How to disable Sberbank Autopayment via SMS 900

Of course, automatic payment from a card for all kinds of services, including housing and communal services, is a very convenient option in 2020. It was and remains one of the most popular among people who use the services of Sberbank. In this way, you don’t have to worry about making regular payments on time and at the same time not accumulating debts for housing and communal services.

Considering the fact that human life periodically undergoes certain changes, including those related to the financial sector, some Sberbank clients have to turn off Autopayment. However, this must be done immediately after the need for the service ceases, since then the money that will no longer have to be received for regular payment will not be returned to the client.

How to cancel Autopayment from a Sberbank card to your phone? Disabling via mobile phone is the easiest, and most importantly, the fastest way.

The client needs to make sure that Sberbank’s Mobile Bank is connected to his phone. From here, he regularly receives useful information and notifications about transactions performed by the client on his account. If this option is activated, to disable Autopayment you should send a message to number 900, following these steps:

- Enter the combination AUTO PAYMENT - without using quotation marks or any other punctuation marks other than a hyphen. Important! The presence of a hyphen is required, but instead of the word AUTOPAYMENT you can enter the words AUTO, AUTO, AVTOTEL or AVTO;

- Next, you should dial ten digits corresponding to the number to which the service is connected;

- After which the client must enter the last four digits of his Sberbank card number, through which regular payments are made. If only one plastic card is linked to a given cell number, you do not need to enter the number.

How to remove via SMS? The message allowing you to cancel the autopay feature should look like this:

- AUTOPLPTAGE-0000000000(xxxx).

- Where 0 is the digits of the cell phone number.

- xxxx – the last four digits of the Sberbank card.

Once the bank receives a request from its customer to cancel the autopay feature, it will send a response message to the phone with information that the operation is completed and successful.

Disabling auto payment via phone in Sberbank.

Thanks to automatic settings for paying regular payments in Sberbank, you don’t have to think about the need to top up your mobile phone. Many users are interested in disabling auto payment via phone in Sberbank. It will be quite useful to find out how this service functions and how quickly this service can be activated.

How can I disable it?

To deactivate the service, the user must select the most convenient deactivation method: at an ATM or through online banking.

Through Sberbank Online

If the client wishes to temporarily disable the service, he must use the “Suspend” button. It allows you not to pay for housing and communal services until the card owner decides to renew the service.

To temporarily refuse “Autopayment for housing and communal services”, the client must select the desired supplier in the “My Auto Payments” – “Manage Auto Payments” tab. Under the service parameters there is a “Pause” button. The action is confirmed using an SMS password.

For complete removal, the client must select the “Disable” button. In this case, the service will be archived and automatic payment will not be made.

Deactivation in the terminal network

To temporarily or completely get rid of the service, the client must enter the “My templates and automatic payments” tab through “Payments and transfers”.

Disconnection and suspension at ATMs occurs without confirmation by SMS code , which significantly reduces the time to complete the operation. Receipts for service deletion requests are printed instantly.

The "Autopayment for Housing and Public Utilities" service allows you to quickly and with a minimum commission pay for utilities and other regular payments to organizations. Receipts are printed at any time, both in terminals and through Sberbank Online.

The client independently selects the parameters and can change the template or refuse the automatic transfer of funds at any time.

Temporary suspension

If the account owner does not want to pay receipts automatically in the current period using a Sberbank card, he can suspend the debit using an SMS notification.

- A day before execution, the client will receive an SMS from the number “900” on his phone indicating the write-off parameters. The message additionally indicates the service cancellation code for the current period.

- To temporarily disable debiting this month, the payer must (in a response message to the bank) send the code specified in the notification to the number “900”.

After sending the code, it is recommended to check whether you have received an SMS from Sberbank with the following content (example) - “Cancel auto payment from a VISA1234 card in the amount of 9876.54 rubles.” The message confirms that the temporary denial of service was completed successfully.

Automatic payment to the balance of a mobile operator or payment for other services (housing and communal services) from a Sberbank card

The way AutoPay works is to maintain a certain amount of money on your phone account. This is ensured as a result of interaction between the mobile operator and Sberbank. If the balance of the operator (MTS, Beeline, MegaFon, Tele2, Yota, Teletai) decreases to the established limit, it sends a request to the bank to transfer money. When the required amount is not in the account, Sberbank will notify you by sending an SMS to the specified phone number.

