Is it possible to donate an apartment that was purchased during marriage to your spouse?

The Civil Code, namely its 32nd chapter, covers all issues related to the preparation of deeds of gift. It considers donation as the alienation of property from the property of the donor and the gratuitous transfer of it to another person.

In this case, the real estate is transferred with the right to use, own and dispose of it. Thus, the donee becomes the new owner of the apartment, and the donor no longer has rights to it.

Thus, the legislation allows the apartment to be transferred as a gift to the donor’s wife. But when performing such a transaction, you need to be attentive to some of its nuances.

Design methods

A deed of gift can be issued in the following ways:

- The standard method is the simplest and involves preparing the contract yourself or carrying out this procedure with the help of a notary or lawyer. The drawn up agreement requires notarization and registration with a special government agency.

- Carrying out purchase and sale. This method is used if it is impossible to formalize a deed of gift. Often this method is used by government officials who do not want to donate an apartment and seek to disguise this transaction. It is noteworthy that there is no need for notarized registration of the purchase and sale agreement. After its bilateral signing, only registration with Rosreestr is required.

- An apartment purchased during marriage can be transferred to the wife by the spouse writing a waiver of his share in favor of the spouse. Such a document must be drawn up and certified by a notary. This way the wife will become the full owner of the home.

- Conclusion of a marriage contract. If you enter information about the spouses' property in it, during a divorce the wife will remain the full owner.

In what cases is a donated apartment subject to division?

The law provides for several situations in which donated property is classified as joint property. This means they share in certain shares.

Lack of proof of donation

If expensive property is presented as a gift, a gift agreement must be drawn up to complete the transaction. And it doesn’t matter whether the gift is an apartment or a piece of jewelry. This is especially true if the gift is presented during a marriage.

If a gift deed was drawn up but was simply lost, it can be restored. This option is relevant if the document has been notarized, which, for example, is required when registering a gift for real estate.

In all other cases, if the property was donated after marriage and there is no gift agreement, it will have to be divided in equal shares with the spouse. Therefore, when a husband gives his wife expensive jewelry or another luxury item, it is worth drawing up an agreement. Otherwise, during a divorce, these gifts may also be divided.

Here everyone can familiarize themselves with a sample gift agreement and, if necessary, it.

Increase in the cost of an apartment

Improving property is the main reason why the personal property of each spouse is recognized as common. This norm is enshrined in Art. 37 RF IC. For example, her parents gave a woman a two-room apartment, drawing up a gift agreement in accordance with all the rules. Having been married for 10 years, she and her husband made renovations in the apartment, after which the cost of the apartment increased by one and a half times. In this case, the housing may be recognized as common property.

They won't split it in half. But the woman will be forced to pay monetary compensation to her husband if he decides to share the apartment. The amount of compensation is calculated as follows. First, they will determine the cost difference between the price of the apartment before renovation and after renovation. If common funds were invested in the improvement, this difference will be divided in half. The resulting amount will be the amount of compensation.

In what cases is a donated apartment subject to division?

Wedding gift for both spouses

When getting married, it is customary to present expensive gifts to the bride and groom. This could be real estate or cars. It is very important that the gift agreement in this case indicates both spouses as recipients. Only then will the property be recognized as common.

But if at the wedding the bride and groom were told that the apartment was being given to both of them, and the gift agreement was drawn up for only one, then only one of the spouses will be the owner of such real estate.

Presence of a marriage contract

Art. 40 of the RF IC establishes that spouses can sign a marriage contract to regulate property relations. The terms of this document allow the parties to establish any regime of ownership of personal property. Those. Spouses can record, for example, that housing given to one of them during the marriage will be recognized as common property, and all owners will remain in the apartment during a divorce if they wish.

When donating any expensive property, an agreement should be drawn up. Even if the spouse is the donor, the apartment donated by him should be properly formalized by registering the agreement with a notary. Otherwise, you may be faced with the need to divide personal property during a divorce.

