Good day, friends! Recently, clients have become increasingly interested in the possibility of getting a mortgage.

But! They are more concerned about the possibility of purchasing not a full-fledged house or apartment, but only one room.

Many people find this option convenient and more profitable. This is partly true - after all, the amount of payments will be low. All that remains is to find out which banks provide a mortgage for the room. But you can find out about this by reading the article below. All the details are there for you.

Which banks give a mortgage for a room?

Many banks do not lend for rooms. This is due to the specifics of selling a room - in order to buy or sell it, the consent of all owners of a communal apartment is required. Consent data is not always easy to obtain. For this reason, the room is not as marketable compared to an apartment.

Warning!Nevertheless, the rooms are in great demand among buyers due to their availability. For most people, this is a good start to buying a separate apartment. Therefore, a number of banks, taking into account the desire of consumers, issue mortgages for the purchase of rooms.

There are not many of them, but they exist. Here is a small list of banks that issue mortgages for a room: Sberbank, MKB (Moscow Credit Bank), DeltaCredit, Zenit Bank. According to the programs of these banks, a buyer can buy a room in any communal apartment. An important condition is that all rooms must be owned.

That is, if one room is not owned, then it is most likely not privatized, which means it is owned by the city, and it most likely will not be possible to buy a room in this apartment.

Interest rates are the same as when buying an apartment.

Banks issuing mortgages to buy a room

There is a simpler situation when you need to buy the last room in the apartment. For example, in a 2-room apartment, you own one room and you need to buy the second one from your neighbor. Here the list of banks is expanded and added to it: VTB24, Absolut Bank, Raiffeisen Bank, Rosevrobank, Rosbank.

Conditions

Purchasing a room with a mortgage is a risky transaction for both the lender and the debtor. To ensure the profitability of the transaction, the bank tightens the terms of the loan to cover its risks, in particular by increasing the interest rate and introducing additional requirements for documents that must be submitted to the borrower.

In addition, the requirements for real estate are increasing.

Providing a targeted loan for the purchase of a room in an apartment does not require signing a mortgage loan agreement, since a mortgage arises by force of law.

The bank's rights to mortgaged property extend not only to a separate room, but also to the common property of the apartment owners. This, of course, does not please other room owners.

The requirements of banks for rooms purchased with a mortgage are also that the room must have a separate certificate of ownership, i.e. the room stands out as an independent object.

Requirements for the subject of mortgage

Also, credit institutions may additionally impose requirements on the collateral purchased on credit.:

- Connection to central communication networks;

- The presence of floors made of reinforced concrete slabs;

- The building in which the room is located should not be in dilapidated or disrepair;

- It is not allowed to purchase a room with unauthorized redevelopment and (or) reconstruction that is not properly legalized;

- Availability of a personal account, as for a separate residential premises

- Approval by the insurance organization.

It will also be necessary to obtain the consent of other room owners in notarized form that they do not intend to buy this room.

After the co-owners have signed a notarized consent to the transaction, the other owners are duly notified of the future transaction against signature.

The borrower is subject to the same requirements as when applying for a mortgage on an apartment:

- Citizenship of the Russian Federation.

- Full legal capacity and capacity;

- Reaching the age of 21;

- Having a total work experience of more than 1 year, as well as work experience at the last place of work of more than 6 months;

- Having a good credit history, the borrower must not have any outstanding debt.

Mortgage for a room at DeltaCredit Bank

Before you take out a mortgage for a room, you need to consider many different subtleties. Few banks provide this type of loans, and those that provide them, as a rule, impose rather strict requirements on potential borrowers.

Expert opinion

Evgeniy Belyaev

Legal consultant, financial expert

Ask

The interest rate on loans for a room is usually slightly higher than for an apartment, and the borrower can choose any debt repayment period within the framework of the lending program.

This suits most borrowers interested in purchasing rooms. A non-targeted mortgage for the purchase of a room secured by existing real estate may also be a solution.

So, if you want to take out a loan to buy a room, it must, among other things:

- be connected to all communications;

- have no utility debts;

- be in a house that does not need major repairs and has a degree of wear and tear of at least 50%.

An additional condition for granting a loan is that the building belongs to the “corridor system” of the layout.

Favorable loan options for buying a room

If you are going to use a mortgage to purchase the type of living space in question, then you are probably considering one of the main options. This:

- apply for a loan for one of the rooms in a communal apartment;

- take out a loan for the last room or share in an apartment, part of which the borrower already owns.

In the second case, not one room, but an entire apartment serves as collateral. In the process of preparing the papers, you will need to draw up, in addition to the loan itself for the purchased part, documents for the rest of the living space.