If there is a sufficient amount of funds, the bank will transfer the specified amount to the account of the mobile company. It will top up your phone account and notify you of the successful completion of the operation.

Disabling automatic payment via telephone in Sberbank or using other services must be carried out taking into account its settings.

Existing limits:

- the upper limit is 600 rubles. (except for Megafon);

- lower limit - 30 rubles;

- At Beeline, replenishment is possible for 30, 150, 600 rubles, and at Tele2 - for 10, 30 and 50 rubles;

- There are no restrictions for such operators as: NSS, Yeniseitelecom.

The procedure for activating and deactivating this service can be carried out at a bank office, with the help of a bank employee, or by other means.

Options for disabling and activating the service:

- via phone if you have a connected Mobile Bank;

- by calling the bank's Contact Center;

- in your Sberbank Online Personal Account or using a mobile application;

- through ATMs and terminals.

At the moment, the most common way to disable autopayment is through the phone, because this is the simplest and easiest way. You can perform the necessary operation at any time without outside participation.

Disabling auto payment Sberbank

Having a card, the client can activate automatic transfers for the following types of payment transactions:

- Mobile connection. A certain amount is expected to be transferred at the moment when the phone balance drops below the value specified by the client. Cooperation is possible with the following operators: MTS, Megafon, Beeline, Tele2, NSS.

- Public utilities. You can set up two options for transfers: a fixed amount once a month or automatic debt verification and payment of the required amount. Before you withdraw money, you receive a confirmation message. The client can cancel or disable Sberbank Autopayment for MTS, Megafon and other operators using a message with the transaction number to 900.

- Telephony, television, communications. On the days specified by the client, transfers are made for the use of a landline telephone, Internet, and television.

- Loans from other institutions. In order not to forget to pay your obligations on time, you can specify the frequency and amount of the monthly transfer. Before transferring funds, you receive a message that gives you the right to cancel the operation at any time.

- Traffic police fines. You can pay your debt with one message.

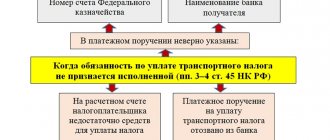

Scheme for replenishing a mobile phone using an automatic payment system

For all transactions, except the first one, a commission is charged - 1%. But the bank does not charge more than 1 thousand rubles as a commission (when transferring large amounts).

Today there are several methods that allow you to activate and deactivate the option. Let's look at each of them in detail.

Read more about how to disable auto payment from Sberbank via phone on our website here.

Connecting and disabling automatic payment via phone (900)

To activate or disable Autopayment from Sberbank, you need to be connected to Mobile Banking. Thus, you can quickly and easily control financial transactions, make transfers and payments, and also connect various useful services by sending SMS with the appropriate commands. For any situation, certain numbers or words are provided, which are automatically recognized by the system.

Connecting the Autopayment service through Mobile Banking (900)

To do this, you need to send a message to number 900 with any of the following words:

- AUTO;

- AUTO PAYMENT;

- AVTOPAY, AUTOPAY;

- AVTOTEL;

- AVTOPLATEZH ;

- AVTO, AUTO;

- AVTOTEL, AUTOTEL.

Example of an SMS command to number 900 to activate the autopayment service:

AUTO 9xx1234567 4321

First, type a command word (any one from the list above), put a space, a phone number (you must first create a template through an ATM or Sberbank Online) and then add the last four digits of the card (to clarify which card to pay for, if there are several of them).

Disabling auto payment via phone 900

Disabling automatic payment via telephone in Sberbank is possible if you specify the same command as when connecting, only add a “-” (minus) sign after the command. This process will be carried out according to the same scheme for other operators.

In response to the SMS you will receive a one-time code, which in order to confirm this operation must be sent to the Sberbank number. Completed actions will be confirmed by information SMS.

Sberbank auto payment for housing and communal services - reviews

- Marina P. “I have a very busy work schedule. Previously, I always forgot to pay for some housing and communal services, mobile phones, Internet, etc. After my sister told me about the possibility of connecting auto payments at Sberbank, paying for a large number of monthly services ceased to be a problem for me.”

- Ivan R. “I never liked paying for certain services. A few months ago I connected auto payment for housing and communal services at Sberbank, whose client I have been for a long time. After the salary “arrives” on the card, the money is automatically transferred to the necessary service providers. This saves incredible time and nerves. I recommend to everyone".

