Ask a lawyer

faster.

It's free! Free legal consultation Moscow and Moscow region: +7 499 938-93-12 St. Petersburg and region: +7 812 467-39-73 Fed.

number: 8 800 350-73-54 CONSULTATIONS CONDUCTED: today - 21, per month - 687, per year - 11,345

The housing issue is very pressing for most Russians. Regularly, the Government of the Russian Federation carries out various programs related to improving the quality of life of Russians. For example, for the military there is the opportunity to purchase housing using a special certificate. The purchase of an apartment with a military certificate and the stages will be discussed in this review.

What is this document

A special feature of a military certificate is that it must be used within 60 days from the date of issue. Otherwise, it will become invalid. During this period, you must not only have time to find a suitable housing property, but also register the transaction with Rosreestr. If the purchase is made for the entire military family, then the period for selecting housing increases to six months.

Expert opinion

Stanislav Ershov

Qualified lawyer. Ready to answer any of your questions! Ask them right now!

Write to an expert

If the document expires, bank representatives submit a petition for its replacement to a special department. You can only spend funds on purchasing a home in a new apartment building or on a secondary market. It is impossible to use public money to participate in the shared construction of a new multi-apartment building.

A military certificate is a document issued in the name of the recipient. In addition to the approved information, it contains the following information:

- the final amount of state aid;

- subject of the Russian Federation in which it is allowed to purchase housing;

- passport details of the certificate holder.

Citizens who do not have housing registered in their name can obtain such a certificate. If a military man has relatives who have retired to the reserve, he also does not have the right to claim delivery of this document.

Before submitting an application for a certificate, you need to register with the registration authorities as a person in need of expanded living space.

If a military man owns housing, but its size does not meet the approved standards for the number of square meters per person, then he has the right to be awarded a housing certificate.

Who is eligible to receive? In 2020, certificates will be issued to the following categories of military personnel: :

- transferred to the reserve. The length of service must be at least 10 years;

- stopping the performance of military duty due to health conditions;

- persons in need of increased living space;

- citizens evicted from military settlements;

- family members of military personnel who died while performing public duty.

There is also a special category of military personnel who are provided with housing certificates without a queue:

- large military families with three or more children;

- citizens suffering from serious diseases established by the Government of the Russian Federation;

- living in emergency premises that cannot be repaired. The military man is obliged to provide the conclusion of the special commission.

The money can only be used to purchase residential properties. The essence of the program is that the state allocates money free of charge to a person for the purchase of real estate.

The certificate is used once. You won't be able to get it again.

Using a military certificate, you can purchase a home without a mortgage. If the cost of the property you like exceeds the subsidy amount, then the military man can pay the difference from his own savings. If the apartment you like costs less than the amount of the subsidy, then the rest of the money is returned to the state.

Algorithm for buying an apartment with a military mortgage, video instructions:

How to buy a house with a military mortgage

After receiving a mortgage certificate, the borrower has 3-6 months to search for a home and prepare documents to complete the transaction.

Important: when purchasing an apartment from relatives, difficulties may arise with completing the transaction. It is subject to certain requirements in order to avoid fraud, such as making payments exclusively by non-cash method.

It is necessary to include an insurance package of services. An independent specialist also evaluates the market value of the property. If a house is purchased with a plot of land, they are valued together.

Mortgage for building a house

The acquisition of land for construction or such use is prohibited under the military housing loan program. The only way to acquire the right to funds under the program without controlling their intended use for the purchase of housing is to be in service for a period of more than 20 years.

The refusal of this program by the state is justified by the following reasons:

- lack of control over the expenditure of funds or the complexity of this process, the need to hire special employees and organize their travel to the work site;

- it will not be possible to register property as collateral due to the lack of results from the financed work at the initial stage;

- the increase in the cost of housing construction every year, the risks of non-completion of the construction of the facility on time due to rising prices for materials;

- impossibility of insuring financial risks, property, termination or suspension of construction;

- Only a plot of land that is the personal property of the borrower can be allocated for construction; erecting a house on a plot owned by other persons or relatives is impossible;

- the need to establish a high interest rate for construction due to high risks, which will reduce the need for this loan offer.