Apply for a mortgage for a room at DeltaCredit Bank

Narrow specialization in the mortgage area, knowledge and experience of specialists allow us to offer clients various options for banking products focused on the purchase of real estate. Thus, DeltaCredit is one of the few banks in the country that provides a mortgage for a room. At the same time, we offer:

- purchasing a room in Moscow or another region of the Russian Federation;

- special programs for relevant categories of borrowers;

- the opportunity to use maternal (family) capital.

Cooperation with the Bank will open up new opportunities for you and allow you to purchase exactly the type of housing that you planned.

Attention! Highly qualified employees and customer focus allow us to process information and documents of potential borrowers in a short time, quickly reaching a deal.

Contact DeltaCredit, and we will be happy to help you purchase a room with a mortgage in Moscow or another region of the Russian Federation.

Features of obtaining a mortgage at Sberbank

Every citizen who meets the lender's requirements will be able to count on getting a mortgage approved by Sberbank in 2020, having previously chosen the appropriate direction for registration. Currently, there are about a dozen lending programs for different categories of persons, taking into account the specifics of purchasing all types of real estate:

- For finished housing.

- For a property under construction.

- For the acquisition of land and construction of a residential building.

- A program with government support within the framework of a family mortgage.

- Purchasing housing using maternity capital funds.

- Mortgage refinancing program.

- Construction of a private house.

- Country housing.

- Mortgage lending for military personnel.

- A loan for any purpose secured by existing property.

Sberbank's offers are constantly updated, with the advent of new preferential lending options and taking into account popular areas in the real estate sector.

To take out a mortgage on an apartment or other real estate, you will need to select a branch that will be located in the region of registration of the future borrower or in the location of the property being purchased. Applications from employees at the location of the employing company's office are also considered.

The issue of purchasing real estate on credit is one of the most important, because the transaction amount is calculated in millions of rubles, and loan obligations will last for decades. It is impossible to predict whether the borrower will be provided with a good job and a high salary for such a long time, just as it is impossible to predict the occurrence of various events that may negatively affect the standard of living of the borrower’s family.

Which banks give a mortgage for a room?

Sberbank - mortgage for a room . In order to get a mortgage for a room, you will need to contribute at least 20% of the total purchase amount.

The maximum loan repayment period is 30 years, the interest rate is from 10.75%. The minimum loan amount is from 300,000 rubles.

Expert opinion

Evgeniy Belyaev

Legal consultant, financial expert

Ask

To get a mortgage for a room from Sberbank, you need to fill out a form, read the loan agreement and provide a certificate of income.

AK Bars - mortgage for a room . AK Bars offer – loan for purchasing a room

- Loan amount: from 300,000 rubles

- The maximum amount is limited by the client's solvency

- Loan term: from 1 year to 25 years

- Rate: — 12.6% (in rubles)

Before applying, it is recommended to familiarize yourself with the terms of provision, use, and repayment of the loan

Advice! TransCapitalBank - mortgage for a room . The opportunity to get a mortgage for a room in this bank is provided under two conditions: either if the room is owned, or if it is a buyout of the last room (when the rest of the living space is already owned by the client).

One of the attractive conditions is a small package of documents (only two identification documents), if the down payment is 40%.

- Loan amount: from 500,000 rubles

- Loan term: up to 25 years

- Interest rate: from 13% per annum

Banks providing loans to buy the last room in an apartment

UralSib, VTB24, and others. Even those banks that are reluctant to draw up an agreement for the purchase of a simple room can agree to such conditions, since as a result of this transaction the liquidity of the property will increase significantly.

Regardless of whether the client wants to purchase rooms in the capital, in the province or abroad, he will always be able to do this, and on fairly favorable terms. The main thing is to find a suitable bank.

Requirements

Borrower's age . The borrower must be over the age of 21, and at the end of the contract he must be no more than 75 (maximum, usually an even younger age is specified in the contract)

Expert opinion

Evgeniy Belyaev

Legal consultant, financial expert

Ask

Borrower's experience . The client must be employed and have a work experience of at least one year and at least six months at the current place of work.

Co-borrowers . It is possible to attract co-borrowers - persons who will potentially also pay for the loan

Features of buying a room with a mortgage

What is the difference between buying a room and buying a regular apartment? Before approving a mortgage application, the bank must assess the liquidity of the property.

Step-by-step instructions on how to get a mortgage from Sberbank

The lender pays special attention to explaining each stage of the transaction. The terms of the loan are described in detail on the pages of the official website, and the assigned branch manager is required to provide complete information about the process of concluding a mortgage transaction.

Step 1 - choosing a mortgage program

You can take out a mortgage from Sberbank for an apartment or residential building. Whatever program the client chooses, the mortgage transaction should begin by choosing the optimal program option, paying special attention to the possibility of applying benefits or subsidies from the state. Even a half percent discount offered by Sberbank on mortgages results in tens and hundreds of thousands of rubles in savings.