- Vika M. “I just recently paid my rent using auto payment from Sberbank. At first I was a little afraid and worried about how the auto payment would happen for the first time. But then I made sure that the payment was absolutely transparent. The bank always sends SMS messages, and I can always refuse to make a payment.”

Sberbank auto payment is a practical service that allows you not to waste your time paying monthly payments.

Connecting automatic payment by calling the Contact Center

You must make a call to the toll-free line of the Sberbank Contact Center. If you call the number 900, then after the automatic greeting you should dial the number 0, which provides for communication with the operator. The Center representative will make all the necessary settings, but will first ask you to provide certain information.

What you will need to indicate when communicating with the operator

- telephone;

- card number;

- limit size;

- replenishment option (upon reaching the limit);

- amount to transfer from the card.

In some cases, more detailed information may be requested: CVC2 / CVV2 code, as well as the validity period.

Disabling autopayment via phone in Sberbank is even simpler. It does not matter how the connection procedure was performed. The Sberbank Contact Center operator will be able to choose the most appropriate method at the present time. To disable, the bank representative must tell the template name.

If you wish, you can visit a bank branch and provide the required information to deactivate (or create) the template. To do this, you must have your passport with you, as well as the card you are using.

Benefits of the service

Automatic regular payments

To appreciate this option, you should know how auto payment for housing and communal services works. First, you need to set up templates for future auto payments for utilities once. These could be payments to management companies, for electricity, Internet (including Rostelecom), heat and water. At the same time, for your convenience, there are two payment methods: a fixed amount or an invoice. The first option is suitable for payments whose amount does not change every month, for example, intercom, Rostelecom (or other Internet provider), HOA, security. The second option is for those services where the accrual depends on consumption - water, heat. With this option, the service provider issues you an invoice with all charges. You also set the frequency of the event yourself, for example, once a month or quarter. You can also set the maximum possible payment amount in order to control the amount of possible write-offs for housing and communal services. Set the name of the service for convenience, for example, Rostelecom, and the service setup is complete. After this, payment for utilities will be made automatically according to the specified parameters.

Informing about charges and payments

The day before the expected payment, the bank will notify you that a payment has been generated for such and such an amount. If for some reason you want to cancel it (for example, if you are overpaid by a supplier), you can send a cancellation code via SMS. The service remains active, and next month everything will happen as usual. If you agree to this payment, you do not need to do anything. The next day, the specified amount will be debited from the Sberbank card.

Loyal tariffs

Tariffs depend on each specific agreement concluded with the service provider. As a rule, they do not exceed 1%. There are restrictions on the maximum commission amount of 1,000 rubles. There may be no commission charged for payments at all, if this is provided for in the agreement between the bank and the recipient of the funds.

Thus, to the question of what is auto payment for housing and communal services from the Russian Sberbank, we answered in detail.

What else can you pay?

The service is not limited to paying utility bills. It helps solve other issues as well.

Automatic replenishment of mobile phones of any operators: MTS, TELE2, Beeline, Yota, Megafon, Rostelecom

This is very convenient, since it is not always possible to monitor the balance. Sometimes you run out of money on your phone at the most inopportune moment, which can put you in a difficult situation. With automatic payment enabled, the phone is topped up whenever the balance is less than thirty rubles. There is no fee for auto top-up.

Payment for Internet and TV providers: Telecard, MTS, Rostelecom, etc.

The principle of operation and tariffs are similar to auto payments for housing and communal services. Paying provider bills on time helps avoid being blocked for non-payment.

Loan repayment

There are few citizens who do not have loans from different banks. Regular automatic payment is connected in the same way, only full bank details are required if it is a third-party bank. The payment date should be set according to the schedule and taking into account the time for transfer. As a rule, this takes up to 3 business days. Since weekends are not considered operational days, it makes sense to set the payment date at least 5 days before the scheduled date. Thus, loans will be paid on time and without delays. The commission for the service will be 1% and no more than 1,000 rubles.

Traffic police fines

By entering information about your driver's license or vehicle registration certificate, you instruct the bank to regularly check information about the presence of traffic police fines. If the system finds such data, you receive an SMS with the amount charged, the number and date of the decision. If you do not agree with such data, you can cancel. Otherwise, the fine will be paid from your account the next day. The commission is also 1%, but not more than 1,000 rubles per payment.

