Before you start talking about restructuring, you need to understand what a mortgage is and what it gives to the average person. In a simple sense, this is a loan provided by a bank for the purchase of housing, in which the property remains the property of the debtor, but is collateral from the creditor, that is, if the debtor does not fulfill his obligations, the creditor can exercise the right to sell the collateral property in order to compensate for his losses. On the one hand, a mortgage makes it possible to acquire housing, but on the other hand, you need to understand that if you purchase an apartment this way, you must remain solvent for a long time. In today's realities, it is quite difficult to maintain solvency due to many reasons: job loss, salary reduction or health problems. However, it does not matter to the bank why the debtor cannot make the required payment. What to do if some kind of force majeure occurs and it is no longer possible to pay contributions in the same manner? This is where a service such as mortgage restructuring comes to the rescue.

What it is?

At the moment, in practice, loan restructuring has not yet become widespread. The thing is that such a solution is beneficial only to the borrower; on the part of the bank, the only benefit is that the debtor will pay, but not in the same way as before. Restructuring is a change in lending conditions, after which the borrower receives more favorable terms for repayment of funds. This procedure does not reduce the size of the payment in the end, and certainly does not relieve the borrower of his debt; he is obliged to continue to repay the loan, but on more favorable terms.

Changes after restructuring may be different, for example, you can change the procedure for repaying debt or the size of the monthly payment. Sometimes banks provide the payer with the opportunity to repay only interest on the use of funds from a financial institution; in this case, payments on the principal debt are postponed for several months.

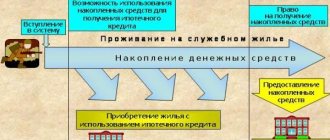

How to refinance a military mortgage?

Previously, it was not possible to refinance a military mortgage. It appeared only in 2020. The authorities decided to revise the law on mortgage lending for the military because, due to the peak of the financial crisis (appreciation of the exchange rate), lending rates increased sharply in 2013-2015, after which they decreased, but those clients who took housing during the crisis , remained in the same conditions. It would seem, why should the military worry about lowering the interest rate, since the state pays for their mortgage? The answer here is simple: many participants in the “military mortgage” program after the end of their service (cessation of government funding) risk being left with debts .

Military mortgage debts may arise due to the fact that in 2014-2016. Indexation of funded contributions was stopped. During this time, rates increased significantly, but deductions to the account remained at the same level.

To avoid being among the debtors, clients who took out a military mortgage during this period are advised to pay attention to refinancing programs. Currently, under these programs, banks offer rates starting from 8.5% per annum. The percentage may then be reduced. Refinancing on such terms will significantly reduce the monthly payment and minimize the risk of remaining in debt to the bank.

Program selection

Until recently, Rosvoenipoteka did not have a program to change the terms of the loan agreement. However, in order to stabilize the situation on the lending market and equalize the conditions of clients who took out a mortgage in different time periods, the department introduced the possibility of refinancing the loan with a change in the terms of the agreement . Military mortgage refinancing programs have already been implemented in many lending institutions. The client has a choice:

- Carry out restructuring in your bank where the loan was taken out;

- Contact another lender for help.

Refinancing with your creditor bank is essentially a restructuring of the loan on more favorable terms. This could be a reduction in the interest rate or a change in payment terms. When refinancing with another bank, the original lender is paid the entire amount of the debt, and the mortgage on the home is transferred to the new lender.

Submission of documents

If the client decides to use the refinancing program at the bank where the mortgage was taken out, he should submit the following documents to consider the application:

- Passport.

- A statement indicating the reasons (it is not possible to make payment under current conditions).

- Certificate of earnings.

Let's learn how to write an application for refinancing a mortgage loan by reading this article.

If the borrower decides to refinance a military mortgage in another bank, he must add to the above documents:

- Documents for the apartment.

- Information from the appraiser.

- Housing registration certificate.

- Certificate of participation in the program (NIS participant).

- Information about the debt balance.

After reviewing all the papers and calculating the risks, the bank will be asked to sign a new loan agreement and additional agreement. According to statistics, if all documents are in order, banks most often make positive decisions on refinancing a military mortgage, since all risks are mitigated by the state, and military service implies financial stability.

Regardless of which program the on-lending will take place (restructuring or refinancing), it is necessary to obtain permission to carry out the procedure from Rosvoenipoteka.

To obtain permission, you need to draw up a report with a request and provide an agreement on the provision of a new loan , an additional agreement to it and a passport. The department does not process the application for long, about 3 days. The reason for refusal to grant permission is most often the lack of any papers, but they can be submitted within 20 days and the necessary certificate can be obtained.