You can reduce the overpayment by 1.0% if, before applying for a loan, you work for at least six months with an employer who pays wages to a Sberbank card.

If you intend to buy a comfortable apartment, it is better to study the offers of developers and objects on the Dom.Click website. This will help you get a discount of 0.3%, and the lowest rates apply to new buildings.

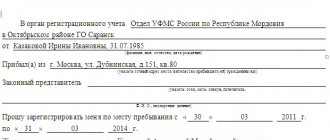

Step 2 - collecting the necessary documents

During the loan approval process, 3 packages of documentation must be prepared:

- For initial approval of the application. A minimum of documents is required - a passport of a citizen of the Russian Federation, a completed application form, and a salary certificate. Additionally, the bank may request SNILS, INN, and marriage certificate. The employer may be required to provide a certified copy of the work record. If you have children, prepare copies of birth certificates.

- After the loan is approved, documents for the transaction are prepared, selecting an object according to the required parameters. Most of the documents are prepared by the seller: technical passport, cadastral passport, USRN extract. Additionally, they prepare a certificate about the residents registered in the living space (an extract from the house register) and papers confirming the absence of debts for housing and communal services. The bank will check the liquidity of the property, the degree of technical wear and tear, and the absence of encumbrances.

- At the final stage, the borrower prepares an independent expert’s opinion on the valuation of the property and takes out insurance.

When preparing documentation, you need to remember that some certificates have a limited validity period. For example, salary certificates and an extract from the house register are valid for no more than a month.

Step 3 - submit an application to the bank

To submit an application and receive approval for your application, you do not need to visit a bank office. Most transactions are carried out online by registered users of Sberbank Online. The request processing time directly depends on the selected program and method of request. For example, for users of the Dom.Click service, the review period is no more than 24 hours.

Step 4 - registration and signing of the contract

When all documents are prepared and the terms of the transaction are agreed upon, a transaction date is set. Along with the loan agreement, a pledge agreement is signed. On the eve of signing the contract, purchase an insurance policy and make a down payment. After signing the agreement, documents are submitted to register the transfer of ownership to Rosreestr.

Communal mortgage

Who would want to take out a mortgage for a room in a communal apartment if they can purchase a separate apartment on credit? It turns out that there are people willing! “Communal” mortgages have always been in demand, and after the crisis they became even more in demand.

Let's figure out how it works, who it is intended for, and which credit institutions are able to satisfy this unusual mortgage demand.

Who needs a room?

Who might need a room? Of course, for those who do not have enough money for more comfortable housing. This is the first thing that comes to mind. But in reality, the issue is not always the limited financial capabilities of the buyer.

Warning! One of the most common reasons for purchasing square meters in a communal apartment is to buy out the missing space from neighbors. This could be just another room, or the last one in the apartment, after which the buyer becomes the owner of a separate home.

Another “popular” option is moving away (due to divorce, when changing apartments, when children decide to live separately from their parents, etc.). Often rooms are purchased by those who need to “get hooked” in the city: get registration and their own housing at minimal cost. A room in a communal apartment is much cheaper than a one-room apartment on the outskirts.

For example, a 12-meter room in a sparsely populated apartment in a residential area of Northern Chertanovo today costs about 2 million rubles (166 thousand rubles per sq. m.). True, prices vary greatly depending on the area and square footage. So, for a 27-meter room in the “four” near the Kitay-Gorod metro station they are asking 6 million rubles (222 thousand rubles per square).

On average, rooms from 13 to 20 meters behind the 4th transport ring cost 2.2-2.7 million rubles, in the Third Transport Ring area - 2.8-3.4 million rubles, within Sadovoye - from 3.5 million rubles In a word, the reasons for purchasing a room can be very different.

Expert opinion

Evgeniy Belyaev

Legal consultant, financial expert

Ask

But the difficulties for those who want to become the owner of “communal squares” with the help of a mortgage arise, as a rule, the same. It would seem that everything is simple: contact the bank, approval of the borrower, assessment of the purchased property and, in the near future, a set of keys in your hands and monthly payment obligations.

It's almost like that. But first you will have to face the fact that finding a suitable bank will be somewhat problematic.

In total

Banks are ready to issue mortgage loans for rooms. Moreover, they saw that after the crisis, the population’s interest in this type of housing lending increased significantly. But most banks did not want to separate “utility” mortgages into a separate loan product.

Why is this happening? The fact is that a loan to buy a room is a niche product (that is, only certain groups of the population need it). Large banks strive for versatility: standardization of products makes it possible to use economies of scale to greater advantage.