Connecting and disabling automatic payment through Sberbank Online

You should familiarize yourself in detail with the options for connecting via the Internet. In order to activate the system, you should request an identifier and secret code with which you will log in. You can get them by calling the bank's Contact Center, at an ATM (a set of one-time codes is issued) or at a bank branch. A reusable identifier is issued over the phone or at a bank branch, which can be changed in the future. In addition, access is also provided through the Mobile Bank, as a result of sending a short command.

Sequence of actions: first open the “Payments and Transactions” item, then “My Auto Payments” or select “My Auto Payments” on the right side of the Personal Menu.

The procedure for connecting auto payment to Sberbank Online:

- log in to your Sberbank Online Personal Account;

- select the required mobile operator from the available list;

- select the “Create auto payment” section;

- select the card that will be used for payment;

- indicate the conditions for replenishment - when the cash balance decreases to a certain limit;

- indicate the limit and the required amount for transfer;

- give the template a name by which it can be identified, adjusted or deleted;

- confirm your actions by clicking “Save”;

- Enter the code received via SMS in a specific column.

Disabling auto payment via telephone in Sberbank is considered even more simplified. You need to find and delete the created template using the “Disable” or “Delete” buttons and then confirm your actions using the SMS code.

The process of filling out an application for connection will be similar at an ATM. The only differences will be in its interface.

Disconnection from Sberbank.

To disable Sberbank’s “Autopayment”, you should use the same tools that were used to connect it. These include the Sberbank-Online system, ATMs, terminals and bank offices. We have prepared detailed instructions for each tool.

Disconnection in Sberbank Online

Deactivation of the option, as well as activation, occurs when connecting to the online service. Having gained access to the Personal Account, the client enters the main menu. Here you are asked to select the Autopayments option. In it you need to define a subsection: cellular communications, loan payment, housing and communal services, traffic police fines, etc. In the appropriate paragraph, following the prompts, indicate the parameters:

- number of the card from which transfers will be made;

- account number to which the transfer is intended (selected according to the name of the organization);

- sum;

- periodicity;

- additional conditions (upon reaching the minimum amount on the balance, no more than a certain amount per day, etc.).

The service can be deactivated through an ATM.

Data is saved in a template and placed in the “My Auto Payments” section. You can always adjust the template, delete it, or create a new one. When this operation occurs, a notification is sent to the client’s phone.

Read more about how to disable Beeline Sberbank auto payment on our website.

To deactivate, you must also select the previously created template in the appropriate section and click “Disable”. Confirmation of the action will be required (using a code sent to the phone).

What is “Autopayment” from Sberbank

“Autopayment” is the ability to pay for various services automatically. Funds are debited from the Sberbank card according to the established schedule or as accounts are generated. The service allows you to pay for:

- Loans issued by other banks (mortgage, car loans, consumer and many others). Payments are made on the due date.

- Housing and communal services - convenient payment of utilities according to a schedule or according to invoices received from service providers (they are generated automatically, the client receives a notification).

- Traffic police fines - information about them comes from the departmental information system automatically. Payments are based on a 50% discount, which applies to some types of fines.

- Services of telecommunications companies - instant payment for home Internet, digital or satellite television, home telephone with real-time crediting. Payment is made on certain dates in fixed amounts or according to invoices issued by operators and providers.

- Mobile communications from any Russian operators - here there is payment at a threshold with the crediting of a predetermined amount.

The service allows you to forget about paying for mobile communications, housing and communal services and traffic police fines. Therefore, all payments will be made automatically by the bank.

A typical example of this is payment for “utilities” - residents submit readings to the supplier, who generates invoices, after which they are transferred to Sberbank. Next, payers receive SMS notifications about the amount of upcoming payments. If payers do not refuse, after some time the system will automatically process all prepared and generated payments. The size of the commission varies from 0% to 1%, but does not exceed 500 rubles.

Particularly popular is “Autopayment”, which can be configured to top up mobile operator accounts. The system monitors the balance status, focusing on a given threshold. As soon as the balance drops below the specified threshold, the system will automatically replenish the account with a pre-specified amount. You can forget about payment terminals and other methods of manually replenishing your personal account - “Autopayment” will do everything independently and without your participation.

Also, a new type of automatic payment has appeared in the Sberbank-Online system - it allows you to top up the balances of credit cards issued by Sberbank.

Despite the obvious convenience, the owner of a Sberbank card may want to disable Autopayment. This is done in the following cases:

- The payer intends to close the card and change the bank.

- The phone number to which “Autopayment” was set up has changed.

- The account details for paying for housing and communal services have changed.