Detailed transaction plan

Stages:

- Before giving an apartment to your spouse, you need to make sure that it is in the sole ownership of the spouse. He must have a purchase and sale agreement and a certificate of ownership in his hands.

- An important preparation before donating an apartment is to find out the circle of heirs to it and the number of registered residents. It is prohibited for an apartment to be pledged or in shared ownership with the participation of minors. Utility debt is also not acceptable.

- You should notify your spouse of your intention, finding out whether she agrees to receive the apartment as a gift.

- Next, you can proceed to drawing up a gift agreement, which involves the gratuitous transfer of real estate to other hands. This document must contain the price of the apartment, what rights and responsibilities are given to both parties, how disputes can be resolved, as well as the validity period. After the deed of gift has been issued, the spouse is deprived of all rights to housing. However, during a divorce, he can prove through the court that he made significant changes to the apartment for his own money, and win his share of it.

- The completed gift deed must be registered by contacting the registration chamber. The law requires this procedure to be carried out. Registration requires payment of a state fee, which will amount to 2 thousand rubles. It can be deposited through any bank branch.

- Chamber specialists will review the papers you provided for registration within 20 days. Next, the spouse receives a certificate of ownership.

Due to the gratuitous transfer of the apartment, the spouse does not have to pay personal income tax. The spouse will also not have to pay this tax.

Can a husband give his wife his share in an apartment and vice versa?

Before answering the gift question, it is important to identify your marital property options:

- The apartment was acquired during marriage and is the joint property of the husband and wife (Article 34 of the RF IC);

- Housing belongs to only one spouse (Article 36 of the RF IC).

The law establishes that jointly acquired property in the form of an apartment is common to husband and wife. Hence the main requirement is to allocate marital shares, and only then give them to your other half. There is no need to give a share to the second spouse if he already has claims to ½ of the housing - in essence, this is legal nonsense.

If the apartment is owned by only one of the spouses, he has the right to donate the share to the second spouse without any reservations. The size of the “gift” is entirely at the discretion of the owner, since it is he who has the right to dispose of his property (Clause 1 of Article 209 of the Civil Code of the Russian Federation).

Alienation of a share in common property requires the consent of the remaining co-owners (clause 2 of Article 246 of the Civil Code of the Russian Federation). However, if we are talking about donating a share of an apartment to a spouse, the principle of gratuitousness (free) applies here. This means no consent is needed. Well, if the share is transferred in an apartment that is owned only by the husband and wife, the procedure is simplified as much as possible.

We conclude: the husband has the right to donate his share in the apartment to his wife, and the wife to her husband , if the quadrature ratios have already been fixed.

What documents will you need?

Let's look at what documents are needed to formalize a deed of gift for a wife:

- Identity documents of both parties (passports).

- Certificate of ownership.

- Certificates from the BTI containing the cost of the apartment.

- Apartment passport.

- Information about everyone living in the apartment.

- A document confirming payment of the state duty.

- Marriage certificate.

- Papers confirming the absence of collateral, debts and encumbrances.

Where to start, where to turn?

First of all, in order for the agreement to be further forwarded to the registering authority, the donor must notify his spouse of his desire to transfer the property into ownership.

If the party agrees to accept the property, you can proceed to the next step.

Next, you draw up an agreement. It can be drawn up by you either with your own hand or by contacting a notary.

One way or another, no matter what method of drawing up the deed of gift is chosen, you must agree on all its points with the other party. And only after that you can move on to the next step.

As we said above, to formalize the agreement you need to contact a notary. It is he who will not only help in drawing up, but also register the transaction.

If you do not have the opportunity to contact a notary, you can completely do it yourself when drawing up an agreement.

You can find out about the cost of registering a deed of gift for an apartment with a notary in our article.

We invite you to familiarize yourself with the difference between individual entrepreneurs and private entrepreneurs - taxation of private entrepreneurs

How is a gift deed prepared?