Mortgage restructuring conditions

First of all, you need to prove to the financial institution whose services you used that you really need it. To do this, you need to collect a package of documents that will confirm your difficult financial situation. It is best not to delay in asking for help, otherwise, if it comes to a delay, this will have a negative impact on the bank’s decision to restructure your mortgage. If your relationship with a financial institution has previously been good, and your supporting documents satisfy it, then you can count on more favorable settlement terms. But there are times when the bank does not meet the client halfway, in which case there is another option - to look for another financial institution that will agree to refinance your loan.

Documents to be collected

Let's consider the standard package of documents that any bank requests when completing a restructuring. So, it includes:

- Original or copy of the work book, certified by the employer.

- Certificate of income from your last job for the last year.

- If you have additional income, you must provide information about it.

- Questionnaire for the provision of restructuring.

- Passport.

- Documents about the existence of debts on other loans, as well as documents confirming already fulfilled obligations.

- A loan agreement concluded between the borrower and the financial institution that provided the mortgage loan.

- A copy of the mortgage, which is certified by the organization that issued the mortgage.

If any, you must provide the following documents:

- A copy of the marriage certificate.

- Documents about the education received.

- Confirming poor health, if restructuring was required for this reason.

- Military ID or registration certificate.

- Documents confirming the ownership of real estate or movable property.

If you use the services of a real estate agency, you will have to collect documents for them:

- Documents establishing ownership of property.

- Real estate title insurance contract.

- Documents of co-borrowers, if any.

For whom is refinancing available?

Military personnel of the Russian Federation who do not plan to leave service in the coming years and who previously received a military mortgage from one of the Russian banks can resort to refinancing.

Each institution has the right to independently establish a list of requirements for potential borrowers, but in most cases these are:

- Positive credit rating.

- An insured residential property purchased with a mortgage (sometimes the borrower also has life and health insurance).

- The minimum period of time until the completion of the mortgage agreement.

- Minimum period for obtaining a mortgage loan.

- No outstanding debts on the current mortgage.

Expert opinion

Antonov Viktor Sergeevich

Practicing lawyer with 8 years of experience. Specialization: military law. Recognized legal expert.

In addition, the current lender should not demand early repayment of the mortgage debt (usually such a condition is imposed on a borrower who does not make mandatory payments for more than 200 days).

This is important to know: Refinancing a military mortgage at Otkritie Bank

Forms of restructuring

Restructuring can be done in various ways:

- Providing credit holidays - during this period the client is given the right not to repay the loan amount, but to pay only accruing interest. The period for which such a right is granted—several months—is determined individually. The consequences of using this refinancing method are the extension of the payment period.

- Restructuring a mortgage through refinancing is one of the best options for a client. When using it, the debtor takes out a loan from another bank for the amount of debt in the first and pays off the mortgage with this money. The benefit is that most often the conditions of the second bank are better than when paying using the usual method, so the payer wins a good amount.

- Increasing the loan term - with this method, mortgage loan restructuring involves extending the period for repayment of funds, as a result of which the amount of the monthly payment decreases.

- Repayment ahead of schedule - everything is simple here, the debtor returns only the funds he took, without interest for using someone else’s money, thus you can save a lot of money.

- Cancellation of penalties and fines in case of late payments. Such mortgage restructuring is possible only if the client contacts the bank on time and provides comprehensive evidence of a difficult financial situation.

- Changing the currency of the loan - this option is provided by some banks if there has been a jump in the exchange rate.

- There is also government restructuring of mortgages. In simple terms, this is government assistance in repaying a loan. The Mortgage Restructuring Act indicates that this could help payers pay off their loan by 25-70%. It all depends on the amount of remaining debt.

The essence of the procedure

Since the beginning of 2008, during the crisis, the restructuring of mortgage loans has become a popular service among the population. It allowed borrowers to defer payments for a grace period. Essentially, this process meant re-signing an agreement with a credit institution with more favorable terms, for example, a reduction in the annual rate.

From the outside it seems that it is completely unprofitable for the bank to change the terms of the agreement, but this is not at all the case. The pitfalls lie in the fact that in fact the total amount of payments will not decrease, and in some cases even increase, because as the interest rate decreases, the repayment period of the mortgage usually increases. In other words, the debt is not reduced, but spread over a longer period of time.

Moreover, in case of late payments, the bank, in order not to take away the client’s property, may even increase not only the period of monthly payments, but also the interest rate. But here it should be noted that the re-conclusion of the contract can only occur with the mutual consent of the parties involved. Usually the initiative comes from the borrower, and the bank supports it.

As a result, the financial institution gets rid of the usually lengthy legal proceedings associated with debt collection, and the debtor does not worsen his credit history and does not lose his home. At the same time, it is important that the borrower, understanding the possible problems with repaying the mortgage, promptly contacts the bank with an application for a preferential agreement. Indeed, in this case, with a high degree of probability, the lender will be able to choose the best solution to the problem.

Restructuring can only be carried out in the bank with which the mortgage agreement has been concluded. But at the same time, no one prohibits the borrower from turning to another lender to repay his debt. This procedure, however, will already be called refinancing.