Attention! For example, Sberbank issues mortgages for rooms, but does not provide it as a separate loan program. They work the same way at Otkritie Bank. According to its representatives, they are ready to consider a loan for the purchase of a room as a separate piece of real estate - the borrower only needs to provide the usual package of documents.

A little more work for our lawyers, but these are the bank’s problems. However, what large players are refusing, second-tier banks are not averse to taking advantage of. A number of these credit institutions still position room lending programs as a separate product.

But the general trend is this: if a bank takes on a room mortgage, it prefers to issue such loans “in the aggregate.” That is, the conditions for these loans are practically no different from “apartment” ones. What are they? It depends on the specific bank.

There are programs that provide for a low or even zero down payment, which is “compensated” by higher rates—sometimes up to 17–18% per annum in rubles. On average, interest on a low down payment starts at 12%. If the borrower contributes at least 50% of his own funds, then he can easily count on a rate of 10% per annum or even lower.

Expert opinion

Evgeniy Belyaev

Legal consultant, financial expert

Ask

To encourage clients to buy a more expensive “entrance ticket,” banks come up with complex multi-stage “discounts.” So, in one of them the rate is reduced by 0.5% for every 10% addition to the down payment. Loan terms are also different.

Depending on the program and loan amount, you can get a loan for either 5, 10 years, or 25 or 30 years. This is very valuable, because everyone’s situation is different. For some, it is more profitable to pay a longer, but less tangible amount in the monthly personal budget.

Some people strive to close the loan faster, especially if the loan is small, and to quickly become the owner of the room.

Become a hostage

The Greek word hypotheke means "pledge." That is, mortgage lending is literally lending against collateral. Usually the purchased apartment becomes the collateral. But other real estate already owned by the borrower (a plot of land, buildings on it, apartments, businesses, etc.) can also become a “hostage”.

Advice! However, not every bank will agree to take it as collateral. If we are talking about residential premises, then it is necessary to have a reinforced concrete, stone or brick foundation, cold and hot water supply, constant power supply, good condition of plumbing equipment, doors, windows and roof (for apartments on the upper floors), absence of illegal alterations and redevelopments.

The building itself should not be in disrepair (permissible wear and tear is no more than 50%) or stand in line for major repairs, reconstruction or demolition. Why are we telling all this? Moreover, collateral is one of the reasons why banks are so reluctant to issue loans for the purchase of rooms. The fact is that there are many legal subtleties in such transactions.

Let's imagine an ideal situation for buying living space in a communal apartment, when you need to buy the only remaining room. Let's say you own two rooms in a 3-room apartment. The neighbor, accordingly, has one.

He agrees to sell it, the deal is easy, and the bank is willing to participate in it. It is easier to apply for a loan to buy a room if the borrower wants to buy the remaining living space from neighbors in order to obtain ownership of the entire apartment.

Expert opinion

Evgeniy Belyaev

Legal consultant, financial expert

Ask

However, you will most likely have to provide the entire apartment as collateral. Banks are not interested in registering individual rooms as collateral, since it is very difficult to implement it if necessary.

It is for this reason that it is unlikely that you will be able to get a mortgage loan to purchase a room in an apartment of which the borrower is not a co-owner: the bank will not agree to pledge one room.”

There are no difficulties when registering transactions with rooms, since they are allocated in kind (ownership rights to them are registered with the registration authority) and have separate personal accounts. The pledge arises by force of law simultaneously with the registration of the right to these real estate objects.

A mandatory requirement for transactions with rooms is the provision of a notarized waiver of pre-emption. But what to do when the remaining rooms in the apartment are not privatized?

This situation occurs quite often. If the room being sold is privatized, has been registered under an agreement for the transfer of residential premises into ownership of citizens, but the rest have not, then in this case a waiver of pre-emptive purchase must be obtained from the executive committee of the municipality.

Property advantage

So, we’ve sorted out the collateral – you shouldn’t be afraid of it. But there remains one more stumbling block - the neighbors’ preemptive right to buy out the room being sold.

Warning! The scheme is as follows: when intending to sell your part of the apartment, you set a price and announce it to your neighbors (note that you will not have the right to subsequently offer a lower price to third parties). They can either purchase your room at the offered price or refuse to purchase. And this is not just a formality.

In order to continue to look for other buyers, the owner of the room must obtain an official, notarized refusal from the other residents to buy it out. At this stage, a conflict with neighbors may arise.

Let's say these people have always dreamed of buying your living space, but now there is no money for this, and they have never heard of a mortgage for rooms (or they simply do not want to get involved with a loan). Most likely, in this situation, residents will stall for time by not filing a waiver of pre-emption.

Buying a room in an apartment where part belongs to another person is possible, but the neighbors must provide their consent by signing a waiver of the preemptive right of ownership.

