of gift.

What is the validity period of a deed of gift for real estate?

In addition, each agreement has a number of conditions that may bring non-material benefits to the donor, for example:

- The right to live in an apartment for the rest of your life;

- Special care received from the donee;

- Conditions for canceling a deed of gift in case of inappropriate behavior of the donee, etc.

A person who does not know the law will simply not be able to provide for all the nuances when drawing up such a document.

The deed of donation for an apartment or other real estate is certified in a notary office associated with the area of registration of housing. Many people are concerned about how long such an agreement is valid and what to do after the deed of gift for real estate has expired.

A real estate gift agreement must be registered with Rosreestr, otherwise the new owner simply will not take ownership of the apartment.

What is a deed of gift? Rights and obligations of the parties

Expert opinion

Tarasov Dmitry Timofeevich

Legal consultant with 7 years of experience. Specializes in the field of civil law. Member of the Bar Association.

A gift agreement is a document that does not require mandatory notarization, which confirms the fact of the gratuitous and voluntary transfer of property from one person to another. In this case, the donee agrees to accept the subject of the transaction as a gift.

Most often, the preparation of such paper occurs between close people. Within the framework of this document, an apartment or house, land, valuables, a car and much more can be transferred.

The deed of gift has many advantages compared to other transactions of this kind:

- Relatively simple registration procedure.

- A small set of documents that need to be collected.

- Prompt registration (the procedure from receiving the form to registration takes less than a month).

- There is no need to pay tax if the parties to the transaction are close relatives, as in the case of a will or the sale of real estate.

- The ability to register a share in the name of another person without alienating the rights of the owner.

- The validity period of a deed of gift for a residential apartment, car or other property can be specified in the text of the document.

- You can draw up a deed of gift either in printed form or by hand.

However, the execution of such a document has a number of nuances that are related to the rights and obligations of the parties. When drawing up the document, the following must be taken into account:

- After a divorce, property officially belonging to one of the spouses cannot be divided. If it was given as a gift, it remains owned.

- The donor cannot be a minor citizen or a person declared incompetent.

- Employees of social government institutions, trustees, if they are a close or distant relative of the donor, can act as a donee. One of the parents has the right to donate movable or immovable property to the child. The consent of the spouse is not required.

- The donor may indicate in the agreement that the recipient does not have the right to evict him if we are talking about the transfer of an apartment, house or room.

Everything about the deed of gift for an apartment: registration, tax payment, challenging

In accordance with Russian Legislation, rights to real estate can be transferred in several ways: by concluding a purchase and sale agreement, drawing up a will, or transferring rights to property as a gift. Statistics show that the latter method of transferring property rights is considered the most preferable.

Therefore, the subject of discussion in this article will be the following topics: what is a deed of gift and what are the features of its preparation? What is the validity period of the executed contract? What are deeds of gift with a deferred period? How to challenge the deadline for a document? Find answers to these and other questions in this article.

Concept, object of donation

A gift agreement is a document confirming the gratuitous transfer of rights to property from one person (donor) to another (donee) . After drawing up an agreement (in accordance with the standards described in Article 32 of the Civil Code of the Russian Federation), it is subject to a mandatory registration procedure.

The rights to a real estate or movable object transferred as a gift can pass to the donee both immediately after the issuance of the registration certificate, and within the appointed period (when drawing up a deed of gift with a deferred period).

The object of the donation can be:

- Apartment;

- A private house;

- Cottage;

- Plot of land;

- Vehicle;

- Rights to property (or its share).

Registration procedure

According to the Law, drawing up a deed of gift is possible in one of the following ways:

- On one's own . This means that you will have to draw up the contract itself (check the legal correctness of its execution), organize the procedure for concluding a transaction (set a date) and its subsequent registration with a government agency (Rosreestr) without the help of a qualified specialist;

Without proper legal knowledge, when you independently draw up a deed of gift for an apartment, there is a high probability that the procedure will go through “complications.” This is due to the presence of a large number of pitfalls in the field of buying and selling real estate.

Attention When drawing up a document yourself (before signing and submitting it for registration), it is recommended to check it several times for grammatical, syntactic, factual and legislative inaccuracies and errors. Otherwise, this may result in the document being returned and registration being refused.

- With the help of a notary/lawyer who will provide competent legal support at all stages of the transaction.

It is important to stipulate in the contract the conditions for transferring rights to the apartment. If one of them is violated by the donee, the transaction will automatically be declared void. This condition could be:

- The donor’s right to live in the apartment, which is transferred as a gift to the donee, for the rest of his life;

- The responsibility of the donee to care for the donor until the end of his life;

- Other grounds for canceling a transaction.

Deferred contract

A gift agreement with a deferred period is a type of gift that does not come into force immediately, but after the occurrence of a certain condition specified in the agreement by the donor.

This condition could be:

- indication of the specific date of transfer of rights to the apartment from the donor to the donee;

- fulfillment of the condition/wishes of the donor, after which the ownership right passes to the donee (marriage, birth of a child, graduation from an educational institution, official employment, etc.);

- an event that accelerates the timing of entry into the right of inheritance (death of the donor, etc.).

Conclusion : despite the fact that the validity period of the deed of gift is indefinite, the beginning of its validity and the reasons for termination can be controlled by the relevant clauses of the contract.

How to dispute?

According to the Law, a donation agreement for an apartment can be challenged in the following cases:

- The contract was drawn up incorrectly;

- The fact of forcing the donor to draw up a deed of gift has been proven;

- The fact of mental insanity of the donor at the time of execution of the document has been proven;

- The donee is given the status of an unworthy heir. This status can be assigned if it is proven that he committed violent acts against the donor and disrespectful actions in relation to the property that was given to him as a gift;

- It has been proven that the transaction of transferring an apartment as a gift is not gratuitous, and after its conclusion the originator received some kind of financial benefit.

Attention An attempt to challenge the deed of gift is made by filing a statement of claim with the appropriate court. ( 2 4.50 out of 5) Loading...