Advantages and disadvantages

There are pros and cons of the program, which are noted by military personnel who have already taken advantage of the housing improvement program.

The advantages include:

- buying an apartment you like without investing your savings;

- partial payment from public funds;

- purchase of a residential property in any region of the country.

Significant disadvantages of such a housing program include:

- long period of waiting for a document;

- citizens transferred to the reserves can buy housing only in the region in which they are registered as low-income;

- you need to buy housing in a short time;

- you need to find a seller who agrees to wait some time to complete the payment;

- You won't be able to cash out. They will go only to the account of the previous owner of the living space;

- the minimum amount for purchasing an apartment, which may not be enough to purchase the home you like.

Despite a sufficient number of disadvantages, more and more military personnel are applying for improved housing conditions.

How to get a document

A housing certificate is issued in the order of priority established by the state. The procedure is divided into several stages:

- a report is drawn up addressed to the commander of the unit in which the applicant for the certificate serves;

- the document is transferred to the department of the unit responsible for improving living conditions;

- the applicant is determined a place in the queue for housing improvement;

- when a person’s turn comes, he is notified and invited to receive a certificate for the purchase of housing.

To obtain a certificate, the following list of documents is attached to the report:

- unified report form;

- ID cards of all family members;

- the applicant's military ID;

- a contract or other paper indicating the period of service of the citizen;

- extract from the house register;

- a certificate confirming the need to improve living conditions.

After submitting the documents, a housing case is opened. If the applicant provides an incomplete package of documents, he will be denied a housing certificate.

According to the terms of use of the certificate, all payments between the parties to the transaction are made by non-cash method. After purchasing an apartment, a military man is obliged to move out of the official housing provided to him .

You can apply for participation in the program no earlier than one year before the end of your military service. It must be given to the unit commander between January 1 and July 1 of the current year.

When presenting the certificate, the person responsible for issuing it puts a date on it, from which the countdown of the established deadlines begins . After acquiring living space, a serviceman is no longer considered a low-income person in need of improved living conditions.

Applying for a loan

At first glance, military mortgages appear to be a simple program to implement. However, even here there are pitfalls. For example, do you know what kind of apartment you can buy with a military mortgage or, for example, what are the stages of obtaining such a loan. Read more about this and more.

Conditions

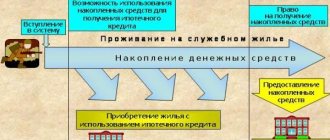

Only citizens of the Russian Federation who serve under a contract, as well as those persons who were officially sent to serve in order to ensure the security and defense of the country, have the right to join the NIS program.

- First of all, persons who have received a military education and entered service (since 2005) apply for participation in the NIS.

- Also eligible for a military mortgage are those citizens who voluntarily entered into a contract and became military personnel.

- The age of the employee also matters. A citizen will not be issued a military mortgage until he is 21 years old. Those over 45 years old will also not be able to take part in the program.

In general, we can highlight the following features of this type of mortgage:

- You can apply for a housing loan using a military mortgage no earlier than three years after joining the program;

- The participant chooses the region and area of housing independently;

- EDV is accrued only in rubles;

- The military man can pay part of the loan himself;

- The interest rate cannot be higher than 11.25% in the secondary market and 10.75% in new buildings;

- Home and life insurance of the applicant is required;

- The loan is issued for a period of 3 to 20 years;

- The family of a military man who died during his service has the right to receive the payments due to him if he has been in the Army for more than 10 years, and in the program for three years or more;

- The maximum amount of government payments (possible loan) is currently 2,350,000 rubles;

- The selected housing must meet the requirements of the Ministry of Defense.