Expert opinion

Evgeniy Belyaev

Legal consultant, financial expert

Ask

Otherwise, in the future they will be able to challenge the deal in court, and it will be declared invalid. The refusal must be formalized in a notarized form, which indicates that the neighbor refuses to purchase the room under these conditions.

But there is a way not to wait endlessly: you can contact a notary yourself. The notary prepares and certifies a letter that is sent to the co-owners of the share being sold. If the neighbors do not buy the room within one month, the notary provides the seller with a “Certificate of Transfer of Letter”. After this, the transaction can be carried out.

Divorces and departures

But what to do when the conflict is already evident? For example, during a divorce. Many people in Russia suffer from living in the same apartment with their ex-spouses. There is nothing to do, there is no other roof over your head. What if you buy out the share and leave in a civilized manner?

It turns out that a mortgage loan to buy a room can help in such a situation. True, there are very few banks willing to work with ex-spouses. In this case, you can take out a regular consumer loan and use the funds received to buy the required share.

Credit alternative

Compared to the price of an apartment, the cost of a room is not that high, and banks are reluctant to issue “utility” mortgages. So maybe it’s better to really take out a regular consumer loan?

Attention! A consumer loan for the purchase of a room can be considered as an alternative option. But it is necessary to take into account that the amount needed is quite high, so, most likely, you will need collateral for real estate that the borrower already has.

Additionally, cash advance rates are higher than mortgage rates.” Interest rates on average start at 14.5% per annum and can reach 30% per annum and higher, and the loan term rarely exceeds five years. But in this case, the bank’s approval of the purchased property is not required.

Conditions for obtaining a mortgage at Sberbank

While offering wide lending opportunities for the purchase of real estate, Sberbank limits its offer to the category of clients with Russian citizenship. To become the owner of a comfortable apartment, you need to be a Russian citizen who meets the bank’s simple parameters:

- Age range 21-75 years. You can take out a home loan at the age of 21 or at an older age, but the last payment is made before your 75th birthday.

- Total work experience – more than 1 year within the last 5 years.

- The duration of work with the current employer is at least 3-6 months (depending on the borrower’s affiliation with the “salary project”).

- The income of a Russian citizen must allow him to pay monthly payments, which cannot exceed 40% of the salary confirmed by the certificate.

- Registration of a client in any region of the Russian Federation.

In rare cases, an official certificate and the actual income of one person are enough to apply for a large loan. In such a situation, co-borrowers are attracted - no more than 3 people who meet the same bank criteria. Married citizens involve their marriage partner as co-borrowers. The exception is when the spouses signed a marriage contract with the distribution of rights and obligations in relation to real estate and loans. Spouses who do not have Russian citizenship cannot act as co-borrowers.

When choosing real estate and determining the amount of a future loan, they proceed from the lender’s current rule - the mortgage line of credit cannot exceed 85% of the appraised value of the purchased property. This is necessary to ensure the return of funds through the forced sale of collateral if the borrower refuses to continue making payments. This rule is easy to follow, since most programs require making a down payment of at least 15-20% of the cost of the property. If the estimated value according to an expert opinion corresponds to the price specified in the purchase and sale agreement, this restriction is not significant.

The duration of the mortgage agreement may vary. Most borrowers, not wanting to overpay interest, try to repay the loan debt within 5-10 years, however, when purchasing expensive real estate, this period is not enough. The maximum loan period limit for most programs is 30 years.

Sberbank pays no less attention to the selection of the purchase object, because it will be pledged to the lender for the entire period of repayment of the debt. When mortgage payments are terminated, the bank will require the property to be sold forcibly, and the higher the liquidity of the property, the faster the money will be returned. Each type of housing has its own special requirements, but there are also uniform conditions for selecting future property:

- Location - within the Russian Federation with preference for urban comfortable housing.

- Simplified registration conditions - for properties from selling companies, accredited developers who have posted information about the sale on the specialized resource Dom.Click.

- The subject of the transaction must be separated into a separate property. The purchase of an unallocated share is not permitted. The minimum agreed upon object is an isolated room in an apartment.

- Connected and serviceable utilities - heating, electricity, water supply, sewerage.

- The technical condition of the house must be in satisfactory condition, with working equipment, good roofing, and a low degree of wear and tear.

For individual lending programs, restrictions are established on the purchased objects, cost, and loan terms. When it comes to purchasing housing with government support, a family with children can count on a preferential rate only for housing from the primary fund.

Mortgage for a room - how to get it, design features, banks

Applying for loans to purchase real estate is one of the most complex and responsible operations in the lending market. The task of correctly filling out documents and preventing violation of someone’s rights becomes several times more complicated if a mortgage is taken out for a room.