If it is possible to pay for the services of drawing up a deed of gift to a notary or lawyer, it is better to contact them. However, the contract can also be drawn up independently. There are several requirements for this document:

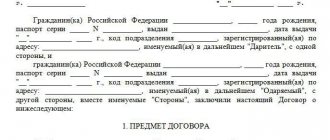

It must be compiled on clean white A4 paper. For this it is better to use a computer font. To fill out everything correctly, you can download a form (sample agreement) on the Internet and fill it out. An example of filling should be before your eyes:

- The first paragraph of the contract indicates who the donor and the donee are, that is, the persons participating in the transaction. It is important to indicate the passport details of both parties, as well as the fact that the donee is the donor’s wife (this fact is confirmed by the marriage certificate, which is also indicated in the contract). We must not forget about the contact information of both parties.

- The following describes the subject of the agreement, that is, the apartment that is being donated.

- The next paragraph indicates the rights and obligations of the parties. All of them should be described in as much detail as possible.

- Then the possible measures of liability in case of neglect of the clauses of the contract are listed, the conditions under which changes are possible are possible. If there are additional requirements of the parties to each other, they are also indicated.

- At the conclusion, a list of documents that were attached is made, dates and signatures are given.

How to properly formalize a donation

Both a marriage contract and an agreement on the division of property are drawn up in the same way. Since a prenuptial agreement is cheaper, I indicated it in the instructions.

In my experience, the most important thing when choosing a notary is the service and service that he provides. Notary prices for all services are almost the same. Therefore, read the reviews - is the notary polite with clients, are his employees fast, are they ready to advise, etc. I advise you to focus on this, because since mid-2020, about 90% of real estate transactions go through notaries.

Go to the Yandex.Map notary search page. It’s convenient to search on Yandex.Map - you can find a notary near you, read reviews about him, look at his ratings, find out his phone number, address, opening hours, etc.

Documents are required in originals. I advise spouses to contact a notary in advance and tell them about their situation. The notary will listen and draw up the entire list of necessary documents that need to be collected.

The main list of documents is as follows:

- Spouses' passports;

- Marriage registration certificate;

- Certificate(s) of registration of rights or a paper extract from the Unified State Register of Real Estate;

They are needed to confirm ownership of the apartment. Registration certificates have been canceled and have not been issued since July 2016. But if there is a certificate that was issued before this date, then bring it.If there is no certificate, then a paper extract from the Unified State Register of Real Estate about the property will do. The property in this case is the donated apartment. The extract also confirms ownership. Anyone can order it for 400 rubles. at the MFC. How to do this is written in detail here.

- Foundation agreement. In our case, this is an apartment purchase and sale agreement.

If spouses want to include any other real estate, car, etc. in the marriage contract, then documents for them must also be provided.

Based on the submitted documents, the notary draws up a marriage contract in several copies. Two copies will be on a special form with watermarks, and one copy will be on plain paper.

The spouses personally sign all copies of the marriage contract in the presence of a notary, and the notary notarizes (certifies) them. Then he will give each spouse a copy on a special form. And he will keep a copy on plain paper for his archive.

The marriage contract must be submitted to the MFC or the Registration Chamber. Based on this agreement, the ownership of the wife will be registered.

Since 2020, in many cities it is possible to submit documents for registration only at the MFC. Then the MFC employees themselves transfer the documents to the Registration Chamber. Those. The Registration Chambers no longer accept citizens directly, but only through an intermediary in the form of the MFC. If in your locality you can submit documents directly to Reg. Chamber, then it’s better to do so.

The submission of documents to the MFC or the Registration Chamber itself does not differ, so I indicated the MFC in the instructions.

- Spouses need to contact the MFC, pay the state fee and submit a marriage contract with other documents.