- The template for payment for a particular service is outdated (this happens too).

The reasons may be different, so we will consider all the available ways to get rid of “Autopayment” using certain tools.

Sberbank auto payment for housing and communal services - commission

Those who are planning to activate automatic payment for utilities are often concerned about whether any commission will be charged and how much it will be.

- Sberbank charges a minimum commission for automatic payment, which is sometimes less than when paying at a Sberbank branch.

- The commission can range from 0% to 1% of the amount, but not exceed the amount of 500 rubles.

- You will be informed of the amount of commission for a specific payment in an SMS message that the bank always sends to the client before making a payment.

- Sberbank reserves the right to change the commission for making a payment to a higher or lower cost, which the client will be made aware of via SMS.

Disabling "Autopayment" using "Sberbank-Online"

The easiest way to fully inform yourself is to visit your personal account in the Sberbank Online system. There are any tools for managing bank accounts and deposits. To disable unnecessary or unused auto payments, go to the “My Auto Payments - Manage Auto Payments” menu. After a few seconds, a list of currently active payments will appear on the screen. Just below is an archive of disabled auto payments.

To delete a particular payment, click on the “Operations” button and select “Disable”.

At the next stage, click the “Continue” button, and then confirm the operation via SMS - a notification with a code will be sent to your phone. Enter the code in the appropriate field on the next page and wait for a notification about the completed operation.

Another notification will arrive on your phone in the form of a text message - our task is completed, the disabled payment will be archived. Autopayments sent to the archive cannot be restored.

Cancellation of automatic payment for housing and communal services

If any of the templates for automatic payments for housing and communal services that you created are no longer relevant or you decide to pay for services yourself, then you can quickly mark it. As in the case of connecting to the described service, to cancel it, you can independently visit a branch of the credit institution in question or use one of the remote methods of account management.

The best method to disable automatic payment is to use an online service. To cope with this task, you need to visit your account in the online service and open the list of templates available to you and disable the one that you no longer want to use. In order to open the list of templates in your personal account of the online service, you should select the “My automatic payments” section in the main menu.

You can also disable an outdated automatic payment template using an ATM. To do this, you need to visit the nearest ATM and perform the following operations:

- Insert the card into a specialized receiver and enter the access code.

- In the ATM main menu, you need to select the “Payments and Transfers” section.

- Next, a new window will appear in front of you, in which you should select the “Autopayments” section.

- In the list of templates that appears in front of you, you must select the one that you want to disable.

Using SMS command

This method disables autopayment for mobile phone payments. To do this, you need to send an SMS with the text “AUTO-9XXXXXXXXXX”. Instead of XXXXXXXXXX, the number for which the payment is configured is indicated. If it is issued to your number, shorten the text to “AUTO-”. Quotes are not entered in SMS commands.

This method is not particularly convenient, since it lacks clarity. Therefore, the easiest way is to use the Sberbank-Online system or the mobile application of the same name. Here you can remove the service as simply and conveniently as possible - there are no such conveniences via telephone. Other types of payments not related to mobile communications via SMS are not disabled.

Service management

There are several ways to activate the service.

Sberbank branches

Just go to a consultant with your passport and card, he will help you set up the necessary auto payments and teach you how to manage them.

PC or mobile app

The most convenient way to use the service is through Sberbank Online. This requires authorization in the service. If you have not previously logged into your personal account, register from the official website by entering your bank card number. Next, go to the personal service menu located on the right side of the screen. select the auto payment option. Click the “Connect” button. Sberbankonline allows you not only to make payments, but also to edit settings and disable them. Disabling is done by clicking the “Disable” button. In the same menu there is an “Edit” button to make changes to the template, and a “Pause” button if you want to temporarily abandon the service. From the payment history, you can print out any receipt with a bank mark for previously performed transactions, if necessary. If you have any questions about connecting and using the service, you can always contact the 24-hour call center by phone, asking a question, for example, how to activate autopayment.

Self-service devices

From the “Payments and Transfers” menu, select automatic payment options. Make settings according to the same principle as in your Sberbank Online personal account.

Terminals and ATMs

Bank terminals and ATMs of Sberbank are installed in bank offices, shopping centers, supermarkets and metro stations. There is no shortage of them, so there will be no problems with disabling the service. We go to any device, insert a bank card, enter the PIN code and get to the menu. Select the item “Personal account, information and service”. There will be an “Autopayment” item here.