Real estate and banks

Borrowers who want to tie themselves up with a bank for a room mortgage must be prepared to overcome the following difficulties:

- The first difficulty is that the room for which the borrower plans to take out a mortgage is not always an independent piece of real estate. Often there are co-owners, shareholders or other third parties who have the right to claim this part of this housing;

- the second difficulty is the low liquidity of rooms as property, through which banks that provide a mortgage on a room will be able to repay their obligations if the borrower suddenly becomes insolvent;

- The third difficulty is the lack of a sufficient number of banks that are willing to issue loans against mortgage obligations for a room and, as a consequence, high lending rates and generally unfavorable lending conditions for borrowers.

It is difficult to overcome these difficulties, but a persistent seeker always ends up with a suitable option.

Room in a communal apartment

The room is decorated with the drawing up of title documents, which indicate that the owner-seller is the sole owner of the offered room.

Expert opinion

Evgeniy Belyaev

Legal consultant, financial expert

Ask

However, even if you have the specified title document, large banks such as Sberbank give a mortgage for a room in a communal apartment only on the security of other real estate. In fact, this is no longer a mortgage, but ordinary consumer lending.

If the bank is satisfied with the ownership documents for the room, the borrower needs to make sure that there are no more third parties who could claim ownership of the room. Mostly such persons are neighbors and spouses.

However, there are non-trivial cases when already sold living space is claimed by missing persons who have been discharged from it, who have served a criminal sentence, etc. To prevent possible claims, banks require borrowers to provide documents about who was registered in the room and when and for what reasons they checked out.

If the room is in satisfactory technical condition. For example, banks in St. Petersburg do not provide a mortgage for the purchase of a room in houses with wooden floors, since such houses are considered to be in disrepair and it is difficult to sell collateral housing in them.

Advice! There is an option when banking institutions are quite loyal to the rooms offered for mortgage: the owners of several rooms of the apartment buy the remaining one on credit.

In this case, the borrower becomes the full owner of the entire apartment and it will be much easier for the bank to collect all the necessary payments from him.

Dorm room

However, in addition to documents confirming that the room is residential real estate, the bank may require documents from the buyer that the entire house has been transferred to housing stock, is serviced by the city's public utilities and is not listed as property from the social fund of any large enterprise.

The absence of confirmation of this circumstance may result in the fact that in the process of reorganization or liquidation of the enterprise, the social fund of which was the hostel, the owners of housing in this hostel will have to defend their rights to it in court.

Banks

Thus, a mortgage for a communal room in St. Petersburg is a rather rare phenomenon, although it is in large cities that the purchase of rooms is in greatest demand.

Expert opinion

Evgeniy Belyaev

Legal consultant, financial expert

Ask

A higher level of income for Moscow and St. Petersburg workers than in the regions, a large number of banks and, accordingly, bank lending programs, the active desire of the borrowers themselves to gain a foothold in Russian capitals - all this fuels the mortgage market.

Borrowers should especially pay attention to those young banks that are just trying to make themselves known and are creating customer demand for their services.

Thus, according to experts, it is much easier to get a mortgage for a room in Moscow from a second-line bank, while, for example, at VTB, a mortgage for a room will only be considered if additional real estate is provided as collateral.

Options

So, for example, if you take out a consumer loan from VTB 24, then you simply won’t need a mortgage for a room. According to modern cash lending conditions, the bank provides a loan of one million rubles for 5 years to a family with an income of up to 70 thousand rubles per month.

Warning! One million is often enough to buy a room in a communal apartment or in a dormitory, and the average Moscow family can confirm an official income of 70 thousand rubles per month.

And this is not the only opportunity to get money on credit. Many banks provide even more favorable loan conditions.

Mortgage rates in rubles

| Amount, rub. | Down payment | From 1 day to 25 years |

| from 600,000 | from 25% | from 8.75% |

| Cost of housing, rub. | First installment, rub. | Loan amount and term | Bid | Monthly payment, rub. | Calculation |

| 7 000 000 | 1 750 000 | RUB 5,250,000 for 1 year | 8,75% | 458 512 Overpayment: 253,336 | |

| 7 000 000 | 1 750 000 | RUB 5,250,000 for 2 years | 8,75% | 239 243 Overpayment: 493 310 | |

| 7 000 000 | 1 750 000 | RUB 5,250,000 for 3 years | 8,75% | 166 338 Overpayment: 740 228 | |

| 7 000 000 | 1 750 000 | RUB 5,250,000 for 4 years | 8,75% | 130 024 Overpayment: 993 627 | |

| 7 000 000 | 1 750 000 | RUB 5,250,000 for 5 years | 8,75% | 108 345 Overpayment: 1,253,576 | |

| 7 000 000 | 1 750 000 | RUB 5,250,000 for 7 years | 8,75% | 83 803 Overpayment: 1,793,371 | |