Thus, restructuring is a financial service aimed at facilitating the payment of bank debt and the fulfillment by borrowers of their obligations under the mortgage agreement. At the same time, reconstruction is also beneficial for the state, since problems in the mortgage market have a negative impact on the economic development of the country. Therefore, in 2020, there are special mechanisms to support the procedure.

On-lending process

Typically, the borrower, realizing that he will not be able to comply with his obligations to the lender, turns to him with a statement indicating good reasons for revising the terms of the mortgage. Also, an authorized manager of a financial institution may be the first to contact the debtor and offer him to change the agreement.

The bank accepts the application, considers the possibility of satisfying it, and if approved, offers the client to renew the agreement on new terms. With the consent of the debtor, a new agreement is signed, and the old one is canceled.

Typically, regardless of the initiator of the procedure, in addition to the application, the borrower will need the following documents to restructure the mortgage:

- passport of a citizen of the Russian Federation;

- questionnaire (can be combined with an application form);

- employment history;

- certificate confirming ownership of real estate;

- previous agreement;

- a certificate from the last place of work about the income received for the last six months (form 2-NDFL);

- in the case of a marriage - permission to change conditions on the part of the spouse.

Ready step-by-step instructions:

The main thing that the bank pays attention to when making a decision is the actual change in the debtor’s level of profitability. The special agent evaluates the client's financial condition and his ability to comply with previous obligations.

It is necessary to understand that for a financial organization, restructuring is a right, not an obligation. Based on Article 310 of the Civil Code of the Russian Federation, unilateral refusal to fulfill the accepted conditions is not allowed. The mere application of the debtor to the bank with an application for restructuring is not a reason for changing his obligations under the mortgage agreement. Therefore, the client will need to prove that he really needs help in repaying the debt. This could be loss of a job, illness, bankruptcy, conscription into the army, caring for a child or a disabled person.

Principles for reconstruction of the agreement

The restructuring procedure is carried out free of charge, but due to the obligation to register the agreement with a notary office, the costs associated with it are usually borne by the borrower. The restructuring program is built on four principles; they guarantee social justice and emphasize the peculiarities of the financial process:

- Repayment - regardless of the situations that arise for the borrower, the borrowed amount must be returned to the lender in full.

- Urgency - sets a certain period of time during which the loan must be repaid. Violation of the established deadline involves penalties in the form of an increase in the amount of payments.

- Payment - means that the mortgage transaction is reimbursable, that is, it provides not only for repayment, but also for the payment of remuneration for using the loan.

- Security - expresses the need to ensure the protection of the bank’s property interests in the event of possible non-compliance by the borrower with its obligations.

Options for renewing the contract

There are several types of mortgage debt restructuring. They can be used together or separately. When choosing new contract terms to be provided, the creditor takes into account not only the current financial condition of the debtor, but also assesses their change in the future.

One of the most popular types of restructuring is extension. It refers to the process by which the bank extends the term of the loan agreement. As a result, the number of payments until the loan is fully repaid increases, and the amount of the monthly obligatory payment decreases (the interest rate decreases).

However, in 2020, there are other options offered when renewing the contract:

- Changing the lending currency. That is, the bank offers to recalculate a mortgage taken in foreign currency into national currency. As a result, the remaining repayment will be made only in rubles. This is relevant for people who have taken out a mortgage at a dollar rate for a long term.

- Credit holidays. They represent an ordinary deferment provided to the borrower. In this case, the bank may offer to postpone the payment of the principal debt, while monthly payments do not change, or freeze the status of all payments for a certain time. Most often, financial institutions provide a deferment of no more than 3 months, but there are exceptions.

- Writing off part of the debt. If the arguments provided to the bank by the borrower prove convincing, the lender may decide to reduce the burden of monthly payments.

- Changing the calculation method. The bank may change the procedure for paying monthly payments, for example, replacing them from monthly to quarterly.

- Reducing the interest rate. In fact, such a proposal refers to the concept of refinancing - buying out debts from another bank. A credit institution may offer such a condition to an existing client in exceptional cases, since such conditions are unprofitable for the bank.

- Introduction of a grace period. The creditor can set a certain period for the debtor during which the reduced interest rate will apply.

OTP bank

The service is valid not only for mortgages, but also for car loans and cash loans. Here, just like at Sberbank, they provide the opportunity for restructuring by increasing the payment period or deferring payments. You need to apply for benefits from the same bank from which you took out the loan.

Remember, not all institutions list restructuring as an official service, but it is still possible. In any case, if you have any difficulties with payments, contact the bank that served you when applying for the loan. As a rule, they are all loyal to their clients, so you always have the opportunity to get help in case of difficulties. You need to provide comprehensive information about the problem that you have and try to collect all the documentation to submit the restructuring.