Go to this menu and click the “Disable auto payments” button. Here you need to find the payment that requires deactivation. We confirm our intentions and receive a check notifying you of the transaction. Some ATMs have a modified menu, but in general the shutdown procedure is carried out in a similar way.

An ATM differs from a bank terminal in that you can withdraw money from it. The rest of their menus are extremely similar.

How to disable auto payment from Sberbank via phone

You can opt out directly from your mobile phone screen. No, we are not talking about SMS commands at all. The conversation is about the Sberbank Online mobile application. It almost completely replicates the functionality of full-fledged online banking, having an intuitive interface. To delete unused payments, go to the “Payments – Autopayments” menu - the desired item is located at the very bottom of the menu.

A list of current payments will appear on the phone screen. It is updated every few hours. Select an unnecessary payment and delete it from the system - a text notification about the completed transaction will be sent to your phone. After some time, it will disappear from your personal account (there is no access to the archive in the application).

Sberbank auto payment for housing and communal services payments - how it works

Autopayment is an incredibly convenient way to pay not only for utilities, but also for landline and mobile phone bills, for the Internet, for cable television, etc. Before connecting a similar service to Sberbank, you need to understand the mechanism of how autopayment works. Let us highlight the most important features of this service:

- autopayment for housing and communal services, as well as for other services, is made according to a template scheme drawn up in advance by the client;

- There are 2 types of auto payment: auto payment based on an invoice and auto payment for a fixed amount. For some services the monthly payment is always the same, but for others it is not. For example, the amount of payment this month will depend on the amount of water, electricity or gas spent. For autopayments for housing and communal services, autopayment for the billed amount is most often chosen. Before withdrawing money from your card, the bank will always notify you of the amount owed. The client can always refuse to make a payment, or he may not react in any way to such a notification, and the automatic payment will be made;

- The auto payment service can be connected to any Sberbank card. The main condition is the presence of a positive balance. You should also understand that this does not apply to the client’s account, but to his specific card;

- Activating the auto payment service is completely free. You also won't have to pay any monthly fee to use the service;

- If payment for housing and communal services was made using the auto payment service from Sberbank, then you can always receive a document confirming the fact of payment - a check. It can be printed from your personal account and you can contact a Sberbank employee at any branch with a request to provide a check;

- if you previously paid for housing and communal services using the usual methods, then by activating the autopayment service you continue to fully control your expenses;

- You can activate the auto payment service in Sberbank in several ways: in a Sberbank branch, in Sberbank branded self-service devices, in the Sberbank Online system or in the Sberbank Online mobile application.

Why do Sberbank clients activate the auto payment service? The most important and most significant reason is saving time. Once you spend some time creating a template for subsequent payment transactions, you will stop wasting time on monthly routine payments. Of course, only those clients who have a regular income on their bank card should enable autopayment. For example, it is convenient to connect auto payment to a salary card.

Contact the Sberbank branch

If you have any problems disabling Autopayment, arm yourself with your passport and contact the nearest bank office. Help here is provided by cashiers-operators and operating room workers. The latter will help you disable the service using the computer installed in the operating room (if available) or through ATMs and terminals. If you don’t have the card on hand, take the electronic queue ticket and wait for a call to a specialist.

Please note that working with automatic payments through the Sberbank hotline is impossible - they are not connected, edited or disabled here. If you need to perform any operation, use online banking or the Sberbank Online mobile application.

Using an ATM to disconnect

There is an equally convenient resource to use - an ATM or terminal. To carry out an operation with automatic payments, you need to go this way:

- Insert card (enter PIN code values).

- Go to “Service, information”.

- Go to the "Autopayments" section.

- Select the required action: “Connect”, “Disconnect”.

An article on our website will tell you in more detail how to disable Sberbank auto payment on MTS.

The remaining steps are similar to those described for Sberbank Online. Instructions and tips will pop up on the screen. Upon completion, the user will receive a check on which it is noted that the bank accepts obligations to perform the service.

When you contact the Contact Center, the operator will carry out the entire procedure without your participation

If Autopayment is connected or disconnected to Sberbank, Megafon, MTS and any other operator sends the client a message about activation or deactivation of the option. The bank will send a message with each transfer so that the client can monitor his payments. Some templates suggest the possibility of confirmation (for example, payments on loans, housing and communal services debts). In this case, the client will be able to promptly refuse the transfer if he considers it unnecessary in a given period.