| 7 000 000 | 1 750 000 | RUB 5,250,000 for 10 years | 8,75% | 65 797 Overpayment: 2,651,465 | |

| 7 000 000 | 1 750 000 | RUB 5,250,000 for 12 years | 8,75% | 59 010 Overpayment: 3,255,113 | |

| 7 000 000 | 1 750 000 | RUB 5,250,000 for 15 years | 8,75% | 52 471 Overpayment: 4,205,858 | |

| 7 000 000 | 1 750 000 | RUB 5,250,000 for 20 years | 8,75% | 46 395 Overpayment: 5 904 243 | |

| 7 000 000 | 1 750 000 | RUB 5,250,000 for 25 years | 8,75% | 43 163 Overpayment: 7,731,777 |

Type of housing

Room

Housing readiness Ready

Calculation scheme Annuity payments, in equal shares

Which banks give a mortgage for a room?

Buying a room is essentially no different from buying an entire apartment. Banks that issue loans for standard housing also lend to people planning to purchase rooms. You just need to find out which banks provide a mortgage for a room, and under what conditions.

Attention! It is worth noting that you will have to face some difficulties - banks are in no hurry to issue mortgage loans for the purchase of rooms. The reason for this is the low liquidity of this type of real estate.

According to the law, the first to receive the right to purchase a room are the residents of the communal apartment to which it belongs. If the purchase is refused, the bank is obliged to sell the meters at a price not lower than cost.

An important point: when applying for a mortgage loan for a room, the list of documents includes a notarized refusal of the residents of the communal apartment to purchase, or a document confirming that they ignored the offer made to them.

The liquidity of a room increases sharply if it is the last one in the apartment and you plan to own it alone. Banks know about this and willingly lend to people planning such a transaction.

With isolated apartments the situation is approximately the same. Low liquidity when purchasing the first room, and its significant increase if you plan to purchase the second and subsequent ones.

Expert opinion

Evgeniy Belyaev

Legal consultant, financial expert

Ask

At Sberbank, the minimum down payment will be at least 10% of the price of the room. The loan will be issued to you for a maximum of 30 years, and the annual interest will vary from 9.5% to 14%, depending on the documents you provide, your solvency, place of work, etc.

Rosevrobank is currently the only credit institution that has developed a special mortgage program for the purchase of rooms.

VTB24, Nikom, Sobinbank and Uralsib bank allow you to purchase only the last room in an apartment if all the previous ones already belong to you.

Purchasing a room in a real communal apartment is possible through Sobinbank, Uralsib and Zenit banks.

What documents are needed to take out a loan from a bank?

The documents that the bank will require can be divided into two groups: documents for the purchased living space, and documents of the borrower himself.

For real estate

You will need to provide the following:

- A document that provides the seller with ownership of the apartment.

- Technical passport and cadastral passport of the living space.

- A document that confirms that the purchased room has not been left as collateral.

- Confirmation of absence of debt on utility bills.

- A copy of the seller's passport.

From the borrower

The buyer must provide the following kit:

- Copies of all pages of the passport.

- Certificate of income of the borrower.

- Consent from the spouse to jointly purchase real estate.

- Borrower's application for a mortgage.

- If necessary, documents that confirm the right to benefits, for example, a copy of a military ID or pension certificate.

Lending for the purchase of shared ownership

Lending for the purchase of shared ownership belongs to the category of transactions associated with increased risks. Therefore, not every bank offers this service to its clients. At the same time, a mortgage on a room from a bank is for many the only way to resolve the issue of obtaining real estate ownership.

Why is it so difficult for creditors and citizens to reach an agreement?

Deal nuances

Before looking for banks that provide a mortgage for a room, it is necessary to understand the general requirements for objects of this type. They are as follows:

- Liquidity - the object must be located in a room suitable for habitation and meeting sanitary standards.

- Legal clarity - which banks give a mortgage for a room that is recognized as a disputed object or has other encumbrances? Having learned about such circumstances, you should not expect a positive decision.

- Property – housing in hostels is almost impossible to purchase on credit, because These objects carry additional risks.

- Compliance with the approval procedure with neighbors - no matter which bank you contact, a mortgage for a room will be approved only if you receive written confirmation that none of the apartment residents are applying to buy out this area.

In addition, there are general requirements for the borrower regarding age, length of service, income level and a number of other parameters. Regardless of whether you want to exchange an apartment for an apartment using credit funds or buy housing in a communal apartment, the requirements will be similar.

Which bank gives a mortgage for a room?

Finding a bank that gives a mortgage for a room is difficult, but possible. The key player in the mortgage lending market is Sberbank. And in terms of issuing loans secured by shared ownership, he was one of the first.