Next, we will tell you about the procedure for purchasing an apartment with a military mortgage.

Order

Several military groups can become a member of the NIS:

- Those who received officer rank after 2005;

- Officers who left the reserve after 2005 and served for at least 3 years;

- Sergeants, sailors, soldiers and foremen who entered into another contract after 2005.

So, how to get a military mortgage? To get into the program, individuals from these groups must collect the following documents:

- Statement (report);

- Passport (copy);

- Contract (copy).

After this, an account is opened at the place of duty, to which the EDV is received.

After three years, the serviceman can submit a new report, but this time to receive a certificate of life certificate. As a result, Rosvoenipoteka issues a Certificate, with which you should go to the bank.

A tripartite agreement is concluded at the bank. The parties to the transaction are the credit institution, Rosvoenipoteka as a representative of the Ministry of Defense and the borrower himself - a participant in the program.

Further events develop as with a regular mortgage (conclusion of a loan agreement, insurance and purchase and sale agreement), with the difference that payments will be made by Rosvoenipoteka, and not by the borrower. To do this, copies of all documents and agreements received from the bank are transferred to this organization.

Visual step-by-step instructions for buying an apartment with a military mortgage are shown in the following video:

We will tell you further what the processing time is for a military mortgage.

Deadlines

As has been mentioned more than once, there are certain time restrictions when applying for a mortgage. Thus, participation in the NIS is possible only for those who entered into an agreement after 2005. You can receive a life certificate no earlier than three years from the date of entry into the program.

The loan is issued for a minimum of three years, and a maximum of 20 years. And now it’s time to talk about where to buy an apartment with a military mortgage, that is, which banks work with such a loan.

Housing acquisition procedure

An educational video about the practice of using a military certificate from Andrey Baranov, director of the real estate agency “Server Krai”:

You can only spend money allocated by the state on purchasing an apartment. You can purchase a residential property without a realtor or use his services for legal support of the transaction. The process of purchasing an apartment begins with a visit to a bank that participates in the military housing acquisition program. An account is opened in this financial institution in the name of the owner of the certificate of ownership. The amount of the subsidy is frozen on it.

Having chosen an apartment in a new building, you must enter into an agreement with the seller, which will include a clause on payment using a housing certificate. The date of commissioning of the house is also indicated. The whole procedure takes place in several stages:

Military mortgage in Sberbank. You can always add your own money and buy a larger apartment.

- a preliminary agreement is concluded with the developer and sent to the bank;

- bank employees transfer money to the seller;

- an act of acceptance and transfer of the apartment is concluded;

- the transaction is registered and the rights of ownership of the home are formalized.

After this, the transaction is considered completed. Purchasing housing on the secondary market is no different from a transaction with a developer. The procedure is carried out in several steps:

- suitable housing is selected;

- a preliminary purchase and sale agreement is drawn up with the owner;

- the agreement is sent to the bank;

- employees of a financial organization transfer finances to the owner;

- The act of acceptance and transfer of housing is signed.

At this point the transaction is considered completed. The buyer can go to Rosreestr and register ownership of the purchased property . What is the value of the certificate? The amount of the subsidy is not fixed. It is calculated based on the average price of 1 sq.m. living space in the region where the applicant is located. The minimum square footage of the home is also taken into account:

- for one citizen - 33 sq.m;

- for two - 42 sq.m;

- married couple with a child - 54 sq.m;

- for four citizens - 72 sq.m.

After transferring money to the seller’s account, bank representatives independently notify the military department of the transaction. They also provide all reporting documents.

If a military man adds his own money when purchasing an apartment, then this clause is written down in the contract. Providing a military certificate is the only opportunity for Russians to become owners of an apartment practically free of charge.

The purchase and sale agreement is drawn up in the usual form. However, it is necessary to reflect in it the amount transferred to the account of the homeowner from public funds.