The state fee for registration is 2000 rubles (clause 22, clause 1, article 333.33 of the Tax Code of the Russian Federation). Payment details can be obtained from an employee. The payment desk is usually located in the MFC building itself, the commission is about 50 rubles.After paying the state fee, in order of priority, the employee must give the original documents: notarized marriage contract, spouses’ passports, marriage registration certificate, purchase and sale agreement for an apartment in marriage.

- An MFC employee will draw up applications for registration of rights, which the spouses need to sign.

- After signing the applications, the MFC employee will pick up the documents (except passports), give each party a receipt for these documents and set a date when they can be picked up.

The received documents are sent to the registrar. All that remains is to wait for registration. According to Art. 16 of the Federal Law of July 13, 2015 N 218-FZ, maximum registration period: 9 working days, if the agreement is submitted to the MFC; 7 working days if the contract is submitted directly to the Rosreestr branch. But not always everything is done on time due to workload. You can call the MFC, give the number on the receipt and check whether registration has been completed. - On the appointed day, spouses can pick up their documents at the MFC. They do not have to pick them up at the same time, but can be picked up separately at different times and days. They will also issue an extract from the Unified State Register of Real Estate (for an apartment). Property registration certificates have been canceled and will not be issued since July 2020. Have your passport and receipts issued by the employee with you.

A gift agreement is drawn up in writing with the participation of two persons - the donor and the donee, or their legal representatives or representatives by proxy. Both parties to the transaction sign at the end of the document. Mandatory notarization of the contract is not required, but it will never be superfluous.

The following cannot be donors:

- persons recognized by the court as legally incompetent and their legal representatives,

- children under fourteen years of age and their legal representatives.

Donees who will not be able to register rights to a gift if they received it from their clients and their relatives:

- civil servants,

- employees of medical and educational institutions,

- social service workers.

If a common apartment (or part of it) is donated by one of the spouses, then the second must give his written consent to this. The same is required from parents if the gift is made by their minor children. In the case where a parent gives housing to their child, the consent of the second parent is not required, even if their housing is shared.

When a part of an apartment divided into several shares is given as a gift, it is necessary to obtain mandatory consent from the remaining shareholders.

We invite you to familiarize yourself with a sample receipt for receipt of deposit money for an apartment.

It is not difficult to draw up a gift agreement with a good sample in hand. But it still needs to be registered with Rosreestr, for which it is necessary to collect an impressive package of documents. And this needs to be done immediately. After the death of the donor or other unforeseen situations, it will no longer be possible to register the fact of the gift. In this case, the transaction will no longer be considered completed.

Documents for registration of a gift agreement for an apartment:

- identity passports of the donor and the donee,

- property donation agreement,

- document on ownership of the apartment,

- cadastral passport with apartment plan,

- BTI certificate about the cost of the apartment,

- certificate of persons registered in the apartment,

- notarized consent of the spouse (if the ownership of the apartment is joint, except for donation to children),

- consent of all homeowners (if a share in the apartment is given),

- consent of the legal representative or guardian (if the donee or donor is incapacitated or a minor),

- power of attorney (if the interests of one or the other party are represented by a third party).

Only if all these conditions are met will the gift agreement be considered valid and the question will not arise whether the donated apartment is divided in the event of a divorce.

Failure Cases

There are cases when registration of a transaction is refused. The most common reason for this is an incorrectly formed package of documents.

You will be refused if:

- there is no paper in the package of documents;

- the gift agreement was drawn up incorrectly;

- if the transaction violates the rights of third parties;

- there is no receipt for payment of the state duty;

- the presence of encumbrances on the apartment.

It is very important to prepare well for the donation procedure, to take into account all the nuances, then refusal of registration will be avoided.

How much will the procedure cost?

Note: As noted above, neither the spouse nor the spouse should pay tax when registering a deed of gift due to their close relationship. This is confirmed by Article 14 of the Family Code.

You will only need to pay a state fee of 2,000 rubles.

If you need to consult a lawyer, you will need to pay him from 1 to 5 thousand rubles.

Registration of a deed of gift from a notary will cost approximately 1.5-2 thousand rubles.