Advice! The down payment here is at least 10% of the cost of the property, and the interest rate ranges from 9.5% to 14% with a maximum term of up to 30 years.

The offer from Zenit Bank is the opportunity to use a loan for up to 25 years by paying at least 20% of the price of the property under the contract. However, there is a nuance here: other housing must be pledged as collateral for the loan.

SKB-BANK requires guarantors and co-borrowers, provides an extended package of documents and sets strict age restrictions. A borrower who has passed a thorough check can receive a loan with a down payment of 12%, a rate of 12% for a term of up to 20 years.

In addition, the purchase of shared ownership on credit is available to clients of the following banks: Rosevrobank, VTB24, UralSib and a number of others.

Under what conditions can you get a mortgage loan?

For rooms in dorms and communal apartments, banks give approximately the same conditions for mortgages.

The conditions are as follows:

- Amount - from 300,000 rubles to 500,000.

- Interest rate - from 10% to 14%.

- The down payment ranges from 15% to 25%.

- The minimum term is 15 years, the maximum is 30.

If you buy it at a communal apartment

As mentioned above, the bank may tighten its requirements if the purchased room is the first one owned by the borrower. The same applies to the terms of the transaction - usually the down payment increases (the maximum figure is 40%), but sometimes the interest rate can rise by several percent.

In addition, banks require any other real estate from the borrower as collateral. With an additional collateral or if there are other communal rooms in the property, the chances of getting a mortgage increase significantly.

Additional nuances

There are certain nuances that the buyer should consider:

- After purchasing the room you can use it immediately .

- Even after one late (or even more so several) payments, the bank has the right to file a lawsuit and seize the apartment.

- The chances of a positive decision from the bank after submitting an application increase many times over if the borrower has a positive credit history in the past .

- Banks are more willing to issue loans to their regular customers (including those who receive wages using a bank card).

Attention! Banks are more willing to cooperate with those borrowers who receive an official fixed rate. Potential clients whose salary is calculated as a percentage of the work performed find it more difficult to obtain loans to purchase a room.

Video: How to get a mortgage for a room in a communal apartment

Is it possible to buy a room with a mortgage without a down payment?

Often, commercial banks give a mortgage for a room and other housing objects, covering part of the cost of the property with capital provided by the loan recipient. The percentage of this amount varies from 15 to 25%.

However, there are a number of programs that provide preferential lending, under which you can buy a room with a mortgage without a down payment.

More loyal demands from Sberbank are put forward to young families and married couples. If citizens do not have their own housing, then this becomes a reason to consider the application on preferential terms. In some cases, people who have been in line for subsidized housing for a long time, as well as clients of other banks who want to renew their mortgage with Sberbank due to more attractive conditions, may not make a down payment when buying a room.

Banks lending for the purchase of a room

Today you can find enough banks offering to take ownership of a room using a housing loan:

- Sberbank.

- SKB Bank.

- Gazprombank.

- MTS Bank.

- DeltaCredit.

- RosEvroBank.

- TransCapital and others.

Having your own savings greatly simplifies the search for a lender and reduces the amount of interest overpayment. Of the current programs, down payment requirements are included almost everywhere, and the amount of required investments amounts to up to 40% of the total cost of the room.

The following table contains current information on mortgages for a room from the main players in the banking sector as of the middle of this year:

| Creditor | Duration, years | Rate from, % | First payment, % |

| Sberbank | 30 | 9,5 | 10,0 |

| VTB 24 | 20 | 11,25 | 20,0 |

| RosEvroBank | 20 | 9,75 | 15,0 |

| Gazprombank | 20 | 11,75 | 20,0 |

Video about a mortgage loan for a room

By comparing many programs and using a loan calculator, you can determine the most profitable options. However, only a direct contact with employees of credit institutions will allow you to find out the amount of the final overpayment, the exact interest on the mortgage and other terms of issuance.

In the case of a communal apartment

Banks are likely to give a positive answer to those who want to finance the purchase of their last room. Having given a small amount, the bank receives an entire apartment as additional collateral.

The likelihood of refusal increases if the property has several potential or current owners. There is only one way to get out of this situation - make a down payment as early as possible and offer high-quality security.

Differences for dormitories

Only a few banks are willing to consider the rooms themselves as collateral.

Such housing has a low level of liquidity, which is due to several factors:

- The presence of a large number of violations in the preparation of accompanying documents.

- Doubts about the legal purity of individual rooms.

What are the differences from regular apartment loans?

More information about a room mortgage

The difference is due to the fact that work is carried out only with the secondary market. In new buildings, selling apartments in separate rooms is not possible.

Owners most often become co-borrowers if a shared ownership scheme is used.

The second difference lies in the fact that all other owners with preferential rights must give their official refusal in this regard.

For the written form of this document, notarization is required.